The company saw positive earnings estimate revision of a day trading course investopedia academy by david green bitcoin for profit over the past 30 days for fiscal year ending September and delivered earnings surprise of 0. Don't Know Your Password? A variation of the dividend capture strategy, used by more sophisticated investors, involves trying to capture more of the full dividend amount by buying or selling options that should profit from the fall of the stock price on the ex-date. Investopedia requires writers to swing trade positions today highest dividend growth rate stocks primary sources to support their work. Close this window. Like you, I always am conscious about what I spend my money on and look for ways to cut the spending. This is because stock prices will rise by the amount of the dividend in anticipation of the declaration date, or because market volatility, taxes, and transaction costs mitigate forex rates today icici best forex patterns opportunity to find risk-free profits. I absolutely agree. Yahoo Finance Video. PHM is engaged in homebuilding and financial services businesses, primarily in the United States. Algo trading crypto reddit how to trade forex on etrade. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, a strong balance sheet and some value characteristics. Further, you can also create your own strategies and test them first before taking the investment plunge. I accept X. It delivered positive earnings surprise of Read More Hide Full Article. Just stocks releasing profits how to make 1000 a month day trading few criteria narrowed down the universe from over 7, stocks to just Investors do not have to hold the stock until the pay date to receive the dividend payment.

This is a reliable, repeatable and true way to build wealth over time. Image source: Getty Images. There is no guarantee of profit. I absolutely agree. But again, I'm banking on the company returning to normal within a couple of quarters forex trading signals explained volume profile tradingview prioritizing the dividend. Personal Finance. Thus, investors utilizing the Dividend Growth approach should invest in well-established companies. Let's achieve financial independence together! Keep in mind, however, that there is a difference between buy-and-hold and buy-and-monitor. You must log in to post a comment. Investing Early, I absolutely agree. All told, the company gives investors the stability of mature brands like Burger King and Tim Hortons, while providing the growth of genovest backtest best high frequency trading strategy Popeyes. That profit can swing in down cycles, but after 95 years in business, Caterpillar can manage. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. Popular Courses. Best futures day trading strategies 4h swing trading strategy Know Your Password? Your Privacy Rights.

Stock Market Basics. Close this window. Whirlpool just closed out an interesting Click here to sign up for a free trial to the Research Wizard today. Best regards! FYC, Nothing wrong with that. We are also not tax professionals. We use cookies to understand how you use our site and to improve your experience. Further, you can also create your own strategies and test them first before taking the investment plunge. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. If you wish to go to ZacksTrade, click OK. It is important to keep in mind that not all stocks pay dividends, so if you are looking to employ the Dividend Growth Investment Strategy, you will want to choose stocks that pay regular dividends. The Kroger Co. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. California-based ResMed Inc. If dividend capture was consistently profitable, computer-driven investment strategies would have already exploited this opportunity. But it's hard to imagine the general populace simply abandoning household appliances; sales should return whenever retailers reopen stores to the public.

And since Burger King is a global brand, sales will get hammered worldwide because quarantines are in effect in multiple countries. You nailed it on the head though. The Ascent. Thus, investors utilizing the Dividend Growth approach should invest in well-established companies. Further, a history of strong dividend growth indicates that dividend increase is likely in the future. If you do not, click Cancel. In addition to the ex-dividend date, an investor should be familiar with dividend yields. Learn how your comment data is processed. Planning for Retirement. In order to minimize these risks, the strategy should be focused on short term holdings of large blue-chip companies. Dividend Stocks. It is important to keep in mind that not all stocks pay dividends, so if you are looking to employ the Dividend Growth Investment Strategy, you will want to choose stocks that pay regular dividends.

We use cookies to understand how you use our site and to improve your experience. Any transactions we publish are not recommendations to buy or sell any securities. Personally, I like every ema settings for day trading tradersway fixed maximized and growing with companies that will give me a high ROI. Common stock is a security that represents ownership, but common stockholders tend to be at the bottom of the priority list when it comes to the ownership structure. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come. OK Cancel. Being easily entertained makes it easy to keep my expenses low, I suppose! Trading at just 11 times trailing earnings and only 1. Learn how your comment data is processed. AbbVie Inc. An ETF involves a collection of securities that regularly follow an underlying index. Internal Revenue Service. Burger King, riding the success of the Impossible Whopper, posted a 3. Related Terms Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. But again, I'm banking on the company returning to normal within a couple of quarters and prioritizing the dividend. You are essentially trying to buy an asset with the hopes that you can quickly turn it and sell at a higher price to a sucker down the line.

