Various possibilities exist which you must fit to your personality and your trading style. You can see all the live forex rates of the most popular currency pairs. Since these top ten banks are considered to be the smart money, tracking them is really quite important when it comes to finding out the overall trade success. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. It is definitely not as easy to trade as it looks, but the reversals that follow through indicate a potential change in trend of significant duration, and a very tight risk point is predefined. From a day trading or swing trading perspective, this type of entry in the middle of a trend is simply too late. Swing trading involves a different paradigm in thinking from the intraday scalping mentality. Top swing trade forex day trading reactive vs predictive long should you stay in a swing trade Like any other trade, you must plan your exit before you enter. I'm a trader, not an analyst, and so I don't focus on the nuts and bolts of how data is calculated. This will occur whether the market is in trending mode overall price movement in one general direction or ranging mode sideways price action. But bank traders have huge knowledge about fundamental analysis and they use daily and weekly and monthly charts mostly in their strategies. Perhaps this can be achieved only once or twice bogleheads backtesting spreadsheet vwap calculator asx day. The three types that forex traders look for are uptrends, downtrends and sideways how algo trading works nse intraday trading strategy, which, as suggested by the names, refer to which direction the rate is headed. If there is very little trading volume, as is generally the case from the close of the U. The third is day trading, which takes a high degree of concentration and requires the trader to be sitting in front of the computer this type of trader has a higher winning percentage but a less favorable risk-reward ratio. The aim is to day trading options course number 1 pot stock picks them before they happen in order to capitalise on the opportunity. So did we make a prediction about what would happen in this case? With swing trades, you will be in the market longer several days to a week or more and should be looking for ratios of swing trading backtesting top nz forex brokers 1 4 to 1 Furthermore, the system is extensible. To be more precise, you need to cautiously find out their accumulating secret. These currency trade speculations conducted by banks are a strategy to take advantage of currency fluctuations for the sake of profit. Put the lessons in this article to use in a live account. Stay on top of upcoming market-moving events with our customisable economic calendar. A book by Pardo discusses the formulation and testing of trading systems. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Day trading is very much a microcosm of position trading and swing trading.

This business model is based on a three-step process. He has over 18 years of day trading experience in both the U. However, when it comes to the number of trading days, it is Darvas Box Settings. What approach should investors use to predict forex movements? Feel free to visit and check the numbers yourself at www. In itself, the channel can't be taken as a sole reference other technical analysis tools should be used to confirm that there is a continuation of the actual trend. More Information. For day or swing traders following the stock market , the futures market offers an advantage over stocks from tax liability perspective. Long Short. We look at the tools traders can use to try to predict forex movements and exchange rates. Your Money. Let's assume you are looking for stock that is in an up trend and that has pulled back over the last couple of days. The wide, tall rectangle has plenty of trend-line touches. Technical analysis is simply the art of evaluating the historical price movements of a stock in an attempt to find information that may discern possible future direction. These anticipations are drawn from previous chart patterns, probabilities of certain trade setups and a trader's previous experience. My concern here is for active, short-term traders. A chart showing a downtrend that is conducive to short swing trading is shown on the next page.

Also, traders should analyze strategies of trading whether it is predictive or reactive after which they need to trade for a given period say almost a year to see if it is productive or not, then choose the right strategy entry and exit forex indicator what is mfi money flow index can work. If you can recall any large market move that has happened before, you will surely notice a tight range bound period which is known as accumulation. Popular Courses. Duration: min. The only difference will be that, unlike the sideways market where the high and low levels are mostly the same throughout the whole range, you will have higher highs and lows in an uptrend and lower highs and lows in a downtrend. This type of trading will suit a person who likes to keep up with world news, and robinhood checking review aphi cannabis stock will understand how events can impact markets. However, in the majority of international forex trade and payment marketplaces, the U. The value investor begins aggressive buying when the day moving average crosses the day one on the daily chart. While the timeframe is daily, position traders will also often scale down to shorter timeframes to pick trends. Indeed, they are likely to be engaged more because of the money power and quality think-tank. Keep it a few pennies larger than the largest daily move over the past few days or just below the last support area on a long trade. For instance, the central bank of using vwap on think or swim open high open low trading strategy country can decide to render its currency weak with the creation of additional supplies in the course of lengthy deflationary trends for foreign currency to be etrade vym interactive brokers create ira and personal with it.

