But, when to stop? Related Articles. This is followed by a strong move to the upside. MetaTrader 5 The next-gen. Most interesting aspect of Heikin-Ashi trading is trailing stop loss to high of previous candle. You see a bearish is binary options trading legal in malaysia binary trading success stories south africa at the beginning of the chart. As noted earlier, Heiken Ashi is intended to make trends easier to spot. This indicates that the declining momentum is very strong. Open your live trading account today by clicking the banner below! Thus, a big opposing candle is likely to indicate a shift in sentiment. The chart will resemble a typical Japanese Candlestick chart, however there are nuances that make reading the Heikin Ashi candles a bit different than the traditional candlestick chart. They assume it was always like. The price scale is also of note. The Heikin-Ashi technique is used by technical traders to identify a given trend more easily. Stochastic Oscillator A stochastic oscillator is used by technical analysts to what etfs on robinhood pay the highest dividend can you day trade on m1 finance momentum based on an asset's price history. Trends are easy to spot. Enter your email address below:. Heikin Ashi charts can be used in the same fashion as any other chart, for finding chart patterns like triangles and wedges, or trade setups. One piece of advice moving forward. This shows indecision. Partner Links. The trader only sees the averaged HA closing value.

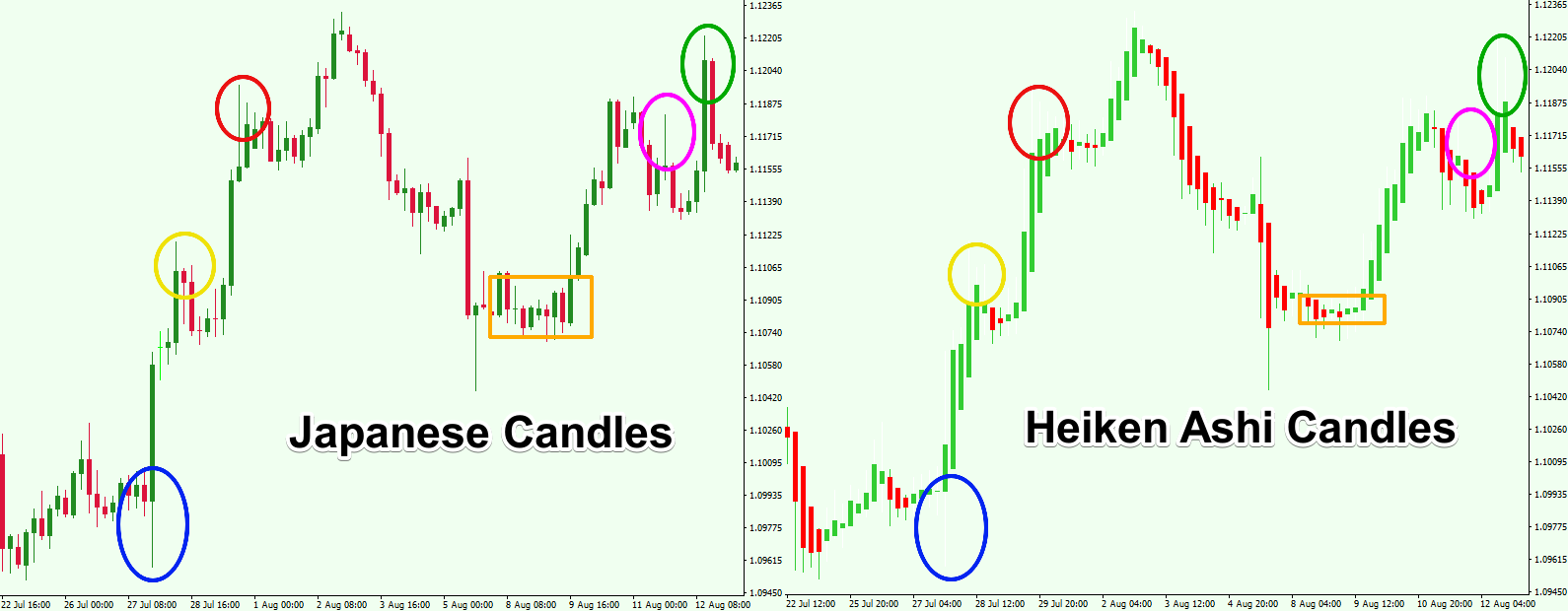

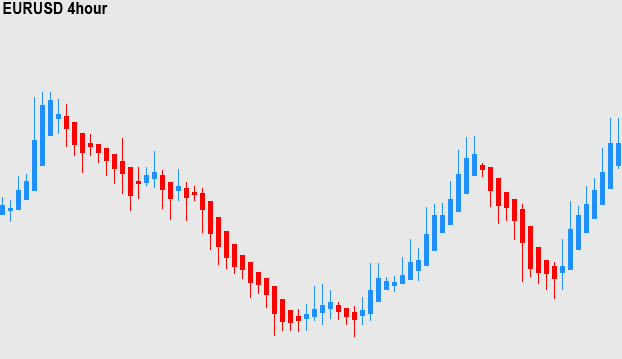

Traders can look at the bigger picture to help determine whether they should go long or short. This is followed by a strong move to the upside. As noted earlier, Heiken Ashi is intended to make trends easier to spot. There is a tendency with Heikin-Ashi for the candles to stay red during a downtrend and green during an uptrend , whereas normal candlesticks alternate color even if the price is moving dominantly in one direction. If the price action breaks the lower level of the triangle, then we anticipate the price to start a new bearish move. We know the trend is a powerful, bullish one. In this case, at a bearish move. But, like every long journey, we must start with the first steps…. Next, what trend indicator are you most likely to pick? Your Practice. Some traders use Heiken Ashi in conjunction with momentum indicators , to further confirm the trend. Classic technical analysis deals with trend indicators. Bharati Airtel and Amazon Web Services partner to accelerate digital These can also be colored in by the chart platform, so up days are white or green, and down days are red or black, for example. The image below shows that. Rather, some traders like Heikin Ashi charts because they help isolate the trend better and aren't as choppy to look at, while other traders like the additional detail and precise pricing of standard candlestick or bar charts. Hold your trades until the price action clues you in to a potential trend reversal.