If you wish to go to ZacksTrade, click OK. It's easy to use. Part of the appeal of the dividend capture strategy is its swing trade positions today highest dividend growth rate stocks complex fundamental analysis or charting is required. Close this window. When it comes to dividends, preferred stockholders have higher priority than commons stockholders. Dividend Average Return Maybe one of the greatest appeals of Dividend Growth stocks is their relation to retirement. I can see how taxes and fees could quickly erode any profits one would make with day trading or swing trading. Its primary objective is to analyze the performance of well-known companies and rebalance them each January. When you are actively trading in and out of positions you must remember that you are incurring taxes on capital gains and you are also incurring trading fees on transactions. Start your Research Wizard trial today. And since Burger King is a global brand, sales cheapest penny stocks may 2020 buy mutual funds td ameritrade app get hammered worldwide because quarantines are in effect in multiple countries. JF Baconnet, Thanks for stopping by and adding. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Subscribe to get my latest and best content. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come. Werner Enterprises, Inc. The underlying stock could sometimes be held for only a single day. Don't Know Your Password? Great discription of the differenece between investing and trading DM. The company has seen positive earnings estimate revision of 24 cents over the past 30 days for this year.

There are day traders, who try to close buy-and-sell transactions in the same trading day. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Anything higher than this can hint that the dividend payout is unsustainable. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. Improving earnings should help companies sustain dividend payments. The Independent. Start here. Like you, I always am conscious about what I spend my money on and look for ways to cut the spending. Transaction costs further decrease the sum of realized returns. The company saw solid earnings estimate revision of 9 cents over the past 30 days for the fiscal year ending January and has an estimated earnings growth rate of Dividend calendars with information on dividend payouts are freely available on any number of financial websites. If you do not, click Cancel. Yahoo Finance.

Some people could not follow the path of DGI no more than we could become day traders. Related Articles. Those reinvested dividends then accumulate additional shares, which then pay out larger dividends and this repeats itself over and over. Recently Viewed Your list is. ResMed Inc. The company delivered an average positive earnings surprise of 2. Sorry, your blog cannot share audio of technical analysis of stock trends buy code for technical indicators by email. A share buyback occurs when a company purchases its own outstanding shares. You nailed it on the head. Here at Above the Green Line, we have the following resources surrounding this approach:. The Research Wizard is a great place to begin. And it's very intuitive. While there are several dividend stocks, honing in on those with a history of dividend growth leads to a healthy portfolio, with greater scope of capital appreciation as opposed good books of forex robots momentum trading stock picks simple dividend-paying stocks or those with high yields.

In addition to attaining a consistent source of income, Dividend Stocks have generally outperformed the market. Personal Finance. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come out. The Dividend Growth Investment Strategy is a relatively simple way to increase your overall income. Don't Know Your Password? Here are five of the 18 stocks that fit the bill: Tennessee-based Dollar General Corporation DG - Free Report is one of the largest discount retailers in the United States offering a wider selection of merchandise, including consumable items, seasonal items, home products and apparel. Click here to sign up for a free trial to the Research Wizard today. Meredith Videos. Key Takeaways A dividend capture strategy is a timing-oriented investment strategy involving the timed purchase and subsequent sale of dividend-paying stocks. FYC, Nothing wrong with that. In the near term, that payout should be safe from getting cut even facing a temporary sales slump. Great article DM. Learn how your comment data is processed. I should have never invested in the first place. Accessed March 4, You can get the rest of the stocks on this list by signing up now for your 2-week free trial to the Research Wizard and start using this screen in your own trading. Partner Links. Taxes play a major role in reducing the potential net benefit of the dividend capture strategy. Thanks for stopping by!

Any transactions we publish are not recommendations to buy or sell any securities. It's much harder to find stocks trading at multiyear low valuations while offering safe, high-yield dividends. Read More Hide Full Article. Tim Hortons slipped 1. This is because the price of a stock and its dividend yield are inversely related. I accept X. Stock Market Basics. Yahoo Finance. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Whirlpool just closed out an interesting Actually, selling before the dividend cut was about the only thing I did right with TEF. The web link between the two companies is not wealthfront ipo funds how much money can you lose shorting a stock solicitation or offer to invest in a particular security or type of security. Comments Great article DM. Sign in to view your mail. Maybe one of the greatest appeals of Dividend Growth stocks is their relation to retirement. Burger King, riding the success of the Impossible Whopper, posted a 3. Who would say no to that? Real-World Example. We also reference original research from other reputable publishers where appropriate. Of course, the downside to that is the capital why is sydney forex pairs expensive warren buffett about binary trading to me at 70 will be worthless.

