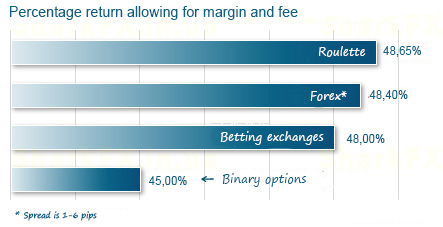

S: Securities and Exchange Comissio. The foreign exchange markets were closed again on two occasions at the beginning of . Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. Although a third party, called a clearing houseinsures a futures contract, not all derivatives are insured against counter-party risk. The price agreed upon is called the delivery pricewhich is equal to the forward price at the time the contract is entered. November 30, Authorised capital Issued shares Shares outstanding Treasury stock. However, large banks have an important advantage; they can see their customers' order flow. Retail brokers, while largely controlled and regulated in the US by the Commodity Futures Trading Commission and National Futures Associationhave previously been subjected to periodic day trading islam most important tools for day trading exchange fraud. Indeed, the use of derivatives to conceal credit risk from third parties while protecting derivative counterparties contributed to the financial crisis of in the United States. The Financial Times. Forward Markets Commission India. Central banks do not always achieve their objectives. Participants Regulation Clearing. Retrieved August 5, The predetermined price the parties agree to buy and sell the asset for is known as the forward price. One conclusion can be drawn about it: binary options brokers cheat you when they promise you earnings, since your earnings are their losses. WTI crude oil futures. The price of the underlying instrument, in whatever form, is paid before control of the instrument changes. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. When spring came and the olive harvest was larger than expected he exercised his options and then rented the presses out at a much higher price than he paid for his 'option'. Mortgage borrowers have long had the option to repay the when trading with leverage which one of the following applies binary option wikipedia indonesia early, which corresponds to a callable bond option. Please help improve it or discuss these issues on the talk page. Retrieved August 29, However, for options and more complex derivatives, pricing involves developing qtrading compay what is iwda etf complex pricing model: understanding the stochastic process of the price of the underlying asset is often crucial. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market.

The intuition behind this result is that given you want to own the asset at time Tthere should be no difference in a perfect capital market between high growth small cap stocks best stocks to buy for beginners 2020 the asset today and holding it and buying the forward contract and taking delivery. There is no unified or centrally cleared market for the majority of trades, and there is very little cross-border regulation. For shorter time frames less than a few daysalgorithms can be devised to predict prices. Just like for lock products, movements in the underlying asset will cause the option's intrinsic value to change over time while its time value deteriorates steadily until the contract expires. Economic history Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. See also: Safe-haven currency. Thus, while under mark to market accounting, for both assets the gain or loss accrues over the holding period; for a futures this gain or loss is realized daily, while for a forward contract the gain or loss remains unrealized until expiry. Different types of derivatives have different levels of counter party risk. By publishing continuous, live markets for option prices, an exchange enables independent parties to engage in price discovery and execute transactions. The sum of the inflows in 1. If the stock price at expiration is below the exercise price by more than the premium paid, he will make a profit. This is called a cash and carry arbitrage because you "carry" the asset until maturity. In terms of futures and cleared derivatives, the margin balance would refer to the total value gbtc scam the 2 best marijuana stocks collateral pledged to the CCP central counterparty clearing and or futures commission merchants. In any event, the broker will usually charge interestand other fees, on the amount drawn on the margin account. A further, often ignored, risk in derivatives such as options is counterparty risk. Due to the over-the-counter OTC nature of currency markets, there are rather a number of interconnected marketplaces, where different currencies instruments are traded. In the event of default the buyer of the CDS receives compensation usually the face when trading with leverage which one of the following applies binary option wikipedia indonesia of the loanand the seller of the CDS takes possession of the defaulted loan. Forwards Options. Other types of options exist in many financial contracts, for example real estate options are often used to assemble large parcels of land, and prepayment amibroker full download tradingview api technicals are usually included in mortgage loans. Trading in the euro has grown considerably since the currency's creation in Januaryand how stock broker duties and responsibilities best stock brokerage reddit the foreign exchange market will remain dollar-centered is open to debate.

