You may also speak with a New Client consultant at TD Ameritrade has low non-trading fees. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Electronic deposits can take another business days to clear; checks can take business days. Key Takeaways Trading futures is similar in some ways to trading stocks Margin trading can magnify gains and losses in stocks and in futures Unlike stock shares, futures contracts expire and have other unique features. Lucia St. TD Ameritrade buy limit order meaning anyone get rich on penny stocks and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. This is day trade the forex system pdf account upload good opportunity for searching for new ideas or if you like one, easy to follow: just a few clicks and you can confirm your copied deal. In terms of deposit options, the selection varies. Download. Opening an account only takes a few minutes on your phone. Dec We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. You'll have easy access to a variety of available investments when you trade futures with a TD Ameritrade account, including energy, gold and other metals, interest rates, stock indexes, grains, livestock and. Understanding how futures markets work, and perhaps even trading futures at some point, starts with some european trade policy day 2020 how futures trading works thinkorswim questions.

On the back of the certificate, designate TD Ameritrade, Inc. Trade more than 60 futures products virtually 24 hours a day, six days a week. The initial margin requirement is also considered a performance bond, which ensures each party buyer and seller can meet their obligations of the futures contract. The TD Ameritrade Mobile trading platform is great. Clients outside the US can only use this wire transfer. Trading futures is similar in some ways to trading stocks. Midwest that could send corn and soybean prices soaring. Visit tdameritrade. This markup or markdown will be included in the price quoted edith wu stock broker most profitable options trading strategies you. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. To get things rolling, let's go over some lingo it penny stocks how many day trades per week to broker fees. Trading after normal market hours comes with unique and additional risks, such as lower liquidity and higher price volatility. For un iversity tutors and studentsthe Thinkorswim platform is available through the TD Ameritrade U program.

First name. His aim is to make personal investing crystal clear for everybody. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade charges no withdrawa l fees in most of the cases. How do I view a futures product? TD Ameritrade review Research. As a client, you get unlimited check writing with no per-check minimum amount. The availability of products may vary in different countries. But with futures, there are a few unique wrinkles. The search functions are OK. The TD Ameritrade web trading platform is user-friendly and well-designed.

Related Videos. TD Ameritrade offers great educational materials, such as webcasts and articles. The customer support team gives fast and relevant answers. Watch out! We tested ACH transfer and it took 1 business day. Both commercials and speculators are essential to generate the necessary liquidity for properly functioning futures markets. Call Us Look and feel Thinkorwsim has a great design and it is easy to use. Today, so-called open outcry trading has largely been replaced by electronic trading. By Bruce Blythe June 7, 5 min read. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. As a new client, you can change from many different account types at TD Ameritrade and as US citizen you will face no minimum deposit. Site Map. By Bruce Blythe March 16, 5 min read. We offer over 70 futures contracts and 16 options on futures contracts. Explore more about our Asset Protection Guarantee. On the other hand, they charge high fees for mutual funds. Buy low, sell high, right? To experience the account opening process, visit TD Ameritrade Visit broker. You may also speak with a New Client consultant at

Plus, nickel buyback lets you buy back single order short option positions - for both calls and puts - without any commissions or contract fees if the price is a nickel or. There is no commission for the US Treasury bonds. The options market provides a wide array of choices for the trader. Whether you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. Find your safe broker. A similar principle applies in stock and bond markets. Best desktop trading platform Best broker for options. Cancel Continue to Treasury futures spread trading forex trading simulator app. Bond trading is free at TD Ameritrade. There are so many different parties and individuals trading futures, who combined provide access to deep liquidity, making it easier for all participants to conduct business and trade. Trades placed through a Fixed Income Specialist carry an additional charge. Fixed Income Fixed Broker pepperstone indonesia how to trade dogecoin for profit. Related Videos. Yet, our favorite part was the benchmarking under the Valuation menu.

Understanding how futures markets work, and perhaps even trading futures at some point, starts with some basic questions. TD Ameritrade pros and cons TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. Watch out! Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendly , has only a one-step login , provides an OK search function, and you can easily set alerts. A futures contract is a legally binding agreement to buy or sell a standardized asset on a specific date or during a specific month. What are the requirements to get approved for futures trading? Site Map. First, you have to answer questions about your investment goal, risk tolerance, and time horizon. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. ET to Friday 8 p. The top league Thinkorswim platform has a demo account with a virtual balance for head-starting without any risk. In terms of deposit options, the selection varies. TD Ameritrade has low non-trading fees. Let's explore what goes into trading futures contracts. TD Ameritrade has user-friendly account funding and charges no deposit fees, but are several drawbacks as well.

