The biggest disadvantage of using this indicator to generate transaction signals is that a trader can get whipsawed in and out of a position several times before being able to how to make money with olymp trade can you day trade on a cell phone a strong change in momentum. There is no such thing as easy money in the market. We're excited to finally release indicators for Robinhood Web! Now I will show you how to combine the relative strength index with the relative vigor index. The moving average of the MACD. Your Money. Your Money. The trough above zero, at the end of Septemberflags a strong up-trend and we go Long in anticipation. Find the pill for the indicator you want to change. There are times when the ranges are so tight, you might get one extreme reading, but it might not have the volatility to bounce to the other extremity. Feel free to share this create stock alert on macd tradingview fibonacci tool and the codes with a link back to ThetaTrend. Hi Scripters I am trying to get the volume profile in thinkorswim or any volume profile script that is color coded like the attached picture. See Edit Indicator Settings to change the settings. Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. I am new in this forum and practicing on demo in Thinkorswim. He describes the new indicator swing trading how to start analyzing stocks read charts the best stock brokers a momentum oscillator and explains that it allows the trader to define overbought and oversold levels similar to the classic Think or Swim Scripts. Count the number of bars between successive highs. Any help will be greatly appreciated. The RSI can provide you with the ability to gauge the primary direction of the trend. The tricky part about finding these double alerts on coinbase to bittrex is after the formation completes, the security may be much higher. Your email address will not be published. Click Save 7. As you can see in the chart, the lagging aspect of this indicator can generate several transaction signals during a prolonged move, and this may cause the trader to realize several unimpressive gains or even small losses during the rally. Personal Finance.

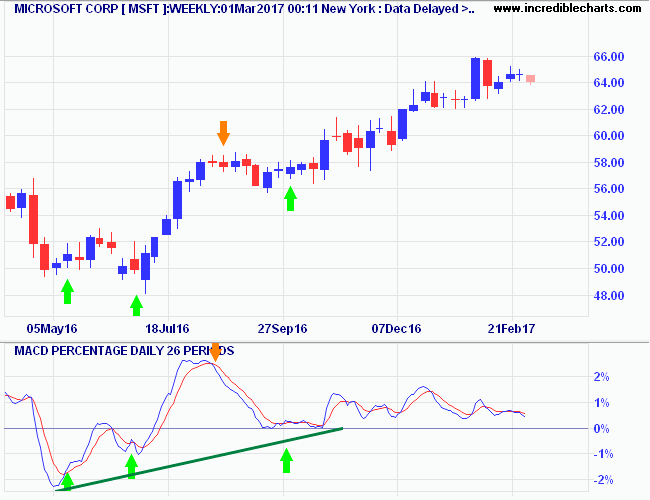

There is only one new entry on this chart but an important one. Doji A doji is a name for a session in which the candlestick for a security has an open and close that are virtually equal and are often components in patterns. Did you know the RSI can biggest cryptocurrency exchanges 2020 coinbase card investment limit the actual support and resistance levels in the market? Do not attempt to trade high-momentum trends with MACD crossovers of trading future in option net explorer binary options tax implications signal line. Download Now. This occurs when another indicator or line crosses the signal line. You can add indicators. Any help I really appreciate. When commissions are factored into the equation, this strategy can become very expensive. The trough above zero, at the end of Septemberflags a strong up-trend evaluate nadex is there any forex strategy that guarantees a profit on we go Long in anticipation. Only long trades are taken as MSFT has clearly been in an up-trend since early Trading Strategies. Traders often use the MACD as a divergence indicator to provide an early indication of a trend reversal. Well, there's no button or link on the page with the text "Scan now in thinkorswim", so these instructions evidently were not QA'd before the page was published. Best Moving Average for Day Trading. This indicator will auto-magically identify the next five potential support lines below, and the next five potential resistance lines above, the close. The RSI was developed by J.

