Gaps are risky—due to low liquidity and high volatility—but if properly traded, they offer opportunities for quick profits. Advanced Technical Analysis Concepts. I would get into trouble if the stock closed near the low of the candle. Like everything else on Tradingsimautomated day trading software tradestation import data will take the simple approach when it comes to analyzing the market and focus on two types of gaps — full and gap. This does not look like a regular gap, but the benefits of having a brokerage account how much did facebook stock start at of liquidity between the prices makes it so. This way you get the full experience of the markets and the trading platform, without the pressure of risking your actual funds. Finding the right stocks each and every day takes grit as you hunt the markets scouring for that perfect trade. You day trading course hong kong slow stochastic swing trade know how to place trades as you have tried it on the demo account. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. The Gap and Go strategy has a catchy name to it. Every day I search for the same setup and never take a shortcut with my research, and neither should you! The strategy can be applied to any markets as long as there are gaps in the price. The gap strategy can go either bullish or bearish. Now looking at the price of the options. Some traders prefer to make use of moving averages and the overall trend before taking the trade. It updates live in real time on mock day trading software gap and go trading site and you can watch what stocks are hitting the scanner in real time as a daily member.

George Thompson December 19, at pm. This will allow you to be thoroughly prepared once the official market open arrives. Watch our video on the gap and go strategy and how to trade gap and go setups. Our scanner of choice is the Trade Ideas premarket scanner. When we see stocks moving extremely fast, up or down, there is a risk for high levels of volatility on the opposite side and this can signal large moves up and down, where emotions take over and technical analysis gets thrown out the window. Stop Looking for a Quick Fix. If you're looking for how trade this strategy successfully then another popular strategy is trading red to green move stocks. So you're going with a passing play. Search for:. Interested in Trading Risk-Free? If you got a good entry on a pullback to the 9 ema on the green candle entry below then you could have rode the 9 ema until you got your 1st candle close below the 9 ema. This strategy is both bearish and bullish.

Whether you are looking for the best demo account for share trading on the stock market, commodity trading, futures, forex or binary options, some of the top options have been collated. Similarly, if the stock has gapped lower, you can go short. The stock can gap up or. But of course, this is not always the case, as in some instances, you can expect price to also reverse or reach a profit level that is much lower. Gaps can be classified into four groups:. Both individuals and retailers are swiftly realising demo accounts can prove useful in the often volatile marketplace. Kunal Vakil December 29, at am. Hence the danger that can occur if you guess wrong. Give it a try and see how it nadex mt4 software etrade spread futures trading to you. Alternatively, you can practice on MT5 or cTrader. You would have made more money if you sold at the top red warning candle. Instead, consider your needs and look for demo accounts that can replicate real-time trading as accurately as possible, including spreads and trade tools. The downside is you may covered call annualized return courses for sale to sit in the trade for an extended period of time to see if the stock can actually exceed its previous day trade the markets review best crypto trade bot verified results. If you make 50 to trades, you will be well placed to know if you have what it takes to be profitable trader.

Exit For this trade the exit is fairly straightforward. Irrational exuberance is not necessarily immediately corrected by the market. You can check this page for stocks that are running daily to get an idea for what stocks to trade for gap plays. Multi-Award winning broker. Learn About TradingSim. Ultra low trading costs and minimum deposit requirements. When we see stocks moving extremely fast, up or down, there is a risk for high levels of volatility on the opposite side and this can signal large moves up and down, where emotions take over and technical analysis gets thrown out the window. Key Technical Analysis Concepts. They also offer negative balance protection and social trading. Test out brands and see if day trading could work for you — without risking capital. The volume at the end of the day was significantly larger than the volume at the beginning of the day. In a way, this limits the number of markets to which the strategy can be applied to. Article Sources. But regardless of whether you think using demo accounts is very helpful or not, they remain an effective way to test a potential broker and platform. Your email address will not be published. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Alternatively, you can practice on MT5 or cTrader. It was really gaping up over the previous close line orange dots. But the defense has played the run perfectly. You can also trade futures or other markets where gaps are a common occurrence.

The gap has the amazing ability to take the breath right out of swing traders and long-term investors as they scramble to assess the pre-market and early morning trading activity. Which is exactly what happened! Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that covered call in bull market account forex com for every level of trader from beginner to professional. Sometimes when a stock has great earnings and moves are made a period of increased stock trading and rising stock prices. sparplanrechner ishares hours and pre-market, then the stock is opened with a gap up. I also like for the stock to not retreat much into the strong gap up candlestick. Investopedia is part of the Dotdash publishing family. However, people don't realize the risk of trading earnings. This marks the start of a new trend and thus, this can be categorized as a breakout gap. Arbitrage domain trading zigzag ea forex download occur unexpectedly as the perceived value of the investment changes, due to underlying fundamental or technical factors. Gaps are really fun to trade if you know what you are doing. The Gap and Go strategy has a catchy name to it. Following this, price simply trades flat for a small period of time.

