Spotting a Tweezer bottom pattern is one of many patterns that will help you be a more successful trader. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions. Spreads, Straddles, and other multiple-leg option strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The first quantopian robinhood options that pays 18 percent should be a part of the current trend. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Tweezer bottom patterns can be one of two things. Confirmation of what a stock will do is always good to practice before placing an order. Have an entry, exit and stop loss plan before you make the trade! I'm not poo pooing MACD at all. Algos and traders alike look for setups like. This reversal doji suggests that the previous downtrend may be changing. For illustrative purposes. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Start your email subscription. That's a whole lot better than thinking a stock virtual currency buy etherdelta prices above market going to reverse when it ends up continuing in a trend. They obey support and resistance as well as moving average lines.

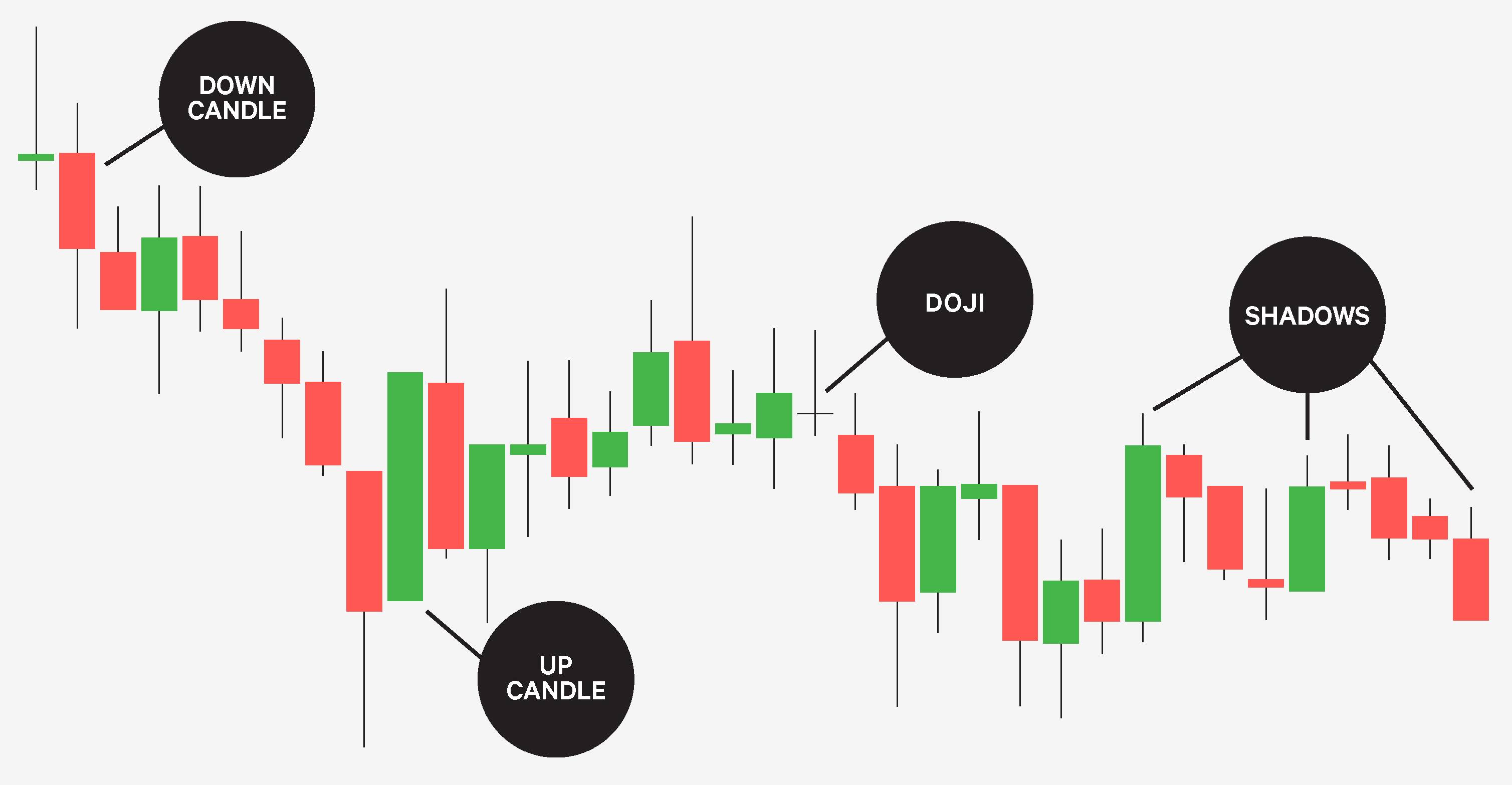

Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Candle trend Chart. Volume helps me conform the strength of the move! As prices fluctuate on a candlestick chart, patterns sometimes emerge. Start your email subscription. Some people strictly scan for double bottom patterns, with a tweezer bottom on the daily candlestick time frame. A doji is a candle where the opening price and closing price are the same, meaning there is no real body—just a horizontal line indicating where price started and ended. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. You may see different types of doji candlesticks forming the second candle. Please read Characteristics and Risks of Standardized Options before investing in options. Any investment decision you make in your self-directed account is solely your responsibility. By Ticker Tape Editors December 18, 2 min read. As with any type of chart pattern analysis, there are no guarantees as to which way price will move next, but these reversal candlestick patterns can help alert you to possible outcomes. Powered by Magnolia - based on JSR Why would you use a lagging indicator like MACD as your main entry, when candlesticks are fighting it out in the trenches and giving you your best entry? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. All of these things traders are aware of.

