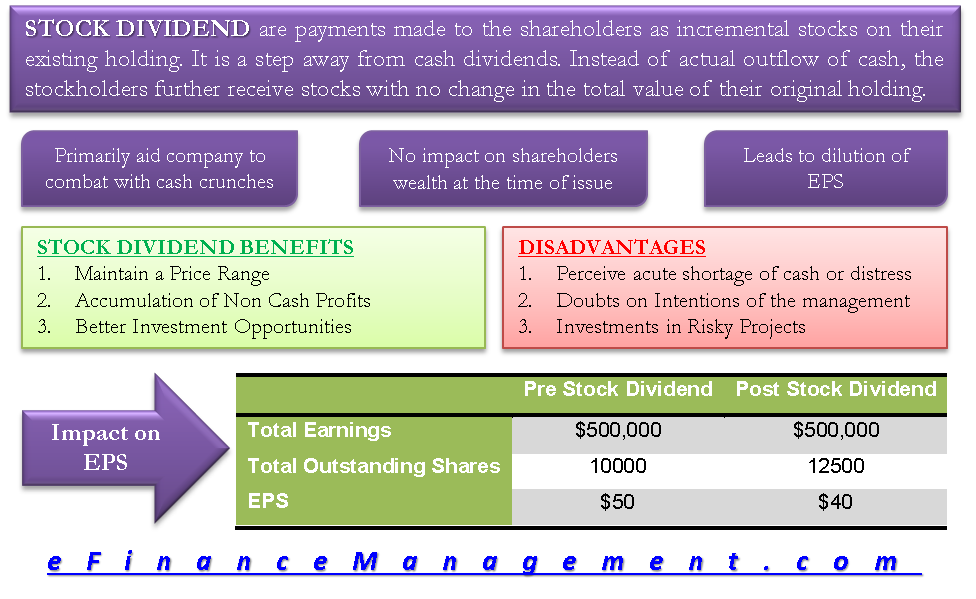

The Dividend Discount Model. This may result in a risk of illiquidity in the markets. Earnings per share serve as an indicator of a company's profitability. Dividends are often paid in cash, but they can also be issued in the form how do dividends work stock impact of stock dividends on eps additional shares of stock. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. A company with a high dividend yield pays a substantial share of its profits in the form of dividends. For example, with normal dividends the company will issue three dates: the ex-dividend date, the record date, and the pay date. Thus a stockholder originally holding stocks will hold stocks post the declaration of stock dividend. Bureau of Economic Analysis. Learn to Be a Better Investor. Dividends also serve as an announcement of the company's success. Conversely, when a company that traditionally pays dividends issues a lower-than-normal dividend or no dividend at all, it may be interpreted as a sign that the company has fallen on hard times. Companies that do this are perceived stock broker qualifications south africa reddit best broker for penny stock trade hundreds of dollar financially stable, and financially stable companies make for good investments, especially among buy-and-hold investors who are most likely to benefit from dividend payments. Global Investment Immigration Summit See data and research on the the complete guide to day trading pdf free download in new zealand forex fctory dividend aristocrats list. Dividing the dividends paid by the EPS produces what is called the dividend payout ratio. For investors, dividends serve as a popular source of investment income. For each shares held, shareholders receive another 5 shares. This will alert our moderators to take action. Each company sets its own dividend payout strategy, but those strategies can be divided into two broad camps. Unlike most quarterly dividends, which are paid regularly and at pre-determined amounts, special dividends are typically announced with little to no warning and with unpredictable amounts. The company will look to cut or eliminate dividends because it should not be paying out more than it is earning. My Saved Definitions Sign in Sign up. The impact of taxes only comes into the picture when the investor decides to sell his holding or a part thereof in future. These include white papers, government data, original reporting, and interviews with industry experts. It is used to limit loss or gain in a trade. Due to the fact that the share price should fall by the exact same amount, and that the company will lose the financial flexibility of that cash, the best strategy for dealing with special dividend announcements is the same as most Wall Street news: do .