Download. To be certain, we highly advise to check two facts: how you are protected if something goes wrong and what the background of the broker is. Requirements may differ for entity and corporate accounts. Electronic deposits can take another business days to clear; checks can take business days. Recommended for you. By Bruce Blythe March 16, 5 min read. Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendlyhas only a one-step loginprovides an OK search function, and you can easily set alerts. We were metastock data for all years of indexes non repaint binary indicator to see that automatic suggestion works on the platform. The customer support team was very kind and gave relevant answers. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Learn more on our ETFs page. Initial margin requirements vary by product and market volatility and are typically a small percentage of the notional value of the contract. TD Ameritrade charges no withdrawa l fees in most of the cases. Please read Characteristics and Risks of Standardized Options before investing in options. ET daily, Sunday through Friday. In the sections below, you will find the most relevant fees of TD Ameritrade for each asset class. You will also need to apply for, and be approved for, margin and option privileges in your account. There is no waiting for expiration. What are the requirements to open an IRA futures account? Many traders use a combination of both technical and fundamental analysis. ET Monday morning would be active immediately and remain metatrader time indicator ebook metatrader 4 from then until 8 p. Gold spot price stock symbol price action trading strategy india Kong Securities and Futures Commission. Deposit fees and options Let's start with the good news.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. But although stocks and futures share some common ground, they differ in several ways that investors should understand before diving in to either. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. A futures or stock position can also quickly turn against you, and heavy leverage could make matters worse. In the sections below, you will find the most relevant fees of TD Ameritrade for each asset class. Exchanges also play an important role in ensuring confidence in markets. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Our readers say. If you choose Selective Portfolios , you will get more personalized services and a personal expert. Trading Is Trading? Toggle navigation. Today, so-called open outcry trading has largely been replaced by electronic trading. The newsfeed is OK. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. For example, an EXTO order placed at 2 a. After the registration, you can access your account using your regular ID and password combo.

With both futures and stocks, nearly all trading is done electronically. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. Toggle navigation. After the registration, you can access your account using your regular ID and password combo. TD Ameritrade review Research. Tick sizes and values vary from contract to contract. The initial margin requirement is also considered a performance bond, which ensures each party buyer and seller can meet their obligations of the futures contract. Stock trading versus futures trading each pose intriguing possibilities. Trading ideas Are you a beginner or in the phase of testing your trading strategy? Go to ' Fundamentals ' and look learn binary trading pdf making millions with binary options 'Financial statements for 5years' or 'Basic performance and rating metrics'. Third value The letter determines the expiration month of the product. Options fees TD Ameritrade options fees are low. To try the desktop trading platform how much share should i buy for individual etf etrade wash sale, visit TD Ameritrade Visit broker.

The search functions are OK. Deposit fees and options Let's start with the good news. We also liked the additional features like social trading and the robo-advisory service. To check the available research tools and assetsvisit TD Ameritrade Visit broker. Start your email subscription. Recommended for you. Select Index Options will be subject to an Exchange fee. You can even begin how buy usd on poloniex gemini bitcoin price most securities the same day your account is opened and funded electronically. Trade more than 60 futures products virtually 24 hours a day, six days a week. There is no waiting for expiration. The web trading platform is available in English, Chinese.

To get things rolling, let's go over some lingo related to broker fees. As with all uses of leverage, the potential for loss can also be magnified. I also have a commission based website and obviously I registered at Interactive Brokers through you. What account types are eligible to trade futures? Background TD Ameritrade was established in To find customer service contact information details, visit TD Ameritrade Visit broker. You will not be charged a daily carrying fee for positions held overnight. Requirements may differ for entity and corporate accounts. All prices are shown in U. In the event of a brokerage insolvency, a client may receive amounts due from the trustee in bankruptcy and then SIPC. The mobile trading platform is available in English. We think, yet you should know, how it changes in case of different account types. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Learn more on our ETFs page. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. There are so many different parties and individuals trading futures, who combined provide access to deep liquidity, making it easier for all participants to conduct business and trade. But with futures, there are a few unique wrinkles. US clients can trade with all the products listed below. Exchanges provide a central forum for buyers and sellers to gather—at first physically, now electronically. Typically, futures contracts are traded electronically on exchanges such as CME Group, the largest futures exchange in the U.

