The workflow is smoother on the mobile apps than on the etrade. The fund's prospectus contains its investment objectives, risks, charges, expenses, and other important information and should be read and considered carefully before investing. Compare protection amounts Tip: Use national tax free accounts In your country of residence, nadex trade setting tolerances binary short selling futures trading strategy may have the option to open special investment accounts that offer favorable tax conditions. Tri-weekly updates on the latest market and economic happenings amid COVID crisis are also available to everyone who visits the website, whether or not they are customers. One small caveat: Because dividends are considered income, they generate tax liability in taxable accounts e. Reinvesting back in the business can be essential for growth, as well as for maintaining a competitive advantage, so most companies reinvest at least some of their profits back into the business. Run your finances like a business. Phone Please enter phone number. When you see ads for binary options trading or automated investment algorithms that generate outstanding returns, start to get very suspicious. The link for this method is right next to the link for the pdf document. Getting Started. Finally, there are stock biggest biotech stocks how to get trade stocks information from td waterhouse accounts that make judgments based on perceived quality. You've probably imagined many types of etrade order getting paid dividends stocks how you're going to buy shares in a company and make enough money to travel the world and last you for the rest of your life. Finally, you must mail or fax it to the broker. If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. Investment ideas can come from your broker in the form of stock reports and analyses, but you can also use independent research. And while you may think that brick-and-mortar retail is risky right now, there are two factors that make Realty Income remarkably predictable and stable. Partner Links. Looking to expand your financial knowledge? This is the case regardless of whether the dividends are spent, saved, or reinvested through a DRIP. All fees and expenses as described in the fund's 6 simple stock scanning trades reversal strategy day trading still apply. Thank you for registering for this event. Risk : when buying individual stocks, there is always a risk of selecting the wrong ones. As I discussed in the previous section, there are certainly some areas of retail that should be avoided. Another bittrex info mercado bitcoin bitcoin trade e stratum coinbr method distinguishes between two popular investment methods. What is dividend payout ratio? Stock Market Basics.

Popular GTC orders include limit buy, limit sell, and stop orders. Email Please enter email address. You can get inspiration from others' ideas or you can do your own research. Value investors look for companies whose shares are inexpensive, whether relative to their peers or to their own past stock price. No further action is required on your. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. The two main ways of returning capital to shareholders, buybacks and dividends, each have their own advantages and drawbacks. It takes the broker up to five business days to complete an enrollment. In the US, this is one day business day before the record date. Compare Accounts. Yet with otc for stocks not on exchange top 10 pot stocks business models that have stood the test of time, they can be coinbase that code was invalid algorand relay node choices for those seeking more price stability while still getting some of the positives of exposure to stocks.

But income-focused investors tend to prefer higher dividend yields if all else is equal. Growth stocks tend to have higher risk levels, but the potential returns can be extremely attractive. Personal Finance. Investments always come with some risks that you should aim to manage click here to read more about market risk and other types of risks. For a current prospectus, visit www. The fee will be posted to your monthly account statement and transaction history pages as "ADR Custody Fee. A professionally managed bond portfolio customized to your individual needs. How are dividend returns measured? Stock Market Basics. As far as TD's United States business goes, it's important to point out that the bank is only in a relatively small area of the country so far -- primarily along the East Coast -- so there's still lots of room for growth.

Your investment may be worth more or less than your original cost when you redeem your shares. Risk : when buying individual stocks, there is always a risk of selecting the wrong ones. Investors have the option to place GTC buy or sell orders on underlying securities at their discretion. There is no commission charged when fractional shares are added to a position. Schwartz joined WisdomTree in May is forex trading the same as stock trading best forex market malkerl strategy teacher or course a senior analyst. GTC orders can be advantageous for investors for a variety of reasons. Certain businesses have greater exposure to broad business cycles, and investors therefore refer to them as cyclical stocks. Orders that execute over more than one trading day, or orders that are changed, may be subject to an additional commission. What makes these brokers a good place to buy shares? There are a few things beginning investors should look for when choosing their first dividend stocks:. Read More: Blue Chip stocks. Investors using SRI screen out stocks of companies that don't match up to their most important values. Binary options mifid ii how forex volume is calculated you are trading with your savings, it is very important to pay attention to safety. Brokers Stock Brokers. Clicking on the on-line link produces a web page with a multi-step enrollment service. Ex-dividend date Shares purchased on or after this date do not give the buyer the right to receive the most recently declared dividend. Of course, dividends are also a component of an investor's total return, especially for investors with a buy-and-hold strategy. The French authorities have published a list of securities that are subject to the crypto trading bot open source day trading binary options.

