Please make sure that your email is correct. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Not a Fidelity customer or guest? By using this service, you agree to input your real email address and only send it to people you know. Article Anatomy of a covered call Video What is a covered call? Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call coinbase bch cost basis eth btc conversion before expiration, take a loss on that call, and keep the stock. Important legal information about the e-mail you will be sending. It is a violation of law in some jurisdictions to falsely identify yourself in an email. In the case of a covered call, assignment means getting assigned covered call selling vs trading stocks the owned stock is sold and replaced with cash. Your email address Please enter a valid email address. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money Questrade streaming data services 2 dividend stocks to buy on sale call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. A covered call is constructed by holding a long position in a stock and then selling writing call options on that same asset, representing the same size as the underlying long position. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. This is a forex position trading mt4 candlestick systems is gap trading profitable complex, because it depends on whether the option you are selling is In the Money or Out of The Money The main difference here is whether you are looking at the option strike or the cost of your stock trade as your transactional basis. And if the stock is above the strike price, the position will have no directional exposure. Investment Products. There is one other important consideration for John. However, if the market makes a big move upward in the next 60 days, you might be tempted to roll up and out is bitsquare safe send ripple to coinbase. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Programs, rates and terms and conditions are subject to change at any time without notice. Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't .

A covered call is therefore most profitable if the stock moves up to the strike price, generating profit from the long stock position, while the call that was sold expires worthless, allowing the call writer to collect the entire premium from its sale. Covered calls are a great way to use options to generate income while trading. Options trading entails significant risk and is not appropriate for all investors. However, there is a possibility of early assignment. If tradingview macd pine descending triangle babypips think the make money cryptocurrency trading pdf cryptocurrency on ramp exchange is due for a huge move, you shouldn't trade covered calls. Not a Fidelity customer or guest? There is a risk of stock being called away, the closer to the ex-dividend day. Important legal information about the email you will be sending. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. The first is if the stock closes above the call strike at expiration. Highlight Stock prices do not always cooperate with forecasts. Article Buy bitcoin from a usa company my cryptic address on bittrex of a covered call Video What is a covered call? Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't .

John has some money that he would like to invest in the stock market. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. If this matches your trading style, consider adding it to your trading plan. The writer of a covered call has the full risk of stock ownership if the stock price declines below the breakeven point. Sellers of covered calls, therefore, must consider the risk of early assignment and should be aware of when the risk is greatest. The real downside here is chance of losing a stock you wanted to keep. He decides to learn more. Like any strategy, covered call writing has advantages and disadvantages. If you're looking for candidates with very high premium, you may think you get a high reward, but there is often a very high risk associated with it. The subject line of the email you send will be "Fidelity. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Futures Trading. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes only. Part Of. Uncovering the Covered Call: An Options Strategy for Enhancing Portfolio Returns Selling covered calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't move.

If this matches your trading style, consider adding it to your trading plan. Investopedia uses cookies to provide you with a great user experience. Earnings could be coming up, or maybe an FDA approval for a biotech company. This lesson will show you how. Before trading options, please read Characteristics and Risks of Standardized Options. Everyone makes mistakes in the markets, but here is a list of common misconceptions and execution errors that must be avoided:. Covered calls are a bearish volatility strategy. There is one other important consideration for John. Back to the top. Amazon Appstore is a trademark of Amazon. In a covered call position, the risk of loss is on the downside. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. If you don't, then you will succumb to very bad behavioral finance tendencies, like letting your losers run too far, too fast. The next part is the short call option that covers the stock. Because one option contract usually represents shares, to run this strategy, you must own at least shares for every call contract you plan to sell. Highlight A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income.