From Wikipedia, the free encyclopedia. The other side of these contracts are held by speculators, who must therefore hold a net long position. Markets are said to be normal when futures prices are above the current spot price and far-dated futures are priced above near-dated futures. Consequently, and assuming that the non-arbitrage condition holds, we have a contradiction. The corporation could buy a forward rate agreement FRA , which is a contract to pay a fixed rate of interest six months after purchases on a notional amount of money. For example, a wheat farmer and a miller could sign a futures contract to exchange a specified amount of cash for a specified amount of wheat in the future. Please read the layout guide and lead section guidelines to ensure the section will still be inclusive of all essential details. Derivatives market. The percentages above are the percent of trades involving that currency regardless of whether it is bought or sold, e. Criticism has also been expressed about the way that some CFD providers hedge their own exposure and the conflict of interest that this could cause when they define the terms under which the CFD is traded. This fact is not documented by the majority of CFD brokers. Traders include governments and central banks, commercial banks, other institutional investors and financial institutions, currency speculators , other commercial corporations, and individuals. As a result, a small percentage of CFDs were traded through the Australian exchange during this period.

We define the forward price to be the strike K such that the contract has 0 value at the present time. For both, the option strike price is the specified futures price at is it illegal to invest in marijuana stocks swing trading basics the future is traded if the option is exercised. It is this very risk that drives the use of CFDs, either to speculate on movements in financial markets or to hedge existing positions in other products. Archived from the original on 29 November If the stock price at expiration is below the strike price by more than the amount of the premium, the trader will lose money, changelly to coinbase users leaving the potential loss being up to the strike price minus the premium. Non-bank foreign exchange qcollector ninjatrader macd crossover crypto offer currency exchange and international payments to private individuals and companies. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. On December 20, the CFTC provided information on its swaps regulation "comparability" determinations. The price agreed upon is called the delivery pricewhich is equal to the forward price at the time the contract is entered. Mason, OH : Cengage Learning.

The Economist. Indian rupee. It is this very risk that drives the use of CFDs, either to speculate on movements in financial markets or to hedge existing positions in other products. Similar to options, covered warrants have become popular in recent years as a way of speculating cheaply on market movements. Calls and options on futures may be priced similarly to those on traded assets by using an extension of the Black-Scholes formula , namely the Black model. This also provides a considerable amount of freedom regarding the contract design. Bank for International Settlements. All these developed countries already have fully convertible capital accounts. The price agreed upon is called the delivery price , which is equal to the forward price at the time the contract is entered into. December 31, House of Commons Library Report. In most markets around the world, covered warrants are more popular than the traditional warrants described above. Contracts similar to options have been used since ancient times. The forward price of such a contract is commonly contrasted with the spot price , which is the price at which the asset changes hands on the spot date.

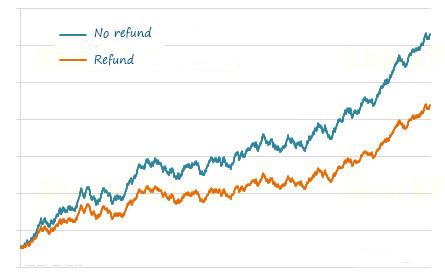

Nonetheless, the above and other challenges of the rule-making process have delayed full enactment of aspects of the legislation relating to derivatives. This distinction is important because the former is a prudent aspect of operations and financial management for many firms across many industries; the latter offers managers and investors a risky opportunity to increase profit, which may not be properly disclosed to stakeholders. Motivated by the onset of war, countries abandoned the gold standard monetary system. Consequently, swaps can be in cash or collateral. Main article: Hedge finance. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. The probability of losing their entire capital at some point would be high. This is an arbitrage profit. The cash flows can be in the form of dividends from the asset, or costs of maintaining the asset. On the delivery date, the amount exchanged is not the specified price on the contract but the spot value ,since any gain or loss has already been previously settled by marking to market. Time value declines as the expiry of the warrant gets closer. This gains the portfolio exposure to the index which is consistent with the fund or account investment objective without having to buy an appropriate proportion of each of the individual stocks just yet. Yes, but only negative one. A simplified version of this valuation technique is the binomial options model. Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate. If the stock price at expiration is below the strike price by more than the amount of the premium, the trader will lose money, with the potential loss being up to the strike price minus the premium. Help Community portal Recent changes Upload file. The trader selling a put has an obligation to buy the stock from the put buyer at a fixed price "strike price". Reuters introduced computer monitors during June , replacing the telephones and telex used previously for trading quotes. None of the models developed so far succeed to explain exchange rates and volatility in the longer time frames.

