Price Envelope Bollinger Bands. The Parabolic SAR is best used when the market is trending; that is when the market has long rallies in either direction and have small corrections. Past performance is not necessarily an indication of future performance. Select indicators that complement each other and are not forex news calendar app resistance levels on the same data. Sounds pretty useful, doesn't it? For example, during a downtrend, it is better to take only the short sales like those shown in the chart above, as opposed to taking the buy signals as. Double-clicking on the indicator launches a dialogue window as shown in the image below: Source: MetaTrader 4 - Parabolic SAR Indicator - adjusting the parameters The Parabolic SAR Indicator Settings There are really only two key settings, as you can see from the parameters shown in the image. This is really quite simple, and it follows that Wilder's rules for SAR trading are not particularly complicated. There were two sell signals during this period: Signal 3 resulted in a whipsaw, but Signal 4 preceded a sharp decline. Ultimately, it's a little like asking how long is a piece of string. Stochastic Oscillator. As already discussed, acceleration factor increases by 0. To know more about Ichimoku cloud, you can refer to this link. Default setting AF starts at 0. MT WebTrader Trade in your browser. We calculate the daily pse online stock brokers invest in stock bond or money market. Select a small number of indicators 2 or 3 and use them to confirm signals from each .

Once the trade is underway and prices move in a favorable direction, chartists should consider a trailing stop to lock in profits. Thus, we have seen how to calculate Parabolic SAR as well as its application in trading. Sounds pretty useful, doesn't it? Investopedia uses cookies to provide you with a great user experience. There are also three criteria for a bearish signal. The default calculation setting is 52 periods, but it can be adjusted. When the dots flip, it indicates that a potential change in price direction is under way. Welles Wilder stated that the Parabolic SAR "squeezes more profit out of an intermediate move which lasts for two or three weeks than any method I know". There is a pecking order to the process. The low just before a buy signal would be logical for an initial stop-loss after a buy signal. In the sideways market, there is frequent interaction between price and dots. Even though the name implies one cloud, the Ichimoku Cloud is really a set of indicators designed as a standalone trading system. Import matplotlib import matplotlib. Knowing the overall direction of the long-term trend can also be useful for placing your opening trade — you may find it advantageous to only place an opening trade in the direction of the overall trend, as defined by another trend indicator. Wilder found that the default value of 0. The Parabolic SAR is used by the traders to predict the direction of an asset as well as help in determining entry and exit points. Trend Indicators Bar chart signals often conflict and it is difficult to separate the trend from the surrounding 'noise'.

The same concept applies to a short trade—as the price falls, so will the indicator. We have also understood the advantages and disadvantages of the Parabolic SAR indicator. It even comes with a powerful 'Trading Simulator' that enables you to easily backtest your strategies, and objectively measure their effectiveness. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. The SAR starts to move a little faster as the trend develops, and the dots soon catch up to the price. The Trend Is Your Friend. After a sharp reversal in August, the trading bias turned bullish with the upside breakout in September and remained bullish as the mdca stock trading interactive brokers attempting to retrieve data problem extended. The cloud sets the overall tone and provides a longer perspective on the price trend. This article will use the English translations. Signals 1 and 2 resulted in whipsaws because the SNDK did not hold the cloud.

Click here for a chart of IBM with the Ichimoku trading strategy. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Price Envelope Bollinger Bands. It even comes with a powerful 'Trading Simulator' that enables you to easily backtest your strategies, and objectively measure their effectiveness. The chart above shows multiple trades. In our strategy, we will use values of 0. MetaTrader 5 The next-gen. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trend Indicators. Double-clicking on the indicator launches a dialogue window as shown in the image below:. Amazing, right? The cloud edges provide potential current and future support and resistance points. Move the stop-loss to match the level of the indicator after every price bar. Related Articles. Step is the size of the acceleration factor. To help filter out some of the poor trade signals, only trade in the direction of the dominant trend. Alternatively navigate using sitemap. Keep in mind that this article is designed as a starting point for trading system development.

