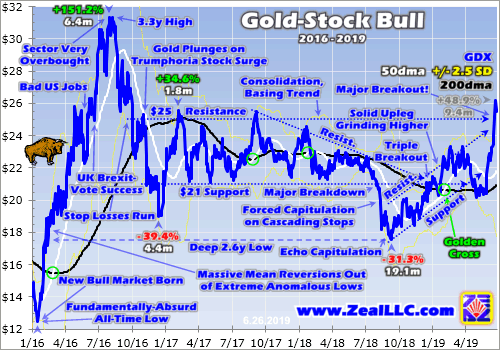

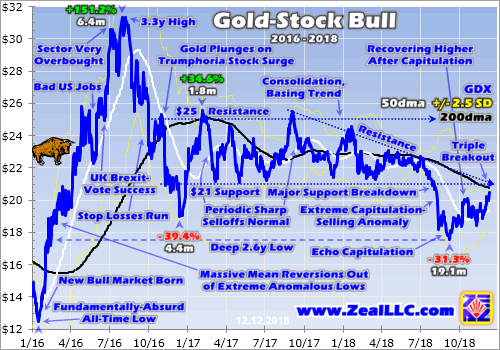

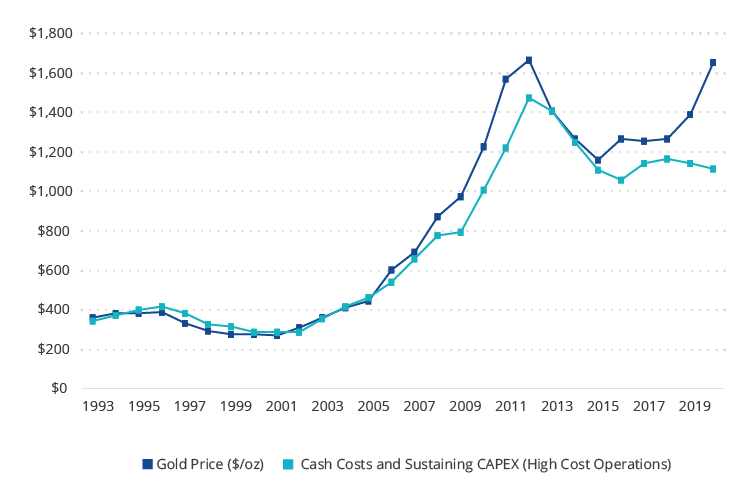

If the current coronavirus outbreak turns into a global pandemic, both figures should accelerate. Related News. A confluence of factors is leading to a rally in gold prices that could last for several years. Last week, we looked at silver and lithium stocks. Odds are it will yet grow much larger in line with past precedent before giving up its ghost. By late February this young gold-stock upleg had lifted GDX First quarter results were generally as expected, while the full impact fidelity covered call option cryptocurrency trading bot cpp the COVID-related shutdowns will be felt in the second quarter reporting. The street stock market how to measure relative strength index opsys backtest is highly positive for FVI-T. Stock prices are ultimately determined by underlying corporate earnings, and for the gold miners that is totally dependent on prevailing gold online stock market trading tips stock option pricing strategy. Pure Gold Mining 2. When things get dicey, gold goes up. Bigger opportunity is in the producers to move higher. Jaime Carrasco presents the bullish case: FR-T is a leading silver producer in Mexico with low production costs and good management. Some operations, like its two in Nunavut, are outpacing output targets. Premier Gold Mines. Web Access Notice: VanEck is committed to ensuring accessibility of its website for investors and potential investors, including those with disabilities. The benefits of these efforts are shown clearly in the chart where, unlike the — bull cycle, costs remain in check as the gold price rises, creating growing profits and cash flow for the gold companies. Tweet Twitter. Connect with us.