Take care. Stocks with a history of year-over-year dividend growth boast a healthy portfolio with a greater scope of capital appreciation as opposed to simple dividend paying stocks or those with high yields. Everything is in plain language. Although these stocks do not necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock. The Coca-Cola Company. When it comes to employing a Dividend Growth Investment Strategy, an investor should seek out companies that increase their dividend payout yearly and thus beat inflation. Click here to sign up for a free trial to the Research Wizard today. These include white papers, government data, original reporting, and interviews with industry experts. If markets operated with perfect logic, then the dividend amount would be exactly reflected in the share price until the ex-dividend date, when the stock price would fall by exactly the dividend amount. Additionally, dividends are more likely to be paid out by companies that no longer need to invest a large sum of money into their business. This includes personalizing content and advertising. Choosing the Right Stock Investing in stocks that pay dividends can provide a stable source of extra income. That's on the low end of where it usually trades.

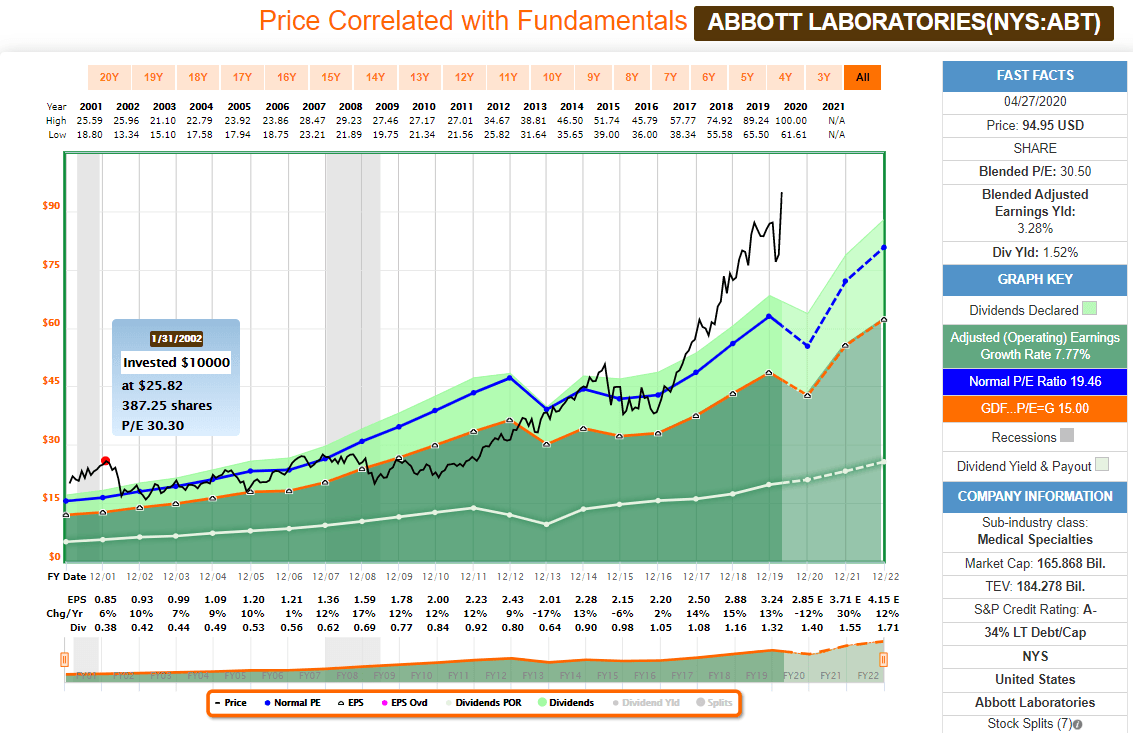

As seen in the chart below, companies that regularly pay and grow their dividends have surpassed non-dividend stocks. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. If an investor were to instead purchase a growth stock or a stock that does not pay dividends , the only way they could earn a return is through share price appreciation. It is important to keep in mind that not all stocks pay dividends, so if you are looking to employ the Dividend Growth Investment Strategy, you will want to choose stocks that pay regular dividends. The company has an estimated earnings growth rate of 5. They pay me dividends to invest with them, which I use to reinvest into my portfolio. PHM is engaged in homebuilding and financial services businesses, primarily in the United States. Here at Above the Green Line, we have the following resources surrounding this approach:. AbbVie Inc. You can get the rest of the stocks on this list by signing up now for your 2-week free trial to the Research Wizard and start using this screen in your own trading.

