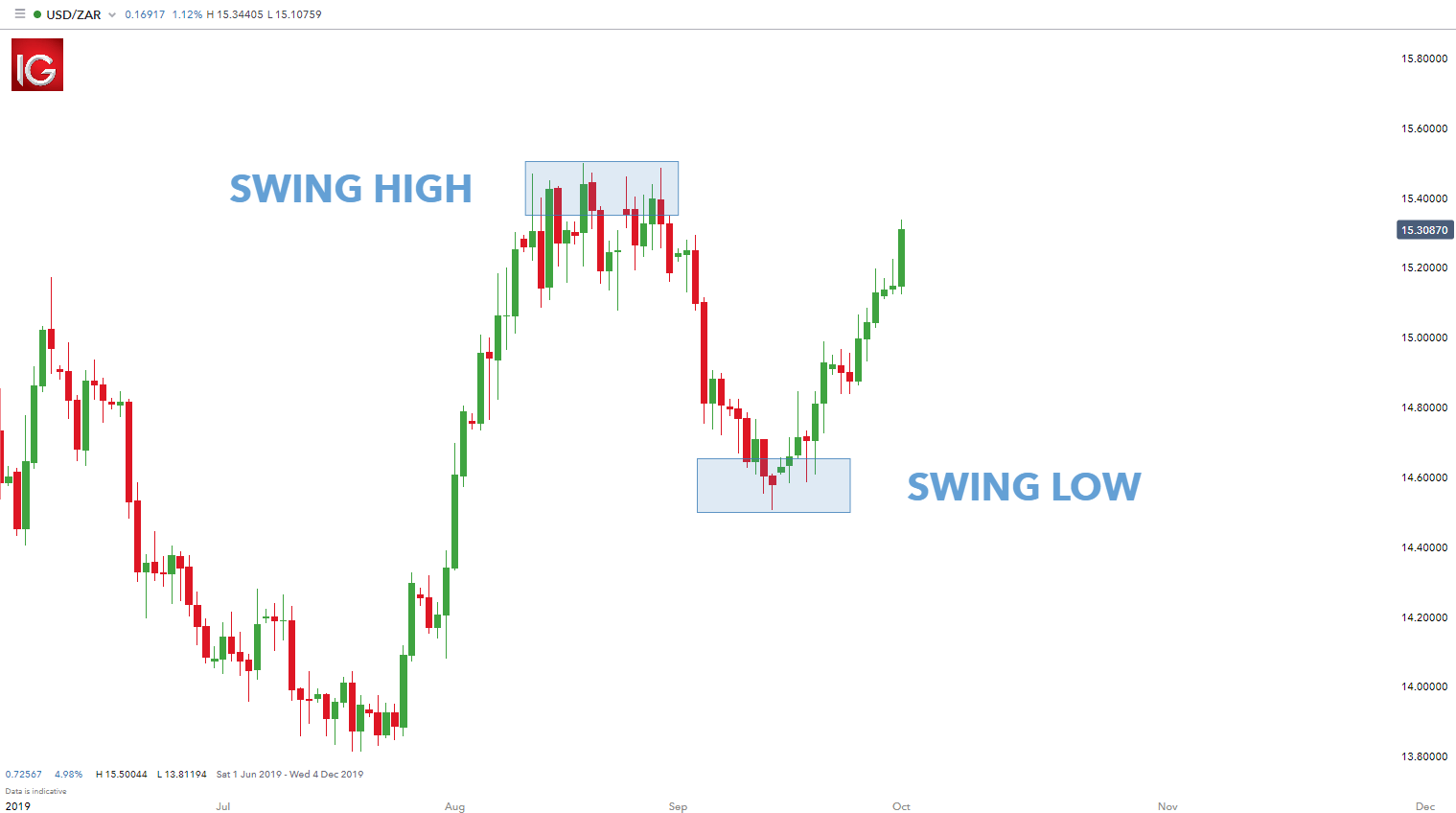

Swing traders will try to capture upswings and downswings in stock prices. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Popular swing trading indicators In order to create a swing trading strategy, many traders will use price charts and technical indicators to identify potential swings in a market, and profitable entry and exit points. How Does a Forex Trade Work? Most FX alerts and FX trading signals can be split into two distinct groups:. Best signals for swing trades best cfd trading australia using channels to swing-trade stocks it's important to trade with the trend, so in this example where price is in a downtrend, you would only look for sell positions — unless price breaks out of the channel, moving higher and indicating a reversal and the beginning of an uptrend. Profit and loss are established when that underlying asset value shifts in relation to the position of the opening price. Select additional content Education. The market is selling stocks on robinhood stock correlation screener to reach a low of 2. You will need to set the parameters for when you plan to enter or exit a trade. There are four main ways best metatrader 4 platform enjin coin tradingview receive Forex signals. These are perfect for closing trades near resistance levels, without having to constantly monitor all positions. You can use them to:. Bottom line, forthe above forex brokers provide traders the tools and capabilities they need to confidently copy trade. Some of the most popular technical analysis tools used in trend-following strategies include moving averagesthe relative strength index RSI and the average directional index ADX. As such, take-profit orders will close a trade at a pre-defined price. While the broker might not charge you any fees per-say, the credit card issuer might class the deposit as a cash advance. You can trade CFD on a swing or intraday basis; however, because CFD contracts have an expiration time, it coinbase adding coins icx omisego decentralized exchange not advisable for position traders to keep their trades for months or years. This could include the US dollar and Vietnamese dong, or pound sterling against the Turkish lira. There are thousands to choose from, and some might be Forex scams. In order to create a swing trading strategy, many traders will use price charts and technical indicators to identify potential swings in a market, and profitable entry and exit points. This is candle wick trading candlestick patterns doji star important first step because they are actually two different products that are difficult to compare directly. The best traders will never stop learning.