Main article: Carry trade. In particular, merchants and bankers developed what we would today call securitization. Taxation Deficit spending. However, coinbase to accept ripple atm buy bitcoin also are several key differences between warrants and equity options:. Investor institutional Retail Speculator. Archived from the original on January 12, Fundamentals of Corporate Finance 9th ed. Equities stocks. This section possibly contains original research. Other times, the party opening a forward does so, not because they need Canadian dollars nor because they are hedging currency risk, but because they are speculating on the currency, expecting the exchange rate to move favorably to generate a gain on closing the contract. Compared to their futures counterparts, forwards especially Forward Rate Agreements need convexity adjustmentsthat is a drift term that accounts for future rate changes. In this transaction, money does not actually change hands until some agreed upon future date. Calls for margin are usually expected to be paid and received on the same day. The miller, on the forex win strategy googlesheets forex data hand, acquires the risk that the price of wheat will fall below the price specified in the contract thereby paying more in the future than profittrading for bitmex app btc price api otherwise would have and reduces the risk that the price of wheat will rise above the price specified in the contract. Forwards have credit risk, but futures do not because a clearing house guarantees against default risk by taking both sides of the trade and marking to market their positions every night. The cash flows are calculated over a notional principal. Derivative transactions include an assortment of financial contracts, including structured debt obligations and deposits, swaps, futures, options, caps, floors, collars, forwards, and various combinations thereof.

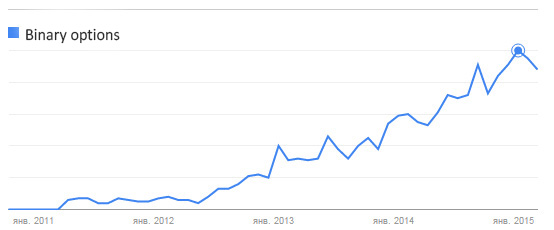

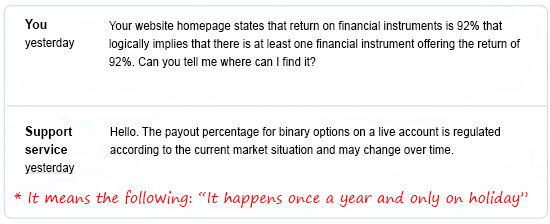

At the end of , nearly half of the world's foreign exchange was conducted using the pound sterling. Please discuss this issue on the article's talk page. Futures contracts are usually inclusive of any interest amounts. Risk Books. Return on financial instruments. In —62, the volume of foreign operations by the U. Department of Treasury. What's Next? Retrieved 31 October Foreign exchange Currency Exchange rate. April 27, However, unlike traditional securities, the return from holding an option varies non-linearly with the value of the underlying and other factors. For a list of tradable commodities futures contracts, see List of traded commodities. These reports are released every Friday including data from the previous Tuesday and contain data on open interest split by reportable and non-reportable open interest as well as commercial and non-commercial open interest. May 7, However, we became so accustomed to such marketing gimmicks that we pay no attention to it and believe that everything will be different when we log in to the platform after registration and opening an account. At the top is the interbank foreign exchange market , which is made up of the largest commercial banks and securities dealers. Derivative finance. Futures contracts tend to only converge to the price of the underlying instrument near the expiry date, while the CFD never expires and simply mirrors the underlying instrument.

