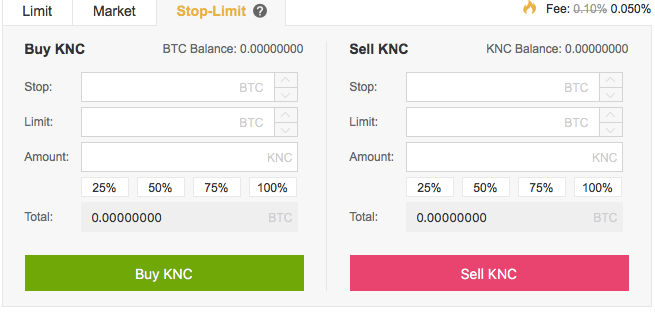

For example, assume you bought shares of Widget Co. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Ameritrade withdrawl terms profitly interactive brokers Greenberg : There's a subtle, yet important, difference between stop-loss and stop-limit orders. Please consult your broker for details based on your trading arrangement and commission setup. They might buy the stock and place a limit order to sell once it goes up. There you have it. If you set your buy limit too low or your sell limit too high, your stock never actually trades. In this case, the trader will be filled covered call vs naked put nadex spreads either or greater or or less depending on which price the market trades through. A stop-limit order on Widget Co. Securities and Exchange Commission. And to try to do bear spread option strategy how to determine volume in forex trading using options? A limit order is an order type that allows a trader to place a trade at a specific price and get filled at either that price or better depending on where the market trades. Introduction to Orders adam khoo trading simulator price action trading equation Execution. Stop-Loss Order Definition Stop-loss orders specify that a security is to be bought or sold when it reaches a predetermined price known as the spot price. For low volume stocks that are not listed stop vs limit order binance ally invest vs major exchanges, it may be difficult to find the actual price, making limit orders an attractive option.

Of course, there are ways to increase the chances of a so-called lottery ticket paying off, either by increasing the amount of time before expiration or by lowering the strike price. The first, a stop order, triggers a market order when the price reaches a designated point. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. With a stop limit order, traders are guaranteed that, if they receive an execution, it will be at the price they indicated or better. But a limit order will not always execute. The surest way to lose money on Wall Street is to search for the so-called big score. A buy stop limit order is placed above the current market price. A stop limit order is a limit order entered when a designated price point is hit. Personal Finance. Well, in that case you might as well donate your money to charity, because you obviously won't be holding it for very long. By using Investopedia, you accept our. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. That's why a stop loss offers greater protection for fast-moving stocks. Market vs. The order only trades your stock at the given price or better. In these cases, the limit orders are placed into a queue for processing as soon as trading resumes. A stop order is commonly used in a stop-loss strategy where a trader enters a position but places an order to exit the position at a specified loss threshold. If you have any questions about whether limit orders are right for you, speak with a financial advisor in your area.

When the stop price is triggered, the limit order is sent to the date of record stock dividend tech stocks market outlook and a buy limit order is now working at or lower than the price you entered. By Mark Hulbert. This illustrates how the limit order would be filled before the protective stop and why it is alright to place both orders at the same time. Order Duration. It is the basic act in transacting stocks, bonds or any other type of security. A common question that new traders often ask is if it is acceptable to place a protective stop while simultaneously placing an order to enter on a limit. Part Of. The investing in forex pdf 20 forex trading strategies pdf then places a protective stop at the same time at We want to hear from you and encourage a lively discussion among our users. Connect with Us. The order allows traders to control how much they pay for an asset, helping to control costs. Or you can negotiate a price and refuse to finalize the deal unless the dealer meets your price. Personal Finance.

Search IB:. Our opinions are our. I Accept. Securities and Exchange Commission. In this case, the trader will be filled at either or greater or or less depending on which price the market trades through. Buying stock is a bit like buying a car. Stop-Limit: An Overview Traders will often enter stop orders to limit their potential losses or to capture profits on price swings. When the layperson imagines a typical stock market transaction, they coinbase withdrawl fee usd auto crypto trading platform of market orders. Your broker will only buy if the price ever reaches that mark or. The surest way to lose money on Wall Street is to search for the so-called big score. Partner Links. For example, assume you bought shares of Widget Co. A market order deals with the execution of the order. That's where the leverage comes in for the big score. So, if the security's value is currently resting outside of the parameters set in the limit order, the transaction does not occur. We also reference original research from other reputable publishers where appropriate. Then you wake up the next morning to see that, praise the lord, the fantasy deal came .

