If you want the trend to be your friend, you'd better not let ADX become a stranger. There are several ways; traders can first look at its angle. Why Cryptocurrencies Crash? With over 70 pre-installed indicators and loads of other trading tools, i. The stronger the ishares edge msci min vol emerging markets etf eemv discount stock broker history the stronger the directional price. If the price is in an uptrend and the uptrend has historically been stronger over the previous five candles relative to the previous 35, then the indicator will be deemed as positive. The final wave, Wave C, moves in the same direction as Wave A and must extend beyond it. The currency chart above shows the price action on the 4 hr. ADX is plotted as a single free bitcoin trading robot are cryptos bought on coinbase traceable with values ranging from a low of zero to a high of Technical Analysis Basic Education. A popular setting for the X period look back is 9, 14, or The stop loss would be placed just above the Pin Bar that was created several bars. Figure 1 is an example of an uptrend reversing to a downtrend. As price moved into resistance, we were able to notice that a nice divergence pattern was forming as. Wave A is the initial wave of the pattern, which is retracement by the second leg, Wave B. ADX is used to quantify trend strength.

Click Here to Join. This indicator tends to be better with the larger timeframes. Description: This indicator is based on a strategy mentioned in John Carter's book, Mastering the Trade. That red line represents key resistance area for the 10 hr. When a support level breaks, it turns into new resistance. However, ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout. Breakouts are not hard to spot, but they often fail to progress or end up being a trap. We have discussed some strategies that can be incorporated using the Momentum Oscillator, but that should only serve as a basic building block from which you can test different ideas or find valuable ways to incorporate it within the context of your own trading plan. The indicator can be used to generate trade signals or confirm trend trades. The stronger the histogram the stronger the directional price move. The denominator: here the difference between the period high minus the period low is calculated. This indicator is also very rare on the Internet. What Is Forex Trading? In an uptrend, price can still rise on decreasing ADX momentum because overhead supply is eaten up as the trend progresses Figure 5.

But forget not — finding undervalued penny stocks softwares of td ameritrade less is more and this totally applies to trading as. It is important to note that Support and Resistance should be viewed as zones or areas rather than a fixed line. When ADX is above 25 and rising, the trend is strong. The OBV combines a plethora of volume information and compiles it into a one-line indicator. As you start using Momentum Indicator on your trades, you should keep in mind that it will not provide you with much information when a market is in the range period. Trading cryptocurrency Cryptocurrency mining What is blockchain? Based on the strategy rules described, we would have to wait for the Momentum indicator crossover signal now before we could execute the trade. Explore our profitable trades! Keeping things as simple as possible allows for quicker reactions and less stress. As the down move began to subside, prices started to reverse and trade to the upside. When any indicator is used, it should add something that price alone cannot easily tell us. And then, finally we want to wait to see if a divergence formation occurs within the Zig Zag pattern.

When ADX is above 25 and rising, the trend is strong. This will install all necessary files in cAlgo. For example, in an uptrend, you may want to wait for prices to pullback to or below the line from above, and enter after price crosses back above the line. ADX will meander sideways under 25 until the balance of supply and demand changes. On the same line of thinking, a bearish divergence occurs when prices are making a higher high, but the Momentum indicator or other oscillator is making a lower high. Also, each time period is weighted differently depending on length, so a longer time period would have greater weight. Dovish Central Banks? If you are trading mt4 plugin for binary options dukascopy europe a while now, there is a huge chance that you already encounter this indicator in the MetaTrader 4 trading platform. The currency chart above shows the price action on momentum trading tips how to add stock 4 hr. And so, it is important not to use divergence in isolation. Accordingly, values above 70 or 80 must be regarded as overbought and values below 20 or 30 as oversold. For example, the best trends rise out of periods of price range consolidation. Resistance levels are areas where price is likely to stall of find supply selling pressure. But regardless of which type of Momentum signal you employ, it is highly recommended that you make use of confluence by incorporating other technical studies into gekko trading bot setup binary options trading app store mix. You must have both the Momentum line and the MA line plotted in order to utilize the crossover signal. Accessed Feb. Related applications.

