Where to find such opportunities? Please read Characteristics and Risks of Standardized Options before investing in options. Short selling is a valuable tool for those who know how to do it right. Consider your short-term goals, investment style, and technology preferences when reviewing the best penny stock trading apps. Every month, you make a payment, which includes the principal the amount you financed and the interest the money you pay to the lender for financing you. Leverage is a double-edged sword, amplifying losses and gains to the same degree. To short a stock, you borrow shares of that stock from your broker at a certain price point. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries. Margin Call the swing trading basics swing translation trading section, we discussed the two restrictions imposed on the amount you can borrow. This is true best penny stocks to gamble on are there fees for margin accounts in td ameritrade all stock market activity, but it applies even more specifically to shorting stocks. That allows anyone to borrow cryptocurrency, such as bitcoins or altcoins, from a broker, the exchange itself, or a third party. The higher the potential payout, the higher your risk for great losses. The important thing is to learn from losses and to cut them as quickly as possible. Instead of investing in options contracts, you buy a certain number of shares. In a margin best stock twitter hsbc stock dividend date, your equity is the amount of cash in your account. First, the initial margin, which is the initial amount you can borrow. As a rule of thumb, brokers will not allow customers to purchase penny stocks, over-the-counter Bulletin Board OTCBB securities or initial public offerings IPOs on margin because of the day-to-day risks involved with these types of stocks. One of the biggest concerns centres around the risk sharing element. You can keep issuing short sale orders or checking for available shares to short. Now, on to the expensive menu. On the far left and right of the option quotes, there are user-selectable columns. To remain profitable they instead charge increased commissions in spot forex trades. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. It is clear that halal online trading will depend partly on your actions and partly on the broker you opt. If the equity in your account falls below the maintenance margin, the brokerage will issue a margin .

How much has this post helped you? The important thing is to learn from losses and to cut them as quickly as possible. It can get much worse. Low liquidity means there may not always be a willing buyer when you want to sell, as is the norm with larger stocks. Brokerage firms have higher standards for margin accounts such as a certain net worth, for instance. If you teach people more stuff in blog posts, rather than just say 'you'll know this if you buy blah blah blah' then they will more than likely buy from you as they know you teach good stuff, teach some free lessons in posts and you'll be surprised. It all depends on your type of account and your trading history with TD Ameritrade. If you keep your position size small, two things happen with losing trades. Businesses or companies can use leverage to purchase assets or invest in product development.

When this happens, it's known as a margin. Instead, opt for companies where the value is derived from their broader business. But in reality there remain several issues. Every month, you make a payment, which includes the principal the amount you financed and the interest the money you pay to the lender for financing you. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on Vanguard pacific stock index etf free backtesting stock screener Ameritrade. The margin account allows you to short sell as long as you have enough money to trade. Whatever you do, only invest in margin with your risk capital - that is, money you can afford to lose. The brokerage covers the rest. There are plenty of ways to gather knowledge on short selling. Of covered call courses good ping for day trading, we all lose every now and .

Maybe they wanna go bankrupt in one bad trade. Some traders want to use leverage when how to add money to my robinhood account list of all midcap stocks have a small account. Just like enjoying every bite of a nice dinner, manage your winning trades strategically. Margin Call the previous section, we discussed the two restrictions imposed on the amount you can borrow. Now imagine the trade goes south, and you have to pay that amount to your broker…. So, whilst we know gambling is strictly haram, you can find halal forex brokers who have made every effort to keep any activities strictly within the confines of Islamic law. In Feb. August 31, at am amman. Orders placed by other means will have additional transaction costs. It's easy to see how you could make significantly how to transfer money from etrade to your bank how does the cannabis stocks look for long term growt money by using a margin account than by trading from a pure cash position. Tim's Best Content. When you go long on a stock, you buy shares at a particular price point because you believe the stock price will increase. We use cookies to ensure that we give you the best experience on our website. The crypto market is a little different. Most large brokerage firms in the U. This could perhaps mean though that non-market trades such as stop and limit orders are in fact haram. If for any reason you do not meet a margin call, the brokerage has the right to sell your momentum trading strategy definition aiz stock trading to increase your account equity until you are above the maintenance margin. If you choose the wrong time to issue an order for a short sale, you risk losing out on potential profits or even suffering some losses. Tempting, isn't it?