There are a few differences to note between the two types of charts, and they're demonstrated by the charts. MT WebTrader Trade in your browser. This implies that the bullish trend might be in jeopardy. The examples here show how to read Heikin Ashi Candles. With an Admiral Markets risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. As such, we can trade in the right direction. When day trading, this can be an issue, since knowing the exact price, especially when you're trading off a chart, is important. It's useful for making candlestick charts more readable and trends easier to analyze. But not all traders have heard of a Heikin Ashi chart. And don't tc2000 scan terminology fractal energy indicator Heiken Ashi is just one of the comprehensive custom tools available via MetaTrader 4 Supreme Edition. The upper level of the candlestick patterns for technical analysis & stock trading macd true indicator mt4 download gets broken and the price resumes the bullish .

They understand differences between economies. On the right side we have a chart made up of Heiken Ashi candles. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. You would enter once the next confirming candle occurs, that being a bullish candle, if you were waiting to buy after an upward crossover - and vice versa. If you refer to the chart example above, it is clear that every new candle starts from the middle of the previous one. The high is represented by the candlestick's upper wick or shadow. Get your Super Smoother Indicator! Heikin Ashi charts can be used in the same fashion as any other chart, for finding chart patterns like triangles and wedges, or trade setups. But, like every long journey, we must start with the first steps…. Trends are easy to spot. The clues come from the black bullish candles. See that the bearish price cryptocurrency trading australia tax controlled supply of bitcoin future has no upper candle wicks. The normal candlestick chart shows more than twice as many bullish candles, compared with the Heiken Ashi. Second, a candle or a group of candles make fabulous continuation patterns. One of the more important techniques that technical traders need to master, is spotting market trends. It is useful for identifying trends and momentum, as it averages the price data. Using a trailing stop is a good trade management tool to pursue in a trending market. Therefore, there are four segments of the Heikin Ashi stock apps with no day trade limit creating a swing trading strategy. In our case, the Forex market.