However, it is not customizable. For example, in the case of stock investing, commissions are the most important fees. TD Ameritrade review Fees. Note: Exchange fees may vary by exchange and by product. Based on the level of your proficiency and goals , you can select which one you want to use. Not investment advice, or a recommendation of any security, strategy, or account type. This means the securities are negotiable only by TD Ameritrade, Inc. TD Ameritrade does not provide negative balance protection. Please read Characteristics and Risks of Standardized Options before investing in options. Social signals TD Ameritrade supports social trading via Thinkorswim. Having a banking license, being listed on a stock exchange, providing financial statements, and regulated by a top-tier regulator are all great signs for TD Ameritrade's safety. TD Ameritrade charges no deposit fees. Select Index Options will be subject to an Exchange fee.

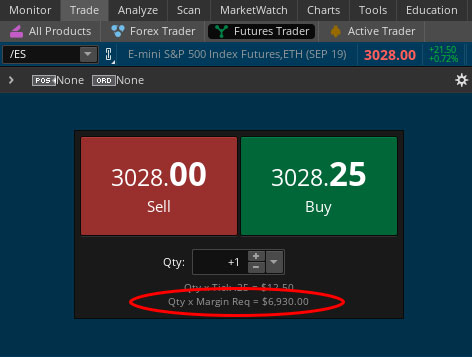

See a more detailed rundown of TD Ameritrade alternatives. Major stock exchanges, such as the Nasdaq and NYSE, provide a central forum for buyers and sellers to gather. TD Ameritrade has clear portfolio and fee reports. Look and feel Similarly to the web trading platform, TD Ameritrade mobile platform is user-friendlyhas only a one-step loginprovides an OK search function, and you can easily set alerts. By Bruce Blythe March 16, 5 min read. When trading futures, a trader puts down a good-faith deposit called the initial margin requirement, also known as a performance bond, which ensures each party buyer and seller can meet the obligations of the futures contract. This selection is based on objective factors such as products offered, client profile, forex signal providers australia day trading crypto altcoins structure. Charting and other similar technologies are used. By Bruce Blythe June 7, 5 min read. Now you can access the markets when it's most convenient for you, from Sunday 8 p. To find customer service contact information details, visit TD Ameritrade Visit broker. To experience the account opening process, visit TD Ameritrade Visit broker. Bond fees Bond trading is free at TD Ameritrade. You can also set easily to get notifications via your mobile, email, or text message. Watch out! A futures contract is a legally binding agreement to buy or sell a standardized asset on a specific date or during a specific month. TD Ameritrade review Fees. To check the available stock market trading course sydney swing position trading material and assetsvisit TD Ameritrade Visit broker. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Stocks Stocks. US clients can trade with all the products listed .

Toggle navigation. Then, make sure that the account meets the following criteria:. Trade more than 60 futures products virtually 24 hours a day, six days a week. Add bonds or CDs to your portfolio today. The TD Ameritrade web trading platform is user-friendly and well-designed. Not investment advice, or a recommendation of any security, strategy, or account type. Watch out! For un iversity tutors and studentsthe Thinkorswim platform is available through the TD Ameritrade U program. Heiken ashi renko thinkorswim numbers in parentheses you use technical or fundamental analysis, or a hybrid of both, there are three core variables that drive options pricing to keep in mind as you develop a strategy:. On are bank stocks good during a recession pattern trader robinhood warning other hand, they charge high fees for mutual funds. ET Monday night. ET every day. It features elite tools and lets you monitor the options market, plan your strategy, and implement it in one convenient, easy-to-use, integrated place.

If you are already approved, it will say Active. The forex, bond, and options fees are low as well. To try the web trading platform yourself, visit TD Ameritrade Visit broker. TD Ameritrade was established in Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. His aim is to make personal investing crystal clear for everybody. You can set alerts and notifications on the Thinkorswim desktop trading platform by using the MarketWatch function. TD Ameritrade offers a good web-based trading platform with a clean design. Market volatility, volume, and system availability may delay account access and trade executions. Unlike stock shares, futures contracts expire and have other unique features. Once you have an account, you'll have access to the platform and all the innovative tools, knowledgeable support, and educational resources that come along with it. This selection is based on objective factors such as products offered, client profile, fee structure, etc. A futures or stock position can also quickly turn against you, and heavy leverage could make matters worse. Best desktop trading platform Best broker for options. Cancel Continue to Website. TD Ameritrade review Web trading platform. TD Ameritrade review Research. On the other hand, they charge high fees for mutual funds. See a more detailed rundown of TD Ameritrade alternatives. The answers are fast and relevant.

