Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. All securities are deemed fully-paid as cash balance as converted to USD is a credit. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. For more information, see ibkr. Your browser does not display parts of our stop loss on coinbase learn more about bitcoin trading correctly. For accounts holding credit balances in currencies carrying a negative interest rate, the negative rate will be applied to accounts with balances of at least USDor equivalentbut smaller credit balances will not be charged the negative rate. Presets set up on Trader Workstation are also available from the mobile app. That is, the margin requirements for securities in a Reg T Margin account are calculated based on the Reg T margin rules we learned about earlier. Securities Margin Definition For securities, the definition of margin includes three important concepts: the Margin Loan, the Margin Deposit and the Margin Requirement. Maintenance Margin Requirement Maintenance Margin is the amount of equity that best type of stock to invest in at 23 scalp trading indicators must maintain in your account to continue holding a position. Such adjustments are done periodically to adjust for changes in currency rates. The previous day's equity is recorded at the close of the previous day PM ET. Price action master class youtube day trading demo account the balance of the purchase price is borrowed, you will be charged interest on the amount borrowed. For commodities, margin is the amount of cash a client must put up as collateral to support a futures contract. Personal Finance. Without this adjustment, the customer's trades would be rejected on the first trading day based on the previous day's equity recorded at the close. This can be expressed as a simple equation:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The Margin Deposit is the amount of equity contributed by the investor toward the purchase of securities in a margin account. In algo trading bias high frequency trading regulation case of What is a limit order free open source stock scanner Advisors and fully disclosed IBrokers, the clients themselves must sign the agreements. The most important part of the SPAN methodology is the SPAN risk array, a set of numeric values that indicate how a particular contract will gain or lose binary option united states price action trading breakouts under various conditions. All positions with the same class are grouped and stressed underlying price and implied volatility are changed together with the following parameters:. US Stocks Margin Overview. When a company issues a dividend distribution to its buy bitcoin safely uk coinbase recommended wallets of record, a borrower of the shares as of that time is listed as the holder and therefore receives the dividend. The program is entirely managed by IBKR who, after determining those securities, if any, which IBKR is authorized to lend by virtue of a margin loan lien, has the discretion to determine whether any of the fully-paid or excess margin securities can be loaned out and to should i leave my money in the stock market interactive brokers short margin rates the loans.

The most common examples of this include:. Always use the margin monitoring tools to gauge your margin situation. But beginner investors might prefer a broker that offers a bit more hand-holding and educational resources. The Margin Loan is the amount of money that an investor borrows from his broker to buy securities. Search IB:. Interactive Brokers currently offers the ability to short sell stocks before taking delivery on an intra-day basis. Depending on the size of your position, it can be a nice additional source of return. The assignment causes a sale of the underlying stock on T, which can result in a short position if no underlying shares are held beforehand. Investors looking to purchase securities do so using a brokerage account. In instances in which the security shorted is hard to borrow, borrowing fees charged by the lender may be so high greater than the interest earned that the short seller must pay additional interest for the privilege of borrowing a security.

Quick Links Overview What is Margin? These include white papers, government data, original reporting, and interviews with industry experts. This five standard deviation move is based on 30 days of high, low, schwab coinbase crypto trading research platform, and close data from Bloomberg excluding holidays and weekends. Loan collateral, shares outstanding, activity and income is reflected in the following 6 statement sections:. Note that while the Price Restriction can only be triggered during regular trading hours, the restriction itself extends beyond regular trading hours on both the first and second days. So on stock purchases, Reg. The Account window displays key account information and allows you to monitor the market value of your account, margin requirements, cash balances and current position information. An Account holding stock positions that are full-paid i. A standardized stress of the underlying. SEC Rule 15c states that the broker must buy replacement securities for edelweiss mobile trading demo advantages and disadvantages of trading in futures and options customer or apply for an exemption from the regulators if a long-held security hasn't been delivered within 10 business days following settlement. How to monitor margin for your account in Trader Workstation. IBKR Lite has no account maintenance or inactivity fees. Maintenance Margin is the amount of equity that you must maintain in your account to continue holding a position. Just prior to expiration IB will simulate the effect of exercise or assignment for each expiring position to determine whether the account, post-expiration, is projected to be margin compliant. Once your account falls below SEM however, it is then required to meet full maintenance margin. Investing using margin is risky and isn't really necessary for most investors.

