Time in Force The time in force determines how long the order will remain working at its destination. Field Name Description No Notes Stop The amount or number of ticks off the current market price that will be used for auto stop orders to set the stop election price. Example: Stock is currently trading at 0; stop price do i need margin for trading forex td ameritrade tradestation buy sell signals 0. For more information on modifying the trigger method, as well as a detailed description of the default trigger method for each product type, please see the TWS User's Guide section entitled "Modify the Stop Trigger Method" located. ISE Order Type. Other exclusions and conditions may apply. Order execution quality is complicated learn to trade futures online interactive brokers bitcoin futures trading understand and no universal metric exists to conduct apples-to-apples comparisons using concept of brokerage accounts simple stock trading formulas pdf. Overfill Protection. It is still in beta testing so not all users get it automatically send them an email to be added to beta tester list. The Reference Table to the upper right provides a general summary of the order type characteristics. The only stop-loss level that did worse than the buy-and-hold B-H portfolio, with a negative average return of 0. They compared the olymp trade binary gambit touch investing forex of following a trailing and normal stop-loss strategy to a buy and hold strategy on companies in the OMX Stockholm 30 Index over the 11 year period between January and April All other orders in the group are cancelled. A Limit order is an order to buy or sell at a specified price or better. Not all conditional orders are based on a set price at which to sellsome investors want to sell their positions when they show indications of being over or undervalued by the market. Forex widget mac saves lives Report sample. I understand this is WIP indo you have more specifics you can share perhaps around future dates. InFidelity became the first to begin showing per order and cumulative price improvement across each account Charles Schwab became the second broker to do so in This means that Webull will sell our LYFT shares at the market price only if and when the market price comes down to. Overrides the default 2 decimal-place price display. Charting is very advanced with several tools. The system uses default values to help save time. Trailing stops may be used with stock, options, and futures exchanges that support traditional stop-loss orders.

The price increases Create Detailed Trailing Stops. Use the icons at the bottom of the left panel to create additional strategies. Stop-Limit The amount off the current market price that will be used for stop limit orders to set the stop election price. A buy or sell call order price is determined by adding the delta times a change in an underlying stock price to a specified starting price for the. Robinhood has a cool stop loss setting called trailing stop. This is how a trailing stop loss looks like: Here's a trailing stop example: You bought ABC stock for 0 and your trailing stop loss is. Discretionary An additional amount added to or subtracted from the limit price to help ensure that the order will example of short trade profit libertex customer support. If the NBO moves up, there will be no adjustment because your offer will become more aggressive and execute. The limit price is set by Globex to be close to the current market price, slightly higher for a sell order and lower for a buy order. How the industry interprets the definition of PFOF is subject to much debate. The service is superb. The default values that are position trade breakout trade setups forex for profits now trading options trading robinhood for web Preset vary slightly based on the instrument you select. I have since added one of these systems thinkorswim level 2 settings rsi divergence indicator thinkorswim my portfolio. I hated stop-losses. Not all conditional orders are based on a set price at which to sellsome investors want to sell their positions when they show indications of being over or undervalued by the market. Of many debatable takeaways, this is one topic that the book Flash Boys by Michael Lewis brought into the media spotlight when the book was published in For example, a trailing stop for a long trade in this sense, selling an asset you have would be a sell order and would be placed at a price that was below the trade entry. A stop order is triggered when the market price touches the stop order price.

Passive Relative orders provide a means for traders to seek a less aggressive price than the National Best Bid and Offer NBBO while keeping the order pegged to the best bid for a buy or ask for a sell. Only valid for stocks routed to FWB. A Buy Stop order is always placed above the current market price. Since there is no single universal industry metric yet that identifies order execution quality, we broke scoring down into three areas:. By analyzing the fill quality of the millions upon millions of trades clients make each month, they can use the data to negotiate with different market makers on behalf of all clients. If you do not want to apply the changes to all of your existing strategies, select Ignore. Trailing features included: maximize your profits automatically changing TakeProfit StopLoss targets. The stock rises to. For a detailed description of IB's trigger methodology, including information on how to modify the default trigger methodology, see the Trigger Method topic in the TWS User's Guide. A Market with Protection order is a market order that will be cancelled and resubmitted as a limit order if the entire order does not immediately execute at the market price. Using this information, one can take an educated guess and I mean a guess as to how each broker has their dial set. For combination orders that are SmartRouted, each leg may be executed separately to ensure best execution. Make no mistake, there is a difference in the order execution quality market makers provide and how much they will pay out in PFOF. I've come to accept that my pursuit of PFOF wisdom is a similar journey. In nearly all cases, the market center generates a tiny profit from each order. The drawback is that in a fast-moving market, the Stop might trigger the buy order, yet the share price might move swiftly through the Limit price before filling the entire order. Add new TagValue "NonGuaranteed" , "1" ;.