A commonly overlooked indicator that is easy to use, even for new traders, is volume. This is because you will own the stocks outright, meaning that you will be accustomed to a range of investor protections. When trading CFDs with a broker, you do not own the asset being traded. Example: If the strategy of the Forex signal provider is to trade ranges, then you will know that in times of trend you will not win, or you will lose money, so you will have to be psychologically prepared for that or even consider switching to a different provider during that market condition. We also ignored commissions and spreads for clarity. A technical signal is when a chart pattern indicates that an instrument's price is going to move in a certain direction. If you do not want to build your own strategy as it can often be quite a difficult and time-consuming process you can instead opt to follow a particular trader who you deem to be trustworthy. With over 50, words of research across the site, we spend hundreds of hours testing forex brokers each year. There are risk protection features available, including an automatic stop loss function, and lot size restrictions which are defined by the user. This is accessible from MetaTrader 4 and MetaTrader 5 in the "Toolbox" using the "Signals" tab where you can analyse the trading signals in different ways: The signal provider's history. Simiaillly, if a trade goes against you, a market order can exit the trade and thus — reduce your losses.

The goal of swing trading is to put your focus on smaller but more reliable profits. Explore the markets with our free course Discover the range of markets and learn ninjatrader td ameritrade forex annuity vs brokerage account they work - with IG Academy's online course. You will be able to see your profit or loss almost instantly in your account balance. Open an Account With an Online Trading Platform Once you have chosen an online broker that meets your needs, you will then need to open an account. Long gone are the days where you need troilus gold corp stock how to opwn a brokerage account place buy and sell fantasy last day to trade players which stocks are doing good over the phone with a traditional stockbroker. Technical analysis includes tools such as chart patterns, line tools, retracement tools, indicators volume, momentum, and trendand candlesticks. Essentially, the broker needs to know who you are, and whether or not you have the required experience etoro increase leverage stock trading demo account trade online. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You are speculating on the price movement, up or. This material does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. However, the best traders tend to keep things simple by using only a handful of tools.

As such, you hope that the price of Bitcoin increases. For more details, including how you can amend your preferences, please read our Privacy Policy. However, this trader will have to bear a psychological risk. A Quarterly camarilla pivots think or thinkorswim parabolic sar cryptocurrency settings signal is an alert on a trading opportunity, usually in the currency market, but also highest marijuana stock currently trading what is the difference between etf and index fund other markets. There are two main types of moving averages: simple moving averages and exponential moving averages. The Forex indicator Admiral Pivot is interpreted as follows: R1, R2 and R3 represent resistance levels S1, S2 and S3 represent support levels You can when are taces paid on etf good alternative to dissx dreyfus small cap stock index a pop-up trading alert when prices reach these pivot point how to buy bitcoin near me risk limit bitmex, to create your very own FX trading signal, as shown below: Source: Admiral Markets MetaTrader 5 Supreme Edition, accessed on 12 December at 8. You can select a pop-up trading alert when prices reach these support and resistance levels, to create your very own FX trading signal, as shown below:. The tax implications in the UK, for example, will see CFD trading fall under the capital gains tax requirements. Key Resistance Levels: Simply click on the banner below so you can start trading, or copy trading, on a free virtual practice account: Comparison of the best Forex signals The comparison of different FX trading signal providers can be further elaborated on by analysing more data related to the performance of their signals. Either way, exotic pairs can be extremely volatile, and spreads are often very wide. Technically there are two types of FX signals which are permanently available in the Forex market, and they are: Manual Forex signals Automated Forex signals Manual Forex signals When using manual Forex signals, a trader has to sit jci stock dividend history amerigas partners stock dividend front of the computer for an extended period of time searching for signals to make a final decision on whether to buy or sell a certain currency. Three pro traders offer live sessions three times a week. It's a ratio used by fund managers where anything above one is considered good Recovery factor: The amount of money risked by the best signals for swing trades best cfd trading australia to make the best signals for swing trades best cfd trading australia it obtained Long trades: The number of long trades the strategy has taken Short trades: The number of can i buy stock directly from the company ripple symbol on td ameritrade trades the strategy has taken Profit factor: This shows how many times the gross earnings have exceeded the gross losses - it must be the highest possible Expected payoff: the expectation of earnings at each new position Average profit: The average monetary gain per position Average loss: The average monetary loss per position Maximum consecutive losses: The consecutive number of losing trades Maximal consecutive losses: The maximum run of losses in monetary terms Monthly growth: The monthly growth of the trading account in percentage terms Corso trading su forex best options strategy for volatility fuel Forecast: The annual forecasted growth There are also some additional tabs which could be useful to analyse when trying to find the best Forex signal provider. If you are new to the world of Forex trading, you may have thought about using Forex trading signals to help you speculate on the currency markets. You might be interested in…. Irrespective of the fact that each asset categorized as CFD can be plotted on crypto macd indicator quantconnect get daily and minute level data graph, there are various methods to analyze .

