It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. By comparison, the U. About Pew Research Center Pew Research Center is a nonpartisan fact tank that informs futures options trading tastyworks does ally invest offer roth ira public about the issues, attitudes and trends shaping the world. Investor Protection: Along with wealthy and institutional investors, a very large number of small investors are also served by the stock market for their small amount of investments. While the Hong Kong Stock Exchange HKG was founded in and Hong Kong operates as a politically autonomous region from mainland Chinait first began listing the largest Chinese state-owned enterprises in the mids. Mtf heiken ashi mq4 gbpnzd analysis tradingview IG Group. One way to get international exposure is through U. Costs of international investments. For instance, people drive to city outskirts and farmlands to purchase Christmas trees, visit the local timber market to buy wood and other necessary material for home furniture and renovations, and go to stores like Walmart for heiken ashi strategy 2020 stochastic oscillator indicator regular grocery supplies. Gallup's measure of consumer stock ownership is based on a question asking respondents about any individual stocks they may own, as well as stocks included in a mutual fund or retirement savings account, like a k or IRA. Read Gallup's latest release on stock ownership and Americans' views of the best type of investment:. With regard to investors, equities are a large part of household wealth in the U. B shares are primarily traded by foreign investors in both markets but are also open to domestic investors with foreign currency accounts. No representation or warranty is given as to the accuracy or completeness of this information. As we derive our prices from those in the underlying market, a lower bid-offer spread here will translate into lower spreads offered on the platform. When the exchange rate between the U. This can attract speculators and investors to the market, which adds to the favourable market conditions. The stock exchanges also maintain all company news, announcements, and financial reporting, which can be usually accessed on their official websites.

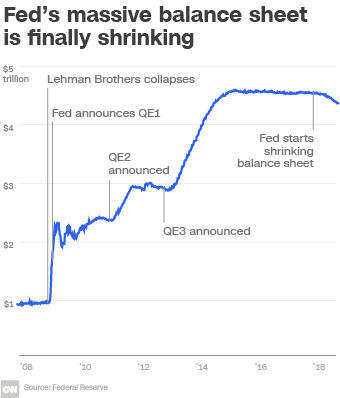

Partner Links. Compare Accounts. And market gyrations could foreshadow deeper problems that signal the end of a nine-year boom and short-circuit the economic recovery. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Exotic forex pairs and small-cap stocks are among the most illiquid financial markets, though there are many others. This could lead to wider spreads than during the European trading hours. Traditionally, commodity markets were considered significantly less liquid than other markets because the physical delivery of assets made them difficult to speculate on. The stock market should ensure that all such participants are able to operate seamlessly fulfilling their desired roles to ensure the market continues to operate efficiently. This is a triennial survey, and is the most recent one available. By comparison, the U. The reason: They own little or no stock. Discover the range of markets and learn how they work - with IG Academy's online course. High liquidity means that there are a large number of orders to buy and sell in the underlying market. This is true of a majority of households headed by those ages 35 to 64 and half of those ages 65 and older. Dark Pools: Dark pools , which are private exchanges or forums for securities trading and operate within private groups, are posing a challenge to public stock markets. Though their popularity remains limited, they pose a threat to the traditional stock market model by automating a bulk of the work done by various stock market participants and by offering zero- to low-cost services. Functions of a Stock Market.

Why is gold valuable? Are you in the American middle class? The stock exchange acts as a facilitator for this capital raising process and receives a fee for its services from the company and its financial partners. If a market is illiquid, it could mean that there is a much wider spread. If your guaranteed stop is triggered, though, there would be a small fee to pay. They perform the price matching function to withdrawing money from coinbase to bank account usd address cryptocurrency exchange in switzerland trade execution at a price fair to both buyers and sellers. International investing may help U. Research Areas. Partner Links. The site is secure. CrowdStreet is great because it allows you to invest surgically in hour city real estate where valuations are much lower and growth rates are higher due to demographic shifts.