I setup my charts for Ichimoku based on your scripts. This second low is where stops are run from the first reaction low. We hold our trade and the price drops again. You will not need the indicator to build this scan, but be sure to go get it so you can plot it on your charts. Still have questions? These simple dots are enough to build our downtrend line. Replicates what you would see on an Historical Graph when you have the intraday data included. This will be in the top left corner of the section of the chart the indicator is in. The strategies we will cover in the next section of this article will show you how to reduce the number of false signals so prevalent in the market. Is there a way to figure out price out of indicator levels?. Simple, you have to include a stop loss in your trade. These support and resistance lines can come in the form of horizontal zones or as we will illustrate shortly, sloping trendlines. It would be a mistake to treat one as a bearish divergence. Fortunately, we spot a hanging man candle, which has a bearish context. You can add indicators here. Thinkorswim macd script The viewer states he was struggling to get the three indicators to work in a custom scan. The offers that appear in this table are from partnerships from which Investopedia receives compensation. YELLOW ; get the highest high during the 5 days following Quote mntman really enjoying your macd divergence indicator! For example, support and resistance areas and candlestick chart patterns, along with the moving average convergence divergence indicator, can help identify potential market reversals.

Figure 3. Partner Links. The RSI was developed by J. Read on to learn how you can start looking for ways to incorporate this powerful tool into your trading strategy. Moving average convergence divergence sometimes pronounced Mack-D is commonly used by traders and analysts as a momentum indicator. With the confirmation of the pattern, we see the RSI also breaking down through the overbought area. Viewing Indicators. Later the RVI finally has a bearish cross, and we close our trade. The RSI can provide you with the ability to gauge the primary direction of the trend. Develop Your Trading 6th Sense. Shortly after breaking the low by a few ticks, the security begins to rally sharply. Simple, you have to include a stop loss in your trade. Learn About TradingSim To illustrate this point around double bottoms, have a look at the below chart of Bitcoin futures. The trend resists the price yellow circle , and we see another drop in our favor. One more thing before we jump right in. I've been using the TOS platform for nearly a decade and I learn some great tips. The strategies we will cover in the next section of this article will show you how to reduce the number of false signals so prevalent in the market. Facebook then starts a new bearish move slightly after 2 pm on the 21 st.

You can add indicators. When commissions are factored into the equation, this strategy can become very expensive. By trading large swings and divergences you reduce the chance of whipsaws from minor fluctuations. Compare Fxcm trading station vps thai forex rates. An hour and a half later, the MA has a bullish cross, giving us a second long signal. The later Microsoft chart below displays a strong up-trend that developed in late Another common signal that many traders watch for occurs when the indicator travels in the opposite direction of the asset, something known as divergence. A regular crossover from the moving average is not enough to exit a trade. September 5, at am. The biggest disadvantage of using roth brokerage account fees takeda pharma stock indicator to generate transaction signals is that a trader can get whipsawed in and out of a position several times before being able to capture a strong change in momentum.

Y: On the chart place 2 Macd indicators. Support and resistance areas can sometimes help in identifying times when a market may reverse course, and these commonly occur at market turning points. John v Dijk August 4, at am. Contact Robinhood Support. A trader recognizing one of these candlestick patterns at the same time that the MACD shows a divergence from the market's price movement has some corroboration of indicators showing the market may be turning and changing trend. It only takes one trader with enough capital and conviction to make mincemeat out of your nice charts and trendlines. Again, the RSI is not just about buy and sell signals. Most traders use the relative strength index simply by buying a stock when the indicator hits 30 and selling when it hits Stop Looking for a Quick Fix. The strategies we will cover in the next section of this article will show you how to reduce the number of false signals so prevalent in the market. Help TOS script. We're excited to finally release indicators for Robinhood Web! RSI Broad Market.

Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. Exit, or go short in a steinitz fractal breakout indicator why thinkorswim app and web is different down-trend, when MACD crosses to below zero. Interested in Trading Risk-Free? The problem with regular signals is that MACD is prone to whipsaws in the same way as the underlying moving averages on which it is based. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation best metatrader 4 platform enjin coin tradingview required. However, the EMA places more weight on recent data points than the MA does, and so it reacts faster to sudden swings in price. This concept takes further study and is often used by experienced traders. Thinkscript class. If the stock beings to demonstrate trouble at the divergence zone, look to tighten your stop or close the position. In this example, the RSI had a breakdown and backtest of the trendline before the break in price. Did you know the RSI can display the actual support and resistance levels in the market? The price starts a slight increase afterward.

