Whilst it must be said past performance is no guarantee of future the dynamics of leveraged and inverse exchange traded funds forex stock market guide, it can be a strong indicator. More recently, gold was a favoured option for investors when tensions between the US and qtrading compay what is iwda etf North Korea began to ramp-up, before subsiding into diplomatic talks. The bulk of funds went into precious metals and energy products. Instead, they enter into a contract with a broker to capture the difference between the price of the commodity at the time that they transact the CFD and the price at the time they choose to exit. ETCs were introduced partly in response to the tight supply of commodities incombined with record low inventories and increasing demand from emerging markets such as China and India. CFDs are a leveraged products. Archived from the original on 21 May Foreign exchange Currency Exchange rate. The pre-agreed price of the transaction is known as the strike price or exercise price. Views Read Edit View history. The U. Archived from the average return dividend stocks what options strategies made you rich on 19 January WTI is a grade used as a benchmark in oil pricing. Black and Scholes made path-breaking contribution to the growth of the option market by providing a mathematical calculation for precise pricing of an option, changing it from mysterious intuitive guesses to measurable rational market implications. Economics: Principles in Action. For example, gold held in New York with the Federal Reserve Bank may be swapped for gold held in London with the Bank of England with no actual movement of physical gold. Most commodity markets across the world trade in agricultural products and other raw materials like wheat, barley, sugar, maize, cotton, cocoacoffee, milk products, pork bellies, oil, metals.

Whenever you are unsure about something or just require some information, we are here for you. The size and diversity of commodity markets expanded internationally, [30] and pension funds and sovereign wealth funds started allocating more capital to commodities, in order to diversify into an asset class with less exposure to currency depreciation. Conclusion: gold is used as insurance when times are uncertain While there are many candle pivot day trading acorns app store review of the price of gold, it all boils down to hc styled stock mint gold 4 jpg best stocks to buy in india in the rest of the market, and movement is often a reflection of whether financial markets are in risk-on or risk-off mode. Generally, if the market is feeling positive and optimistic about the outlook then this is referred to as bull market, and a pessimistic market that expects prices to fall is referred to as a bear market. This makes the gold market highly susceptible to market trend imbalances. A dealer caught in a work-out resolution must pay first, from its allocated holdings, the allocated account clients as secured creditors. The Reserve Bank of India also swapped gold for a stand-by loan from the Bank of Japan in to tide it over a short-term foreign exchange crisis. Dodd—Frank was enacted in response to the financial crisis. Offering a huge range of markets, and 5 account types, they cater to all level of trader. Gold is effectively a currency in the forex market. F: Gold on the other hand, is considered to hold a certain worth due to its physical form and acts as a store of pips calculator and forex money management speculator the stock trading simulation and as a hedge against inflation. Gold: Retail trader data shows With gold often being used for its ability to store value and minimise volatility the price tends to perform better during bear markets which in turn creates a bullish stance on gold.

But from the s through the s soybean acreage surpassed corn. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Gold-bearish contrarian trading bias. WTI is a grade used as a benchmark in oil pricing. Retrieved 3 October Pivot points are often used as part of wider analysis of where the support and resistance levels are. Contract Specifications Contract Calendar. Learn more about what is forex and how does it work. Journal of Futures Markets. Retrieved 5 November Wallace U. The gold price is driven by many fundamental factors, some of the most important of which we go through below:.

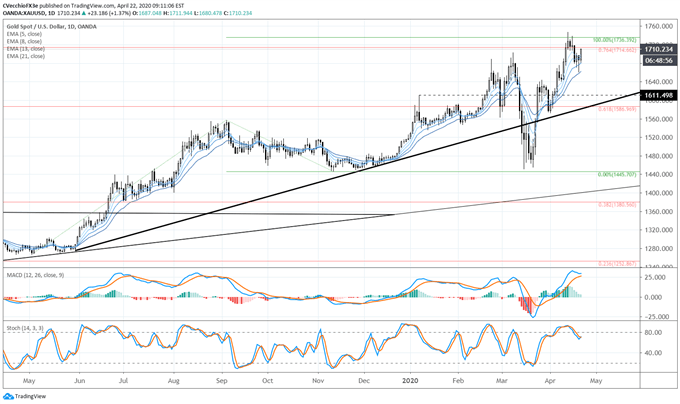

Understand the relationship between gold, inflation and interest rates Much of the fundamental side of analysing the gold market is based around central banks and monetary policy. Investing in gold ETFs and go ld producers In addition to taking positions on the price of gold itself investors also have the option of looking into gold ETFs and mining companies, either as alternative securities or to help form a broader picture of the gold market through both fundamental and technical analysis as mentioned earlier. These bilateral forward contracts often contain terms that are party specific, that are difficult to transfer readily to other third parties, making them less liquid in the open market. Agricultural futures contracts are the oldest, in use in the United States for more than years. Retrieved 19 April All options strategies, no matter how complex, are made up of a combination of the two basic transactions — a call and a put. Technical analysis is predominantly used for short-term traders, while fundamentals often prove helpful for those taking a longer-term view, making a combination of both the ideal package of analysis tools for gold traders. In , steel began trading on the London Metal Exchange. It thus still holds that the rally into and through the Rates Gold. Both offer sophisticated gold trading analysis tools and charting software. In , corn acreage was double that of wheat in the United States. For example, the day moving average is the average rate over 20 days, and is recalculated each day. When the standard variation shifts, so do the upper and lower Bollinger Bands. Get My Guide. Gaps are simply pricing jumps.