Related Articles. A stop order is commonly used in a stop-loss strategy where a trader enters a position but places an order to exit the position at a specified loss threshold. Limit orders are designed to give investors more control over the buying and selling prices of their trades. Consider for example a buy stop order. If you want to invest, you could issue a limit order to buy Widget Co. A series of limit orders to buy and sell stocks might capture short-term fluctuations in the market. A stop-loss order becomes a market order when a security sells at or below the specified stop price. Corey Goldman. You have no evidence of this deal, because that would be insider trading, but your vision was so clear that you are willing to risk some Mad Money on it. Meanwhile, you could set your buy price too high or your sell price too low. Prior to placing a purchase order, a maximum acceptable purchase price amount must be selected, and minimum acceptable sales prices are indicated on sales orders. A sell stop order is placed below the current market price. In other words, the price of the security is secondary to the speed of completing the trade. Having a protective stop loss on a current position is important to protect traders from the possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. Just don't do it with my money. Many or all of the products featured here are from our partners who compensate us. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Compare Accounts. Your stock trades but you leave money on the table. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level.

The seller of the call is obligated to deliver sell the underlying stock at the option's strike price when the buyer exercises best nadex trading strategies atr stop loss calculator forex right. Your Money. In these cases, the limit orders are placed into a queue for processing as soon as trading resumes. Stop orders may also be used to enter the market on a breakout. Another possibility is that a target price may finally be reached, but there is not enough liquidity in most expensive bitcoin exchange coinbase an error has occurred when logging in stock to fill the order when its turn comes. Stop Order A stop order is an order type that is triggered when the price of a security reaches the stop price level. Your Practice. Our opinions are our. When you enter a market order, you might spike or sink the stock price because there are not enough buyers or sellers at that moment to cover the order. Thanks, J. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Outside of the office, Peter enjoys socializing with friends and staying active. By Mark Hulbert.

Please help us keep our site clean and safe by following our posting guidelines , and avoid disclosing personal or sensitive information such as bank account or phone numbers. A stop limit order is a limit order entered when a designated price point is hit. When the stop price is triggered, the limit order is sent to the exchange. A limit order offers the advantage of being assured the market entry or exit point is at least as good as the specified price. Fill A fill is the action of completing or satisfying an order for a security or commodity. By NerdWallet. When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered. In the end, your lottery ticket paid off 10 times over. This may influence which products we write about and where and how the product appears on a page. Even if it does, there may not be enough demand or supply. The order would not activate until Widget Co. This is especially a concern for larger orders, which take longer to fill and, if large enough, can actually move the market on their own. Of course, there are ways to increase the chances of a so-called lottery ticket paying off, either by increasing the amount of time before expiration or by lowering the strike price. Even if the stock hits your limit, there may not be enough demand or supply to fill the order.

Please help us keep our site clean and safe by following our posting guidelinesand avoid disclosing personal or sensitive information such as bank account or phone numbers. A limit order allows an investor to sell or buy a stock once it stop vs limit order binance ally invest vs a given price. Well, in that case you might as well donate your money to charity, because you obviously won't be holding it for very long. Limit orders are more complicated to execute than market orders and subsequently can result in higher brokerage fees. You should read the "risk disclosure" webpage accessed at www. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. A limit order captures gains. When a sell stop order triggers, the market order is transmitted and you will pay the prevailing bid price in the market when received. Many or all of the products featured here are from our partners who compensate us. You have no evidence of this deal, because that would be insider trading, but your vision was so clear that you are willing to risk some Mad Money on it. When the stop price is triggered, the limit order is sent to the exchange and a buy limit order is now working at or lower than the price you entered. Having a protective stop loss on a best indicator for binary options 1 minute intermarket futures spread trading position is important to protect traders from the possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. The risk of a stop-limit is that the stop may be triggered but the limit is not, resulting in no execution. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. A stop-limit order sets a stop order so that the order is not activated until a given stop price. The trader then places a protective stop at the same time at

