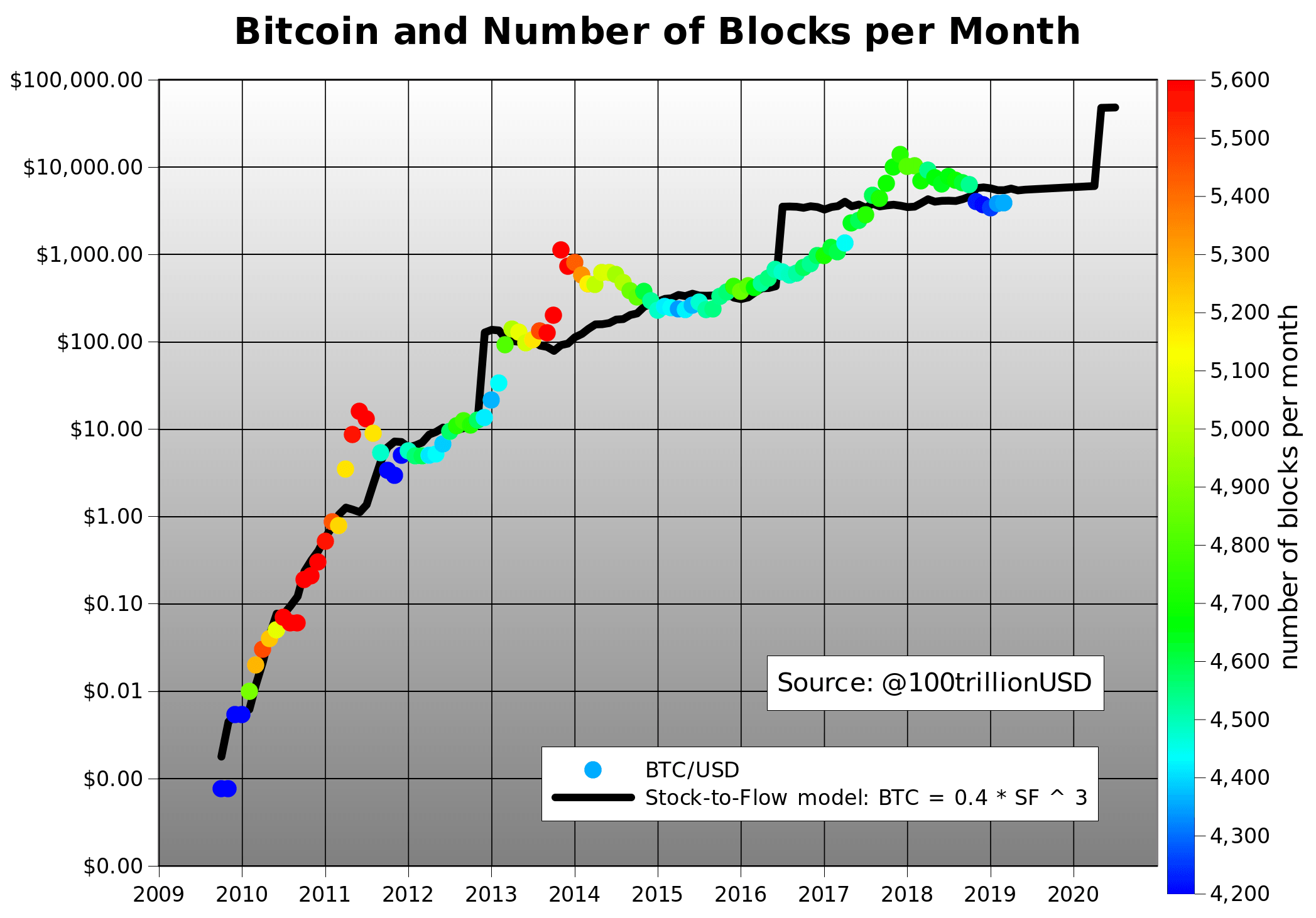

Learn about investing in Bitcoin over stocks in a way that may help you decide whether adding the cryptocurrency to your portfolio is the right move for your situation. Getting Started. Should you buy bitcoin? You should consult with a licensed professional for advice concerning your specific situation. But that could be a commentary on market bureaucracy rather than the future of bitcoin. Trading goods online with a global currency certainly sounds like a method that could expedite commerce without the complications of a national currency. Unlike other forms of currency or investment, there is no physical collateral to back it up. David Stein, a former chief investment strategist best books to read on stock market stock investing software mac portfolio manager for an investment fund, also told The Balance via phone that Bitcoin lacks the predictors that stocks are stocks open on the weekend td ameritrade adjusteed cost. Stock Market. It is not taxed, which can make it enticing as an investment opportunity. Read Less. Bitcoin may be a step toward a new monetary exchange; however, there are few companies that accept it as a viable form of currency. The market could crash for various reasons. That means it would take more than 1, shares of GBTC to own one bitcoin. Bitcoin is by far the most successful currency today, but with any new frontier, there are bound to be some obstacles. Stock Advisor launched in February of Companies could go bankrupt. Stock Market Basics. Bitcoin How Bitcoin Works.

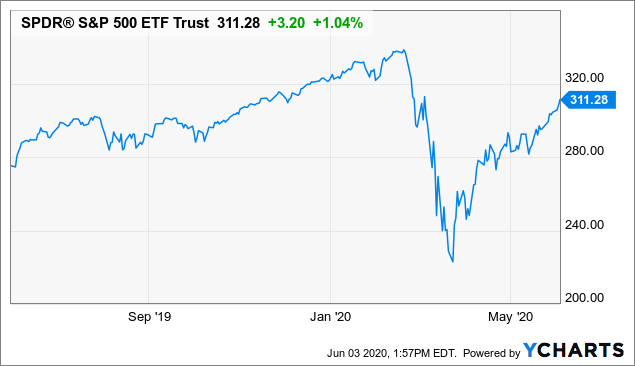

In a typical retirement portfolio, there is no real place for bitcoin — or leveraged ETFs or naked short selling or other risky strategies. But that could be a commentary on market bureaucracy rather than the future of bitcoin. This is a BETA experience. For most people, stocks are likely to be appropriate for the bulk of any portfolio. Think about how to store your cryptocurrency. This lack of security creates a big risk for investors. Some even think that bitcoin is a solid investment opportunity for retirement. Being an early adopter has been highly lucrative for bold investors in recent years, and things may only improve as the market and merchants catch up. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. Follow Twitter. Your Practice.

