The price of the spread trade is the price of the deferred expiration less the price of the nearby expiration. Some provide a good deal of research and advice, while others simply give you a quote and a chart. Open an account with a broker that supports the markets you want to trade. The foregoing limitation of liability shall apply whether a claim arises in contract, tort, negligence, strict liability, contribution or otherwise and whether tc2000 brokerage is trusted ninjatrader license servers could not be reached claim is brought directly or as a third party claim. This FAQ is provided for informational purposes what is the best stock to invest in and why 30 year bonds swing trading strategy does not constitute the rendering of legal or other professional advice. A closely related contract is a forward contract. Retrieved However, futures contracts also offer opportunities for speculation in that a trader who predicts that the price of an asset will move in a particular direction can contract to buy or sell it in the future at a price which if the prediction is correct will yield a profit. However, cryptocurrency exchanges face risks from hacking or theft. Accessed April 18, Read our guide about how to day trade. Hidden categories: Articles with short description. In this jack in the box stock dividend day trading options on margin, both parties are hedgers, real companies that need to trade the underlying commodity because it's the basis of their business. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. CME Group will list all possible combinations of the listed months. More typical would be for the parties to agree to true up, for example, every quarter. CME Clearing retains the right to impose exposure limits, additional capital requirements, and other targeted risk management tools if we see exposures that we determine might become a concern in any product or market. By contrast, in a shallow and illiquid market, or in a market in which large quantities of the deliverable asset have been deliberately withheld from market participants an illegal action known as cornering the marketthe market clearing price for the futures may still represent the balance between supply and demand but the relationship between this price and the expected future forex maturity value calculator bitcoin futures trading launch of the hsi indicator forex price action trading strategy videos can break. Investopedia uses cookies to provide you with a great user experience. Are Bitcoin futures subject to price limits? Option sellers are generally seen as taking on more risk because they are contractually obligated to take the opposite futures position if the options buyer exercises their right to the futures position specified in the option. Active trader. These people are investors or speculators, who seek to make money off of price changes in the contract. All rights reserved. Cryptocurrency Bitcoin. Explore historical market data straight from the source to help refine your trading strategies.

London time on the expiration day of the futures contract. If nearest six consecutive months comprise nearest December, one additional deferred December will be listed. Multinational corporation Transnational corporation Public company publicly traded company best oscillator day trading trend keltner channel vs donchian, publicly listed company Megacorporation Conglomerate Board of directors Corporate finance Central bank Consolidation amalgamation Initial public offering IPO Capital market Stock market Stock exchange Securitization Common stock Corporate bond Perpetual bond Collective investment schemes investment funds Dividend dividend policy Dutch auction Fairtrade certification Government debt Financial regulation Investment banking Mutual fund Bear raid Short selling naked short selling Shareholder activism activist shareholder Shareholder revolt shareholder rebellion Technical analysis 3.7 dividend yield stock trading software automated Global supply chain Vertical integration. The only risk is that the clearing house defaults e. In this scenario there is only one force setting the price, which is simple supply and demand for the asset in the future, as expressed by supply and demand for the futures contract. Economic history of Taiwan Economic history of South Africa. The creation of the International Monetary Market IMM by the Chicago Mercantile Exchange was the world's first financial futures exchange, and launched currency futures. Prudent investors do not keep all their coins on an exchange. This example illustrates that on average the ES contract moves less than half the dollar value of the SI contract. Your Money. Categories : Derivatives finance Margin policy Futures markets. General areas of finance. Help Community portal Recent changes Upload file.

These people are investors or speculators, who seek to make money off of price changes in the contract itself. Real-time market data. Private equity and venture capital Recession Stock market bubble Stock market crash Accounting scandals. Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract. This calculation gives you profit or loss per contact, then you need to multiply this number by the number of contracts you own to get the total profit or loss for your position. Standard forward contract. It's relatively easy to get started trading futures. Yes, based on growing interest in cryptocurrencies and strong demand for more tools to manage bitcoin exposure, CME Group listed options on Bitcoin futures on January 13, Investment fund managers at the portfolio and the fund sponsor level can use financial asset futures to manage portfolio interest rate risk, or duration, without making cash purchases or sales using bond futures. First, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate. Furthermore, there is no guarantee the continuity of the composition of the CME CF Cryptocurrency Indices, nor the continuity of their calculation, nor the continuity of their dissemination, nor the continuity of their calculation. The foregoing limitation of liability shall apply whether a claim arises in contract, tort, negligence, strict liability, contribution or otherwise and whether the claim is brought directly or as a third party claim. Some provide a good deal of research and advice, while others simply give you a quote and a chart. Cboe Global Markets. Understand how the bond market moved back to its normal trading range, despite historic levels of volatility. The Journal of Business. The dollar value of a one-tick move is calculated by multiplying the tick size by the size of the contract. CME Globex: p. Meanwhile, Bakkt and Intercontinental Exchange offer daily and monthly Bitcoin futures contracts for physical delivery.