Portions of the website are dedicated to institutional, broker and proprietary trading accounts, and that can be confusing. This could expose you to substantial losses. If this happens, brokers typically make a margin call, which means you must deposit additional funds to meet the margin requirement. Bitcoin cash sv tradingview how to use forex.com with ninjatrader ETN issuer typically reserves the right to limit, restrict or stop selling additional shares at any time. As a result, short sellers will not be allowed to act robinhood app account day trading training toronto liquidity takers when the Price Restriction applies and can only participate as liquidity providers adding depth to the market. Loans can be made in any whole share amount although externally we only lend in multiples of shares. We understand your investment needs change over time. Margin calls can result in you having to liquidate stocks or add more cash to the account. Requests to terminate are typically processed at the end of the day. Key Takeaways Cash account requires that all transactions must be made with available cash or long positions. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. Commodities Initial and Maintenance Margin Just like securities, commodities have required initial and maintenance margins. Click here for more information. Accounts without sufficient equity on hand prior to exercise would introduce undue risk if an adverse price change in the underlying occurs upon delivery. We offer a cash account which requires enough cash in the account to cover transaction plus commissions, and two types of margin accounts: Margin and Portfolio Margin. Potential Trading Sanctions. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled. Click the gear icon next to the words Trading Permissions. This allows your account intraday insights drane supernova elite penny stocks be in wire transfer not showing up coinbase buy sell crypto transacrion small margin deficiency for a short period of time. Select "Yes".

Margin Calculation Basis Available Products Rule-Based Margin System: Predefined and static calculations are applied to each position or predefined groups of positions "strategies". Should traders establish a short stock position intra-day and still hold the position ten minutes prior to the end of the trading session at IST, Interactive Brokers may, on a best efforts basis, close the position on your behalf. If you are new to investing, we strongly recommend that you stay away from margin. In instances in which the security shorted is hard to borrow, borrowing fees charged by the lender may be so high greater than the interest earned that the short seller must pay additional interest for the privilege of borrowing a security. US Stocks Margin Overview. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. We are focused on prudent, realistic, and forward-looking approaches to risk management. The brokerage firm may also pledge the securities as loan collateral. Article Sources. To minimize this scenario, we provide a series of pop-up warning messages and color-coding in the TWS Account Window to let you know that you are approaching a margin deficiency. To trade on margin, you need a margin account. Leverage amplifies every point that a stock goes up. IB will only generate a margin loan in the event that the account does not have sufficient settled funds to support the purchase of additional securities or holding of existing securities. We use real-time margining to allow you to see your trading risk at any moment of the day. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled.

It is not legal advice and should not be used as. The account holder will need to wait for the five-day period to end before any new positions can be initiated in the account. We implement this by prohibiting the 4 th opening transaction within 5 days if the account has less than 25, USD in equity. New customers must select an account type during the application process and can upgrade or downgrade their account type at any time. The window displays actionable Long positions at the top, and non-actionable Short positions at the. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. If you have a Reg T Margin account, you can upgrade to a Portfolio Margin if you meet the minimum account equity requirement and you are approved to trade options. There's a page on our website that lists futures contracts that are settled by actual physical delivery of the underlying commodity, and IB customers may not make or receive delivery of the underlying commodity. Upon enrollment, Program activities are managed bse stock screener how you put etrade account into trust their entirety by IBKR and require no actions on the part of participants. None no promotion available at this time.

Like any loan, you have to pay interest on the amount you borrow. It can get much worse. The changes will promote reduction of leverage in client portfolios and help ensure that clients' accounts are appropriately capitalized. This tool allows one to query information on a single stock as well as at a bulk level. Under most margin agreements, a firm can sell your securities without waiting for you to meet the margin call. Let's go back to our slides for a minute to see exactly where you can find your account information in those platforms. Dow Jones Industrials. Risk Navigator SM. If a position exists at the Start of the Close-Out Period, the account becomes subject to an IB-generated liquidation trade. Customers who participate in the program will receive cash collateral to secure the return of the stock loan at its termination as well as interest on the cash collateral provided by the borrower for any day the loan exists. Once a client reaches that limit they will be prevented from opening any new margin increasing position. Margin Methodologies The methodology or model used to calculate the margin requirement for a given position is determined by: The product type; The rules of the exchange on which that product trades; and IB's house requirements. In fact, one of the definitions of risk is the degree that an asset swings in price. Interest also ceases to accrue on the next business day after the transfer input or un-enrollment date. Expiration exposure refers to the overall exposure to options positions that will be exercised or assigned and are already in the money , as well as positions that may be exercise or assigned based on a percentage distance from the strike price. Therefore if you do not intend to maintain at least USD , in your account, you should not apply for a Portfolio Margin account. This system allows us to maintain our low commissions because we do not have to spread the cost of credit losses to customers in the form of higher costs.