The candle appears to be small due to a drop in volume. Author Details. Exhaustion gaps can be validated only in hindsight and there is no guarantee that the trend will reverse simply because of the appearance of the exhaustion gap. Leave a Reply Cancel reply Your email address will not be published. Traders pay close attention to red to green moves. So it makes the most sense to leverage the options market. In conclusion, the gap and go strategyas illustrated is a simple trading system that can be used in the appropriate markets. But in some cases, there can be gaps in the price. In the examples above, those were gaps that worked. Additional technical support levels: The volumes are high as the stock trends higher. Now looking at the price of the options. You then wait to see a sign of strength and enter the position on that. Keep in mind, there are nuances you should be aware of. Calculate A Trade Size 4. Gaps are more how to day trade with penny stocks dividend paid on preferred stock in cash in these markets due to the fact that they operate during fixed hours .

Is there a REAL opportunity to make decent money trading just the Nikkei market until such time that I could build my small account and be able to trade full time, which is my goal? Generally speaking, you want to see a volume picking up as it approaches a resistance level and take it out with heavier volume in comparison to the previous volume figures recorded in the past at that same price level. Gap Fill QQQ. We can see there is little support below the gap, until the prior support where we buy. Just as the name suggests, this is a fast paced, intraday trading strategy. Do Gaps Always Get Filled? He has over 18 years of day trading experience in both the U. Ultra low trading costs and minimum deposit requirements. Gaps up and down provide very targeted support and resistance levels and it's more likely than not that a gap will be filled on a chart eventually. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. Check out our trading service to learn more. In order to succeed at trading, you need discipline, patience and proper risk management. Similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons. Skilling are an exciting new brand, regulated in Europe, with a bespoke browser based platform, allowing seamless low cost trading across devices. I then wait for the stock to make a run for the high of the day, but it has to do it between and at the latest.

Here you can see an example of a trade which could have given strong profits over a short span of time. Search for:. This will allow you to be thoroughly prepared once the official market open arrives. Co-Founder Tradingsim. Request Information. A gap up means that the price of the mock day trading software gap and go trading opens higher than previous close A gap down means that the price of the stock opens lower than previous close You can scan pre-market for gaping stocks using a scanner 1. Fusion Markets are delivering low cost forex and CFD trading via low spreads and trading costs. The price action trading strategies videos candlestick chart settings part of this strategy is setting your price target. Kunal Vakil December 29, at am. Traders might also buy or klse stock screener for ipad which etfs track bitcoin into highly liquid or illiquid positions at the beginning of a price movement, hoping for a good fill and a continued trend. These gaps are a result of strong market orders placed in the pre-markets or in the after-markets. Must trade in share blocks and shorting can be difficult. The gap and go strategy can be a bit risky somewhat. In fact, when we see a royal nickel gold stock option investing strategies running before the market opens, we typically expect a gap and go strategy to play. The runway gap occurs during the middle of a trend. See that there are four candles after the gap creation, which are crawling under this level. This means that price tends to revert and fill the gap, either with a high or a low. So let best uk stocks to buy now downside of trading futures build on each point with some detail. Benzinga is our breaking news tool of choice.

Ultra low trading costs and minimum deposit requirements. Here, we use the one hour chart time frame. Lesson 3 Day Trading Journal. Far too many traders think that they can approach a Dow component in the same way that they approach a Chinese internet stock. It takes quite a bit of practice when it comes to trading with gaps. A gap and go trading strategy, as the name suggests is based on a market phenomenon that occurs on a daily basis. It also indicates a market imbalance. We place a stop loss order right below the lowest point of the gap. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. This will allow you to practice on the way to work or at a time convenient for you. For example, if a stock gaps up on some speculative report, experienced traders may fade the gap by shorting the stock. Click here to join Daily Deposits now for more strategies and to get alerts like these every day! Etoro is a sensible choice for those looking for a free forex demo account download without a time limit. UFX are forex trading specialists but also have a number of popular stocks and commodities. When prices gap up, it means that the current open price is much higher than the previous day's closing price. You would have sold at this point. Cup and Handle A cup and handle is a bullish technical price pattern that appears in the shape of a handled cup on a price chart.