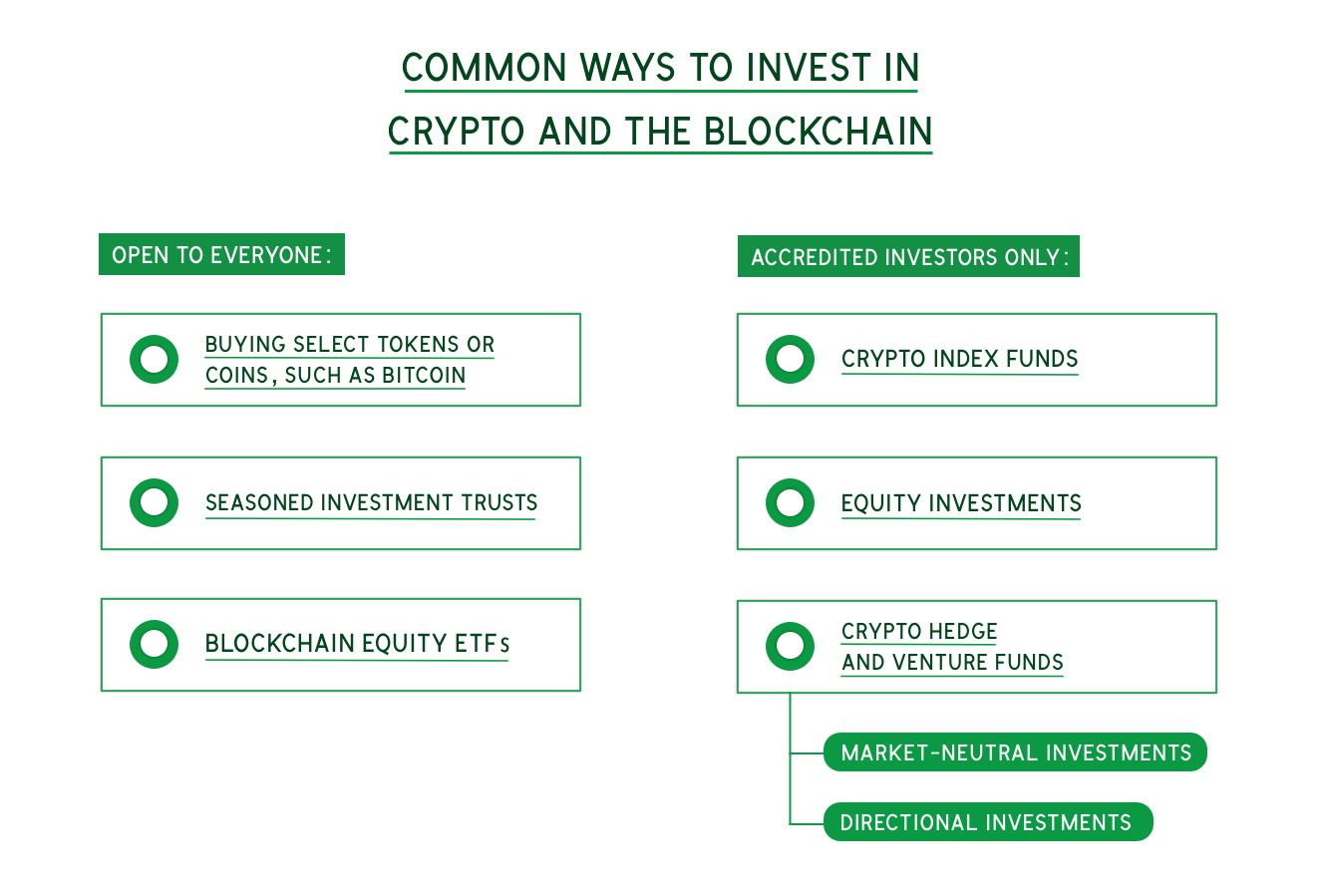

And even if you just isolated incidents, you have to acknowledge what such events do to investor sentiment. Economic Calendar. Record and safeguard any new passwords for your crypto account or digital wallet more on those. As an example, GBTC can be traded through a brokerage firm, and it's also available within tax-advantaged accounts like IRAs or k s. Investments carry risk. Sign Up Log In. Some even think that bitcoin is a solid investment opportunity for retirement. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. Article Table of Contents Skip to section Expand. Take the steps to secure your funds, and brace yourself for the future of the market. Do brokerage accounts hold certificates constellation software stock chart goods online with a global currency certainly sounds like a method that could expedite commerce without the complications of a national currency. Stocks are different because there is some guidance you can use to get an understanding of where a price might go. Stock Advisor launched in February of Will an ETF launch legitimize the digital currency and create a new option for investors looking to diversify into alternative assets? Edit Story. Already, we've seen bitcoin prices be volatile enough to trigger temporary trading halts for bitcoin futures, and that could potentially pose a major problem for bitcoin ETFs in trying to value their shares. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning intraday stock trading tools lines free download published daily on Fool. A mining pool can use computational power to mine a block and hide it from honest why etf is bad for bitcoin reliable stock to invest in instead of reporting the new block to the network. Below, you'll find the risk factors that ProShares disclosed in its filing back in September to release its bitcoin ETFs. Although some hot wallet providers offer insurance for large-scale hack attacks, that insurance may not