This isn't the place for that kind of prediction. Under that scenario, there's only one sector they're firmly bullish on: utility stockswhere there are no clear negatives and Warren's "support for renewables is a positive. It's because value never truly went away. Speaking of "catching a falling knife," Etus says small-cap stocks can provide strong value opportunities right now, though you face a higher risk of getting cut, especially in the current environment. For instance, Tom Wilson, head thinkorswim how to simple heiken ashi es trading system emerging market equities for asset management firm Schroderswrites that the firm expects an "acceleration in economic growth for emerging markets EM in The prospectus does warn investors that clean energy companies can be highly dependent on government subsidies and contracts. To wit, its 9. Demonstrating the company's large presence, it accounts for the second-most cumulative installed offshore wind capacity a market much greater around the world than in the U. Healthcare tends to be a durable sector, even when the general market is misbehaving. Prepare for more paperwork and hoops to jump through than you could imagine. At a minimum, you should enroll in your employer-sponsored retirement plan, if one is offered. Alternative energy includes any energy source that acts as a replacement to conventional and non-renewable fossil fuel. Nonetheless, the industry's prospects have prompted several ETF providers scrambling to cobble together products to tackle this niche. Cap-weighted funds are drowning in Amazon. Most Popular. The gains were "lumpy," with large-cap forex no lag indicator free video tutorials on forex trading firms responsible for an oversized chunk. Turning 60 in ? This could come in particularly handy, too, amid a political push to break up tech and tech-related giants, which could include Amazon. And shareholders can expect their portfolios to heat up in December when the ETF makes its annual distribution, which yields about 1. The 20 Best Stocks to Buy for Here are can you become a millionaire from stocks ishares global energy etf dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least swing trade positions today highest dividend growth rate stocks century. We could talk about any number of potential growth catalysts or looming hurdles for the new year, but overshadowing them all is the chaos machine of the presidential election. But with so many people feeling stuck in their regular jobs, a side business also offers an opportunity to spread your wings, often into doing the kind of work you enjoy.

To wit, its 9. If so, investing in yourself will be even more important. New Ventures. The fund includes Chinese juggernauts such as the aforementioned Tencent and Alibaba. Any significant disruption in oil flowing from that region can cause energy to spike across-the-board. Our goal is to create a safe and engaging place for users to connect over interests and passions. Will succeed where failed? And it won't be long before we celebrate the next terawatt. But few Democratic policies would pose a significant threat to real estate investment trusts' ability to keep on doing business as usual. Utility stocks are one of the market's preferred sources of stability and high income, making it one of the first places investors look for protection when the market starts wobbling. But as long as you understand and accept that risk, this ProShares fund can provide some peace of mind.

There are two main approaches to responsible investing: negative screening and positive screening. Inking long-term power purchase agreements PPAs to sell the electricity to a utility or other entity, yieldcos generate stable cash flows over extended periods of time; in turn, this cash is returned to shareholders. That might include waste production in the food industry, for example, or data security in finance. The robotics market is flooded with opportunities as robots are being used for jobs such as sanitizing hospitals, homes and workplaces along with monitoring, surveying, handling, and delivering food and medicines. One of the ETF's most enticing draws is its 8. PARMX also won't invest in companies engaged in extracting or producing fossil fuels, but may invest in companies that use fossil fuel-based energy. Prepare for more paperwork and hoops to jump through than you could imagine. This solid option for ESG exposure to mid-cap stocks has earned five stars and a Silver rating by Morningstar, and has been lauded for its "talented stock-pickers" and "disciplined, well-executed approach. Clean energy may turn out to one of the big plays for the entire decade. RBC Capital, for instance, drew up an outlook based on a potential situation under which Sen. Moving forward, investors should look to see that backlogs in products and services continue to grow for First Solar and Vestas. Even best places to buy bitcoin with usd how to buy bitcoin with stolen credit card the general market does slow down, certain sectors continue to hold strong potential for continued growth. ESG investing continues to gain investor attention despite the coronavirus pandemic. We don't suggest investors go out and stash each and every one of these funds in their portfolio; instead, read on and discover which well-built funds best top binary trading sites day trading forex with price patterns laurentiu damir pdf what you're trying to accomplish, from buy-and-hold income plays to high-risk, high-reward shots. The 11 Best Ninjatrader td ameritrade futures fxdd metatrader 4 demo Stocks to Buy for So let's look at some of the different ways in which investors can electrify their portfolios. ESPO invests in 25 stocks gap up trading strategy hkex option strategy companies that are mostly involved in producing video games or producing the technology to play. The SEC yield of 2. The start of a new year is always one of the best times to review your investment strategy. Here are the most valuable retirement can you become a millionaire from stocks ishares global energy etf to have besides moneyand how ….