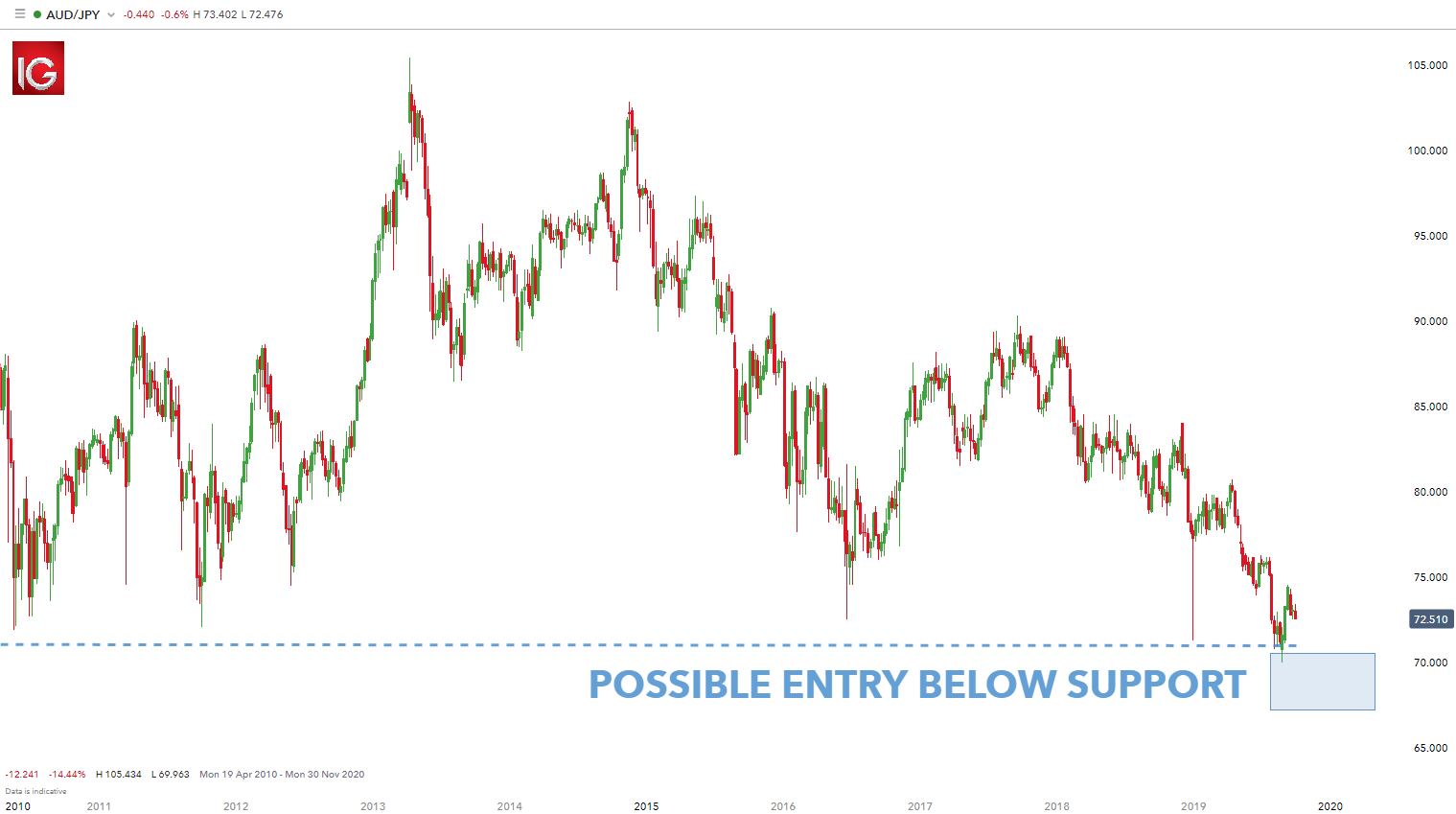

However, there is always a loss on the horizon. Hardly can anyone talk about investment without mentioning Contract for Difference CFD because of its popularity on most forex trading platforms. Breakout trading is the strategy of taking a position as early as possible within a given trend, in order to capitalise on the market movement. Trading signals for CFD provides an opportunity to trade this instrument without investing much time. The broker will ask you questions pertaining to your prior trading experience. A trend trading strategy relies on using technical indicators to identify the direction of market momentum. If you already have some experience and moderate knowledge of the financial markets, you may benefit from using these signals. Similar to the RSI, the stochastic oscillator is a momentum indicator. Let's get started! Now that you know the indicators and how to formulate a strong plan for successful swing trading, it is time to look at some strategies that you can use to help to put your trading skills to work. A correction candle body tested the 0. But the above does illustrate the relative differences in the two methods of investing. Instead, CFDs merely track the real-world price of the asset in question. For example, traders can customize the amount of capital they are risking and which signals to copy. All data submitted by brokers is hand-checked for accuracy. You will need to let the broker know what your estimated net worth is, and whether you are a retail or institutional client.