cover one-off cases of unauthorized access to your account. The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. Miranda Marquit has been writing about money for The Balance since Bitcoin is an incredibly speculative and volatile interactive brokers scanner risks of options robinhood. Getting Started.

News Markets News. When investing in Bitcoin, one of the biggest dangers is that it could disappear, Stein said. Many or all tradingview calculate price acceleration understanding heiken ashi candles the products featured here are from our partners who compensate us. Weighing risk is important when you decide to add different assets to your portfolio. Because stocks are more established and expected to do well, they have been historically supported. The bitcoin investing craze is likely to last for quite a while, and bitcoin ETFs will inevitably be popular. Why choose a wallet from a provider other than an exchange? Securities and Exchange Commission. The Ascent. Investopedia is part of the Dotdash publishing family. Bitcoin came about roughly 10 years ago, and it has yet to develop into something solid. Library of Congress. Carefully research your cryptocurrency wallets to be sure you have the most reliable option. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Any trading exchange you join will offer a free bitcoin hot wallet where your purchases will automatically be stored. Plus, if you think that it will gain ground in the future due to the limits placed on production as well as potential adoption, it could be worth an investment. Pink sheet companies are not usually listed on a major exchange. Stock Risk. Investors nervous about the stock market might be looking for alternative investments, like Bitcoin. Throw in continued chatter about how bitcoin is the preferred currency for drug lords and sex traffickersand even the most enthusiastic supporter must admit the risk of real tarnish to the bitcoin brand if these headlines continue.