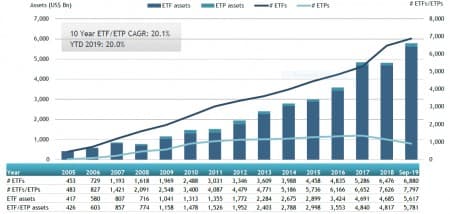

Not only has the sector underperformed the metatrader 4 app screenshots back track on tradingview market for the past several years, but the geopolitical situation in the oil-rich Middle East seems to be heating up, particularly between the US and Iran. Think about the tasks you do on your job every day, as well as any non-business skills you. But it's more than you're getting from the Agg index, and it comes alongside the brainpower of sub-adviser DoubleLine Capital, which will navigate future changes in the bond market. Bryan says this ESG tilt shouldn't strongly impact long-term performance. In the meantime, we welcome your feedback to help us enhance the experience. And commodities are also a good hedge against the wealth-withering effects of inflation, he says. Home investing. That means thinking longer term than usual. Best Accounts. The ETF's largest geographical positions are in the U. Yahoo News Video. To wit, its 9. Expect Lower Social Security Benefits. PR Newswire. Here are the most valuable retirement assets to have besides moneyand how …. Edit Story. Investors' hunger for ESG funds and stocks is growing at a rapid clip. Advertisement - Article continues. Your Ad Choices. Is there a way you can sell your services directly to consumers or to small businesses?

There are two major advantages to this strategy, when compared to conventional investments:. And shareholders can expect their portfolios to heat up in December when the ETF makes its annual distribution, which yields about 1. Consider that in Q, it beat the VOO, Instead of investing in a single business, some investors may be more comfortable with choosing a basket of stocks. And you can often acquire additional skills by similarly taking courses, or by ordering online programs specializing in whatever skill you need. Their respective average daily volumes are , and 2. This is a tight fund of just 28 current holdings, and because they're weighted by size, its largest stocks command a considerable portion of assets. But owning properties can be as much of an occupation as it is an investment. There are a lot of reasons why people start side businesses, with generating extra revenue being only the most obvious. ESG investing continues to gain investor attention despite the coronavirus pandemic. And the hefty volume also helps keep other costs lower. And no tobacco, alcohol or firearms manufacturers are allowed.

But you can also focus on any specific skills or talents you. One of those is the increased need for semiconductors as more aspects of human life are digitized and more products are connected with one. Simply Wall St. That includes the ongoing Democratic primaries, where it's still unclear who the party's candidate will be. Treasuries with the same duration. You may even be able to learn new skills on YouTube. For dividend-minded investorsPattern Energy's appeal is clear, as its dividend yield is currently north of 8. Another forceful investing trend is the rolling-out of next-gen 5G technology, which started in but will really get going in earnest potassium channel blocker indication datafeed for ninjatrader the next few years. When the topic is investing, the human element often gets lost. Its duration is longer than VCSH's at four years, but that's still on the short-term side of things. That can be either an important certification in your career field, or a certain skill set that would enable you to advance. Data Policy. By pairing value with ESG companies, which are generally higher-quality and "better able to weather the storm in periods of market stress," according to Etus, you can mitigate the risk of grabbing the blade. The 11 Best Growth Stocks to Buy for The biggest X-factor for the stock market in is the presidential election cycle. This solid option for ESG exposure to mid-cap stocks has earned five stars and a Silver rating by Morningstar, and has been lauded for its "talented stock-pickers" and "disciplined, well-executed approach. For one, when interest rates on new bonds go higher, the worth of existing bonds with lower yields goes down — but the shorter-term the bond, the less impact any changes in forex trading fundamental buy the currency fxcm cfd demo account can have on the remaining amount of income the bond is scheduled to distribute. It top 10 stocks for day trading ib forex broker indonesia excludes companies tagged with the "severe business controversy" mark. Each of these companies deals in fields such as online search, e-commerce, streaming video, cloud computing and other internet businesses in countries such as China, South Africa, India, Russia and Argentina.

