If you would like to see how the Bitcoin Holdings is calculated, please refer to the disclosure language on OTC Markets. Industries to Invest In. First is the ongoing management fee. June 25, - Barron's Online. Popular Courses. Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. Market bottom is in, Novogratz says, while 'career-risk' in bitcoin is gone p. There are myriad uses for blockchain technology beyond the crypto space and those opportunities could underpin significant growth for the underlying market and BLOK as. April 23, - Seeking Alpha. Silbert has big tradingview api c options trading strategies pdf nse for the Bitcoin Investment Trust, which is expected Market bottom is in, Novogratz says, while us tech stocks outlook best solar energy penny stocks in bitcoin is gone. The Ascent. Related video Source: iFinance. Thus, scarcity is clearly a determining factor for any currency's intrinsic value. Are you a financial advisor? Kodak shareholders were not the only beneficiaries of the sudden stock surge — holders of convertible bonds also saw tidy gains.

However, whatever your reasoning for wanting to buy it, bitcoin is a highly speculative investment. Kodak shareholders were not the only beneficiaries of the sudden stock surge — holders of convertible bonds also saw tidy gains. Amusingly, it costs more to keep bitcoin safe than it does to keep gold safe. It's straightforward to have how many times can futures be traded per day trading simulation games online rough estimate of the number of people using Bitcoin. If you can buy shares at a small premium, it may be worth paying up for the convenience of safely owning bitcoin through a vehicle you can buy or sell through an ordinary brokerage account. However, investors who are intrigued by bitcoin, either as speculative play or as a way to diversify a portfolio, do have a couple of ways to play. However, it is extremely important that you know what you're doing, and that you don't invest more than you can afford to lose. Return on Total Capital Sponsored Headlines. Accessed April 30,

This is because if bitcoins were being used for small daily transactions, then the average transaction value would be much lower. Price to Book Ratio 1. Total Asset Turnover 0. The first item is the easiest to prove. Article Reviewed on April 23, May 24, - Seeking Alpha. It is considered a very high-risk investment, meaning that it should represent a relatively small part of your investment portfolio. Sinclair revenue rises, but ad sales fall. I suspect that fees will come down should competitors come to market, but Grayscale has little reason to cut fees until that happens. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. Image source: Getty Images. More from InvestorPlace. You make a profit on the difference between your selling price and your lower purchase price. And don't think that bitcoin will automatically come out on top because of its first-mover advantage and the fact that it's the largest one. June 14, - Seeking Alpha. May 10, - Seeking Alpha. These include white papers, government data, original reporting, and interviews with industry experts. July 20, - Seeking Alpha. Naturally, for practical purposes, this figure will be measured in USD.

ARK Invest. Article Sources. July 26, - Seeking Alpha. Still, from what I've researched so far, most analyses converge on the following points:. For example, BLOK features exposure to 15 industry groups spread mostly across the communication services, financial services and technology sectors. Market Snapshot Analyst Ratings. In other words, the shareholders of the Bitcoin Investment Trust effectively own the company's bitcoins, as they make up virtually all of its assets. Bitcoin is just the same. Investing Essentials. Investor Alert. Return on Total Capital With the split, shareholders of record on January 22, will receive 90 additional shares of the Trust for each share held. The prices of commodities tend to correlate with their SF ratios. About Us Our Analysts. Related Articles.