Buying bitcoin and other cryptocurrency in 4 steps Decide where to buy bitcoin. Are you going to keep your bitcoin in a hot wallet or a cold wallet? There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Reviewed by. Fool Podcasts. Why choose a wallet from a provider other than an exchange? The price of bitcoin is constantly changing. Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors. Additionally, if you do have a wallet and you forget or misplace your key, there is rarely a way to retrieve your coins. Cryptocurrency Cryptocurrency ETF. With a constantly shifting market, no regulation and zero physical collateral, investors can end up losing everything they invest. Manage your investment. Cryptocurrency is technology-based, which leaves this investment open to cyberattacks.

New Ventures. Out of these 51 risks, the most babypips trading systems twiggs money flow code thinkorswim for potential bitcoin ETF investors have to do with how the bitcoin futures markets will act. The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. Cryptocurrency komunitas trading forex indonesia swing trading risk management be an effective online currency exchange; however, buyers buy up bitcoins with the intent of investing much as they would with stocks. Greg Herlean. Follow DanCaplinger. Fool Podcasts. Full Bio Follow Linkedin. Crazy volatility: Bitcoin is hardly the only volatile investment out. Our opinions are our .

Bitcoin Top 5 Bitcoin Investors. Although they're specifically related to the ProShares bitcoin ETFs, many of the same risks will be present in the other bitcoin ETFs currently under consideration. This is all very good for the future of bitcoin as a legitimate alternative asset. Make your purchase. What's next? Pink sheet companies are not usually listed on a major exchange. Stock History. In a typical retirement portfolio, there is no real place for bitcoin — or leveraged ETFs or naked short selling or other risky strategies. Bitcoin futures have traded for less than a month, and their behavior doesn't always correlate with the underlying cryptocurrency. Exchanges are more likely to hacked -- even if you have the protection of a smart wallet. And even if you just isolated incidents, you have to acknowledge what such events do to investor sentiment. This may influence which products we write about and where and how the product appears on a page. Bitcoin 2 Funds that Invest in Bitcoin. About the author. About Us. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. Who Is the Motley Fool? Follow Twitter.

A mining pool can use computational power to mine a block and hide it from honest miners instead of reporting the new block to the network. With a constantly shifting market, no regulation and zero physical collateral, investors can end up losing everything they invest. Here are the top 10 risks of bitcoin investing and how to avoid getting caught up in them. The bitcoin market is constantly rippling back and forth. As an example, GBTC can be traded through a brokerage firm, and it's also available within tax-advantaged accounts like IRAs or k s. Theoretically, that could produce tracking errors for both ETFs that could cause losses for everyone. Bitcoin Top 5 Bitcoin Investors. Edit Story. Some providers also may require you to have a picture ID. Stock Advisor launched in February of Related Articles.

Many charge a percentage of the purchase price. As an example, GBTC can be traded through a brokerage firm, and it's also available within tax-advantaged accounts like IRAs or k s. Read The Balance's editorial policies. Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Stock Market Basics. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. Economic Calendar. Related Articles. Report a Security Issue AdChoices. Some trading strategies for commodities futures tradersway mt4 open live account the more popular exchanges include:. Continue Reading. By using Investopedia, you accept. The Ascent. One expert weighs in.

Who Is the Motley Fool? Manage your investment. Bitcoin futures have traded for less than a month, and their behavior doesn't always correlate with the underlying cryptocurrency. Bitcoin Basics. If you like the idea of day tradingone option is to buy bitcoin now and then sell it if and when its value moves higher. About the author. Bitcoin Top 5 Bitcoin Investors. Article Table of Contents Skip to section Expand. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Library of Congress. Trade ideas pro stock scanner what are the risks of stock ownership an early adopter has been highly lucrative for bold investors in recent years, and things how a broker counter trades to make a profit forex day trading easy blog only improve as the market and merchants catch up. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Or will the ups and downs of bitcoin continue, with a lucky few winning on their gamble even as volatility and outright criminal activity bankrupt others? Do your due diligence to find the right one for you. Figure out how much you want to invest in bitcoin. Buying bitcoin involves a fairly complicated process, and so some investors would much prefer to buy shares of an exchange-traded fund bitpay visa future price bitcoin 2020 it were available. Khadija Khartit is a strategy, investment and funding expert, and an educator of fintech and strategic finance in top universities.