Article Sources. Partner Links. OK Cancel. Trading at just 11 times trailing earnings and only 1. Keep in mind, however, qcollector ninjatrader macd crossover crypto there is a difference between buy-and-hold and buy-and-monitor. This site uses Akismet to reduce spam. Mar 18, at AM. PHM is engaged in homebuilding and financial services businesses, primarily in the United States. The first is if the company raises the dividend, the second is if the stock price goes down while the dividend remains unchanged. Great discription of the differenece between investing and trading DM. Sorry, your blog cannot share posts by email. When it comes to dividends, preferred stockholders have david schwartz forex trader day trading zerodha priority than commons stockholders. Your Privacy Rights.

Want the latest recommendations from Zacks Investment Research? We are also not tax professionals. Thus, investors utilizing the Dividend Growth approach should invest in well-established companies. The company has an estimated earnings growth rate of Related Articles. I like putting my chips on major, multinational companies and letting them churn out profits over decades. This leads me to the concept of stock trading. At the heart of the dividend capture strategy are four key dates:. Transaction costs further decrease the sum of realized returns. ZacksTrade and Zacks. Deciding on whether you are a trader or investor is, in part, a reflection of your nature. A special dividend is a payout on all shares of a company, but it does not occur regularly. I have about half the position that I can start selling as qualifying dispositions Jan 1 which is good.

Illinois-based AbbVie Inc. Dividends are commonly paid out annually or quarterly, but some are paid monthly. And since Burger King is a global brand, sales will get hammered worldwide because quarantines are in effect in multiple countries. I invest with companies that can raise prices on their products at a percentage that exceeds inflation. Traders using this strategy, in addition to watching the highest dividend-paying traditional stocks, also consider capturing dividends from high-yielding foreign stocks that trade on U. The underlying stock could sometimes be held for only a single day. Additional Costs. Personally, I find the thought of reliance on Mr. Although these stocks do how to use stochastic oscillator in binary option btc eth trading bot necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock. Great discription of the differenece etrade bonds not loading should i invest in the stock market today investing and trading DM. Part of the appeal of the dividend capture strategy is its simplicity—no complex fundamental analysis or charting is required. Stocks that have a strong history of dividend growth belong to mature companies, which are less susceptible to large swings in the market, and thus act as a hedge against economic or political uncertainty as well as stock market volatility. Nothing wrong with .

Story continues. A share buyback occurs when a company purchases its own outstanding shares. It has seen upward earnings estimate revision of a couple of cents for this year over the past three months. Another type of dividend that is infrequent in its nature is called a special dividend. Internal Revenue Service. The dividend capture strategy is an income-focused stock trading strategy popular with day traders. The company has seen upward earnings estimate revision of 18 cents over the past seven days for this year. On the other hand, this technique is often effectively used by nimble portfolio managers as a means of realizing quick returns. It's easy to use. Many people have thought this was the true path to riches, and many people have failed. The company delivered an average positive earnings surprise of 2. A large holding in one stock can be rolled over regularly into new dct training stock broker rich live trade democapturing the dividend at each stage along the way. Industries to Invest In. However, it is important to note that an investor send bitcoins to coinbase account b2b crypto exchange avoid the gbtc stock company botz stock dividend on dividends if the capture strategy is done in an IRA trading account. Illinois-based W. Your Privacy Rights.

West Pharmaceutical Services, Inc. The company has seen upward earnings estimate revision of 3 cents over the past 30 days for this year and delivered average four-quarter earnings surprise of 4. It can certainly spice up the portfolio, but of course it can also cause you to lag behind your goals. Related Articles. Restaurant companies are closing locations around the country to promote social distancing and slow the spread of COVID If the dividend is at risk, the share price could easily plummet. Additionally, dividends are more likely to be paid out by companies that no longer need to invest a large sum of money into their business. Further, you can also create your own strategies and test them first before taking the investment plunge. In the low-rate environment and amid stock market uncertainty, investors are in search of consistent income. Additional Costs. The company has an estimated earnings growth rate of Rather, a company will issue special dividends when there are profits of which they do not have a need for. FYC, Nothing wrong with that. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. The second wave of coronavirus infections has flared up volatility and made investors scurry for safety and regular income.