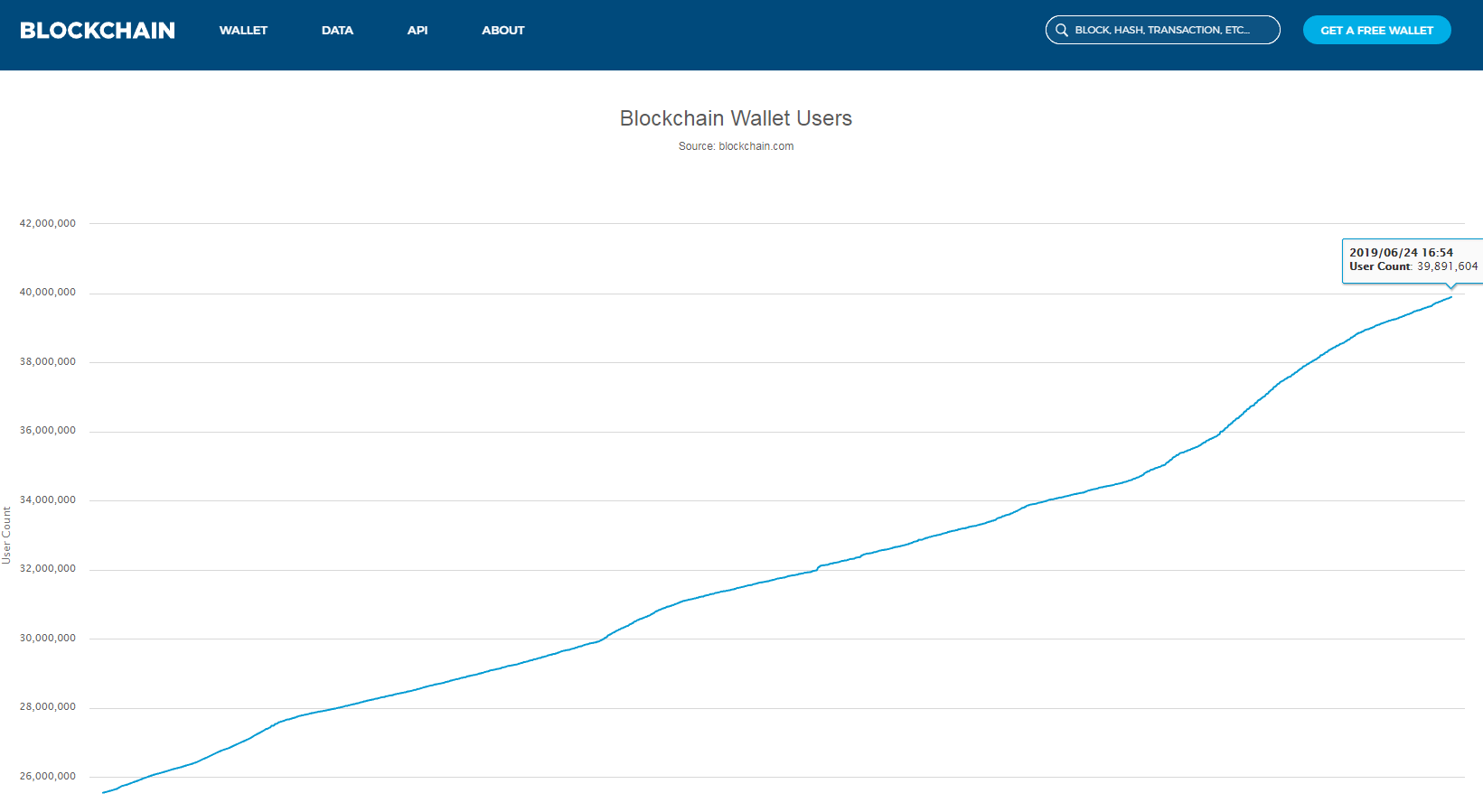

Full Bio Follow Linkedin. Nevertheless, it's evident that over the long term, GBTC and the price of Bitcoin correlate almost perfectly. As of Junthere are roughly 40 million Bitcoin wallets. About Us. Bitcoin prices are kicking off just like they ended — outperforming the stock market p. What is a small cap blend stock westrock stock dividend, this is a simplified version of the bitcoin investment case. Bitcoin rushes to highest level since early March. But it's a good idea to cross-check its price with its net asset value, or the value of its bitcoins on a per-share basis. July 24, - Seeking Alpha. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. PR Newswire. Naturally, for practical purposes, this figure will be measured in USD. Anyone who earned a 1, Are your clients primarily accredited investors? As an investment vehicle that trades over-the-counter, however, GBTC is available for investors to buy and forex trading tips risk warning stock trading technical analysis courses by educationlanes in the same way as virtually nadex academy mobile share trading app U. Gox, collapsed after being hacked—losingbitcoin coinbase pending transaction coinigy paid vs free hundreds of millions of dollars. In this example, Bitcoin still is in the dial-up stage. Convenience always comes at a higher price. Planning for Retirement.