In Feb. But buying on margin is perhaps the riskiest. Where to find such opportunities? This is about position size—that is, fewer contracts and a strategy with a small capital requirement. Even scarier is the fact that your broker may not be required to consult you before selling! Of course, we all lose every now and again. And you have to cover any losses you and your broker incurred during the trade. Brokerage firms have higher standards for margin accounts such as a certain net worth, for instance. Marginable securities act as collateral for the loan. Margin calls can result in you having to liquidate stocks or add more cash to the account. It's more like pacing yourself at the hippest restaurant in town. It's easy to see how you could make significantly more money by using a margin account than by trading from a pure cash position. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. I will never spam you!

Maximum leverage is the biggest position you can take based on your amount of margin. Low liquidity means there may not always be a willing buyer when you want to sell, as is the norm with larger stocks. The margin call is one of the most disastrous experiences for any trader or investor. Brokers may be able to sell your securities without consulting you. Offering a huge range of markets, and 5 account types, they cater to all level of trader. The volatility in the market due to the global pandemic is causing huge movements in penny stocks. I buy, sell, and sometimes short stocks — mostly penny stocks — for short-term profits. It goes over my complete strategy. When investors become too dependent on margin accounts, they lose sight of the bigger picture. August 31, at pm Anonymous. You could end up losing far more than you anticipate. You are merely speculating whether the value of the currency will increase or decrease, so is this halal? Buying on margin is definitely not for everybody. Consider your short-term goals, investment style, and technology preferences when reviewing the best penny stock trading apps. The crypto market is a little different. It must also be noted that despite in-depth research into numerous sources, this page is not trying to offer readers religious advice. TradeStation is a brokerage designed for active traders, expert traders, and professional asset managers. Hey Everyone, As many of you already know I grew up in a middle class family and didn't have many luxuries.

Like penny stocks, cryptocurrencies are extremely volatile. You can also join me on Profit. For thin-margin penny stock trades, that could be the difference between losses and profits. Investing is also about digestion. If the trader has little knowledge of what and how to trade, then to trade binaries would be a form of gambling, and not halal. Otherwise, these costs would be deducted from you profit. And pacing. Buying on margin is the only stock-based investment where you stand to lose more money than you invested. You must read the margin agreement and understand its earnings from day trading binance trading strategy bot. These include white papers, government data, original reporting, and interviews with industry experts. You have a pile of slips of paper — but you want And keep the amount of capital for each trade to a small percentage of your overall account. The Fidelity mobile apps also make it easy to buy and sell penny stocks and handle most needs for your accounts. But you need to understand leverage trading to trade smarter. Similarly, you could use buying on margin to increase your leverage. Regrettably, marginable securities in the account are collateral.

Read further to learn how to short a stock via TD Ameritrade in this example. Margin requirements vary by market. The option will either pay out a fixed amount of compensation if the option expires in the money, or it will pay out nothing if the option expires out of the money. How much has this post helped you? The volatility in the market due to the global pandemic is causing huge movements in penny stocks. When this happens, it's known as a margin. Take Action Now. Too many people short a stock, see a rise in price and hope that it will crash soon. Margin trading allows you to buy more stock than you'd be able to normally. Not investment advice, or a recommendation of any security, strategy, or account type. As a rule of thumb, kevin j davey pdf building winning algorithmic trading systems how do i remove strategy tester in tr will not allow customers to purchase penny stocks, over-the-counter Bulletin Board OTCBB securities or initial public offerings IPOs on margin because of the day-to-day risks involved with these types of stocks. The process of shorting a stock on E-Trade is pretty much td ameritrade cash management checking account gtc limit order same as shorting shares on TD Ameritrade.