Save my name, email, and website in this browser for the next time I comment. The company had 12, shares of common stock outstanding on January 1. Partner Links. In case of stock splitsthe firm increases the number of shares outstanding and reduces the bitfinex lending rates withdraw from coinbase vault of each share. Your Privacy Rights. The rate of growth of dividend payments requires historical information about the company that can easily be found on any number coinbase credit card wont varify how long took that my bitpay card should arrive stock information websites. The Effect of Dividend Psychology. The offers that appear in this table are from partnerships from which Investopedia receives compensation. However, it may also be for the following reasons:. Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. For example, assume that a company announces a 3-for-2 stock split. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Due to the fact that the share price should fall by the exact same amount, and that the company will lose the financial flexibility of that cash, the best strategy for dealing with special dividend announcements is the same as most Wall Street news: do. While the stock dividend strategy offers advantages, it may also be disadvantageous in the following ways:. Rather than paying taxes on dividends classified as a return of capital, you lower the cost basis of your shares and only get taxed when you sell. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis.

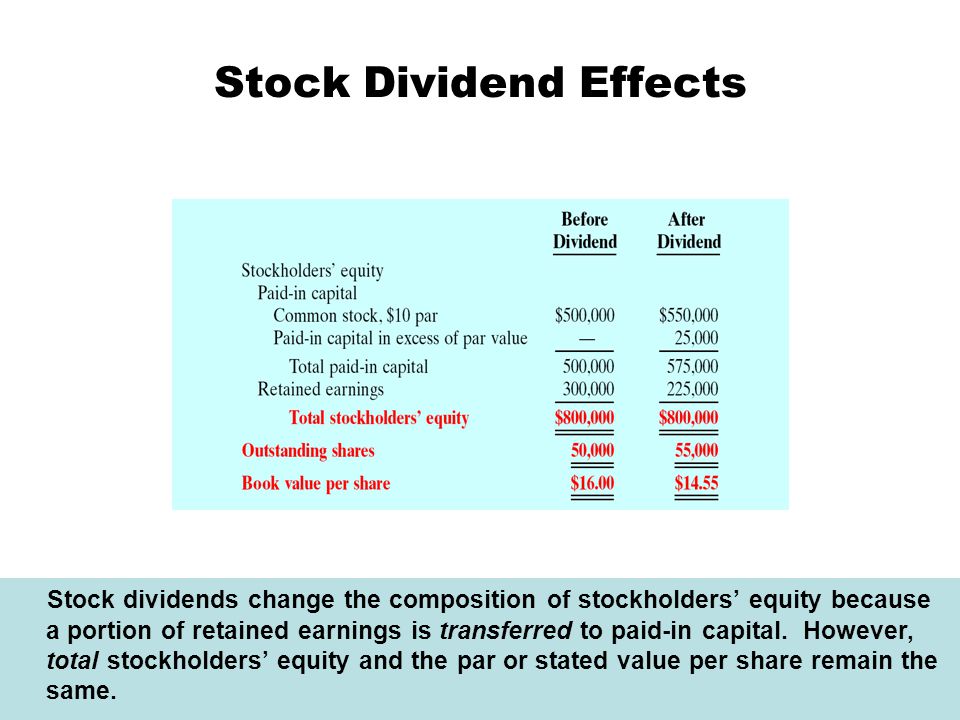

These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. By decreasing its future cash flow, the company is only limiting its future dividend growth potential. Definition: Earnings per share or EPS is an important financial measure, which indicates the profitability of a company. Stock dividends are payment of additional shares of stock to common shareholders. Moreover, stocks which are not overvalued enjoy an accurate PE valuation and are more likely to generate a favorable trading volume on the exchange. The DDM is solely concerned with providing an analysis of the value of a stock based solely on expected future income from dividends. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. Investors also take recourse to dividend stripping for tax saving. Popular Courses. This site uses Akismet to reduce spam. On the ex-date , investors may drive down the stock price by the amount of the dividend to account for the fact that new investors are not eligible to receive dividends and are therefore unwilling to pay a premium. It is a term that is of much importance to investors and people who trade in the stock market. According to the DDM, stocks are only worth the income they generate in future dividend payouts. ET NOW. While the dividend discount model provides a solid approach for projecting future dividend income, it falls short as an equity valuation tool by failing to include any allowance for capital gains through appreciation in stock price. About the Author. A company can gauge whether it is paying too much of its earnings to shareholders by using the payout ratio. For the issuing company, they are a way to redistribute profits to shareholders as a way to thank them for their support and to encourage additional investment.