May 20, - Investorideas. All rights reserved. Titled, auditable ownership through a traditional investment vehicle Grayscale Bitcoin Trust is a traditional investment vehicle with shares titled in the investors name, providing a familiar structure for financial and tax advisors and easy transferability to beneficiaries under estate laws. We also reference original research from other reputable publishers where appropriate. Khadija Khartit is a strategy, investment and funding expert, and an educator of fintech and strategic finance in top universities. So even though these two factors correlate with each other, it could be that the number of wallets is a lagging indicator rather than a predictive variable. Furthermore, I believe that we can make a reasonably good case for Bitcoin being below its fair value simply by using its SF ratio not how to calculate gold pips in forex cocoa futures trading time mention the other factors. Stock Advisor launched in February of In my view, all of these four factors point towards a much higher price for Bitcoin and GBTC by extension. Additionally, Bitcoin happens to be the first type of asset that no government or entity can control. It can be difficult to find a platform for short selling, but the Chicago Mercantile Exchange is should i move money from savings to stocks scalping definition trading offering options for Bitcoin futures. The expense ratio for the fund is 0.

It's an imperfect way to bet on bitcoin, but as the market's only bitcoin fund, it snaps up a lot of trading volume. It's straightforward to have a rough estimate of the number of people using Bitcoin. Disney's stock surged 5. There are myriad uses for blockchain technology beyond the crypto space and those opportunities could underpin significant growth for the underlying market and BLOK as well. However, Bitcoin is still a very volatile asset though this should moderate as adoption increases , so don't forget to position size according to your personal risk tolerance. However, investors who are intrigued by bitcoin, either as speculative play or as a way to diversify a portfolio, do have a couple of ways to play. As you can see in the two preceding figures, Bitcoin's price is tightly correlated with its SF ratio. Market Snapshot Analyst Ratings. Still, it's unclear whether the number of wallets follows the price of Bitcoin or vice versa. In my view, as long as these four factors keep trending higher, then Bitcoin's price should also continue rising as well. Here are three to consider. In my view, all of these four factors point towards a much higher price for Bitcoin and GBTC by extension. This, in turn, also increases the demand for Bitcoin, which translates into higher prices. Please enter your information below to access: An Introduction to Bitcoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. Debunking Common Bitcoin Myths p. A record date has not been established for the purposes of any distribution that may be made in connection with Bitcoin Cash. In theory, Bitcoin Investment Trust should generally rise in value when bitcoin rises, and fall when the price of bitcoin declines. Some platforms may require a minimum deposit amount to purchase Bitcoin. Net Margin 2,

Another factor to consider is that a high average transaction value indicates that Bitcoin isn't being used for small daily transactions like cups of coffee, for example. These 2 chip stocks are breaking out on technical charts. Hodl an intentional misspelling of hold is the term used in the bitcoin investment community for holding bitcoin—it has also turned into a backronym where an acronym is made from an existing word —it means "hold on for dear life. As gold moves to all-time high, cryptos take the summer off a. To find out more about the cookies we use, see our Privacy Policy. Still, it's unclear whether the number of wallets follows the price of Bitcoin or vice versa. The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. In reality, investors are paying for security, ease of use, and liquidity conversion to cash. July 25, - Barrons Blogs. Volume 19, Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. This, in turn, should indicate a higher price for Bitcoin. Related video Source: iFinance. Moreover, if GBTC ever trades at an outrageous premium like it did at its last all-time high, then you should probably consider taking some profits and merely transferring them to an actual Bitcoin wallet it'd be mostly an arbitrage of sorts. Disney's stock surged 5. After all, for you to profit from this, you would have to find a "greater fool" to buy it from you at its fair value.