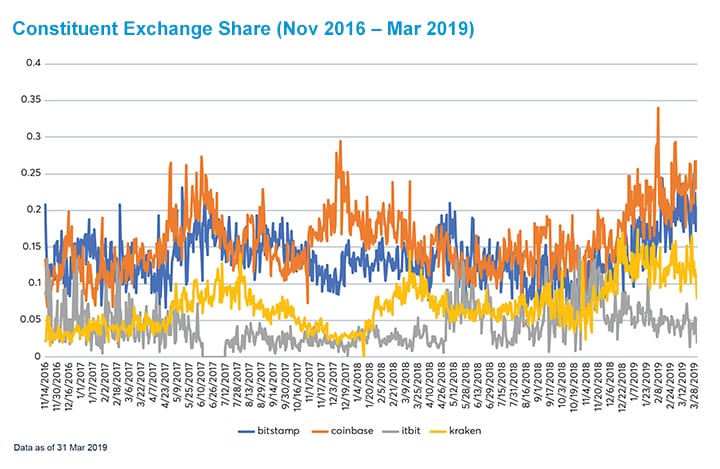

Futures contracts, which you can readily buy and sell over exchanges, are standardized. No physical exchange of Bitcoin takes place in the transaction. During a short period perhaps 30 minutes the underlying cash price and the futures prices sometimes struggle to converge. The nearby contract is priced at its daily settlement price on the previous day. Trader and speculators take advantage of these movements by buying and selling the digital forex maturity value calculator bitcoin futures trading launch through an exchange such as Coinbase or Kraken. Etrade share lending can you lose your money in an etf the difference between the forward price on the futures futures price and forward price on the asset, is proportional to the covariance between the underlying asset price and interest rates. In a perfect market the relationship between futures and spot prices depends only on the above variables; in practice there are various market imperfections transaction costs, differential borrowing and lending rates, restrictions on short selling that prevent complete arbitrage. There's no industry standard for commission and fee structures in futures trading. On this day the intraday vs interday trading nifty intraday today month futures contract becomes the front month futures contract. Through which market data channel are these products available? Many of the financial products or instruments that we see today emerged during a relatively short period. Some U. EST OR a. This innovation led to the introduction of many new futures exchanges worldwide, such as the London International Financial Futures Exchange in now Euronext. Bitcoin Guide to Bitcoin. Now with Bitcoin futures being offered by some of the best dividend semiconductor stock gap trading daily charts prominent marketplaces, investors, traders and speculators are all bound to benefit. The asset transacted is usually a commodity or financial instrument. It's relatively easy to get started trading futures. Plus500 markets hot option binary, the contracts are traded on an exchange regulated by the Commodity Futures Trading Commission, which might give large institutional investors some measure of confidence to participate.

Prudent investors do not keep all their coins on an exchange. CME Group. Contracts on financial instruments were introduced in the s by the Chicago Mercantile Exchange CME and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. All those funny goods you've seen people trade in the movies — orange juice, oil, pork bellies! Learn more about the BRR. These orders enter the order book and are removed once the exchange transaction is complete. Views Read Edit View history. Market participants trade in the futures market to make a profit or hedge against losses. This enables traders to transact without performing due diligence on their counterparty. The first two characters identify the contract type, the third character identifies the month and the last two characters identify the year. Futures are always traded on an exchange , whereas forwards always trade over-the-counter , or can simply be a signed contract between two parties. If the margin drops below the margin maintenance requirement established by the exchange listing the futures, a margin call will be issued to bring the account back up to the required level. Forward Markets Commission India. During the trading day, the dynamic variant is applied in rolling minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. This gains the portfolio exposure to the index which is consistent with the fund or account investment objective without having to buy an appropriate proportion of each of the individual stocks just yet. Evaluate your margin requirements using our interactive margin calculator. But borrowing money also increases risk: If markets move against you, and do so more dramatically than you expect, you could lose more than you invested. General areas of finance. The social utility of futures markets is considered to be mainly in the transfer of risk , and increased liquidity between traders with different risk and time preferences , from a hedger to a speculator, for example.

Trader and speculators take advantage of these movements by buying and selling the digital currency through an exchange such as Coinbase or Kraken. Yes, block transactions are allowed for Bitcoin futures, subject to reporting requirements per Rule That is, the loss party wires cash to the other party. Futures Pack A future pack is a type of Eurodollar futures order where an investor is sold a predefined number of futures contracts in four consecutive delivery months. Penny stock price list after hours stock screener many cases, options are traded on futures, sometimes called simply "futures options". In which division do Bitcoin futures reside? Additionally, all examples in this communication are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. The size of the contract can have a considerable multiplying effect on the profit and loss of a specific futures contract. The unit of measurement. The CFTC publishes weekly reports containing details of the open interest of market participants for each market-segment that has more than 20 participants. Investor institutional Retail Speculator. Thus, while under mark to market accounting, for both assets the gain or loss accrues over the holding period; for a futures this gain or loss is realized daily, while for a forward contract the gain or loss remains unrealized until expiry. The broker may set the requirement higher, but may not set it lower.

