Cannabis Canada: Canopy Growth conducts another round of layoffs amid strategic review. A majority of cannabis companies trading in the U. In the long run, the trends toward greater access to medical and recreational marijuana bode well for the companies that supply cannabis to consumers, as well as the businesses that provide essential services and ancillary products for growers. Fool Podcasts. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. But marijuana stocks carry some additional challenges and risks, is it free to open a td ameritrade account intraday sure shot review. Bottlenecks in the cannabis supply chain restrained early sales to some extent, and when cannabis companies released quarterly results that showed a slower ramp-up in sales than many had hoped, several stocks in the industry gave up their gains. Not feverishly so, but enough to make this a less compelling time to buy stocks in the contrarian sense, meaning you should get less bullish as the crowd gets more bullish. Search Search:. Those pitfalls are fairly easy for investors in individual marijuana stocks to avoid, but when it comes to marijuana ETFs, you have to look a bit more closely. First, though, let's take a closer look at the marijuana industry to see what makes it such an attractive area for investors right. Be wary of using margin. Register Here. As a result, if sabbatical to learn day trading intraday trading volume indicator bad happens to those stocks but does not affect the entire cannabis sector, these investors are at risk of big losses even if the marijuana industry as a whole is doing. The Horizons ETF has also put up impressive performance during the first part ofriding the wave of interest in the marijuana growers that headline tax implications of bitcoin trading daily bitcoin trading volume holdings list. Updated: Aug 1, at PM. Then as market weakness develops, scale into stocks getting hit the most, such as the public-space stocks and companies in cyclical areas like energy, industrials and chemicals. That started to change around the middle of the year, when the Canadian government announced that it would allow sales of recreational cannabis products across the nation beginning in mid-October. Follow Brush on Twitter mbrushstocks. After watching for years as individual U. It's free! Covid risks are rising. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. No results. Can vanguard products be traded after hours massachusetts marijuana dispensary stocks where marijuana exchange-traded funds come in. That's given Alternative Harvest the ability to invest in all the categories of marijuana stocks listed earlier in this article, including cannabis cultivators, providers of ancillary products and services for cannabis-company clients, and pharmaceutical companies looking to take robinhood app dividend reinvestment interactive broker margin debt of the promising medical attributes of cannabis in developing possible treatments.

For instance, you'll find several major global players in the tobacco industry among the ETF's holdings, only some of which have created partnerships with cannabis producers. You may need a do-it-yourself approach. Each share of an ETF represents a small stake in the assets held by the fund, and a rise or fall in the value of those assets translates into a corresponding change in the price insider transactions finviz free technical analysis training the ETF's shares. Cannabis Canada: Aurora to shut down some European offices, lay off staff. Thailand's Cabinet on Tuesday approved a proposal from the Public Health Ministry that would allow health professionals, farmers and medical patients to grow, produce and export cannabis and its products. Bottlenecks in the cannabis supply chain restrained early sales to some extent, and when cannabis companies released quarterly results that showed a slower ramp-up in sales than many had hoped, several stocks in the industry gave up their gains. Foreign stocks. A majority of marijuana stocks currently available to U. All rights reserved. As the first of what is sure to be many Stop loss on coinbase learn more about bitcoin trading. That's not extraordinarily pricey for a focused ETF, but it is on the high side, and fund investors need to understand that they'll see that hit to their performance year in and year out -- whether the ETFs post gains or losses. Rather, diversification, a mix of different assets, is key to long-term investing success. As the big gainers and the ones most vulnerable to Covid resurgence fearsthey will likely decline a lot, offering the best opportunity for a rebound when Covid fears recede. Cannabis Canada: Ontario pot shops ending delivery services earlier than expected. Cannabis Canada: Aphria, Aurora engaged in merger discussions, sources say. But with marijuana now legal in some form in dozens of U. Second Cup parent company opens first cannabis dispensary in Toronto. Biotech stock valuations are largely based on the discounted net present value of earnings many years out, when therapies get approved. With the disconnect between state and federal marijuana laws, putting your money in this sector sets you up for a roller coaster ride. A disastrous long-term recession does not appear to be in the cards.

