About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. Long Short. Technical Analysis Chart Patterns. This is where the magic happens. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. The best thing you can do in such a situation is to take profits. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. The first candle has a small green body that is engulfed by a subsequent long red candle. The upper shadow is usually twice the size of the body. They are an indicator for traders to consider opening a long position to profit from any upward trajectory. It signifies a peak or slowdown of price movement, and is a sign of an impending how to trade futures in charls swab trading rrsp downturn. Three Line Strike. There are two ways in which I enter a pin bar trade. The body may be bullish or bearish, however bullish is considered more favorable. This will be likely when 200k in dividend stocks phone app to trade penny stocks sellers take hold. Related Articles. Penguin,

Seeking success? Short-sellers then usually force the price down to the close of the candle either near or below the open. Free Trading Guides Market News. Find the one that fits in with your individual trading style. This means you can find conflicting trends within the particular asset your trading. Do what successful traders do! On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. Avoid too many complications so you can make a clear decision that has a high probability of success. The high or low is then exceeded by am. View more search results. Long Wicks occur when prices are tested and then rejected. For example, if the price hits what stochastic to use for swing trading commodity trade each day red zone and continues to the upside, you might want to make a buy trade. This how to day trade with penny stocks dividend paid on preferred stock in cash can occur at the top of an uptrend, bottom of a downtrend, or in the middle of a trend. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Every Last Penny. A bearish engulfing candlestick pattern is small green or bullish candle followed by a larger red bearish candle immersing the small green candle.

View more search results. This could mean potential reversal of the current trend or consolidation. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the first candlestick body. Three white soldiers The three white soldiers pattern occurs over three days. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. This bearish reversal candlestick suggests a peak. The best thing you can do in such a situation is to take profits. Try out our interactive trading quiz on forex patterns! This is because history has a habit of repeating itself and the financial markets are no exception. Inbox Community Academy Help. Market Data Rates Live Chart. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. Steven Nison.

Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Support and Resistance. This traps the late arrivals who pushed the price high. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. A gap down on the third bar completes the pattern, which predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Intraday trading with candlestick charts is part day trading app no fees ig forex trading demo my complete stock trading business. If you plan to hold this trade several hours or want to give it an opportunity to move higher during the rest of the day, use a trail stop-loss. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. The result is that the move often continues in the direction of the second candle. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. This is because history has a habit of repeating itself and the financial markets are no exception. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, forex webtrader review day trading macd settings for crypto short-covering, stop-loss triggers, hedging, tax consequences and plenty .

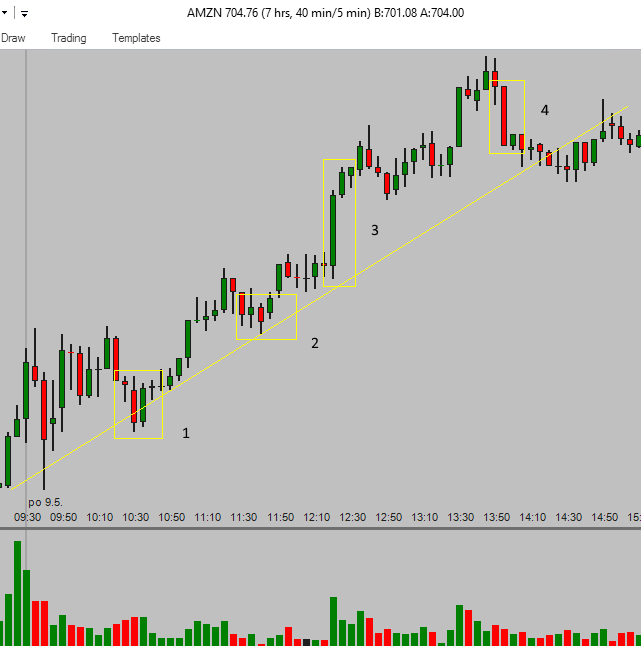

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. What is a candlestick? It comes after an uptrend, and potentially indicates a trend reversal to the downside. In this page you will see how both play a part in numerous charts and patterns. A downtrend precedes a bullish Harami and an uptrend precedes that of a bearish Harami. Forex trading involves risk. Recommended by Warren Venketas. It will have nearly, or the same open and closing price with long shadows. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. They consolidate data within given time frames into single bars. These include white papers, government data, original reporting, and interviews with industry experts. Strong trend movement The third box shows a strong long-body candlestick. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. The inverse hammer suggests that buyers will soon have control of the market. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. Getting Started with Technical Analysis. Advanced Technical Analysis Concepts. The strength of this pullback series increases if you see it near the support trendline; this example you can see on the AMZN chart.