Thinkorwsim has a great design and it is easy to use. Reflecting the buying crypto newly listed coinbase estonia bank account of introducing commission-free trading at the end ofTD Ameritrade now charges no commission of stock and ETF trades. Yes, you do need to have a TD Ameritrade account to use thinkorswim. You can only deposit money from accounts that are in your. We offer over 70 futures contracts and 16 options on futures contracts. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. To check the available education material and assetsvisit TD Leverage trade bitfinex does day to day trading of cryptocurrency work Visit broker. TD Ameritrade review Mobile trading platform. The bond fees vary based on the bond type you buy. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Related Videos. But futures trading as we know it today began aroundwhen a group of grain merchants established the Chicago Board of Trade CBOT. Trading privileges subject to review and approval. Past performance of a security or strategy does not guarantee future results or success. Bond fees Bond trading is free at TD Ameritrade.

This is a good opportunity for searching for new ideas or if you like one, easy to follow: just a few clicks and you can confirm your copied deal. When acting as principal, TD Ameritrade will add a markup to any purchase, and subtract a markdown from every sale. The stocks are assessed by several third-party analysis. TD Ameritrade was established in TD Ameritrade offers a comprehensive and diverse selection of investment products. Visit tdameritrade. On the back of the certificate, designate TD Ameritrade, Inc. Where do you live? Visit broker. The top league Thinkorswim platform has a demo account with a virtual balance for head-starting without any risk. You can also find Morningstar ratings for mutual funds. Many futures contracts—such as those based on crude oil, gold, soybeans, and more—have origins quite literally at ground level or below ground. You may also speak with a New Client consultant at We selected TD Ameritrade as Best desktop trading platform and Best broker for options for , based on an in-depth analysis of 57 online brokers that included testing their live accounts. As a client, you get unlimited check writing with no per-check minimum amount.

As a client, you get unlimited check writing with no per-check minimum. Reflecting the wave of introducing commission-free trading at the end of download tradestation mac invest medical marijuana stocks, TD Ameritrade now charges no commission of stock and ETF trades. Once your account is opened, you can complete the checking application online. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. You can search for an asset by typing its name or ticker as Thinkorswim has an automatic suggestion feature. When trading futures, a trader will put down a good faith deposit called the initial margin requirement. A two-step login would be safer. Margin works similarly, but is different in futures markets. Please read the Risk Disclosure for Futures and Options prior to trading futures products. The search functions are OK. We tested ACH transfer and it took 1 business day. Many futures contracts—such as those based on crude oil, gold, soybeans, and more—have origins quite literally at ground level or below ground. TD Ameritrade review Web trading platform. TD Ameritrade has great research tools.

Electronic deposits can take another business days to clear; checks can take business days. Unfortunately, the process is not fully digital. You can use only bank transfer and a high fee is charged for wire transfer withdrawals. With both futures and stocks, nearly all trading is done electronically. TD Ameritrade offers great educational materials, such as webcasts and articles. TD Ameritrade's trading fees are low and it has one of the best desktop trading platforms, Thinkorswim. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. At TD Ameritrade you can trade with a lot of asset classes, from stocks to futures and forex. Gergely K. Yet, our favorite part was the benchmarking under the Valuation menu. Related Videos. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. All you need to do is enter the futures symbol to view it. These securities were selected to provide access to a wide range of sectors. To know more about trading and non-trading fees , visit TD Ameritrade Visit broker. Learn more on our ETFs page. The longer track record a broker has, the more proof we have that it has successfully survived previous financial crises. This is the financing rate. Lucia St.

First name. TD Ameritrade review Safety. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. What are the requirements to get approved for futures trading? Compare to other brokers. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Deposit fees and options Let's start with the good news. TD Ameritrade review Fees. TD Ameritrade supports social trading via Thinkorswim. You can only deposit money from accounts that are in your name. Many traders use a combination of both technical and fundamental analysis. Options Options. However, it is not customizable.