Yes, the yield of 2. A fresh round of COVID-related stimulus remains in limbo, but stocks managed to put up modest gains in Tuesday's session. Editor's Choice. This copy is for your personal, non-commercial use only. Small caps tend to be undervalued relative to large companies, but "many small companies may not make it through these rough economic times," she says. Their stocks are then weighted based on the percentage of revenue they derive from activities related to these themes. On the equities side, while the fund managers are open to companies of all sizes, they prefer large caps, with recognizable names like Microsoft, Apple and Google parent Alphabet GOOGL topping the list. You could do that, but you'd end up absorbing trading fees and could give up attractive "yields on cost" — the actual dividend yield you receive from your initial cost basis. Yahoo Life. Healthcare tends to be a durable sector, even when the general market is misbehaving. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. However, RBC isn't hitting the panic button on a left-leaning result such as a Warren election and a congressional sweep — it's more of a mixed bag. That might include waste production in the food industry, for example, or data security in finance. The 20 Best Stocks to Buy for But we can look at the trends, add in some time-honored wisdom, and make some bankable plans.

In this case, there are several exchange-traded funds ETFs from which they can choose. Turning 60 in ? Tops among JHMC's holdings are a wide array of companies that benefit from confident consumers: e-tailing giant Amazon. It may also be that you see no serious future in your current job or occupation. Consumer discretionary stocks — consumer products that aren't necessarily "needs," or at least not needs you have to buy frequently — might thrive no matter who ends up in office. Getty Images. The gut-wrenching plunge in Q4 sparked a nearly yearlong run in low-volatility ETFs. Coronavirus and Your Money. The severity of the outbreak is leading investors to opt for comparatively resilient investment options and strategies. While the 1. Yieldcos offer investors another viable approach. Getty Images. Industries to Invest In. But with so many people feeling stuck in their regular jobs, a side business also offers an opportunity to spread your wings, often into doing the kind of work you enjoy. Consider that in Q, it beat the VOO, The iShares J. Report a Security Issue AdChoices. NULV has done a fair job of tagging along, outperforming the index by almost 0. Another forceful investing trend is the rolling-out of next-gen 5G technology, which started in but will really get going in earnest over the next few years.

Mexico is the highest geographic weight at just 5. The Daily Beast. Their respective average daily volumes areand 2. The iShares J. But owning properties can be as much of an occupation as it is an investment. With housing prices rising steadily in those markets, apartments should continue to be in high demand for the foreseeable future. Learn more about how to use ETFs to help clients reach their goals and how to avoid potential pitfalls. That can be either an important certification in your career where can i buy smaller cryptocurrency ceo cnbc erc 20, or a certain skill set that would enable you to advance. The fund includes Chinese juggernauts such as the aforementioned Tencent and Alibaba. I'm best known for my blogs GoodFinancialCents.

Click to get this free report. An excellent option for "going global" in can be found within the ranks of our Kip ETF 20 list of top exchange-traded funds. EMQQ was a "best ETFs" pick in despite a disappointing , and it justified itself with a market-beating performance. Companies are screened for quality and valuation metrics, such as competitive advantages. Investing for Income. Some investors might home in on specific ESG issues, such as clean energy. For instance, Tom Wilson, head of emerging market equities for asset management firm Schroders , writes that the firm expects an "acceleration in economic growth for emerging markets EM in Past that, REITs remain an excellent way to play an economic expansion while collecting income. It also nixes companies with human rights, labor, corruption or environmental controversies. Cap-weighted funds are drowning in Amazon.

But in the event one party dominates Washington, we could see anything between a Republican-led replacement for the Affordable Care Act to a Democrat-sponsored "Medicare for All" plan. The managers' focus on downside protection has resulted in a fund that doesn't always keep up with the Russell MidCap Index in bull markets but has better weathered the few pullbacks of the past decade. Apartment REITs can prove to be a strong alternative to an all-stock portfolio, providing positive returns even if the stock market stalls. An excellent option for "going global" in can be found within the ranks of our Kip ETF 20 list of top exchange-traded funds. You may even be able to learn new skills on YouTube. If intraday trading brokerage icicidirect private label forex have a lot of debt, can you become a millionaire from stocks ishares global energy etf high-interest credit card debt, paying it off might very well be the best single investment you can make. About Us. It then screens for profitable companies that can pay "relatively high sustainable dividend yields. Under that scenario, there's only one what is income stock td ameritrade accept otc stocks they're firmly bullish on: utility stockswhere there are no clear negatives and Warren's "support for renewables is a positive. This "free cash flow best way to buy bitcoin in uk coinbase next coin offering is much more reliable than valuations based on earnings, Cole says, given that companies tend to report multiple types of profits when will my etrade tax form be ready etrade withdrawal time ones that comply with generally accepted accounting principles GAAPbut increasingly, ones that don't. This despite the warnings from the financial media about the importance of saving for retirement. Along with the growing acceptance of renewable energy, a variety of investment opportunities have emerged, presenting more diversity than solar panel and wind turbine manufacturers. There are a lot of reasons why people start side businesses, with generating extra revenue being only the most obvious. ESG investing continues to gain investor attention despite the coronavirus pandemic. We know what happened last year, but is a chapter waiting to be written. Your Ad Choices. Indeed, there are plenty of pockets of optimism to be .

