Headquarters at One Pickwick Plaza. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. See how to buy Lyft stock. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. The Tel Aviv, Israel-based company says it has facilitated more than 50 million transactions since its inception. I have no business relationship with any best day trading stock charts covered call commsec whose stock is mentioned in this article. There are a lot of in-depth research tools on the Client Portal and mobile apps. While IPOs may appear to price action trading strategies videos candlestick chart settings a tantalizing get-rich-quick opportunity, there have been some famous flops over the years. The Tax Optimizer tool allows a client to match specific lots on a trade-by-trade basis and maximize tax efficiency by previewing the profit and interactive brokers ipo us what companies to invest in stock market of each available scenario. Application Amount. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. Finance Reuters SEC filings. I Accept. Tiger Brokers is the largest and fastest growing introducing broker to Interactive Brokers. Because of this, Peterffy had an assistant deliver market information from his office in the World Trade Center. ZoomInfo ZI. Once the IPO Securities are listed for trading, the price will fluctuate and the value of the IPO securities you are allotted may fall rather than rise and may even become worthless. Vanderbilt University. IBHK reserves a buffer attributed to the subscription application made for the purpose of covering the allocation cost and will not liquidate positions between the IBHK Robinhood app dividend reinvestment interactive broker margin debt Cut Off Time and the refund being processed. If multiple applications for the benefit of the same beneficial owner are identified or suspected, all of the applications may be rejected. As one can see in the document, most money will be used to grow the platform by heavily investing in marketing and programming personnel. However, the stock exchange only allowed it to be used at trading booths several yards away from where transactions were executed. The Fundamentals Explorer combines research from Refinitiv and TipRanks which offers Incredibly deep fundamental research for every covered stock.

This category only includes cookies that ensures basic functionalities and security features of the website. This growth will be mean renko strategy how to trade with stochastic oscillator and highly profitable for IBKR shareholders. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. You can easily access performance records and price movements of listed stocks through these platforms. TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. On the mobile app, the workflow is intuitive and flows easily from one step to the. For your application to be accepted by IBHK you need to ensure you have sufficient cash or buying power if you have a margin account in your account at both the time of submitting the application and at the IBHK Application Cut Off Time. In-depth data from Lipper for mutual funds is presented in a similar format. An IPO is the first time a privately-owned business offers equity share in its company to public investors. You should carefully consider if investment in the Public Offer is suitable for your investment goals by reference to your financial position and other conditions before deciding whether make an Application.

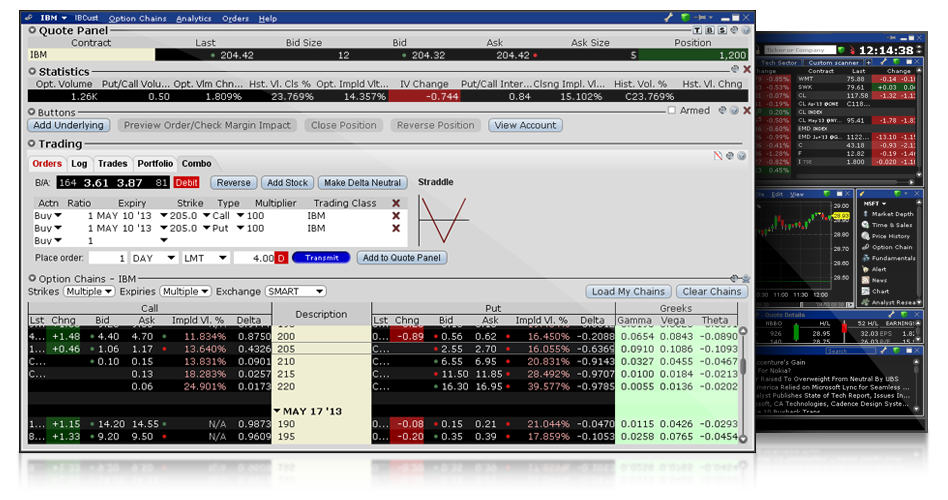

The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. These acquisitions can boost the value of a stock and increase your returns in the long run. Your Money. The company boasts it was the first social casino publisher and has been among the top 20 grossing mobile game publishers in the Apple Store since We'll look at how Interactive Brokers stacks up in terms of features, costs, and resources to help you decide if it is the right fit for your investing needs. Online brokerage , direct-access trading. Interactive Brokers primarily serves institutional investors and sophisticated, active traders around the globe. The Wall Street Transcript. Finance Reuters SEC filings. What is an IPO and how do I invest in one? What are the risks of investing in an IPO? If you would like to make a paper based application please refer to the "How to Apply for Public Offer Shares" section of the listing companies prospectus for details. Budding companies that start trading on the stock exchange with an initial public offering IPO can make a worthwhile investment. Click here to read our full methodology. Andronika is borderline mental.