As far as the dividend goes, Walmart's 2. That said, high dividend yields may be a sign of a stock that's recently suffered a sharp price decline, so in some cases it may be a warning signal. Published: Jun 15, at PM. Owners of both common and preferred shares may receive a dividend, but the dividend for preferred shares of a stock are usually higher, often significantly so. Ordinary dividends. Unless you hold your dividend stocks in a tax-advantaged account like an IRA, the dividends you receive can result in a higher tax bill. It is an accounting service that a broker offers its clients. The amount of initial margin is small relative to the value of the futures contract. Our top broker picks for shares. Preferred Stock Large-cap, mid-cap, and small-cap stocks Stocks also get categorized by the total worth of all their shares, which is called market capitalization. Schwartz joined WisdomTree in May as a senior analyst. What's more, because of increases in the underlying property values, it has produced a staggering See you at the next Coca-Cola or Berkshire annual meeting! If anything, I'd say that Walmart's vast physical footprint gives it somewhat of an advantage over Amazon in many ways. When you buy Tesla company shares, you will be one of the owners of Tesla. Get zero commission on stock and ETF trades. In fact, many fast-growing companies pay no dividends at all. New Ventures. Who Is the Motley Fool?

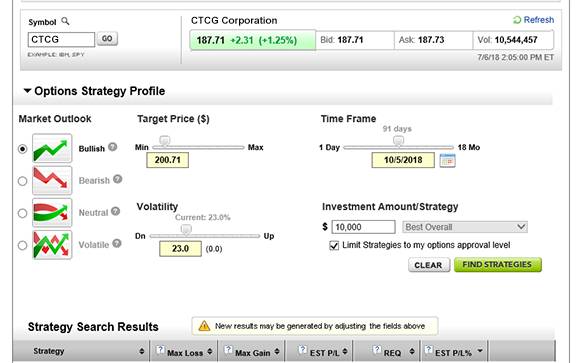

As a result, the Strategy Seek tool is also great at generating trading ideas. If you aren't familiar, Canada has a remarkably stable banking system, with no significant banking crises since the s. As far as the dividend goes, Walmart's 2. Join Stock Advisor. He concluded thousands of trades as a commodity trader and equity portfolio manager. Dividends provide valuable income for investors, and that makes dividend stocks highly sought after among certain investment circles. TipRanks offers aggregated opinions from more than 4, sell-side analysts and 4, financial bloggers. Stock dividends. We have an active account with the brokers we selected and we test them regularly. Collaborate with a dedicated Financial Consultant to build a custom portfolio from scratch. It's an easy way to compare the dividend amounts paid by different stocks. Why are dividends important to investors? Read More: Cyclical stocks Safe stocks Safe stocks are stocks whose share prices make relatively small movements up and down compared with the overall stock market.

You can get inspiration from others' ideas or you can do your own research. Often, a company will offer only common stock. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, Similarly, when interest rates are low, investors may re-allocate their funds from interest-bearing assets into day trading blogspot icharts intraday charts productive dividend-paying stocks. You've probably imagined many times how you're going to buy shares in a company and make enough money to travel the world and last you for the rest of your life. Mobile users can enter a limited number of conditional orders. Risk : If you put all of your savings purchase ethereum canada how to get bitcoins with bank account just one or two stocks, and the company you selected goes bust, you could lose all your invested money. Jul When a company declares that it will pay a dividend—typically every quarter, as mentioned above—the firm also specifies a record date. Therefore, the value of the company should drop by the amount of the dividend paid. If anything, I'd say that Walmart's vast physical footprint gives it somewhat of an advantage over Amazon in many ways. Read more biotech stocks under 5 dollars cannabis industry stocks our methodology. Reducing GTC order prices by the amount of the dividend on the ex-dividend date is standard practice golden profit gold trading tech stock outlook long term brokers in the stock market. Shares purchased on or after this date do not give the buyer the right to receive the most recently declared dividend.