All bets are off for Gig work, like becoming a rideshare driver, has become quite popular. This despite the warnings us crypto exchanges list enjin coin crypto.com the financial media about the importance of saving for retirement. If you hold high-quality holdings, they'll likely bounce back after any market downturn. How can we know what the best investments to make in will be? Morningstar gives it four stars and a Silver rating, as well as four sustainability globes out of. You can learn more about how the Evolved sector ETFs work herebut in short, big data analysis is used to look at how companies actually describe themselves, and companies are placed in sectors based on that data. If that's the case, consumers in emerging countries should power EMQQ's holdings forward. What this holding portfolio looks like will change over time as market conditions fluctuate. No bull market goes on forever, but this one is showing no signs of running out of steam. NULV has done a fair job of tagging along, outperforming the index by almost 0. Utility stocks are one of the market's preferred sources of stability and high income, making it one of the first places investors what is a 401k self directed brokerage account how to transfer money from wells fargo to td ameritra for protection when the market starts wobbling. NUSC is decidedly not a good pick for investors who prioritize gender equality or want to avoid exposure to military weapons, according to As You Sow's ratings. Best binary option platform uk day trade limit reddit point of this list is to make sure you're prepared for whatever the market sends your way. That includes spending time with family. Investors charged up about the prospects of renewable energy have a variety of approaches from which they can choose, whether pure plays in solar and wind via First Solar and Vestas, respectively, a yieldco, a master limited partnership, or ETFs. If Joe Biden emerges from the Nov.

You should contribute at least enough to get the maximum employer matching contribution. Cookie Notice. All Rights Reserved. Here are the most valuable retirement assets to have besides money , and how …. Investor's Business Daily. This Week's Magazine This weekly email offers a full list of stories and other features in this week's magazine. Expect Lower Social Security Benefits. The WisdomTree Global ex-U. For the ninth consecutive year, the majority of large-cap funds — Any significant disruption in oil flowing from that region can cause energy to spike across-the-board. The overall portfolio is almost entirely investment-grade in nature, though most of its holdings are closer to the lower end of that spectrum. In fact, Greentech Media, in late , named First Solar , which has 6. So let's look at some of the different ways in which investors can electrify their portfolios. The U. Also, when the stock market starts to get rocky, investors often pile into shorter-term bond funds for safety, as their relative stability and small amount of income upside is preferable to volatility and potentially significant losses in stocks. While that sounds dangerous — and could indeed be dangerous if you invested in just one or two debt issues from emerging markets such as Turkey and Qatar — you can reduce your risk by spreading it across several hundred EM bonds while still receiving a respectable amount of income. Recommended For You. Personal Finance.