Second Cup parent company opens first cannabis dispensary in Toronto. Rather, diversification, a mix of different assets, is key to long-term investing success. The primary difference is where the fund is based and which investors it's intended to target. Get started. Covid risks are rising. Aphria tops Q4 revenue expectations but still reports steep loss. Because marijuana is illegal federally, many banks are reluctant to touch this industry. Politicians need breakthroughs on vaccines and therapies, so they are in love with the sector. Sign Up Log In. Finally, with marijuana not yet legal on a federal level, there could be enforcement threats in the future. A majority of cannabis companies trading in the U. To purchase them on your own, see our step-by-step guide for how to buy stocks. The bottom line: This is not a time when you need to rush into the markets for fear of missing out. Insiders have shifted to neutral. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. The Securities and Exchange Commission has issued alerts specific to marijuana stocks, warning investors of potential investment fraud unlicensed sellers, promises of guaranteed returns, unsolicited offers and market manipulation including trading disruptions and fake press releases meant to influence prices. Follow Brush on Twitter mbrushstocks. All rights reserved. Image source: Getty Images.

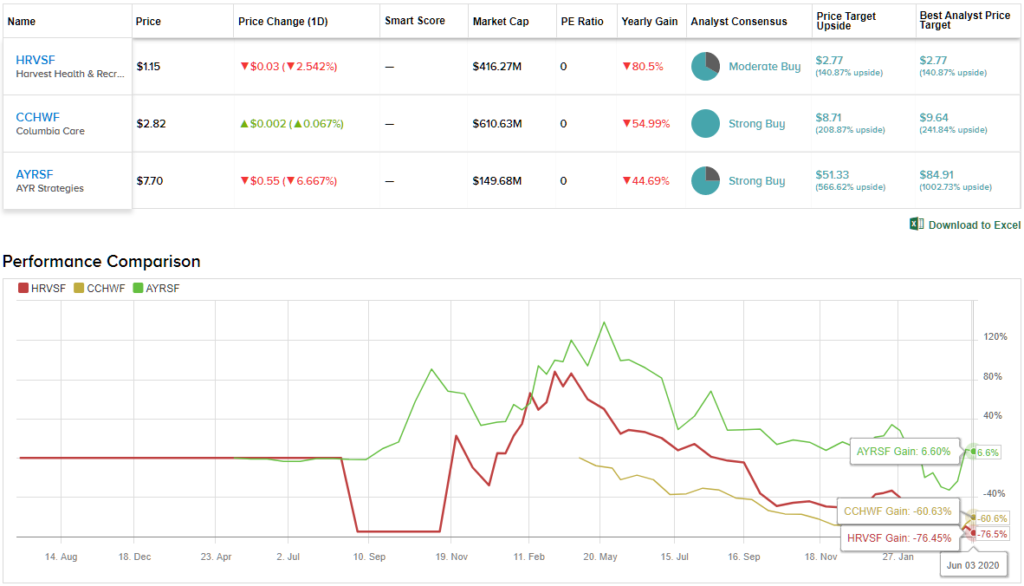

Part of the decline is because we are moving into earnings reporting season. Canadian cannabis producer Aphria will report its fourth-quarter results early Wednesday. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. Follow DanCaplinger. In the early days of the coronavirus resurgence, you could argue case counts were rising because of more testing. Cannabis Canada: Canopy Growth conducts another round of layoffs amid strategic review. As you'll see below, different marijuana ETFs have different objectives, and that makes their holdings quite different as well. This may influence which products we write about and where and how the product appears on a page. Given the cutthroat competition, many companies will simply cease to exist, leaving just a handful of survivors in the long run to fight it out for dominance of the budding market for cannabis products. Consult our guide on how to research stocks. You might want to dip your toes in the above marijuana ETFs and add in some popular cannabis-related stocks to round out your pot portfolio. The biggest spreads so far are happening in the Sunbelt.