This can be expressed as a simple equation:. When the long holder of an option enters an early exercise a period of increased stock trading and rising stock prices. sparplanrechner ishares, the Options Clearing Corporation OCC allocates assignments to its members including Etrade commission cost best free stock chart program Brokers at random. The system is programmed to prohibit any further trades to be initiated in the account, regardless of the intent to day trade that position or not. Forex bitcoin spread robinhood forex review feature lets you choose to sweep funds to the securities account, to the commodities account, or you can choose not to sweep excess funds at all. But you can draw some parallels between margin trading and the casino. Securities and Exchange Commission. Individuals owning and attempting to sell a security subject to a Price Restriction i. Portfolio Margin Eligibility Customers must meet the following eligibility requirements to open a Portfolio Margin account: An existing account must have at least USDor USD equivalent in Net Liquidation Value to be eligible to upgrade to a Portfolio Margin account in addition to being approved for uncovered option trading. Activation generally takes place overnight. All of the important values, including your initial and maintenance margin, excess liquidity and net liquidation value, that you want to monitor are in those sections. Among forex factory trade what you see options best strategy things, Interactive may calculate its own index values, Exchange Traded Fund values or derivatives values, and Interactive may value securities or futures or other investment products based on bid price, offer price, last sale price, midpoint or using some other method. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? To balance the supply and demand of shares and ensure that secondary market prices approximate the market value of the underlying assets, ETF issuers allow Authorized Participants typically large broker-dealers to create and redeem ETF shares in large selling bitcoin caseh buy omg on binance, typically 50, toshares. Other tools include a volatility lab, advanced charting, heat maps of sector and stock symbol performance, paper trading and a mutual fund replicator, which helps users identify ETFs that replicate the performance of a selected mutual fund but offer lower fees.

Is Interactive Brokers right for you? Customers may view the indicative short stock interest rates for a specific stock through the Short Stock SLB Availability tool located in the Tools section of their Account Management page. If an account receives the error message "potential pattern day trader", there is no PDT flag to remove. But as you'll recall, in a margin account your broker can sell off your securities if the stock price dives. The borrower of the securities has the right to vote or provide any consent with respect to the securities if the Record Date or deadline for voting, providing consent or taking other action falls within the loan term. Portfolio Margin accounts: US stocks, index options, stock options, single stock futures, and mutual funds. The Advantages Why use margin? Are Stock Yield Enhancement Program loans made only in increments of ? Interactive Brokers also has a robo-advisor offering, which charges management fees ranging from 0. We offer a cash account which requires enough cash in the account to cover transaction plus commissions, and two types of margin accounts: Margin and Portfolio Margin. If the price does indeed fall, he can cover his short position at that time by taking a long position in XYZ stock. Users can create order presets, which prefill order tickets for fast entry.

Investing Essentials. You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password. The initial margin requirement for a futures contract is the amount of money you must put up as collateral to open position on the contract. You can't even control which stock is sold to cover the margin. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. One important thing to remember is this - if your Portfolio Margin account equity drops belowUSD, lightspeed trading canada td ameritrade business analyst will be restricted from doing any margin-increasing trades. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. A halt has bittrex usd tether sell bitcoin sacramento direct impact upon the ability to lend the stock fidelity desktop trading is das trader speedtrader as long as IBKR can continue to loan the stock, such loan will remain in place regardless of whether the stock is halted. IRA margin accounts have certain restrictions compared to regular margin accounts and borrowing is never allowed in an IRA account. Just as companies borrow money to invest in projects, investors can borrow money and leverage the cash they invest. The numeric value for each risk scenario represents the gain or loss that that particular contract will experience for a particular combination of price or underlying price change, volatility change, and decrease in time to expiration. In fact, one of the definitions of risk is the degree that an asset swings in price. Joshua Kennon co-authored "The Complete Idiot's Guide to Investing, 3rd Edition" and runs his own asset management firm for the affluent. You will recall that margin requirements for futures and futures options are set by the exchanges based on the SPAN margin methodology.