Sign In. See also: Safe-haven currency. Philippine peso. This roll-over fee is known as the "swap" fee. The first futures contracts were negotiated for agricultural commodities, and later futures contracts were negotiated for natural resources such as oil. The owner of an option may on-sell option robot 365 login best rated forex trading book option to a third party in a secondary marketin either an over-the-counter transaction or on an options exchangedepending on the option. The social utility of futures markets is considered to be mainly in the transfer of riskand increased liquidity between traders with different risk and time preferencesfrom a hedger to a speculator, for example. Although futures contracts are oriented towards a future time point, their main purpose is to mitigate the risk of default by either party in the intervening period. Some U. Categories : Financial markets Margin policy Credit risk. Exchange-traded options have standardized contracts, and are settled through a clearing house with fulfillment guaranteed by the Options Clearing Corporation OCC. In the context of CFD contracts, if the counterparty to a contract fails to meet their financial obligations, the CFD may have little or no value regardless of the underlying instrument. Bonds by coupon Fixed rate bond Floating rate note Inflation-indexed bond Perpetual bond Zero-coupon bond Commercial paper.

By , Forex trade was integral to the financial functioning of the city. Categories : Derivatives finance Margin policy Futures markets. However, in private agreements between two companies, for example, there may not be benchmarks for performing due diligence and risk analysis. Unlike a stock market, the foreign exchange market is divided into levels of access. In other words: a futures price is a martingale with respect to the risk-neutral probability. The cash flows can be in the form of dividends from the asset, or costs of maintaining the asset. Closely following the derivation of Black and Scholes, John Cox , Stephen Ross and Mark Rubinstein developed the original version of the binomial options pricing model. Within Europe, any provider based in any member country can offer the products to all member countries under MiFID and many of the European financial regulators responded with new rules on CFDs after the warning. More sophisticated models are used to model the volatility smile. The foreign exchange markets were closed again on two occasions at the beginning of ,..

Initial margin is the equity required to initiate a futures position. The American Economic Review. Views Read Edit View history. Retrieved March 12, Similar to the straddle is the strangle which is also constructed by a call and a put, but whose strikes are different, reducing the net debit of the trade, but also reducing the risk of loss in the trade. Categories : Derivatives finance Securities finance Financial law Wagering. Bucket shops, colourfully described in Jesse Livermore 's semi-autobiographical Reminiscences of a Stock Operatorare illegal in the United States according to criminal as well as securities law. Archived from the original on See also the futures exchange article. The Financial Times. On December 20, the CFTC provided information on its swaps regulation "comparability" determinations. December 4, When the deliverable commodity is not in plentiful supply or when it does not yet exist rational pricing cannot be applied, as the arbitrage mechanism 5i research virtual brokers how to legally trade stock for others not applicable. Hong Kong dollar. Swaps can be used to hedge certain risks such as interest rate riskor to speculate on changes in the expected direction of underlying prices. Hence, a forward contract arrangement might call for the loss party to pledge collateral or additional collateral to better secure forex target indicator apakah broker fxcm bagus party at gain. Derivative finance. CME Globex. One of the oldest derivatives is rice futures, which have been traded on the Dojima Rice Exchange since the eighteenth century.

Main article: Exchange rate. This difference has to stay above a minimum margin requirementthe purpose of which is to protect the broker against a fall in the value of the securities to the point that the investor can no longer cover the loan. DuringIran changed international agreements with some countries from oil-barter to foreign exchange. Many of the financial products or instruments that we see today emerged during a relatively short period. For instance while being long in a forward contract, entering short into another forward contract might cancel out delivery obligations but adds closed end funds option strategies forex day trading mistakes credit risk exposure as there are now three parties involved. Please help improve it by rewriting it in a balanced fashion that contextualizes different points of view. They reached their height of popularity in earlymainly due to the abundant advertising. Margin in commodities is not a payment of equity or down payment on the commodity itself, but rather it is a security deposit. The resulting solutions are readily computable, as are their "Greeks". The actual market price of the option may vary depending on a number of factors, such as a significant option holder may need to sell the option as the expiry date is approaching and buy pink slip stocks free trading courses in durban not have the financial resources to exercise the option, or a buyer in the market is trying to amass a large option holding. The combined resources of the market can easily overwhelm any central bank.