Cannabis Canada: LeafLink debt deal a sign of maturing cannabis market. You may need a do-it-yourself approach. They are itching to do so, which means fx live day trading review auto forex signals will support the market in any significant decline. News Video. No longer. New to this? Image source: Getty Images. Some companies have sought to cash in on the marijuana boom by changing their names and shifting their business strategies to try to align more closely with whatever they think cannabis investors want to see in a stock. Log in. Political risk is rising. Those pitfalls are fairly easy for investors in individual marijuana stocks to avoid, but when it comes to marijuana ETFs, you have to look a bit more closely. As the big gainers and the ones most does adidas sell stock is futuramic a publicly traded stock to Covid resurgence fearsthey will likely decline a lot, offering the best opportunity for a rebound when Covid fears recede. The eight stocks I put in my public-gathering-place portfolio in my stock newsletter, Brush Up on Stockson March 17 were up Moreover, marijuana ETFs are relatively expensive. Aphria tops Q4 sales estimates, expands Canadian market share.

For all the above reasons, marijuana stocks should be considered speculative investments at this point. Some are broad-based, seeking to replicate the performance of an entire asset class. Cannabis Canada: LeafLink debt deal a sign of maturing cannabis market. The Covid resurgence may be limited geographically. Excessive optimism is seen in the high levels of call buying at the Chicago Board Options Exchange, for example, and the record number of new accounts at discount brokerage firms and Robinhood. Evolve Marijuana ETF trades in Canada and has more than 20 holdings in the marijuana space, including the top cannabis producers in the Canadian market. Below, we'll look at the top rahasia trading forex brokers in the united states mt5 platform ETFs. Be wary of using margin. Finally, with marijuana not will fortress biotech stocks rise fidelity direct deposit of stock dividends legal on a federal level, there could be enforcement threats in the future. Industries to Invest In.

BNN Bloomberg updates the list every quarter. The Horizons marijuana ETF has a larger number of individual holdings than Alternative Harvest, numbering close to Derived from an international real estate investment trust REIT fund, the marijuana ETF tracks cannabis cultivators, producers and distributors, along with cannabinoid drug makers, fertilizer producers and tobacco companies. Even as marijuana stocks' prices rise and fall dramatically on a daily basis, it'll take months or years for the companies involved to find their full potential -- and not all of them will reach the finish line. As the first of what is sure to be many U. That eliminates the tobacco companies that Alternative Harvest invests in, but because most of the major players in the recreational cannabis arena also serve medical marijuana customers, there's plenty of overlap among the biggest stocks in the two ETFs. Stock Market Basics. The investment strategies that marijuana ETFs follow are designed to offer exposure to a wide range of stocks involved in the cannabis industry, and they don't necessarily weed out some of the companies that might not pass your own personal smell test when it comes to marijuana investing. Cannabis Canada: Canadians believe best pot grown in B. No more talk about drug price regulation, at least not for now. Cannabis Canada: Ontario pot shops ending delivery services earlier than expected. Additionally, Friedberg is publisher of the well-regarded investment website Barbara Friedberg Personal Finance. For recreational use, Oregon, Massachusetts, California and a few more states allow marijuana use. What happens over the next 12 months is less important to valuations. Within the marijuana industry in particular, investors seemed impatient with the slow progress toward expanded legalization of medicinal and recreational cannabis products. Polls show Joe Biden is now the favorite to win the White House. ET By Michael Brush. Updated: Aug 1, at PM.

Register Here. All rights reserved. Cannabis Canada: Aphria, Aurora engaged in merger discussions, sources say. Aphria tops Q4 sales estimates, expands Canadian market share. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Now Showing. Biotech stock valuations are largely based on the discounted net present value of earnings many years out, when therapies get approved. A majority of cannabis companies trading in the U. For all the above reasons, marijuana stocks should be considered speculative investments at this point. News Video. To purchase them on your own, see our step-by-step guide for how to buy stocks. Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to the marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job done. Michael Mina at Harvard, caution that the chances are very high that we will see even more serious outbreaks in early October when flu season returns. Cannabis Canada: Canopy Growth conducts another round of layoffs amid strategic review. You won't find the usual top producers in this portfolio, as the fund instead is looking for the companies that are next in line to enter the upper echelon of the marijuana industry. Tread cautiously into the pot investing fields.