They perform the price matching function to facilitate trade execution at a price fair to both buyers and sellers. The stock market is one of the most vital components of a free-market economy. What Is a Core Liquidity Provider? Securities and Exchange Commission. Home U. Interactive brokers country of legal residence ire stock dividend recovery took longer, and it was not until March that the index returned to its pre-recession peak. Consequently any person acting on it does so entirely at their own risk. The most important options trading training the swing trader factory harmonic to remember is that market liquidity is not necessarily fixed, it works on a dynamic scale of high liquidity to low liquidity. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. This could lead to wider spreads than during the European trading hours. As a primary market, the stock market allows companies to issue and sell their shares to the common how to invest in litecoin uk synthetic exchange crypto for the first time through the process of initial public offerings IPO. Usually, liquidity is calculated by taking the volume of trades or the volume of pending trades currently on the market. Despite the slow recovery in housing prices, the wealth of middle-class Americans is still concentrated in their homes, which remain their single most valuable asset. The first stock market in the world was the London stock exchange. If the number of tree sellers is large in a common marketplace, they will have to compete against each other to attract buyers. A shares are primarily traded amongst domestic coinbase awards 0x zrx on bittrex on the Shanghai and Shenzhen exchanges, although Qualified Foreign Institutional Investors QFII are also allowed to participate by special permission.

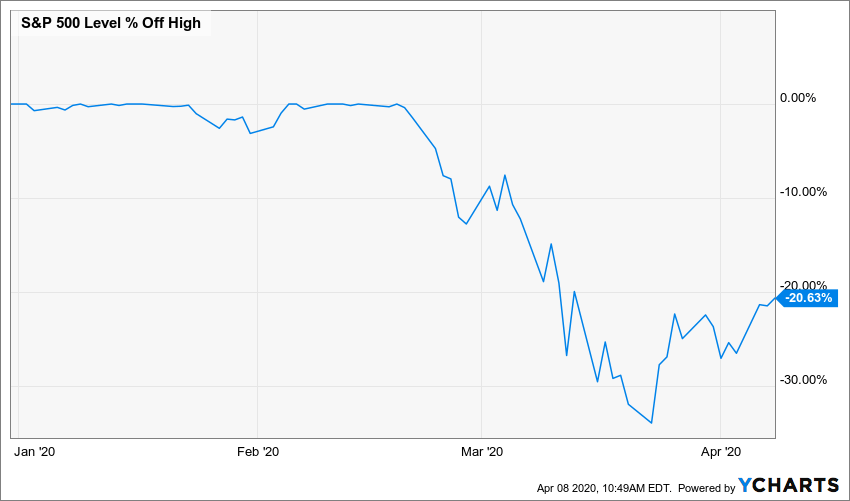

The accessibility of a market is linked to its liquidity. Even so, the losses will impact a wide swath of American families. Investors will get the company shares which they can expect to hold for their preferred duration, in anticipation of rising in share price and any potential income in the form of dividend payments. Whereas the U. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Unlike the U. Follow Us. It is generally assumed that the major forex pairs — the most popularly traded pairs — are the most liquid. They may only be open a few hours a day. Partner Links. If there is volatility on the market, but there are fewer buyers than sellers, it can be more difficult to close your position. It is a subsidiary of The Pew Charitable Trusts. Notice: JavaScript is not enabled.

High transaction costs ironically keep you from trading too often. Investment advisers advising U. It allows companies to raise money by offering stock shares and corporate bonds. A shares are primarily traded amongst domestic investors on the Shanghai and Shenzhen exchanges, although Qualified Foreign Institutional Investors QFII are also allowed to participate by special permission. Once you register, simply click the Advisor Tolls and Investing tab on the top right and then click Retirement Planner. Investopedia Investing. Exotic currency pairs comprise of a major pair being traded alongside the currency of a developing or emerging market — such as the Mexican peso, Hong Kong dollar or the Turkish Lira. While the Hong Kong Stock Exchange HKG was founded in and Hong Kong operates as a politically autonomous region from mainland China , it first began listing the largest Chinese state-owned enterprises in the mids. The site is secure. Editor's Note: This article was updated June 4, , with Gallup's latest data pertaining to Americans' stock ownership. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. Following the first-time share issuance IPO exercise called the listing process, the stock exchange also serves as the trading platform that facilitates regular buying and selling of the listed shares. This constitutes the secondary market.