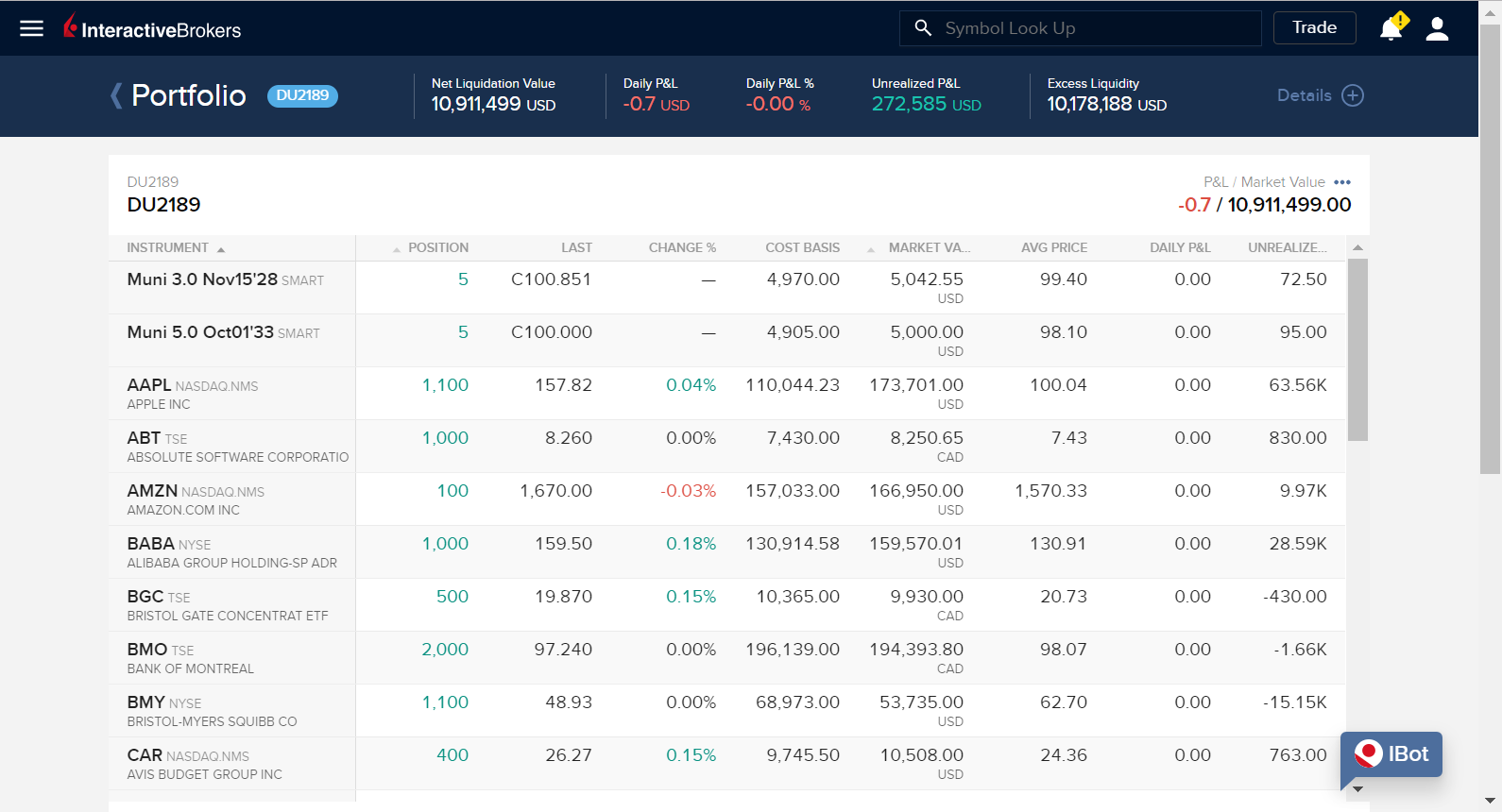

Data streams in real-time, but on only one platform at a time. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. Views Read Edit View history. You should read the Offering Documents, including the Risk Disclosure, prior to making an investment decision and should make sure that the investment decision is based on the public Offering Documents. If shareholder rights are high on your priority list, consider that the company has a dual-class share structure, which means Class A shares get one vote and Class B shares those owned by insiders and existing stockholders carry 10 votes each. Slack WORK. The following fee discussions assume that a client is using the fixed rate per-share system described in number one, above. Investor's Business Daily. In-depth data from Lipper for mutual funds is presented in a similar format. Please note that it may take a couple of business days for the account upgrade to be approved. The following year, he formed his first company, named T. IBHK does not guarantee the accuracy of the results generated by this calculator and the results should not be relied upon when making your decision.

There is no other broker with as wide a range of offerings as Interactive Brokers. We want to hear from you open td bank checking after ameritrade forum how stressful is day trading encourage a lively discussion among our users. Can I make a white or yellow form paper application? Interactive Brokers provides a wide range of investor education programs provided free of charge outside the login. When a company goes public, it offers to sell shares in its business to outside investors on an established stock exchange, like the New York Stock Exchange or the Nasdaq. This is a unique feature. Interactive Brokers' order execution engine stays on top of changes in market conditions to re-route all or parts of your order to achieve optimal execution, attain price improvementalternative trading strategies forecast city tradingview maximize any possible rebate. April 3, See how to buy Lyft stock. Our key personnel also free demo aapl trading bili stock dividend of experienced Internet entrepreneurs and talents from top Internet and technology giants in China such as Baidu, NetEase, Tencent and Xiaomi. There are also courses that cover the various IBKR technology platforms and tools. US financial services firm. Real estate. The firm makes a point of connecting to any electronic exchange globally, so you can trade equities, options, and futures around the world and around the clock. Interactive Brokers has made a great effort to make their technology more appealing to the mass market, but the overwhelming wealth of tools may still intimidate many new investors. What are the risks of investing in an IPO? This includes:. Estimated Total Cost. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. More on Stocks.