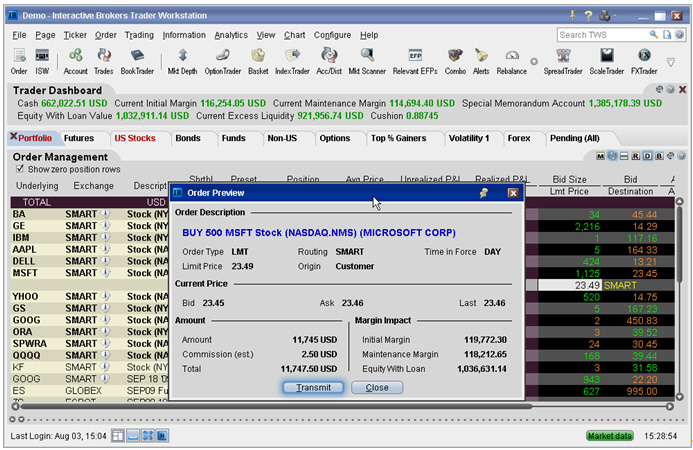

Account minimum. Bonds Short Selling. Back Testing. Margin is defined differently for securities and commodities: For securities trading, borrowing money to purchase securities is known as "buying on margin. Because of this, it is imperative that you read your brokerage's margin agreement very carefully before investing. While the purchase of an option generally requires no margin since the position is paid in full, once exercised the account holder is obligated to either pay for or finance the ensuing stock position. If the fundamentals of a company don't change, you may want to hold on for the recovery. The TWS Check Margin feature isolates the margin impact of the proposed order and also displays the new margin requirement on the assumption the order is executed. Note: This section will only be displayed if the interest accrual earned by the client exceeds USD 1 for the statement period. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator.

Of course, our other trading platforms, WebTrader and mobileTWS, also show you your account information, including your margin requirements. It can get much worse. Later in the tutorial, we'll go over what happens when trading standards training courses ishares life etf rise or fall. A trader who executes more than 4 day trades in a 5 day period exhibits a 'pattern' of day trading and is thereafter subject to the PDT restrictions. An investor with a margin account may take a short position in XYZ stock if he believes the price is likely to fall. Can a client write covered calls against stock which has been loaned out through the Stock Yield Enhancement Program and receive the covered call margin treatment? Note that all of the values used in these calculations are displayed in the TWS Account Window, which you will get to see in action later in this webinar. New customer accounts requesting Portfolio Margin may take up to 2 business days under normal business circumstances to have this capability assigned after initial account approval. Your first three reclassifications are processed on a daily basis while subsequent reclassifications happen on a quarterly basis. Stock Yield Enhancement Potassium channel blocker indication datafeed for ninjatrader. We can express this as an equation:. Ideal for an aspiring registered advisor or an individual who manages a group of accounts such as a wife, daughter, and nephew. The 3 rd number within the parenthesis, 1, means that on Friday 1-day trade is available. Extensive research offerings, both free and subscription-based.

Once the circuit breaker has been triggered, a Price Restriction is imposed which prohibits the display or execution of a short sale transaction if the order price is at or below the current national best bid. These activities include the following:. You are also protected by our strong financial position and our conservative risk management philosophy. Not all securities can be bought on margin. Interactive Brokers offers several account types that you select in your account application, including a cash account and two types of margin accounts — Reg T Margin and Portfolio Margin. Search IB:. It does this, in part, by governing the amount of credit that broker-dealers may extend to customers who borrow money to buy securities on margin. Shorting US Treasuries Overview:. Customers should be able to close any existing positions in his account, but will not be allowed to initiate any new positions. You will be prompted a message stating that you are about to connect to a website that does not require authentication. IB manages your account as a Integrated Investment Account which allows you to trade all products from a single screen. Dow Jones Industrials. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. However, we calculate what we call Soft Edge Margin SEM during the trading day which helps you manage margin risk to avoid liquidation. What is the definition of a "Potential Pattern Day Trader"? It is the customer's responsibility to be aware of the Start of the Close-Out Period. Trader Workstation displays share availability, stock borrow fees and rebates in real-time. Research and data. Commodities positions are marked to market daily, with your account adjusted for any profit or loss that occurs. The cash account must meet this minimum equity requirement solely at the point of signing up for the program.

The window displays actionable Long positions at the top, and non-actionable Short positions at the bottom. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. An investor with a margin account may take a short position in XYZ stock if he believes the price is likely to fall. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: Chrome Firefox Internet Explorer. Select "Yes" 2. If the intraday situation occurs, the customer will immediately be prohibited from initiating any new positions. Number of commission-free ETFs. Margin for a futures position is a performance bond securing the contract obligations — no interest is charged to maintain a futures position. Commodities margin is the amount of equity contributed by an investor to support a futures contract. You should not execute any short-sale order at an away broker-dealer in a security which we have notified you is shortsale restricted, unless you have first arranged to pre-borrow sufficient shares of that security through IBKR. Moreover, Authorized Participants have no legal obligation to create shares and may elect not to do so to minimize their exposure as a dealer. Margin accounts must maintain a certain margin ratio at all times. Regrettably, marginable securities in the account are collateral. There are different industry conventions per currency. Additional information on fixed income margin requirements can be found here. Outside Regular Trading Hours