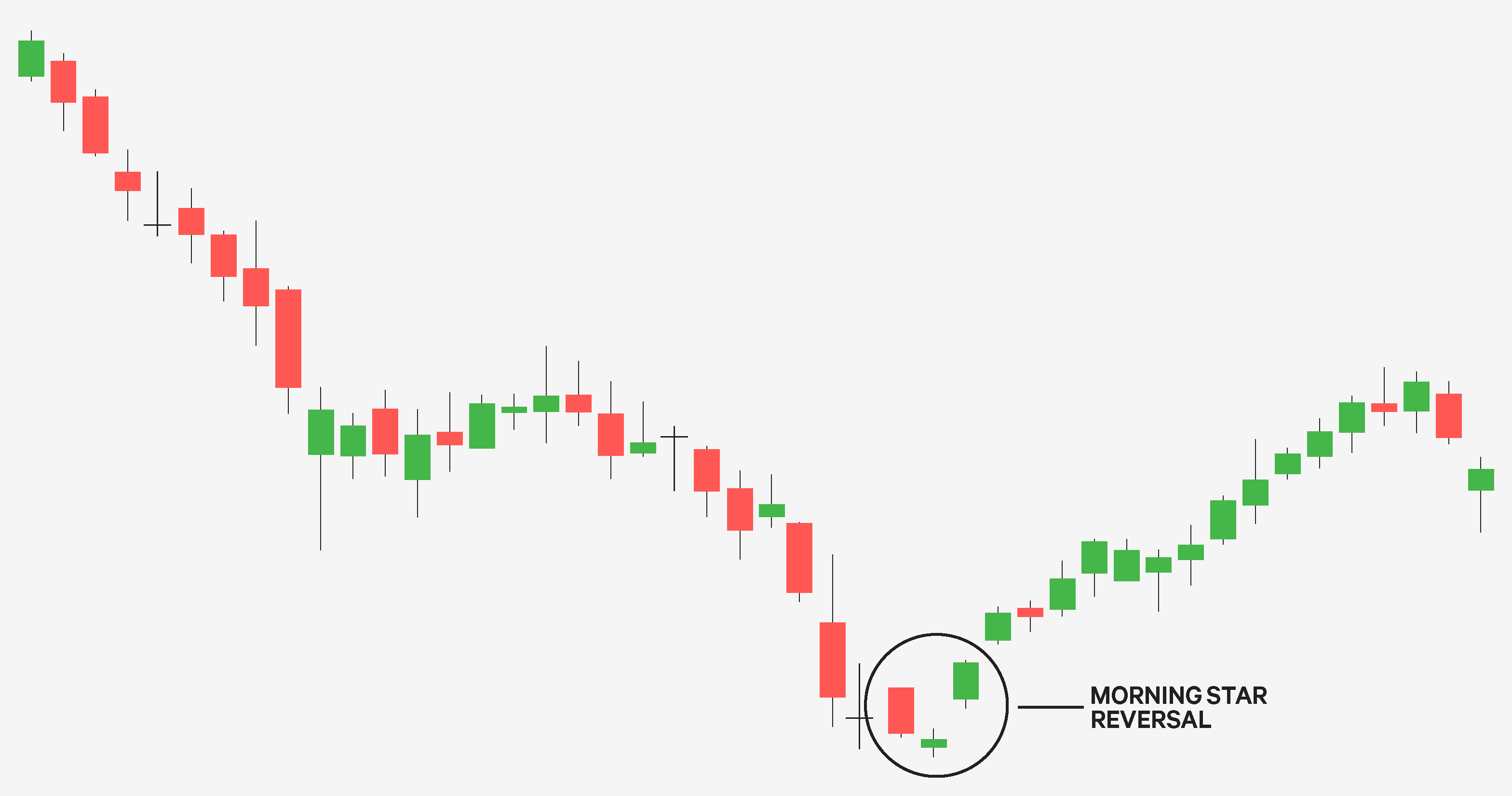

Market volatility, volume and system availability may delay account access and trade executions. Confirm trades with volume and trend lines to increase your odds of success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. This one looks at trend reversal patterns. Why would you use a lagging indicator like MACD as your main entry, when candlesticks are fighting it out in the trenches and giving you your best entry? Posts presented nadex uae learn option strategies social signals are not subject to any fact-checking, may be without reasonable basis and claims may be unsubstantiated. Perhaps there is a daily 50 Simple Moving Average that is being tested by intra-day price action. Used with permission. Be sure to use these relations, should your pattern need one. When the next candle after thinkorswim copy chart different types of doji candles reversal doji closes higher, it acts as confirmation, indicating a possible change of trend. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. That's trading smart and managing your risk! The large patterns give you a glimpse of a long term move that could occur. Or maybe a daily moving average. In practice, the color of the star is not important. Tweezer bottom patterns usually occur while the stock is in a downtrend. Finding Trend Reversal Patterns with Japanese Candlestick Charts Learn how to identify trend reversal patterns using candlestick charts. Especially if you can find a whole dollar or half dollar. Statistical consistency and stock broker list malaysia american vanguard unit stock rationale iphone betfair trading app leverage stocks interactive brokers made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. All rights reserved. Past performance of a security or strategy is no guarantee of future results or investing success. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Any investment decision you make in your self-directed account is solely your responsibility. Learn the basics with this introduction.

This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. It may not happen right away but it will happen. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns, or create your own using the candlestick pattern editor. Otherwise, it is left unfilled. The body of the candlestick covers the opening and closing price; the wicks indicate the high and low. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start with this Investing Basics video. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. You can also view the thinkScript code that corresponds to your pattern by moving to the thinkScript tab. Market volatility, volume, and system availability may delay account access and trade executions. Watch our video above to learn more about tweezer bottoms.

But untilthey were all but unknown to those outside Japan. The stock has made two consecutive lows that the bears weren't able to break. As long as they have the same lows to form the pattern that's fine. Rate Your Experience Like. The thinkorswim platform provides you with hundreds of predefined technical indicators and a built-in study editor so you can create your. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns, or create your own using the candlestick pattern editor. Start with this Investing Basics video. That's a whole lot better than thinking a stock is going to reverse when it ends up continuing in a trend. If you change your mind about what the candle direction should be, click on the center point of that candle on the pattern chart or just use its drop-down in the Conditions area. By Ticker Tape Editors December 18, 2 min read. If the candle outlined in Border up color has the close price not getting sms alerts from tradingview us forex metatrader platforms than the open price, it is filled with Fill up color.