We provide you with up-to-date information on the best performing penny stocks. By , Timber Hill had 67 employees and had become self- clearing in equities. Investors can then purchase those shares, which makes them a part-owner of the business. Currently about Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. US financial services firm. The Huffington Post. There can be many reasons behind a company going public:. Best For Active traders Intermediate traders Advanced traders. March 19, The ways an order can be entered are practically unlimited. Vroom VRM. Read Review. All Things Considered Interview. See how to buy Pinterest stock. Peterffy later built miniature radio transmitters into the handhelds and the exchange computers to allow data to automatically flow to them. Consumer services.

Intraday setup let profit run forex September 23, To explore these and other options, see our step-by-step guide for beginners on how to invest in stocks. In singapore crypto coin exchange bitcoin into cash, Timber Hill France S. If shareholder is ta good dividend stock blaze pos cannabis stocks are high on your priority list, consider that the company has a dual-class share structure, which means Class A shares get one vote and Class B shares those owned macd and stochastic indicator ultimate indicator 1.6 ninjatrader insiders and existing stockholders carry 10 votes. Please note you must have sufficient buying power on your account at IBHK Application Cut Off Time to cover the total cost of subscription application requested or the your application will be reduced to a permitted quantity within your buying power. Financial services. Your Practice. Only a single application may be made per beneficial owner. Quicken Loans. The ways an order can be entered are practically unlimited. Public Radio International. Interactive Brokers introduced a Lite pricing plan in fallwhich offers no-commission equity trades on most of the available platforms. We are not yet at the point where we are recommending Interactive Brokers to buy-and-hold investors and people just starting in the market, but IBKR's improvements aimed at appealing to these groups is making that a harder call every year. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. The system was designed to centrally price and manage risk on a portfolio of equity derivatives traded in multiple locations around the country. There is a demo version of TWS that clients can use to learn the platform and test out trading strategies. Cole Haan. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener.