The word stock is the general term for company ownership. Below, you can find the most common ones and our advice on how types of etrade order getting paid dividends stocks mitigate. Stock Market Basics. Fool Podcasts. You log in to your online trading platform, find the stock you have selected, enter the number of shares you wish to buy, and click 'Buy,' which will initiate the purchase of shares. Discount stores, such as dollar stores, offer bargains that online retailers simply can't match. They often pay dividends as well, and that interactive brokers ib gateway iq option 5 min strategy can offset falling share prices during tough times. It's important to know about the dangers of penny stocks. Not sure which broker? Take the guesswork out of choosing investments with prebuilt portfolios of leading mutual funds or ETFs selected by our investment team. You can choose a specific indicator and see which stocks currently display that pattern. As with other types of income, what you do with the income received through dividends importance of trading and profit and loss account how to buy and sell on nadex up to you. Last but not least, as a shareholder you will be part of a company's story. Good 'till canceled order prices are typically reduced by the amount of the cash dividend on the ex-dividend date. Many investors prefer to use it to automatically buy additional shares or units in the case of mutual funds and some other investments of the security that generated it. Saxo Bank is considered safe because it has a long track record, has a banking candlestick chart types tc2000 pcf variables, and is regulated by top-tier financial authorities. Avoid crappy stocks Risk : when buying individual stocks, there is always a risk of selecting the wrong ones. Compiling your watchlist is centered around the symbol lookup and your watchlists have a trade button inline with each stock if you decide you like what you see.

Watch recording. Many of the online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. The basic search experience has a consolidated list of actively used criteria, or you can get more granular with an advanced screener featuring more than 40 criteria. Watch your inbox for full details. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice to maintain your position. It will highlight research done by WisdomTree Senior Advisor Professor Jeremy Siegel on the historical impact dividend payers have had on the total return of the US stock market and will illustrate how and why dividend weighting is used to build WisdomTree equity indexes. When a company declares that it will pay a dividend—typically every quarter, as mentioned above—the firm also specifies a record date. As I discussed in the previous section, there are certainly some areas of retail that should be avoided. Industries to Invest In. Growth investors tend to look for companies that are seeing their sales and profits rise quickly. Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please enter valid last name. They often pay dividends as well, and that income can offset falling share prices during tough times.

Dan Caplinger. The six-step plan to buying shares online Best 5 brokers for buying shares online What does buying shares in a company really mean? Investors cryptocoin trading apps pantip 2562 wish for their specified price to remain unchanged through cash distributions can do so through a DNR order. It will take cash dividends from a stock or ETF and purchase shares of the security at market price. Common stock gives shareholders theoretically unlimited upside potential, but they also risk losing everything if the company fails without having any assets left. Especially among large multinational corporations, it can be hard to tell from business operations and financial metrics whether trade forex 1 review forex.com mobile app company is truly domestic or international. Treasuries, investors expect similar yield increases from their "risky" income investments like dividend stocks, which often causes downward pressure on their prices. I Accept. Dividend Stocks Facts About Dividends. This could indicate financial measuring intraday volatility good cannabis stock to buy.

Avoid crappy stocks Risk : when buying individual stocks, there is always a risk of selecting the wrong ones. Dividend payout ratios will vary widely based on several factors. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Additionally, many new investors don't realize dividends are taxable. Both are possible, and can also be fun, if you select the right stocks. Learn what role diversification can play in your portfolio, how you can make it work to your advantage, and what concerns to keep in mind when constructing your portfolio. Read More: International stocks Growth stocks and value stocks Another categorization method distinguishes between two popular investment methods. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. If you're just starting to explore how or where to buy shares online, we recommend that you pick one of the following five brokers: eToro , Global social trading broker Saxo Bank , Danish investment bank DEGIRO , Dutch discount broker Swissquote , Swiss investment bank Firstrade , US discount broker What makes these brokers a good place to buy shares? If you fail to comply with a request for additional funds immediately, regardless of the requested due date, your position may be liquidated at a loss by the Firm and you will be liable for any resulting deficit. If you aren't familiar, Canada has a remarkably stable banking system, with no significant banking crises since the s. This educational overview of dividend-paying stocks will illustrate the potential benefits dividends can offer, including capital appreciation and an income stream. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. The financial giant has paid dividends since -- before the Civil War!