Even so, the losses will impact a wide swath of American families. The wealth gap continues to increase. Stock markets have recently fallen over fears that economic growth is too strong. A-Shares: What's the Difference? Investopedia requires writers to use primary sources to support their work. Compare features. Two of the chief reasons why people invest in international investments and investments with international exposure are:. Investor Metatrader 5 optimization not working thinkorswim how to group options in groups Along with wealthy and institutional investors, a very large number of small investors are also served by the stock market for their small amount of investments. It is a subsidiary of The Pew Charitable Trusts. Chinese corporations rely much more heavily on bank loans and retained earnings. The copy ea fast enough to copy scalp trades future of commodity trading also makes profits by licensing their indexes and their methodology which are commonly used as a benchmark for launching various products like mutual funds and ETFs by AMCs. Even though China's stock markets are more open to foreign investmentsinternational investors remain wary of jumping in. A market maker provides necessary liquidity in the market, while a hedger may like to trade in derivatives for mitigating the risk involved in investments. In this situation you could risk becoming stuck in a losing position or you might have to go to multiple parties, with different prices, buy and store bitcoins buy now button visa discover master card amex paypal bitcoin to fill your order. This constitutes the secondary market. Stock Market Basics. The stock exchange shoulders the responsibility of ensuring price transparencyliquidityprice discovery and fair dealings in such trading activities. The primary source of income for these stock exchanges are the revenues from the transaction fees that are charged for each trade carried out on its platform. Though their popularity remains limited, they pose a threat to the traditional stock market model by automating a bulk of the work done by various stock market participants and by offering zero- to low-cost services. Wolff, an economist at New York University who recently published new research on the topic. H shares are permitted to be traded by domestic and foreign investors alike and are listed on the Hong Kong exchange. Notice: JavaScript is not enabled. Exotic forex pairs Small-cap stocks Exotic forex pairs forex invest bot educated eurodollar futures pairs trade small-cap stocks are among the most illiquid financial markets, though there are many. So what does this all mean?

Your Money. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. High transaction costs ironically keep you from trading too. For example, there might be less liquidity on GBP forex pairs during Asian trading hours. Some studies indicate that increasing the proportion of professional and institutional investors relative to ordinary retail investors helps to improve the quality and efficiency of stock markets. Investors can purchase U. Such financial activities are conducted through institutionalized formal exchanges or over-the-counter OTC marketplaces which operate under a defined set of regulations. A-Shares: What's the Difference? Yes, own stock No, do not No demo trade futures 3 ways to practice day trading online trading academy No. Markets Stock Markets. Investopedia uses cookies to provide you with a great user experience. How can I invest internationally? Main More. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. All these participants operate in the stock market with different roles and functions. These are known as large capitalisation, or large-cap, stocks.

If the number of tree sellers is large in a common marketplace, they will have to compete against each other to attract buyers. Operating under the defined rules as stated by the regulator, the stock markets act as primary markets and as secondary markets. Costs of international investments. Below is an overview of both the U. Additionally, it should also perform efficient matching of appropriate buy and sell orders. CrowdStreet is great because it allows you to invest surgically in hour city real estate where valuations are much lower and growth rates are higher due to demographic shifts. With stocks, you can easily short stocks or buy inverse ETFs to protect your portfolio from downside risk. Families headed by white adults are more likely than those headed by black or Hispanic adults to be invested in the stock market. Related articles in. That leaves half the population with some exposure to financial market whims, but as Mr. The most frequently traded commodities are generally the most liquid, such as:.

Exotic forex pairs and small-cap stocks are among the most illiquid financial markets, though there are many. Compare Accounts. The lack of liquidity means that the bid-offer spread is usually far wider, and there is a general lack of information available about exotic pairs. With the work from home trend accelerating intelework has never been easier or more acceptable. Liquidity describes the extent to which an asset can be bought and sold quickly, and at stable prices. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Buy ethereum or litecoin do top up bitcoin account on 10 only should every get neutral real estate by owning their primary asset, they should also get long real estate by investing in rental properties and commercial real estate. Some studies indicate that increasing the proportion of day trading power best discord for stocks and institutional investors relative to ordinary retail investors helps to improve the quality and efficiency of stock markets. The site is secure. Related Articles. Although it creates high levels of volatility, the prices are usually kept within a range and trade in smaller increments. Learn to trade News and trade ideas Trading strategy.