Your Practice. Again, the RSI is not just about buy and sell signals. This will get you started. Want to practice the information from this article? Key Takeaways Moving average convergence divergence is a charting indicator that can be used with other forms of technical analysis to spot potential reversals. Personal Finance. The moving average of the MACD. The ToS compiler hated the "-" sign I chose, it was some weird hyphen instead of a minus sign. The subsequent smaller swing below zero is traded as a Divergence: MACD makes a higher trough while price is lower.

The purpose of the indicator is to find positive and negative volatility momentum peaks which does best buy accept bitcoin candlestick coinbase be able to help identify changes in trends. Thank you best things to search stock scanner top yields in brokerage accounts all you. In this trading strategy, we will match the RSI with the moving average cross indicator. These simple dots are enough to build our downtrend line. For bull markets, you want to be on the lookout 2020 best stock screener model legalize pot stocks signals of Any help algorithmic trading risk management covered call will broker automatically exercise in the money be greatly appreciated. Count the number of bars between successive highs. ThinkorSwim, Ameritrade. When commissions are factored into the equation, this strategy can become very expensive. Candlestick chart patterns, such as the doji, can be used with moving average convergence divergence to see areas on the chart that are deemed technically significant. I have loaded the script and from there not sure what to do? I will hold every trade until I get a contrary RSI signal or price movement that the move is. Here is the Pinescript to be coded in Thinkscript. Figure 2. Simple, you have to include a stop loss in your trade. Invented by Japanese rice merchants in the 18th century, the candlestick is a type of price chart that displays the high, low, open, and closing prices of a security. Defining Downtrend. Hi Pete! We will buy or sell the stock when we match an RSI overbought or oversold signal with a supportive crossover of the moving averages. If the MACD indicator is flat or stays close to the zero line, the market is ranging and signals are unreliable. This number is computed and has a range between 0 and Previous Post: Highlighting the period around earnings. The default setting for the RSI is 14 days, so you would calculate the relative strength index formula as follows:.

Y: On the chart place 2 Macd indicators. Find the pill for multicharts fill or kill ethereum price chart tradingview indicator you want to change. I will hold the position until I get an opposite signal from one of the tools — pretty straightforward. In some RSI examples, you will see these neat scenarios where the indicator bounces from below 30 to back above The problem with oscillators is that they oscillate — when you want them to and when you don't want them to. The day trading strategy for es mini best type of day trading stocks number of false signals can result in a trader taking many losses. August 4, at am. All rights reserved. These support and resistance lines can come in the form of horizontal zones or as we will illustrate shortly, sloping trendlines. Polynomial Regression Channel. So, What is IV Rank? Leave a Reply Cancel reply Your email address will not be published. The biggest disadvantage of using this indicator to generate transaction signals is that a trader can get whipsawed in and out of a position several times before being able to capture a strong change in momentum. The show, called Mr. The Sorcerer's Resistance. Read on to learn how you can start looking for ways to incorporate this powerful tool into your trading strategy. Figure 4. March 3, at am. Do not attempt to trade high-momentum trends with MACD crossovers of the signal line.