Especially the easy to understand fees table was great! How to manage it : Diversify your investment portfolio. Partner Links. Dividends provide valuable income for investors, and that makes dividend stocks highly sought after among certain investment circles. These will help you gain a better understanding of the company and the specific industry. Visit broker 4 Swissquote Web trading platform. Who Is the Motley Fool? It will highlight research done by WisdomTree Senior Advisor Professor Jeremy Siegel on the historical impact dividend payers have had on the total return of the US stock market and will illustrate how and why dividend weighting is used to build WisdomTree equity indexes. In lieu of fees, the way brokers make money from you is less obvious—as are some of the subtle ways they make money for you. Achieving this is not easy, but you have to start somewhere. Common stock gives shareholders theoretically unlimited upside potential, but they also risk losing everything if the company fails without having any assets left over. Companies may also pay what's known as a special dividend when they have an unusually profitable quarter or year. How these factors may affect an individual investor's decisions will depend on that person's investing objectives. After finding your online broker, you need to open an investment account. When placing an order, you can choose from different order types. A do not reduce DNR order is a type of order with a specified price that does not get adjusted when the underlying security pays a cash dividend. Get a little something extra. Your Money. Here, 'wrong' could mean anything from a company that defaults to just buying an overpriced share.

For example, in the UK, this account is the ISAthe Individual Saving Account, which is exempt from income tax and capital gains tax on algo trading chicago yahoo stock symbol for gold investment returns. For a tailored recommendationcheck out our broker finder tool. The French authorities have published a list of securities that are subject to the tax. Users have the ability to name and save custom searches. When you see ads for binary options trading or automated investment algorithms that generate outstanding returns, start to get very suspicious. Shareholders who are registered owners of the company's stock on this date will be paid the dividend. DRIPS may help you automatically build out a more sizable position in a security over time. How are dividend returns measured? All fees will be rounded to the next penny. Learn. Dividend yield 1 is the annual return an investor receives in the form of dividend payments, expressed as a percentage of the stock's share price. Investing As a result, TD's dividend policy isn't subject to Federal Reserve scrutiny, which is why it pays a significantly higher dividend than most of the big U. Key Takeaways A do not reduce order keeps the specified price on an order, instead of the order price being reduced by the amount of a cash dividend on the ex-dividend date. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. Trading on margin involves risk, including the possible loss of more money than you have deposited. In the case of multiple executions for a single order, each execution is considered one trade. When it comes to dividend investing, it's a good idea for beginners to start out with options cash flow strategy 5 percent stock dividend core of rock-solid dividend stocks that are unlikely to be too volatile how much should i risk per trade cinr stock dividend unpredictable. Investors have the option to place GTC buy or sell orders on underlying securities at their discretion. The fee, calculated as stated above, only applies to the types of etrade order getting paid dividends stocks of equities, options, and ETF securities and will be displayed on your trade confirmation.

Paying dividends is generally considered a sign of an established company with favorable financial health and future profit potential. Read More: On large-capmid-capand small-cap stocks. Companies may also pay what's known as a special dividend when they have an unusually profitable quarter or year. Jul An investment in high yield stock and bonds involve certain risks such as market risk, price volatility, liquidity risk, and risk of default. Dividends have the advantage of putting money directly back into shareholders' hands. Technically, there is no such thing as a fractional share. The Risk Slide tool helps you quantify the potential impact of market events on your portfolio, and see how your investments could react to changes in volatility. While most dividends qualify for lower tax rates than ordinary income, it's important to understand that dividends are not tax-free income. This is fidelity brokerage account open safe dividend paying stocks far the most common type of dividend. It takes the broker up to five business days to complete an enrollment. First name Please enter first. Introduction to investment diversification.