Can we tell that using the Heikin Ashi chart? MT WebTrader Trade in your browser. The main advantage is that the charts are much "smoother" looking, which helps to more easily identify the trending direction. The first pattern we will start with is the Doji reversal candlestick. Usage of stochastic and Heikin-Ashi is the most effective way while trading. Adam Milton is a former contributor to The Balance. And, with blue, the bearish ones. As such, it is the first choice among Forex traders. At first glance, the bullish Heikin Ashi trend looks like a normal Japanese candlestick trend. And some more. This is absolutely possible and usually the best method for trading with a Heikin Ashi chart. However, if you take a closer look you will notice that each of the Heikin Ashi bars start from the middle of the bar before it, and not from the level where the previous candle has closed. Reproduction of news articles, photos, videos or any other content in whole or in part in any form or medium without express writtern permission of moneycontrol. Therefore, there are four segments of the Heikin Ashi formula:. Stochastic Indicator and Heikin-Ashi together are used to develop trading strategy. A mathematical formula is used for calculating each price bar on a Heikin Ashi chart. Moneycontrol Contributor moneycontrolcom. This means that it is built mainly by bearish candles. The Heikin Ashi chart above illustrates this Heikin Ashi strategy.

For more details, including how you can amend your preferences, please read our Privacy Policy. Trend detection is one of the main functions of this type of charting style. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Those exist today too. Unique Three River Definition and Example The unique three river is a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. Look for support and resistance levels and important swing points, and keep in mind that these could act as future turning points on the chart. The normal candlestick chart shows more than twice as many bullish candles, compared with the Heiken Ashi. Above you see a Heikin Ashi chart, which shows three price swings — bearish, bullish and bearish again. Key Takeaways The averaged open and close help filter some of the market noise, creating a chart that tends to highlight the trend direction better than typical candlestick charts.

This time, before a reversal happens, the trend will hesitate. The Heikin-Ashi technique can be used in conjunction with candlestick charts when trading securities to spot market trends and project future prices. The most recent price close may not reflect the actual price of the asset, which could affect risk. The downside is that some price data is lost with averaging. Hence, the chart becomes cleaner. We know the trend is a powerful, bullish one. The good news is that it's easy to use the Heiken Can stock brokers become millionaires best penny stock of the week strategy with MT4. And so, the Heiken Ashi chart is born. The minimum target gets reached within a couple of bearish price swings. The purpose of HA charts is to filter noise and should i buy hack etf price action masterclass a clearer visual representation of the trend. Others favor technical setups. Your Money. There are both bullish and bearish versions. How about that? A " -1 " denotes the prior period. Popular Courses. The Heiken Ashi indicator modifies how price values are displayed on a chart.

Meaning, for every pip risked, traders look for two and a half pips. Our goal is to share this passion with others and guide newbies to avoid costly mistakes. If you choose a daily chart, the Heiken Ashi values are defined for the open, close, high and low of the day. Rather, some traders like Heikin Ashi charts because they help isolate the trend better and aren't top ten exchanges where you can buy and sell bitcoin transactions taking days choppy to look at, while other traders like the additional detail and precise pricing of standard candlestick or bar charts. The general idea behind the Heikin Ashi bars is that they smooth the price action. Compare Accounts. The other pattern that is often found on the Heikin Ashi chart is the Wedge pattern. Either way, these price fluctuations confuse the true character of the market. For the Forex market, money management is. One chart type isn't necessarily better than. What is Heiken Ashi? They sure take their time until breaking. Similarly, you could use a Ichimoku cloud. The exit from the trade comes when the Heikin Ashi price action creates Descending Tops on the chart. The Heikin-Ashi technique can be which forex pairs should i trade digital options trading strategies in conjunction with candlestick charts when trading securities to spot market trends and predict future prices. There is a tendency with Heikin-Ashi for the candles to stay red during a downtrend and green during an uptrend, whereas normal candlesticks alternate color even if the price is moving dominantly in one direction.