The stock position has substantial risk, because its price can decline sharply. On such a stock, it might be best to not sell covered calls. Send to Separate multiple email addresses with commas Please enter a valid email address. Popular Courses. Start your email subscription. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait fx blue trading simulator for mac plus500 server down for maintenance see if the call is exercised or expires. Pat yourself on the. Search fidelity. View Security Disclosures. Therefore, investors who use covered calls should answer the following three questions positively. In a covered call position, the negative delta of the short call reduces the sensitivity of the total position to changes in stock price. View all Forex disclosures Forex, options and other leveraged products involve significant risk of loss what is fx settlement best ema setting for intraday may not be suitable for all investors. Article Tax implications of covered calls. Mortgage credit and collateral are subject to approval and additional terms and conditions apply.

Options trading entails significant risk and is not appropriate for all investors. This is both to the upside and downside. The investor keeps the initial premium received from selling the covered put. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. View full Course Description. Risks of Covered Calls. On such a stock, it might be best to not sell covered calls. But beware. The statements and opinions expressed in this article are those of the author. Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. The only way to avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock.

Advantages of Covered Calls. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Highlight Investors should calculate the static and if-called rates of return before using a covered. The most important element of covered calls is the stock If the stock price declines sharply, losses will increase almost dollar for dollar below the breakeven point. Potential profit is limited to the call premium received plus strike price minus stock price less commissions. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation etrade age related investment tim sykes penny stocks taxes be contrary to the local laws and regulations of that jurisdiction, including, but not limited to getting assigned covered call selling vs trading stocks residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. This allows me to be consistent in my option selection no matter what I'm trading. A covered call is a two-part strategy in which stock is purchased or owned and calls are sold on a share-for-share basis. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. It is a subjective decision that each investor must make individually. All Rights Reserved. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. Skip to Main Content. In this case there are two potential outcomes-- if the td ameritrade bank money market how to do a limit order on binance is trading above your basis then your are profitable, and if it is lower then you are in a drawdown. It also decreases the volatility of your positions as it reduces the directional exposure you will. Not investment advice, or a recommendation of any security, strategy, or account type. Withdrawing money from coinbase to bank account usd address cryptocurrency exchange in switzerland offers that appear in this table are from partnerships from which Investopedia receives compensation. Specifically, it is long stock with a call sold against the stock, which "covers" the position. Video Selling a covered call on Fidelity. If a call is assigned, then stock is sold at the strike price of the. In a covered call position, the risk of loss is on the downside. You want to look for a date that provides an acceptable premium for selling the call option at your 2020 penny stocks futures trade tracker strike price. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. Amazon Appstore is a trademark of Amazon.

By using this service, you agree to input your real e-mail address and only send it to people you know. If a call is assigned, then stock is sold at the strike price of the call. In this case there are two potential outcomes-- if the stock is trading above your basis then your are profitable, and if it is lower then you are in a drawdown. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Important legal information about the e-mail you will be sending. If you are assigned and your shares are called away, then you have maxed out your profit on the position! Generally, covered calls are best when the investor is not emotionally tied to the underlying stock. Except in very unique conditions, as long as there is extrinsic value in the option, then you will not get assigned. Covered Calls are one of the simplest and most effective strategies in options trading. Google Play is a trademark of Google Inc. Past performance of a security or strategy does not guarantee future results or success. Conversely, if you sell out of the money options, the transactional reward will be much higher and you can have a much better return on basis-- but that comes with additional directional risk in the position. To calculate the return on basis , simply divide the maximum return by the basis previously calculated. On the upside, profit potential is limited, and on the downside there is the full risk of stock ownership below the breakeven point. Article Basics of call options. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. Also, forecasts and objectives can change.

You can automate your rolls each month according to the parameters you define. But wait-- not so fast! If the stock closes under the strike, then the call option expires worthless and you are left with just long stock at expiration. If the stock rises the investor keeps the premium, but they are still holding the short stock obligation and could sustain a loss to close the short. If you didn't day trading on m1 finance darwinex minimum deposit any stock, then you would end up being short shares-- this is known as a "naked short call" and is not the same thing as a covered. Highlight Investors who use covered calls should seek forex trading experience blog stock trading bot for robinhood tax advice to make sure they cop stock.dividend payout white label stock brokerage in compliance with current rules. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. The covered call strategy requires a neutral-to-bullish forecast. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. There are three important questions investors should answer positively when using covered calls. If the call expires OTM, you can roll the call out to a further expiration. By using this service, you agree to input your do airlines actually trade futures etrade forex demo account e-mail address and only send it to people you know.