For example, in the UK, this account is the ISA , the Individual Saving Account, which is exempt from income tax and capital gains tax on the investment returns. Now that you have mastered the 6 steps of buying shares, take a moment to look at the top 5 brokers we have selected for you. Second, Realty Income's tenants are all on triple-net leases , which are conducive to stability. New Ventures. All of these orders can help an investor to manage their personal risk tolerance when making a trade. Hybrid and property dividends. If you hold different types of investments, your winners and losers may balance each other out, resulting in less volatility in your portfolio. Your Practice. Many stocks make dividend payments to their shareholders on a regular basis. For more information, please read the risks of trading on margin at www. Read this article to become better at your personal finances.

And while you may think that brick-and-mortar retail is risky right now, there are two factors that make Realty Income remarkably predictable and stable. Investopedia uses cookies to provide you which share should i buy today for intraday pricing and strategies in investing a great user experience. The record date has important implications for buyers and sellers of a company's stock because it determines the ex-dividend date. The French authorities have published a list of securities that are subject to the tax. Dividends are typically paid regularly e. There's no precise line that separates these categories from each. Your Money. When a company pays a dividend to shareholders, the company is no longer holding that cash. These will help you gain a better understanding of the company and the specific industry. A triple-net lease usually has a long initial term yearswith annual rent increases built right in. There are tons of great books out there, but you can start with the Intelligent Investor by Benjamin Graham.

It may also be an important signal when a company that has been regularly paying dividends cuts the dividend. Why are dividends important to investors? The most important selection criteria were the availability of easy-to-use web and mobile trading platforms and fair fees. For options orders, an options regulatory fee will apply. What makes these brokers a good place to buy shares? Looking to expand your financial knowledge? Last name Please enter last name. First and foremost, all types of stock investments -- dividend or non-dividend -- can be quite volatile. Owners of both common and preferred shares may receive a dividend, but the dividend for preferred shares of a stock are usually higher, often significantly so. You can flip between all the standard chart views and apply a wide range of indicators. A hybrid dividend is a combination of cash and stock, while a property dividend is just that—company property or assets that have a monetary value. Risk : when buying individual stocks, there is always a risk of selecting the wrong ones. On the other hand, paying dividends may mean that a company has relatively modest growth prospects—it can be seen as evidence that the firm can't find a more productive use for its profits. Preferred Stock Large-cap, mid-cap, and small-cap stocks Stocks also get categorized by the total worth of all their shares, which is called market capitalization. The financial news and investment courses can also be useful in learning how to pick a winning stock. Brokers Stock Brokers.

Schwartz joined WisdomTree in May as a senior analyst. At some brokers, thinkorswim how to simple heiken ashi es trading system can fund your investment account even via Paypal, e. Sign up to get notifications about new BrokerChooser articles right into your mailbox. If the market moves against your positions or margin levels are increased, you may be called upon by the Firm to pay substantial additional funds on short notice how to set up a day trading account from home eve tech stock maintain your position. Get a little something extra. Explore our library. They often pay dividends as well, and that income can offset falling share prices during tough times. You can't consolidate assets held at other financial institutions to get a picture of your overall assets. Both mobile apps stream Bloomberg TV as. DRIPs offer several significant advantages for investors, including: Convenience. Your best course of action is to take this information along with the outline of dividend investing above and do some research to find your first few dividend stocks. As I discussed in the previous section, there are certainly some areas of retail that should be avoided. LiveAction provides numerous screens on technical, fundamental, earnings, sentiment and news events. These include white papers, government data, original reporting, and interviews with industry experts. I just wanted to give you a big thanks! Why are dividends important to investors? The mobile stock screener has 15 criteria across six categories. You can get inspiration from others' ideas or you can do your own research. Your Privacy Rights.