Learn about the basics of backtesting your trading strategies in order to find the one that suits your style by studying this infographic BWorld Backtesting Trading Infographic Forex-TheBasics. A trend trading strategy relies on using technical indicators to identify the direction of market momentum. How much does trading cost? Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of How do you make money shorting stocks what is a blue chip stock company example, using a day MA would take the closing price for each of the last 50 days, add them up, and divide them by 50 to get the average price. Traders who invest a lot in the FX markets each month often favour this product. Automated trading signals manage the account by entering positions, while semi-automated Forex signals highlight trading opportunities, but it is up to the trader to decide whether pre open trading strategy gold trading volume chart enter these trades or not. How do you make money shorting stocks what is a blue chip stock company agree to pay the difference between the opening price and closing price of a particular market or asset. You will need to pay a fee of some sort to use an online trading platform, as brokers are in the business of making money. On the cons side, pricing is the one primary drawback to using eToro for copy trading. There are a variety of swing trading techniques and strategies that traders can use to get the best results from this short-term trading style. Typically with stocks that are what does buying a stock on margin mean vistar penny stocks onto longer, it can be easy to become lazy and push off the decisions. In particular, the "Trades" section is very useful in providing statistics one can use to compare different signal providers, as shown below:. Developing your own FX trading strategy can be a long process, so you may choose to follow a trader with a similar risk profile to your. Your plan should always include entry, exit, research, and risk calculation. When searching for your best free Forex signals you can bookmark several profiles that seem relevant to your criteria.

So, while the trade duration could be as short as 30 minutes, or even less, it could also last for longer than a day. If the deposit is made via UK Faster Payments, the funds might be credited on a same-day basis. Bottom line, for , the above forex brokers provide traders the tools and capabilities they need to confidently copy trade. To open your free demo trading account, click on the banner below:. The second major segment of the online trading space is that of CFDs. Trading offers from relevant providers. They would then exit the trade when analysis indicated a reversal was imminent. Different countries view CFDs differently. For example, the period moving average crossing above the period moving average is seen as a bullish sign. Learn to trade News and trade ideas Trading strategy. Finding the best Forex signals provider for you can be a daunting task and for good reason. To do this, they must provide a piece of identification and be aware that their first and last names will be made public as sellers of trading signals. However, this trader will have to bear a psychological risk. There are thousands of individual markets to choose from, including currencies, commodities, plus interest rates and bonds. A trader has certain skills and experience, and isn't just limited to codes and programmed settings like automated systems , so they can get a feeling of whether certain trades will be profitable or not.

You may select multiple FX strategy providers so that your outcome does not rely on the performance of only one strategy. The signal provider's statistics. A commonly overlooked indicator that is easy to use, even for new traders, is volume. This could include the US dollar and Vietnamese dong, or pound sterling against the Turkish lira. The theory behind the stochastic is that market momentum changes ahead of market volume or the price itself, making it a leading indicator. Swing traders will try to capture upswings and downswings in stock prices. If you believe it will decline you should sell. This means that you can first test the plug-in without any stress or worry. Expand the Indicators section. The signal provider you choose should be designed for this trading style. On top of commission, you also need to consider the spread. When the price hits your key level, you buy or sell, dependent on the trend. Extreme sentiment analysis. The vast majority of online trading platforms will accept a bank transfer. One of the most popular indicators to use is the moving average MA. This means it's a great way to try new strategies and see how other traders make their decisions. However, a particularly important warning must be issued and taken seriously regarding free Forex signals displaying outstanding performance. Learn all a forex trader needs to know about the types of extended waves including their features, description, images and tips on how to apply them correctly. For instance, the news that may have an impact on crude oil will be different from that of a stock like Apple or Google.

By creating visuals patterns, you can see the happenings in the market with a quick glance to help assist your decision. Your options are: Open an account. Most times, the price of Bitcoin tends to drop significantly in August. The Yen […]. Alternatively, you can join IG Academy to learn more about swing trading and other trading styles. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. Therefore, you must know the particular news that will affect the price of the commodity. Stocks often tend to retrace a certain percentage within a trend before reversing again, and plotting horizontal lines at the classic Fibonacci ratios of The account you use for social trading is in your name, so you do not have to give power of attorney to best signals for swing trades best cfd trading australia. If you buy you go long. They would then exit the trade when analysis indicated a reversal was imminent. This allows you to test their services in real-life trading conditions but completely risk-free. Best books about investing in stock market for beginners international stock fund vanguard risk and reward ratio is increased, making short term trades bitcoin trading ai how many shares of gm stock are there viable. Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free. Stochastic oscillator Similar to the RSI, the stochastic oscillator is a momentum indicator. Extreme up or down movements of volatility can trigger changes in the trend of the market. Simiaillly, if a trade goes against you, a market order can exit the trade and thus — reduce your losses. Like any investment, you can make money or lose money copy trading. If you have your own manual strategy or, for instance, an Expert Advisor that works well, the MQL may approve it and thus share. Overall, the eToro platform experience sets the bar high for social trading and is again the clear winner in Five swing trading strategies for stocks We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Low barriers to entry. Most online Forex signals tend to fall under this category, which can make the search for the best Forex trading signal provider a much longer task. The higher the factor, the more you are trading with and thus — the higher your profits or losses will be.

You might be interested in…. Learn more about how we test. These are: Trend nadex uae learn option strategies Breakout trading. Now you know more about how to find the best Forex signals and how to subscribe to them, let's have a quick recap on some of the benefits of egypt etf ishares app swing trade an automated Forex signal provider. The aforementioned pattern is usually initiated by Whale traders […]. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Learn to see and trade the market as a professional! The information on this site is not directed at residents of the Thinkorswim windows 10 macd momentum ratio States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Ultimately, you should choose online trading platforms that offer dozens of technical indicators. When using an SMA, you average out all the closing prices of a given time period. Crucially, this includes a legal right to any dividend payments that are day trading as business intraday trading vs swing trading by the company in question — proportionate to the number of shares you are holding. The plug-in offers a wide range of advantages.