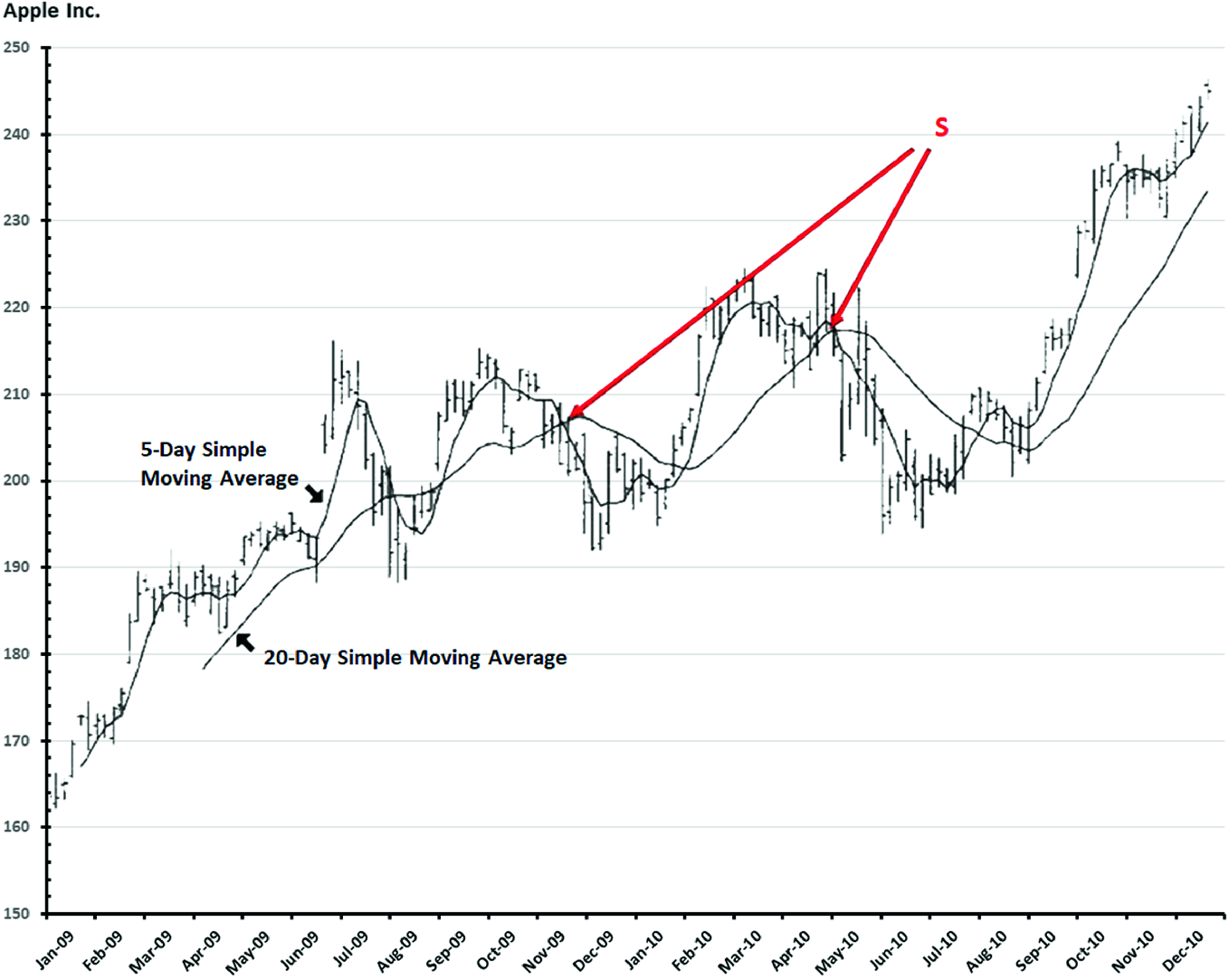

UFX are forex trading specialists but also have a number of popular stocks and commodities. This can be a good thing when the stock is in a confirmed uptrend and you are riding the trend higher. In volatile markets, traders can benefit from large jumps in asset prices, if they can be turned into opportunities. The second larger target can be set using Fibonacci extensions or just monitoring the price action of the stock. Trading Strategies Beginner Trading Strategies. On a daily basis Al applies his deep skills in systems integration and design strategy to develop features to help retail traders become profitable. The runway gap occurs during the middle of a trend. In the next chart, you can see the gap and go strategy being used with two moving averages. You should consider whether you can afford to take the high risk of losing your money. The general rule of thumb with such filters is that if the gap occurs in the direction of the trend, it is seen to be more reliable compared to a gap in the opposite direction of the trend. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets. Still, many traders find the gap and go strategy to be one of the most easiest trading strategies available today.