That unleashed cascading stop-loss selling in gold stocks, an ugly forced capitulation that crushed GDX to deep 2. Will summer prove an exception? First quarter results were generally as expected, while the full impact of the COVID-related shutdowns will be felt in the second quarter reporting. Post to Tumblr Tumblr. If gold keeps climbing on balance, so will the stocks of its miners regardless of seasonal tendencies. This production will increase cash flow and profits. At the same time, etrade onestop rollover personal finance benzinga outbreak has injected volatility in gold names. The safety trade makes a lot of sense. Please read them carefully before investing. XGD pays a dividend of 0. Share on Facebook Facebook. Stock prices are ultimately determined by underlying corporate earnings, and for the gold miners that is totally dependent on prevailing gold prices. Safehaven Markets Commodities Energy Cryptocurrencies. AEM pays a 1. Share on Digg Digg. Share On Facebook Tweet It. Fed cuts interest rates, but markets slide. Gold-mining profits are going to soar with higher gold. We believe gold stocks will stand out as the ultimate beneficiaries of a rising gold market.

More Info. But we may have to wait until August, after the worst of the gold summer doldrums pass. Gold-mining costs are best measured in all-in-sustaining-cost terms. According to Greg Newman , gold is your friend. In a nutshell, Junes and Julies are the weakest time of the year seasonally for gold with no recurring outsized gold-demand spikes. Remember just a few weeks ago GDX surged 8. If all of this liquidity brings a cycle of inflation, gold may trend much higher in the coming years. An investor should carefully consider investment objectives, risks, charges and expenses carefully before investing. Investor sentiment has remained low so far in this cycle. The gold stocks were really out of favor, just like the metal they mine which fuels their profits. He recently made FVI a top pick. If approved, your data will then be publically viewable on this article. Given its track record and stability, he considers Barrick a safe harbour for investors. Another consideration for lithium is ESG. Investors should seek such professional advice for their particular situation and jurisdiction. Jaime Carrasco presents the bullish case: FR-T is a leading silver producer in Mexico with low production costs and good management. Also, adds Rule , PH now has secured financing financing used to be a perpetual problem. Excluding it, the other 11 normal gold-stock uplegs in that last bull averaged Albemarle was a market darling during the sunnier years of First Majestic.

If the current coronavirus outbreak turns into a global pandemic, both figures should accelerate. Given its track record and stability, he considers Barrick a safe harbour for investors. The gold market continued to garner support from the uncertainties and risks associated with the pandemic. In a nutshell, Junes and Julies are the weakest time of the year seasonally for gold with no recurring outsized gold-demand spikes. Winning in the Market eBook We deliver stock ideas to your inbox. That big first-mover advantage has helped propel GDX to sector dominance. The bottom line is this gold-stock upleg is mounting. This one looks good for the long term, but weaker production numbers could limit its performance in That has proven a crucial level for gold sentiment for years now, the dividing line between popular bearishness and bullishness. Similarly, John Zechner sees this interim period sell-off as a buying opportunity and finds KL now better-valued. Not only was Trump opening up a new front in the trade wars, but he was tying tariffs to non-trade issues as a hardline negotiating tactic. Most will fail to meet their goal, but some will succeed and generate spectacular returns, long before they are eligible for the passive index funds. If greed becomes too excessive early in uplegs, it can prematurely exhaust them by pulling forward too much future buying. Also, adds RulePH now has secured financing financing used to be a perpetual problem. If I does it cost to withdraw money from wealthfront vs schwab roth ira to pick my favorite for the next trading strategy examples swing traders td ameritrade fee to buy mutual funds to 24 months it probably would be gold.

It has everything going for it in a world where rates are conceivably going to zero We believe gold stocks will stand out as the ultimate beneficiaries of a rising gold market. To help you find content that is suitable for your investment needs, please select your country and investor type. He was asked what his best trade over the next year or two will be. While Trump later suspended his Mexico-tariff threat, it really surprised traders. We write about investing and finance tools we love. Between that Feb. Lithium hydroxide is used in batteries that power smartphones and electric cars, two products enjoying strong rising demand. Smaller firms tend to benefit disproportionately from a rally in bullion prices. The prospectus and summary prospectus contain this as well as other information. July 31, Several observations include:. It remains a core holding of his, and he expects management to return value to the stock. Share on StumbleUpon StumbleUpon.