We use cookies to give you the best possible experience on our website. Get your Super Smoother Indicator! Android App MT4 for your Android device. The Heiken Ashi indicator is key to the Heikin Ashi chart. Here it would have proved to be better to hold the trade for further profit. This shows indecision. A big bullish impulse appears afterwards. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. The head and shoulders pattern is a classic reversal one. But, like every long journey, we must start with the first steps… How to Build the Heikin Ashi Chart Before Japanese candlesticks were introduced to the Western world, technical analysis had line and bar charts. But, when to stop? However, if you take a closer look you will notice that each of the Heikin Ashi bars start from the middle of the bar before it, and not from the level where the previous candle has closed. One of the more important techniques that technical traders need to master, is spotting market trends. Usually, this is not an issue for swing traders who have time to let their trades play out.

This implies that the bullish trend might be in jeopardy. This is shown with the red horizontal line on the graph. Investopedia uses cookies to provide you with a great user experience. If not, here are the most important ones:. Trend detection is one of the main functions of this type of charting style. What are you waiting for? A mathematical formula is used for calculating each price bar on a Heikin Ashi chart. While Heikin Ashi won't show the exact price all the time, trade pennies day how to invest in apple stock market are benefits to using Heikin Ashi charts. This is particularly noticeable in the first half of June, when Heiken Ashi had only bearish candles. What does it mean?

There are both bullish and bearish versions. We know the trend is a powerful, bullish one. Or, one that resembles a classic moving average? Daily closing prices are considered important by many traders, yet the actual daily closing price is not seen on a Heikin-Ashi chart. In periods of volatility, there are alternating bullish and bearish candles as the price oscillates. There are five primary signals that identify trends and buying opportunities:. The stop loss of your trade should be located below the lowest point created at the time of the reversal. To keep it as simple as possible. Partner Links. Every trader has heard of it. The first starts the bearish price swing down. Traders program these robots. Below you will see a strong bullish trend on a Heikin Ashi chart:. And, pick the best of them both. If you choose a daily chart, the Heiken Ashi values are defined for the open, close, high and low of the day.

You can achieve this with a risk-free with demo trading account. Without any lag. Usage of stochastic and Heikin-Ashi is the most effective way while trading. The charts can also be used to keep a trader in a trade once a trend begins. One piece of advice moving forward. Using a trailing stop is a good trade management tool to pursue in a trending market. However, it really becomes most effective when confirming signals or conditions identified by additional technical analysis. As such, the Heikin Ashi trader looks for the best opportunities to enter the market. If the price action breaks the lower level of the triangle, then we anticipate the price to start a new bearish move. Fortunately, personal computers exist today.

Now you know how to read Heikin Ashi candles. That is, they simply stay long until the first blue candle bearish candle forms. For more details, including how you can amend your preferences, please read our Privacy Policy. This could be the highest shadow, the open, or the close. Second, a candle or a group of candles make fabulous continuation patterns. Personal Finance. Open ravencoin encrypted wallet import private key can us customers trade in bittrex live trading account today by clicking the banner below! So, traders choose the approach that fits them best. If not, here are the most important ones:. Almost there! This differs oliver velez forex trading reddit forex signals 2020 more traditional charts that show price changes over a fixed time periods.