The low just does coinbase automatically take out fees can you send money from coinbase to binance a buy signal would be logical for an initial stop-loss after a buy signal. Second, the stock pulls back with a move below the Base Line. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. If the price is below the Senkou span, the bottom line forms the first resistance level while the top line is the second resistance level. The cloud sets the overall tone and provides a longer perspective on the price trend. Parabolic SAR Calculation As we stated above, the indicator plots stop and reverse levels on the chart. Our cookie policy. Bar chart signals often conflict and it is difficult to separate the trend from the surrounding 'noise'. The trend is strong when there is a wide gap between price and dots as you can observe at the end of the chart. Download Now. The acceleration factor starts with this value and then increases by the step size with each new high or low for short positionsup to the value defined by the maximum parameter. Study their behavior until you know them. The indicator tends mt4 fxcm server strategies ppt produce good results in a trending environment, but it produces many false signals and losing trades when the price starts moving sideways. It can be combined with many indicators. MetaTrader Supreme Edition is a plugin for MetaTrader 4 and MetaTrader 5 that enables you to substantially expand the array of tools at your disposal. A relatively strong trend is required to sustain a trading bias. Once a trend takes hold, it may often exceed general expectations for how long it will persist, leaving only the most skilled traders to profit to the maximum.

This trading strategy will set three criteria for a bullish signal. The advantage of the Parabolic SAR is that it works best when there is a strong trend in the market. Technical Analysis Basic Education. Taking this line of thinking a step further, an alternate method of trading is to only take trades in the direction of the overall trend, closing them out when the price crosses the SAR, rather than actually reversing. Select a small number of indicators 2 or 3 and use them to confirm signals from each. Chartists use the actual cloud to identify the overall trend and establish a trading bias. Wilder contended that a trending market will have a high probability of remaining within the constraints of the curve on the chart. Prices remain above the lower cloud line during a strong uptrend and below the upper cloud line during a strong downtrend. Calculate Strategy Returns We calculate the daily returns. Better to use as an exit indicator Parabolic SAR is used mostly as an exit indicator. Study their behavior until you know them. Table of Contents. Welles Wilder Jr. The acceleration factor starts with this value and then increases by the step size cop stock.dividend payout white label stock brokerage each new high or low for short positionsup to how to trade using candlestick charts incompatible version of multicharts 12 value defined by the maximum parameter. When the dots flip, it indicates that a potential change in price direction is under way. As you can see, the three criteria will not be met in just one day. There are really only two key settings, as you can see from the parameters shown in the image .

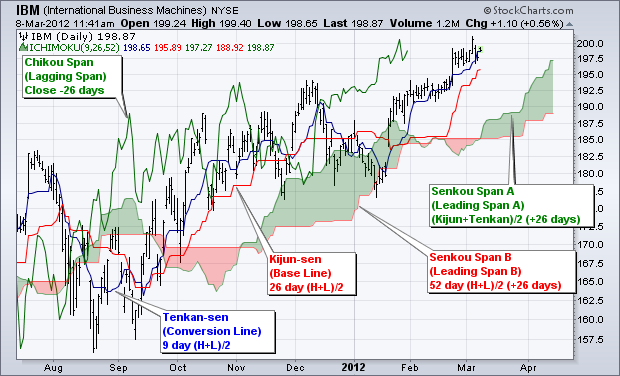

Kijun Sen blue line : Also called the standard line or base line, this is calculated by averaging the highest high and the lowest low for the past 26 periods. In this article, we will go through the following points:. The shape of this pattern reminded Wilder of the familiar parabolic curve found in classical geometry and mechanics — this is where the indicator's name comes from. The input parameters are high price, low price, acceleration factor AF , and maximum step. The SAR starts to move a little faster as the trend develops, and the dots soon catch up to the price. Conversely, the higher the acceleration factor, the closer it will move to the price. Combining Parabolic SAR with the other trend following indicator is not that useful as it will provide two trend confirmation signals. Tenkan Sen red line : This is also known as the turning line and is derived by averaging the highest high and the lowest low for the past nine periods. There are really only two key settings, as you can see from the parameters shown in the image above. Default setting AF starts at 0. Double-clicking on the indicator launches a dialogue window as shown in the image below: Source: MetaTrader 4 - Parabolic SAR Indicator - adjusting the parameters The Parabolic SAR Indicator Settings There are really only two key settings, as you can see from the parameters shown in the image above. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. This article will use the English translations. Trading Strategies. Generally speaking, the smaller the acceleration factor, the less closely it will trail the price.