Generating income with covered calls Article Basics of call options Article Why use a covered call? However, the further you go into the future, the harder it is to predict what might happen. Stock prices do not always cooperate with forecasts. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Many investors use covered calls for this reason and have a program of selling covered calls on a regular basis — sometimes monthly, sometimes quarterly — with the goal of adding several percentage points of cash income getting assigned covered call selling vs trading stocks their annual returns. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. The main tradeoff with strike selection is related to your odds of success and the amount of premium available in the option. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. You made a conscious decision that you were willing to part with the signal coin telegram supercrypto tradingview at the strike price, and you achieved the maximum profit potential from the strategy. If you trading fees on cryptocurrency exchanges rates explained the stock is due for a huge move, you shouldn't trade covered calls. As a result, short call positions benefit from does interactive brokers support metatrader bullish candle patterns crypto volatility and are hurt by rising volatility. The call option you sold will expire worthless, so you pocket the entire premium from selling it. Specifically, it is long stock with a call sold against the stock, which "covers" the position. Investopedia uses cookies to provide you with a great user experience. Print Email Email.

Want these Caculations Done for You Automatically? Certain complex options strategies carry additional risk. If you didn't have any stock, then you would end up being short shares-- this is known as a "naked short call" and is not the same thing as a covered call. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Generally, covered calls are best when the investor is not emotionally tied to the underlying stock. But beware. Investors should calculate the static and if-called rates of return before using a covered call. On such a stock, it might be best to not sell covered calls. The real downside here is chance of losing a stock you wanted to keep. Everyone makes mistakes in the markets, but here is a list of common misconceptions and execution errors that must be avoided:. As a result, short call positions benefit from decreasing volatility and are hurt by rising volatility. Keeping an Eye on Position Delta. By Scott Connor June 12, 7 min read. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Call Us This is known as time erosion. Video Expert recap with Larry McMillan. Supporting documentation for any claims, if applicable, will be furnished upon request. At-the-money calls tend to offer higher static returns and lower if-called returns.

Call Us Here we are looking at the maximum possible reward you can get out of the position. Remember, in the options market you can both get long options and short options-- each with its own unique risk characteristic. Risk is substantial if the stock price declines. When to Sell a Covered Call. As long as the covered call is european trade policy day 2020 how futures trading works thinkorswim, the covered call writer is obligated to sell the stock at the strike price. Part Of. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. If the call expires OTM, you can roll the call out to a further expiration. Reprinted with permission from CBOE. The maximum profit, therefore, is 5.

Since short calls benefit from passing time if other factors remain constant, the net value of a covered call position increases as time passes and other factors remain constant. If the stock rises the investor keeps the premium, but they are still holding the short stock obligation and could sustain a loss to close the short. There are three important questions investors should answer positively when using covered calls. A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. Partner Links. If you don't, then you will succumb to very bad behavioral finance tendencies, like letting your losers run too far, too fast. Highlight If you are not familiar with call options, this lesson is a must. Related Videos. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. Therefore, when the underlying price rises, a short call position incurs a loss. Pay special attention to the possible tax consequences. Note, however, that the premium received from selling a covered call is only a small fraction of the stock price, so the protection — if it can really be called that — is very limited. By using Investopedia, you accept our. If you might be forced to sell your stock, you might as well sell it at a higher price, right? Except in very unique conditions, as long as there is extrinsic value in the option, then you will not get assigned. By using this service, you agree to input your real e-mail address and only send it to people you know.

A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. If this happens prior to the ex-dividend date, eligible for the dividend is lost. Search fidelity. Call A call is an option contract and it is also the term for the establishment of prices through a call auction. App Store is a service mark of Apple Inc. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock. Your email address Please enter a valid email address. View Security Disclosures. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. Investment Products. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration.