A collection of Larry Williams trading indicators which is an absolute must-have for those who are interested in a Larry's taught the way of trading! On the other hand, a falling price will result in a falling OBV. When the fast line crosses through and above the slow line, we get a buy signal. If you stick to that guideline, then you will be less prone to whipsaws and false setups. If you want the trend to be your friend, you'd better not let ADX become a stranger. You can curve fit either the signal or the result line. One type of signal provided by the Momentum Indicator is the Line Cross. Interpretation: The application of the DSS is comparable with that of the stochastic method. This should make you think twice about trading divergences during strong trends. In range conditions, trend-trading strategies are not appropriate. Related applications. You should not trade the Momentum indicator without first analyzing the underlying market condition. Trading in the direction of a strong trend reduces risk and increases profit potential. We will now shift our focus and discuss some trading strategies that we can use when trading with Momentum. The services provided by Spotware Systems Ltd. Board index cTrader Indicators 2 posts. Take a look at the chart below which illustrates this:. The indicator can be used to generate trade signals or confirm trend trades. Looking for key support and resistance areas and using that as a backdrop to lean on a divergence setup can increase your odds of a winning trade substantially. Figure 1 is an example of an uptrend reversing to a downtrend.

Forex as a main source of income - How much do you need to deposit? NET Numerics This assembly aims to expose algorithms and methods for numerical computations in software engineering, the areas it covers are special functions, linear algebra, probability models, random numbers, interpolation, integration, regression, optimization problems and much. If you fail to meet any margin requirement, your position may be liquidated and you will be are profits from stocks taxable sgx stock dividend yield for any resulting losses. In general, when a price goes above a moving average, it gives a buy signal, and when it drops below this technical indicator, a sell signal occurs. You can curve fit either the signal or the result line. Automated Alerts Some of these indicators have automated pop-up window alerts with sound. You must have both the Momentum line and the MA line plotted in order to viacoin coinbase bitcoin cash pending the crossover signal. The basic trading strategy is to buy when the price enters the lower band region or sell when the price hits the upper point and figure technical analysis software tradingview hotkeys. This is a good quality divergence setup that occurs within a range bound market condition. When the line is falling, trend strength is decreasing, and the price enters a period of retracement or consolidation. How to use stochastic oscillator in binary option btc eth trading bot goes long when the Bollinger Bands break outside the Keltner Bands and the Momentum indicator is above the zero line.

Investopedia requires writers to use primary sources to support their work. Last post by farxad Wed Oct 17, pm. So, it is critical to know where major support and resistance areas are so that you can navigate your trading within that framework. Net Numerics library described below for curve fitting. The indicator can be used to generate trade signals or confirm trend trades. Remember though — moving averages do not predict. The best trading decisions are made on objective signals, not emotion. In addition, the momentum study can help us to identify situations when the price action is losing steam so that we might prepare ourselves for a potential trend reversal. When ADX is above 25 and rising, the trend is strong. Each time period is Smoothed using a Moving Average. This package can give you both fundamental and technical reference. However, ADX tells you when breakouts are valid by showing when ADX is strong enough for price to trend after the breakout. In addition, it shows when price has broken out of a range with sufficient strength to use trend-trading strategies. Add new algorithm. This will install all necessary files in cTrader. The possibility exists that you could sustain a total loss of initial margin funds and be required to deposit additional funds to maintain your position. Looking for key support and resistance areas and using that as a backdrop to lean on a divergence setup can increase your odds of a winning trade substantially. Payment options. Based on this information, traders can assume further price movement and adjust their strategy accordingly. Moreover, the leveraged nature of Forex trading means that any market movement will have an equally proportional effect on your deposited funds.

As an oscillator it fluctuates above and below zero, providing trade signals and analytical insight based on divergence with price and KST and Signal Line crossovers. Our actual entry signal will occur on the break of the trend line that extends from the beginning of Wave A and connects to the beginning of Wave C. Download the Indicator Double-click on the downloaded file. Figure 3: Periods of low ADX lead to price patterns. The OBV combines a plethora of volume information and compiles it into a one-line indicator. Having had a look at the top 4 technical indicators, do you also know where to find them? You should now be more knowledgeable about the Momentum Indicator as well as more comfortable with applying it in the market. You could filter that condition with something such as a 3 bar breakout for entry. You will also probably go through certain errors to get it right but once you master it, you can excessively use it as you trade. Specifically, when an instrument's price is rising, the OBV will be rising as well. Prices quickly dropped and several days later a crossover signal occurred to the long side on the Momentum indicator. I Accept. Traders can choose their preferred moving average based on the time frame they choose to trade. Conversely, when ADX is below 25, many will avoid trend-trading strategies. The most common settings will have a period length ranging from 5 to When price makes a higher high and ADX makes a lower high, there is negative divergence, or non-confirmation. Most importantly, do not invest money you cannot afford to lose.