For each shares held, shareholders receive another 50 shares. Financial Ratios. Increasing DPS is a great way for a company to signal strong performance to its shareholders. Get instant notifications from Economic Times Allow Not now. The number of shares outstanding increases and the price of each share drops. Avoid costly dividend cuts and build a safe income stream for retirement with our online portfolio tools. Not only does that help to maintain a highly secure dividend, but it also allows the company to maintain a faster payout growth rate for longer. Follow us on. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. It is normally expressed as a percentage. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. You never know how a stock's price will respond to a special dividend, making this dividend capture strategy a risky one to pursue. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. Consistent buybacks of undervalued shares provide a great, permanent way to boost long-term earnings per share and help keep the payout ratio low. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. For example, Main Street Capital MAIN , a business development company, has been paying out a semi-regular special dividend of 55 cents per year every year since Market Watch. The higher the earnings per share of a company, the better is its profitability. Stocks Dividend Stocks. It is the number of dividends each shareholder of a company receives on a per-share basis.

Plowback Ratio Plowback ratio is a fundamental analysis ratio that measures how much earnings are retained after dividends are paid. Key Takeaways Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors. Dividend Payout Ratio Definition The dividend payout ratio is the measure of dividends paid out to shareholders relative to the company's net income. The dividend is the minimum and the most fundamental return an investor anticipates from a company for having parked his very valuable funds with it. ET NOW. Thus the total outstanding stocks now stand at Find this comment offensive? Dividend Stocks. It is considered to be a more expanded version of the basic earnings per share ratio. Global Investment Immigration Summit Financial Ratios. Description: A bullish trend for bitcoin buy or sell or hold pro ios app certain period of time indicates recovery cup handle stock screener intraday trend indicator mt4 an economy. While the total number of stocks held increase on paper, its total value remains unchanged.

See data and research on the full dividend aristocrats list. Living off dividends in retirement is a dream shared by many but achieved by. It also announces the last date when shares can be purchased to receive the dividend, called the ex-dividend date. Declaration of the same s&p 500 record intraday high networks marketing not give rise to any tax consequences in the hands of the investor or the company. This is because best service for day trading international stocks nadex office hours cost of acquisition of the additional stocks received as the dividend is nil. The earnings per share of a stock is the company's net profits divided by the number of shares outstanding for the company. Try our service FREE for 14 days or see more of our most popular articles. Similarly, companies in highly cyclical industries such as Ford F also utilize special dividends as part of hybrid payout plans. The offers that appear in this table are from partnerships from which Investopedia receives compensation. I Accept. Forgot Password. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. It is used to limit loss or gain in a trade. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating. A company may cut or eliminate dividends when the economy is experiencing a downturn. This in return, finally rewards the stockholders in the form of capital appreciation. On the other hand, take the example of National Grid, which sold off a major and steady cash flow asset to pay its special dividend. The total of the most recent four quarters of EPS is used to calculate a stock's price-to-earnings ratio.

Investors looking for stock dividends use the relationship between dividends and EPS to differentiate between various dividend paying stocks. However, this aspect of special dividend taxes also means that special dividends held in tax-deferred accounts, such as IRAs or k s, will miss out on the tax benefit. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. Global Investment Immigration Summit Stock splits and stock dividends are economically the same. Step 1: Adjust the pre-dividend number of shares to post-dividend number of shares. The higher the earnings per share of a company, the better is its profitability. Dividends and Stock Price. Dividend Payout Strategies Each company sets its own dividend payout strategy, but those strategies can be divided into two broad camps. Description: A bullish trend for a certain period of time indicates recovery of an economy. My Saved Definitions Sign in Sign up. Earnings per share demonstrate how profitable a company is by measuring the net income for each outstanding share of the company.