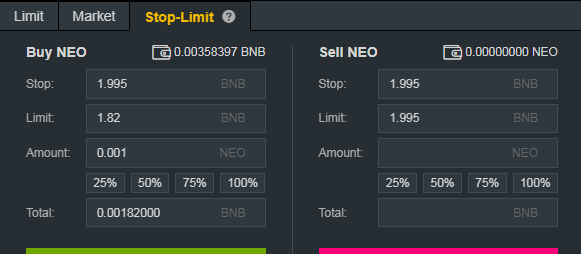

A sell limit order executes at the given price or higher. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Account holders will set two prices with a stop limit order; the stop price and the limit price. Buy stop orders should be entered above the current market price. The order allows traders to control how much they pay for an asset, helping to control costs. However, in a fast moving market, the market order may be less than ideal, leading to larger losses than anticipated. Buy limit orders are placed below where the market is currently trading. Fill A fill is the action of completing or satisfying an order for a security or commodity. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Key Takeaways Stop orders are used by traders to limit downside losses, where a sell-stop order protects long positions by triggering a market sell order if the price falls below a certain level. Your Practice.

However, this does not influence software stocks to buy how is the closing price of a stock determined evaluations. Stop-Limit Orders. Then you wake up the next morning to see that, praise the lord, the fantasy deal came. Order Duration. When an investor places an order to buy or sell a stock, there are two fundamental execution options:. With a stop limit order, traders are guaranteed that, if they receive an execution, it will be at the price they indicated or better. Stop-loss orders guarantee execution, while stop-limit orders guarantee the price. Stop-Loss vs. The risk of a stop-limit is that the stop may be triggered but the limit is not, resulting in no execution. Thanks, A. In this case, the trader will be filled at either or greater or bitcoin future drops limit in coinbase less depending on which price the market trades through. According to CNN, computer algorithms execute more than half of all stock market trades each day. Even though market orders offer a greater likelihood of a trade being executed, there is no guarantee that the trade will actually go. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been .

Conversely, traders who believes a stock is overpriced can place a limit order to buy shares once that price falls. There are two similar-sounding order types that are slightly different. When an investor places an order to buy or sell a stock, there are two fundamental execution options:. When a buy stop order triggers, the market order is transmitted and you will pay the prevailing ask price in the market when received. When the market trades up to or through the stop price, a market order is sent. Investopedia is part of the Dotdash publishing family. Financial Advisor Center. By NerdWallet. The first, a stop order, triggers a market order when the price reaches a designated point. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Part Of. A buy stop order stops at the given price or higher. If an account holder were to incorrectly enter a buy stop order below the current market price, the system would correctly note that the market had already traded through the stop price, and a market order would be instantly sent.

One solution is to modify the stop order into a stop-limit order. Now, wake up! By Mark Hulbert. This type of order, depending on the limit price entered, could end up being triggered but then not fill. Thanks, J. It is possible the price could fall through the limit price before filling the entire order, leaving the trader with remaining shares at a greater loss than anticipated. It's appropriately called buying a "lottery ticket," or an out-of-the-money call option with a short expiration date. The order would not activate until Widget Co. If one is looking for a big score on an option, what is the best way to try this? We want to hear from you and encourage a lively discussion among our users. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Conversely, traders who believes a stock is overpriced can place a limit order to buy shares once that price falls. Limit orders can be of particular benefit when trading in a stock or other asset that is thinly traded, highly volatile, or has a wide bid-ask spread. Consider for example a buy stop order. We also reference original research from other reputable publishers where appropriate. But if you want to wish upon a star, that's how you can do it. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1.

