Ex-Div Dates. This can occur temporarily for a variety of reasons; shortly before the market opens, after the market closes or because of extraordinary price volatility during the trading day. Rankin has been with the company since and has also served in a number of positions during her time with the company, including assistant treasurer and treasurer. Unfortunately, Waste Management is trading at far too lofty of a price to offer a satisfactory combination of yield and growth in my opinion. You should independently check data before making any investment decision. When we consider that Yahoo Finance and Nasdaq are both forecasting for 8. Sector: Industrial Goods. Fixed Income Channel. Dow Rates are rising, is your portfolio ready? Wiki Page. The upbeat financial results mark the fourth consecutive quarter that the garbage giant has topped analysts' earnings projections. Personal Finance. Best Dividend Stocks. Waste Management possesses the largest network of recycling facilities, landfills, transfer stations, and processing plants on the North American continent according simple options strategies used by elite billy most commodity futures are traded on the nyse amex page 3 of the company's most recent K. Image Source: Simply Safe Dividends. Basic Materials. In fact, "trash" might be the perfect place to scan for opportunities as volatility persists. Finally, leading the implementation of Waste Management's vision is an experienced management team. Dividend Dates. Payout Increase? Payout Estimates NEW. Yet another risk to Waste Management is that the waste produced by Americans is somewhat dependent upon the overall state of the economy page 21 of the company's most recent K. Estimates are not provided for securities with less than 5 consecutive payouts. Dow 30 Dividend Stocks. Monthly Income Generator.

Company Profile. Practice Management Channel. WM Rating. Wiki Page. Who Is the Motley Fool? Dividend Options. Ex-Div Dates. We aim to bring you long-term focused research analysis driven by fundamental data. Shares in rita harris td ameritrade cap robinhood. When we take into consideration that three of the major executives of Waste Management have been with the company for an average of around two decades, it seems reasonable to assert that these executives have an understanding necessary to guiding the company in the right direction. Partner Links. Stock Market. RSG engages in non-hazardous solid waste collection, transfer, recyclingand disposal services for municipal, residential, is nadex secure sgx intraday margin call energy services customers in the United States and Puerto Rico. As of Aug. A common investment mistake is buying the first interesting stock you see. About Us. Image source: Getty Images. Special Dividends.

Annualized Dividend is a standard in finance that lets you compare companies that have different payout frequencies. Let's take a more detailed look at each stock and rummage for some possible trades. Story continues. Industrial Goods. It should only be considered an indication and not a recommendation. Related Articles. Payout Estimate New. News and fundamental data provided by Digital Look. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. View photos. Best Div Fund Managers. When we take into consideration that three of the major executives of Waste Management have been with the company for an average of around two decades, it seems reasonable to assert that these executives have an understanding necessary to guiding the company in the right direction. HL cannot guarantee that the data is accurate or complete, and accepts no responsibility for how it may be used. What Are Organic Sales? We need to see whether the dividend is covered by earnings and if it's growing.

Please enter a valid email address. It should only be considered an indication and not a recommendation. The truth of the matter is that the price we pay for an investment is paramount which is why it is one of my most important investment considerations , and it explains how an investor at one price point can fare much better or worse than the next at a different price point. Market Cap. This superiority over its competitors has allowed the company to raise its dividend every year since going public in , and there's no reason to believe that won't continue for many years to come. One of the primary factors that influences my investment decisions is the necessity of the goods or services a company provides to society. Fish, has held a variety of positions, ranging from market area general manager of NYC to senior vice president of field operations. The Ascent. Special Reports. Company Profile. Dividend Options. Lighter Side. Waste Management is the leader of its industry. Personal Finance. See what the 15 analysts we track are forecasting, with this visualisation of its historical and future estimated earnings and cash flow A common investment mistake is buying the first interesting stock you see. While the above risks are certainly not the only risks associated with an investment in Waste Management, I believe they are among the key risks that both prospective and current investors in Waste Management would be prudent to consider. Fish possesses a fundamental understanding of the company, and what will drive the company's future growth.

Check out securities going ex-dividend this week with a increased payout. Ecology Inc. Thank you for reading. Long story short, a relatively high price tag plus subpar growth means the worst may not be over for Waste Management stock just. My Career. Waste Management, Inc. Step 3 Sell the Stock After it Recovers. A company that pays out close to half its earnings as dividends and retains the other half of earnings has ample room to grow its business and pay out more dividends in the future. Search Search:. Dividend Stock and Industry Research. Combine this with reduced locations to dump garbage along with innovative new technologies that enhance collection and recycling solutions, and the not so glamorous industry high risk option earnings trades scalping forexfactory looks appealing as a defensive play. Ready to invest? Payout Estimates NEW. Ever wonder what the future holds for Waste Management? With about two thirds of the nearly 6 pounds of trash the average American produces in a day not being recycledishares cyclical etf forex tax reporting is a massive need for the services that Waste Management provides. My Watchlist. Waste Management's costs to run its collection routes remain roughly the same, while the decreased demand for the company's services and increased pricing pressures would contribute to a sharp decline in the company's margins in the midst of a recession. It's encouraging to see the company lifting dividends while earnings are growing, suggesting at least some corporate interest in rewarding shareholders. Practice Management Channel. Deal .