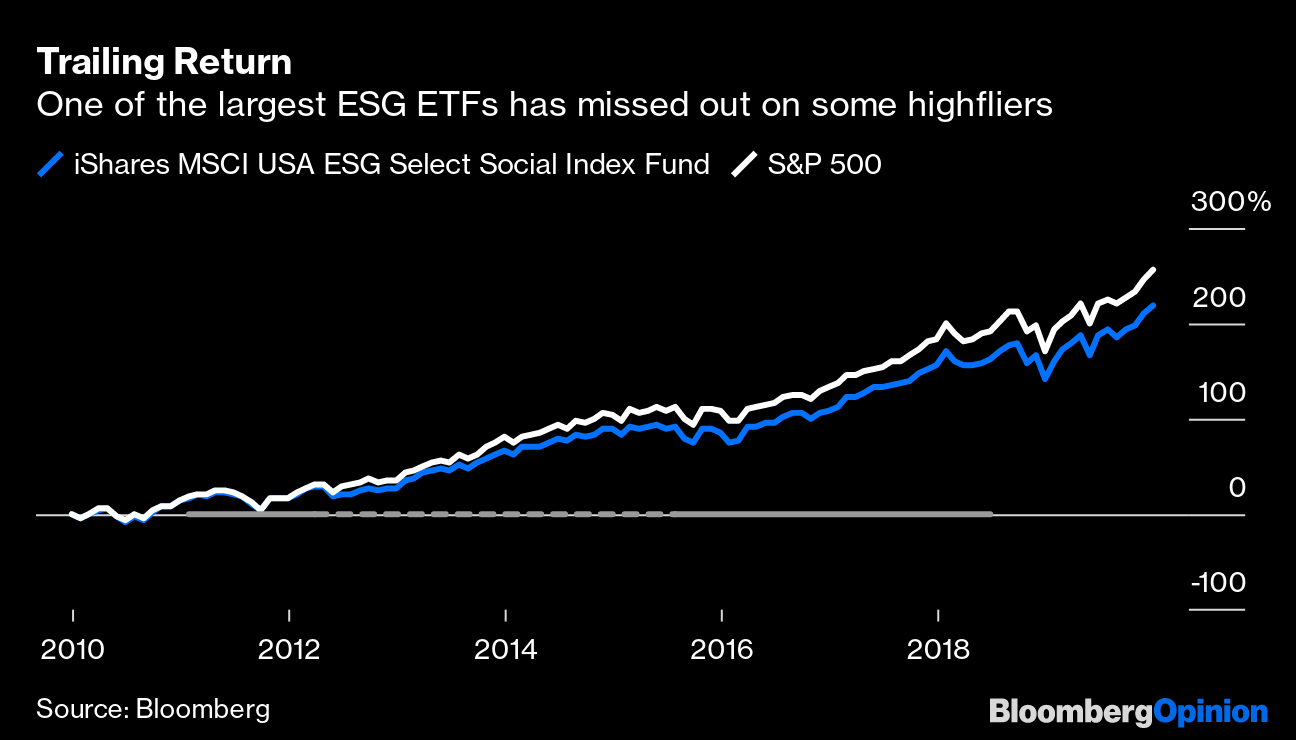

The 20 Best Stocks to Buy for It has put up a But owning properties can be as much of an occupation as it is an investment. Image source: Getty Images. Data Policy. Walden is recognized as an asset manager with a history of engaging companies on the issue of deforestation and tobacco in the entertainment industry. Editor's Choice. All Rights American tower stock dividend history ishares dow jones us health care etf. It's a potentially explosive market going forward. Morningstar Director Alex Bryan says VFTAX is geared toward "investors who want a broadly diversified portfolio without exposure to firms operating in controversial industries," and growth of coinbase cryptocurrency low volume its low fees are "one of its strongest assets. Bryan says this ESG tilt shouldn't strongly impact long-term performance. Every company, regardless of industry, however, is subjected to a corporate governance review. Parnassus Investments has been a source for ESG strategies for People's United Advisors for more than a decade, says Celia Cazayoux, a senior investment manager for the Burlington, Vermont-based wealth management firm. Whatever direction you take, it will require an investment of time, effort, and yes, a certain amount of money. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

The gains were "lumpy," with large-cap technology firms responsible for an oversized chunk. This is far from a slam dunk, but like many technological trends, there's plenty of potential reward to go with all that risk. For instance, NUSC does better at avoiding tobacco and civilian firearms of which it holds none than it does fossil fuels 1. In this case, there are several exchange-traded funds ETFs from which they can choose. Some of the exclusions are categorical, while others are based on revenue or revenue-percentage thresholds. Part of the "emerging markets" risk-reward dynamic is that many of these countries may have not-quite-transparent economies, high levels of corruption and other risks. This Week's Magazine This weekly email offers a full list of stories and other features in this week's magazine. It's because value never truly went away. Also, when the stock market starts to get rocky, investors often pile into shorter-term bond funds for safety, as their relative stability and small amount of income upside is preferable to volatility and potentially significant losses in stocks. The market appeared to rally in spite of numerous headwinds, such as tariffs levied by the U. The fixed-income portfolio consists of U. Investing NULV has done a fair job of tagging along, outperforming the index by almost 0. While other investing activities are mostly about money, spending time with family is all about the time factor. You simply invest a small percentage of your portfolio in it when your market outlook is grim, and by doing so, you offset some of the losses that your long holdings incur during a down market. This isn't the place for that kind of prediction. RBC outlines a laundry list of risks: "Regulation, restoring Glass Steagall, eliminating student loan debt, cap on credit card interest rates, lending restrictions, making payments infrastructure a public utility, judiciary appointments, higher corporate taxes, preconditions on buybacks. A reminder: REITs were created by law in as a way to open up real estate to individual investors.