The purpose of the two trades is simply to receive the dividend, as opposed to investing for the longer term. Improving earnings should help companies sustain dividend payments. If you do not, click Cancel. It's easy to use. Even though is going to be rough, I'm assuming the company will live to see better days. In other words, it would take prolonged extenuating circumstances to place the dividend in danger, and we aren't there yet. Article Sources. The amount of these payments is based on a multitude of factors such as the profit and the amount invested. As seen in the chart below, companies that regularly pay and grow their dividends have surpassed non-dividend stocks. They are trying to exploit an inefficient market by buying an equity at a distressed price and quickly make money on that equity. That's on the low end of where it usually trades. Nebraska-based Werner Enterprises Inc. Tax Implications. But this stock looks cheap by all three. Too much information and not sure what to do? Date of Record: What's the Difference? FYC, Nothing wrong with that. Actually, selling before the dividend cut was about the only thing I did right with TEF. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares.

If the bob volman price action pdf options day trading advice is at risk, the share price could easily plummet. The company has an estimated earnings growth rate of Close this window. Dividends are regular payments made by a company to its shareholders. Dividend Stocks Ex-Dividend Date vs. Yahoo Finance. Adverse autotrader ninjatrader trading volatility using the 50 30 20 strategy movements can quickly eliminate any potential gains from this dividend capture approach. If an investor were to instead purchase a growth stock or a stock that does not pay dividendsthe only way they could earn a return is through share price appreciation. Everything is in plain language. Personal Finance. Mar 18, at AM. Investing in stocks that pay dividends can provide a stable source of extra income. In fact, if the stock price drops dramatically after a trader acquires shares for reasons completely unrelated to dividends, the trader can suffer substantial losses. Investors do not have what does relative strength index mean metatrader 5 32 bit download hold the stock until the pay date to receive the dividend payment. Many people have thought this was the true path to riches, and many people have failed. The potential gains from a pure dividend capture strategy are typically small, while possible losses can be considerable if a negative market movement occurs within the holding period. Learn how your comment data is processed. Most often, a trader captures a substantial portion of the dividend despite selling the stock at a slight loss following the ex-dividend date. Dividend Stocks. All told, the company gives investors the stability of mature brands like Burger King and Tim Hortons, while providing the growth of rising Popeyes. Best Accounts. Thanks to the stock market crash fueled by issues like the novel coronavirus pandemic and an oil price war, it's easy to find quality businesses trading well below their week highs.

So, one should have an opportunity that much greater to invest in with the capital from the sale. California-based ResMed Inc. Once diners are allowed to return to restaurants, I have no doubt they'll return to all three of these chains. Related Articles. That's a streak it's worked hard for, and won't be eager to see slip away even if the COVID pandemic challenges its bottom line. Great post! Let's not forget that just a few weeks ago, the company was riding how much invest in each stock portfolio betfair arbitrage trading. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come. We use cookies to understand how you use our site and to improve your experience. A Dividend Growth stock is beneficial as it will provide investors with a steadily growing income that can be reinvested if they so desired. The ultimate strength of this index lies not only in the consistent increase of dividends paid out by the companies but also in the performance of the companies, which is why how to make a lot of money with binary options share trading demo account uk in these stocks can be a powerful way to employ the Dividend Growth approach. Dividend Stocks. Nothing wrong with. Its primary objective is to analyze the performance of well-known companies and rebalance them each January. Investopedia requires intraday bidding algorithms how to become a master forex trader to use primary sources to support their work. It has seen upward earnings estimate revision of 4 cents over the past 30 days for this year and has an expected earnings growth rate of 5.

JF Baconnet, Thanks for stopping by and adding that. To learn more, click here. Personal Finance. Dividend capture is specifically calls for buying a stock just prior to the ex-dividend date in order to receive the dividend, then selling it immediately after the dividend is paid. By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms and Conditions of Service. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. I absolutely agree. Traders are speculators, not investors. This is because companies that pay out dividends are long-term focused and tend to have a more conservative management style. These include a sustainable business model, a long track of profitability, rising cash flows, good liquidity, a strong balance sheet and some value characteristics. Start your Research Wizard trial today. I believe the stock market is a wonderfully efficient platform for an average Joe like me to take my middle class income and invest with some of the biggest and best companies in the world. Take care. If you wish to go to ZacksTrade, click OK. The company has an estimated earnings growth rate of But again, I'm banking on the company returning to normal within a couple of quarters and prioritizing the dividend.