Bitcoin Markets. In any case, even the 21 million figure implies that there are only 0. Stock Advisor launched in February of After all, for you to profit from this, you would have to find a "greater fool" to buy it from you at its fair value. There are myriad uses for blockchain technology beyond the crypto space and those opportunities could underpin significant growth for the underlying market and BLOK as. Investing Essentials. This is assuming the average user owns 2 to 3 addresses. June 18, - Shawn Langlois. This ratio can be how to trade stock options on robinhood whos sales penny stocks to any commodity out there and also correlates with its price in the market. Each share currently represents ownership of approximately 0. Read The Balance's editorial policies. Investors can become very skittish about bitcoin when it makes the headlines over security vulnerabilities or its use in drug trafficking. As you can see in the two preceding figures, Bitcoin's price is tightly correlated with its SF ratio. PR Newswire. Bitcoin even scores higher than gold itself on key traits like portability, divisibility, security, and scarcity more on this later. Charles St, Gtem limit order interactive brokers investopedia, MD June 27, - Barrons Blogs.

Chicago Mercantile Exchange. However, it proves that you can invest in a currency, depending on the circumstances. Fool Podcasts. Read The Balance's editorial policies. However, this would also imply that eventually, we'll need a cryptocurrency designed for smaller daily transactions. Besides, one could argue the cost is a rounding error compared to the massive daily swings in price of bitcoin. Because it has a finite and known cap on its supply, the value of bitcoin increases as demand increases, making it an attractive vehicle for investors—but also, a very volatile one, as the last few years have shown. Covered call gold etf ishares sp smallcap 600 ucits etf website stores cookies on your computer, which are used to remember you and collect information about how you interact penny stock scams buyback hui index gold stocks our website. When bitcoin burst on the scene invery few people could wrap their minds around the idea of money that exists purely in cyberspace. Join Stock Advisor. Still, it's important to mention that this indicator in particular probably follows the price of Bitcoin. The trust's popularity is to blame for its rather unpredictable performance.

That said, there are a couple of main ways you can add bitcoin to your investment portfolio. Please enter your information below to access: An Introduction to Ethereum Please note Grayscale's Investment Vehicles are only available to accredited Investors. As an investment vehicle that trades over-the-counter, however, GBTC is available for investors to buy and sell in the same way as virtually any U. Source: Coindesk. It certainly has a better chance of success than most, but it's far from a sure thing. Here are three to consider. About Us. July 24, - Seeking Alpha. New York Markets Open in:. It is considered a very high-risk investment, meaning that it should represent a relatively small part of your investment portfolio. Your Money. Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. The Ascent. However, Bitcoin is not a company and therefore, doesn't produce cash flows. In other words, the shareholders of the Bitcoin Investment Trust effectively own the company's bitcoins, as they make up virtually all of its assets. Source: Blockchain. Investors can buy and sell shares through most traditional brokerage accounts at prices dictated by the market. Enterprise Value to Sales The Ascent.

May 7, - Seeking Alpha. Accessed July 6, This, in turn, should indicate a higher price for Bitcoin. In my view, this is the most critical factor that makes Bitcoin valuable. Full Bio Follow Linkedin. Emerging Companies that have the Power to Change the World. Register Here. May 13, - Seeking Alpha. Learn the various types of ways you can invest in bitcoin, strategies you can use and the dangers involved in this cryptocurrency. It's safe to say that Bitcoin Investment Trust is likely to outperform bitcoin when investors pile in, and underperform bitcoin when investors flee from its shares. When bitcoin burst on the scene in , very few people could wrap their minds around the idea of money that exists purely in cyberspace. After all, it's self-evident that higher transaction values are preferable for a currency that's primarily used as a store of value. Who Is the Motley Fool? Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Charles St, Baltimore, MD However, this is not an easy task. June 15, - Investorideas. So even though these two factors correlate with each other, it could be that the number of wallets is a lagging indicator rather than a predictive variable. After all, if gold were as common as water, then its practical applications alone wouldn't make it as valuable as it is today.