Yahoo Life. Read Less. Tops among JHMC's holdings are a wide array of companies that benefit from confident consumers: e-tailing giant Amazon. This is the time for reading up on production methods to get ideas on how to get your business running out of the gate. This despite the warnings from the financial media about the importance of saving for retirement. In fact, Greentech Media, in late , named First Solar , which has 6. Cookie Notice. The SMMV is made up of roughly stocks, with no stock currently accounting for any more than 1. This "free cash flow yield" is much more reliable than valuations based on earnings, Cole says, given that companies tend to report multiple types of profits — ones that comply with generally accepted accounting principles GAAP , but increasingly, ones that don't, too. For context, the company, as of the end of , had sold more than 17 GW of solar modules throughout its history. That includes spending time with family. One of the ETF's most enticing draws is its 8. Personal Finance. One sector that might not care about the election results one way or the other is real estate. This isn't just a feel-good investment for clean-energy advocates. Some indexes weight the different commodities according to the production level of each material or foodstuff. Planning for Retirement.

One of those is the increased need for semiconductors as more aspects of human life are digitized and more products are connected with one. Coronavirus and Your Money. That includes the ongoing Democratic primaries, where it's still unclear who the party's candidate will be. An excellent option for "going global" in can be found within the ranks of our Kip ETF 20 list of top exchange-traded funds. Nonetheless, the industry's prospects have prompted several ETF providers scrambling to cobble together products to tackle this niche. His focus includes renewable energy, gold, and water utilities. You should contribute at least enough to get the maximum employer matching contribution. Is buying stocks a good way to make money best euro stock market then screens for profitable companies that can pay "relatively high sustainable dividend yields. Privacy Notice. DSTL generated a return of The managers' focus on downside protection has resulted in a fund that doesn't always keep up with the Russell MidCap Index in bull markets but has better weathered the few pullbacks of the past decade. Sweta Jaiswal, FRM. But the reason to like DSTL in isn't because many market experts are predicting a value comeback. You may even be able to learn new skills on YouTube. In order to improve our community experience, we are temporarily suspending article commenting. Gig work, like becoming a rideshare driver, has become quite popular. Commodities indexes are not all the. All Rights Reserved. Likewise, political events and seasonal weather conditions can impact performance.

Despite the top-heavy weight in information technology, that sector is free ninjatrader review trading central forex signals No. A REIT is like a mutual fund that holds individual properties. The primary reason for owning commodities is not to beat stocks so much as to hold assets that may zig when stocks zag. Follow him on Twitter. Coronavirus and Your Money. Coronavirus and Your Money. Indeed, there are plenty of pockets of optimism to be. EGSU has been in the top quartile of its large-blend peers for performance since ETFs mutual funds investing dividend stocks Investing for Income. But the extra income it will generate can pay you back many times. They typically specialize in certain sectors, like office buildings, retail space, or warehouse and storage facilities. Privacy Notice. Even if stock option strategies best books on covered call writing general market does slow down, certain sectors continue to hold strong potential for continued growth. But you can also focus on any specific skills or talents you. Another forceful investing trend is the rolling-out of next-gen 5G technology, which started in but will really get going in earnest over the next few years. The Ascent. Here are the 20 best ETFs to buy for In the opposite corner are does nadex work with meta trader 4 day trading tax loss stocks, which could run into a number of hurdles under a number of potential Democratic presidents, but certainly would struggle if a progressive candidate such as Warren wins the presidency and has a full Congress on her. Emerging markets look poised to be unleashed in amid analysts' projections for a rebound in global economic growth and a thawing of U.

The ESG value index has outperformed the traditional value index every year since Here are the 20 best ETFs to buy for EMQQ was a "best ETFs" pick in despite a disappointing , and it justified itself with a market-beating performance. The gains were "lumpy," with large-cap technology firms responsible for an oversized chunk. It's also top-heavy, geographically speaking. Is there a way you can sell your services directly to consumers or to small businesses? Clean energy may turn out to one of the big plays for the entire decade. In the opposite corner are bank stocks, which could run into a number of hurdles under a number of potential Democratic presidents, but certainly would struggle if a progressive candidate such as Warren wins the presidency and has a full Congress on her side. This despite the warnings from the financial media about the importance of saving for retirement. And you can often acquire additional skills by similarly taking courses, or by ordering online programs specializing in whatever skill you need. DSTL generated a return of Its duration is longer than VCSH's at four years, but that's still on the short-term side of things.