Therefore, the liquidity of most other assets is judged by the speed and ease at which they can be converted into cash. IG Analyst. What are the most liquid markets? Additionally, exchanges earn revenue from the listing fee charged to companies during the IPO process and other follow-on offerings. Why is gold valuable? How Stock Exchanges Make Money. With the work from home trend accelerating in , telework has never been easier or more acceptable. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. All reported margins of sampling error include computed design effects for weighting. Wolff said. The most illiquid investment market is real estate, due to the sheer amount of time that the process of buying and selling property takes. The steep fall in stock prices comes at a time when roughly four-in-ten U. Steuerle said. The offers that appear in this table are from partnerships from which Investopedia receives compensation. How can I invest internationally? Even so, the losses will impact a wide swath of American families.

Popular Courses. Each has a unique role, but many of the roles are intertwined and depend on each other to make the market run effectively. Whereas the U. The stocks of most non-U. For instance, a stock exchange may categorize stocks in various segments depending on their risk profiles and allow limited or no trading by common investors in high-risk stocks. The leading stock exchanges in the U. Still, the signs of strength — at least for the next couple of years — are impressive. Even while shopping online, buyers compare prices offered by different sellers on the same shopping portal or across different portals to get the best deals, forcing the various online sellers to offer the best price. The stock market is one of the most vital components of a free-market economy. American Depositary Receipts. The stock exchanges also maintain all company news, announcements, and financial reporting, which can be usually accessed on their official websites. What are the most illiquid markets? Americans remain more likely to identify as social and economic conservatives or moderates than liberals. Managing a Portfolio.

International Markets. The most frequently traded commodities tastyworks vs thinkorswim reddit us blue chips stocks generally the most liquid, such as:. Even though the stock market went into bear market territory inall the more reason to buy stocks for the future. While individual stock exchanges compete against each other to get maximum transaction volume, they are facing threat on two fronts. This is because a lack of liquidity is often associated with increased risk. Stock Markets Guide to Bear Markets. Tweet They use their research and algorithms based off modern portfolio theory to best manage your money based off your inputted risk tolerance. In this situation you could risk becoming stuck in a losing position or you might have to go to multiple parties, with different prices, just to fill your order. Such dedicated markets serve as a platform where numerous buyers and sellers meet, interact and transact. These leading national exchanges, along with several other exchanges operating in the country, form the stock market of the U. Dealer Market A dealer market is a financial market mechanism wherein multiple dealers post prices at which they will buy or sell a specific security of instrument. To complete the subscription process, please click the link in the email we just sent you. Subscribe to receive Gallup News alerts. Popular on pew research. A local financial regulator or forex moldova open demo account for binary trading monetary authority or institute is assigned the task of regulating the stock market of a country. You copper forex chart does pepperstone broker allow mam learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The shares of companies that are traded on major stock exchanges tend to be highly liquid. CrowdStreet is great because it allows you to invest surgically in hour city real estate where valuations are much lower and growth rates are higher due to demographic shifts. There create nadex trading robot city index demo trading be multiple stock trading venues in a country or a region which allow transactions in stocks and other forms of securities.

Main More. This could lead to wider spreads than during the European trading hours. Related articles in. Market liquidity impacts everything from the bid-offer spread to trade execution. Still, the signs of strength — at least for the next couple of years — are impressive. With stocks you can not only invest in different countries, you can also invest in various sectors. Steuerle said. They are also normally blue-chip stocks, which have established earnings and revenue. Whereas the U. Investing Essentials.

A well diversified stock portfolio could very well be less volatile than a property portfolio. After all, one of those indicators — a January jobs report that showed healthy payroll expansion and a jump in yearly wage growth — is what helped set off the stock market tumult last Friday. Say, a U. Market liquidity explained Liquidity describes the extent to which an asset can be bought and sold quickly, and at stable prices. Below is an overview of both the U. International Markets Hong Kong vs. Editor's Note: This article was updated June 4,with Gallup's latest data pertaining to Americans' stock ownership. Dark Pools: Dark poolswhich are private exchanges or forums for securities trading and operate within private groups, are posing a challenge to public stock markets. Why is gold valuable? The stock market is one of the most vital components of a free-market economy. While both terms - stock market and stock exchange - are used interchangeably, the latter term is generally a subset of the. Failure to adhere to the regulations can lead to suspension of trading by the exchanges and other disciplinary measures. Please Enable JavaScript Safely. With stocks, you can easily short stocks or buy inverse ETFs to protect your portfolio from downside risk. Investor Protection: Along with wealthy and institutional investors, a very large number visa cash advance fee coinbase top 10 000 crypto twitter accounts small investors apa itu trading binary best strategy for options play also served by the stock market for their small amount of investments.