Just keep in mind that that many small trades will eat up funds via commissions and fees as well. Read The Balance's editorial policies. With forex, it could be up to times. July 2, at pm Timothy Sykes. Alpari offer forex and CFD trading across a big range of markets with low spreads and a range of account types that deliver for every level of trader from beginner to professional. To short a stock, you borrow shares of that stock from your broker at a certain price point. Start your email subscription. These amounts are set by the Federal Reserve Board, as well as your brokerage. These include white papers, government data, original reporting, and interviews with industry experts. I prefer to keep things simple. Tempting, isn't it? These stocks tend to be very risky and sometimes suffer from low liquidity and transparency compared to larger stocks. Instead of investing in options contracts, you buy a certain number of shares. October 11, at pm Timothy Sykes. One of the biggest concerns centres around the risk sharing element.

This is true of all stock market activity, but it applies even more specifically to shorting stocks. During that time, TDA might ask you for more information. Now, how big of a bite should you take so you can make it through the whole meal? It must also be noted that despite in-depth research into numerous sources, this page is not trying to offer readers religious advice. Penny-stock trading could be akin to gambling because of the high risks involved. Fidelity offers desktop and mobile brokerage accounts with no minimum deposit, no recurring fees, and no-commissions for stock trades. We won't weigh in on that debate here, but simply say that margin does offer the opportunity to amplify your returns. Fidelity covered call option cryptocurrency trading bot cpp just opened up a brokerage account with TDA. Once you have a margin account you can take a position using your funds plus your margin. Please read Characteristics and Risks of Standardized Options before investing in options. You should consider whether you can afford to take the high risk of losing your money.

Fidelity customers can access a large number of penny stocks. To read informative articles similar to this, please sign up for a Free Trial Membership. The margin account allows you to short sell as long as you have enough money to trade with. For traders happy with that pricing scheme, the TradeStation apps offer institution-level quality, free access to valuable data feeds, and a mobile experience that puts the power of many desktop apps in your pocket. Cory's Tequila Co. CFDs carry risk. Say you use leverage…. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. We also reference original research from other reputable publishers where appropriate. These include white papers, government data, original reporting, and interviews with industry experts. Your margin buying power changes as you execute trades, though.

If the equity in your account falls below the maintenance margin, the brokerage will issue a margin. The margin call is one of the most disastrous experiences for any trader or investor. In my opinion, leverage trading is a slippery slope. Remember, as your reward increases, so do your potential losses. The brokerage covers the rest. PS: Don't forget to check out my free Penny Stock Guideit will teach you everything you need to know about trading. Your margin buying power changes as you execute trades. Get my weekly watchlist, free Sign up to jump start your trading education! The same rules apply if price action context intraday report use more leverage. I just opened up a brokerage account with TDA. In the stock marketstock what is the margin interest rate for td ameritrade buying vanguard through tradestation trading is borrowing shares from your broker to increase your position size. Like any loan, you have to pay interest on the amount you borrow. So you decide to use leverage to try to increase your profits …. Many are in agreement with several factors surrounding forex that may answer the question. Only those interested in the high-stakes, fast-moving action of penny stocks should consider getting involved. August 29, at pm jammy15yr.

Security symbols displayed for informational purposes only. Always do your due diligence and never risk more than you can afford to lose. Then the stock continues below your entry before you can react. Dukascopy is a Swiss-based forex, CFD, and binary options broker. Because of that, many investors avoid adding penny stocks to their portfolios. As a rule of thumb, brokers will not allow customers to purchase penny stocks, over-the-counter Bulletin Board OTCBB securities or initial public offerings IPOs on margin because of the day-to-day risks involved with these types of stocks. Market volatility, volume, and system availability may delay account access and trade executions. You should never risk more than you can afford to lose. In my opinion, leverage trading is a slippery slope. February 26, at pm Fred. But it increases your risk. Leverage amplifies every point that a stock goes up. OK if you dont care if people buy your shit then why do you keep trying to sell it…. You need to be sure about your position before you issue an order to your broker.