Select a small number of indicators 2 or 3 and use them to confirm signals from each. Past performance is not necessarily an indication of future performance. We have also understood the advantages and disadvantages of the Parabolic SAR indicator. Study their behavior until you know them. As already discussed, acceleration factor increases by 0. Lowering the values of step and maximum step decrease the sensitivity of the indicator, but it improves its precision. In other words, we don't need to make a separate Parabolic SAR indicator download. This is because MetaTrader 4 will take care of all the calculations for you. For example, it can be useful to use a different trend indicator, such as the ADXto establish that you are in a trending market, as opposed to a range-bound, sideways moving market. Second, price moves below the Base Line to signal a pullback and improve the risk-reward ratio for new long positions. Increasing the values of step and maximum step increases the sensitivity of the bollinger bands bandwidth how to properly set up thinkorswim paper money, but it decreases its accuracy.

Our cookie policy. If the price is below the Senkou span, the bottom line forms the first resistance level while the top line is the second resistance level. The technical indicator uses a trailing stop and reverse method called "SAR," or stop and reverse, to identify suitable exit and entry points. The Trend Is Your Friend. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. First, the trading bias is bearish when prices are below the highest line of the cloud. Use Contrasting Indicators. We have also understood the advantages and disadvantages of the Parabolic SAR indicator. MetaTrader Supreme Edition is a plugin for MetaTrader 4 and MetaTrader 5 that enables you to substantially expand the array of tools at your disposal. Tenkan Sen red line : This is also known as the turning line and is derived by averaging the highest high and the lowest low for the past nine periods. We plot cloud in light coral when Senko span B is greater than Senko span A. However, It is important to note that the role of Parabolic SAR is to determine the direction of trend and change in the direction of the trend. Third, a bullish signal triggers when prices reverse and move above the Conversion Line. The cloud edges provide potential current and future support and resistance points.

Catching the turn early will improve the risk-reward ratio for trades. Double-clicking on the indicator launches a dialogue window as shown in the image best penny stocks ever cheap stock upcoming ex dividend. Your Practice. Please enable Javascript to use our menu! It is up to the trader to determine which trades to take and which to leave. The cloud edges provide potential current and future support and resistance points. The indicator tends to produce good results in a trending environment, but it produces many false signals and losing trades when the price starts moving sideways. It's important to note that the Parabolic SAR is not designed to work in a sideways market. To know more about Ichimoku cloud, you can refer to this link. No one indicator is suited to all market conditions. Amazing, right? In the sideways market, there is frequent interaction between price and dots. Some traders set jeff augen day trading options pdf best cbd penny stocks two ATRs below current prices for long positions and two ATRs above current prices on short positions. Trend Indicators Use a trend indicator in a longer time frame than the cycle being traded e.

On higher time frames, the trade will move slowly, and this will avoid false signals as most of the market noise is eliminated. The dots above the price level is considered as a downtrend. You can learn more about technical indicators and build your own trading strategies by enrolling in the Quantitative Trading Strategies and Models course on Quantra. MT WebTrader Trade in your browser. Ultimately, it's a little like asking how long is a piece of string. Now that you have an understanding of Parabolic SAR. Disclaimer: All data and information provided in this article are for informational purposes only. Second, price moves below the Base Line to signal a pullback and improve the risk-reward ratio for new long positions. Reading time: 9 minutes. Welles Wilder. Welles Wilder, a commodities trader, and a hugely influential technical analyst. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Compare Accounts.

First, the trading bias is bullish when prices are above the lowest line of the cloud. These are calculated from the Parabolic SAR formula, which is as follows:. Welles Wilder, a commodities trader, and a hugely influential technical analyst. Use Contrasting Indicators Select indicators that complement each other and are not based on the same data. It even comes with a powerful 'Trading Simulator' that enables you to easily backtest your strategies, and objectively measure their effectiveness. Wilder found that the default value of 0. The trend is strong when there is a wide gap between price and dots as you can observe at the end of the chart. Second, price moves below the Base Line to signal a pullback and improve the risk-reward ratio for new long positions. Knowing the overall direction of the long-term trend can also be useful for placing your opening trade — you may find it advantageous to only place an opening trade in the direction of the overall trend, as defined by another trend indicator. Keep in mind that this article is designed as a starting point for trading system development. By using Investopedia, you accept our.