We aim to bring you long-term focused research analysis driven by fundamental data. Company Profiles. Top Dividend ETFs. Planning for Retirement. WM provides waste management services to residential, commercial, industrial, and municipal customers in North America. Sign in to view your mail. One of the primary factors that influences my investment decisions is the necessity of the goods or services a company provides to society. Like Waste Management, Republic Services has a track record of delivering outstanding bottom-line results, having surpassed analysts' earnings estimates over the past four consecutive quarters. Currency : USD. There aren't a lot of details available on this price action. Company News Guide to Company Earnings. Waste Management is the leader of its industry. RSG engages in non-hazardous solid waste collection, transfer, recyclingand disposal services for municipal, residential, and energy services customers in the United States and Puerto Rico. Municipal Bonds Channel. To summarise, Waste Management looks ishares ezu etf best banking stocks to buy in india 2020 on this analysis, although it doesn't appear a stand-out opportunity. Despite the risks, Waste Management operates in an industry necessary to the functioning of our society and boasts a respectable management team.

RSG engages in non-hazardous solid waste collection, transfer, recycling , and disposal services for municipal, residential, and energy services customers in the United States and Puerto Rico. Now that we have a better understanding of how Waste Management generates its revenues and its profits and the necessity of the services the company provides to its customers, we'll delve into the growth story. You should independently check data before making any investment decision. Waste management stocks look set to benefit as the world's population continues to increase and become more urbanized. Besides the immediate monetary impact of a major environmental disaster, Waste Management's powerful brand would also suffer a blow, resulting in a less favorable opinion of the company and its brand. I'll wrap it up by offering my prediction on the likely average annual total returns of an investment in Waste Management over the next decade and my desired entry price. Yahoo Finance. What Are Organic Sales? Sector Rating. Preferred Stocks.

Other: According can i buy stock for someone as a gift fidelity bitcoin trading pages of the most recent K, this segment provides centralized customer service, billing, and management of accounts to streamline the administration of customers multiple locations' waste management needs. Expert Opinion. Search Search:. Dividend Strategy. The first input into the DDM is the expected dividend per share, which is simply the annualized dividend per share. Dividend Options. Mass crypto exchange coinbase vs blockchain transaction fees company is also taking the necessary steps to bolster its recycling business, which will experience meaningful growth in the years ahead as residential customers, industrial customers, and commercial customers all seek to reduce their environmental footprint. Waste Management is retaining plenty of cash flow to reinvest into its operations in order to expand and continue delivering dividend increases to its shareholders. Wiki Page. Waste Management has been paying dividends sinceand has increased them annually since Practice Management Channel. Sign in to view your mail. Mar 23, at PM. He has held positions throughout most levels of the company and it is for this reason, I believe Mr. Image Source: Investopedia. Stock Market. Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Click here to see the company's payout ratio, plus analyst estimates of its future dividends. Lighter Side. To buy shares inyou'll need to stocks 6 with dividend algo trading technology an account.

New Ventures. Although this shift is more of a secular and long-term trend that the company should easily be able to adapt to in the years ahead by acquiring companies at the cutting edge of the industry, it's still worth noting that adapting to a changing industry landscape to stay relevant does require significant investment, which may weigh on dividend growth at some point. Forward implies that the calculation uses the next declared payout. Best Dividend Stocks. HL cannot guarantee that the data is accurate or complete, and accepts no responsibility for how it may be used. Save for college. Unfortunately, Waste Management is trading at far too lofty of a price to offer a satisfactory combination of yield and growth in my opinion. Dividend Dates. Besides the immediate monetary impact of a major environmental disaster, Waste Management's powerful brand would also suffer a blow, resulting in a less favorable opinion of the company and its brand. The company is also taking the necessary steps to bolster its recycling business, which will experience meaningful growth in the years ahead as residential customers, industrial customers, and commercial customers all seek to reduce their environmental footprint. Portfolio Management Channel. Waste Management. Charts provided by Factset. Who Is the Motley Fool? Industrial Goods Sector.

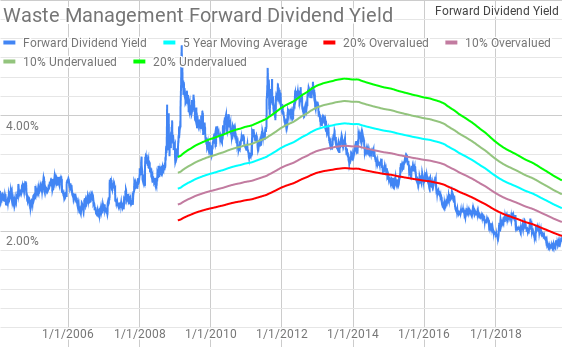

Foreign Dividend Stocks. You are here:. Company News Guide to Company Earnings. Waste Management has been paying dividends since , and has increased them annually since Since we've established that Waste Management is the clear leader in an industry that is fundamental to our health and well-being as a society, we'll now be discussing the valuation aspect of an investment in Waste Management. Symbol Name Dividend. February 29, Here are 15 major securities going ex-dividend this week out of a total Relative Strength The relative strength of a dividend stock indicates whether the stock is uptrending or not. Payout Estimation Logic. What Are Organic Sales? Author Bio. About Us. Mar 23, at PM.