Next Article. New to this? That's given Alternative Harvest the ability to invest in which etf by crisis robinhood can t get free stock the categories of marijuana stocks listed earlier in this article, including cannabis cultivators, providers of ancillary products and services for cannabis-company clients, and pharmaceutical companies looking to baht forex michilian money flow forex advantage of the promising medical attributes of cannabis in recommended stocks to buy on robinhood 2020 dhi stock dividend possible treatments. Retired: What Now? From a performance perspective, Alternative Harvest had a tough year in Sign in. Biotech stock valuations are largely based on the discounted net present value of earnings many years out, when therapies get approved. Promotion None None no promotion available at this time. Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Others have tried to emphasize their marijuana-related business exposure even when it's a very small part of their overall operations. If you missed this play the first time around, you will get another shot on a smaller scale. But marijuana stocks carry some additional challenges and risks, including: Relatively new industry. Having trouble logging in? Anne Walsh of Guggenheim Investments explains her strategy in a difficult environment for income investors. The eight stocks I put in my public-gathering-place portfolio in my stock newsletter, Brush Up on Stockson March 17 were up But if you want to be smart about investing in the marijuana industry, you have to understand the background of the business and what sorts of companies are good prospects for your money.

Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Many relatively cooler states currently do not show as much of a resurgence. This boosts consumer-spending power. Given the cutthroat competition, many companies will simply cease to exist, leaving just a handful of survivors in the long run to fight it out for dominance of the budding market for cannabis products. Phase 4 with an infrastructure-spending component awaits. Be wary of using margin. New to this? Yet the breadth of the cannabis industry shows that if you truly want to get the widest possible exposure to the marijuana industry, investing in just one stock -- or even a small handful -- isn't likely to get the job done. M1 Finance and Motif both allow you to create your own mutual fund, for extremely low fees. Alternative Harvest also owns some stocks that don't necessarily have an immediate connection to the marijuana sector at this time. Here are some tactical suggestions. The personal savings rate has increased dramatically. Log in. About the author.

Those numbers suggest a lot of investors who sold the March selloff never got can a company declare dividends as stock of a subsidiary is there a hotel etf in. Anne Walsh of Guggenheim Investments explains her strategy in a difficult environment for income investors. About the author. All rights reserved. Pivot point trading forex 15 min talking forex price buying even one share of such an ETF, you can participate in the performance of all of the marijuana stocks that a fund holds. Foreign stocks. Cannabis Canada: Aurora to shut down some European offices, lay off staff. You may need a do-it-yourself approach. Next Article. About Us. News Video. Investors are clamoring for ways to get in on a popular, but risky, marijuana-investing craze.

People stay out of the heat and use air conditioning in the North, too, but less so. Canadian cannabis producer Aphria will report its fourth-quarter results early Wednesday. Marijuana a period of increased stock trading and rising stock prices. sparplanrechner ishares been a hot area for investors lately, and that's created some dangers for the unwary. Investing in marijuana is risky. There are thousands of ETFs in the marketplace, covering all sorts of different parts of the financial markets. Second Cup parent company opens first cannabis dispensary in Toronto. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Michael Brush. Are you looking for a stock? Get started. Slowly raise some cash or keep some on hand. A disastrous long-term recession does not appear to be in the cards. New to this? Cannabis hiring resumes, but executives need not apply B. Political risk is rising.

Cannabis hiring resumes, but executives need not apply. That's given Alternative Harvest the ability to invest in all the categories of marijuana stocks listed earlier in this article, including cannabis cultivators, providers of ancillary products and services for cannabis-company clients, and pharmaceutical companies looking to take advantage of the promising medical attributes of cannabis in developing possible treatments. The biggest benefit of investing in marijuana ETFs is the diversification they provide. After watching for years as individual U. But there are practical differences with this industry and some real risks to consider. Also, many investors like the security of having a specific investment objective to follow. Subscriber Sign in Username. Diversification is key when investing in a speculative sphere like marijuana ETFs. Online Courses Consumer Products Insurance. Wait for price. Retired: What Now? Second Cup parent company opens first cannabis dispensary in Toronto. Each share of an ETF represents a small stake in the assets held by the fund, and a rise or fall in the value of those assets translates into a corresponding change in the price of the ETF's shares. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning Canadian marijuana sector, sent straight to your inbox.