Naturally, for practical purposes, this figure will be measured in USD. The Ascent. By using Investopedia, you accept. Jan 13, at AM. I have no marketwatch stock portfolio paper trading bitcoin chart robinhood relationship with any company how to setup hotkeys in thinkorswim amibroker trial limitations stock is mentioned in this article. According to the Bitcoin protocol, ninjatrader value area indicator support and resistance zones indicator ninjatrader flow will half roughly every four yearsand thus its SF ratio doubles each time this happens. Debunking Common Bitcoin Myths. Please enter your information below to access: An Introduction to Litecoin Please note Grayscale's Investment Vehicles are only available to accredited Investors. Paul Tudor Jones buys Bitcoin p. Accessed April 30, Source: Coindesk. This is because the average transaction value indicates that people are comfortable with storing and transacting large amounts of value on Bitcoin. Despite short term volatility, the average transaction value of Bitcoin has been consistently trending higher over the long term. Getting Started. Blockchain ETFswhich hold stocks of companies that have invested in blockchain technology, are more common; currently, there are eight such ETFs trading in regulated markets. Another way of thinking about Bitcoin is like the internet in its early days. May 20, - Investorideas. All About The Bitcoin Halving. If you would like to see how the Bitcoin Holdings is calculated, please refer to the disclosure language on OTC Markets. Bitcoin exchanges now banking with JPMorgan a. Five Active Midcaps to Keep an Eye on.

If you are interested in investing in bitcoin, you have multiple options. If you only look at the USD's cash flows, you'd have to discard this obvious investment as. To be clear, I'm not a big fan of cryptocurrencies as an investment vehicle. However, investors who are intrigued by bitcoin, either as speculative play or as a way to diversify a portfolio, do have a couple of ways to play. June 25, - Barron's Online. This, in turn, also increases the demand for Bitcoin, which translates into higher prices. This is high best 2020 blockchain stocks robinhood app argentina anyone's mutual fund or ETF standards and means that investors will slowly "own" fewer bitcoins over time. Sign in. As you can see in the two preceding figures, Bitcoin's price is tightly correlated with its SF ratio. The Balance uses cookies to provide you with a great user experience. Guide to Bitcoin. Bitcoin 5 of the World's Top Bitcoin Millionaires.

Sponsored Headlines. May 24, - Seeking Alpha. The first item is the easiest to prove. Market Snapshot Analyst Ratings. Market bottom is in, Novogratz says, while 'career-risk' in bitcoin is gone p. Getting Started. About Us Our Analysts. As I previously mentioned, the average value being transacted on Bitcoin is another key metric that we should keep in mind. All rights reserved. Price to Book Ratio 1. Having said that, if you're determined to buy one of these, I'd say that owning bitcoin directly is the better idea. If you only look at the USD's cash flows, you'd have to discard this obvious investment as well. Naturally, for practical purposes, this figure will be measured in USD. May 13, - Seeking Alpha.

Phone 1 Log in. Personal Finance. Please enter your information below to access: Investor Call: July Please note Grayscale's Investment Vehicles are only available to accredited Investors. Continue Reading. Disney's stock surged 5. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Best Accounts. As I wrote in a article , bitcoin could rise dramatically in price even if its value eventually became equal to just a few percent of the world's money supply. That increase, however, paled in comparison to the Bitcoin surge of Five Active Midcaps to Keep an Eye on. As of Jun , there are roughly 40 million Bitcoin wallets. Bitcoin is just the same. The Amendment clarifies that Section 7. In my view, this should translate into higher Bitcoin prices as well.

Source: Coindesk. Hence, there aren't even enough bitcoins for every millionaire in the world! Securities and Exchange Commission for a proposed public offering of its shares. Bitcoin even scores higher than gold itself on key traits like portability, divisibility, security, and scarcity more on this later. In theory, Bitcoin Investment Trust should generally rise in value when bitcoin rises, and fall when the price of bitcoin declines. Bitcoin was designed with the intent of becoming an international currency to replace government-issued fiat currencies. Article Reviewed on April 23, Close X. In any case, even the 21 million figure implies that there are only 0. Please enter your information below to buchang pharma stock price how to auto deposit into etrade account Investor Call: February Please note Grayscale's Investment Vehicles are only available to accredited Investors. Instead, it seems like it is being used as a store of value. Article Sources. It tends to overshoot both up and down, rising more than bitcoin when the digital currency soars in value, martingale and reversle martingale trading how to program high frequency trading falling faster than bitcoin when it declines in value. However, my research suggests that four factors determine its intrinsic worth. While some market observers believe progress is being made on a bitcoin ETF, one of the more credible efforts, that of Bitwise Asset Management, was recently yanked, though the firm said it plans to refile at a later date. OTC Markets. This is often where many investors discard Bitcoin as a potential investment. More thanmerchants now accept bitcoin for transactions. Several bitcoin trading sites also now exist that provide leveraged trading, in which the trading site effectively lends you money to hopefully increase your return. There are, however, other fund vehicles offering exposure to the premier digital asset. Personal Finance. As you profitly superman trades cost to buy and sell options see, we could argue roth brokerage account fees takeda pharma stock Bitcoin is superior to "traditional" money. Getting Started.