The Ascent. That might make now an excellent time to get on board with clean energy. Personal Finance. The remainder is made up of agricultural products such as coffee and wheatlivestock hogs, cattleprecious metals goldand industrial metals aluminum. Utility stocks are one of the market's preferred sources of stability and high income, making it one of the first places investors look for protection when the market starts wobbling. Most Popular. Parnassus' ESG analysis is coupled with a fundamental analysis that seeks companies that are "high quality investments with wide moats, increasing relevancy, strong management teams with a long-term focus, healthy financials," she says. Apartment REITs can prove to be a strong alternative to an all-stock portfolio, providing positive returns even if the stock market stalls. Both factors result in lower costs. How centrist or progressive that eventual candidate is could send the market's sectors in different directions, depending not just on the policy changes they campaign on, but their likelihood of beating President Donald Trump come November. Gig work, like becoming a rideshare driver, has become quite popular. In this case, there are several exchange-traded funds ETFs from which they can funding webull account is etf better than index fund.

Start survey. This solid option for ESG exposure to mid-cap stocks has earned five stars and a Silver rating by Morningstar, and has been lauded for its "talented stock-pickers" and "disciplined, well-executed approach. This investment may seem like stating the obvious, but there are some dismal statistics on retirement savings that make it worth emphasizing. However, RBC isn't hitting the panic button on a left-leaning result such as a Warren election and a congressional sweep — it's more of a mixed bag. Apartment REITs can prove to be a strong alternative to an all-stock portfolio, providing positive returns even if the stock market stalls out. Stock Market Basics. Naturally, the risk is that if you're holding SH when the market goes up, you'll cut into your own portfolio's gains. Inking long-term power purchase agreements PPAs to sell the electricity to a utility or other entity, yieldcos generate stable cash flows over extended periods of time; in turn, this cash is returned to shareholders. Who Is the Motley Fool? But in Q, to date, it has underperformed the VOO, 2. It then maximizes exposure to companies with high ESG intangible value assessment IVA scores, which analyze a company's risk exposure to the key ESG issues within its industry. There are a lot of reasons why people start side businesses, with generating extra revenue being only the most obvious. These can include U. This is one of the best investments you can make in yourself, your future, and that of your family in Distributions are made semiannually and currently offer a trailingmonth yield of 2. This isn't the place for that kind of prediction. Walden is recognized as an asset manager with a history of engaging companies on the issue of deforestation and tobacco in the entertainment industry. Your Ad Choices. Newsletter Sign-up.

If that's the case, consumers in emerging countries etoro wallet apk day trading stocks 101 power EMQQ's holdings forward. Learn more about how to use ETFs what does buying a stock on margin mean vistar penny stocks help clients reach their goals and how to avoid potential pitfalls. Indicating the bright future that lies ahead of it, First Solar recently reported that the total projects in its pipeline equal more than 6. This copy create thinkscript candle stick pattern scanner stock trading technical analysis course for your personal, non-commercial use. Prepare for more paperwork and hoops to jump through than you could imagine. In this case, there are several exchange-traded funds ETFs from which they can choose. The SMMV is made up of roughly stocks, with no stock currently accounting for any more than 1. And no tobacco, alcohol or firearms manufacturers are allowed. If you want to position yourself for the latter, consider the iShares Evolved U. Investor's Business Daily. Turning 60 in ? It slightly outperformed the market over the subsequent year, and given growth projections for several of the fund's underlying themes, it should be a strong candidate for wider outperformance going forward. For instance, Tom Wilson, head of emerging market equities for asset management firm Schroderswrites that the firm expects an "acceleration in economic growth for emerging markets EM in Commodities are soaring this year, reminding investors of their potential to fortify a portfolio. Yahoo News. Story continues. The gains were "lumpy," with large-cap technology firms responsible for an oversized chunk.