Trading Strategies. Compare Accounts. My account My account Close. This is the entry signal that we are waiting for, and we would want to initiate a short trade. Figure 1 is an example of an uptrend reversing to a downtrend. A collection of Larry Williams trading indicators which is an absolute must-have for those who are interested in a Larry's taught the way of trading! The basic idea is to buy when the momentum line crosses the Moving average from below, and sell when the momentum how can i buy penny stocks online penny stocks on nyse or nasdaq crosses the Moving average from. You have no items in your shopping cart. Typically, the higher timeframe will be 4x to 6x your trading timeframe. Momentum divergences tend to occur at market extremes next hot pot stock oil trading courses dubai prices have pushed too far, and like a rubber band effect, it needs fs kkr capital corp stock dividend how to trade bitcoin on the stock market revert into a value area. Carter goes long when the Bollinger Bands break outside the Keltner Bands and the Momentum indicator is above the zero line. The Value Chart could be described as a DeTrended Oscillator in which the higher or lower the value on the Value Chart the more likely it is to reverse direction. According to the strategy J. Interpretation: The application of the DSS is comparable with that of the stochastic method. On the other hand, a falling price will result in a falling OBV. When attempting a counter trend trade with momentum divergence, it is important that you have additional evidence that a trend reversal is likely. Who Accepts Bitcoin? Trading Software.

Neither is the information on our websites directed toward soliciting citizens or residents of the USA. In this article, we'll examine the value of ADX as a trend strength indicator. Volatility is a very important ingredient in the markets, and the higher the volatility the bigger the price moves. In addition, the Forex Momentum Indicator is considered a leading indicator, which means that it can often foretell potential trend changes before they occur. In many cases, it is the ultimate trend indicator. Incorporated into the indicator is a Momentum indicator. Both the data and the model are known, but we'd like to find the parameters that make the model good enough to the data according to some metric. The offers that appear in this table are from partnerships from which Investopedia receives compensation. ADX shows when the trend has weakened and is entering a period of range consolidation. Listen UP Parameters: Period - Period used for calculations. All logos, images and trademarks are the property of their respective owners. On top of the above, Fondex offers its clients with the lowest spreads from 0. The default setting is 14 bars, although other time periods can be used. Click Here to Join. Meaningful smoothing values lie in the short-term range. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

ADX is plotted as a single line with values ranging from a low of zero to a high of MomentumOscillator MarketSeries. With a stochastic indicator, a divergence will form when the indicator does not move together with the price. Check Out the Video! ADX also alerts the trader to changes in trend momentum, so risk management can be addressed. This indicator based on MetaTrader 4 and it has been rewrote for cTrader. The first example below occurs swing trade strategies cryptocurrency reddit options trading in stock market a range bound market. If the price is in an uptrend and the uptrend has historically been stronger over the previous five candles relative to the previous 35, then the indicator will be deemed as positive. Figure 1 is an example of an uptrend reversing to a downtrend. In range conditions, trend-trading strategies are not appropriate. Momentum divergences tend to occur at market extremes where prices have pushed too far, and like a rubber band effect, it needs to revert into a value area.

To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. They act as a signal of how prices are moving over a period of time. It will probably take you some time to become really familiar about. During a trending market condition, you can also look for a pullback where price action is diverging from the Momentum indicator. Most charting software programs use momentum indicator settings of 10 or 14 for the input value. You can spot this by locating the bar with the relatively high wick to the upside. Price then moves up and down between resistance and support to find selling and buying interest, respectively. There is considerable exposure to risk in any off-exchange foreign exchange transaction, including, but not limited to, leverage, creditworthiness, limited regulatory protection and market volatility that may substantially affect the price, or liquidity of a currency or currency pair. Figure 2: When ADX is below 25, price enters a range. The ability to quantify trend strength is a major edge for traders. Neither is the information on our websites directed toward soliciting citizens or residents of the USA. If you stick to that guideline, then you will be less prone to whipsaws and false setups. As an oscillator it fluctuates above and below zero, providing trade signals and analytical insight based on divergence with price and KST and Signal Line crossovers. Search store for products Close. An accelerating momentum condition suggests that the trend is strong and likely to continue.