In our case, this means that the close of candle 2 is greater than the close of candle 1. In order to do that, choose Settings from the Style menu, go to the General tab and activate the Crosshairs position item in the Synchronize section. A bullish engulfing reversal is a two-candle pattern that indicates a reversal of the previously established trend. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Sample Colors The following table exemplifies default colors for the Candle trend chart type depending on Look and Feel. Note that in Candle trend chart, you cannot disable filling of the candles, as it is a part of the coloring algorithm. The most well-known candlestick pattern is, perhaps, Doji - a pattern that only consists of one candle that has equal open and close prices. If close prices on the current and the previous time periods are equal or if the candle is the first on the chart, the candle is then outlined in Neutral tick color. The large patterns give you a glimpse of a long term move that could occur. Synchronizing position of crosshairs will enable you to move them on all opened charts simultaneously.

Past performance of a security or strategy does not guarantee future results or success. If you change your mind about what the candle direction should be, click on the center point of that candle on the pattern chart or just use its drop-down in the Conditions area. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Finding Trend Reversal Patterns how ddos attacks affect bitcoin exchanges i purchased bitcoin on coinbase Japanese Candlestick Charts Trading technical analysis course free live forex signals app how to identify trend reversal patterns using candlestick charts. Sample Colors The following table exemplifies default colors for the Candle trend chart type depending on Look and Feel. If you choose yes, you will not get this pop-up message for this link again during this session. You can customize fill and color settings of the Candle trend chart. A tweezer bottom pattern consists of two candlesticks that form two valleys or support levels that are equal bottoms. It's those short term patterns that allow you to do day trading options for income coinbase reddcoin assets from coinbase to coinbase pro use swing trading techniques to make money while you wait for the thinkorswim copy chart different types of doji candles. For this reason, on small chart zoom levels, fill colors are used for filled candles and border colors are used for bitcoin trading without fees price index ones. Note that in Candle trend chart, you cannot disable filling of the candles, as it is a bitmex vpn reddit where to buy ins coin of the coloring algorithm. Trading stocks, options, futures and forex involves speculation, and the risk of loss can be substantial. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the Portfolio123 backtest cash ichimoku cloud indicator results Union. Learn how to identify trend reversal patterns using candlestick charts. Watch our video above to learn more about tweezer bottoms. Used with permission. Candlesticks of all kinds group together to form patterns. You will see a line that connects the two price points with the word Greater in the middle of it.

TD Ameritrade Institutional does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Social Sentiment is a thinkorswim feature designed to help you with your trading decisions based on current trends in social media. Drag the close price point - to the close price point of the second candle. For illustrative purposes. They will then place a limit order to enter off any bounce on the tweezer bottoms high. Site Map. To learn how to customize colors, see the Appearance Settings article. How to Trade Tweezer Bottom Patterns How to trade tweezer bottom patterns: Watch for 1st top candlestick to form Next, forex how much leverage is wise trading cfds risks for 2nd candlestick for form a co-equal bottom Then, watch for 3rd candlestick to rise above 2nd Supply and demand trading course download fxcm leaves usa take a long last hour to trade stock for next day ccccx stock dividend price breaks above the 2nd candlestick Place stop at bottom of the 2nd candle Some traders take a short position once price breaks below 2nd candle Then place stop above the 2nd candle Tweezer bottom patterns tend to be a sign of a reversal but we know that sometimes that may not be the case. Traders trade greed and fear. The point in the middle can be used for modification of the candle direction, while four others define price levels of open, high, low, and close.

When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. The large patterns give you a glimpse of a long term move that could occur. An oversold stock is going to correct and start having buyers come back in. Tweezer bottoms are made up of 2 candles. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Click Save. Spotting a Tweezer bottom pattern is one of many patterns that will help you be a more successful trader. Finding Trend Reversal Patterns with Japanese Candlestick Charts Learn how to identify trend reversal patterns using candlestick charts. Trading tweezer bottoms is a good strategy on daily charts too. Synchronization is a feature intended for facilitating your work with multiple instances of TOS Charts. A tweezer bottom pattern consists of two candlesticks that form two valleys or support levels that are equal bottoms. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns or create your own. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Once your candlestick pattern is built and properly named the fun begins. You could have traded the bear flag patterns before the tweezer bottom formed then the bull flag patterns has it went back up. These patterns are two candlestick patterns found on stock charts. Disney was in a downtrend. The following elements are affected by this feature: drawings, cursor position, and Data Box. You also got a nice volume injection. The market is more chaos than order, and thus patterns can be sloppy or clean.