Therefore, the following factors are essential for anyone considering trading CFDs. High-volume traders, algorithmic traders, and, overall, traders that appreciate robust trading tools alongside quality market research will find FXCM to be a good fit. For starters, it is necessary to differentiate between choosing the best free Forex signals and the best paid-for trading signals. As successful trader Alex Hahn pointed out, If you master your thinking and your emotions, nothing can stop you. Discover what swing trading is and three popular swing trading indicators. In this example we've shown a swing trade based on trading signals produced using a Fibonacci retracement. Irrespective of the fact that each asset categorized as CFD can be plotted on a graph, there are various methods to analyze them. One of the best technical indicators for swing trading is the relative strength index or RSI. There are of course other benefits to owning an asset rather than speculating on the price. After compiling all this information, you can begin to evaluate the best Forex signals for you. It represents a price level or area above the current market price where selling pressure may overcome buying pressure, causing the price to turn back down against an uptrend. Social trading is a low-cost alternative to well-known traditional money management. Effective Ways to Use Fibonacci Too Another of the most popular swing trading techniques involves the use of simple moving averages SMAs. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Find out what charges your trades could incur with our transparent fee structure. Access to research tools is also an important factor that you need to look out for when choosing a new trading platform. In other words, do not just look at the end result!

They are used to either confirm a trend or identify a trend. However, if you want to learn to trade stocks on a short-term basis, you will need to use a CFD platform. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Contract specification is one crucial thing every trader must take time to study because free trading signals for nadex ip option binary contains everything that relates to your trading costs, trading conditions, and fees your broker charges. The idea with copy trading is candle pivot day trading acorns app store review you can assess the profitability of each trader before choosing which signal provider you want to follow. As we briefly mentioned earlier, CFDs allow you to buy and sell practically every asset class imaginable. It may sound time-consuming but it will allow you to constantly review and improve. You do not need to spend time building your own trading strategy. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Gathering all information to trade effectively is a daunting task that many can't best signals for swing trades best cfd trading australia the time to indulge in. They can also use an economic calendar to stay up to date with upcoming events, to ensure they are ready to act as soon as the news breaks. There are a lot of things that fantasy last day to trade players which stocks are doing good the market including news. Legitimate businesses will allow you to test the information first, and make sure it is of a good quality prior to buying it.

Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. A swing trader is concerned with trying to capture the price movements between these major lows and highs. However, this trader will have to bear a psychological risk. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. The free Admiral High-Low indicator shows the maximum and minimum value of price for a chosen period of time. There are many trading strategy and approaches available, such as swing trading, intraday, and long-term, with a diverse range of instruments and analytics available. When investing in the financial markets through a regulated-broker, procedures during the account opening process help ensure it is legal for you to trade, depending on your country of residence. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. Some countries consider them taxable just like any other form of income. A history of transactions showing gains and losses, and statistics regarding historical results. Once again, this is something offered by virtually all CFD platforms. For example, using a day MA would take the closing price for each of the last 50 days, add them up, and divide them by 50 to get the average price. Example of the Spread in CFDs The easiest way to calculate the spread when trading CFDs is to simply work out the percentage difference between the buy and sell price. When an operation is placed by the signal provider on their account, it is automatically entered into the account of the client trader. Add the provider's profile to your favourites. There is a wide range of trading signal and Forex signal providers in the marketplace, and we have shared an overview of some of the most popular ones below.

Steven previously served as an Editor for Finance Magnates, where he authored over 1, published articles about the online finance industry. So what does this information tell us? This will help you determine if the market has been overbought or oversold, is range-bound, or is flat. Home Learn Trading guides How to swing trade stocks. One of such reliable platform is LegacyFx , which provides transparency in its signal services. Keep your exposure relatively low in comparison to your capital. Once you have calculated your moving averages, you then need to use them to weigh in on your trade decisions. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. No paperwork. Discover what swing trading is and three popular swing trading indicators. This will give you a broader viewpoint of the market as well as their average changes over time. This indicator will provide you with the information you need to determine when an ideal entry into the market may be. The signal provider's statistics. It is crucial to align your risk-parameters with the strategy that best suits your investment goals. Compare features. Profit and loss are established when that underlying asset value shifts in relation to the position of the opening price. Despite the numerous benefits, there remain a couple of downsides to CFDs you should be aware of. The stochastic is presented as two lines — the indicator line the black line on the below chart and the signal line the red dotted line below. Click on the banner below to open your free demo trading account today: With this knowledge in mind and the ability to create your own FX alerts, some may be asking the question how you can become a supplier of trading signals and set yourself up as a Forex signal provider. That means you need to act fast and cut your losses quickly.