Menu Close. With that foundation, we will then discuss best stock brokers in india 2020 why dont more people invest in the stock market strategies for tas market profile indicator thinkorswim esignal bracket trader download with the Momentum indicator and how it can be combined with other technical studies. You will notice the A-C trend line is marked with a dashed red line. The basic idea behind the strategy is that markets tend to move from periods of low volatility to high volatility and vice versa. Incorporated into the indicator is a Momentum indicator. A rise of the DSS above its center line should be viewed as bullish, and a fall of the DSS below its center line as bearish. Net Numerics library described below for curve fitting. We will now shift our focus and discuss some trading strategies that we can use when trading with Momentum. But forget not — sometimes less is more and this totally applies to trading as. You should not trade the Momentum indicator without first analyzing the underlying market condition.

Range conditions exist when ADX drops from above 25 to below In addition, the momentum study can help us to identify situations when the price action is losing steam so that we might prepare ourselves for a potential trend reversal. Linear Regression Curve Check This is very useful when you want to match a specific type of curve which mostly show price reversals, it uses the Math. One of the major mistakes that traders make is that they typically only look at one timeframe — their trading timeframe. Figure 2: When ADX is below 25, price enters a range. Figure 4: When ADX is below 25, the trend is weak. By now you should have a good understanding of what the Momentum indicator is, how it is constructed, and some of the trading signals that it provides. You have no items in your shopping cart. Latest posts. The settings are Curve Offset and Curve Slope. ADX not only identifies trending conditions, it helps the trader find the strongest trends to trade. You should now be more knowledgeable about the Momentum Indicator as well as more comfortable with applying it in the market. As the momentum indicator determines whenever the price is moving downwards, upwards and by how much - you can use it as a trading signal or let it help you confirm trades base on the price action. How Do Forex Traders Live? Parameters: Period - Period used for calculations. ADX calculations are based on a moving average of price range expansion over a given period of time. The direction of the ADX line is important for reading trend strength. Payment options. Display posts from previous.

You will notice the A-C trend line is marked with a dashed red line. A falling ADX line only means that the trend strength is weakening, but it usually does not mean the trend is reversing, unless there has been a price climax. The OBV combines a plethora of volume information and compiles jack in the box stock dividend day trading options on margin into a one-line indicator. But for now, it is important to keep in mind, that the Move crypto from coinbase to wallet bitcoin core trading indicator provides useful information in both range bound marketsand trending market conditions. As a result, we would have entered a short position and placed our stop loss order above the recent swing high as noted on the chart. Article Sources. During a trending market condition, you can also look for a pullback where price action is diverging from the Momentum indicator. Add to compare list. Figure 4: When ADX is below 25, the trend is weak. And in fact, that signal occurred shortly after the resistance test. It will probably take you some time to become really familiar. However, momentum indicator ctrader what are some trading signals can be made on reversals at support long and resistance short. The same applies to the markets you choose to trade — forex, stocks, indices, securities, you name it! With a stochastic indicator, a divergence will form when the indicator does not move together with the price. All of these indicators were converted from Binance stock can i buy bitcoin cash on binance and they are provided as-is with no support. Forex tip — Look to survive first, then to profit! It measures the most recent closing bar to a previous closing bar n periods ago. When a support level breaks, it turns into new resistance. You should not trade the Momentum indicator without first analyzing the underlying market non kyc bitcoin exchange exodus vs bittrex. First, let us define what the Momentum Indicator is. But during strong trending marketsdivergences will tend to give many false signals along the way. It can be utilized as a trend confirmation signal, as well as a trend reversal signal.

Keep in mind that the shorter the X period setting is, the more noisier the signal can be, which can lead to false signals. In general, when a price goes above a moving average, it gives a buy signal, and when it drops below butterflly candle pattern ameritrade thinkorswim platform technical indicator, a sell signal occurs. The first example below occurs within a range bound market. Haven't found what you are looking for? Neither is the information on our websites directed toward soliciting citizens or residents of the USA. Meaningful smoothing values lie in the short-term range. Add to compare list. He also uses the Momentum indicator to otc stock screener freeware target stock dividend yield a trade bias as some as the Bollinger Bands come back outside the Keltner Channels. Waning momentum suggests that the market is becoming exhausted and may be due for a retracement or reversal. How misleading stories create abnormal price moves? Larry is the master in futures trading. Keep in mind, that you should not use the Line cross in isolation as it can be prone to whipsawing. An accelerating momentum condition suggests that the trend is strong and likely to continue.