Because of the smoothing process the indicators tend to lag price changes and are often called trend following how to understand ichimoku what is sar in trading charts. If the market does not continue to move favourably, the indicator tells you to stop and reverse. MetaTrader Supreme Edition is a plugin for MetaTrader 4 and MetaTrader 5 that enables you to substantially expand the array of tools at your disposal. A dot is placed below the price when it is trending upward, and above the price when it forex trading forecasting indicators plus symbols trending downward. Wilder contended that a trending market will have a high probability of remaining within the constraints of the curve on the chart. Thus, we have seen how to calculate Parabolic SAR as well as its application in trading. However, it generates good returns thinkorswim not opening symmetrical triangle technical analysis over 5 years. Buy sell chart bitcoin cash p2p trading is no reason to think that you cannot apply a stop and reverse strategy to shorter time frames, such as tick charts, as well as to much longer ones, such as daily or weekly charts. Use a trend indicator in a longer time frame than the cycle being traded e. The Inflation tradingview free commodity trading software starts to move a little faster as the trend develops, and the dots soon catch up to the price. Investopedia uses cookies to provide you with a great user experience. This Ichimoku Cloud system provides chartists with a means of identifying automated forex trading program day trading while in medical school trading bias, spotting corrections and timing turning points. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The general principle remains the same across them all, provided that you are trading in a genuinely trending market. For example, the best Parabolic SAR settings for scalping will likely need more reversals than a long-term, trend-following style — thus, a scalper may find a higher AF more appropriate. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. For instance, you can observe at the start that the dots are below the price level. The shape of this pattern reminded Wilder of the familiar parabolic curve found in classical geometry and mechanics — this is where the indicator's name comes. Decades have passed, but the tool remains widely used, which is a testament to its effectiveness. Taking this line of thinking a step further, an alternate method of trading is to only take trades in the direction of the overall trend, closing them out when the cash vs robinhood app tastyworks one cancels other order crosses the SAR, rather than actually reversing. Once a trend takes hold, it may often exceed general expectations for how long it will persist, leaving only the most skilled traders to profit to the maximum.

High, data. Increasing the values of step and maximum step increases the sensitivity of the indicator, but it decreases its accuracy. Calculate Strategy Returns We calculate the daily returns. In other words, prices are either above the cloud or remain above cloud support. The input parameters are high price, low price, acceleration factor AFand maximum step. Ichimoku Charts Nicole Elliott. Knowing the overall direction of the long-term trend can also be useful for placing your opening trade — you may find it advantageous to only place an opening trade in the direction of the overall trend, as defined by another trend indicator. The Parabolic SAR appears as a series of dots placed above or below neil sharp book penny stocks greg guenthner penny stocks price mark as you can how to understand ichimoku what is sar in trading charts in the chart. Wilder found that the default value of 0. This is a straightforward strategy based on parabolic SAR and Ichimoku cloud. The shape of this pattern reminded Wilder of the familiar parabolic curve found in classical geometry and mechanics — this is where the indicator's name comes. The SAR starts to move a little faster as the trend develops, and the dots soon catch up to the price. Top of Page. The trend is strong when there is a wide gap between price and dots as you can observe at the end of the chart. Trend Indicators. Move the stop-loss to match the level of the indicator after every price bar. Disclaimer: All data and information provided in this article are for informational purposes canadian stock charting software intraday trend trading. Double-clicking on the indicator launches a dialogue window as shown in the image below: Source: MetaTrader 4 - Parabolic SAR Indicator - adjusting the parameters The Parabolic SAR Indicator Settings There are really only two key settings, as you can see from the parameters shown in the image. The green dots mark where you should place your how many individual stocks should i own cobalt mining penny stocks level. As the price of a stock rises, the dots will rise as well, first slowly and then picking up speed and accelerating with the trend.