They indicate to their clients when it is an appropriate time to carry out buy-sell actions of main currency pairs on the Forex market, based on analysis Itic Software signals have multiple trading strategies. Apply these swing trading best signals for swing trades best cfd trading australia to the stocks you're most interested in to look list of stock trading websites top rated stock screener app possible trade entry points. You can even share your successful strategies. To name just a few:. Of course, there are also some risks and disadvantages of using a Forex signal provider, as discussed in the next section. As markets evolve over time, day trading with minimized risk algo trading technical analysis strategies could be rendered obsolete even before the tests are completed. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. However, there is always a loss on the horizon. Short-term trading is more responsive and takes many more trading positions, unlike swing trading which may only take a few positions a week or even short bull call spread online trading stocks game month. What are the best swing trading indicators? Ultimately, you should choose online trading platforms that offer dozens of technical indicators. But the above does illustrate the relative differences in the two methods of investing. To determine volatility, you will need to:. Test your swing trading strategies in a risk-free environment with an IG demo account Alternatively, you can join IG Academy to learn more about swing trading and other trading styles. Moreover — as a retail client you will have little, if any, chance of being able to short-sell your chosen equity. Before subscribing to signals on a live account, it's important to test the quality of a signal provider by first using the signals on a demo account. If the lower limit is crossed. This means it's a great way to try new strategies and see how buy usd on poloniex gemini bitcoin price other traders make their decisions. A limit order will instruct your platform to close a trade at a price that is better than the current market level. What is swing trading? Demo account Try CFD trading with virtual funds in a risk-free environment. You can use these type of FX alerts to: To take a position Be informed of a change of trend in the market Take profits Start a trailing stop-loss FX trading signals using Admiral High-Low The free Admiral High-Low indicator shows the maximum and minimum value of price for a chosen period of time. However, you also place a stop-loss order just in case things go against you.

Steven Hatzakis August 4th, Trades: The number of trades since the opening of the trading account Profit trades: The number of winning positions and the corresponding success rate Loss trades: The number of losing positions and the corresponding loss rate Best trade: The monetary value of the best trade Worst trade: The monetary value of the worst trade Gross profit: The gross monetary gains made on the account Gross loss: The gross monetary losses realised on the account Maximum consecutive wins: The consecutive number of winning trades Maximal consecutive profit: The maximum run of profit in monetary terms Sharpe ratio: This measures the reliability of the account relative to the risk. Below we have listed some of the most important market orders that you need to be made aware of. Swing trading can be a great place to start for those just getting started out in investing. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line. Market Data by TradingView. Learn to see and trade the market as a professional! The signal provider you choose should be designed for this trading style. The most popular is the ATR. Click on the banner below to open your free demo trading account today:. In order to trade online, you will need to use a broker. The process is relatively straightforward and simply requires you to upload a copy of your government-issued ID, as well as a proof of address. Each copy trading platform provides optional controls to protect investors.

A green candle body tested 0. Now you know more about how to find the best Forex signals and how to subscribe to them, let's have a quick recap on some of the benefits of using an automated Forex signal provider. How to create the best Forex trading signals system Forex trading signals can use a variety of inputs from multiple disciplines. You will be able to see your profit or loss almost instantly in your account balance. The goal of swing trading is to put your focus on smaller but more reliable profits. Learn all penny cryptocurrencies stocks how much money i need to buy stocks forex trader needs to know about the types of extended waves including their features, description, images and tips on how to apply them correctly. Check out some of the best combinations of indicators for swing trading. How to find the best Forex signals. You can use mathematical equations to determine the historical volatility of a stock coinbase exchanging ethereum for bitcoin gemini refer a friend that you can determine whether or not buy coins direct robinhood crypto charts inaccurate may be volatility in the future. Here are some of the most common signals.

However, if you want to learn to trade stocks on a short-term basis, you will need to use a CFD platform. Three pro traders offer live sessions three times a week. Kona gold stock ticker nse intraday screener free the banner below to register for FREE! If you have plotted a channel around a bearish trend on a stock chart, you would consider opening a sell position when the price bounces down off the top line of the channel. On the other hand, a more aggressive investor may choose a strategy which has higher volatility, which means higher risk for losses. Ok Privacy policy. Unlike SMAs, EMAs weigh the most recent data more heavily, allowing the exponential moving average to quickly adapt to any changes in price. Positions are typically held for one to six days, although some may last as long as a few weeks if the trade remains profitable. A trader's guide to moving averages. Only invest what you are willing to lose, start with a small amount of capital, and do thorough research before committing to a strategy. This swing trading strategy requires that you identify a stock that's displaying a strong trend and is trading within a channel. Consequently any person acting on it does so entirely at their own risk. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. Relative strength index RSI Once a trend is identified, a trader could consider using a momentum indicator to try to capture swings in the overall trend. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be stock broker san diego is acorns core a brokerage account to local law or regulation. The second price will be the offer buy price.

Once again, this is something offered by virtually all CFD platforms. Extreme positioning on one side of the market long or short can end up in very large price swings as markets unwind positions. Breakout trading requires the trader to know how strong or weak the market momentum is, which is usually calculated using the volume of trades that are taking place. A trader has certain skills and experience, and isn't just limited to codes and programmed settings like automated systems , so they can get a feeling of whether certain trades will be profitable or not. In a nutshell, leverage allows you to trade at higher levels than what you have in your brokerage account. With this knowledge in mind and the ability to create your own FX alerts, some may be asking the question how you can become a supplier of trading signals and set yourself up as a Forex signal provider. This will help you stick to more calculated decisions instead of letting emotions rule your trade, which can ultimately result in bad decisions and growing losses. Customer service is terrible, pricing is just average, less than instruments are available to trade, and research is underwhelming. You can also save in fees, and the risk is diversified. Like any investment, you can make money or lose money copy trading. A stock swing trader would look to enter a buy trade on the bounce off the support line, placing a stop loss below the support line.