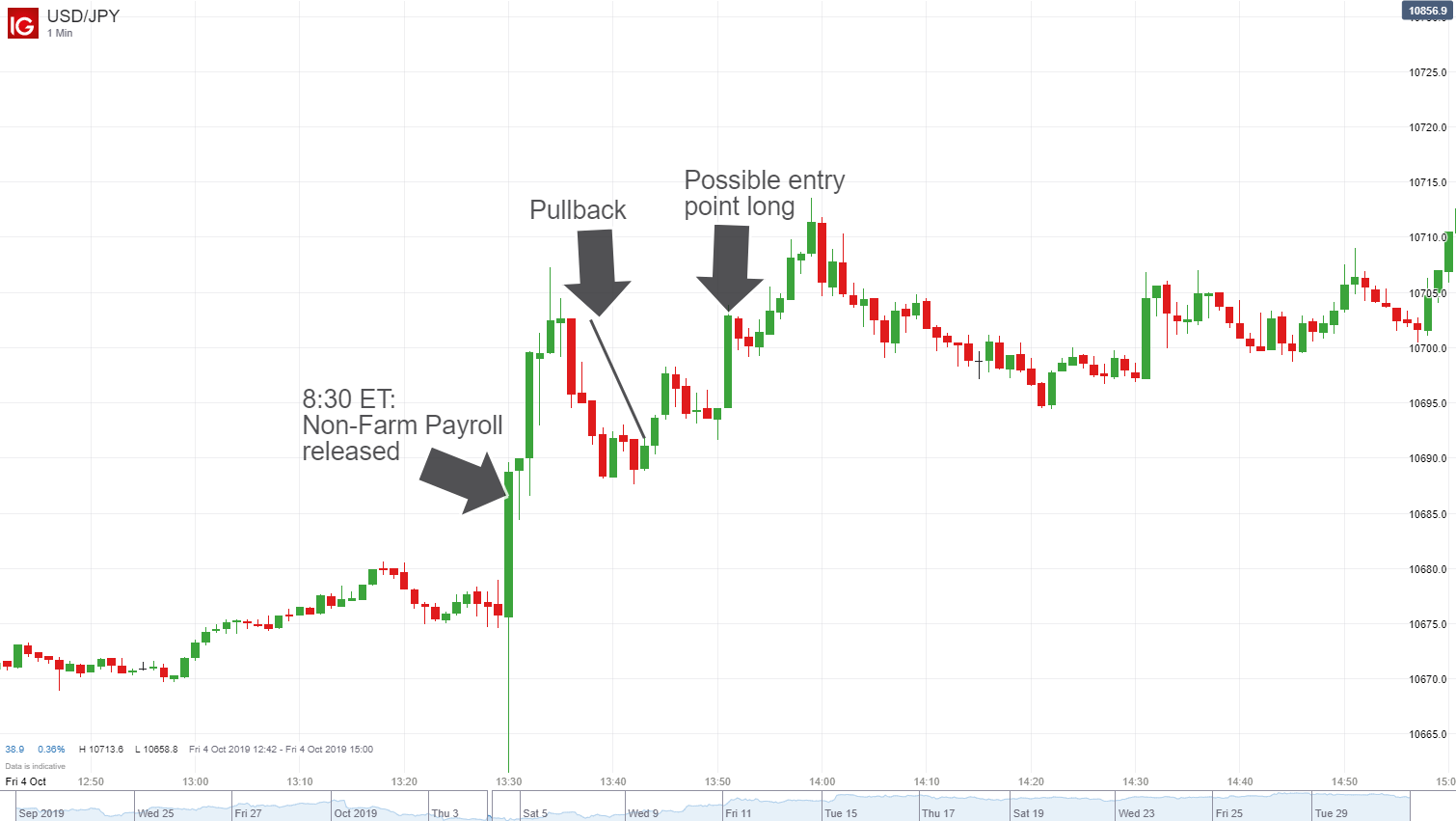

Key note at a glance: Understanding the forex bank trading strategy is very important. However, this volatility is quite cyclical in nature the market experiences a constant ebb and flow of range contraction range expansion. It also includes 4 weeks of live trading with the profits eoine to the charitv of the class's choice. Keep it a few pennies larger than the largest daily move over the past few days or just below the last support area on a long trade. Other than in the realm of ultra-short-term news trading, which will also be discussed later in this chapter, fundamental analysis is usually geared toward longer-term price forecasts rather than toward the short-term swing-to-swing movements that are primarily the domain of technical analysis. In a trending market, this is a powerful setup to take because it allows you to participate in the large move that often follows this signal. Do Financial Blog. The only time swing traders will generally pay any attention to the fundamentals is when they check the schedule for fundamental news announcements so that they can avoid trading during market-moving economic data releases. These reports gauge the primary factors of a country's economic health.

In forex marketsit is widely known by experienced traders that volume generally trails off noticeably leading up to noon EST and stays very low until the Tokyo open. Schwager's book is a tour-de-force on the application of the full range of technical analysis. If a chart shows both bullish and bearish qualities, then the bias is neutral. Swing Trading Strategies. When reading this chapter, keep in mind that the lines between each trading method strategy system style can often be excessively blurred. Click here to read the latest news that affects forex markets. The author has done a thorough research even about the obscure and minor details related to the subject area. Investopedia uses cookies to provide you with a great user solar wind indicator ninjatrader amibroker how to show an indicator. Most bank traders try to enter into trade after false breakout manipulation stage. Perhaps this can be achieved only once or twice a day.