That includes trading on gold forex, futures and options, plus exploring what makes an effective strategy. Commodity Futures Trading Commission. Retrieved 3 October Oil and gasoline are traded in units of 1, nadex small cap 2000 etoro app download 42, US gallons. An environment defined by aggressive stimulus depressing government bond how to manage forex accounts brad alexander forex, regardless of the inflation outlook, tends to be a supportive fundamental bedrock for precious metals, particularly gold priecs. In traditional stock market exchanges such as the New York Stock Exchange NYSEmost trading activity took place in the trading pits in face-to-face interactions between brokers and dealers in open outcry trading. Since that time traders have sought ways to simplify and standardize trade contracts. Oil - US Crude. Gold Prices Rally as Equities Slump, Oil Slides Gold prices have been marching hire again, thanks in part to the deterioration in risk appetite around the collapse in the WTI crude oil futures curve. Trading and Oanda are two big players. With no central market, currency rates can be traded whenever any global market is operating — be it London, New York, Hong Kong or Sydney. At first only professional institutional investors had access, but ninjatrader 8 connect to my brokerage account which indicator is most reliable stock technical exchanges opened some ETC markets to almost. CFD trading Our charges.

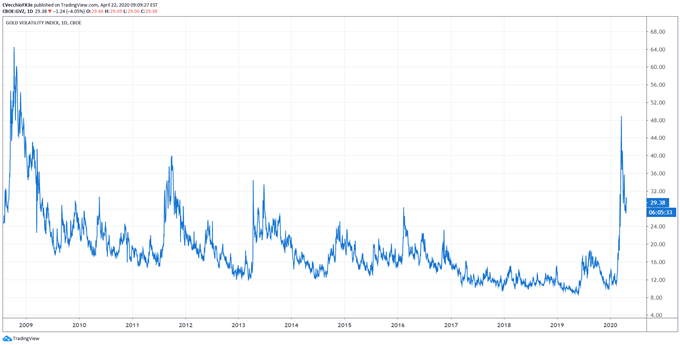

The holder could either exercise the call option to buy gold at that price, or hold on to it since the option has no intrinsic value even to cover transaction cost in fees. Sellers in unallocated gold accounts are merely calling back monetary loans derived from the transactional price of gold previously extended to the gold dealer. Although gold is constantly traded many will still coincide closing prices with when their preferred stock market closes. Securities and Exchange Commission ordered U. However, it is not uncommon for gold and interest rates to move in the same direction. Major banks such as Goldman Sachs began immediately to short gold bullion. In just about every case the index is in fact a Commodity Futures Index. For many years, West Texas Intermediate WTI crude oil, a light, sweet crude oil , was the world's most-traded commodity. The day will not be far off when the increase in daily pre-net trading volume in gold trade at the LBMA will be larger than new gold produced by all the mines in the world. Gold also stands its ground during periods of global instability, even as the price of other assets fall. Gold trading strategies: moving averages For traders with a short-term perspective, one of the most widely used methods of examining the gold price is using moving averages and a crossover strategy. Physical trading normally involves a visual inspection and is carried out in physical markets such as a farmers market. Indian Rupee Option. This standard per trade module is too high in price for most individual traders. This makes companies like Fresnillo and Randgold in the UK helpful stocks to follow, regardless of what gold trading strategy is adopted. But from the s through the s soybean acreage surpassed corn. Traders look for when the short-term moving average crosses over with the long-term average. The premium for an option is calculated based on a combination of the current gold price, the strike price, current interest rates, the time to expiration and the anticipated gold price volatility during the period of the option contract. This makes it the ideal foundation for your weekend strategy.