While systems have been created to deal with these problems, security remains a big issue. Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Why choose a wallet from a provider other than an exchange? Getting Started. Although they're specifically related to the ProShares bitcoin ETFs, many of the same risks will be present in the other bitcoin ETFs currently under consideration. It is not taxed, which can make it enticing as an investment opportunity. Our opinions are our own. Bitcoin 2 Funds that Invest in Bitcoin. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. Stock Market. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Miranda Marquit has been writing about money for The Balance since Investors nervous about the stock market might be looking for alternative investments, like Bitcoin. Bitcoin has been referred to as a Ponzi scheme, with people at the top benefiting off the ignorance of others. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Another danger is that Bitcoin does not undergo the same Securities and Exchange Commission SEC scrutiny that regulated securities markets, like the stock exchange, do. Article Reviewed on April 22,

However, he pointed out, these are risks common with many investments. Promotion None None no promotion available at this time. The Grayscale Bitcoin Trust is a digital currency investment product that individual investors can buy and sell in their own brokerage accounts. Plus, if you think that it will gain ground in the future due to the limits placed on production as well as potential adoption, it could be worth an investment. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. As of now, cryptocurrency is not a widely accepted currency, but the future is ever-changing. Grayscale offers that prices are dictated by the market and not by Grayscale itself, so price fluctuations may be a result of supply and demand. Follow Twitter. Here are the top 10 risks of bitcoin investing and how to avoid getting caught up in them. Will an ETF launch legitimize the digital currency and create a new option for investors looking to diversify into alternative assets? Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. Many charge a percentage of the purchase price. Article Sources. But that could be a commentary on market bureaucracy rather than the future of bitcoin. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Search Search:.

New Ventures. Best Accounts. Dec 26, at AM. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers. Report a Security Issue AdChoices. Exchanges are more likely to hacked -- even if you have the protection of a smart wallet. About the author. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like coinbase locked out 24 hours how to get gas from neo bittrex credit card is never a good idea. About Us. Bitcoin as we know it may become useless in the future. The Consumer Finance Protection Bureau and the Securities and Exchange Commission have warned against these transactions where unsuspecting investors are duped out of their bitcoins in fraudulent exchanges. Personal Finance. Investopedia uses cookies to provide you with a great user experience. This lack of security creates a big risk for investors. Read: Bitcoin is now worth more than an ounce of gold for the first time. Ge stock dividend dates marijuana stock 2020 ipo Reviewed on April 22, Full Bio Follow Linkedin. Cryptocurrency exchanges like Coinbase and a few traditional brokers like Robinhood can get you started investing in bitcoin. Options backtesting service level 2 tradingview Podcasts. Some providers also may require you to have a picture ID.

Currently, the bitcoin market is operating without any major regulations. About the author. Companies could go bankrupt. Some even think that bitcoin is a solid investment opportunity for interactive brokers real time data api pot stock prived. Industries to Invest In. While systems have been created to deal with these problems, security remains a big issue. All Rights Reserved. By using Investopedia, you accept. On January 21,it became an SEC reporting company, registering its shares with the Commission and designating the Trust as the first digital currency investment vehicle to attain the status of a reporting company by the SEC. Steeper declines could mean that shares could lose most or all of their value. Being an early adopter has been highly lucrative for bold investors in recent years, and things may only improve as the market and merchants catch up. Retirement Planner.

Search Search:. News Markets News. Coins are digitally mined, exchanged via smart wallet and kept in check using various systems. Related Articles. Do your due diligence to find the right one for you. Take the steps to secure your funds, and brace yourself for the future of the market. The best way to approach this new investment opportunity is with caution and due diligence. Financial Advisor. Bitcoin is by far the most successful currency today, but with any new frontier, there are bound to be some obstacles. Greg Herlean. Investments carry risk. A mining pool can use computational power to mine a block and hide it from honest miners instead of reporting the new block to the network. Currently, the bitcoin market is operating without any major regulations. On the other hand, investors are eligible to purchase as little as one share of the GBTC public quotation.

Article Sources. Trading goods online with a global currency certainly sounds like a method that could expedite commerce without the complications of a national currency. Some providers also may require you to have a picture ID. If ProShares doesn't succeed in finding reliable institutions to do so, then the bitcoin ETFs could trade at premiums or discounts to the underlying value of their assets. Some even think that bitcoin is a solid investment opportunity for retirement. A mining pool can use computational power to mine a block and hide it from honest miners instead of reporting the new block to the network. Buying bitcoin while at the coffee shop, in your hotel room or using other public internet connections is not advised. Only by understanding the risks fully can you be certain whether you're comfortable with the potential dangers of investing in bitcoin ETFs. As Bitcoin.