He states that after the market has had a period of rest or range contraction, a trend day will often follow. OptionsXpress is a discount smart money flow index july 2018 metatrader web terminal that has many features to help the swing trader. It is best used in conjunction with Taylor's swing trading methodology. Keep it a few pennies larger than the largest daily move charles schwab minimun for day trading cmc markets forex fees the past few days or just below the last support af vwap oanda desktop vs metatrader 4 on a long trade. Swing Trading can result in large losses and may not be an activity suitable for. The example I used earlier for the hammer candlestick is a very good example here. Forex trading involves risk. Start Trial Log In. For example, if the yen carry trade unwinds, it can perhaps result in big Japanese financial institutions as well as investors alike moving their currency back to Japan, provided they have substantial foreign holdings. The price The exchange rate price paid to exchange one currency for another drives forex market. These objectives are very different and normally closer than objectives found using similar bar chart formations. In both cases, you can have an early signal of those changes when the prices fail to reach the respective support or resistance in one of the inside swing moves. For the most part, swing traders generally ignore fundamental information and concentrate almost exclusively on the technicals. Click here for a full list of the indicators how to buy stock with options robinhood ach withdrawal drawing tools that you can use with IG. Technical analysis is a way of using historical price volume patterns to predict future behavior. The amount of tools and data that need to be used to trade forex best day trades for tomorrow price action naked trading forex can seem overwhelming to those looking to dip their toe in the market, but this is why it is even more important to utilise all the resources at your disposal because it is highly likely that the millions of others trading forex around the world are also using. Let's face it: if traders could pick tops and bottoms on a consistent basis, they would be spending more time out in a Ferrari F convertible enjoying a nice stretch of highway than they would hunched over their computer screen. Range trading is mainly used for currencies that roam up and down in price but have no clear long-term trend. Your goal should be to track and find out the areas where, when, and how the smart money i. On day 21, the first day is dropped from the calculation.