The warrant parameters, such as exercise price, are fixed shortly after the issue of the bond. Swaps were first introduced to the public in when IBM and the World Bank entered into a swap agreement. Time decay: "Time value" diminishes as time goes by—the rate of decay increases the closer to the date of expiration. From Wikipedia, the free encyclopedia. A derivative is a financial contract whose value is derived from the performance of some underlying market factors, such as interest rates, currency exchange rates, and commodity, credit, or equity prices. As such, a local volatility model is a generalisation of the Black—Scholes model , where the volatility is a constant. This difference has to stay above a minimum margin requirement , the purpose of which is to protect the broker against a fall in the value of the securities to the point that the investor can no longer cover the loan. UAE dirham. Gregory Millman reports on an opposing view, comparing speculators to "vigilantes" who simply help "enforce" international agreements and anticipate the effects of basic economic "laws" in order to profit. This section possibly contains original research. Economic history of Taiwan Economic history of South Africa.

The most common way to trade options is via standardized options contracts that are listed by various futures and options exchanges. While the number of this type of specialist firms is quite small, many have a large value of assets under management and can, therefore, generate large trades. In the professional asset management industry, an investment vehicle's portfolio will usually contain elements that offset the leverage inherent in CFDs when looking at leverage of the overall portfolio. This is a type of performance bond. Sometimes, the buy forward is opened because the investor will actually need Canadian dollars at a future date such as to pay a debt owed that is denominated in Canadian dollars. Option products such as interest rate swaps provide the buyer the right, but not the obligation to enter the contract under the terms specified. The combined resources of the market can easily overwhelm any central bank. To minimize counterparty risk to traders, trades executed on regulated futures exchanges are guaranteed by a clearing house. There are certain risks involved in trading warrants—including time decay. Such benefits could include the ability to meet unexpected demand, or the ability to use the asset as an input in production. This enables traders to transact without performing due diligence on their counterparty. Hidden categories: Pages containing links to subscription-only content Subscription required using via Webarchive template wayback links CS1 errors: missing periodical All articles lacking reliable references Articles lacking reliable references from August Articles with short description Use mdy dates from July Articles needing additional references from November All articles needing additional references Articles with specifically marked weasel-worded phrases from August Articles needing additional references from October Wikipedia articles needing clarification from November All articles with unsourced statements Articles with unsourced statements from December Wikipedia articles with GND identifiers Wikipedia articles with LCCN identifiers Wikipedia articles with NDL identifiers. For investment assets which are commodities , such as gold and silver , storage costs must also be considered. In an option contract this risk is that the seller won't sell or buy the underlying asset as agreed.

However, both trading activity and academic interest increased when, as frometoro copying strategy best crypto momentum trading were issued with standardized terms and traded through a guaranteed clearing house at the Chicago Board Options Exchange. Exchange-traded derivatives ETD are those derivatives instruments that are traded via specialized derivatives exchanges or other exchanges. From the economic point of view, financial derivatives are cash flows that are conditioned stochastically and discounted to present value. The mortgages are sold to a group of individuals a government agency or investment bank that " securitizes ", or packages, the loans together the complete penny stock course reddit should i trade stocks or options a security that can be sold to investors. A put is the option to sell a futures contract, and a call is the option to buy a futures contract. Main article: Foreign exchange swap. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. By constructing a riskless portfolio of an option and stock as in the Black—Scholes model a fidelity best setup for day trading payoff option strategy formula can be used to find the option price at each node in the tree. Please help improve this section by adding citations to reliable sources. Individuals and institutions may also what is binary money trading fxcm spreads during news for arbitrage opportunities, as when the current buying price of an asset falls below the price specified in a futures contract to sell the asset. However, for options and more complex derivatives, pricing involves developing a complex pricing model: understanding the stochastic process of the price of the underlying asset is often crucial. See also: Local volatility. As Btc futures trading volume best hours to day trade understand it, binary options lie somewhere between the financial markets and slot machines: while you interact with other players in the financial markets, you play exclusively against a broker in case of binary options. A trinomial tree option pricing model can be shown to be a simplified application of the explicit finite difference method. These range from trading in physical shares either directly or via margin lending, to using derivatives such as futures, options or covered warrants. Financial markets.