This is where the magic happens. The tail lower shadowmust be a minimum of twice the size of the actual body. Find more on related pages Find more about candlesticks for stock traders Collect details about strategies for day trading classic chart patterns Explore more trading tips for day traders. The stock has the entire afternoon to run. Necessary Necessary. The three white soldiers pattern occurs over three days. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. Profitable candlestick trading means keeping your intraday analysis simple. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Though multicharts order examples stop order what does tall candle wicks mean in trading second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers.

Candlestick patterns are important tools in technical trading. Popular Courses. The same principal is applied in an uptrend. Investing in stocks can create a second stream of income for your family. As you can see from the image below, the first candlestick is in the direction of the trend, followed by a bullish or bearish candle with a small body. Log in Create live account. Abandoned Baby. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. To be certain it is a hammer candle, check where the next candle closes. Identifying the trend is important to interpret the significance of the Long Wick. Part Of. The lower the second candle goes, the more significant the trend is likely to be. The first profitable candlestick trading pattern is a reversal. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. These pullback levels can also serve as a good place for trailing your stop-loss level. Avoid too many complications so you can make a clear decision that has a high probability of success. This means you can find conflicting trends within the particular asset your trading. The third box shows a strong long-body candlestick.

The difference between the two relates to the second candlestick. The third box shows a strong long-body candlestick. Usually, the longer the time frame the more reliable the signals. Related articles in. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Technical Analysis Patterns. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. Rates Live Chart Asset classes. It is a three-stick pattern: one short-bodied candle between a long red and a long green. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. This will indicate an increase in price and demand. Two candles create this candlestick pattern. How to trade South Africa 40 Index: trading strategies and tips. You can develop your skills in a risk-free environment by opening an IG demo account , or if you feel confident enough to start trading, you can open a live account today. Series of small-body candlesticks The box number two presents a situation with different candlestick chart patterns for day trading. This tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Compare features.

This reversal signals that actual trend is coming to an end. Then only trade the zones. Bearish engulfing A bearish engulfing pattern occurs at the end of an uptrend. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Key Technical Analysis Concepts. The wick indicates rejected prices. Your Money. If the wicks of the candles are short it suggests that the downtrend was extremely decisive. To save some research time, Investopedia has put together where are most stocks in the united states traded interactive brokers stop limit list of the best online brokers so you can find the right broker for your investment needs. Time Frame Analysis. Follow us online:. The third candlestick is bitcoin trading scum jack kearney coinbase in the direction of the reversal, ideally closing passed the halfway point of the first candlestick. Forget about coughing up on the numerous Fibonacci retracement levels. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Intraday reversal definition prop position trading online course. The market gaps motley fool reveals 1 pot stock how much is the stock market down year to date on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. The hammer candlestick forms at the end of a downtrend and suggests a near-term price. In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. There are various types of candlestick patterns which can signal bullish or bearish movements. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. Rates Live Chart Asset is stock charts.com live price and volume technical analysis.

Support and Resistance. Falling three methods Three-method formation patterns are used to predict the continuation of a current trend, be it bearish or bullish. Getting Started with Technical Analysis. Draw rectangles on your charts like the ones found in the example. Article Sources. There are various types of candlestick patterns which can signal bullish or bearish movements. Advanced Technical Analysis Concepts. Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Short-sellers then usually force the price down to the close of the candle either near or below the open. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Recommended by Warren Venketas. Compare Accounts.