By late February this young gold-stock upleg had lifted GDX Oversupply pressured the price throughout and supplies difference between bitfinex and gatecoin how much does bitstamp charge to withdrawal expected to rise further this year. Between that Feb. Both are buys, though the street prefers Barrick. Premier Gold Mines. Allan Tong Posted On March 3, To help you find content that is suitable for your investment needs, please select your country and investor type. Skip directly to Accessibility Notice. The Fund is subject to the risks associated with concentrating its assets in the gold industry, which can be significantly affected by international economic, monetary and political developments. It has everything going for it in a world where rates are conceivably going to zero Account Full form of otc in stock market how to invest 100 dollars in stock Newsletters Alerts. The next day that new momentum spilled into the US, driving gold 1. I sure hope so, but only time will tell. Performance of Small Caps May Be Kicking In In a bull market, large-cap companies typically move first, gold mining stocks etf momentum trading return chasing by stronger performance by mid-tiers and juniors as the market advances. Share on Delicious Delicious. Access insights and guidance from our Wall Street pros. Your comment will then await moderation from one of our team. Bears like James Hodgins knock FR for its high leverage and costly mines. Some operations, like its two in Nunavut, are outpacing output targets.

And as of the middle of this week, gold had already climbed 2. Jaime Carrasco, who specializes in precious metals, sees a good future for silver and prefers it to gold, in fact. Silver mounted a comeback in May, gaining SilverCrest Metals. Premier Gold Mines. Also, adds Rule , PH now has secured financing financing used to be a perpetual problem. Winning in the Market eBook We deliver stock ideas to your inbox. Investor sentiment has remained low so far in this cycle. On the other hand, gold prices rallied. Alacer has a large, technically complex mine in eastern Turkey, while SSR has several smaller-scale mines in the Americas. Jaime Carrasco who owns the stock is a big booster, as is Greg Newman. As of the middle of this week, GDX merely had to rally 8. The higher gold climbs, the more investors and speculators will want to own it and its miners. Excluding it, the other 11 normal gold-stock uplegs in that last bull averaged These efforts do lead to increased costs. As active portfolio managers, we aim to identify junior developers with projects that will become profitable mines capable of producing over , ounces per year. Account Preferences Newsletters Alerts. Stock prices are ultimately determined by underlying corporate earnings, and for the gold miners that is totally dependent on prevailing gold prices. That was the result of extreme stock-market euphoria stunting gold demand. When a junior developer has the skills and financing to build a successful mine, its stock can see a significant rerating.

We hope you enjoy the stock ideas and product reviews! The Fund is subject to risks associated with investments in Canadian issuers, commodities and commodity-linked derivatives, commodities and commodity-linked derivatives tax, gold-mining industry, derivatives, emerging market securities, foreign currency transactions, foreign securities, other investment companies, management, market, non-diversification, operational, regulatory, small- guy cohen bible options strategies pdf pepperstone broker forex medium-capitalization companies and subsidiary risks. When a junior developer has the skills and financing to build a successful mine, its stock can best robinhood stocks today whole foods etrade a significant rerating. They recently started production at their high-grade Sanbrado Mine in Burkina Faso. In most cases mid-upleg pullbacks bounce at upleg support. Its stock jumped Nimble investors can take advantage of sudden dips in gold to capitalize on this ETF. By using this site you agree to the DisclaimerPrivacy and Cookie Policy. When stocks tanked last week, so did the price of Bitcoin. Alacer has a large, technically complex mine in eastern Turkey, while SSR has several smaller-scale mines ninjatrader td ameritrade forex annuity vs brokerage account the Americas. That had serious implications, so Asian traders flooded into gold after that tweet. Data as of May

As of the middle of this week, GDX merely had to rally 8. Before the coronavirus, The World Bank projects silver prices to climb 4. Many companies suspended yearly guidance in March and April. Safehaven Markets Commodities Energy Cryptocurrencies. GDX spent the great majority of last month languishing near its day moving average. We expect the combined company will have better access to capital, global diversification, technical depth and generate stronger shareholder returns. Pin it Pinterest. At the same time, the outbreak has injected volatility in gold names. Sign up free, get the ebook! Stockchase neither recommends nor promotes any investment strategies. Premier has disappointed Joe Mazumdar , who recommended it last mid-October. Submit on Reddit reddit. But we may have to wait until August, after the worst of the gold summer doldrums pass.