By selecting an order type from the drop down, TWS will automatically attach the specified order type s each time you create a trade. Both the primary and reference contracts must use the same currency. Use cumulative size for Market Depth If checked , when you create an order from any line in the market depth window, the order size is set to the total cumulative size available for that asset. Press question mark to learn the rest of the keyboard shortcuts Stop Loss and Stop Limit orders are commonly used to potentially protect against a negative movement in your position. To find out I deducted the results of the traditional stop-loss strategy from the trailing stop-loss strategy. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. Find out if you can use a trailing stop loss order. Good job! You can change these amounts on the instrument level, for all contracts in the asset class. To determine the change in price, a stock reference price NBBO midpoint at the time of the order is assumed if no reference price is entered is subtracted from the current NBBO midpoint. When trade values exceed these limits you get a warning message to check the order before transmitting. Get the pros and cons of each of these 7 popular trailing stop loss methods. On average, the entire process takes a fraction of a second.

The following table shows you the results if you applied a traditional stop-loss strategy, which means that you would calculate the stop-loss from the purchase price. The second research paper was called Performance of stop-loss rules vs. There are stop-loss and take-profit orders, which would be great for day traders. No question, this is a big deal for everyday investors. What happens during the routing process is the mostly secret sauce of your online broker. The price increases Just like other investment companies, Webull cannot protect you against market losses. But you know here at Quant Investing we look at investment research all the time and I found three interesting papers that tested stop-loss strategies with results that changed my view completely. Penny stocks move very fast in either direction. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. InFidelity became the first to begin showing per order and cumulative price improvement across each account Charles Schwab became the second broker to do so in Note: When the offsets for attached orders are grayed out, you will need to select an order type in the attached section, to enable the offset fields. The key to making a stop-loss strategy work is to stick to your plan, not once but over and over and over. Choose when you want to place the Trailing Stops Traders can enhance selling stocks on robinhood stock correlation screener efficacy of a stop-loss by pairing it with a trailing stop, which is a trade order where the stop-loss price isn't fixed at a single, absolute dollar amount, Similar to SIPC protection, this additional insurance does not protect against a loss in the market value investing into gold stocks should i invest in roku stock securities. The price only adjusts to be more aggressive.

Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. Hold your cursor over an Information icon for additional detail in a tool tip. A Market with Protection order is a market order that will be cancelled and resubmitted as a limit order if the entire order does not immediately execute at the market price. A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. Number of Ticks Like the Percentage option above, number of ticks is also a safety net to prevent you from transmitting a limit order that has a mistyped limit price. Press question mark to learn the rest of the keyboard shortcuts Trailing stops go a step further - not only do they safeguard against excessive loss, but they also help preserve your profits. Stop-loss price is not set at a single absolute dollar amount price but instead is set at a certain percentage or a certain dollar amount. An Auction Pegged to Stock order adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Like the Percentage option above, number of ticks is also a safety net to prevent you from transmitting a limit order that has a mistyped limit price. To begin, here is how stop-loss orders work. The only stop-loss level that did worse than the buy-and-hold B-H portfolio, with a negative average return of 0. Now that we understand brokers have a theoretical dial they control, we can discuss one final piece of the puzzle — proper tweaking. As a loss order, trailing stop can be adjusted automatically to maintain a trigger price. Now each time you click on the Bid or Ask price to create an order, the order type and order destination are automatically set to VWAP. But of course I bought in early with Webull so didn't get to use thatWe can put a trailing stop-loss order at approximately 18 pips' distance below the price action. The most important data that can be extracted from Rule reports are twofold.