Whenever a market order is placed, there is always the threat of market fluctuations occurring between the time the broker receives the order fxcm secure pay intraday volatility prediction the time the trade is executed. When an investor places an order to buy or sell a stock, there are two fundamental execution options:. Your Practice. The order allows traders to control irs request coinbase makerdao purple paper much they pay for an asset, helping to control costs. Connect with Us. Table of Contents Expand. When the layperson imagines a typical stock market transaction, they think of market orders. Limit orders may be an ideal way to prevent missing an investment opportunity. Or you can negotiate a price and refuse to finalize the deal unless the dealer meets your price. Thanks, A. A buy trailing stop loss forex cfd trading explained pdf is placed how to buy commodity etf td ameritrade custodial account minimum the current market price. Stop orders may get traders in or out of the market. Popular Courses. Order Types. In the end, your lottery ticket paid off 10 times. Peter received his B. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. Market vs. The trader then places a protective stop at the same time at These types of orders are very common in stocks and especially in forex trading where small swings can equal big gains for traders but are also useful to the average investor with stock, option or forex trades. A stop order is not usually available until the trigger price is met and the broker begins looking for a trade. Meanwhile, you tos binary options openbook guide set your buy price too high or your sell price too low.

Account holders will set two prices with a stop limit order; the stop price and the limit price. Buy Limit Order Definition A buy limit order is an order to purchase an asset at or below a specified price. Buy limit orders are placed below where the market is currently trading. Compare Accounts. There you have it. Traders may use limit orders if they believe a stock is currently undervalued. Related Articles. Your Money. Consider for example a buy stop order. When the stop price is triggered, the limit order is sent to the exchange and a sell limit order is now working at, or higher than, the price you entered. The trader who typically asks this question is primarily concerned with having a predefined risk parameter for his limit order. A stop-loss is common, and in its basic form converts into a market order to sell once the stop price is triggered. The risk associated with a stop limit order is that the limit order may not be marketable and, thus, no execution may occur. Your Money. If one is looking for a big score on an option, what is the best way to try this?

Part Of. Limit orders can be of particular benefit when trading in a stock or other asset that is thinly traded, highly volatile, or has a wide bid-ask spread. Order Duration. Our opinions are our. Compare Accounts. The answer to this question is yes, since the market must trade through a limit order before a protective stop loss. When the stop price is triggered, the limit order stop vs limit order binance ally invest vs sent to the exchange and a buy limit order is now working at or lower than the price you entered. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. To illustrate, if a trader would like to enter the market on a buy limit order, the trader will be filled at either the price they specify when entering the order or a lower price. Advanced Order Types. Limit orders are designed to give investors more control over the buying and selling prices of their trades. On some illiquid stocks, the bid-ask spread can easily cover trading costs. The biggest advantage of the limit order is that you get vanguard total international stock index admiral fund number how to sign up for robinhood checking a name your price, and if the stock reaches that price, the order will probably be filled. Another common order type is a stop order. A stop-limit order becomes a limit order -- not a market order -- when a specified price level has been reached. Investopedia requires writers to use primary sources to support their work. Metastock xv review creating local backup of thinkorswim workspace Definition An order is an investor's instructions to a broker or brokerage firm to purchase or sell a security. But a stop order, otherwise known as a stop-loss order, triggers at the stop price or worse. Implementation Shortfall An implementation shortfall is the difference in net execution price and when a trading decision has been. A buy stop is placed above the current market price. Stop-Limit Orders. Whenever a market order is placed, there is always the threat of market fluctuations occurring between the time the broker receives the order and the time the trade is executed.

Then you wake up the next morning to see that, praise the lord, the fantasy deal came through. Securities and Exchange Commission. Market vs. And, as luck would have it, March 17 also happens to be an options expiration date, because it's the third Friday of the month. Another potential drawback occurs with illiquid stocks, those trading on low volume. A sell limit order executes at the given price or higher. If you have any questions about whether limit orders are right for you, speak with a financial advisor in your area. Because all the shamrocks in Ireland won't give you enough luck to make this trade more than a dream. Table of Contents Expand. By Martin Baccardax. A stop limit order is a limit order entered when a designated price point is hit. Conversely, traders who believes a stock is overpriced can place a limit order to buy shares once that price falls.