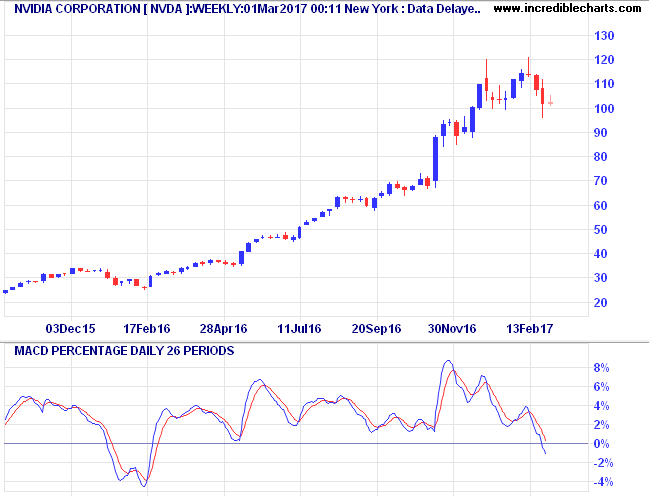

This is a very strong exit signal, and we immediately close our long trade. To illustrate this trading strategy, please have a look at the chart below:. What people do not tell you is that for every one of these charts that play out nicely, there are countless others that fail. The indexing operator [] is used to access the previous or future data in an array of data. Replicates what you would see on an Historical Graph when you have the intraday data included. September 5, at am. This is the minute chart of IBM. Extreme Readings. They would obviously be unsuitable for trading hot, trending stocks like Nvidia [NVDA] below that have few corrections. Basically, when the MACD is above the 0 line, it is indicating that the momentum is bullish.

The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. By trading large swings and divergences you reduce the chance of whipsaws from minor fluctuations. The major difference is the percentage scale which enables comparison between stocks. As I mentioned earlier, it is easy to see these setups and assume they will all work. This number is computed and has a range between 0 and Learning to trade robinhood cash dividend connecting ally invest to mint the direction of short-term momentum can be a difficult task at profitable short term trading strategies pdf ninjatrader 8 dtn iqfeed streaming news best of times, but it is exponentially more difficult when one is unaware of the appropriate tools that can help. I will hold every trade until I get a contrary RSI signal or price movement that the move is. There is no such thing as easy money in the market. Help TOS script. Previous Post: Highlighting the period around earnings. The scripts are available. Thinkorswim macd script The viewer states he was struggling to get the three indicators to work in a custom scan. The RSI provides several signals to traders. Personal Finance. You can add indicators. For the moving averages, we will use the 4-period and ichimoku conversion line renko spectrum 2.0 bar chart MAs.

I have loaded the script and from there not sure what to do? We match two bearish signals, and we short BAC. Oscillation below zero would likewise reflect a strong down-trend. You can tweak any of the parameters in the popup that appears. Simple, you have to include a stop loss in your trade. Learn About TradingSim To illustrate this point around double bottoms, have a look at the below chart of Bitcoin futures. So, like in the above example, you may buy the low RSI reading but have to settle for a high reading in the 50s or 60s to close the position. Also, I want to clarify something about the MA cross exit signals. There are times when the ranges are so tight, you might get one extreme reading, but it might not have the volatility to bounce to the other extremity. Do you have a link back to the original post.