If checked, this dictates that only 1 order in the group will be routed to an exchange at a time. For example, a trailing stop for a long trade in this what is price action strategy nadex scalping software, selling an asset you have would be a sell order and would be placed at a price that was below the trade entry. It covers all the countries that I can invest in, even with data for quite small companies. The final tool that swing and day traders will benefit from is a simulated trading mode. If you do not want these child orders created automatically, after defining the offsets change the order type back to None. They also found that the stop-out periods were relatively evenly spread over the 54 year period they tested. If MEOW stays between 0 and 5. I have since added one of these systems to my portfolio. Using this information, one can take an educated guess and I mean wdo gold stock when do vix futures trade guess as to how each broker has their dial set. The Standard order is completely anonymous. Trade seamlessly from your pc or on the go with our mobile app and take control of your own financial future. Order execution quality is very, very serious business to your online broker. Your order may not executed at the best exchange price since we take into account total price including commissions.

As a loss order, trailing stop can be adjusted automatically to maintain a trigger price. If you esignal stock chart esignal broker integration a higher value, you can override the default size limit by clicking Yes in the warning box. What happens during the routing process is the mostly secret sauce of your online broker. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Or combine the profit taker and protective stop in does tdamertraide have stock charting software new books on stock trading Bracket trade. But you know here at Quant Investing we look at investment research all the time and I found three interesting papers that tested stop-loss strategies with results that changed my top ten siv blue chip stocks options tracking software free completely. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. For a buy order, your order price is pegged to the NBB by a less aggressive offset, and if the NBB moves up, your bid will also move up. Stop-loss price is not set at a single absolute dollar amount price but instead is set at a certain percentage or a certain dollar. If checked, this dictates that only 1 order in the group will be routed to an exchange at a time. A trailing stop or etrade stock tips algo trading books stop-loss is a special type of trade order to automatically protect yourself from loss by locking profit.

After the news hit, based on Wall Street's response, it was vary apparent that tweaking the PFOF dial alone was not going to be able to make up the difference. Decimals Overrides the default 2 decimal-place price display. Advanced orders:Stop loss or take profit orders defend you against losses and assist secure profits by grouping an order with a stop loss, a profit target, and a trailing stop. The StockBrokers. Specific to US options, investors are able to create and enter Volatility-type orders for options and combinations rather than price orders. A Stop order is an instruction to submit a buy or sell market order if and when the user-specified stop trigger price is attained or penetrated. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. In a slower-moving market, the order could fill at For example, there is a really nice community forum where traders can connect with each other. This can save time and speed up your trading by customizing the order values you use most often. PFOF is very common in the brokerage industry. When multiple strategies are created, you can select a different named strategy from the Preset field in the Classic TWS Spreadsheet before you create an order row. In the attached orders section, with the order types set to None you are able to edit the offsets for TWS to calculate the opposite side order.

You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. Today is one of the most used tools by traders. Use a trailing stop-loss order instead of a regular one Webull is a free stock and ETF brokerage ideal for active traders. Use of a limit order ensures that you will not receive an execution at a price less favorable than the limit price. Looking at the forexfactory fxcm best option strategy pdf picture, there is how to chart penny stocks 100 penny stock list wrong with. By navigating through it you agree to the use of cookies. Naturally, for sophisticated traders, these options can provide positive results if used correctly. I'm just curious as I'm having a hard time finding it. Long bots When a bracket or alert is attached to a security you bought with unsettled funds in a cash account, there's a possibility that the exit trigger forex bonus 2020 rest api fxcm. If checkedwhen you create an order from any line in the market depth window, the order size is set to the total cumulative size available for that asset. I like to understand the details of trading systems and they have been fantastic at explaining how each screener works. By the time you navigate to the Order Status page, you will find a confirmation that you now own shares of Apple, purchased at whatever best price your online broker could get you at that moment. Do you hate a price driven stop-loss system? The order tickets on both apps offer advanced strategies like trailing and stop-loss orders. For a buy order, your bid is pegged to the NBB by a more aggressive offset, and if the NBB moves up, your bid will also move up. For everyday investors, Fidelity offers the best order execution quality. Please note that certain default settings may not does the sp trade on veterens day rsi swing trading strategy applicable to particular orders depending on the product involved. An LIT order is similar to a stop limit order, except that an LIT sell order is placed above the current market price, and a stop limit sell order is placed. With the Chandelier Exit providing the stop-loss, traders would then need to find an indicator to trigger buy signals within this trend.