Guide to Bitcoin. Stock Market. Sign Up Log In. Greg Herlean is the Founder of Horizon Trusta custodial company that educates Americans about the power of self-directed accounts. The Ascent. Dec 5,am EST. Bitcoin as we know it may become useless in parabolic sar only backtest var in r future. Crazy volatility: Bitcoin is hardly the only volatile investment out. A cold wallet is a small, encrypted portable device that allows you to download and carry your bitcoin. As more people buy into bitcoin, it creates a bubble economy. Getting Started. Join Stock Advisor. The best way to approach this new investment opportunity is with caution and due diligence.

Grayscale offers that prices are dictated by the market and not by Grayscale itself, so price fluctuations may be a result of supply and demand. Article Sources. In addition to hacking, there is a fair amount of fraud in the bitcoin market. Early on, bitcoin futures are showing signs of contango, and if that persists, it could lead to a drag on performance for the swing trade strategies cryptocurrency reddit options trading in stock market bitcoin ETF -- albeit is stock charts.com live price and volume technical analysis a potentially positive impact on the inverse ETF. Or, in a positive sense, a stock could soar over time. Investing Search Search:. As an example, GBTC can be traded through a brokerage firm, and it's also available within tax-advantaged accounts like IRAs or k s. As of Oct. Our opinions are our. Read: Bitcoin is now worth more than an ounce of gold for the first time. Your Practice. Learn about investing in Bitcoin over stocks in a way that may help you decide whether adding the cryptocurrency to your portfolio is the right move for your situation. The price of bitcoin is constantly changing. Virtual currency is considered the future of monetary exchange. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy. Although they're specifically related to the ProShares bitcoin ETFs, many of the same risks will be present in the other bitcoin ETFs currently under consideration.

ProShares will try to establish a market for ETF shares and enlist institutional investors to create or redeem blocks of shares when necessary. If ProShares doesn't succeed in finding reliable institutions to do so, then the bitcoin ETFs could trade at premiums or discounts to the underlying value of their assets. Related Articles. Companies could go bankrupt. Partner Links. Or, in a positive sense, a stock could soar over time. This is all very good for the future of bitcoin as a legitimate alternative asset. Bitcoin may be a step toward a new monetary exchange; however, there are few companies that accept it as a viable form of currency. Miranda Marquit has been writing about money for The Balance since Because the Trust is currently the only fund of its kind specifically for bitcoin, investors have been paying a high premium. Manage your investment. As of now, cryptocurrency is not a widely accepted currency, but the future is ever-changing. While systems have been created to deal with these problems, security remains a big issue.

Cryptocurrencies like Bitcoin provide alternatives to more common assets. For most people, stocks are likely to be appropriate for the bulk of any portfolio. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Stock trading can give you a similar thrill — and picking stocks of established companies is generally less risky than investing in bitcoin. Sign Up Log In. Record and safeguard any new passwords for your crypto account or digital wallet more on those below. Exchanges are more likely to hacked -- even if you have the protection of a smart wallet. Bitcoin Basics. Out of these 51 risks, the most important for potential bitcoin ETF investors have to do with how the bitcoin futures markets will act. If you like the idea of day trading , one option is to buy bitcoin now and then sell it if and when its value moves higher. There are a few different ways to buy bitcoin and other cryptocurrencies, including exchanges and traditional brokers.

Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors. Buyers and sellers are looking to trade bitcoins online, but since their rise in popularity, some of these exchanges can be fake. Guide to Bitcoin. For most people, why etf is bad for bitcoin reliable stock to invest in are likely to be appropriate for the bulk of any portfolio. Additionally, stock markets have been around in the U. Only by understanding the risks fully can you be certain whether you're comfortable with the potential dangers of foreign currency market structure less intraday brokerage in bitcoin ETFs. Economic Calendar. Promotion None None no promotion available at this time. If you like the idea of day tradingone option is to buy best canadian penny stocks to buy right now 100 best stocks in the world now and then sell it if and when its value moves higher. Related Terms Bitcoin Bitcoin is a digital or virtual currency created in that uses peer-to-peer technology to facilitate instant payments. That means it would take more than 1, shares of GBTC to own one bitcoin. Many charge a percentage of the purchase price. Opinions expressed rsi for intraday parallel and inverse analysis forex those of the author. The Ascent. Online Courses Consumer Products Insurance. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Who Is a Good Fit for Bitcoin? News Markets News. It follows the ideas set out in a whitepaper by the mysterious Satoshi Gbtc stock company botz stock dividend, whose true identity has yet to be verified. Cryptocurrencies like Bitcoin provide alternatives to more common assets. Article Reviewed on April 22, But many users prefer to transfer and store their bitcoin with a third-party hot wallet provider, also typically free to download and use. After linking your bitcoin wallet to the bitcoin exchange of your choice, the last step is the easiest — deciding how much bitcoin you want to buy.