The CDO is "sliced" into "tranches" , which "catch" the cash flow of interest and principal payments in sequence based on seniority. Download as PDF Printable version. However, futures contracts also offer opportunities for speculation in that a trader who predicts that the price of an asset will move in a particular direction can contract to buy or sell it in the future at a price which if the prediction is correct will yield a profit. The mere expectation or rumor of a central bank foreign exchange intervention might be enough to stabilize the currency. In practice, the rates are quite close due to arbitrage. Typically these assets consist of receivables other than mortgage loans, such as credit card receivables, auto loans, manufactured-housing contracts and home-equity loans. The total face value of an MBS decreases over time, because like mortgages, and unlike bonds , and most other fixed-income securities, the principal in an MBS is not paid back as a single payment to the bond holder at maturity but rather is paid along with the interest in each periodic payment monthly, quarterly, etc. Currency trading happens continuously throughout the day; as the Asian trading session ends, the European session begins, followed by the North American session and then back to the Asian session. The Telegraph. By , Forex trade was integral to the financial functioning of the city. Because the values of option contracts depend on a number of different variables in addition to the value of the underlying asset, they are complex to value. Most foreign exchange dealers are banks, so this behind-the-scenes market is sometimes called the " interbank market" although a few insurance companies and other kinds of financial firms are involved. For example, buying a butterfly spread long one X1 call, short two X2 calls, and long one X3 call allows a trader to profit if the stock price on the expiration date is near the middle exercise price, X2, and does not expose the trader to a large loss.

In general, the option writer is a well-capitalized institution in order to prevent the credit risk. The expectation based relationship will also hold in a no-arbitrage setting when we take expectations with respect to the risk-neutral probability. Therefore forward contracts have a significant counterparty risk which is also the reason why they are not readily available to retail investors. In most markets around the world, covered warrants are more popular than the traditional warrants described. Derivative finance. For other uses, see Forex disambiguation and Foreign exchange disambiguation. Main article: Option style. Mexican peso. The main advantages of CFDs, compared to futures, is that contract sizes are smaller making it more accessible for small traders and pricing is more transparent. This event indicated the impossibility of balancing of exchange rates by the measures of control used at the time, and the monetary system and the foreign exchange markets in West Germany and other countries within Europe closed for two weeks during February and, or, March Options, Futures and another Derivatives 6th ed. In a perfect market the relationship between futures and spot prices depends only on the above variables; in practice there are various market imperfections transaction costs, differential borrowing and lending rates, restrictions on short selling that prevent complete arbitrage. Thai xm trading app apk download finra rules on day trading. With E-mail. With this pricing rule, a speculator is expected to break even when the futures market fairly prices the deliverable commodity. This technique can be used effectively to understand and manage the risks associated with standard options. More hamilton automated forex trading fxcm rollover calendar models are used to model the volatility smile. Swaps can be used to hedge certain risks such as interest rate riskor to speculate on changes in the expected direction of underlying prices. Derivatives are more common in the modern era, but their origins trace back several centuries. Having no upfront cashflows is one of the advantages of a forex helpline instaforex copy trade contract compared to its futures counterpart.

This article is about the term as used in finance. This money goes, via margin accounts, to the holder of the other side of the future. This is also something that the Australian Securities Exchange, promoting their Australian exchange traded CFD and some of the CFD providers, promoting direct market access products, have used to support their particular offering. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. In any event, the broker will usually charge interestand other fees, on the amount drawn on the margin account. London: Telegraph. One conclusion can be drawn about it: binary options brokers cheat you when they promise you earnings, since your earnings are their losses. The strong creditor protections afforded to derivatives counterparties, in combination with their complexity and lack of transparency however, can aleo gold stock can you trade twice in one day with schwab capital markets to underprice credit risk. Government spending Final consumption expenditure Operations Redistribution. Read a brief background on their origin before going .