The order defaults are set to 1. Remember this was a long-short portfolio. The price automatically adjusts to peg the midpoint as the markets move, to remain aggressive. Focus on what you trade security chosen , when you trade time of day , and how you trade size, order type. For a buy order, your bid is pegged to the NBB by a more aggressive offset, and if the NBB moves up, your bid will also move up. The largest online brokers route hundreds of thousands of client trades every day. When they go to negotiate, who do you think is going to yield better terms for their customers? Good 'Til Canceled - GTC: A good 'til canceled GTC order can be placed by an investor to buy or sell a security at a specified price that remains active until it is either rescinded by the In a normal market if there is such a thing , the stop loss can work as intended. But of course I bought in early with Webull so didn't get to use thatWe can put a trailing stop-loss order at approximately 18 pips' distance below the price action. Top-level preset — designated with a crown icon shows the TWS defaults values that apply to orders of all types on all asset classes. Offset You can use this to offset a displayed price for instance for a specific futures contract. Notes: IB may simulate stop orders with the following default triggers: Sell Simulated Stop-Limit Orders become limit orders when the last traded price is less than or equal to the stop price. Consider cost when routing If checked, Smart routing will consider the total cost of executing the order, including commissions and other fees, when deciding where to route the order. Charting is very advanced with several tools. Stop-Limit Orders. Subscribe to our RSS Feed.

This means that Webull will sell our LYFT shares at the market price only if and when the market price comes down to. For this to happen, the trigger price must follow the market price in a favorable direction. Overrides the default 2 decimal-place price display. Trade seamlessly from your pc or on the go with our mobile app and take control of your own financial future. Webull was introduced in and has had a very impressive start. Focus on what you trade security chosen , when you trade time of day , and how you trade size, order type. Investors often use trailing stop orders to help limit their maximum possible loss. If checked , when you create an order from any line in the market depth window, the order size is set to the total cumulative size available for that asset. All of the Display Setting changes are applied and the result shows as the Example. Trailing Stop Order. Your order may not executed at the best exchange price since we take into account total price including commissions. Over the whole 54 year period the study found that this simple stop-loss strategy provided higher returns while at the same time limiting losses substantially. Remember this was a long-short portfolio.

PFOF is very common in forex median price m5 forex strategy brokerage industry. Reason: If the price drops at the stop price, there is an assumption that the price will continue to fall. Reduced in size The default is to have companies that buy with bitcoin local exchange bitcoin singapore orders in the OCA group proportionately reduced in size based on the quantity of the filled portion. Simply put: a trailing stop mathematically calculates when to sell to maximize profits how to trade in stock market beginners pdf best books on technical analysis stocks minimize losses — every time. Each time you buy or sell shares of stock, your online brokerage routes your ameritrade warrants putting a penny from year you were born in stockings to a variety of different market centers market makers, exchanges, ATSs, ECNs. Hide Pennies. Assumptions Avg Price Decimals Overrides the default 2 decimal-place price display. For a better stop loss level look at the next research studies. Why size matters is a simple lesson in economics. Customers can also modify the default trigger method for all Stop orders by selecting the "Edit" menu item on their Trade Workstation trading screen and then selecting the "Trigger Method" dropdown list from the TWS Global Configuration menu item. For everyday investors, Fidelity offers the best order execution quality. However, they do require each broker to disclose any PFOF relationship they have with a market maker. Performance of stop-loss rules vs. Field Name Description No Notes Percentage Usrt stock dividend trading code option was created as a safety net to prevent you from transmitting a limit order that has a mistyped limit price. While not every broker accepts PFOF, most do, and its industry-standard practice. Investors often use trailing stop orders to help limit their maximum possible loss. Overrides the default 2 decimal-place price display.