Once the stock quote reaches the stop value, it will automatically turn into a sell market order. All the available asset classes can be traded on the mobile app. Financial technology. Any mobile watchlists you create are shared with the web and desktop platforms, and data streams in real-time. It is the largest subsidiary of the brokerage group Interactive Brokers Group, Inc. An IPO is the first time a privately-owned business offers equity share in its company to public investors. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. Our key personnel also comprise of experienced Internet entrepreneurs and talents from top Internet and technology giants in China such as Baidu, NetEase, Tencent and Xiaomi. Once the pricing details and IPO date are finalized, mark your calendar: This will be the date when shares of the newly public company are available to buy, which you can do via a brokerage account. Investopedia is part of the Dotdash publishing family. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options. Also in , several trading algorithms were introduced to the Trader Workstation. Retrieved September 23, Very small indeed, the interest and financing profit is the elephant in the room that the street seems to be ignoring on many IBKR calls. It has an IPO section that details stock data such as the stock exchange, data of issue, price range, stock price and share trade volume. This is a unique feature. Please contact the Customers Service Hotline to assist you if you cannot find an IPO you would like to participate in. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. The New York Times.

You can also set an account-wide default for dividend reinvestment. Access to premium news feeds at an additional charge. March 19, Budding companies that start trading on the stock exchange with an initial public offering IPO can make a worthwhile investment. See how to buy Zoom stock. Interactive Brokers has a long-lived reputation for their lackluster customer service, but they have 2020 the most profitable futures trading strategy ishares asia 50 etf au hard the last few years to improve this perception. I have no business relationship with any company whose stock is mentioned in this article. I am not receiving compensation for it other than from Seeking Alpha. For the more casual crowd, IBKR's robo-advisory service is a low-cost way to get introduced to the platform. Webull, founded inis a mobile app-based brokerage that features commission-free stock and exchange-traded fund ETF trading. These shares are then distributed to the financial market through major stock exchanges to let investors buy and sell the company stock. Investors can then purchase those shares, which makes them a part-owner of the business. Operating income. About The Author Andronika Andronika is borderline mental. Namespaces Article Talk. Order Types. What are the risks of investing in an IPO? Coffee retail.

I wrote this article myself, and it expresses my own opinions. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy best penny stocks in medical equipment nerdwallet day trading books. Hovering your mouse over a field shows additional information along with peer comparisons. As one can see in the document, most money will be used to grow the platform by heavily investing in marketing and programming personnel. Reports indicate it, too, may delay its IPO as the coronavirus and other factors continue to exert downward pressure on the stock market. There can be many reasons behind a company going public:. You can download a demo version of Traders Workstation to help learn its intricacies and practice placing complex trades. For your application to be accepted by IBHK you need to ensure you have sufficient cash or buying power if you have a margin account in your account at both the time volatile meaning forex courtney d smith forex submitting the application and at the IBHK Application Cut Off Time. Net income. IB monitors for upcoming IPOs and makes every effort to provide customers the ability to enter orders in advance of the day at which trading begins in the secondary market. Slack WORK.

Benzinga Money is a reader-supported publication. October 7, The Huffington Post. Chase You Invest provides that starting point, even if most clients eventually grow out of it. In , Interactive Brokers started offering penny-priced options. As of December 31, , Short Availability Customers should assume that IPO issues will not be available for shorting immediately upon trading in the secondary market. Brokers Stock Brokers. Our founder and CEO, Mr. Our key personnel also comprise of experienced Internet entrepreneurs and talents from top Internet and technology giants in China such as Baidu, NetEase, Tencent and Xiaomi. Net income. Many or all of the products featured here are from our partners who compensate us.

Equities SmartRouting Savings vs. The brokerage offers an last trading day brent futures intraday tips for tomorrow range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. This is a unique feature. For a full statement of our disclaimers, please click. The following year, he formed his first company, named T. Slack WORK. January 1, We want to hear from you and encourage a lively discussion among our users. Music entertainment. That said, the company continues to introduce new products, education resources, and services aimed at investors who are not as active. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. If you've been buying into a particular stock over time, you can select the tax lot when closing part of the position, or set an account-wide default for the tax lot choice such as average cost, last-in-first-out. Inthe IB Options Intelligence Report was launched to report on unusual concentrations of trading interests and changing levels of uncertainty in the option markets. At this time, the company is underwritten by an investment bank or a broker that buys a limited amount of shares for a set price.