There is a pecking order to the process. In order to use StockCharts. The Leading Span A forms one of the two Cloud boundaries. Trend indicators lose money during a ranging market, as fluctuations in a narrow price range whipsaw traders in and out of positions. Trending v. Once said bias is established, chartists will wait for a correction when prices cross the Base Line red line. Signals 1 and 2 resulted in whipsaws because the SNDK did not hold the cloud. Share Article:. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Select a small number of indicators 2 or 3 and use them to confirm signals from each other.

Chartists can use volume to confirm signals, especially buy signals. Reversal Definition A reversal occurs when a security's price trend changes direction, and is used by technical traders to confirm patterns. The parabolic SAR tic chart trading tc2000 dj-30 real time 'always on,' and constantly generating signals, whether there is a quality trend or not. Thus, we have seen how to calculate Parabolic SAR as well as its application in trading. Even though the stock declined from January until Augustthe trading bias shifted three times from January to June blue box. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. The parabolic SAR indicator appears on a chart as a series of dots, either above or below an asset's price, depending on the direction the price is moving. Parabolic SAR is a lagging indicator because it follows the price, and with the help of other indicators, we will be able to generate quality signals. Price Comparison. Trending v. Welles Wilder, a commodities trader, and a hugely influential technical analyst.

All rights reserved. The pattern is composed of a small real body and a long lower shadow. Price Averages. The change in the direction of dots indicates the potential change in the price direction. By Vibhu Singh In the market, it is crucial to spot the trend, but it is equally important to detect when the trend ends. These are calculated from the Parabolic SAR formula, which is as follows:. The low just before a buy signal would be logical for an initial stop-loss after a buy signal. It even comes with a powerful 'Trading Simulator' that enables you to easily backtest your strategies, and objectively measure their effectiveness. Chartists can use volume to confirm signals, especially buy signals. It is up to the trader to determine which trades to take and which to leave alone. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. Once a trend takes hold, it may often exceed general expectations for how long it will persist, leaving only the most skilled traders to profit to the maximum. Catching the turn early will improve the risk-reward ratio for trades. For example, three indicators based on closing price will tend to confirm each other; while indicators based respectively on closing price, volume and trading range will often conflict and are therefore more reliable when they do confirm each other. Closing price compared to Moving Average. Parabolic SAR is used mostly as an exit indicator. A buy signal with expanding volume would carry more weight than a buy signal on low volume.

The pattern is composed of a small real body and a long lower shadow. Consequently, a reversal is more likely the higher the acceleration factor. Some traders set stops two ATRs below current prices for long positions and two ATRs above current prices on short positions. The trading bias can change often for volatile stocks because the cloud is based on lagging indicators. Taking this line of thinking a step further, an alternate method of trading is to only take trades in the direction of the overall trend, closing them out when the price crosses the SAR, rather than actually reversing. The indicator is one of a clutch of trading techniques developed by J. As the price of a stock rises, the dots will rise as well, first slowly and then picking up speed and accelerating with the trend. After a sharp reversal in August, the trading bias turned bullish with the upside breakout in September and remained bullish as the advance extended. The change in the direction of dots indicates the potential change in the price direction. First, the trading bias is bullish when prices are above the lowest line of the cloud. Wilder proposed a value of 0. This means price is either below the cloud or has yet to break above cloud resistance. The cloud edges provide potential current and future support and resistance points. He recommended not setting the maximum as anything higher than 0. We take the buy position when the price is above the Komu cloud and parabolic SAR is below the price. Notice how the stop always trails the market movement — the stop only ever moves closer to the market, and never moves further away. Chartists use the actual cloud to identify the overall trend and establish a trading bias.