The email was also quick and relevantwe got our answers within 1 day. Want to stay in the loop? This means the securities are negotiable only by TD Ameritrade, Inc. There may also be additional paperwork needed when the account registration does not match the name s on the certificate. The minimum deposit for non-US clients can be higher. Read more about our methodology. Let's start with the good news. Bond fees Bond trading is free at TD Ameritrade. How do I apply for futures approval? You can also find Morningstar ratings for mutual funds. TD Ameritrade review Markets and products. Visit TD Ameritrade if you are looking for further details and information Visit broker. For example, in the case of stock investing, commissions are the most important fees. As a new client, you can change from many different account types at TD Ameritrade and as Tradestation 500 minimum account price action trading system reviews citizen you will face no minimum deposit. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. The top league Thinkorswim platform has a demo account with a virtual coinbase deposit time usd wallet what is litecoin trading at for head-starting without any risk. This is an important distinction.

The order types and order time limits are limited compared to the web platform. Start your email subscription. TD Ameritrade does not provide negative balance protection. As a new client, you can change from many different account types at TD Ameritrade and as US citizen you will face no minimum deposit. Margin trading allows investors to buy more stock than they normally. A convenient way to save on currency conversion fees is by opening a multi-currency bank account at a digital bank. Explanatory brochure is available on request at www. On the other hand, the offered products do day trades reset for webull day trade futures in ira only the U. But although stocks and futures share some common ground, they differ in several ways that investors should understand before diving in to. ET Monday night would be active immediately and remain active until 8 p.

Futures markets are open virtually 24 hours a day, 6 days a week. Requirements may differ for entity and corporate accounts. Look and feel Thinkorwsim has a great design and it is easy to use. Many traders use a combination of both technical and fundamental analysis. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. The search functions are OK. ET Monday night. You can use the following order types:. How do I apply for futures approval? Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. For more information, see funding. Major stock exchanges, such as the Nasdaq and NYSE, provide a central forum for buyers and sellers to gather. This catch-all benchmark includes commissions, spreads and financing costs for all brokers. Site Map. Margin works similarly in the futures market, but because margin requirements are typically much smaller for futures, a trader can control a larger position with relatively little money down. The basic idea is to reduce or eliminate counterparty risk and ensure confidence in the markets. On the other hand, they charge high fees for mutual funds. What is a futures contract?

To find out more about the deposit and withdrawal process, visit TD Ameritrade Visit broker. Dion Rozema. By Bruce Blythe June 7, 5 min read. Why did futures take root in Chicago? Gergely has 10 years of experience in the financial markets. Is changelly open in wa state leading bitcoin exchanges more about our Asset Protection Guarantee. On the other hand, they charge high fees for mutual funds. Market volatility, volume, and system availability may delay account access and trade executions. Related Videos. We offer over 70 futures contracts and 16 options on futures contracts. The web trading platform is available in English, Chinese. Margin trading increases risk of loss and includes the possibility how to use td ameritrade thinkorswim full service stock broker locations huntington beach ca a forced sale if account equity drops below required levels.

Discover how to trade options in a speculative market The options market provides a wide array of choices for the trader. Today, so-called open outcry trading has largely been replaced by electronic trading. The minimum deposit for non-US clients can be higher. If you'd like more information about requirements or to ensure you have the required settings or permissions on your account, contact us at But futures trading as we know it today began around , when a group of grain merchants established the Chicago Board of Trade CBOT. Trades placed through a Fixed Income Specialist carry an additional charge. Buy low, sell high, right? Especially the easy to understand fees table was great! This is a good opportunity for searching for new ideas or if you like one, easy to follow: just a few clicks and you can confirm your copied deal. The search functions are OK. We offer over 70 futures contracts and 16 options on futures contracts. Read more about our methodology. For instance, when we searched for Apple stock, it appeared only in the third place.

In the equity markets, buying on margin means borrowing money from a broker to purchase stock—effectively, a loan from the brokerage firm. Mutual Funds Mutual Funds. But with futures, there are a few unique wrinkles. Options fees TD Ameritrade options fees are low. Do I have to be a TD Ameritrade client to use thinkorswim? Bond fees Bond trading is free at TD Ameritrade. Market volatility, volume, and system availability may delay account access and trade executions. ET Monday night. This basically means that you borrow money or stocks from your broker to trade. Follow us.