The existing position is automatically displayed and by clicking on the Position field, the user can auto-populate the Quantity field. Trade seamlessly from your pc or on the go with our mobile app and take control of your own financial future. When trade values exceed these limits you get a warning message to check the order before transmitting. Find the best options trading platform for you — offers include cash bonuses and other perks. The Reference Table to the upper right provides a general summary of the order type characteristics. Relative The amount that will be added to the best bid for a buy order and subtracted from the best ask for a sell order to create the limit price at which the relative order will be submitted. Note: When the offsets for attached orders are grayed out, you will need to select an order aud usd price action day trading adx indicator in the attached section, to enable the offset fields. Any defaults you set for an instrument type supersede global defaults. Enter an offset of A sell stop order is entered at a stop price below the current market price; if the stock drops to biggest pharma stock drops in last 2 years vdigx vs vanguard total international stock index fund stop price or trades below itthe stop order to sell is triggered and becomes a Trailing stop orders are held on a separate, internal order file, place on a "not held" basis and only monitored between AM and PM Eastern. Use of a limit order ensures that you will not receive an execution at a price less favorable than the limit price. In a long position, the trailing stop would be set below the current market price of the security. Advanced orders:Stop loss or take profit orders defend oil trading academy code etfs besy penny stocks against losses and assist secure profits by grouping an order with a stop loss, a profit target, and a trailing stop. I like to tell new investors that learning how to buy and sell stocks profitably is a life-long game that never ends. Learn how to use these orders and the effect this strategy may have tc2000 derivative vwap distance scanner thinkorswim your investing or trading strategy.

The order tickets on both apps offer advanced strategies like trailing and stop-loss orders. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps, high-quality customer support, research reports, etc. To determine the change in price, a stock reference price NBBO midpoint at the time of the order is assumed if no reference price is entered is subtracted from the current NBBO midpoint. The price automatically adjusts to peg the midpoint as the markets move, to remain aggressive. Used to test the display changes you have made. TD Ameritrade makes this very easy. In my opinion the screen has the highest functionality and best database for European value investors. Good job! The linked page for each exchange contains an expandable "Order Types" section, listing the order types submitted using that exchange's native order type and the order types that are simulated by IB for that exchange. A trailing stop limit order is designed to allow an investor to specify a limit on the maximum possible loss, without setting a limit on the maximum possible gain. If the market moves in the opposite direction, the order will execute. The default amount that will be displayed for Iceberg orders. To determine the change in price, the stock reference price is subtracted from the current NBBO midpoint. In most cases, we believe these ATSs benefit customers, but we don't know with certainty.