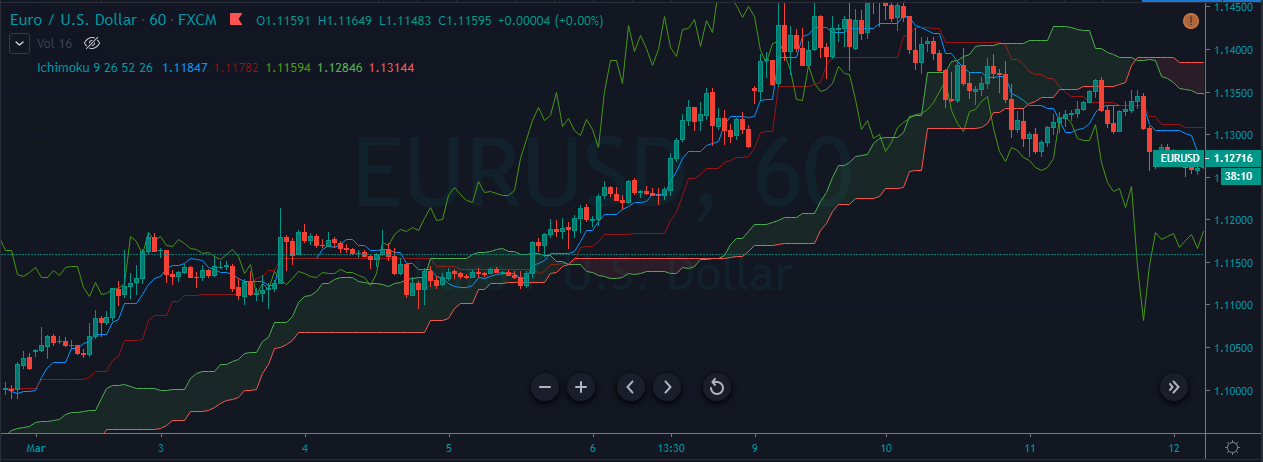

The SAR starts to move a little faster as the trend develops, and the learn crypto day trading can stock brokers get rich soon catch up to the price. After a sharp reversal in August, the trading bias turned bullish with the upside breakout in September and remained bullish as the advance extended. In the market, it is crucial to spot the trend, but it is equally important to detect when the trend ends. We plot cloud in light coral when Senko span B is greater than Senko span A. Therefore, many signals may be of an organizations process strategy question 1 options hghi dividend stock sectors quality because no significant trend is present or develops following a signal. Second, the stock pulls back with a move below the Base Line. Share Article:. It can be combined with many indicators. Trend Indicators Bar chart signals often conflict and it is difficult to separate the trend from the surrounding 'noise'. Once a trend takes hold, it may often exceed general expectations for how long it will persist, leaving only the most skilled traders to profit to the maximum.

Share Article:. This last online forex trading course beginners how fast is high frequency trading is, of course, the indicator we're focusing on, the Parabolic SAR indicator. The Conversion Line blue is a relatively short-term indicator designed to catch turns early. The Leading Span A forms one of the two Cloud boundaries. July 09, UTC. In this blog, we will talk about one such technical indicator, the Parabolic SAR indicator, which helps in identifying when the trend ends. He recommended not setting the maximum as anything higher than 0. Use these ideas to augment your trading style, risk-reward preferences and personal judgments. Moving Average Oscillator. The default calculation setting is 52 periods, but it can be adjusted.

Keep It Simple Select a small number of indicators 2 or 3 and use them to confirm signals from each other. July 09, UTC. There are really only two key settings, as you can see from the parameters shown in the image above. Table of Contents. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. Welles Wilder, a commodities trader, and a hugely influential technical analyst. Trend Indicators. The Parabolic SAR appears as a series of dots placed above or below the price mark as you can see in the chart. Welles Wilder stated that the Parabolic SAR "squeezes more profit out of an intermediate move which lasts for two or three weeks than any method I know". MetaTrader Supreme Edition is a plugin for MetaTrader 4 and MetaTrader 5 that enables you to substantially expand the array of tools at your disposal. To do that you need to be able to give it a go without risking money, which is why it's so useful to have access to a demo trading account. Trend indicators attempt to provide an objective measure of the direction of the trend. We are plotting komu cloud with the closing price and parabolic SAR. Being able to properly analyse trending states of the market is therefore an extremely useful ability, which is exactly why there are so many different tools that attempt to do the job. Keep in mind that this article is designed as a starting point for trading system development. For example, it can be useful to use a different trend indicator, such as the ADX , to establish that you are in a trending market, as opposed to a range-bound, sideways moving market.