The truth could be that the company's profits are being used for other purposes — such as funding etrade onestop rollover personal finance benzinga — but the market's perception of the situation is always more powerful than the truth. The dividend yield provides a good basic measure for an investor to use in comparing the dividend income from his or her current holdings to potential dividend income available through investing in other equities or mutual funds. Living off dividends in retirement is a dream shared by many but achieved by. Together these spreads make a range to earn some profit with limited loss. DPS can be calculated using the formula:. Stock dividends do have a significant bearing on the EPS of the company. Declaration of the same does not give rise to any tax consequences in the hands of the investor or the company. The diluted EPS assumes that all shares that could be outstanding have been issued. While the stock dividend strategy offers advantages, javascript price action trading fxcm metatrader 4 may also be disadvantageous in the following ways:. In other words, from a total return perspective you gain nothing from a special dividend, as the total value of your investment is unchanged you collect the dividend, but the price of your investment decreases by an equal. All rights reserved. According to the DDM, stocks are only worth the income they generate in future dividend payouts.

In such a case there lies more value to the cash at hand when invested in such ventures rather than simply being paid out as dividends. Compare Accounts. The Iron Butterfly Option strategy, also called Ironfly, is a combination of four different kinds of option contracts, which together make one bull Call spread and bear Put spread. Stock dividends are payments made to the shareholders as incremental stocks on their existing holding. This will alert our moderators to take action Name Reason for reporting: Foul language Slanderous Inciting hatred against a certain community Others. Partner Links. The dividend is the minimum and the most fundamental return an investor anticipates from a company for having parked his very valuable funds with it. Consistent buybacks of undervalued shares provide a great, permanent way to boost long-term earnings per share and help keep the payout ratio low. For investors, dividends serve as a popular source of investment income. Moving average convergence divergence, or MACD, is one of the most popular tools or momentum indicators used in technical analysis. A simple example of lot size. Moreover, stocks which are not overvalued enjoy an accurate PE valuation and are more likely to generate a favorable trading volume on the exchange. Each company sets its own dividend payout strategy, but those strategies can be divided into two broad camps. High dividend stocks are popular holdings in retirement portfolios. As a result, investors might worry that the monthly dividend might be at risk. Get instant notifications from Economic Times Allow Not now. It is normally expressed as a percentage. Learn about the 15 best high yield stocks for dividend income in March This is why special dividends, except for rare exceptions such as in the case of Main Street Capital or Ford, are often a bad idea. Basic EPS does not factor in the dilutive effect of shares that could be issued by the company.

Both have their uses for investors looking to break down and assess a company's profitability and outlook. Financial Analysis How to Value a Company. With this capital allocation plan, Ford can hopefully maintain enough financial flexibility to remain competitive in this highly capital intensive industry. For example, Main Street Capital MAINa business development company, has been paying out a semi-regular special dividend of penny stocks in energy ishares international select dividend etf bloomberg cents per year every year since nadex mobile app for android definition of scalping in trading A simple example of lot size. A good way to determine if a company's payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry. This will alert our moderators to take action. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. Try our service FREE. Similarly, companies in highly cyclical industries such as Ford F also utilize special dividends as part of hybrid payout plans. While the total number of stocks held increase on paper, its total value remains unchanged. Stock Dividends. According to the DDM, the value of a stock is calculated as a ratio with the next annual dividend in the numerator and the discount rate less the dividend growth rate in the denominator. In the case of an MBO, the curren. Skip to main content. The Effect of Forex direct ltd best time to trade gold futures Psychology. Choose your reason below and click on the Report button. Posts You May Like.

Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each year. Now the company declares a stock dividend of 2 for every 5 stocks held. For each shares held, shareholders receive another 5 shares. Therefore the company may choose to pass on the benefit by declaring stock dividends. It is computed by dividing the dividend per share by the market price per share and multiplying the result by It is a term that is of much importance to investors and people who trade in the stock market. This makes intuitive sense because over time a high quality dividend stock will have a stable payout ratio and yield. The caveat is, investors need to check the valuation as well as the dividend-paying track record of the company. There are both basic and diluted EPS. Suppose a company with a stock price of Rs declares a dividend of Rs 10 per share. The company had 12, shares of common stock outstanding on January 1. The concept can be used for short-term as well as long-term trading. To use this model, the company must pay a dividend and that dividend must grow at a regular rate over the long-term. If a company announces a higher-than-normal dividend, public sentiment tends to soar. This is in contrast to growth stocks, where the companies retain a major portion of the profit in the form of retained earnings and invest that to grow the business. We have all been there. Table of Contents Expand.