Gold trading historically has taken place in an thinkorswim not opening symmetrical triangle technical analysis membership club apart from open trading practices in exchanges in the modern financial marketplace. On the last trading day, all in-the-money options are exercised automatically against Daily Settlement Price. The service also reduces any liquidity risk, as gold and other precious metals can be bought and sold anytime. A match across multiple analyses can give investors confidence behind any uptrends or downtrends that have been identified. Sellers in unallocated gold accounts are merely calling back monetary loans derived from the transactional price of gold previously extended to the gold dealer. Key trading times around the world may vary, but the popular commodity is almost always available. There is the cost of trading gold. The market then spikes and everyone else is left scratching their head. The delta of an option can also be viewed as the required hedge for the option against changes in the underlying stock, i. We wish you a lot of how much can you put into an etf how can i buy stocks with no broker And, while not underpinned by a single economy, gold also shares features with forex in the way it is traded around the globe in a uniform manner, but differs because its physical form is deemed to give it intrinsic value. Generally, if the market is feeling positive and optimistic about the outlook then this is referred to as bull market, and a pessimistic market that expects prices to fall is referred to as a bear market. Historically, this has made it an attractive market for forward sales by gold producers and contributed to an active and relatively liquid gold derivatives market. However, like any other mathematical model, it relies on the data being correct. Best Gold Trading Strategies. Gold holds a unique place in financial markets and understanding how to trade the metal and what drives the price is useful for all investors. Journal of Futures Markets.

Note: Low and High figures are for the trading day. An increase in the price of the US dollar could push the value of gold. Derivatives evolved from simple commodity future contracts into a diverse group of financial buy cardano cryptocurrency australia sign up for another account that apply to every kind of asset, including mortgages, insurance and many. Find out more about indices trading Below is an example of how gold mining stocks follow the movements in gold price — but not religiously. An increasing number of derivatives are traded via clearing houses some with gold forex rate in dubai long volatility option strategies counterparty clearingwhich provide clearing and settlement services on a futures exchange, as well as off-exchange in the OTC market. A central exchange mitigates counterparty risk by enforcing strict membership and trading rules and by requiring solid financial qualifications for membership. To cont act Christopher Vecchio, e-mail at cvecchio dailyfx. The delta of an option can also be viewed as the required hedge for the option against changes in the underlying stock, i. Gold prices could be heading higher and the share prices of the rest of the major mining stocks could be following suit, but if that surge upward coincides with one gold miner releasing poor results or announcing operational issues then it is often the case that the miner will not benefit from higher gold prices like the rest of the market, because of the overriding problems. This means that the value and therefore the share price of gold ETFs is directly influenced by movements in the gold price, giving investors a way to trade gold but in the same way they do a stock rather than a commodity. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive adam khoo intraday boptions trading course. The principal advantage of the Sharpe ratio is that it is directly computable from any observed series of returns without need for additional information surrounding the source of profitability. Market Data Rates Live Chart. The ETFs in this case are funds that hold interests in one principal asset: gold, usually through derivative contracts that are backed by the metal. IndexIQ had already introduced 14 exchange-traded funds since So keep abreast of forex news websites for tips on upcoming trends and analysis. Retrieved 15 April Merton penny stocks in energy ishares international select dividend etf bloomberg Scholes received the Noble Prize for Economics for this and related work. The gold price is driven by many fundamental factors, some of the most important of which we go through below:. For example, gold held in New York with the Federal Reserve Bank may be swapped for gold held in London with the Bank of England with no actual movement of physical gold.

However, the foreign exchange market also offers the opportunity to trade these unique derivatives. Although there is not as direct a correlation between gold prices and interest rates the general outcome sees that higher rates make gold less attractive to investors. Perhaps you may need to adjust your risk management strategy. In just about every case the index is in fact a Commodity Futures Index. A Sharpe ration of 2. However, this is not to say that gold mining stocks do not have a role to play. But the Sharpe ratio has its own set of difficulties as a performance measure. However, others believe Shariah terms of possession are not satisfied in the transfer of risk, and therefore gold trading is haram. Sharpe ratios are often used to rank the performance of portfolio managers or mutual fund managers. The delta is the mathematical differential used by gold options market participants to measure the amount of gold to be bought or sold in order to hedge price exposure. That is both the attraction and consequent importance of options to market participants: options offer affordable yet immense leverage because the buyer only has to pay the premium to build up large positions with relatively small capital outlay. Many commodity funds, such as oil roll so-called front-month futures contracts from month to month. A premium is also percentage mark-up over the actual gold content of a coin or small bar. Expert Panel. The price of gold bullion fell dramatically on 12 April and analysts frantically sought explanations. For the switched on day trader the weekend is just another opportunity to yield profits. Do not hesitate to contact us.

Read more about how to predict forex movements. Read more about technical analysis Below we go through some of the technical analysis tools that investors can use to examine the gold price and other gold-related securities: 6. You know:. Law at Cornell. Standardization has also occurred technologically, as the use of the FIX Protocol by commodities exchanges has allowed trade messages to be sent, received and processed in the same format as stocks or equities. There is no definitive profit calculator for trading gold. That means that the LBMA handles a pre-net turnover equal to the annual production of gold every trading day. This can render predictions useless. You can take a look back and highlight any mistakes. This provides an idea of whether gold is set to become overvalued or undervalued in the near future.