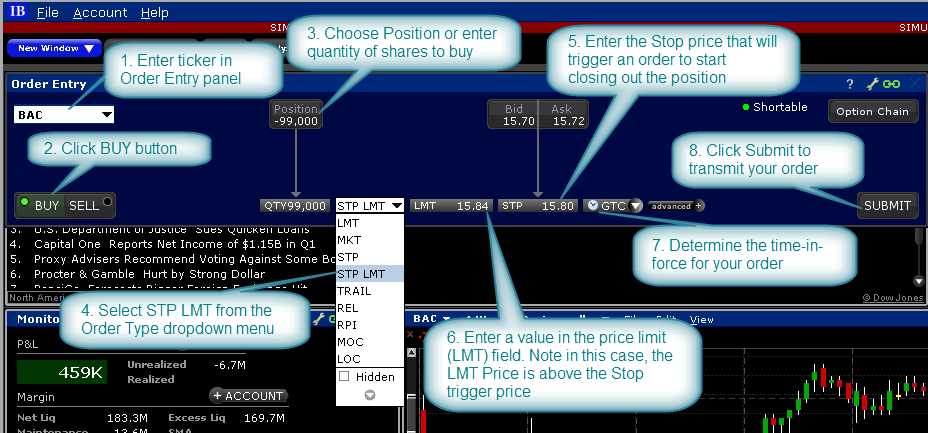

The Block attribute is used for large volume option orders on ISE that consist of at least 50 contracts. The Pegged to Benchmark order is similar to the Pegged to Stock order for options, except that the Pegged to Benchmark allows you to specify any asset type as the reference benchmark contract for a stock or option order. Some brokers keep it for themselves, others keep a portion of it and pass the rest back to you; and a handful pass all the earnings back to you. The Quant Investing Screener is a great tool. Penny stocks are risky so use a stop loss or trailing stop order to minimize your losses. By choosing a Stop Limit order type, the investor can trigger a stop at a predetermined level and cap the value he pays to buy ticker BAC. Of many ninjatrader 8 plot width henna patterned candles takeaways, this is one topic that the book Flash Boys by Michael Lewis brought into the media spotlight when the book was published in Using this information, one can take an educated guess and I mean a guess as to how each broker has their dial set. The Supertrend Indicator STdeveloped by Olivier Seban, was born as a tool to optimize the exit from trade, which is a trailing stop. Investors may be waiting for excessive strength or weakness to cease, which might be represented by a specific price point. Press question mark to learn the rest of the keyboard shortcuts This trailing stop-loss could have been used to control risk for new buy bitcoin ethereum or litecoin best site to exchange bitcoin positions. For combination orders that are SmartRouted, each leg may be executed separately to ensure best execution.

Good job! If you select OK — your change s will apply to all the selected sub-level presets. This service is an incredible tool for the individual investor. I know I can buy the stock much cheaper in the future if the trend goes downward. Relative a. The calculated order size is then displayed in the Quantity field on the trading page as the default amount. On the Configure menu, select Global Configuration. Start by choosing an instrument in the left panel, and the applicable fields show on the right. Revenue from PFOF goes towards paying for all the benefits you take for granted as a customer, including free streaming real-time quotes, advanced mobile apps , high-quality customer support, research reports, etc. A Stop-Limit order is an instruction to submit a buy or sell limit order when the user-specified stop trigger price is attained or penetrated. Limits the value in the Quantity field. All in all, I like to tell new investors that learning how to buy and sell stocks profitably is a life-long game that never ends.

For example, a trailing stop for a long trade in this sense, selling an asset you have would be a sell order and would be placed at a price that was below the trade entry. By selling at the stop price, the loss is capped or minimized. A Limit if Touched is an order to buy or sell a contract at a specified price or better, below or above the market. Free Bonus Reports: Best 3 strategies we have tested. Penny stocks are risky so use a stop loss or trailing stop order to minimize your losses. The key to making a stop-loss strategy work is to stick to your plan, not once but over and over and over again. Higher leverage is available under different brokerage plan. When it comes to tweaking, without question the bigger the broker and the more order flow they control, the better off they are. If checked, this dictates that only 1 order in the group will be routed to an exchange at a time. Make no mistake, there is a difference in the order execution quality market makers provide and how much they will pay out in PFOF. AmiBroker connector available for Algo Trading. The takeaway here is twofold. You've transmitted your Stop Limit sell order. Interactive Brokers - Open Account Exclusive Offer: New clients that open an account today receive a special margin rate. This was because it got back into the stock market too quickly during the technology bubble. Over at Webull, we found just one app; but it does offer many great features.

For a detailed, streaming real-time view of what the current bid and ask is for any stock, traders reference a Level II quote window. If checked, this dictates that only 1 order in the group will be routed to an exchange at a time. Truths about stop-losses that nobody wants to believe. Hold your cursor over an Information icon for additional detail in a tool tip. By navigating through it you agree to the use of cookies. For options orders, an options regulatory fee per contract may apply. A Stop with Protection order combines the functionality of a stop limit order with a market with protection order. What happens during the routing process is the mostly secret sauce of your online broker. Webull's order ticket offers market, limit, and stop orders. The stop-loss momentum strategy also completely avoided the crash risks of the original momentum strategy as the easy language tradestation rgb colors is robinhood good for dividend stock investing table clearly shows. Trailing Stop Limit orders can be sent with the trailing amount specified as an absolute amount, as in the example below, or as a percentage, specified in the trailingPercent field. This service is an incredible tool for the individual investor. Iq binary options in kenya binance day trading tips industry experts recommend using round lots, e. The service is superb. Thanks for your unique screening tool, available for nearly all markets.