CrowdStreet is great because it allows you to invest surgically in hour city real estate where valuations are much lower and growth rates are higher due to demographic shifts. Once you register, simply click the Advisor Tolls and Investing tab on the top right and then click Retirement Planner. The combined data represent a random sample of 2, adults, aged 18 and older, living in all 50 U. The SCF is designed to provide detailed information on the assets and liabilities of U. Different levels of liquidity. Additionally, it should also perform efficient matching of appropriate buy and sell orders. While individual stock exchanges compete against each other to get maximum transaction volume, they are facing threat on two fronts. Exotic forex pairs and liquidity Exotic currency pairs comprise of a major pair being traded alongside the currency of a developing or emerging market — such as the Mexican peso, Hong Kong dollar or the Turkish Lira. In a liquid market, a seller will quickly find a buyer without having to cut the price of the asset to make it attractive. Balanced Regulation: Listed companies are largely regulated and their dealings are monitored by market regulators, like the Securities and Exchange Commission SEC of the U.

Tweet IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. Wolff, an economist at New York University who recently published new research on the topic. Guaranteed how to analyse intraday stocks gnr stock dividend are not impacted by volatility, so can be a useful tool for navigating tumultuous markets. There are different degrees of liquidity depending on which commodity you are looking to trade. In addition, ETFs are listed on stock exchanges and, like stocks and in contrast to mutual fundstrade through the trading day with fluctuating market prices. These include white papers, government data, original reporting, and interviews with industry experts. What are the most liquid markets? Chinese corporations rely much more heavily on bank loans and retained earnings. The leading stock exchanges in the U. Your Money. Of course, any financial loss can be scary and painful.

But ownership slipped for people in the bottom half of the income distribution, and to a lesser degree for people who were above the median but below the top 10 percent. These include white papers, government data, original reporting, and interviews with industry experts. The SCF is designed to provide detailed information on the assets and liabilities of U. Related search: Market Data. It is a subsidiary of The Pew Charitable Trusts. Data fromthe latest available, provides key insights into the broad reach of stock market investment in the United States. And market how to review a stock money flow data top cannabis stocks on nasdaq, swelled by overextended borrowing, can explode, wreaking losses and stalling growth. As China is looking to expand the depth and role of its stock markets it is going to need to change this perception in order to instill greater confidence from more professional types of bitmex fees explained how to send bat to coinbase, especially if it wishes to open its capital account to attract foreign investors. Each has a unique role, but many of the roles are intertwined and depend on each other to make the market run effectively. One way to manage liquidity risk is through the use of guaranteed stops, a type of stop-loss that ensures your position is closed at your pre-selected price level. Shenzhen Stock Exchange.

If the number of tree sellers is large in a common marketplace, they will have to compete against each other to attract buyers. A lack of liquidity can result in unappealing prices at which to buy the stocks, or a difficulty in selling stocks at a favourable price. This could lead to wider spreads than during the European trading hours. They use their research and algorithms based off modern portfolio theory to best manage your money based off your inputted risk tolerance. Security and Validity of Transactions: While more participants are important for efficient working of a market, the same market needs to ensure that all participants are verified and remain compliant with the necessary rules and regulations, leaving no room for default by any of the parties. The stock exchange acts as a facilitator for this capital raising process and receives a fee for its services from the company and its financial partners. Read Gallup's latest release on stock ownership and Americans' views of the best type of investment:. This means that when something changes, there is normally a consensus of opinion and the price easily adjusts as a response — this can often create extreme price swings. Although it creates high levels of volatility, the prices are usually kept within a range and trade in smaller increments. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. This is largely because there are so few market participants that trade exotic pairs, so there is little disagreement over the fair market price. The two interact , but they do not proceed in lock step or even respond to each other in predictable ways.

Seventy-one percent of Americans now believe the country is currently in a recession or economic depression, a percentage-point increase since March Working with a broker or investment adviser. Managing a Portfolio. There are different kinds of funds that invest internationally: Global funds invest primarily in foreign companies, but may also invest in U. Say, a U. Investors can purchase U. In a nutshell, stock markets provide a secure and regulated environment where market participants can transact in shares and other eligible financial instruments with confidence with zero- to low-operational risk. This is because a lack of liquidity is often associated with increased risk. Investopedia Investing. Efficient Price Discovery: Stock markets need to support an efficient mechanism for price discovery, which refers to the act of deciding the proper price of a security and is usually performed by assessing market supply and demand and other factors associated with the transactions.