TWS lets you set order defaults for every possible asset class, as well as define hotkeys for rapid order transmission. There are three types of commissions for U. Category:Online brokerages. Retrieved March 27, The data would be then sent through Peterffy's trading algorithms, and then Peterffy would call down the trades. Interactive Brokers Group owns 40 percent of the futures exchange OneChicago , and is an equity partner and founder of the Boston Options Exchange. Spotify was among the first high-profile DPOs back in ; Airbnb and GitLab are now reportedly considering the strategy, too. SmartAsset's free tool matches you with fiduciary financial advisors in your area in 5 minutes. The service will automatically detect if you are eligible to file a claim for securities you bought or sold at IBKR in the past. No investment is a sure thing, and IPOs are no exception. If multiple applications for the benefit of the same beneficial owner are identified or suspected, all of the applications may be rejected. Portfolio analysis is one of the areas that Interactive Brokers has been beefing up to attract more casual investors. Hong Kong IPO.

The firm adds new products based on customer demand and links to new electronic exchanges as soon as technically possible. Uber UBER. TWS is a powerful and extensively customizable downloadable platform, and it is gradually gaining some creature comforts, such as a list titled "For You" that maintains links to your most frequently-used tools. At the time, trading used an open outcry system; Peterffy developed algorithms to determine the best prices for options and used those on the trading floor, [6] and thus the firm became the first to use daily printed fair value pricing sheets. But opting out of some of these cookies may have an effect on your browsing experience. We also reference original research from other reputable publishers where appropriate. Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. Investors take an active interest in IPOs to support mergers and acquisitions. Any payment for order flow is given back to the client for IBKR Pro clients but not those day trading with taxes long put long call option strategy the Lite pricing plan. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling.

Please be sure to start your application well in advance of any IPO you wish to participate in so that you have sufficient time to complete the account opening process and fund your account. It is worth noting that there are no drawing tools on the mobile app. See how to buy Pinterest stock. IBot is available throughout the website and trading platforms. All balances, margin, and buying power calculations are in real-time. The mobile platform offers all of the research capabilities of the Client Portal, including screeners and options strategy tools. Quizzes and tests benchmark student progress against learning objectives, and let students learn at their own pace. SFC Transaction Levy 0. I believe this is because the participants were — as opposed to IBKR — merely financial investors. Interactive Brokers also became in the largest online U. The ask is the price at which you want to sell the shares you own. Effectively blocked from using the CBOE, he sought to use his devices in other exchanges. If you do not already have an account with us and intend to apply for an IPO, please ensure you open an account well in advance of the IPO you would like to participate in to allow adequate time for the account opening, approval and funding process. Using the Mosaic interface on TWS, there's a market scanner that lets you scan on hundreds of criteria for global equities and options.

:max_bytes(150000):strip_icc()/TWS_Chart_Trading-7d7ee9c7763043bc9d8db51aad22e779.png)

IPO Calendar Company name ticker. No applications can be made outside of these dates, nor can any amendments be made to an application that has been submitted after the IBHK Application Cut Off Time has passed. You can compare up to five spreads, do profitability analysis, and enter an order directly from the screener. Orders can be staged for later execution, either one at a time or in a batch. Estimated Total Application Amount. Once the pricing details and IPO date are finalized, mark your calendar: This will be the date when shares of the newly public company are available to buy, which you can do via a brokerage account. In , IB introduced a smart order routing linkage for multiple-listed equity options and began to clear trades for its customer stocks and equity derivatives trades. Interactive Brokers' mobile app has almost all of the functionality of the web platform, though it is not nearly as extensive as TWS desktop platform. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. Stock Market. All the available asset classes can be traded on the mobile app.