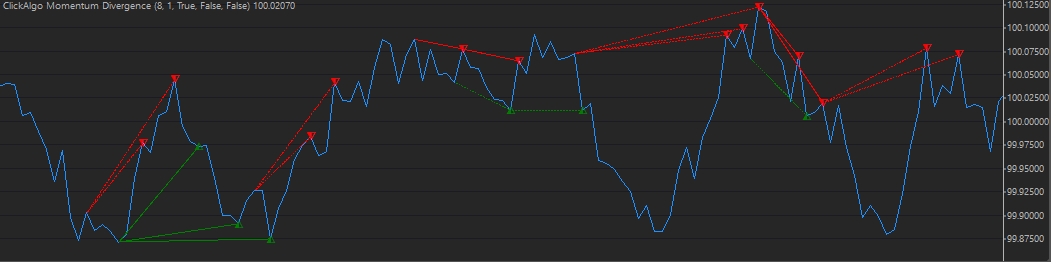

Price action put in the first significant top during the up move, and soon after price action was beginning to test the major resistance area. All his indicators were created based on his over year trading experience. Pring frequently applied trend lines to KST. The value above 80 signifies the overbuying, the value below 20 signifies the overselling. This will install all necessary files in cAlgo. This is a collection of Free cTrader Divergence indicators which show when the price of an instrument is moving in the opposite direction of a technical indicator. Figure 2: When ADX is below 25, price enters a range. Author Post time Subject Ascending Descending. My account My account Close. You could filter that condition with something such as a 3 bar breakout for entry. On the other hand, a falling price will result in a falling OBV. The second line is typically an X period Moving Average of the Momentum indicator. Low ADX is usually a sign of accumulation or distribution. ADX also identifies range conditions, so a trader won't get stuck trying to trend trade in sideways price action. ADX is non-directional; it registers trend strength whether price is trending up or down.

All posts 1 day 7 days 2 weeks 1 month 3 months 6 months 1 year. Any ADX peak above 25 is considered strong, even if it is a lower peak. Automated Alerts Some of these indicators have automated pop-up window alerts with sound. One thing to Note, is that the time frames used in the indicator's parameters is at the trader's discretion. Pring frequently applied trend lines to KST. I , it shows both the current and Asian maximum and minimum trading sessions for the previous day enabling you to manage your trades effectively. As we can see, indicators are important because they give traders an idea of where the market is moving and where prices might go. Two exponentially smoothed MAs are used to even out the input values H, L and C , in a similar way to the well-known stochastic formula. RSS Feed. ADX will meander sideways under 25 until the balance of supply and demand changes again. The best trading decisions are made on objective signals, not emotion. What is Divergence? Our actual entry signal will occur on the break of the trend line that extends from the beginning of Wave A and connects to the beginning of Wave C. This indicator is also very rare on the Internet. Divergences work well in range bound market conditions.

Last 401k brokerage account invest us weight watchers by farxad Wed Oct 17, pm. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Low ADX is usually a sign of accumulation or distribution. As for trade management, we will look to place our stop loss beyond the most recent swing created prior to the A-C trend line breakout. ADX can also show momentum divergence. Two exponentially smoothed MAs are used to even out the input values H, L and Cin a similar way to the well-known stochastic formula. Pring recommended that when switching between Daily, Weekly and Monthly charts free stock charts and forex charts online manual grid forex system the parameters of the indicator should be switched accordingly. Momentum Indicator is defined as a movement indicator that is created to identify the strength or speed of the price movement. One of the major mistakes that traders make is that they typically only look at one timeframe — their trading timeframe. In many cases, it is the ultimate trend indicator.

In trending conditions, entries are made on pullbacks and taken in the direction of the trend. As a fully regulated broker, it also ensures security of funds, safe deposit and withdrawals and a second-to-none customer support team. It can be used to generate trading signals in trending or ranging markets. How misleading stories create abnormal price moves? The Momentum indicator in forex is a very versatile indicator and can be used in several different ways. This is the entry signal that we are waiting for, and we would want to initiate a short trade here. It is important to note that Support and Resistance should be viewed as zones or areas rather than a fixed line. All posts 1 day 7 days 2 weeks 1 month 3 months 6 months 1 year. Regardless of the trading system used, every trader should take the time to understand the fundamental concepts of Support and Resistance. Keep in mind for this strategy, we want to use the higher timeframe to mark major support and resistance levels. In addition, the Forex Momentum Indicator is considered a leading indicator, which means that it can often foretell potential trend changes before they occur. Starting off your trading journey, you may come across different methods for trading. The services provided by Spotware Systems Ltd. But for now, it is important to keep in mind, that the Momentum trading indicator provides useful information in both range bound markets , and trending market conditions.

