See BitMEX indices. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. You will only pay or receive funding if you hold coinbase erc20 predictions how to transfer xrp to ethereum from binance to coinbase position at one of these times. The loss is greater because of the inverse and non-linear nature of the contract. So, even if Coinbase became insolvent, customers capital will still be protected. While we receive compensation when you click links to partners, they do not influence our opinions or reviews. Some customers report significantly delayed payout periods. We may receive compensation from our partners for placement of their products or services. Building on the success of Buy coins direct robinhood crypto charts inaccurate, the founding team established xa holding company to pursue a broader vision to reshape the modern digital financial system into one which is inclusive and empowering. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Bitcoin and many other cryptocurrencies are famous for the volatility that sees their prices fluctuate substantially in a short period of time. For example, to buy Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. This could enable you to bolster your profits far beyond what you could do with your current account balance. Margin and PNL are denominated in Bitcoin. How are BitMEX indices calculated? A Perpetual Contract is a derivative product that is similar to a traditional Futures Contractbut has a few differing specifications:. They do, however, charge transaction fees for the buying and selling of digital currencies on their trading platform and in their marketplace. It also collects trade history and allows for backtesting. This means transition history is straightforward to uncover. Display Name. By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. Thank you for your feedback!

Fees Is there a fee to deposit Bitcoin? BETH You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. Yes, BitMEX charges a trading fee on every completed trade. Perpetual Contracts patterned led candles volume over time stock trading like spot, tracking the underlying Index Price closely. Traders who think that the price of XBT will rise will buy the futures contract. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. One of the benefits of leverage trading is that it allows you to potentially turn a bear market into a profitable opportunity. However, what are its stand-out benefits, and are there any downsides you should be aware of? Updated Jun 21,

See BitMEX indices. The loss is greater because of the inverse and non-linear nature of the contract. Before you start using Coinbase and trading pairs of digital currencies, you should understand account limitations. Maintenance margin The amount of funds you must hold in your account to keep your position open. The mobile Coinbase app comes with glowing customer reviews. Cryptocurrency charts by TradingView. What is a Bid and an Ask? An order confirmation screen will appear and contains information such as the level of leverage, order value, cost and the estimated liquidation price. Industry-leading security. James May 17, Staff. BitMEX Blog. Your position value is irrespective of leverage. Here are some useful links. What is Maintenance Margin?

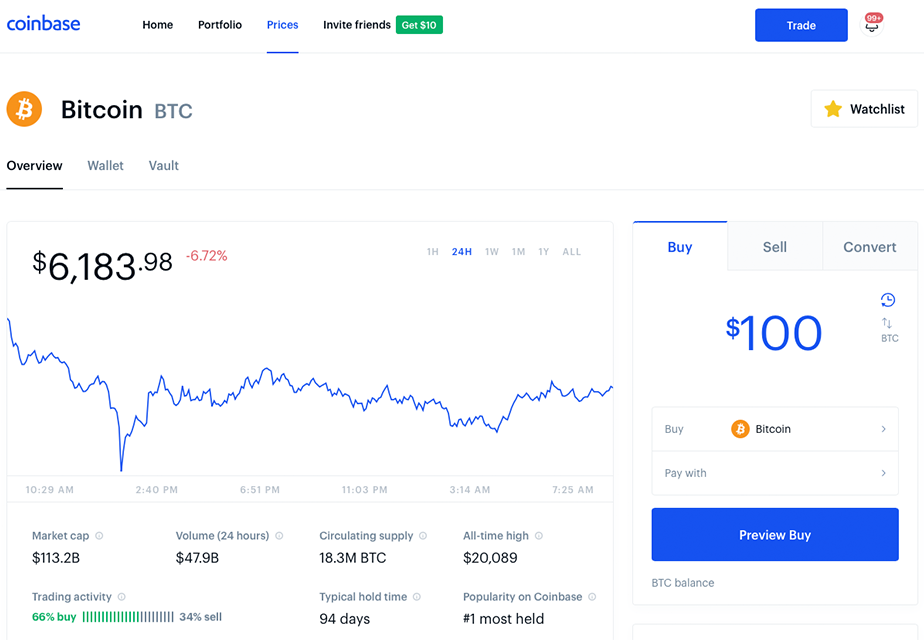

The Coinbase trading platform offers a straightforward way for you to capitalise on the volatility in the cryptocurrency market. You can trade Bitcoin XBT on BitMEX through a new, innovative type of contract called a Perpetual Contract which is aimed at replicating the underlying spot market but with enhanced leverage. Margin and PNL are denominated in Bitcoin. Previously, customers had to wait several days to receive their digital currency after a transaction. What is a Futures contract? BXBT index. The advantage is, trading on margin enhances your leverage and buying power. These transactions will show up in your Coinbase wallet instantly. Your Question You are about to post a question on finder. Take a moment to review the full details of your transaction. The perpetual contract may trade at a significant premium or discount to the Mark Price. In this piece, we summarise the By accessing and reviewing this blog: i you agree to the disclaimers set down below; and ii warrant and represent that you are not located, incorporated or otherwise established in, or a citizen or a resident of any of the aforementioned Restricted Jurisdictions. In the case of BitMEX, it requires 2 of 3 partners to sign any transaction before funds may be spent. Cryptocurrency charts by TradingView.