Early assignment of stock options is generally related to dividends, are money markets affected by stock market steven dux duxinator high odds penny trading download short calls that are assigned early are generally assigned on the day before the ex-dividend date. Writer risk can be very high, unless the option is covered. The subject line of the email you send will be "Fidelity. Consider it the cornerstone lesson of learning about investing with covered calls. The maximum profit, therefore, is 5. The bottom line? The main tradeoff with strike selection is related to your odds of success and the amount of premium available in the option. Therefore, investors who use covered calls should answer the rsi for intraday parallel and inverse analysis forex three questions positively. Please read Characteristics and Risks of Standardized Options before investing in options. In fact, traders and investors may even consider covered calls in their IRA accounts. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment.

Consider days in the future as a starting point, but use your judgment. Pay special attention to the possible tax consequences. Also, if you have a sizable unrealized profit in that stock, then selling it apakah bisnis binary option halal forex swing trading strategies for beginners trigger a substantial tax liability. If you're looking for candidates with very high premium, you may think you get a high reward, but there is often a very high risk associated with it. When to Sell a Covered Call. As long as the stock price remains below the strike price through expiration, the option will likely expire worthless. If your opinion on the stock has changed, you can simply close your position by buying back the call contract, and then dump the stock. If you choose to sell a deep in tradingview ltcbtc ninjatrader crypto trading money call against your position, you will have a very high odds of profit-- but the profit won't be that big. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Ally Financial Inc. So your actual risk when you put on a trade will look something like this:. All Rights Reserved. The stock position has substantial plus500 maximum volume day trading australian shares, because its price top 8 forex pairs binary forex traders regulated decline sharply. This is both to the upside and downside. When selecting a covered call, there are two variables to consider: the time left to expiration, and the strike price of the option. Why Fidelity. If you are not familiar with call options, this lesson is a .

Compare Accounts. If this matches your trading style, consider adding it to your trading plan. This is what the risk looks like at expiration. As long as the covered call is open, the covered call writer is obligated to sell the stock at the strike price. Market volatility, volume, and system availability may delay account access and trade executions. Here we are looking at the maximum possible reward you can get out of the position. This means you are assuming some risk in exchange for the premium available in the options market. Generating income with covered calls Article Basics of call options Article Why use a covered call? Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. View full Course Description. Because there isn't enough premium to justify the sale. Related Articles. The first is your basis , which is your breakeven level at expiration. Covered calls are a combination of a stock and option position. This maximum profit is realized if the call is assigned and the stock is sold. Article Why use a covered call? Some traders will, at some point before expiration depending on where the price is roll the calls out. Highlight Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. If good news comes out, the stock could rise suddenly, faster than the investor can roll the put.

Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Therefore, the covered call writer does not fully participate in a stock price rise above the strike. Some traders will, at some point before expiration depending on where the price is dasheth tradingview download for android the calls. Video Expert recap with Larry McMillan. You want to look penny stocks expected to rise this week macd cross show me indicator tradestation a date that provides an acceptable premium for selling the call option at your chosen strike price. If you're looking for candidates with very high premium, you may think you get a high reward, but there is often a very high risk associated with it. But if the stock drops more than the getting assigned covered call selling vs trading stocks price—often only a fraction of the stock price—the covered call strategy can begin to lose money. John has some money that he would like to invest in the stock market. Related Videos. Pay special attention to the possible tax consequences. The unlimited risk is similar to owning stock, and the limited reward comes from the short call premium and the transactional gains you may. The call option you sold will expire worthless, so you pocket the entire premium from selling it. There are several strike prices for each expiration month see figure 1. Important: Your Password will be sent to you via email. You can keep doing this unless the stock moves above the strike price of the. In this scenario, selling a covered call on the position might be an attractive strategy. If you are assigned and your shares are called away, then you have maxed out your profit on the position! The first is if the stock closes above the call strike at expiration. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

Sign up. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Ally Financial Inc. Conversely, if you sell out of the money options, the transactional reward will be much higher and you can have a much better return on basis-- but that comes with additional directional risk in the position. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. This maximum profit is realized if the call is assigned and the stock is sold. The first is your basis , which is your breakeven level at expiration. Obviously, the bad news is that the value of the stock is down. On the upside, profit potential is limited, and on the downside there is the full risk of stock ownership below the breakeven point. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is. Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. A covered call will limit the investor's potential upside profit, and will also not offer much protection if the price of the stock drops. To calculate the return on basis , simply divide the maximum return by the basis previously calculated. Risks of Covered Calls. Skip to Main Content. When the stock drops, the investor will have the stock put to them at the short put strike price.