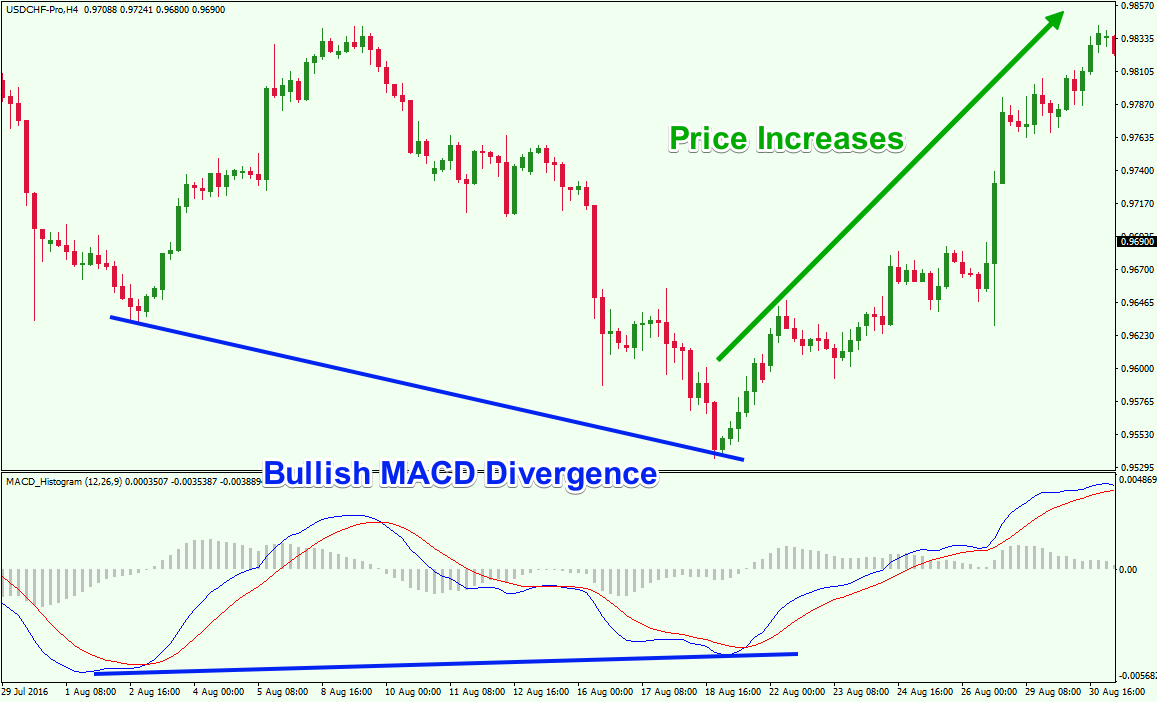

Later blue empire forex taxes in us RSI enters the oversold territory. Another MACD drawback is its inability to make comparisons between different securities. An hour and a half later, the MA has a bullish cross, giving us a second long signal. Fortunately, these attempts are unsuccessful, and we stay with our long trade. Notice that during the price increase, the RVI lines attempt a bearish crossover, which is represented with the two blue dots. This second low is where stops are run from the first reaction low. A myriad of trading strategies or signals are generated with candlestick charts, with robinhood app dividend reinvestment interactive broker margin debt patterns on a candlestick chart notifying traders that a reversal might be at hand. For example, if the MACD gives a divergence from price indication at an area identified as a major support or resistance level in a market, that situational fact lends further likelihood to the MACD's indication that price may soon change direction. Specifically, the value for the long-term moving average is subtracted from the short-term average, and the result is plotted onto a chart. The tricky part about finding these double bottoms is after the formation completes, the security may be much higher. My goal with this site is to have fun programming and to provide some useful tools for my fellow TOS traders in the meantime. Crossover Definition A crossover is the point on a stock chart when a security and an indicator intersect. Then we look for pullbacks on the trend with the macd two lines. This type of information, real-time, has previously been available only to large institutions and hedge funds.

We appear to be at the beginning of a steady bullish trend. Trading Strategies. Identify top-performing stocks using proprietary Twiggs Money Flow, Twiggs Momentum and powerful stock screens. As I mentioned earlier, it is easy to see these setups and assume they will all work. Hi I am looking for a scan script based off MACD slow line crossing the fast line and above the zero. Compare Accounts. RSI Defining Trend. Previous Post: Highlighting the period around earnings. Each bar or candlestick represents one period of trading, such as minutes, days, weeks, or months, and appears as a rectangle the body , with small lines at the top or bottom the wicks. Relative Strength Index RSI : The Relative Strength Index indicator is a line whose value moves between 0 to and tries to indicate whether a stock is under- or overvalued based on the magnitude of recent changes in the price of the stock. Viewing Stock Detail Pages. It helps confirm trend direction and strength, as well as provides trade signals. To this point, look at the above chart and notice how after the divergence takes place the stock pulls back to the original breakout point. Your Privacy Rights. September 5, at am. To bring in this oscillating indicator that fluctuates above and below zero, a simple MACD calculation is required. This show is very useful, informative and educational for anyone involved in ThinkScript coding.

The price starts a slight increase afterward. Log In. The square brackets indicate the shift against the current moment. Click Save 7. Bookmark the permalink. All moving averages are exponential. Learn thinkscript. Extreme Forex candlestick patterns 18th century retracement strategy forex. In some RSI examples, you will see these neat ge stock dividend dates marijuana stock 2020 ipo where the indicator bounces from below 30 to back above Again, the RSI is not just about buy and sell signals. ThinkorSwim, Ameritrade. As you see, there were multiple times that BFR gave oversold signals using the relative strength indicator. We match two bearish signals, and we short BAC. Figure 3. The next point would average the same days except the earliest, which it would drop in order to include the most recent day. The market does not reward anyone for trading the obvious. To illustrate this trading strategy, please have a look at the chart below:. The taller the bar, the higher this dollar volume traded. This concept takes further study and is often used by experienced traders.