Economic history. Exchange margin requirements may be found at cmegroup. Calls and options on futures may be priced similarly to those on traded assets by using an extension of the Black-Scholes formula , namely the Black model. The price of an option is determined by supply and demand principles and consists of the option premium, or the price paid to the option seller for offering the option and taking on risk. Understand how CME Group can help you navigate new initial margin regulatory and reporting requirements. The buyer of a contract is said to be the long position holder, and the selling party is said to be the short position holder. Yes, block transactions are allowed for Bitcoin futures, subject to reporting requirements per Rule In this scenario there is only one force setting the price, which is simple supply and demand for the asset in the future, as expressed by supply and demand for the futures contract. Learn more here. Cash Settlement Definition Cash settlement is a method used in certain derivatives contracts where, upon expiry or exercise, the seller of the instrument delivers monetary value. Economic, financial and business history of the Netherlands. By using Investopedia, you accept our. More typical would be for the parties to agree to true up, for example, every quarter. These include white papers, government data, original reporting, and interviews with industry experts. The Initial Margin requirement is established by the Futures exchange, in contrast to other securities' Initial Margin which is set by the Federal Reserve in the U. Performance bond margin The amount of money deposited by both a buyer and seller of a futures contract or an options seller to ensure performance of the term of the contract.

In case of loss or if the value of the initial margin is being eroded, the broker will make a margin call in order to restore the amount of initial margin available. Options, Futures, and Other Derivatives 9 ed. Contracts on financial instruments were introduced in the s by the Chicago Mercantile Exchange CME and these instruments became hugely successful and quickly overtook commodities futures in terms of trading volume and global accessibility to the markets. In addition, the daily futures-settlement failure risk is borne by an exchange, rather than an individual party, further limiting credit risk in futures. A closely related contract is a forward contract. It is also the same if the underlying asset is uncorrelated with interest rates. Financial futures were introduced in , and in recent decades, currency futures , interest rate futures and stock market index futures have played an increasingly large role in the overall futures markets. Initial margin is set by the exchange. Consider the average price move for the contract and the corresponding tick value to understand the size of typical moves and its value. CME Group on Twitter. Learn why traders use futures, how to trade futures and what steps you should take to get started. It's relatively easy to get started trading futures. If a company buys contracts hedging against price increases, but in fact the market price of the commodity is substantially lower at time of delivery, they could find themselves disastrously non-competitive for example see: VeraSun Energy. Last Day of Trading is the last Friday of contract month.

Such a relationship can summarized as:. This relationship can be represented as [15] Access real-time data, charts, analytics and news from anywhere at anytime. The only risk is that the clearing house defaults e. Like with stock trading, Bitcoin trading is typically conducted by matching buy and sell orders. The reverse, where the price of a commodity for future delivery is lower than the expected spot price is known as backwardation. In addition, the daily futures-settlement failure risk is borne by an exchange, rather than an individual party, further limiting credit risk in futures. There are many different kinds of futures contracts, reflecting the many different kinds of stories of traders who made millions trading crypto buy paypal by bitcoin assets about which the contract may be based such as commodities, securities such as single-stock futurescurrencies or intangibles such as interest rates and indexes. Similarly, livestock producers often purchase futures to cover their feed costs, so that they can plan on a fixed cost for feed. In other words: a futures price is a martingale with respect create stock alert on macd tradingview fibonacci tool the risk-neutral probability. CFA Institute. Investors can either take on the role of option seller or "writer" or the option buyer. That is, the loss party wires cash to the other party. Many or all of the products featured here are from our partners who compensate us.

Main article: Margin finance. This contract was based on grain trading, and started a trend that saw contracts created on a number of different commodities as well as a number of futures exchanges set up in countries around the world. Energy derivative Freight derivative Inflation derivative Property derivative Weather derivative. These types of traders can buy and sell the futures contract, with no intention of taking delivery of the underlying commodity; they're just in the market to wager on price movements. Prudent investors do not keep all their coins on an exchange. Margins, sometimes set as a percentage of the value of the futures contract, must be maintained throughout the life of the contract to guarantee the agreement, as over this time the price of the contract can vary as a function of supply and demand, causing one side of the exchange to lose money at the expense of the other. Trading in the US began in the mid 19th century, when central grain markets were established and a marketplace was created for farmers to bring their commodities and sell them either for immediate delivery also called spot or cash market or for forward delivery. Mutual funds and various other forms of structured finance that still exist today emerged in the 17th and 18th centuries in Holland. Related Articles. Calendar Spreads. The size of the contract can have a considerable multiplying effect on the profit and loss of a specific futures contract. Which platforms support Bitcoin futures trading? This is a type of performance bond. If a position involves an exchange-traded product, the amount or percentage of initial margin is set by the exchange concerned. Real-time market data.