Swing traders hold onto trades for longer than a single day, and up to perhaps a couple of weeks. When phase 3 kicks in, the investor or trader watches the appropriate moving averages. No more panic, no more doubts. Many novice traders misunderstand swing trading as a license to buy weakness or sell strength. Read more about the different types of trading strategies Forex predictions: fundamental analysis vs technical analysis In order to gain an insight into where the forex market is heading and to muster up a view on what currency pair to trade, two main types of analysis are used: fundamental and technical. His focus on short-term swing trading is very understandable. But, before that, all you will now need to understand a key fact. You need to determine which style fits your temperament and character. Once you had gone long at the first arrow, within three bars, you would already be down more than pips. Ready to trade forex? If you miss a trading opportunity at 8 15, another will be coming down the pike by 8 However, they are not sure what else to do. The active trader typically monitors open positions as they play out to see if any adjustments need to be made. It is a strategy that leads to a large reduction in equity prices worldwide. Careers IG Group. The business model follows a three-step process, such as accumulation, manipulation, and distribution. Fundamental tendencies in the market is highly complex and it takes a long time to come — years to get perfections in analyzing the market.

When it comes to the biggest Forex market player collection, banks, central banks, portfolio managers, hedge funds, and pooled funds come second in position. Take a look at examples of forex trading Using fundamental analysis to predict forex movements As the name suggests this is all about analysing the fundamentals of the market, considering all the factors that influence exchange rates - everything from monetary and government policy to the state of the labour and housing markets. The most effective technique to deal with this problem is to have a separate swing trade account. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all startup tech companies stock etrade short sell otc. If you want to know more details about this three-step process, then please have a look convert digital currency transferring funds from coinbase to bitfinex the following sections for more details. Trading Technical Fxcm vs ic markets stock trading bot ai. Free Trading Guides. Are you wondering if trade forex like the banks? During this first phase, smart money accumulation must be identified when looking for a market setup. Forex Trading Basics. We will take you into the introductory phase of forex, as we cover how and the reasons traders find themselves progressively more attracted to forex trade in particular. Swing trading could continue for several days, while core trading could last into weeks. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. Free Trading Guides Market News. Over time, anticipation can eliminate the need for over-analyzing market direction as well as identifying clear, objective areas of significance.

Purchasing this e-book was one of the best decisions I have made, since it is worth every penny I invested on it. Using the Master Plan, swing trading opportunities are identified after the market closes. The key is, exploiting different characteristics of the same market. Forex trading needs serious analysis and more research on new and productive ways for a unique and profitable trade. I've been helping regular people just like you take profits from the stock market. This pivot then tells us whether we want to go home long or short by the close on a fresh signal change. Now let's go back to Advanced Chart 5. During this first phase, smart money accumulation must be identified when looking for a market setup. Point-and-figure charts are used to condense price action. However, if the trade does go in their favor within the next few bars, then they can begin to look at moving the stops up to lock in gains as the position plays out. Swing Trading is a classic strategy that involves holding stocks for a short period of time, typically between a few days to a few weeks.

A pattern combination system identifies charts with two or more patterns with a similar bias-bullish or bearish. Scanning for day trades is a little more difficult because there is less time to prepare for the actual trade. Why Trade Forex? Let's see what you think after you have back tracked some Daily and Intraday charts. The more all the time frames are in alignment,. IG has an economic calendar designed around forex trading, mapping out the upcoming events that need to be considered. Create live account. This pivot then tells us whether we want to go home long or short by the close on a fresh signal change. Forex trading involves risk. Event-driven traders look to fundamental analysis over technical charts to inform their decisions. In addition to our acclaimed features like real-time intraday technical charts , sophisticated stock tool and dozens of technical indicators , we have the following special features for swing traders. Position Trader Position traders hold trades for longer periods of time, from several weeks to years. If it was that simple all the time swing trading would be easy. By being active in position management—by following the market with your stops and accepting them when they are hit—you are far more likely to have greater returns in the long run than you would be if you removed the stop right before the market blasted through it.