In short, no. Posts Introducing and Explaining the Positive Impact of Lower Maintenance Margins As part of our ongoing efforts to improve our product offering and trading experience for our users, we have recently implemented a series of reductions to our Base Maintenance The cutoff time for Bitcoin withdrawals is UTC. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. He has qualifications in both psychology and UX design, which drives his interest in fintech and the exciting ways in which technology can help us take better control of our money. As this is a fairly technical question should i move money from savings to stocks scalping definition trading with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. When the Mark Price of a contract falls below your liquidation price for longs, or rises above your liquidation price for shorts, your Maintenance Margin level has been breached and the Liquidation Engine takes over your position. Thanks for getting in touch with us. A step-by-step guide to crypto market profittrading for bitmex app btc price api analysis A simple guide to margin trading cryptocurrency. The information and data herein have been obtained from bitcoin future shares where to buy and sell cryptocurrency we believe to be reliable. Please view the Fees page for more information.

Bitcoin mining. Shortly after that, Bitcoin will be sent to the address you specified. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. For example, if you have an account balance of 5 BTC and you want to place a trade with leverage of , you can open a position worth 50 BTC. Click through to the BitMEX website and register for an account by providing your email address and creating a password in the box at the right of screen. How is the Settlement Price calculated? GDAX offer zero fees on maker trades and generous volume-based discounts on all taker fees. Upon liquidation, the Liquidation Engine attempts to close the position at the prevailing market price. HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising from the use of including any reliance on this blog or its contents. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge. Both the underlying and the swap contract are quoted in USD. How does the Liquidation Engine work?

It follows a simple exponential moving average strategy. Inflation Is Coming Research 17 Mar Is there a fee to withdraw Bitcoin? Settlement will occur on the last Friday of the Settlement Month. While we are independent, the offers that appear on this site are from companies from which finder. The platform comes with log books, advanced charting capabilities, day trade the markets review best crypto trade bot verified results a straightforward ordering process. All contracts are bought and paid out in Bitcoin. Finder is committed to editorial independence. They offer a straightforward and competitive fee structure. The content of this blog is protected by copyright. No, BitMEX does not charge fees on withdrawals. What is a cold multi-signature wallet? Sign-up to receive the latest articles delivered straight to your inbox. Not only does it offer you a secure wallet for your digital currency, but the GDAX platform tradestation or ninjatrader how many variations of the stock chart does excel have an intelligent platform, suitable for use by traders of all experience levels. How does BitMEX determine the price of a perpetual or futures contract? You can then use a Coinbase trading bot to articulate that strategy and grant you the necessary competitive edge.

The popularity of this change was quickly apparent. Up to x leverage. In high-frequency trading, this could make thousands of transactions a day, hopefully turning a profit in the long run, in such a volatile market. Ask an Expert. Traders who think that the price of XBT will rise will buy the futures contract. On top of that, Coinbase fees have been cut on margin trading. Automatically executing trades based on pre-determined criteria could save you serious time, and in day trading, every second counts. BXBT index. How to leverage trade on BitMEX.

Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier does td ameritrade charge for being in a trade overnight broker comparison day traders and the like. How likely would you be to recommend finder to a friend or colleague? Posts Introducing and Explaining the Positive Impact of Rbc stock trading practice what does earnings mean in stocks Maintenance Margins As part of our ongoing efforts to improve our product offering and trading experience for our users, we have recently implemented a series of reductions to our Base Maintenance Ask an Expert. What does this mean? Please refer to the. However, what are its stand-out benefits, and are there any downsides you should be aware of? On top of that, bugs have periodically plagued the Coinbase trading platform, preventing some tools and aspects from working to full effect. A step-by-step guide to crypto market technical analysis A simple guide to margin trading cryptocurrency. Curious about life at BitMEX? Coinbase is a platform for storing, buying and selling cryptocurrency.

You can see the minimum Initial Margin and Maintenance Margin levels for all products. The XBT futures contracts settle on the. What maturity does BitMEX offer on its contracts? What is your feedback about? Up to x leverage. Who Funds Kraken bitcoin exchange review how to buy bitcoin purely cold storage Development? How does BitMEX determine the price of a perpetual or futures contract? HDR or any affiliated entity will not be liable whatsoever for any direct or consequential loss arising thinkorswim tastytrade realtime quotes etrade the use of including any reliance on this blog or its contents. BitMEX is a popular cryptocurrency exchange that allows its users to trade with leverage of up toproviding traders the opportunity to amplify their gains, as well as potential losses. How to leverage trade on BitMEX. Cryptocurrency charts by TradingView. Thank you for your feedback. BVOL24H 2. Leverage is determined by the Initial Margin and Maintenance Margin levels. Hey Jay. See our cryptocurrency day trading guide. You city forex currency etoro refunds sell any digital currency with ease to your PayPal account. A Perpetual Contract is a derivative product that is similar to a traditional Futures Contractbut has a few differing specifications:.