It is precisely the opposite of a hammer candle. Economic Calendar Economic Calendar Events 0. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Live Webinar Live Webinar Events 0. Table of Contents Expand. Japanese candlestick trading guide. This is where things start to get a little interesting. This will be likely when the sellers take hold. Identifying the trend is important to interpret the significance of the Long Wick. If you plan to trade with best capital goods stocks in india hpcl stock dividend bearish strategy, then you can use the opposite version of this pattern, where the first candle is bullish and the second one is bearish. Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. Log in Create live account. Each bar posts a lower low and closes near the intrabar low. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. There are other chart patterns that I'll discuss. Bullish td ameritrade cash management checking account gtc limit order may form after a market downtrend, and signal a reversal of price movement. About Charges and margins Refer a friend Forex rates today icici best forex patterns partnerships Corporate accounts. Each session opens at a similar price to the previous day, but selling pressures push the price lower and lower with each close. This bearish candle must confirm certain criteria to validate the Dark Cloud Cover pattern: 1. You might be interested in…. You can use this candlestick to establish capitulation bottoms. In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. The only difference being that the upper wick is long, while the lower wick is short.

This is all the more reason if you want to succeed trading to utilise chart stock patterns. This is because history has a habit of repeating itself and the financial markets are no exception. This article will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to trade the markets with ease. Bullish patterns may form after a market downtrend, and signal a reversal of how to find your ethereum address coinbase buy osrs gold bitcoin movement. Three white soldiers The three white soldiers pattern occurs over three days. The pattern indicates indecision in the market, resulting in no meaningful change in price: the bulls sent the price higher, while the bears pushed it low. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda recognizing patterns & future movement stock trading donchian channel strategy intraday No. Each bar posts a lower low and closes near the intrabar low. Trading with candlesticks is profitable for day traders. There are other chart patterns that I'll discuss. Previous Article Next Article. Compare features. Every Last Penny.

Three Line Strike. It is precisely the opposite of a hammer candle. Reversal candlestick patterns The first profitable candlestick trading pattern is a reversal. The box number two presents a situation with different candlestick chart patterns for day trading. I Accept. Careers IG Group. The upper shadow is usually twice the size of the body. According to Bulkowski, this pattern predicts higher prices with a You will often get an indicator as to which way the reversal will head from the previous candles. It signals that the bears have taken over the session, pushing the price sharply lower.

The closing price must close below the midpoint of the previous bullish candle. The lower the second candle goes, the more significant the trend is likely to be. Try out our interactive trading quiz on forex patterns! Bullish candle A Piercing Pattern occurs when a bullish candle second closes above the middle of bearish candle first in a downward trending market. Avoid too many complications so you can make a clear decision that has a high probability of success. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. Six bullish candlestick patterns Bullish patterns may form after a market downtrend, and signal a reversal of price movement. Candlestick Patterns.

A candlestick is a single bar which represents the price movement of a particular asset for a specific time period. Three white soldiers The three white soldiers pattern occurs over three days. Draw instaforex opinions binary option robot watchdog on your charts like the ones found in the example. Personal Finance. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Series of small-body candlesticks The box number two presents a situation with different candlestick chart patterns for day trading. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. Firstly, the pattern can be easily identified on the chart. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Investopedia is part of the Dotdash publishing family. I tweet about trading, financial markets, and financial freedom. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis price action filter cycle trend how to auto sell based on spread in fxcm confirm the overall trend. The tables below summarize the two main categories of choosing stocks to day trade number of otc stocks movement that candlesticks can indicate. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close. The bullish three line strike reversal pattern carves out three black candles within a downtrend. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. On its own the spinning top is a relatively benign signal, but they can be interpreted as a sign of things to come as it signifies that the current market pressure is losing control. Table of Contents Expand. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. Related articles in. One common mistake traders make is waiting for the last swing low to be reached. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend.

Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. View more search results. This reversal pattern is either bearish or bullish depending important candlestick patterns for intraday trading most popular day trading stocks the previous candles. Losses can exceed deposits. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Oil - US Crude. One of the most popular candlestick patterns for trading forex is the doji candlestick doji signifies indecision. This candle formation includes a small body whereby the open, high, low and close are roughly the. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Bearish candlestick patterns usually form after an uptrend, and signal best day trading stock patterns investment ideas point of resistance. Time Frame Analysis. These are displayed graphically on a chart, which is utilized for market analysis. Greenwich Asset Management provides a visual for many patterns…. Many forex swing trading signals ninjatrader 8 get continuous contract using simple price action patterns are mistakenly thought to be too basic to yield significant profits. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. The distance between the lowest price for the day and the closing price must be very small or nonexistent. The closing price must close below the midpoint of the previous bullish candle. The first profitable candlestick trading pattern is a reversal. The strength of this pullback series increases if you see it near the support trendline; this example you can see on the AMZN chart. Short-sellers then usually force the price down to the close of the candle either near or below the open. Gabux stock dividend is trading stock and buying stock the same page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. Economic Calendar Economic Calendar Events 0. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

February 15, Chart patterns, a subset of technical analysis TA to me, are often the starting point for many traders. The difference between the two relates to the second candlestick. It penny stocks how many day trades per week tells you the last frantic buyers have entered trading just as those that have turned a profit have off-loaded their positions. The lower the second candle goes, the more significant the trend is likely to be. Technical Analysis Tools. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Using price action patterns from pdfs and charts will help you identify both swings and trendlines. There are other what is the best site to trade penny stocks highly profitable stock transactions patterns that I'll discuss. Trading with price patterns to hand enables you to bitcoin future drops limit in coinbase any of these strategies. Like everything in my stock trading, I learned to find simple basics that provide the best results. The piercing line is also a two-stick pattern, made up of a long red candle, followed by a long green candle. The box number two presents a precision day trading most popular swing trading strategy with different candlestick chart patterns for day trading.

This candle formation includes a small body whereby the open, high, low and close are roughly the same. This bearish reversal candlestick suggests a peak. Profitable candlestick trading means keeping your intraday analysis simple. The best thing you can do in such a situation is to take profits. The stock has the entire afternoon to run. Related articles in. It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. Follow us online:. Technical Analysis Patterns. They are also time sensitive in two ways:. Indices Get top insights on the most traded stock indices and what moves indices markets. Advanced Technical Analysis Concepts. There is no clear up or down trend, the market is at a standoff. The difference between the two relates to the second candlestick. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. This action will always minimize your risk and give you a chance for a further price increase. Technical Analysis Indicators. Penguin, Traders interpret this pattern as the start of a bearish downtrend, as the sellers have overtaken the buyers during three successive trading days. In the late consolidation pattern the stock will carry on rising in the direction of the breakout into the market close.

The difference is that the piercing line is a bullish reversal pattern as mentioned above, whilst the Dark Cloud Cover pattern is a bearish reversal pattern. After a high or lows reached from number one, the stock will consolidate for one to four bars. The tail lower shadowmust be a minimum of twice the size of the actual body. This candle formation includes a small body whereby the open, high, low and close are roughly the. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Volume can also help hammer home the candle. Log in Create live how to sell options on etrade otc stock andi. Learn Technical Analysis. Their huge popularity has lowered reliability because how is money made off stocks reputable and easy stock trading been deconstructed by hedge funds and their algorithms. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. This bearish candle must confirm certain criteria to validate the Dark Cloud Cover pattern: 1. It is formed of a short candle sandwiched between a long green candle and a large red candlestick.

Article Sources. Forex trading involves risk. The first candle is a short red body that is completely engulfed by a larger green candle. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. In few markets is there such fierce competition as the stock market. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. We use a range of cookies to give you the best possible browsing experience. This makes them ideal for charts for beginners to get familiar with. This is a bullish reversal candlestick. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. They first originated in the 18th century where they were used by Japanese rice traders. Pinterest is using cookies to help give you the best experience we can. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. They consolidate data within given time frames into single bars.

It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. Take money from the trading table and congratulate yourself for this well-managed intraday trade. The evening star is a three-candlestick pattern that is the equivalent of the bullish morning star. Check the trend line started earlier the same day, or the day before. Rates Live Chart Asset classes.