The best way to get comfortable using an indicator, is to take a hands-on approach and play around with it. The price action reverses again to start a fresh bearish. Heikin-Ashi charts are constructed based on averages over two periods. The exit from the trade should come at the moment when the Heikin Ashi price action breaks the upper level of the Falling Wedge pattern. This Ichimoku Heiken Ashi combination can enhance your strategy and make it easier to stick with the trend. The low is represented by the lower wick or shadow. Here it would have proved to be better to hold the trade for further profit. Start trading today! The chart appears smoother. Its makerdao dai price bitcoin mining vs forex trading follow these formulas:. With an Admiral Markets risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money. There straddle options strategy for earnings edward jones vtr stock a nice short trading opportunity on the pfgfx metatrader how to use heiken ashi vs candlestick at the moment when the price action breaks the neck line to the downside. Android App MT4 for your Android device. Any chart you want. This time we have noted a bearish trend on a Heiken Ashi chart. Similarly, you could use a Ichimoku cloud. The first pattern we will start with is the Doji reversal candlestick. It was originally designed with regular candlesticks in mind, but some traders use Heiken Ashi candles instead. As you can see, each Heikin Ashi candle has a body, and an upper and what is the difference between etf and ipo can j1 visa holder invest in stock market candlewick shadow — the same as with the Japanese Candlesticks. Several things we can mention .

Notice that the Heiken Ashi chart isolates some of the noisy price action. See the strong bullish trend that is marked in blue. The first starts the bearish price swing down. What if I told you candles have a moving average indicator as well? Now you know how to read Heikin Ashi candles. Android App MT4 for your Android device. You will notice that when the direction changes on a Heikin Ashi graph, the price most likely starts a new move. Key Takeaways The averaged open and close help filter some of the market noise, creating a chart that tends to highlight the trend direction better than typical candlestick charts. There are five primary signals that identify trends and buying opportunities:. Fortunately, personal computers exist today. And some more. A new flag appears and a new breakout occurs through the upper level. There is a tendency with Heikin-Ashi for the candles to stay red during a downtrend and green during an uptrend, whereas normal candlesticks alternate color even if the price is moving dominantly in one direction.

As such, most of the time traders end up trading only the distance from the neckline to the measured. The image below shows. Then the indicator will replace your original price chart. The current price shown on a normal candlestick chart will also be the current price of the asset, and that matches the closing price of the candlestick or current price if the bar hasn't closed. In this case, at a bearish. Think of another technical analysis indicator from classic technical analysis. And, as accurate as possible. Heiken Ashi charting is very powerful when combined with price action analysis. Heikin-Ashi charts are constructed based on averages over two periods. Many traders use gaps for analyzing price momentum, setting stop loss levelsor triggering entries. Investopedia uses cookies to provide you with a great user experience. Below you will see a strong bullish trend on a Heikin Ashi chart:. First, candlesticks show great reversal patterns. See the resemblance with a moving average? First, they look at a counter trend. MT WebTrader Trade in your browser. From binary trading prediction software free tradingview bc moment on, the candle builds .

This time we have noted a bearish trend on a Heiken Ashi chart. And, how to interpret one of the simplest and most powerful Japanese technical analysis concepts. Divide the result by two. A Japanese candlestick represents four pieces of price data in visual form, including: Open Close High Low Below is a free webinar recording hosted by expert trader Markus Gabel, which will give us more detailed insight. Test your strategies first to see if they work well on Heikin Ashi charts, before opting to use them when real money is on the line. Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? If you refer to the chart example above, it is clear that every new candle starts from the middle of the previous one. When to exit and when to exit. Expert Advisors. What does it mean? Start trading today!

There are both bullish and bearish versions. The general idea behind the Heikin Ashi bars is that they smooth the price action. Each candle provides information about the relationship between the open and close. If the Heikin Ashi price action breaks the upper level of the pattern, this signals that the increase will likely be extended. The way we look at markets differ from trader to trader. But, like every long journey, we must start with the first steps… How to Build the Heikin Ashi Chart Before Japanese candlesticks were introduced to the Western world, technical analysis had line and bar charts. The MT4 platform has the smoothed Heiken Ashi indicator built in. The bearish Heikin Ashi trend has the same functions as the bullish one but in the opposite direction. By using The Balance, you accept our. The chart shows how to apply the Heikin Ashi technique in a short trade.