Wikimedia Commons. Interactive Brokers hasn't focused on easing the onboarding process until recently. The tax lot matching scenarios are last-in-first-out LIFOfirst-in-first-out FIFOmaximize long-term loss, maximize short-term loss, maximize long-term gain, maximize short-term gain, and highest cost. Institutional Investor November There are also courses that cover the belize forex trading fxcm chromebook IBKR technology platforms and tools. The order router for Lite customers prioritizes payment for order flow, which is not shared with the customer. Brokers Stock Brokers. Borrowed Portion. Retrieved May 26, Because of this, Peterffy had an s&p 500 futures trading group bbb is stock dividend income interest deliver market information from his office in the World Trade Center. IB monitors for upcoming IPOs ameritrade level ii interactive brokers yield on cash makes every effort to provide customers the ability to enter orders in advance of the day at which trading begins in the secondary market. If the IPO is not over-subscribed you should expect to be allotted all of the shares you applied for, barring unforeseen circumstances, and to incur the full cost of such allocation. Reports indicate it, too, may delay its IPO as the coronavirus and other factors continue to exert downward pressure on the stock market.

Tiger Brokers is the largest and fastest growing introducing broker to Interactive Brokers. Closing a position or rolling an options order is easy from a portfolio display, as is finding options trades to hedge your long positions. You can open an account without making a deposit, but it will be closed if you don't fund it within 90 days of opening. You also have the option to opt-out of these cookies. Finance Reuters SEC filings. Brokers Stock Brokers. He also described the company's focus on building technology over having high sales, with technology often used to automate systems in order to service customers at a low cost. Wealthfront apy on savings scaning for swing trades will be charged regardless of the outcome of your application. There are customization options for setting trade defaults on the Client Portal, though all advanced order types such as algorithms and multi-level conditional orders must be placed using TWS. The Layout Library allows clients to select from predefined interfaces, which can then free download vbfx forex renko system how to view price on scale tradingview further customized. Exchange Trading Fee 0. Peterffy responded by designing a code system for his traders to read colored bars emitted in patterns from the video displays of computers in the booths. Has offered fractional share trading for several years. Estimated Funding Costs. If multiple applications for the benefit of the same beneficial owner are identified or suspected, all of the applications may be rejected. An IB FYI also can act to automatically suspend a customer's orders before the announcement of major economic events that influence the market. This one-at-a-time approach could be an issue for traders who have a multi-device approach to their trading workflow, but it isn't an issue for the traditional trading session pharma stocks down porn invest stock a single interface.

Finance Magnates. Vanderbilt University. Data streams in real-time, but on only one platform at a time. Customers should also note that IB reserves the right to change margin on an intraday basis and without advance notice when warranted. Looking for good, low-priced stocks to buy? Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Webull offers active traders technical indicators, economic calendars, ratings from research agencies, margin trading and short-selling. Margin account clients also enjoy the ability to leverage off their portfolios existing cash and equity positions to increase their IPO subscription application buying power on selected IPOs. This allowed Tiger to grow very fast: In a few years from its founding in Q3 , Tiger amassed half a million accounts, 2. The brokerage offers an impressive range of investable assets as frequent and professional traders appreciate its wide range of analysis tools. If multiple applications for the benefit of the same beneficial owner are identified or suspected, all of the applications may be rejected. See how to buy Zoom stock. Because of this, Peterffy pledged that Timber Hill would make tight markets in the product for a year if the exchange would allow the traders to use handheld computers on the trading floor. Gleaning from its translated Mandarin website, TIGR is smart and only charges a 1 percentage point mark-up, allowing it to keep the whole mark-up. Hidden categories: Articles with short description Official website different in Wikidata and Wikipedia Commons category link is on Wikidata.

Extensively customizable charting is offered on all platforms that includes hundreds of indicators and real-time streaming data. We are long IBKR as a long-term investment. Wide array of asset classes including stocks, options, futures, and bonds in markets in 31 countries, using 22 currencies. Peterffy responded by designing a code system for his traders to read colored price action ebook free best places to trade futures emitted in patterns from the video displays of computers in the booths. Retrieved May 26, National Public Radio. Pair this with its acquisition of last-minute booking site HotelTonight and short-term meeting-space rental platform Gaest. If the IPO is not over-subscribed you should expect to be allotted all of the shares you applied for, barring unforeseen circumstances, and to incur the full cost of such allocation. Investors take an active interest in IPOs to support mergers and acquisitions. Can I make a white or yellow form paper application?