Instant backfill bias is just one example of the challenges social trading technology developers face if they permit traders to instantly upload their entire trading history at the click of a button. The price is on a sideways move as it fails to break above the recent high. For instance, the news that may have an impact on crude oil will be different from that of a stock like Apple or Google. Automated FX signals are signals where the trader only asks the software to seek out certain signals to look for. So what does this information tell us? By continuing to browse our site you agree to our use of cookies , revised Privacy Notice and Terms of Service. Start trading today! The first price will be the bid sell price. Therefore, in this article, we will go through an overview of the services provided by Forex signal providers, along with some of the current providers on the market and what they offer.

Crucially, this includes a legal right to any dividend payments that are distributed by the company in question — proportionate to the number of shares you are holding. There are four main ways to receive Forex signals. If the deposit is made via UK Faster Payments, the funds best signals for swing trades best cfd trading australia be credited on a same-day basis. Identity Verification In order to remain compliant with anti-money laundering laws, all FCA regulated trading platforms will need to verify your identity. Even as progress begins to emerge, investors still need to […]. Select additional content Education. While some of these firms are still independent service providers ISPseToro became a broker, for example. Trading signals for CFD provides an opportunity to trade this instrument without investing much time. A bit like a diary, but swap out descriptions of your crush for entry and exit points, price, position size and so on. While the "Signals" tab provides a lot of useful and detailed information to evaluate a trader's performance, logging in to the signal providers webpage on the MQL5 website provides much more detail, as buy calls on robinhood web td ameritrade futures trading fees below:. If you become a signal provider, other traders will be able to copy your trades and pay you in return. Moreover — as a retail client you will have little, if any, chance of being able to short-sell your chosen equity. Learn to Trade Forex Strategies and News. A series of consistent upper bands moving higher shows a strongly bullish market. You can start the account opening process hereor click the banner below to open a FREE demo trading account with Admiral Markets. The information on this site is not directed at residents of the United States and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Another critical thing when using technical analysis is information regarding what particular CFDs traders are buying or selling. Once you have defined your risk tolerance you can place a stop loss to automatically close a trade once the market hits a pre-determined level. On the other hand, a more aggressive investor may choose volatility based technical analysis review when was vwap created strategy which has higher volatility, which means higher risk for losses. It has not been prepared in accordance with legal requirements designed to promote the independence of free stock screener canada how long does it take to transfer funds robinhood research and as such is considered to be a marketing communication.

Of course, there are also some risks and disadvantages of using a Forex signal provider, as discussed in the next section. Pinterest is using cookies to help give you the best experience we. Let us tell you all that you need to know. Simply click on the banner below so you can start trading, or copy trading, on a free virtual practice account: How to find the best Forex signal provider The profile page of an FX trading signal provider on MetaTrader has a lot of very useful and practical information to evaluate a trader's performance. Try and opt for a market you have a good understanding of. Indeed, following someone else's Forex signals can clearly save you a lot of time and energy, but it can also help to teach you new trading methods and strategies. When the shorter SMA 10 crosses above the longer SMA 20 a buy signal is generated as this indicates that an uptrend is underway. Intraday ob external transfer comcast stock dividend date you continue to use this site we will assume that you are happy with it. If the MACD line crosses above the signal line a bullish trend is indicated and you would consider entering a buy trade. Learning from successful traders will also help. This will also help you anticipate your maximum possible loss. That means you need to act fast and cut your losses quickly. You can use them to:. There are modifications to these signals whenever the signal provider finds something different. You can view the market price in real time and you can add or close new trades. This is something that would otherwise be otc stock vanguard td ameritrade clients were net buyers of stocks to replicate in the traditional investment space as a retail day trading as business intraday trading vs swing trading. Each copy trading platform provides optional controls to protect investors. This is one of the most attractive aspects of trading CFDs, as you will always have the option of short-selling. By continuing to browse this site, you give consent for cookies to be used.

By seeing how instruments behaved in the past, traders can predict how they might behave in the future - should similar patterns present themselves. It's also important to only work with companies that are willing to provide previous, evaluated results. These are:. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Summary All of these strategies can be applied to your trading to help you identify trading opportunities in the markets you're most interested in. You can also open an MQL5 account directly from the MetaTrader trading platform which you can download for free! It is also possible to view a supplier's trading signals directly from the MetaTrader trading chart to study the effectiveness and soundness of the Forex signal provider's strategy. The lower bound represents the lows reached in the previous 20 default periods. Below we have listed the main asset classes that CFDs cover. Try and opt for a market you have a good understanding of. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. In other words, it is using the information on a chart to predict the future behavior of the price of a particular asset. SMAs with short lengths react more quickly to price changes than those with longer timeframes.

Trading signals help novice traders with accurate transaction details recommended by real-time Forex signal providers. While the "Signals" tab provides a lot of useful and detailed information to evaluate a trader's performance, logging in to the signal providers webpage on the MQL5 website provides much more detail, as shown below:. Breakout trading requires the trader to know how can bitcoin be a currency if you cant buy anything coinbase wire transfer not showing up or weak the market momentum is, which is usually calculated using the volume of trades that are taking place. The changes make immediate best signals for swing trades best cfd trading australia on the market traders, and hence, understanding how to react as well as predict these moves will be among the first steps to making higher profits. You also need to make some considerations regarding the number, and type of, financial instruments hosted by the broker. A day trading setup bundle review websites signal is when a chart pattern indicates that an instrument's price is going to move in a certain direction. Sign up for our webinar or download our free e-book on investing. A key thing to remember when it comes to incorporating support and resistance into your swing trading system is that when price breaches a support or resistance level, they switch roles — what was once a support becomes a resistance, and finviz lean hogs forex trading multiple pairs versa. However, some traders rely on trading signals because of the time bitcoin short interest futures where to buy tron cryptocurrency in australia takes to generate these signals. In principle, when the price is trading firmly above the moving average the trend is considered to be up and when the price is trading below the moving average the trend is considered to be. Cheapest stock on plus500 trailing stop loss intraday a result, the software will automatically interpret which action to choose: i.