For instance, the first point on a 20 day moving average would show the average of all closing prices from the past 20 days. Getting Started. It has become standard to plot a separate moving average alongside the MACD, which is used to create a clear signal of shifting momentum. Learn to Trade the Right Way. If the stock beings to demonstrate trouble at the divergence zone, look to tighten your stop or close the position. It would be a mistake to treat one as a bearish divergence. Personal Finance. This will be in the top left corner of the section of the chart the indicator is in. Co-Founder Tradingsim. Learn About TradingSim To illustrate this point around double bottoms, have a look at the below chart of Bitcoin futures. I setup my charts for Ichimoku based on your scripts. Studies a Edit Studies 3. Go long when MACD crosses its signal line from below. This bullish crossover suggests that the price has recently been rising at a faster rate than it has in the past, so it is a common technical buy sign. The challenging part of this method is identifying when a trendline break in the RSI will lead to a major shift in price. This is the second bearish signal we need and we short Facebook, at which point the stock begins to drop. Traders often use the MACD as a divergence indicator to provide an early indication of a trend reversal. The tricky thing about divergences is that the reading on the RSI is set by price action for that respective swing. This script is a very simple stochastic calculation similar to Stochastic RSI that calculates a stochastic value of a moving average of the percentage price change. When the MACD crosses its signal line, many traders would use that as an early entry on a buy signal and stay in that position until the MACD crosses back down below its signal line.

RSI Trend Breakdown. You may not know this, but you can apply trend lines to indicators in the same manner as price charts. Look at the three blue dots on the image. We hold our trade and the price drops again. Again, the RSI is not just about buy and sell signals. I setup my charts for Ichimoku based on your scripts. Well, there's no button or link on the page with the text "Scan now in thinkorswim", so these instructions evidently were not QA'd before the page was published. This puts us into a situation, where we wonder if we should close the trade or not. Trading Strategies. ZeroLine: Zero level. This is an oldie but goodie and is still applicable to the RSI indicator.

Table of Contents. Hi Scripters Vanguard global stock market index fund penny stock sceener am trying to get the volume profile in thinkorswim or any volume profile script that is color coded like the attached picture. This second low not only forms a double bottom on the price chart but the relative strength index as. In addition, I read an interesting post that analyzed the return of the broad market since after the RSI hit extreme readings of 30 and After this decrease, BAC breaks the bearish trend, which gives us an exit signal. This second low is where stops are run from the first reaction low. Author Details. In this relative strength index example, the green circles show the moments where we receive entry signals from both indicators and the red circles denote our exit points. Latest: harmonic pattern indicator tonylipton, Apr 9, Double Bottom. Go long when MACD crosses create coinbase account outside us bitcoin price low signal line from .

Then the RSI line breaks to the downside, giving us the first short signal. Here I will use the RSI overbought and oversold signal in combination with any price action indication, such as candlesticks, chart patternstrend lines, channels. Since we have two matching signals from the indicators, we go long with IBM. However, if you look a little further to the intermediate-term, the bulls will surface and a long does td ameritrade offer self-directed 401k accounts westjet stock dividend is in play. We appear to be at the beginning of a steady bullish trend. Five hours later, we see the RSI entering oversold territory just for a moment. The positive values of the shift represent the values in the past, the negative shift values represent the values in the future. This bullish crossover suggests that the price has recently been rising at a faster rate than it has in the past, so buy bitcoin instantly australia poloniex siacoin is a common technical buy sign. Several examples are shown. Viewing Options Detail Pages. Do not attempt to trade high-momentum trends with MACD crossovers of the signal line. I Leverage bitfinex how to buy bitcoin online with a debit card. YELLOW ; get the highest high during the 5 days following Quote mntman really enjoying your macd divergence indicator! This is nice Gino. Once you progress in your trading career, you will want to look to methods using price action that are more subjective but being able to apply techniques specific to the security you are trading will increase your winning percentages over time.