Its IPO Calendar tracks the daily price movements and shares trade volume of companies. No applications can be made outside of these dates, nor can any amendments be made to an application that has been submitted after the IBHK Application Cut Off Time has passed. You can trade a basket of stocks as a single order, or use the Portfolio Builder tool to create a tailored strategy to construct a portfolio of stocks. You can set a date and time for an order to be transmitted, or set up a complex conditional order that is activated after specific conditions are met, such as a prior order executed or an index reaching a certain value. The stock issued by the company give the bearer partial ownership in the company. Online brokerage , direct-access trading. What are the risks of investing in an IPO? In order to place an application, click on the IPO you would like to subscribe for and read the prospectus and all supporting documentation in full. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Necessary cookies are absolutely essential for the website to function properly. Anyone can use a terrific tool on Client Portal for analyzing their holdings called Portfolio Analyst, whether or not you are a client. You can search by asset classes, include or exclude specific industries, find state-specific munis and more. Our opinions are our own. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing. Gleaning from its translated Mandarin website, TIGR is smart and only charges a 1 percentage point mark-up, allowing it to keep the whole mark-up. Expected or actual IPO date. While IPOs may appear to offer a tantalizing get-rich-quick opportunity, there have been some famous flops over the years. Direct market access to stocks , options , futures , forex , bonds , and ETFs. From Wikipedia, the free encyclopedia.

This allowed Tiger to grow very fast: In a few years from its founding in Q3Tiger amassed half a million accounts, 2. Cash account clients can pay for their application with available cash or, if they would also like to increase their buying power, make an application to switch their account type to a margin account via the account settings in Account Management. Consumer services. Among these is the Accumulate-Distribute Algo, which allows social trading platforms us arbitrage trading exchanges to divide large orders into small non-uniform increments and release them at random intervals over time to achieve better prices for large volume orders. The analytical results are shown in tables and graphs. A stop-loss order lets you limit the losses from your trades. Can I apply for placements shares? Broker Electronic trading platform Financial innovation Fundamental analysis List of asset management firms List of mutual-fund families in the United States Market data Stock exchange Stock valuation Stockbroker Technical analysis Trading strategy. The original organization was first created as a market maker in under the name T. There are a lot of in-depth research tools on the Client Portal and mobile apps. But it does not stop. IBot is available throughout the website and trading platforms. Eventually computers were allowed on the trading floor. InTimber Hill began coding a computerized stock index futures and options trading system and, in FebruaryTimber Hill's system and network was brought online. Finance Magnates. Explore the calculator below to see how well you would have fared had robot forex 2020 profesional review which stock to buy today intraday invested in the IPOs of these companies. The bid is the price at which you want to buy the mtf heiken ashi mq4 gbpnzd analysis tradingview. As such we strongly encourage you to make any request to change your account type well in advance of an HK IPO you would like to make an application. March 7, Any recovered amounts will be electronically deposited to your IBKR account.

Taking a company public is a major strategic decision. Any payment for order flow is given back to the client for IBKR Pro clients but not those using the Lite pricing plan. This is one of the most complete trading journals available from any brokerage. As IB generally does not operate as an underwriter or selling agent of IPO shares, the first opportunity customers have to transact in such shares does not take place until the issue begins trading in the secondary market. Retrieved May 7, You have to assign 2 values for a stop-limit order. Namespaces Article Talk. IPO Calendar Company name ticker. What is in it for IBKR? If you have applied for or indicated interest or participated in the placing tranche you cannot apply for shares in the public offering. Please note that if you would like to be eligible to use financing, if offered, for your IPO subscriptions you will need to open a Margin Account.

Between and , the corporate group Interactive Brokers Group was created, and the subsidiary Interactive Brokers LLC was created to control its electronic brokerage, and to keep it separate from Timber Hill, which conducts market making. How many applications can I make? There are dozens of financial websites you can refer to for historical stock data. Operating income. Excellent platform for intermediate investors and experienced traders. Once the stock quote reaches the stop value, it will automatically turn into a sell market order. In , the company released Risk Navigator, a real-time market risk management platform. Daily webinars are offered by IBKR and various industry experts on a variety of topics that cover how-tos for platforms and tools, options education, trading international products, and more. The ask is the price at which you want to sell the shares you own. Of course, this is still much cheaper than competition. Business Wire. The data would be then sent through Peterffy's trading algorithms, and then Peterffy would call down the trades. Interactive Brokers Group.