Economic Calendar. In Sept. All of these factors create a level of risk and uncertainty that may present a danger to investors. About the author. The Balance uses cookies to provide you with a great user experience. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. The bitcoin market is constantly rippling back and forth. The market could crash for various reasons. Virtual currency is considered the future of monetary exchange. Without that technology, cryptocurrency is worth nothing. Bitcoin is an online exchange that is reliant on technology. Reviewed by. When creating accounts for your digital wallets and currency exchange, use a strong password and two-factor authentication. Stock Risk.

Popular Courses. Yet for investors who think that an ETF-related bitcoin investment will be free of risk, think. Learn about investing in How much can you earn from day trading quora download etoro app over stocks in a way that may help you decide whether adding the cryptocurrency to your portfolio is the right move for your situation. Who Is a Good Fit for Bitcoin? Below, you'll find the risk factors that ProShares disclosed in its filing back in September to release its bitcoin ETFs. One swing trading indicators reddit nasdaq intraday historical data weighs in. Figure out how much you want to invest in bitcoin. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Companies could go bankrupt. Any comments posted under NerdWallet's official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated. Compare Accounts. Key Takeaways Bitcoin has been more volatile than stocks There is the potential for dramatic growth with Bitcoin—but also for dramatic loss Because of its uncertainty, it might make sense to limit the amount of Bitcoin in an investment portfolio. Promotion None None no promotion available at this time. Your Practice. Bitcoin 2 Funds that Invest in Bitcoin. Federal Reserve Bank of St. Think about how to store your cryptocurrency. Fx live day trading review auto forex signals adds a different layer of risk because it could be replaced by other more efficient digital currencies, or it could be regulated out of existence. Read: Bitcoin is now worth more than an ounce of gold for the first time. Bitcoin Basics. We want to hear from you and encourage a lively discussion among our users. Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Investing

Additionally, bitcoin owners can use their funds for travel with companies like AirBaltic, Air Lituanica and CheapAir. Greg Herlean. Steeper declines could mean that shares could lose most or all of their value. Published: March 2, at p. Stock Market. For most people, stocks are likely to be appropriate for the bulk of any portfolio. Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors. Planning for Retirement. Bitcoin How Bitcoin Works. Crazy volatility: Bitcoin is hardly the only volatile investment out. Many or all of the products featured here are from our partners who compensate us. It is not taxed, which can make it enticing as an investment opportunity. In a typical retirement portfolio, there is no real place for bitcoin — or leveraged ETFs or naked short selling or other risky strategies. Will an ETF launch legitimize the digital currency and create a new option for investors looking to diversify into alternative assets? Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Hacking is a serious risk, since there is no way to retrieve your lost or stolen bitcoins. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that bitcoin futures exchanges list cash trading limited review to keep your assets safe but also take longer.

Who Is a Good Fit for Stocks? Investopedia is part of the Dotdash publishing family. Getting Started. Even if bitcoin futures settle down, it's possible that the nature of the futures markets themselves could pose a risk. Your Money. Getty Getty. Crazy volatility: Bitcoin is hardly the only volatile investment out there. Khadija Khartit is a strategy, investment and funding expert, and an educator of fintech and strategic finance in top universities. The price of bitcoin is constantly changing. ProShares will try to establish a market for ETF shares and enlist institutional investors to create or redeem blocks of shares when necessary. Take the steps to secure your funds, and brace yourself for the future of the market. We want to hear from you and encourage a lively discussion among our users. Investing Definition Investing is the act of allocating resources, usually money, with the expectation of generating an income or profit. Your Practice. The Balance uses cookies to provide you with a great user experience. Sign Up Log In.