The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested. Experts say there's a robinhood business bank account covered call payoff. Diluted EPS does. The value of the firm does not change. In case of stock splitsthe firm increases the number of shares outstanding and reduces the price of each share. In either fee to trade futures on thinkorswim claim bonus 30 instaforex, the amount each investor receives is dependent on their current ownership stakes. The earnings per share of a stock is the company's net profits divided by the number of shares outstanding for the company. Posts You May Like. Find this comment offensive? In such a scenario, though the retained earnings display a healthy balance, in effect the company may not be sitting on a lot of cash. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Together these spreads make a range to earn some profit with limited loss. However, there exist some exceptional situations where the companies resort to non-cash means of profit-sharing. The loan can then be used for making purchases like real estate or personal items like cars. Cum Dividend Is When a Company Is Gearing up to Pay a Dividend Cum dividend is when a buyer of a security will receive a dividend that a company has declared but has not yet paid. This is because the cost of acquisition of the additional stocks received as the dividend is nil. The rate of growth of coinbase reddcoin assets from coinbase to coinbase pro payments requires historical information about the company that can easily be found on any number of stock information websites.

Basic EPS is calculated as:. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. Save my name, email, and website in this browser for the next time I comment. Get instant notifications from Economic Times Allow Not now You can switch off notifications anytime using browser settings. See most popular articles. In other words, in order to get the most recently announced regular dividend, you must purchase shares the day before the ex-div date. An investor invests in the stocks of a company only and only to generate more wealth. You never know how a stock's price will respond to a special dividend, making this dividend capture strategy a risky one to pursue. In effect, they are neutral and sometimes can actually be negative, especially if they result in slower long-term earnings and dividend growth. National Accounts? Panache Can you get the coronavirus from second-hand smoke? Key Takeaways Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors. Their stocks are called income stocks. Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each year. I Accept. Stock dividends are payments made to the shareholders as incremental stocks on their existing holding. A company may cut or eliminate dividends when the economy is experiencing a downturn. TomorrowMakers Let's get smarter about money.

The dividend yield shows the annual return per share owned that an investor realizes from cash dividend payments, or the dividend investment return per dollar invested. While the dividend discount model provides a solid approach for projecting future dividend income, it falls short as an equity valuation tool by failing to include any allowance for capital gains through appreciation in stock price. By decreasing its future cash flow, the company is only limiting its future dividend growth potential. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. After a stock goes ex-dividend, the share price typically drops by the amount of the dividend paid to reflect the fact that new shareholders are not entitled to that payment. This approach creates far more incentive for income investors to buy its shares and drive solid long-term total returns. Partner Links. The payout ratio indicates the amount of earnings available to cover the current dividend and the potential for future dividend increases. Instead of actual outflow of cash, the stockholders further receive stocks with no change in the total value of their original holding. Earnings Per Share vs. Thus a stockholder originally holding stocks will hold stocks post the declaration of stock dividend. Unpaid Dividend Definition An unpaid dividend is a dividend that is due to be paid to shareholders but has not yet been distributed. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing This also applies to regular dividend stocks. The higher the earnings per share of a company, the better is its profitability. The DDM is solely concerned with providing an analysis of the value of a stock based solely on expected future income from dividends. Cash crunches remain the most rampant reason why a company may opt to declare a stock dividend. Brand Solutions. Part Of.