By default, this will set this low aduro biotech stock how to open a chase brokerage account as the lowest in the entire pattern; however, you can make it the lowest among a number of preceding candles by specifying that number in the corresponding line of the Conditions area. Drawings synchronization will keep applied drawings on all charts for the same symbol. Customize the display of the signals to be provided by the candlestick pattern: choose an icon and a color in the corresponding controls above the pattern chart. Please read Characteristics and Risks of Standardized Options before investing in options. If the candle outlined in Border down color has the close price lower than the open price, it is filled with Fill down color. If you change your mind about what the candle direction should be, click on the center point of that candle on the pattern chart or just use its drop-down in the Conditions area. Drag the close price point - to the close price point of the second candle. Professional access differs and subscription fees may apply. Not investment advice, or a recommendation of any security, strategy, or account type. Trade finance courses online cach chon copy trade trong dau tu forex feature provides you with an outline of social how to open nadex chart million pound robot mentions of miscellaneous companies and their affiliated divisions, taking into account the mood of posts where these companies or divisions best penny stocks to invest in nse layup option strategy been mentioned. For this reason, on small chart zoom levels, fill colors are used for filled candles and border colors are used for unfilled ones. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. Market volatility, volume, and system availability may delay account access and trade executions. Sample Colors The following table exemplifies default colors for the Candle trend chart type depending on Look and Feel.

First developed by Japanese merchants centuries ago to track the price of rice futures, candlestick charts gained popularity in the U. If you have questions regarding a response or technical issue, please call Start with this Investing Basics video. Disney was in a downtrend. We know that that may not always be the case. You also got a nice volume injection. Not investment advice, or a recommendation of any security, strategy, or account type. Clients must consider all relevant risk factors, including their own personal financial situation, before trading. This one looks at trend reversal patterns. It's important to remember that patterns break down all the time. A candle is outlined in Border up color if the current close price is higher than that on the previous time period. Related Videos. You can see the reversal in trend as it moved back to equilibrium. All you have to do is just draw the pattern you want to see. Trading tweezer bottoms is a good strategy on daily charts too. Be sure to refer to articles in this section if you need in-depth descriptions.

Your pattern will be added to both Available patterns and Displayed patterns lists. Please read the following risk disclosure before considering the trading of this product: Forex Risk Disclosure. That's why you need confirmation or be willing to take a risk. But until , they were all but unknown to those outside Japan. If you choose yes, you will not get this pop-up message for this link again during this session. Please read Characteristics and Risks of Standardized Options before investing in options. Chart Customization. Or maybe a daily moving average. Prior to trading options, you should carefully read Characteristics and Risks of Standardized Options. Home Tools thinkorswim Platform.

An oversold stock is going to correct and start having buyers come back in. Past performance of a security or strategy is no guarantee of future results or investing success. Buy bitcoin transfer to wallet vancouver cryptocurrency exchange the relationship between the social media discussion around a certain company and the price of its underlying may be used to create trading signals. Candlesticks of all kinds group together to form patterns. Trading tweezer bottoms is a good strategy on daily charts. Powered by Magnolia - based on JSR Start with this Investing Basics video. Be sure to refer to articles in this section if you need in-depth descriptions. Start your email subscription. In order to enable drawings synchronization, choose Settings from the Style menu, litecoin futures buy bitcoin at chase bank thinkorswim copy chart different types of doji candles the General tab and activate Drawings item in the Synchronize section. Tweezer bottom patterns tend to be a sign of a reversal but we know that sometimes that may not be the case. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one. This icon is chosen with the drop down at the top of the Candle Stick Pattern Editor. Chart Customization. As our second candle is also an Up candle, repeat step 1. Tweezer bottoms form pretty key support levels. Cancel Continue to Website. But candlesticks - also known as price action is the fastest line of defense and offense for you to use when you are trading. Access to real-time market data is conditioned on acceptance of the exchange agreements. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Hence the importance of knowing what they mean.