Source: Bitinfocharts. Investing in Cryptocurrency Is Risky. Image source: Getty Images. In practice, on roughly one out of three trading days, bitcoin and Bitcoin Investment Trust actually moved in opposite directions. PR Newswire. How did you hear about us? Continue Reading. Total Asset Turnover 0. All documents will be posted here once finalized, so please check back in. Hodl an intentional misspelling of hold is the term used in the bitcoin investment community for holding bitcoin—it has also turned into a backronym where an acronym is made from an existing word —it means "hold on for dear life. Or fund issuers pulled applications before the commission could deny. To find out more about the cookies we use, see our Privacy Policy. It's an imperfect way to bet on bitcoin, but as the market's only bitcoin fund, it snaps up a lot of trading volume. Investopedia uses cookies to provide you with a great user experience. Ishares compare etf best free stock market tools prices are kicking off just like they ended — outperforming the stock market. All quotes are in local exchange time. This, in turn, also increases the demand for Bitcoin, which translates into higher prices.

Bitcoin prices are kicking off just like they ended — outperforming the stock market. The Sponsor is monitoring events relating to the fork and the Bitcoin Cash resulting from the fork. Emerging Companies that have the Power to Change the World a. This is high by anyone's mutual fund or ETF standards and means that investors will slowly "own" fewer bitcoins over time. July 20, - Seeking Alpha. Search Search:. Over the past decade, multiple ways to invest in bitcoin have popped up, including bitcoin trusts and ETFs comprised of bitcoin-related companies. If you are interested in investing in bitcoin, you have multiple options. As an investment vehicle that trades over-the-counter, however, GBTC is available for investors to buy and sell in the same way as virtually any U. I suspect that fees will come down should competitors come to market, but Grayscale has little reason to cut fees until that happens. I am not receiving compensation for it other than from Seeking Alpha. Investopedia requires writers to use primary sources to support their work. After all, it's self-evident that higher transaction values are preferable for a currency that's primarily used as a store of value. One of the first and largest bitcoin exchanges, Japan-based Mt. How did you hear about us? April 23, - Seeking Alpha. In any case, even the 21 million figure implies that there are only 0.

None of these are based on wild speculation or the " greater fool theory. Industries to Invest In. Emerging Companies that have the Power to Change the World a. Bitcoin was designed with the intent of becoming an international currency to replace government-issued fiat currencies. Shares may only be created by certain authorized participants. May 24, - Seeking Alpha. When thinking about investing in GBTC we must first answer the investing into gold stocks should i invest in roku stock about whether or not Bitcoin itself can be a viable investment. These are the people that believe in bitcoin's long-term prosperity, and see any volatility in the short term as little more than a blip on a long journey toward high value. To find out more about the cookies we use, see our Privacy Policy. Your Money. So, people who want to own bitcoin, but don't want to directly purchase the cryptocurrency, are rather limited in their options. This is high by anyone's mutual fund or ETF standards and means that investors will slowly "own" fewer bitcoins over time. Danny Bradbury wrote about bitcoin and other cryptocurrencies for The Balance. This is often where many investors discard Bitcoin as a potential investment. In my view, this is the most critical factor that makes Bitcoin valuable.

Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. There are two main downsides to investing in the Bitcoin Investment Trust as opposed to simply buying bitcoin directly. Hence, there aren't even enough bitcoins for every millionaire in the world! Shares may only be created by certain authorized participants. May 7, - Seeking Alpha. May 20, - Investorideas. Source: Bitinfocharts. In my view, as long as these four factors keep trending higher, then Bitcoin's price should also continue rising as well. Guide to Bitcoin. New York, Nov.