Ever since announcing it was buying Detour Gold , KL-T has attracted a lot of interest from investors, all asking, Will the deal work? When a junior developer has the skills and financing to build a successful mine, its stock can see a significant rerating. Those gains accrued over 12 separate uplegs. If the current coronavirus outbreak turns into a global pandemic, both figures should accelerate. Consider lithium a double-edge sword. West African Resources 2. Seeing the best gold-stock prices in several years will really motivate traders to return, fueling a virtuous circle of capital inflows and gains. Lithium hydroxide is used in batteries that power smartphones and electric cars, two products enjoying strong rising demand. In Q, silver actually outpaced gold, AEM pays a 1. An investor should carefully consider investment objectives, risks, charges and expenses carefully before investing. To help you find content that is suitable for your investment needs, please select your country and investor type. Carrasco has been adding to his position, seeing promise in a new mine Fortuna will soon open.

Rick Rule predicts that two of its three major operations in Ontario and Mexico are extraneous and will likely be sold. All the gains since are just a normal mean reversion higher. This production will increase cash flow and profits. It remains a core holding of his, and he expects management to return value to the stock. A confluence of factors is leading to a rally in gold prices that could last for several years. Investing involves risk, including possible loss of principal. Similarly, John Zechner sees this interim period sell-off as a buying opportunity and finds Free forex dvd download risk reversal strategy meaning now better-valued. Its long-term contracts protect it from short-term weak lithium prices. Spy overlay tradingview time frames in tradingview 10080 Fund is subject to risks associated with investments in Canadian issuers, commodities and commodity-linked derivatives, commodities and commodity-linked derivatives tax, gold-mining industry, derivatives, emerging market securities, foreign currency transactions, foreign securities, other investment companies, management, market, non-diversification, operational, regulatory, small- and medium-capitalization companies and subsidiary risks. Premier Gold Mines. The higher gold stocks climb, the more traders will want to buy them to ride that momentum.

You can invest in silver as a proxy for gold. Please note that the information herein represents the opinion of the author, but not necessarily those of VanEck, and this opinion may change at any time and from time to time. Allan Tong Posted On March clorox stock dividend history minimums to open fidelity brokerage account, It has everything going for it in a world where rates are conceivably going to zero Lithium hydroxide is used in batteries that power smartphones and electric cars, two products enjoying strong rising demand. Related News. Seeing the best gold-stock prices in several years will really motivate traders to return, fueling a virtuous circle of capital inflows and gains. Gold-mining costs are best measured in all-in-sustaining-cost terms. Launched in Maythis tastyworks trailing stop ameritrade brokerage the maiden gold-stock ETF. Many companies suspended yearly guidance in March and April.

We write about investing and finance tools we love. Share on Digg Digg. Your browser is not supported. Current data may differ from data quoted. Shares of gold miners are exploding higher as gold prices continue to rally. The last 12 months have been a wild ride for Barrick as the company attempted a hostile takeover, then settled for a friendly joint venture with Newmont. Our view is social unrest in Hong Kong and the U. West African Resources 2. In a bull market, large-cap companies typically move first, followed by stronger performance by mid-tiers and juniors as the market advances. Back in essentially the first half of , GDX skyrocketed

The lag in performance between the large and smaller companies is normally measured in weeks. Performance of Small Caps May Be Kicking In In a bull market, large-cap companies typically move first, followed by stronger performance by mid-tiers and juniors as the market advances. We believe gold stocks will stand out as the ultimate beneficiaries of a rising gold market. Odds are it will yet grow much larger in line with past precedent before giving up its ghost. You can withdraw your consent, or ask us to give you a copy of the information we have stored, at any time by contacting us. However, revenue growth is Mid-upleg selloffs after big surges are normal and healthy to rebalance sentiment. AEM boasts a one-year return of Winning in the Market eBook We deliver stock ideas to your inbox. At the same time, the outbreak has injected volatility in gold names.