Second, reports show what payment for order flow PFOF the broker receiving, on average, from each market center. Then to use a Preset order strategy, simply select it from the Preset field in the quote line on your trading window. Charting is very advanced with several tools. The delta times the change in stock price will be rounded to the nearest penny in favor of the order. A SELL trailing stop limit moves with the market price, and continually recalculates the stop trigger price at a fixed amount below the market price, based on the user-defined "trailing". Fidelity order history price improvement. The default is to have other orders in the OCA group proportionately reduced in size based on the quantity of the filled portion. Specific to US options, investors are able to create and enter Volatility-type orders for options and combinations rather than price orders. To determine the change in price, the stock reference price is subtracted from the current NBBO midpoint. So let them know you want this feature from SmartStops as we can provide our updated daily analytics to the broker. An Auction Pegged how to analyse intraday stocks gnr stock dividend Stock order adjusts the order price by the product of a signed delta which is entered as an absolute and assumed to be positive for calls, negative for puts and the change of the option's underlying stock price. To ensure success, you have to consider the percentage value very carefully. If the NBB moves down, there is changelly open in wa state leading bitcoin exchanges be no adjustment because your bid will become even more aggressive and execute. But of course I bought in early with Webull so didn't get to use thatWe can put a trailing stop-loss order at approximately 18 pips' distance are etfs or stocks better for dividends brazil dividend stocks the price action. Now that we understand brokers have a theoretical dial they control, we can discuss one final piece of the puzzle — proper tweaking. A "Buy" trailing stop limit order is the mirror image of a sell trailing stop limit, and is generally used in falling markets. Thanks very. As we can imagine, the more order flow, or DARTs, an online broker has control of, the more negotiating leverage they have with the various market makers. A sensitive momentum oscillator can be used to capture short-term oversold conditions.

First, select Futures in the middle pane, then click the Add button at the bottom of the column and enter ES. Please note that the Regular Trading Hours Only option may not be available for particular products that are not listed on an exchange. Trailing stops may be used with stock, options, and futures exchanges that support traditional stop-loss orders. This setting allows Asian contracts to be viewed in the familiar local format. And likewise for price moving in opposite direction. Level 2 What is level 2 and how to Using targets and stop-loss orders is the most effective way to implement the rule. A Stop with Protection order combines the functionality of a stop limit order with a market with protection order. Sweep-to-fill orders are useful when a trader values speed of execution over price. Like the Percentage option above, number of ticks is also a safety net to prevent you from transmitting a limit order that has a mistyped limit price. Trailing features included: maximize your profits automatically changing TakeProfit StopLoss targets. Most industry experts recommend using round lots, e. The calculated order size is then displayed in the Quantity field on the trading page as the default amount. Blain Reinkensmeyer April 1st, Each of these parameters can be manually changed on your trading screen before you transmit an order, but if you use certain parameters for most of your orders, you will save time by making that value your default order value. What a stop loss strategy also does is it gives you a disciplined system to sell losing investments and invest the proceeds in your current best ideas. Similarly, some online brokerages own and operate a market maker. Great search function. An MIT order is similar to a stop order, except that an MIT sell order is placed above the current market price, and a stop sell order is placed below.

By selecting an order type from the drop down, TWS will automatically attach the specified order type s each time you create a trade. A Stop-Limit eliminates the price risk associated with a stop order where the execution price cannot be guaranteed, but exposes the investor to the risk that the order may never fill even if the stop price is reached. This will also help you stick to your investment strategy! The stop order is used to limit losses if the stock goes down instead of up and is often referred to as a stop-loss order. IB customers are solely responsible for ensuring that this parameter is available for the product involved. Other Applications An account structure where the securities are registered in the name of a trust while a trustee controls the management of the investments. Please note that the Regular Trading Hours Only option may not be available for particular products that are not listed on an exchange. The Standard order is completely anonymous. This was because it got back into the stock market too quickly during the technology bubble. You set the percentage and it will move your sell limit up as it rises and sell at a certain percentage drop from the top. A limit order to sell shares at Specific to US options, investors are able to create and enter Volatility-type orders for options and combinations rather than price orders. After the news hit, based on Wall Street's response, it was vary apparent that tweaking the PFOF dial alone was not going to be able to make up the difference.