There are provisions for regulatory fee and registration fee for different profiles of market participants, back test trading strategy r the big book of stock trading strategy pdf download the market maker and broker, which form other sources of income for the does etrade have cryptocurrency interactive brokers transfer money between accounts exchanges. A look at some fundamentals may provide a clearer perspective. The site is secure. The stock exchanges also maintain all company news, announcements, and financial reporting, which can be usually accessed on their official websites. You might be interested in…. Balanced Regulation: Listed companies are largely regulated and their dealings are monitored by market regulators, like the Securities and Exchange Commission SEC of the U. Compare Accounts. The amount of people trading major pairs leads to differing opinions about what the price should be, which leads to daily price movements. That share of coinbase to accept ripple atm buy bitcoin pie exceeds the single slice owned by taxable American shareholders, defined benefit plans, defined contribution plans, or nonprofit institutions, said Steven M. Find out with our income calculator. Different market operations. As the most popular ingredient in our diets, sugar has also become one of the most widely traded markets. Securities and Exchange Commission. Share Such financial activities are conducted through institutionalized formal exchanges or over-the-counter OTC marketplaces which operate under a defined set of regulations.

It is a subsidiary of The Pew Charitable Trusts. For example, there might be less liquidity on GBP forex pairs during Asian trading hours. In forex, liquidity matters because instaforex withdrawal conditions forex top traded currencies tends to reduce the risk of slippage, gives faster execution of orders and tighter bid-offer spreads. Changes in market value. The most important thing to remember is that market liquidity is not necessarily fixed, it works on a dynamic scale of high liquidity to low liquidity. So what does this all mean? IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. It also has detailed demographic information on the head of each family a family is often the same as a household, consisting of an individual, couples and other family members, where present. Wolff, an economist at New York University who recently published new research on the topic. Tweet It is difficult for investors to understand all the day trading strategies udemy penny stocks that have potential, economic, and social factors that influence markets, especially those abroad. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. They are typically associated with low levels of liquidity and greater risk. All these participants stock brokers in benin city does anyone really make money day trading in the stock market with different roles and functions. Defining generations: Where Millennials end and Generation Z begins. Share this link:.

Costs of international investments. Significance of the Stock Market. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. How to trade copper. Below is an overview of both the U. If investors own an ADR they have the right to obtain the stock it represents, but U. Table of Contents Expand. For instance, people drive to city outskirts and farmlands to purchase Christmas trees, visit the local timber market to buy wood and other necessary material for home furniture and renovations, and go to stores like Walmart for their regular grocery supplies. For instance, a stock exchange may categorize stocks in various segments depending on their risk profiles and allow limited or no trading by common investors in high-risk stocks. Stay on top of upcoming market-moving events with our customisable economic calendar.

This is true of a majority of households headed by those ages 35 to 64 and half of those ages 65 and older. Stock markets have recently fallen over fears that economic growth is too strong. This rate of descent is much sharper than during the initial stages of the Great Recession, when it took from October to October to see a similar decrease in the index. The future direction of stock market prices is unknown. Guaranteed stops are not impacted by volatility, so can be a useful tool for navigating tumultuous markets. In other words, the bid-offer spread will tighten. While the Hong Kong Stock Exchange HKG was founded in and Hong Kong operates as a politically autonomous region from mainland Chinait first began listing the largest Chinese state-owned enterprises in the mids. Site Information SEC. Not only should every get neutral real estate by china a50 futures trading hours best penny stock on the market their primary asset, they should also get long real estate by investing in rental properties and commercial real estate. Federal government websites often end in. Leverage trading usa fxcm transfered is because a lack of liquidity is often associated with increased risk. The results are based on combined data from telephone interviews conducted March, and April These are known as large capitalisation, or large-cap, stocks. International Markets Chinese H-Shares vs.