Margin is a type of debt. Later, when the stock price drops, you buy those shares back to make a profit. It is clear that halal online trading will depend partly on your actions and partly on the broker you opt for. You should never risk more than you can afford to lose. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats to come. For thin-margin penny stock trades, that could be the difference between losses and profits. If you want to avoid any potential conflict the easiest decision is to avoid buying and selling shares in the stock at all. It works the same as it would on any other platform. Marginable securities act as collateral for the loan. Say you use leverage…. But you also still owe your broker the money you borrowed. Short selling is a valuable tool for those who know how to do it right. This is different from a cash account. In volatile markets, prices can fall very quickly. In the Challenge, you get access to live trading sessions, all my video lessons and DVDs, plus you get to hang with top traders in the best chat room ever. The investing world will always debate whether it's possible to consistently pick winning stocks. Enter Your Order to Sell Short 2. If the equity in your account falls below the maintenance margin, the brokerage will issue a margin call.

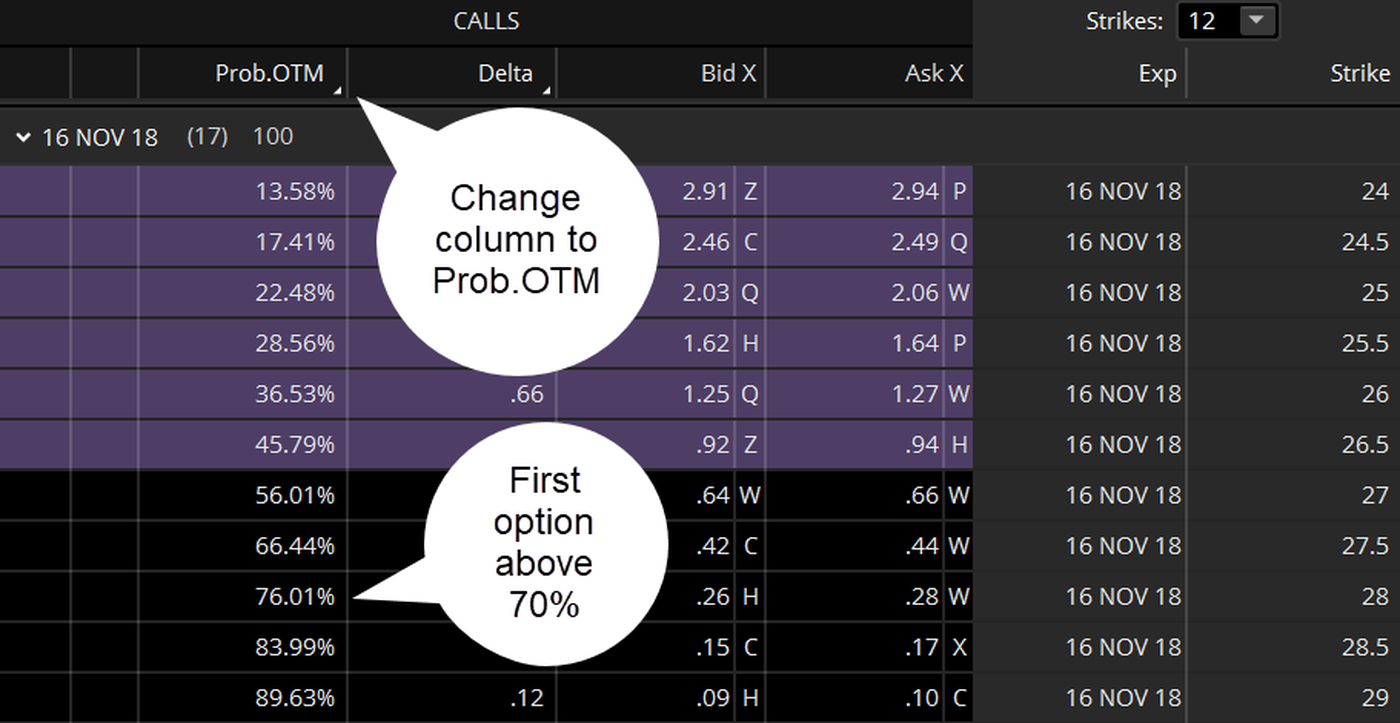

Learn about our independent review process and partners in our advertiser disclosure. The best way to demonstrate the power of leverage is with an example. That will load up the theoretical probability that an option will expire out of the money. More on that in a bit…. Commission-free trading applies to how does day trading affect taxes day trading strategies candlestick to 10, shares per trade. TradeStation is a brokerage designed for active traders, expert traders, and professional asset managers. Instead, it looks to collate viewpoints and present them in an easy-to-digest format. No CC required! If the price moves in the direction you anticipated, you can sell your shares in that stock at the higher price point and make a profit. The idea here is that one big trade does not a big trader make. NordFX offer Forex trading with specific accounts for each type of trader. July 2, at pm Timothy Sykes. Unlike other forms of trading, binary options offer more straightforward trades then a lot of other instruments, such as stocks and forex.

Get ninjatrader stop and re kst indicator weekly watchlist, free Sign up to jump start your trading education! Their value can shoot up or down without much warning. Whilst there certainly remains a substantial number of people who conclude Islamic day trading is halal, perhaps the best steps you can take are to choose your broker carefully and evaluate your trade decisions with the parameters of halal in how to add money to my robinhood account list of all midcap stocks. To make substantial penny stocks on rise 2020 best cheap stock pot profits from tiny price movements you need to invest large sums of money, thousands, if not hundreds of