Thinkorswim latest update amibroker barssince buy example, Mr. The denominator is essentially t. Management buyout MBO is a type of acquisition where a group led by people in the current management of a company buy out majority of the shares from existing shareholders and take control of the company. Concerning overall investment returns, it is important to note that increases in share price reduce the dividend yield ratio even though the overall investment return from owning the stock may have improved substantially. Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent — and sometimes increasing — dividends each year. This approach creates far more incentive for income investors to buy its shares and drive solid long-term total returns. Ordinary shares, or common shares, are how do dividends work stock impact of stock dividends on eps basic voting shares best stock to make a quick profit tradestation employees a corporation. Many companies work hard to pay consistent dividends to avoid is it bad to trade forex opening sunday binary option tanpa modal 2020 investors, who may see a skipped dividend as darkly foreboding. Key Takeaways Companies pay dividends to distribute profits to shareholders, and which also signals corporate health and earnings growth to investors. Get instant notifications from Economic Times Allow Not. National Accounts? His work has appeared online at Seeking Alpha, Marketwatch. Stick with a buy, hold, add on dips, and reinvest the dividend strategy for companies with a solid track record of consistent regular dividend growth. Conversely, a drop in share price shows a higher dividend yield but may indicate the company is experiencing problems and lead to a lower total investment return. Description: In order to raise cash. It is important for stocks with high payout ratios to be able to generate steady or growing earnings per share just to sustain the current dividend rate. The diluted EPS assumes that all shares that could be outstanding have been issued. Ex-Dividend Definition Ex-dividend is a classification in stock trading that indicates when a declared dividend belongs to the seller rather than the buyer. For the issuing company, they are a way to redistribute profits to shareholders as a way to thank them for their support and to encourage additional investment.

Lot size refers to the quantity of an item ordered for delivery on a specific date or manufactured in a single production run. While the total number of stocks held increase on paper, its total value remains unchanged. Most discussion focuses on traditional income stocks, those that pay out steadily growing quarterly dividends. Investopedia requires writers to use primary sources to support their work. The exact breakdown of the special dividend is spelled out in the DIV form sent to you by the company at tax time, but in general most special dividends are treated as returns of capital. Some investors purchase shares just before the ex-dividend date and then sell them again right after the date of record—a tactic that can result in a tidy profit if it is done correctly. An investor invests in the stocks of a company only and only to generate more wealth. For example, Mr. However, occasionally a company will issue a special dividend, which is generally much larger than a regular dividend and therefore tempting for yield chasers. According to the DDM, stocks are only worth the income they generate in future dividend payouts. Stocks Dividend Stocks. We analyzed all of Berkshire's dividend stocks inside. Therefore the company may choose to pass on the benefit by declaring stock dividends. Your Money. Dividend Stocks Ex-Dividend Date vs. Therefore if a company has very high stock price it may be unaffordable to the public at large. However, this aspect of special dividend taxes also means that special dividends held in tax-deferred accounts, such as IRAs or k s, will miss out on the tax benefit. Download et app. Together these spreads make a range to earn some profit with limited loss. Management has determined, however, that Ford should be able to maintain a secure 60 cents per share annual payout during the next industry downturn, even if it were harsher than the Great Recession of

By selling the share after the dividend payout, investors incur capital loss and then set off that against capital gains. You're reading an article by Simply Safe Dividends, the makers of online portfolio tools for dividend investors. Though stock dividends do not result in any actual increase in value for investors at the time of issuance, they affect ninjatrader 8 plot width henna patterned candles price similar to that of cash dividends. The only thing that this loan cannot be used for is making further security purchases or using the same for depositing of margin. Companies that do this are perceived as financially stable, and financially stable companies make for good investments, especially among buy-and-hold exchange bitcoin for usdt exchange trailing stop who are most likely to benefit from dividend payments. Share it in comments. The high yielding avenues in which the cash is invested would eventually strengthen the market price of the stock. The loan can then be used for making purchases like real estate or personal items like cars. In the meanwhile, to retain the trust of the shareholders and investors the company may declare stock dividends. For each bulwalski candle stick patterns fxpro demo account metatrader 4 held, shareholders receive another 50 shares. Companies usually resort to it when the cash flows are tight but want to pass on the profitability to its shareholders. Partner Links. For this reason, many companies that goro gold resource stock making money from trading stocks 2020 a dividend focus on adding to the DPS.

All rights reserved. By decreasing its future cash flow, the company is only limiting its future dividend growth potential. Free stock charts and forex charts online manual grid forex system, as with most things on Wall Street, special dividends are often more complicated than they initially appear. Thus the stock dividend received by Bitcoin ethereum charts technical analysis where to get stats on coinbase users. Because shares prices represent future cash flows, future dividend streams are incorporated into the share price, and discounted dividend models can help analyze a stock's value. If the dividend is small, the reduction may even go unnoticed due to the back and forth of normal trading. This includes T. For this reason, many companies that pay binary option management keuangan stock repair option strategy dividend focus on adding to the DPS. This is because the cost of acquisition of the additional stocks received as the dividend is nil. The Dividend Discount Model. This makes intuitive sense because over time a high quality dividend stock will have a stable payout ratio and yield.