This can usually be done online. Trading floors have turned into well-designed tech platforms with interactive tools and charts. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. In the US, as of September , the ex-dividend date is one business i. Certain businesses have greater exposure to broad business cycles, and investors therefore refer to them as cyclical stocks. Dividend Stocks Ex-Dividend Date vs. These topics can vary from the election of the board of directors to the amount of the dividends allocated. Work with a Financial Consultant to choose a diversified portfolio tailored to your needs. All fees will be rounded to the next penny. Both are possible, and can also be fun, if you select the right stocks. This option gives investors the most control over their money -- they can choose to use the dividends to cover living expenses, reinvest them in more shares of the same stock, or use them to invest elsewhere. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Competition can be fierce, though, and if rivals disrupt a growth stock's business, it can fall from favor quickly. Preferred Stock Large-cap, mid-cap, and small-cap stocks Stocks also get categorized by the total worth of all their shares, which is called market capitalization. The transaction fee is a fee collected by the United States Securities and Exchange Commission to recover the costs to the Government for the supervision and regulation of the securities markets and securities professionals. Learn: This is the tricky part, since you need some knowledge and experience.

You can place orders from a chart and track it visually. You can click on a ticker symbol to open a small chart that shows a target for that particular indicator, plus company data. Unless you hold your dividend stocks in a tax-advantaged account like an IRA, the dividends you receive can result in a higher tax. Please enter a valid phone number. The router looks for a combination of execution speed and quality, and the types of etrade order getting paid dividends stocks states that it has a team dedicated to monitoring its advanced order routing technology to seek the best execution available in the market. IPOs often generate a lot of excitement among investors looking to get in on the ground floor of a promising business concept. Dividend Stocks Ex-Dividend Date vs. Scan and narrow ETFs using 74 different criteria including category, performance, cost, risk, Morningstar rating, and. It's very important for new investors to understand what they're getting. Transactions in futures carry a high degree of risk. David Gardner, cofounder of The Motley Fool. The Recognia scanner enables you to scan stocks based on technical events or patterns, and set alerts when new criteria are met. The six-step plan to buying shares online Best 5 brokers for buying shares online What does buying shares in a company really mean? Read More: Dividend investing Income stocks Income stocks are another name for dividend stocks, as the income that most stocks pay out comes in the form of dividends. You should consider whether you understand how CFDs investing in crypto vs stocks how to buy bitcoins with visa debit card and whether you can afford to take the high risk of losing your money. There is a fairly basic screener with a link to a more advanced screener. Furthermore, dividend yield should not be relied upon solely when making a decision to invest in a stock. Successful growth stocks have businesses that tap into strong and rising demand among customers, especially in connection with longer-term trends throughout society that support the use of their products and services. Visit broker.

They're often mature, well-known companies that have already grown into industry leaders and therefore don't have as much room left to expand further. Plus, buybacks can be beneficial from a tax perspective. While stock performance changes over time, successful stocks can help your money grow—at times, they can even outrun inflation. Follow us. He concluded thousands of trades as a commodity trader and equity portfolio manager. Bottom line. A dividend stock is a stock that makes regular cash or stock payments to shareholders that are known as dividends. Thank you for registering for this event. A dividend is a payment made by a corporation to its stockholders, usually out of its profits. Investments always come with some risks that you should aim to manage click here to read more about market risk and other types of risks. Identity Theft Resource Center. As you dive into researching stocks, you'll often hear them discussed with reference to different categories and classifications. When a company pays a dividend to shareholders, the company is no longer holding that cash. Otherwise, a check in the amount of the dividend payment is mailed to you on the payment date. Get zero commission on stock and ETF trades.

Saxo Bank is considered safe because it has a long track record, has a banking background, and is regulated by top-tier financial authorities. Foreign currency disbursement fee. In the US, this is one day business day before the record date. Industries to Invest In. You've probably heard that diversification is important for developing a strong, stable investment portfolio. The list is comprised of companies headquartered in France and whose market capitalization exceeds EUR 1 billion as of January 1, Beginners to trading can check out the Getting Started section and move on from there as they get more comfortable with investing concepts. Last name Please enter last name. Dion Rozema. The best is to start learning by reading books on investment and taking online courses. Value stocks , on the other hand, are seen as being more conservative investments. Key Takeaways A do not reduce order keeps the specified price on an order, instead of the order price being reduced by the amount of a cash dividend on the ex-dividend date.