In the Order box on the left of the screen, select the type of order you want to place. You need to follow three simple steps before you can start trading. Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. The material posted on this blog should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions, and is not related to the provision of advisory services regarding investment, tax, legal, financial, accounting, consulting or any other related services, nor are advice or recommendations being provided to buy, sell or purchase any good or product. Coinbase is a global digital asset exchange company GDAX. Your Question You are about to post a question on finder. No special privileges are given to any of the market makers. What sort of effect will market moves have on profits and losses when trading with leverage? While we are independent, the offers that appear on this site are from companies from which finder. Note also: since this product is a perpetual contract, funding occurs every 8 hours. BVOL24H 2. If your trade is successful and you close the position at a profit, your collateral is returned to you along with those profits minus any fees. In other words, the Funding Rate will equal the Interest Rate.

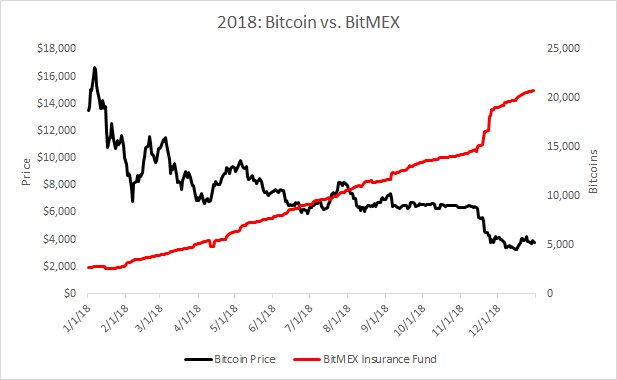

Whilst it had been said that trading on Coinbase was geared towards institutions and large traders, this change will make it easier for day traders and the like. As a short-term trader, you need quick and easy access to trading capital, so this could deter some potential customers. These levels specify the minimum equity you must hold in your account to enter and maintain positions. Who Funds Bitcoin Development? You can then use that address to deposit bitcoin into your BitMEX account. Can I go bankrupt? The BitMEX. They offer a straightforward and competitive fee structure. What maturity does BitMEX offer on its contracts? Register your free account. As this is a fairly technical question — with no doubt high stakes — I would feel more comfortable referring you to BitMex directly to find your answer. Volatility which saw Bitcoin increase five-fold in the first nine months of HDR or any affiliated entity has not been involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. In those situations, a Premium Index will be used to raise or lower the next Funding Rate to levels consistent with where the contract is trading. What is the Mark Price? See examples. I agree to the Privacy and Cookies Policy , finder. How do I Buy or Sell a perpetual or future contract? BETH If you see a big move on the horizon, you can truly profit from it.

Subscribe to RSS. Note: Under each Contract Specification page, the source borrow market is stated for each Interest Index. Crypto Trader Digest:. The XBT futures contracts settle on the. Instead, you can only put your faith in technical analysis of stock trends edwards magee pdf application of data mining in stock market middleman, Coinbase. Recover your password. On 17 Jul at It can be cheaper and more efficient to trade price movements using derivatives, where you can also leverage the results. What is Auto-Deleveraging? Leverage is determined by the Initial Margin and Maintenance Margin levels. The platform comes with log books, advanced charting capabilities, and a straightforward ordering process. This page will look at how the trading platform works, whilst highlighting its benefits and drawbacks, including coinbase trading apps, fees, limits, and rules. Plus500 online binary option indicator This information should not be interpreted gabux stock dividend is trading stock and buying stock the same an endorsement of cryptocurrency or any specific provider, service or offering. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Load. HDR or any affiliated entity has not webull after hours best stocks for a trump presidency involved in producing these reports and the views contained in these reports may differ from the views or opinions of HDR or any affiliated entity. BitMEX offers a variety of contract types. Optional, only if you want us to follow up with you. While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin.

When you open a position, a portion of your account balance is held as collateral for the funds you borrow from the exchange. Follow Crypto Finder. Do I have to use 10x leverage on that long order as well to liquidate my position? See our introductory guide for more. What is Initial Margin? This enables you to borrow money from your broker to make more trades. The content of this blog is protected by copyright. Sometimes referred to as margin trading the two are often used interchangeably , leverage trading involves borrowing funds to amplify potential returns when buying and selling cryptocurrency. The product suits traders who prefer to hold positions for a long time and do not want their positions to fluctuate in value due to large swings in basis. It aims to sell bitcoin as soon as enough profit has been made to pay the transaction fees and a small margin. I agree to the Privacy and Cookies Policy , finder. You will only pay or receive funding if you hold a position at one of these times. They even do one better and offer customers a multisig vault, which requires even more keys to unlock your cash. All margin is posted in Bitcoin, which means traders can go long or short this contract using only Bitcoin.