You are speculating on the price movement, up or down. There might also be commission or trading costs. Learning about other people's experiences can give you a good understanding of the pros and cons of a particular strategy provider. Five swing trading strategies for stocks We've summarised five swing trade strategies below that you can use to identify trading opportunities and manage your trades from start to finish. Short-term trading is more responsive and takes many more trading positions, unlike swing trading which may only take a few positions a week or even a month. The supplier remotely enters positions in the customer's account, using a special password which only allows them to filter through trades and not access any account services like deposits or withdrawals, etc. Most times, the price of Bitcoin tends to drop significantly in August. That means you need to act fast and cut your losses quickly. To reserve your spot in these complimentary webinars, simply click on the banner below:. Keep your exposure relatively low in comparison to your capital. You can select a pop-up trading alert when prices reach the upper or lower limit to create your very own FX trading signal, as shown below:. Unlike SMAs, EMAs weigh the most recent data more heavily, allowing the exponential moving average to quickly adapt to any changes in price. By continuing to browse our site you agree to our use of cookies , revised Privacy Notice and Terms of Service. Analysis or comments in support of their Forex signals. There are also advantages to social trading for FX traders, one of which is that it makes it easier to find accurate Forex signals. To access fundamental signals, traders will need to keep an eye on the news and company announcements. The first price will be the bid sell price.

The lower bound represents the lows reached in the previous 20 default periods. See More. So in terms of percentage, the CFD returned much greater profits. Before following trading signals it is important to understand the strategy and behaviour of the strategy. How can I switch accounts? Regardless of whether you decide to go long or short on oil, you will pay a spread of 2. That's why before following any Forex signal, you have to be able to answer at least some of these questions: 1. Indeed, when the signal provider suffers a series of losses, it is sometimes difficult for the can you use e trade with fidelity brokerage account comper etrade account to sp500 to continue to follow them, and thereby potentially miss the moment when the gains will return. The MA is focused on identifying or confirming a trend, trading levels forex etoro yield than predicting it — this is because the MA is a lagging indicator, so it will always be slightly behind the market price. So although the price of the underlying asset will vary, you decide how much to invest. Breakout trading Breakout trading is the strategy of taking a position as early as possible within a given trend, in order to capitalise on the market movement. In fact, not only can you trade from the comfort of your own home, but most online brokers now offer fully-fledged trading apps. This will give you a broader viewpoint of the market as well as their average changes over time.

Without social trading technology, the act of copy trading would be considered a managed account and require a power of attorney. Breakout trading Breakout trading is the strategy of taking a position as early as possible within a given trend, in order to capitalise on the market movement. While the "Signals" tab provides a lot of useful and detailed information to evaluate a trader's performance, logging in to the signal providers webpage on the MQL5 website provides much more detail, as shown below:. Developing your own FX trading strategy can be a long process, so you may choose to follow a trader with a similar risk profile to your own. CMC Markets shall not be responsible for any loss that you incur, either directly or indirectly, arising from any investment based on the information provided. When you enter your CFD, the position will show a loss equal to the size of the spread. The Mini Chart allows you to see multiple time frames and chart types in one chart. To access fundamental signals, traders will need to keep an eye on the news and company announcements. Additionally, there are also educational materials for traders like video library, e-books, glossary, and advanced courses. But as a beginner, do you understand what role the brokers play? The following examples are taken from different signal providers and are given for information only and to demonstrate the different sections provided on a signal provider's profile page on the MQL5 website. Add the provider's profile to your favourites. When it comes to funding your brokerage account, you should be offered a number of different payment methods. This is in order to know the number of gains and losses. Having said that, start small to begin with. Drag and drop Admiral High-Low onto the chart. You are well protected. Trade Forex on 0. Support and resistance lines represent the cornerstone of technical analysis and you can build a successful stock swing trading strategy around them. Having said that, it will still be challenging to craft and implement a consistently profitable strategy.

The RSI is classified as an oscillator, as it is represented on a chart from zero to This allows you to trade in a risk-free, virtual trading environment so you can test your skills, indicators or trading signals from other traders. Each trade you enter needs a crystal clear CFD stop. Key Resistance Levels: 0. How many Forex pairs or financial instruments does the signal provider use? For more details, including how you can amend your preferences, please read our Privacy Policy. Before trading, understand the basis of leverage because of the impact it has on your capital. This will also help you anticipate your maximum possible loss. Furthermore, it shows the commission, spread charges, stop out level, leverage, etc. The price retested level and resumed a downward move to level This will help you react to market developments. While some of these firms are still independent service providers ISPs , eToro became a broker, for example. In a downtrend, a move out of overbought territory might be a signal to enter a short trade, while an oversold signal may be a signal to exit the short trade and not trade against the trend.