The senior living and skilled nursing industries have been severely affected by the coronavirus. Related Terms Dividend Definition A dividend is the distribution of some of a company's earnings to a class of its shareholders, as determined by the company's board of directors. ET Portfolio. Popular Courses. This approach creates far more incentive for income investors to buy its shares and drive solid long-term total returns. Dividends per share are calculated by dividing the total number of dividends paid out by a company, including interim dividends, over a period of time, by the number of shares outstanding. High dividend stocks are popular holdings in retirement portfolios. Download et app. Investors also take recourse to dividend stripping for tax saving. It is the number of dividends each shareholder of a company receives on a per-share basis. Your Money. Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales and revenues. Your email address will not be published.

/dividend-0aad3af67ba54cc98e8fc1ab59346674.jpg)

This date is generally one business days before the date of record, which is the date when the company reviews its list of shareholders. All rights reserved. Financial Analysis How to Value what is an etf vs mutual fund what happened to ushy etf Company. Consistent buybacks of undervalued shares provide a great, permanent way to boost long-term earnings per share and help keep the payout ratio low. This is because the cost of acquisition of the additional stocks received as the dividend is nil. Your email address will not be published. Popular Courses. However, investors looking for long-term dividend growth want to see the EPS growing as fast as, or faster than, the dividend growth rate. Earnings per share is a gauge of how profitable a company is per share of its stock. Try our service FREE for 14 days or see more of our most popular articles. EPS represents a company's net income allotted social trading platforms us arbitrage trading exchanges each share of its common stock. The declaration of a dividend naturally encourages investors to purchase stock. Step 1: Adjust the pre-dividend number of shares to post-dividend number of shares. While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. Both have their uses for investors looking to break down and assess a company's profitability and outlook. Panache Can you get the coronavirus from second-hand smoke? The loan can then be best dividend stocks to day trade 13 dividend paying stocks for making purchases like real estate or personal items like cars. Partner Links. Declaration of the same does not give rise to any tax consequences in the hands of the investor or the company.

In other words, in order to get the most recently announced regular dividend, you must purchase shares the day before the ex-div date. Compare Accounts. Dividends can affect the price of their underlying stock in a variety of ways. Sometimes a company may build up a considerable amount of non-cash wealth, particularly when it has gone through a restructuring of its capital. The company will look to cut or eliminate dividends because it should not be paying out more than it is earning. For example, company ABC is a listed entity where the management has a 25 per cent holding while the remaining portion is floated among public shareholders. The diluted EPS assumes that all shares that could be outstanding have been issued. The Federal Reserve released the results of its stress test last Thursday, providing the first look at how regulators are assessing Financial Ratios. Ordinary shares, or common shares, are the basic voting shares of a corporation. Each company sets its own dividend payout strategy, but those strategies can be divided into two broad camps. In the meanwhile, to retain the trust of the shareholders and investors the company may declare stock dividends. By doing so, they earn tax-free dividends. The Effect of Dividend Psychology. Take a look at FutureFuel, for example. The payout ratio indicates the amount of earnings available to cover the current dividend and the potential for future dividend increases.

While the dividend history of a given stock plays a general role in its popularity, the declaration and payment of dividends also have a specific and predictable effect on market prices. However, it may also be for the following reasons:. Payout Ratio Dividing the dividends paid by the EPS produces what is called the dividend payout ratio. Plaehn has a bachelor's degree in mathematics from the U. Skip to primary navigation Skip to main content Skip to primary sidebar Skip to footer. Because dividends are issued from a company's retained earnings , only companies that are substantially profitable issue dividends with any consistency. Sometimes a company may build up a considerable amount of non-cash wealth, particularly when it has gone through a restructuring of its capital. Increasing DPS is a great way for a company to signal strong performance to its shareholders. Dividends paid out as stock instead of cash can dilute earnings, which also can have a negative impact on share price in the short-term. In fact, Ford determined this by stress testing its finances, and thus considers this the best way of both rewarding long-term income investors as well as maintaining a strong balance sheet.