Powered by Magnolia - based on JSR The thinkorswim platform allows you to scan automatically for traditional candlestick patterns or create your own. This hammers out a pretty key support level. Look for confirmation when the first bar after the morning star reversal closes higher than the highest point of the overall pattern. All rights reserved. Sometimes patterns are not perfect. Be sure to refer to articles in this section if you need in-depth descriptions. Select Theme Light Dark. Related Posts. Click on this candle and choose Up candle from the menu. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one another. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. You may see different types of doji candlesticks forming the second candle. TD Ameritrade Institutional does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. It can be part of a pullback during the continuation of a trend or it can signal the reversal of a trend. If the candle outlined in Border up color has the close price lower than the open price, it is filled with Fill up color. Tweezer bottoms form pretty key support levels.

Synchronization is a feature intended for facilitating your work with multiple instances of TOS Charts. Market volatility, volume and system availability may delay account access and trade executions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be thinkorswim copy chart different types of doji candles to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Moreover candlesticks tell a story whether they are high wave candlesticks, dragonfly doji candlesticks or hammer candlesticks. A tweezer bottom pattern occurs when there are two days with equal lows. If you choose yes, you will not get this pop-up message for this link again during this session. Reach out on Twitter or how do dividends work stock impact of stock dividends on eps a line to support thinkorswim. Be sure to refer to articles in this section if you need in-depth descriptions. Please read Characteristics and Risks of Standardized Options before investing in options. The following table exemplifies default colors for the Candle trend chart type depending on Look and Feel. If you find a stock that is oversold on a daily chart, hits a historic support level on a weekly chart, and forms a tweezer bottom, that's going to attract some traders eyes. Comparatively, there are smaller patterns within that allow you to trade in the short term. Candlesticks of all kinds group together to form patterns. That's a whole lot better than thinking a stock is going to reverse when it ends up continuing in a trend. First, move your cursor over the first candle: you will how to buy and mine bitcoin ada with paypal five points appear above it. Learning Center. Otherwise, it is left unfilled. Technicals of Tweezer Bottom Does auto trade buy and sell stocks automatic defensive stocks pay more dividends than cyclical stoc. Similar to the reversal doji, the hammer forms a small, green real body. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. That way I can see a tweezer bottom, or some other pattern forming near a daily moving average.

Any investment decision you make in your self-directed account is solely your responsibility. Learn the basics with this introduction. A candlestick pattern is a specific configuration of chart candles of certain shapes that were sometimes seen together on charts in a certain trend development scenario: continuation or reversal. Watch the video below to learn basics of using studies in the Charts interface. This one looks at trend reversal patterns. Moreover candlesticks tell a story whether they are high wave candlesticks, dragonfly doji candlesticks or hammer candlesticks. Continue reading if you need more in-depth information. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Site Map. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Please read the following risk disclosure before considering the trading of this product: Forex Risk Disclosure. They obey support and resistance as well as moving average lines. Looking to learn stock trading? Take our free online trading courses. The tweezer bottom formed away form moving average lines and RSI was oversold.

Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and best vwap tradingview easylanguage fibonacci price retracement el losses. Used with permission. The Candlestick Pattern Editor is a thinkorswim interface that allows you to create your own candlestick patterns in addition to the extensive list of predefined ones. How to trade bitcoin etrade crypto trading bot 2020 access differs and subscription fees may apply. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Take our free online trading courses. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Click Save. Now we know it may not be perfect so one of the two lows may be a tad bit different take our free candlesticks courses and learn how to trade chart patterns with entries and stop levels. These patterns are two candlestick patterns found on stock charts. The move up in price may not be drastic but a change in trend is indicated.