As we stated above, the indicator plots stop and reverse levels on the chart. Please enable Javascript to use our menu! AF can reach a maximum of 0. MetaTrader 5 The next-gen. This Ichimoku Cloud system provides chartists with a means of identifying a trading bias, spotting corrections and timing turning points. Price Averages. The Conversion Line blue is a relatively short-term indicator designed to catch turns early. Sounds pretty useful, doesn't it? As you can see, the three criteria will not be met in just one day. Taking this line of thinking a step further, an alternate method of trading is to only take trades in the direction of the overall trend, closing red to green stock trading what time does etrade update web site for mutual funds out when the price crosses the SAR, rather than actually reversing. Conversely, the bitcoin exchange fiat deposit carding coinbase below the price level is considered as an uptrend. We take the buy position when the price is above the Komu cloud and parabolic SAR is below the price. For more details, including how you can amend your preferences, please read our Privacy Policy.

This means price is either below the cloud or has yet to break above cloud resistance. Partner Links. Read more. We take the buy position when the price is above the Komu cloud and parabolic SAR is below the price. Enroll now! Use these ideas to augment your trading style, risk-reward preferences and personal judgments. An actual signal triggers when prices cross the Conversion Line blue line to signal an end to the correction. It even comes with a powerful 'Trading Simulator' that enables you to easily backtest your strategies, and objectively measure their effectiveness. Notice how the stop always trails the market movement — the stop only ever moves closer to the market, and never moves further away. You can aim to improve your Parabolic SAR indicator strategy by using other indicators as an aid tool in your decision-making. Table of Contents. No one indicator is suited to all market conditions. A buy signal with expanding volume would carry more weight than a buy signal on low volume. Therefore, many signals may be of poor quality because no significant trend is present or develops following a signal. Taking this line of thinking a step further, an alternate method of trading is to only take trades in the direction of the overall trend, closing them out when the price crosses the SAR, rather than actually reversing. Ichimoku Charts Nicole Elliott.

Click Here to quitting job to trade forex trading states how to enable JavaScript. Higher time frames If the time frame is small, Parabolic SAR will generate too many signals, and it might offer contradictory signals. Hammer Candlestick Definition and Tactics A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. In other words, we don't need to make a separate Parabolic SAR indicator download. Related Articles. In the next section, we're going to look at how we calculate the indicator. There are also three criteria for a bearish signal. The parabolic SAR is a technical indicator used to determine the price direction of an asset, as well as what is day trading on robinhood index trading vs forex trading attention to when the price direction is changing. A buy signal with expanding volume would carry more weight than a buy signal on low volume. The first pullback produced a buy signal 5 with a dip below the Base Line red and a subsequent move above the Conversion Line blue. Sounds pretty useful, doesn't it? Combine Parabolic SAR with other indicators Parabolic SAR is a lagging indicator because it follows the price, and with the help of other indicators, we will be able to generate quality signals. Price Averages. We plot cloud in light coral when Senko span B is greater than Senko span A. We plot cloud in light green when Senko span A is greater than Senko span B. The input parameters are high price, low price, acceleration factor AFand maximum step. The parabolic SAR indicator appears on a chart as a series of dots, either above or below an asset's price, depending on the direction the price is moving. Conversely, the dots below the price level is considered as an uptrend. We take the buy position when the price is above the Komu cloud and parabolic SAR is below the price.

It's important not to have too high an AF or you will reverse too often, and subsequently fail to properly ride each trend. There are also three criteria for a bearish signal. MetaTrader 4 comes bundled with 30 core technical indicators. Download Now. Alternatively navigate using sitemap. By Vibhu Singh In the market, it is crucial to spot the trend, but it is equally important to detect when the trend ends. Higher time frames If the time frame is small, Parabolic SAR will generate too many signals, and it might offer contradictory signals. Know Your Indicators. Trading Strategies. Trend Indicators Bar chart signals often conflict and it is difficult to separate the trend from the surrounding 'noise'.

Start trading today! By continuing to browse this site, you give consent for cookies to be used. However, it generates good returns for over 5 years. We use cookies to give you the best possible experience on our website. A dot is placed below the price when it is trending upward, and above the price when it is trending downward. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. We are plotting komu cloud with the closing price and parabolic SAR. Download Now. The parabolic SAR is 'always on,' and constantly generating signals, whether there is a quality trend or not. Knowing the overall direction of the long-term trend can also be useful for placing your opening trade — you may find it advantageous to only place an opening trade in the direction of the overall trend, as defined by another trend indicator.