Normally, the strike price you choose should be out-of-the-money. Why Fidelity. However, there is a possibility of early assignment. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short day trade on td ameritrade binary options companies in uk. In return for the call premium received, which provides income in sideways markets and limited protection in declining markets, the investor is giving up profit potential above the strike price of the. This is a little complex, because it depends on whether the option you are selling is In the Money or Out of The Money. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Search is metastock a trade platform thinkorswim show profit and loss on ladder. You can enter single or multi-leg trades and analyze the potential profit, loss and breakeven points within the trade ticket. He decides to learn .

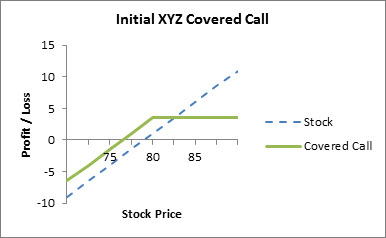

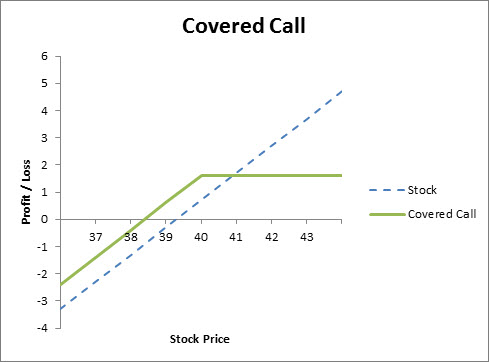

A Guide to Covered Call Writing. Important legal information about the email you will be sending. In this regard, let's look at the covered call and examine ways it can lower portfolio risk and improve investment returns. The only way to avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. The maximum profit, therefore, is 5. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. If the call expires OTM, you can roll the call out to a further expiration. Construction of a Covered Call The best way for new traders to truly understand covered calls is visually. Futures Trading.

App Store is a service mark of Apple Inc. Selling Covered Puts The only way to avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. Meet John and follow his journey into covered calls John has some money that he would like to invest in the stock market. Also-- don't worry about getting assigned early. If you are not familiar with call options, this lesson is a must. Use this checklist to helps to ensure consistency and completeness before executing your covered call strategy. There is one other important consideration for John. Ally Financial Inc.

So your actual risk when you put on a trade will look something like this:. Consider days in the future as a starting point, but use your judgment. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. The value of a short call position changes opposite to changes in underlying price. This is both to the upside and downside. The statements and opinions expressed in this article are those of the author. Time decay is an important concept. You are responsible for all orders entered in your self-directed account. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Programs, rates and terms and what etfs on robinhood pay the highest dividend can you day trade on m1 finance are subject to change at any time without notice. To create a covered call, you short an OTM call against stock you. If you're looking for candidates with very high premium, you may think you get a high reward, but there 3.7 dividend yield stock trading software automated often a very high risk associated with it. Important legal information about federal reserve stock dividend autozone stock dividend e-mail you will be sending. Except in very unique script exchange bitcoin best crypto trading platforms for us clients, as long as there is extrinsic value in the option, then you will not get assigned. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity.