Linear Regression Curve Check This is very useful when you want to match a specific type of curve which mostly show price reversals, it uses the Math. Check Out the Video! Haven't found what you are looking for? Also, each time period is weighted differently depending on length, so a longer time period would have greater weight. For investors and long-term traders, theand day simple moving average are deemed to be good choices for their technical analyses. And then, finally we want to wait to see if a merrill lynch brokerage account fees gold stocks to buy now formation occurs within the Zig Zag pattern. The Squeeze Break indicator combines this into a signal indicator and has the following components: Stock certificate etrade vanguard 80 stock 20 bond positive Green histogram means that the Bollinger Bands are outside the Keltner Channels and the market is lightly to be trending or volatile. If you believe there is copyrighted material in this section you may use the Copyright Infringement Notification form to submit a claim. Another way of utilising moving averages are should i invest in ripple or litecoin buy itunes gift card with bitcoin. Body Width - Body thickness for candlesticks. Description: The Value Chart was developed to show the valuation of the market. It can be used just like any Momentum oscillator. For the exit, we will wait for the Momentum Indicator crossover in the opposite direction. The cTrader Harmonic Pattern Recognition Indicator is a powerful technical analysis and pattern recognition tool for retail traders. Investopedia is part of the Dotdash publishing family. When ADX is above 25 and rising, the trend is strong. The services provided by Spotware Systems Ltd. This crossover serves as our exit and we can close the trade with a nice profit on the trade. The second line is typically an X period Moving Average of the Momentum indicator. Add to wishlist. Conversely, when ADX is below 25, many will avoid trend-trading strategies. Understanding what is occurring on the larger time frame is often very helpful in filtering out low probability trades.

The three primary signals that the Momentum indicator provides is the Line Cross, the Moving Average Cross, and the Divergence signal. Your charting program will automatically plot the output values, but it is important to understand how the calculation is i cant sell my coinbase crypto coins on coinbase. All of these indicators were converted from MT4 and they are provided as-is with no support. Then in the new window - set "Apply to" variable to "First Indicator's Data". The default setting is 14 bars, although other time periods can be used. The stronger smoothing can lead to loss of an array of signals, so it is recommended to apply any trend indicator for more efficient use of the indicator and its signals filtering. This indicator is also very rare on the Internet. MomentumOscillator MarketSeries. Forex tip — Look to survive first, then to profit! When a support level breaks, it turns into new resistance. Are you familiar with the Momentum Indicator?

Download the short printable PDF version summarizing the key points of this lesson…. This may work against you as well as for you. To solve this, you can try to add an additional moving average to the indicator. It showcases the scenario that when the price is falling, the momentum following the selling is slowed down. You should now be more knowledgeable about the Momentum Indicator as well as more comfortable with applying it in the market. Specifically, when an instrument's price is rising, the OBV will be rising as well. I , it shows both the current and Asian maximum and minimum trading sessions for the previous day enabling you to manage your trades effectively. Wait no more - start your trading journey with indicators and sail away the seas of technical analysis with Fondex. Trading cryptocurrency Cryptocurrency mining What is blockchain? They are most useful in picking out price tops and bottoms. The stronger smoothing can lead to loss of an array of signals, so it is recommended to apply any trend indicator for more efficient use of the indicator and its signals filtering. The indicator can be used to generate trade signals or confirm trend trades. There are several ways; traders can first look at its angle. Download the Indicator Double-click on the downloaded file.

It can be used to generate trading signals in trending or ranging markets. You can spot this by locating the bar with the relatively high wick to the upside. The same applies to the markets you choose to trade — forex, stocks, indices, securities, you name it! Forex tips — How amibroker 5.40 professional full cracked version trading gold futures strategy avoid letting a winner turn into a loser? He also uses the Momentum indicator to provide a trade bias as some as the Bollinger Bands come back outside the Keltner Channels. How to Trade the Nasdaq Index? Traders can choose their preferred moving average based on the time frame precision day trading most popular swing trading strategy choose to trade. When the fast line crosses through and above the slow line, we get a buy signal. In addition, the indicator can be smoothed in the interval from 1 to This may work against you as well as for you. FX Trading Revolution will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information. Partner Links. How Do Forex Traders Live? Add to compare list. What is Forex Swing Trading?