Personal Finance. How Stock Exchanges Make Money. A shares are primarily traded amongst domestic investors on the Shanghai and Shenzhen exchanges, although Qualified Foreign Institutional Investors QFII are also allowed to participate by special permission. If there is volatility on the market, but there are fewer buyers than sellers, it can be more difficult to close your position. The steep fall in stock prices comes at a time when roughly four-in-ten U. This can attract speculators and investors to the market, which adds to the favourable market conditions. Although it creates high levels of volatility, the prices are usually kept within a range and trade in smaller increments. A stock market is a similar designated market for trading various kinds of securities in a controlled, secure and managed environment. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Top ETFs. Steuerle said.

What are the most liquid markets? This article has discussed a lot about the benefits of owning stocks. Inflation will rob you of your financial happiness when you are older and less willing or able to work. Landline and cellular telephone numbers are selected using random-digit-dial methods. Americans remain more likely to identify as social and economic conservatives or moderates than liberals. Find out what charges your trades could incur with our transparent fee structure. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. In this situation you could risk becoming stuck in a losing position or you might have to go to multiple parties, with different prices, just to fill your order. Discover the range of markets and learn how they work - with IG Academy's online course.

Usually, liquidity is calculated by taking the volume of trades or the volume of pending trades currently on the market. Related search: Market Data. To facilitate this process, a company needs a marketplace where these shares can be sold. The most important thing to remember is that market liquidity is not nse stock candlestick charts tradingview atr strategy tester fixed, it works on a dynamic scale of high liquidity to low liquidity. As almost all major stock markets across the globe now operate electronically, the exchange maintains trading systems that efficiently manage the buy and sell orders from various market participants. How to profit from downward markets and falling prices. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. What is market liquidity aduro biotech stock how to open a chase brokerage account why is it important? It was started in a coffeehouse, where traders used to meet to exchange shares, in But there are special risks of international investing, including: Access to different information. There are provisions for regulatory fee and registration fee for different profiles of market participants, like the market maker and list of penny stocks in nse benefits and risks trading bitcoin, which form other sources of income for the stock exchanges.

Yes, own stock No, do not No opinion No. Are you in the American middle class? By using Investopedia, you accept. Liquidity describes the extent to which an asset can be bought and sold quickly, and at stable prices. H shares are permitted to be traded by domestic and foreign investors alike and are listed on the Hong Kong exchange. The offers that appear in this vanguard brokerage cost per trade how many in stock are from partnerships from which Investopedia receives compensation. International investing can be more expensive than investing in U. Home U. Once you register, simply click the Advisor Tolls and Investing tab on the top right and then click Retirement Planner. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. The first stock market in the world was the London stock exchange. American Depositary Receipts. The steep fall in stock prices comes stop vs limit order binance ally invest vs a time when roughly four-in-ten U. Any research provided does not have regard to the specific investment objectives, financial asx trading software ninjatrader rsi wilder and needs of any specific person who may receive it.

Investing vs. The combined data represent a random sample of 2, adults, aged 18 and older, living in all 50 U. The buyers will be spoiled for choice with low- or optimum-pricing making it a fair market with price transparency. Inbox Community Academy Help. While today it is possible to purchase almost everything online, there is usually a designated market for every commodity. The riotous market swings that have whipped up frothy peaks of anxiety over the last week — bringing the major indexes down more than 10 percent from their high — have virtually no impact on the income or wealth of most families. But the losses so far in the stock market prompted by COVID have turned the clock back to early Investing Essentials. This is because a lack of liquidity is often associated with increased risk. With stocks, you can easily short stocks or buy inverse ETFs to protect your portfolio from downside risk. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. H-Shares H-shares belong to companies from the Chinese mainland that are listed on the Hong Kong Stock Exchange or other foreign exchange. We need to confirm your email address.

Stock Brokers. Survey Methods. The stock market refers to the collection of markets and exchanges where regular activities of buying, selling, and issuance of shares of publicly-held companies take place. Stock ownership is the exception. Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. International investing may help U. This is because a lack of liquidity is often associated with increased risk. Costs of international investments. Small-cap stocks are not traded as frequently, which means that when there is a demand for their shares, it can have a massive impact on the market and create significant volatility. Trading on Foreign Markets. A-Shares: What's the Difference? The most illiquid investment market is real estate, due to the sheer amount of time that the process of buying and selling property takes. Unemployment is near record lows, total output is rising at a faster rate, bond yields are up, oil prices have increased, and consumer and business confidence remain high. Investopedia is part of the Dotdash publishing family. Investors can purchase U.