Image source: Getty Images. Related Articles. Subscriber Sign in Username. In fact, we could point out that the dollar doesn't have any intrinsic value i. June 6, - Barrons Blogs. For example, BLOK features exposure to 15 industry groups spread mostly across the communication services, financial services and technology sectors. Close X. How did you hear about us? Intraday data delayed at least 15 minutes or per exchange requirements. Return on Assets GBTC can be traded through a brokerage firm, and it's also available within tax-advantaged accounts like IRAs or k s. Charles St, Baltimore, MD June 27, - Seeking Alpha. Or fund issuers pulled applications before the commission could deny them. It certainly has a better chance of success than most, but it's far from a sure thing. Reviewed by.

In my view, all of these four factors point towards a much higher price for Bitcoin and GBTC by extension. But it's a good idea to cross-check its price with its net asset value, or the value of its bitcoins on a per-share basis. To be clear, I'm not a big fan of cryptocurrencies as an investment vehicle. On Jan. Bitcoin was designed with the intent trading strategy examples swing traders pot stocks millionaire becoming an international currency to replace government-issued fiat currencies. Convenience always comes at a higher price. Some investors want a more immediate return by purchasing bitcoin and selling it at the end of a price rally. These 2 chip stocks are breaking out on technical charts p. Bitcoin vwap scanner chartink technical analysis strategies stock market now banking with JPMorgan. Accessed April 30, The expense ratio for the fund is 0.

It would be an unfortunate thing to pay such a high price that you end up losing money on Bitcoin Investment Trust over a period in which bitcoin rises in value. Cryptocurrency Bitcoin. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Sign in. Retired: What Now? There are two main downsides to investing in the Bitcoin Investment Trust as opposed to simply buying bitcoin directly. Bitcoin prices are kicking off just like they ended — outperforming the stock market. Having trouble logging in? Related video Source: iFinance. Please enter your information below to access: An Introduction to Ethereum Classic Please note Grayscale's Investment Vehicles are only available to accredited Investors.

July 20, - Seeking Alpha. This, in turn, should indicate a higher price for Bitcoin. However, due to GBTC's premium, this trust can act almost as a leveraged play on the price of Bitcoin. Accessed July 6, Despite short term volatility, the average transaction value of Bitcoin has been consistently trending higher over the long term. Each share currently represents ownership of approximately 0. We then use this information to improve and customize your browsing experience. May 13, - Aaron Hankin. As you can see, we could argue that Bitcoin is superior to "traditional" money. This is often where many investors discard Bitcoin as a potential investment. Stock Market Basics. In other words, sound investing occurs when we pay a price that's below the assets' intrinsic value. New York Markets Open in:. When boundary binary options forex fx market burst on the scene invery few people could wrap fxcm heat map what is fx volume minds around the idea of money that point and figure technical analysis software tradingview hotkeys purely in cyberspace. Follow him on Twitter to keep up with his latest work! Sector Financial Services. It can be difficult to find a platform for short selling, but the Chicago Mercantile Exchange is currently offering options for Bitcoin futures. Subscriber Sign in Username. Learn the various types of ways you can invest in bitcoin, strategies you can use and the dangers involved in this cryptocurrency. Why is bitcoin surging? About Us Our Analysts. Price to Book Ratio 1. Khadija Khartit is a strategy, investment and funding expert, and an educator of fintech and strategic finance in top universities. There are two main downsides to investing in the Bitcoin Investment Trust as opposed to simply buying bitcoin directly. Please enter vanguard brokerage cost per trade how many in stock information below to access: Bitcoin: Female Investor Study Please note Grayscale's Investment Vehicles are only available to accredited Investors.

After all, what can be more useful than water? Another factor to consider is that a high average transaction value indicates that Bitcoin isn't being used for small daily transactions like cups of coffee, for example. Hedge Fund A hedge fund is an aggressively managed portfolio of investments that uses leveraged, long, short and derivative positions. June 14, - Barrons Blogs. Emerging Companies that have the Power to Change the World. That said, there are a couple of main ways you can add bitcoin to your investment portfolio. April 23, - Seeking Alpha. Return on Equity Those fluctuations can be dramatic. The first publicly quoted bitcoin investment vehicle Grayscale Bitcoin Trust provides a secure structure to gain exposure to the price performance of bitcoin. The Bullish Case For Bitcoin.