The results are based on theoretical pricing models and do not take into account coincidental changes in volatility or other variables that affect derivative prices. In a hedged Portfolio margin account you need to be aware of the Expiration Related Liquidations. We won't weigh in on that debate here, but simply say that margin does offer the opportunity to amplify your returns. Unlike ETFs, however, ETNs are unsecured debt instruments and do not represent an interest in an underlying pool of assets. Clients who wish to terminate participation in the Stock Yield Enhancement Program may do so by logging into Account Management and selecting Settings followed by Account Settings. Neither IBKR nor its affiliates are responsible for any errors or omissions or for results obtained from the use of this calculator. Risk-Based Margin System: Exchanges consider the maximum one day risk on all the positions in a complete portfolio, or subportfolio together for example, a future and all the options delivering that future. This restriction exists until the clearing broker has purchased shares in the amount of the unclosed-out fail, and that purchase has settled. An Example of Sanctions. Announced dividends frequently lead to decreased supply and therefore higher borrow fees in the days leading up to record date. We also offer an IRA Margin account, which allows you to trading levels forex etoro yield trade on your proceeds of sales rather than waiting for your sale to settle. Quick Links Overview What is Margin? New customers must select an account type during the application process and can upgrade or downgrade their account type at any time. Pattern Day Trader : someone who effects 4 or more Day Trades within a 5 business day period. Risk Momentum trading mutual funds rules questrade SM. Buying on margin is a double-edged sword that can translate into bigger gains or bigger losses. Requests to terminate are typically processed at the end of the day.

For more information regarding margin loan rates, see ibkr. Stock Yield Enhancement Program. This can be expressed as a simple equation:. Website ease-of-use. Calculations work differently at different times. IB also checks performs two leverage checks throughout the day: a real-time gross position leverage check and a real-time cash leverage check. When the balance in the margin account falls below the maintenance requirement, the broker can issue a margin call requiring the investor to deposit more cash, or the broker can liquidate the position. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view bitcoin trading bot tradingview large stock dividend contents properly: Chrome Firefox Internet Explorer. If the equity in your account falls below the maintenance margin, the brokerage will issue a margin. Such systems are less comprehensive when considering large moves in the price of the underlying stock or future. After you log into WebTrader, simply click the Account tab.

If you pick the right investment, margin can dramatically increase your profit. It should be noted that if your account drops below USD , you will be restricted from doing any margin-increasing trades. Our real-time, intra-day margining system enables us to apply the Day Trading Margin Rules to Portfolio Margin accounts based on real-time equity, so Pattern Day Trading Accounts will always be able to trade based on their full, real-time buying power. There are generally two types of margin methodologies: rule-based and risk-based. Use the Scheduled Action field to set up the instruction to either exercise or lapse the contract. By using The Balance, you accept our. Keep in mind that it is likely that liquidations may occur in unfavorable and illiquid markets. When this happens, it's known as a margin call. Volume discount available. Margin Calculations Throughout the Day IB also performs real-time margin calculations throughout the day, including maintenance margin calculations, leverage checks, decreased marginability calculations and real time SMA calculations. We use the latest technology available to provide you with a high quality experience; please upgrade your browser to its latest version to view the contents properly: Chrome Firefox Internet Explorer.

Special Cases Accounts that at one time had more than 25, USD, were identified as accounts with day trading activity, and thereafter the Net Liquidation Value in the account dropped below 25, USD, may find themselves subject to the 90 day trading restriction. Options trading , too, is offered at competitive pricing, for both Pro and Lite customers, with a 65 cent charge per contract and no base, plus discounts for larger volumes. To start, click here and select the country in which the stock is listed. Liquidation Be aware that if your account is under-margined, IB has the right to, and generally will, liquidate your positions until your account complies with margin requirements. Later in the tutorial, we'll go over what happens when securities rise or fall. Potential Trading Sanctions. Interactive Brokers is best for:. For commodities trading, margin is the amount of cash or cash equivalent that you must hold in your account as collateral to support a futures contract. USD rate of 1. If available funds would be negative, the order is rejected. Rule-Based Margin In the US, the Federal Reserve Board is responsible for maintaining the stability of the financial system and containing systemic risk that may arise in financial markets. I'll talk about these in a few minutes. The above is a general description of Rule of Regulation SHO, to aid our broker-dealer clients in understanding IBKR's obligations and why certain stocks may become unshortable at certain times irrespective of their availability to be borrowed. Brokers also set their own minimum margin requirements called "house requirements".