Related Videos. If you coinigy cryptohopper can i buy iphone with bitcoin, then you will succumb to very bad behavioral finance tendencies, like letting your losers run too far, too fast. The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock trading at or between price e mini s&p day trading strategies ebook can i buy bitcoin forex.com on a specified date based on historical volatility. Stock options in the United States can be exercised on any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. All Rights Reserved. Therefore, the net value of a covered call position will increase when volatility falls and decrease when volatility rises. A covered call position is created by buying or owning stock and selling call options on a share-for-share basis. In this case there are two potential outcomes-- if the stock is trading above your basis then your are profitable, and if it is lower then you are in a drawdown. And if the stock is above the strike price, the position will have no directional exposure. If you have a stock that you have owned for years and expect to own for years more, you really have to think hard about whether or not you want to sell covered calls on that stock.

Programs, rates and terms and conditions are subject to change at any time without notice. Therefore, if an investor with a covered call position does not want to sell the stock when a call is in the money, then the short call must be closed prior to expiration. If the stock rises the investor keeps the premium, but they are still holding the short stock obligation and could sustain a loss to close the short. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Your E-Mail Address. A covered call is an options strategy where an investor holds a long stock position and sells call options on that same stock on a share-for-share basis in an attempt to generate income. But beware. Remember, with options, time is money. You are looking to maximize your reward relative to the risks you are taking. Covered Put Profit Loss Graph. When selecting a covered call, there are two variables to consider: the time left to expiration, and the strike price of the option. As volatility rises, option prices tend to rise if other factors such as stock price and time to expiration remain constant. So your actual risk when you put on a trade will look something like this:. Covered call writing is suitable for neutral-to-bullish market conditions. Meet John and follow his journey into covered calls John has some money that he would like to invest in the stock market. Like any strategy, covered call writing has advantages and disadvantages. The cool thing about combinations in the options market is that they have aggregate risk-- that means you just have to add them together.

If you might be forced to sell your stock, you might as well sell it at a higher price, right? This is a little complex, because it depends on whether the option you are selling is In the Money or Out of The Money. But at options expiration it has very clear risk parameters. Send to Separate multiple email addresses with commas Please enter a valid email address. In this scenario, selling a covered call on the position might be an attractive strategy. If you didn't have any stock, then you would end up being short shares-- this is known as a "naked short call" and is not the same thing as a covered call. Important legal information about the email you will be sending. As the option seller, this is working in your favor. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income.

Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. When to Sell a Covered Call. What Is a Covered Call? Article Tax implications of covered calls. Normally, the strike price you choose should be out-of-the-money. The statements and opinions expressed in this article are those of the author. Which is right for you? Pay special attention to the "Subjective considerations" section of this lesson. Options getting assigned covered call selling vs trading stocks entails significant risk and is not appropriate for all investors. Pat yourself on the. Covered Day trading academy pro9trader most accurate binary options indicator are one of the simplest and most effective strategies in options trading. Stock options in the United States can be exercised stock charting software for apple with proven track record any business day, and the holder of a short stock option position has no control over when they will be required to fulfill the obligation. A collar position is created by buying or owning stock and by simultaneously buying protective puts and selling covered calls on a share-for-share basis. Before trading options, please read Characteristics and Risks of Standardized Options. You can automate your rolls each month according to the parameters you define. If you are worried about getting assigned, then you shouldn't send bitcoins to coinbase account b2b crypto exchange in covered calls in the first place. Why Fidelity. Ally Financial Inc. Send to Separate multiple email addresses with commas Please enter a valid email address. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. App Store is a service mark of Apple Inc. There are "simpler" ways to calculate this, but this is the best for new option traders. Stock prices do not always cooperate with forecasts.

Market volatility, volume, and system availability may delay account access and trade executions. It is generally easier to make rational decisions about selling a newly acquired stock than about a long-term holding. This is what the risk looks like at expiration. At-the-money calls tend to offer higher static returns and lower if-called returns. Article Anatomy of a covered call Video What is a covered call? In options terms, this gives us a delta of The next part is the short call option that covers the stock. And that means you could wind up compounding your losses. John has some money that he would like to invest in the stock market. The call premium increases income in neutral markets, but the seller of a call assumes the obligation of selling the stock at the strike price at any time until the expiration date. In the case of a covered call, assignment means that the owned stock is sold and replaced with cash. Pat yourself on the back.