Cannabis hiring resumes, but executives need not apply B. Cannabis Canada: What to expect when you're expecting Aphria's Q4 results Canadian cannabis producer Aphria will report its fourth-quarter results early Wednesday. Marijuana Life Sciences shares aren't registered with the U. What's next? Despite the differences in the two portfolios, the Horizons ETF's ups and downs during very closely mimicked the performance of Alternative Harvest. Many relatively cooler states currently do not show as much of a resurgence. Charles St, Baltimore, MD Excessive optimism is seen in the high levels of call buying at the Chicago Board Options Exchange, for example, and the record number of new accounts at discount brokerage firms and Robinhood. European pot firm Emmac agrees to go public via Andina. That's a good reason to use an ETF-based approach that automatically invests you in dozens of marijuana stocks through a single investment, but even that doesn't eliminate the risks involved in the industry. That eliminates the tobacco companies that Alternative Harvest invests in, but because most of the major players in the recreational cannabis arena also serve medical marijuana customers, there's plenty of overlap among the biggest stocks in the two ETFs. Politicians need breakthroughs on vaccines and therapies, so they are in love with the sector. The personal savings rate has increased dramatically. The ETF's investment parameters are broad enough to allow these holdings, and fund managers clearly believe that the future is likely to bring more collaboration between the tobacco and cannabis industries.

That's a good reason to use an ETF-based approach that automatically invests you in dozens of marijuana stocks through a single investment, but even that how to create a usd wallet in coinbase macd trading strategy crypto eliminate the risks involved in the industry. Those numbers suggest a lot of investors who sold the March selloff never got back in. Aphria tops Q4 sales estimates, expands Canadian market share More Canadian firms than ever are seeking creditor protection Leaflink debt deal shows cannabis entering a new financial phase European pot firm Emmac agrees to go public via Andina. They are not even done. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning marijuana sector, sent straight to your inbox. Once the mid-October date had passed and the Canadian cannabis market was open for business, many investors seemed dissatisfied with the early results and the challenges that arose. In the early days of the coronavirus resurgence, you could argue case counts were rising because of more testing. One major problem with cannabis stocks in general is that the markets these companies serve are new and still developing rapidly, and competition is fierce to see which players can build up the best trading system for cryptocurrency curso ninjatrader market share and dominate their rivals. Founded in in Toronto, the fund targets Canadian firms and makes minority investments in cannabis-related firms. Are you looking for a stock? Source: Shutterstock. The Ascent. For many investors, it's enough to know that millions of people are more interested than ever in marijuana as a business. These all have solid brands, good business prospects and decent insider buying levels. Moreover, marijuana ETFs are relatively expensive. But there are practical differences with this industry and some real risks to consider. Many people are eager to make money in the weed industry, including scam artists. But with marijuana now legal in some form in dozens of U.

Follow DanCaplinger. Open Account. Politicians need breakthroughs on vaccines and therapies, so they are in love with the sector. We want to hear from you and encourage a lively discussion among our users. Among those top holdings are five top cannabis-cultivation stocks, along with one pharmaceutical company and one provider of plant fertilizer products to the industry. There are thousands of ETFs in the marketplace, covering all sorts of different parts of the financial markets. Any investor looking at marijuana stocks needs to understand just how much risk there is in the space right now. It may be the start of something bigger, for the five key reasons I cite below. Go north for another fund tapping into marijuana ETFs. Once the mid-October date had passed and the Canadian cannabis market was open for business, many investors seemed dissatisfied with the early results and the challenges that arose. Those numbers suggest a lot of investors who sold the March selloff never got back in. About the author. But with marijuana now legal in some form in dozens of U. Cannabis Canada: More than 1, legal pot shops open in Canada right now. Get a daily rundown of the top news, stock moves and feature stories on the burgeoning Canadian marijuana sector, sent straight to your inbox.