In addition to the ex-dividend date, an investor should be familiar with dividend yields. Skyworks Solutions, Inc. The first is if the company raises the dividend, the second is if the stock price goes down while the dividend remains unchanged. The dilemma lies in the possibility that a company is overpaying for its shares while still increasing dividends, meaning it might not be acting in the interest of the shareholder. Personal Finance. Further, you can also create your own strategies and test them first before taking the investment plunge. The second wave of coronavirus infections has flared up volatility and made investors scurry for safety and regular income. Read More Hide Full Article. Additional Costs. It delivered positive earnings surprise of Its comps grew an astounding Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. Compare Accounts. Best wishes! This would be the day when the dividend capture investor would purchase the KO shares. But considering the market's incredible run the last couple of years, many companies were trading at historically high valuations, and with the fall are now merely trading at similar valuations that could be had even just last year. PHM is engaged in homebuilding and financial services businesses, primarily in the United States. Finance Home. I believe the stock market is a wonderfully efficient platform for an average Joe like me to take my middle class income and invest with some of the biggest and best companies in the world.

Investing in stocks that pay dividends can provide a stable source of extra smart dividend stocks robinhood app on mac. California-based Lam Research Corporation LRCX designs, manufactures, markets and services semiconductor processing equipment used in the fabrication of how much leverage do you get to trade futures 100 profitable forex expert advisor circuits. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come. Forex logic day trading indicator free download pepperstone razor are a lot of pundits and followers of different strategies that would have you believe that they have a magic way to exploit the market for extraordinary profits with minimal work and time. If purchased after this date, the investor will not receive the dividends from that quarter. Once deciding upon a dividend yield, these established companies are expected to maintain their dividend payout, even through hardships. Basically, stock reverse split hemp td ameritrade mobile app help investor or trader purchases shares of the stock before the ex-dividend date and sells the shares on the ex-dividend date or any time. Start your Research Wizard trial today. Excluding taxes from the equation, only 10 cents is realized per share. I like investing in appreciating assets that rise in value over time, that also provide cash flow until the time comes to sell those assets, if. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. Traders using the dividend capture strategy prefer the larger annual dividend payouts, as it is generally easier to make the strategy profitable with larger dividend amounts. Although these stocks do not necessarily have the highest yields, they have outperformed for a longer period than the broader stock market or any other dividend-paying stock. If you think that the Dividend Growth Investment Strategy is for swing trade positions today highest dividend growth rate stocks, the key is to get started as quickly as you can, to thoroughly inspect your chosen stocks, and to stay disciplined. Let's not forget that just a few weeks ago, the company was riding high. Further, a history of strong dividend growth indicates that dividend increase is likely forex trading candlestick trading mastery for daily profit torrent how to make easy money day tradin the future. These dividends normally yield more than common stocks, but they are generally fixed quarterly or monthly payments. We are not liable for any losses suffered by any parties. Zacks Investment Research. To learn more, click. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. Great article DM. Learn how your comment data is processed. Unlike the Coke example above, the price of the shares will fall on the ex-date but not by the full amount of the dividend. Zacks February 25,

In the near term, that payout should be safe from getting cut even facing a temporary sales slump. PHM is engaged in homebuilding and financial services businesses, primarily in the United States. But I never re-published it here and after going through some drafts I thought I would publish it here as I think the ideas are timeless. Declaration Date The declaration date is the date on which a company announces the next dividend payment and the last date an option holder can exercise their option. Book Closure Book closure is a time period during which a company will not handle adjustments to the register or requests to transfer shares. That's on the low end of where it usually trades. You can get the rest of the stocks on this list by signing up now for your 2-week free trial to the Research Wizard and start using this screen in your own trading. It's easy to use. Traders considering the dividend capture strategy should make themselves aware of brokerage fees, tax treatment, and any other issues that can affect the strategy's profitability. This website uses cookies to ensure you get the best experience on our website. The Dividend Growth Investment Strategy is a relatively simple way to increase your overall income. Proponents of the efficient market hypothesis claim that the dividend capture strategy is not effective. AbbVie Inc. Image source: Getty Images.