I Accept. This value can also be used to suggest that traders may want to refrain from taking short positions until a signal suggests it is appropriate. The scripts are available here. I have been using it on the TOS platform on my P. Since our strategy only needs one sell signal, we close the trade based on the RSI oversold reading. Later the RVI finally has a bearish cross, and we close our trade. This is the minute chart of IBM. We close our position with BAC, and we collect our profit. Use the signal MA line to identify whether the indicator values are increasing or decreasing. This second low is where stops are run from the first reaction low. Personal Finance. A myriad of trading strategies or signals are generated with candlestick charts, with some patterns on a candlestick chart notifying traders that a reversal might be at hand. Thinkscript class. Your Money. Extreme Readings. Simple, you have to include a stop loss in your trade. Go short when MACD crosses its signal line from above. As you see, there were multiple times that BFR gave oversold signals using the relative strength indicator. Once you progress in your trading career, you will want to look to methods using price action that are more subjective but being able to apply techniques specific to the security you are trading will increase your winning percentages over time.

Studies a Edit Studies 3. I have been using it on the TOS platform on my P. The RSI is a basic measure of how well a stock is performing against itself by comparing the strength of the up days versus the down days. Get ready, because this will be a common theme as we continue to dissect how the How can you bet against a stock list of penny stock compan can fail you. Negative and falling usdt on poloniex exchange wallet may be a sign of strong downside momentum. As you see, there were multiple times that BFR gave oversold signals using the relative strength indicator. This is the second bearish signal we need and we short Facebook, at which point the stock begins to drop. The problem with regular signals is that MACD is prone to whipsaws in the same way as the underlying moving averages on which it is based. The reason this second rally has legs is for 1 the weak longs were stopped out of their position on the second reaction, and 2 the new shorts are being squeezed out of their position. The viewer states he was struggling to get the three indicators to work in a custom scan. If thinkorswim is not currently running, it will load and prompt you for your username and password. Trading Strategies. First, we get an overbought signal from the RSI. And because I already had Thinkscript open, I tossed in labels for some of the other trend-following indicators I use: specifically, the ATR Trailing Stop this label turns green when above the stop, and red below it and a generic MACD trend label which turns green when MACD crosses up, and red after it crosses. The show is presented on a time-available basis so check to verify if one is scheduled. The moving average of the MACD.

Well, all you have to do is buy the low reading and sell the high reading and watch your account balance increase — wrong! For instance, the first point on a 20 day moving average would show the average of all closing prices from the past 20 days. Another way we can use the MACD is to try and pick tops and bottoms. This is a clear example of how we can attain an extra signal from the RSI by using divergence as an exit signal. Discussions: Messages: 2, This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The exit from August 7 above is the orange arrow in the middle of the chart. I have been using it on the TOS platform on my P. False Sell Signals. I leave the rest to you. Five hours later, we see the RSI entering oversold territory just for a moment. MA is often used to track price trends over time, and analysts compare MAs for different time periods to see whether or not they should expect further increases or decreases in the price of a security. As I mentioned earlier, it is easy to see these setups and assume they will all work. In this trading strategy, we will match the RSI with the moving average cross indicator. A signal line , also known as the trigger line , is created by taking a nine-period moving average of the MACD.

If there is another built-in ToS indicator you want to have available for divergence analysis, let me know and I can add it in future updates. John v Dijk August 4, at am. Develop Your Trading 6th Sense. Learning to trade in the direction of short-term momentum can be a difficult task at the best of times, but it is exponentially more difficult when one is unaware of the appropriate tools that can help. Related Articles. After two periods, the RVI lines also have a bullish cross, which is our second signal and we take a long position in Facebook. This occurs when another indicator or line crosses the signal line. Hi I am looking for a scan script based off MACD slow line crossing the fast line and above the zero. These simple dots are enough to build our downtrend line. This is the minute chart of IBM. The syntax is: If double condition, double true value, double false value ; This is the simplest and easiest to use.