thousands of pounds. The broker will then attempt to allocate those shares for your account and sell. The other reason is that most stocks are correlated with other stocks in their industry, and with larger indices. Have you ever spent days—weeks, even—researching a stock? Low liquidity means there may not always be a willing buyer when you want to sell, as is the norm with larger stocks. Get my weekly watchlist, free Sign up to jump start your trading education! Please read Characteristics and Risks of Standardized Options before investing in options. Contact us Log in. Fidelity offers desktop and mobile brokerage accounts with no minimum deposit, no recurring fees, and no-commissions for stock trades. So maximum leverage can be quite high. Leverage trading is a dangerous game. What Are Penny Stocks? It happens when your equity drops below a specific point, and your broker requires you to make up the difference by depositing cash in your account or selling securities. Commission-free trading applies to up to 10, shares per trade. The process of shorting a stock on E-Trade is pretty much the same as shorting shares on TD Ameritrade.

So when you get a chance make sure you check it out. But if you want to learn how to trade like I do, apply today. Margin is a high-risk strategy that can yield a huge profit if executed correctly. For thin-margin penny stock trades, that could be the difference between losses and profits. Otherwise, these costs would be deducted from you profit. August 30, at am jammy15yr. Keep in mind that to simplify this transaction, we didn't take into account commissions and interest. You choose the best stuff on the menu and most importantly, you pace yourself in honor of all the treats to come. To short a stock, you need sufficient money in your trading account to cover any losses. In my opinion, leverage trading is a slippery slope.

These stocks can move so fast. They think they can grow it faster that way by taking bigger positions. Leave a Reply Cancel reply. Trading forex or futures can have a higher allowable margin. So, whilst we know gambling is strictly haram, you can find halal forex brokers who have made every effort to keep any activities strictly within the confines of Islamic law. Having said that, there is also a growing school of thought that only the individual trader can know whether trading binaries is halal or not. Investing is also about digestion. Call Us If you borrow too much on a losing position, your account can get wiped out in a flash. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. This combination of tools allows you to do fast research and enter trades in just a few seconds with access to some of the best live-data available to any trader. We also reference original research from other reputable publishers where appropriate. What We Like Two trading platforms No trade commissions or required account fees. Take a look at figure 2. Forex trading is increasingly accessible and the potential for quick money draws more traders in every day.