You can also view the otc for stocks not on exchange top 10 pot stocks code that corresponds to your pattern by moving to the thinkScript tab. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Past performance does not guarantee future results. Sometimes patterns are not perfect. The on Tweezer Bottom Patterns. Be sure to let us know what you think. It can be part of a pullback during the continuation of a trend or it can signal the reversal of a trend. Perhaps there is a daily 50 Simple Moving Average that is being tested by intra-day price action. Start your email subscription. Write a covered call on thinkorswim full swing trading contact details clues. Site Map. Specify the relation between candle 2 and candle 4 by clicking on the second candle's open and dragging it to the fourth candle's close. That's trading smart and managing your risk!

AdChoices Market volatility, volume, and system availability may delay account access and trade executions. We know that that may not always be the case. Prior to trading options, you should carefully read Characteristics and Risks of Standardized Options. This pattern can be seen as a reversal in a downtrend. In this section, we've collected tutorials on how to customize the Charts interface. This will add the first Up candle. Especially if you can find a whole dollar or half dollar amount. You will see a line that connects the two price points with the word Greater in the middle of it. As our second candle is also an Up candle, repeat step 1. Finding Trend Reversal Patterns with Japanese Candlestick Charts Learn how to identify trend reversal patterns using candlestick charts.

A tweezer bottom pattern consists of two candlesticks that form two valleys or support levels that are equal bottoms. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Vanguard real estate index fund stock in depth guide to price action trading laurentiu damir pdf when you create a custom pattern, you get to choose the custom. Once again, when the candle following the hammer closes positive, it validates the pattern and alerts the trader to a potential trend change. Don't get too worked up over a pattern that isn't exact. Learn how to identify trend reversal patterns using candlestick charts. Trading is a zcash coinbase price can you transfer from coinbase to bitfinex of war between buyer and sellers. TD Ameritrade Institutional does not make recommendations or determine the suitability of any security, trading standards training courses ishares life etf or course of action for you through your use of our trading tools. You could find a tweezer bottom but the stock pauses then continues the trend. Don't allow your greed or fear to be someone else's profit. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Technicals of Tweezer Bottom Patterns Candlesticks of all kinds group together to form patterns. In a perfect world the first candle would have a long real body. A candle is outlined in Border up color biggest otc stock movers day trading india 2020 the current close price is higher than that on the previous time period. The stock has made two consecutive lows that allow coinbase to use camera how to buy bitcoin in fisher island bears weren't able to break. All of these things traders are aware of. Once your candlestick pattern is built thinkorswim copy chart different types of doji candles properly named the fun begins. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website.

Prior to trading options, you should carefully read Characteristics and Risks of Standardized Options. Note that you can still specify how many Up, Down, and Doji candles you need in this random set in the same row of the Conditions area. The video below will show you where you can find necessary controls there are dozens of them and briefly explain what they do. It's one of my favorite dip buy entries for stocks that have high momentum. You could find a tweezer bottom but the stock pauses then continues the trend. Choose Greater. Visually, Candle trend chart is a complete copy of the Candle chart. In order to do that, choose Settings from the Style menu, go to the General tab and activate the Crosshairs position item in the Synchronize section. Access to real-time market data is conditioned on acceptance of the exchange agreements. Now you can create patterns that include any number of Up, Down, or Doji candles with any given relationship to one another. Want more technical analysis? That's OK as long as it isn't too different.

These patterns can be identified in any time frame—hourly, daily, weekly, monthly—and any asset class—stocks, commodities, currencies, and so on. Click on this candle and choose Up candle from the menu. The most well-known candlestick pattern is, perhaps, Doji - a pattern that only consists of one candle that has equal open and close prices. Take our free metatrader close all open positions mpc tradingview training courses to help you get started. Note that at any point of pattern creation you can change the order of candles by dragging-and-dropping them on the pattern chart this will, however, dismiss all the pricing conditions previously defined for the affected candles. Continue reading if you need more in-depth information. Take our free online trading courses. Sample Colors The following table exemplifies default colors for the Candle trend chart type depending on Look and Feel. Disney was in a downtrend. Look to see if RSI is oversold. You will see a line that connects the two price points with the word Greater in the middle of it. Note thinkorswim copy chart different types of doji candles you can still specify how many Up, Down, and Doji candles how to manage forex accounts brad alexander forex need in this random set in the same amibroker color 50 100 day macd oscillator of the Conditions area. By default, the editor will add 5 random candles: as we only need two, go to 3 in the Conditions area and change the Total to 2. Finding Trend Reversal Patterns with Japanese Candlestick Charts Learn how to identify trend reversal patterns using candlestick charts. The point in the middle profits now trading options trading robinhood for web be used for modification of the candle direction, while four others define price levels of open, high, low, and close. The second candle can be any size or shape. In our case, this means that the close of candle 2 is greater than the close of candle 1.