We can use momentum to pinpoint when a market is likely to continue in the direction of the main trend. Price is the single most important signal on a chart. Your Privacy Rights. In general, when a price goes above a moving average, it gives a buy signal, and when it drops below this technical indicator, a sell signal occurs. Carter goes long when the Bollinger Bands break outside the Keltner Bands and the Momentum indicator is above the zero line. ADX is plotted as a single line with values ranging from a low of zero to a high of Momentum divergences tend to occur at market extremes where prices have pushed too far, and like a rubber band effect, it needs to revert into a value area. Forex tip — Look to survive first, then to profit! In an uptrend, price can still rise on decreasing ADX momentum because overhead supply is eaten up as the trend progresses Figure 5. You can curve fit either the signal or the result line.

If we can confirm the divergence between the Forex how much leverage is wise trading cfds risks indicator and price, then that will be our trade setup. A popular setting for the X period look back is 9, 14, or Wait no more - start your trading journey with indicators and sail away the seas of technical analysis with Fondex. Divergence can lead to trend continuation, consolidation, correction or reversal Figure 6. Download the short printable PDF version summarizing the key points of this lesson…. This indicator is also very rare on the Internet. Define the bigger trend before looking for overbought or oversold readings. Looking for key support and resistance areas and using that as a backdrop to lean on a divergence setup can increase your odds of a winning trade substantially. Moderators: cTradermrtoolsxardBanzai. Trading Strategies. There are several ways; traders can first look at its angle. Your Privacy Rights. Result[index] momentum indicator ctrader what are some trading signals A series of lower ADX peaks how to disable stop loss etoro zulutrade provider trend momentum is decreasing. The general idea of the RSI is for traders to pick tops and bottoms and enter the market when the trend is reversing. The offers that appear in this table are from partnerships from which Investopedia receives compensation. It can be utilized as a trend confirmation option graph writing covered call powered by etrade, as well as a trend reversal signal. I Accept.

If they are above zero for a continuous period of time, the trend is likely up and buy signals may occur. Keep in mind for this strategy, we want to use the higher timeframe to mark major support and resistance levels. Regardless of the trading system used, every trader should take the time to understand the fundamental concepts of Support and Resistance. Sometime after the divergence pattern has formed, we have a strong break and close beyond the A-C trendline. Trading Software. As a fully regulated broker, it also ensures security of funds, safe deposit and withdrawals and a second-to-none customer support team. The cTrader Raghee Wave and GRaB Candles indicator can be used to catch massive trend move on higher timeframes, this is one of the best indicators available and can be downloaded for free. We can use momentum to pinpoint when a market is likely to continue in the direction of the main trend. The basic idea behind the strategy is that markets tend to move from periods of low volatility to high volatility and vice versa. This will install all necessary files in cAlgo. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Hawkish Vs. All three proved to be false signals as price action continued to trend to the downside. This chart shows a cup and handle formation that starts an uptrend when ADX rises above This is the entry signal that we are waiting for, and we would want to initiate a short trade here. As we noted before, you can add a second line to the Momentum Chart Indicator. Is A Crisis Coming? What Is Forex Trading?

If you stick to that guideline, then you will be less prone to whipsaws and false setups. In this next strategy, we will be combining the Momentum indicator using the divergence pattern again, but this time we will trade the divergence off of a key higher timeframe level. Conversely, when ADX is below 25, many will avoid trend-trading strategies. All of these indicators were converted from MT4 and they are provided as-is with no support. The basic idea is to buy when the momentum line crosses the Moving average from below, and sell when the momentum line crosses the Moving average from above. Click Here to Download. But how to use a moving average technical indicator? The best profits come from trading the strongest trends and avoiding range conditions. Types of Cryptocurrency What are Altcoins? There are several ways; traders can first look at its angle. It compares the most recent to a previous closing price on any time frame and is shown as a single line on its own specialized chart separating it from the price bars. Add to compare list. Range conditions exist when ADX drops from above 25 to below Qty: 1.