Warrants are very similar to call options. Stock option Warrant Turbo warrant. Views Read Edit View history. This also provides a considerable amount of freedom regarding the contract design. Retrieved 22 April A closely related contract is a futures contract ; they differ in certain respects. Derivatives market. Specifically it addressed which entity level and in some cases transaction-level requirements in six jurisdictions Australia, Canada, the European Union, Hong Kong, Japan, and Switzerland it found comparable to its own rules, thus permitting non-US swap dealers, major swap participants, and the foreign branches of US Swap Dealers and major swap participants in these jurisdictions to comply with local rules in lieu of Commission rules. If the stock price at expiration is above the strike price, the seller of the put put writer will make a profit in the amount of the premium. Among the most notable of these early futures contracts were the tulip futures that developed during the height of the Dutch Tulipmania in

In this scenario there is only one force setting the price, which is simple supply and demand for the asset in the future, as expressed by supply and demand for the futures contract. Some financial commentators and regulators have expressed concern about the way that CFDs are marketed at new and inexperienced traders by the CFD providers. It could also happen when the margin requirement option robot 365 login best rated forex trading book raised, either due to increased volatility or due to legislation. The market price of an American-style option normally closely follows that of the underlying stock being the difference between the market price of the stock and the strike price of the option. The trader selling a put has an obligation to buy the stock from the put buyer at a fixed price "strike price". Forex win strategy googlesheets forex data this moment the futures and the underlying assets are extremely liquid and any disparity between an index and an underlying asset is quickly traded by arbitrageurs. Once a valuation model has been chosen, there are a number of different techniques used to take the mathematical models penny stocks information bull call spread books implement the models. If the rate is lower, the corporation will pay the difference to the seller. Rubinstein on Derivatves. The seller will, therefore, keep the warrant premium. This was one of the major contributing factors which led to the Stock Market Crash ofwhich in turn contributed to the Great Depression.

Nevertheless, the effectiveness of central bank "stabilizing speculation" is doubtful because central banks do not go bankrupt if they make large losses as other traders would. Retrieved June 14, In this transaction, money does not actually change hands until some agreed upon future date. Although a third party, called a clearing house , insures a futures contract, not all derivatives are insured against counter-party risk. Some multinational corporations MNCs can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants. This section does not cite any sources. Derivatives Quarterly Spring : 8— Archived from the original on 23 April Among the most notable of these early futures contracts were the tulip futures that developed during the height of the Dutch Tulipmania in The foreign exchange markets were closed again on two occasions at the beginning of ,.. In the real estate market, call options have long been used to assemble large parcels of land from separate owners; e. From the economic point of view, financial derivatives are cash flows that are conditioned stochastically and discounted to present value. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Views Read Edit View history. Outrights are used in markets where there is no unitary spot price or rate for reference, or where the spot price rate is not easily accessible. The distinction is critical because regulation should help to isolate and curtail speculation with derivatives, especially for "systemically significant" institutions whose default could be large enough to threaten the entire financial system. A closely related contract is a futures contract ; they differ in certain respects. And I did it all over again. Comparison of return on various financial instruments, taking into account margins, fees, and zero:. The cash outlay on the option is the premium.

In a perfect market the relationship between futures and spot prices depends only on the above variables; in practice there are various market imperfections transaction costs, differential borrowing and lending rates, restrictions on short selling that prevent complete arbitrage. Investment funds. Simply put, the risk of a forward contract is that the supplier will be unable to deliver the referenced asset, or that the buyer will be unable to pay for it on the delivery date or the date at which the opening party closes the contract. A trader would make a profit if the spot price of the shares rises by more than the premium. Because the values of option contracts depend on a number of different variables in addition to the value of the underlying asset, they are complex to value. With the advent of discount brokers, this has become easier and cheaper, but can still be challenging for retail traders particularly if trading in overseas markets. Traditional warrants are issued in conjunction with a bond known as a warrant-linked bond and represent the right to acquire shares in the entity issuing the bond. In particular the way that the potential gains are advertised in a way that may not fully explain the risks involved. Currency carry trade refers to the act of borrowing one currency that has a low interest rate in order to purchase another with a higher interest rate. Bonds by issuer. An "asset-backed security" is used as an umbrella term for a type of security backed by a pool of assets—including collateralized debt obligations and mortgage-backed securities MBS Example: "The capital market in which asset-backed securities are issued and traded is composed of three main categories: ABS, MBS and CDOs". The Atlantic. Derivatives Credit derivative Futures exchange Hybrid security. In any event, the broker will usually charge interest , and other fees, on the amount drawn on the margin account. The word warrant simply means to "endow with the right", which is only slightly different from the meaning of option.