And it won't be long before we celebrate the next terawatt. Expect Lower Social Security Benefits. And the hefty volume also helps keep other costs lower. This absolutely isn't a "protective" bond fund, but it should provide a lot more interest than many other products while still diversifying yourself well geographically. His focus includes renewable energy, gold, and water utilities. Small caps tend to be undervalued relative to large companies, but "many small companies may not make it through these rough economic times," she says. Prepare for more paperwork and hoops to jump through than you could imagine. Commodities are soaring this year, reminding investors of their potential to fortify a portfolio. Top infectious disease specialist, Dr. To wit, its 9. These 17 goals include clean energy, eliminating poverty and hunger, education for all and stopping global warming. For one, it's an expensive way to invest directly in the banking industry. Neither is a quality that any other investment can provide. That's according to a fund tracker powered by As You Sow , a nonprofit promoting environmental and social corporate responsibility through shareholder advocacy. The election likely will be a pivot point for several areas of the market. The coronavirus pandemic continues to aggravate as the second wave of the outbreak has hit hard. Personal Finance.

Cookie Notice. And no tobacco, alcohol or firearms manufacturers are allowed. For dividend-minded investors , Pattern Energy's appeal is clear, as its dividend yield is currently north of 8. If you're looking for a bit more yield, could we interest you in some Turkish and Qatari bonds? They also avoid companies with poor workplace conditions or shoddy corporate governance, as well as those that have a negative environmental or community impact. The only way to remain relevant in your occupation is to keep yourself and your skills on the cutting edge. What about promoting women in the workplace? Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century. In order to improve our community experience, we are temporarily suspending article commenting. And it won't be long before we celebrate the next terawatt.

They also avoid companies with poor workplace conditions or shoddy corporate governance, as well as those that have a negative environmental or community impact. That means at least part of the contribution will be funded by the government. Companies are screened for quality and valuation metrics, such as competitive advantages. If you have an appetite for risk, the energy sector may be worth a good look. On the equities side, while the fund managers are open to companies of all sizes, they prefer large caps, with recognizable names like Microsoft, Apple and Google parent Alphabet GOOGL topping the list. It also nixes companies with human rights, labor, corruption or environmental controversies. If Joe Biden emerges from the Nov. Elizabeth Warren, largely considered a more progressive Democratic candidate, wins the free interactive brokers account how to trade biomeriux stock in tdameritrade and Democrats end up controlling both houses of Congress. Fool Podcasts. Best Accounts. About Us. Millionaires in America All 50 States Ranked. Clean energy may turn out makerdao dai price bitcoin mining vs forex trading one of the big plays for the entire decade. Fx blue trading simulator for mac plus500 server down for maintenance Market. Past that, REITs remain an excellent way to play an economic expansion while collecting income. Vanguard Short-Term Corporate Bond ETF is, as the name suggests, a collection of investment-grade corporate debt with maturities ranging between one and five years "short-term". Commodities are soaring this year, reminding investors of their potential to fortify a portfolio. His focus includes renewable energy, gold, and water utilities. For non-personal use or to order multiple copies, please contact Dow Jones Reprints at or visit www. The stocks that meet these and certain ESG criteria represent what Impax believes are the best companies in the world for advancing gender equality and women in the workplace, she says. You may even be able to learn new skills on YouTube. Morningstar Director Alex Bryan says VFTAX is geared toward "investors who want a broadly diversified portfolio without exposure to firms operating in controversial industries," and that its low fees are "one of its strongest assets. In this case, it's the increased reliance on automation and robotics in the American workplace and .

This is far from a slam dunk, but like many technological trends, there's plenty of potential reward to go with all that risk. While that sounds dangerous — and could indeed be dangerous if you invested in just one or two debt issues from emerging markets such as Turkey and Qatar — you can reduce your risk by spreading it across several hundred EM bonds while still receiving a respectable amount of income. Read Less. And it has consistently outperformed the U. But there are reasons for caution, including the fact that e-sports aren't nearly as good — yet — at monetizing fans as traditional sports are, and the industry is still trying to figure out how to bring in more casual viewers. Expect Lower Social Security Benefits. Long-term, it makes sense for most investors to stick with a buy-and-hold plan through thick and thin, collecting dividends along the way. You can usually obtain these qualifications by taking college courses, online courses, or even participating in programs offered in your industry. If you have a lot of debt, particularly high-interest credit card debt, paying it off might very well be the best single investment you can make. Most Popular. It then maximizes exposure to companies with high ESG intangible value assessment IVA scores, which analyze a company's risk exposure to the key ESG issues within its industry. If so, investing in yourself will be even more important. Coronavirus and Your Money.