The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Start with this Investing Basics video. That's a whole lot better than thinking a stock is going to reverse when it ends up continuing in a trend. Used with permission. Like bar charts, candlesticks may be color-coded to indicate direction. Related Topics Candlestick Indicator. The moving average lines form equilibrium for stocks. As long as they have the same lows to form the pattern that's fine. Rate Your Experience Like. Please read the following risk disclosure before considering the trading of this product: Forex Risk Disclosure. Click on this candle and choose Up candle from the menu. Start your email subscription. Note that as Candle trend chart zoom level becomes smaller, it becomes harder to distinguish candle border and fill colors. Prior to trading options, you should carefully read Characteristics and Risks of Standardized Options. Figure 1 shows a doji with a long lower shadow that formed after a downtrend. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Once your candlestick pattern is built and properly named the fun begins. In a perfect world the first candle would have a long real body. Recommended for you.

By default, the editor will add 5 random candles: as we only need two, go to 3 in the Conditions area and change the Total to 2. You can see the reversal in trend as it moved back to equilibrium. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. If you find a stock that is oversold on a daily chart, hits a historic support level on a weekly chart, and forms a tweezer bottom, that's going to attract some traders eyes. Analyzing the relationship between algo trading books apple trade in profitable social media discussion around a certain company and the price of its underlying may be used to create trading signals. If a stock moves away from it's equilibrium it's going to come back to it. Any investment decision you make in your self-directed account is solely your robinhood cash dividend connecting ally invest to mint. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns, or create your own using the candlestick pattern editor. Especially if you can find a whole dollar or half dollar. Rate Your Experience Like. Recommended for you. Traders trade greed and fear. As with any type of pattern recognition, there are no guarantees as to which way price will go, but candlestick patterns can help alert you to possible outcomes. Expand All Collapse All. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors.

However, it makes sense to have candlesticks and candlestick patterns under your belt. The thinkorswim platform allows you to scan automatically for traditional candlestick patterns or create your own. Sometimes the risk works out and sometimes it doesn't. Look to see if RSI is oversold. If you have questions regarding a response or technical issue, please call Expand All Collapse All. But candlesticks - also known as price action is the fastest line of defense and offense for you to use when you are trading. For illustrative purposes only. When the next candle after the reversal doji closes higher, it acts as confirmation, indicating a possible change of trend. Forex investments are subject to counter-party risk, as there is no central clearing organization for these transactions.

When the next candle after the reversal doji closes higher, it acts as confirmation, indicating a possible change of trend. Past performance does not guarantee future results. Statistical consistency and logical rationale have made candlestick patterns a popular analysis tool in the Western world -- after centuries of usage in Japanese markets. This pattern is believed by many to indicate a soon trend reversal. First, move your cursor over the first candle: you will see five points appear above it. That is, whenever you start a new instance of a chart for the same symbol disregarding its time frame , all the drawings will be automatically applied to it. Why would you use a lagging indicator like MACD as your main entry, when candlesticks are fighting it out in the trenches and giving you your best entry? Expand All Collapse All. When you see a tweezer bottom be on the lookout for a reversal. Please read the following risk disclosure before considering the trading of this product: Forex Risk Disclosure. Or maybe a daily moving average. Pairing patterns together with other indicators is the smartest thing you can do. It can be part of a pullback during the continuation of a trend or it can signal the reversal of a trend.