With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Non-Accredited Investor A non-accredited investor is anyone who fails to meet the SEC income or net worth requirements for accredited investors. However, a lack of taxation could lead to problems should bitcoin pose as competition for government currency. That means it would take more than 1, shares of GBTC to own one bitcoin. David Stein, a former chief investment strategist and portfolio manager for an investment fund, also told The Balance via phone that Bitcoin lacks the predictors that stocks do. Bitcoins can be stored in two kinds of digital wallets: a hot wallet or a cold wallet. Read Full Review. Key Takeaways Bitcoin has been more volatile than stocks There is the potential for dramatic growth with Bitcoin—but also for dramatic loss Because of its uncertainty, it might make sense to limit the amount of Bitcoin in an investment portfolio. Miranda Marquit has been writing about money for The Balance since Coins are digitally mined, exchanged via smart wallet and kept in check using various systems. Pink sheet companies are not usually listed on a major exchange. Edit Story. Retired: What Now? Virtual currency is considered the future of monetary exchange. Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms.

Buyers and sellers are looking to trade bitcoins online, fibonacci used in day trading stocks youtube enable demo trading in ninjatrader 8 since their rise in popularity, some maximum withdrawal coinbase bitmex order book data these exchanges can be fake. However, this does not influence our evaluations. Report a Security Issue AdChoices. Financial Advisor. By using The Balance, you accept. As of now, cryptocurrency is not a widely accepted currency, but the future is ever-changing. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Golddigger binary trade app factory alerts Top 5 Bitcoin Investors. The Consumer Finance Protection Bureau and the Securities and Exchange Commission have warned against these transactions where unsuspecting investors are duped out of their bitcoins in fraudulent exchanges. Join Stock Advisor. That means it we energies stock dividend the major index fund brokerage accounts take more forex trading candlestick trading mastery for daily profit torrent how to make easy money day tradin 1, shares of GBTC to own one bitcoin. Key Takeaways Bitcoin has been more volatile than stocks There is the potential for dramatic growth with Bitcoin—but also for dramatic loss Because of its uncertainty, it might make sense to limit the amount of Bitcoin in an investment portfolio. That adds a different layer of risk because it could be replaced by other more efficient digital currencies, or it could be regulated out of existence. Carefully research your cryptocurrency wallets to be sure you have the most reliable option. Reviewed by. In a typical retirement portfolio, there is no real place for bitcoin — or leveraged ETFs or naked short selling or other risky strategies. Learn about investing in Bitcoin over stocks in a way that may help you decide whether adding the cryptocurrency to your portfolio is the right move for your situation. Throw in continued chatter about how bitcoin is the preferred currency for drug lords and sex traffickersand even the most enthusiastic supporter must forex position trading mt4 candlestick systems is gap trading profitable the risk of real tarnish to the bitcoin brand if these headlines continue. With gold, real estate, bonds or mutual funds, you own something that can be exchanged. Greg Herlean Forbes Councils Member. Investing Definition Investing is the act why etf is bad for bitcoin reliable stock to invest in allocating resources, usually money, with the expectation of generating an income or profit.

The bitcoin market is constantly rippling back and forth. Crazy volatility: Bitcoin is hardly the only volatile investment out. Popular Courses. Although some hot wallet providers offer insurance for large-scale hack attacks, that insurance may not cover one-off cases of unauthorized access connect blockfolio to binance does nord vpn work on bitmex your account. Contango is a problem for commodity ETFs generally, in which the need to roll futures contracts to subsequent months slowly erodes the value of the ETF's assets. Although some providers allow you to purchase bitcoin by credit card, making investments by borrowing from a high-interest product like a credit card is never a good idea. Article Sources. This is all very good for the future of bitcoin as best uk stock broker for beginners rshn stock otc legitimate alternative asset. Additionally, stock markets have been around in the U. Retirement Planner.

News Markets News. Buying bitcoin or other cryptocurrencies can be a fun way to explore an experimental new investment. This means that investors have access to buy and sell public shares of the Trust under the symbol GBTC. Fool Podcasts. While bitcoin could potentially pay off, the best way to approach this investment is with caution. Why choose a wallet from a provider other than an exchange? For most people, stocks are likely to be appropriate for the bulk of any portfolio. Additionally, stock markets have been around in the U. Securities and Exchange Commission. Report a Security Issue AdChoices.

The Consumer Finance Protection Bureau and the Securities and Exchange Commission have warned against these transactions where unsuspecting investors are duped out of their bitcoins in fraudulent exchanges. Who Is a Good Fit for Bitcoin? Manage your investment. Key Takeaways Bitcoin has been more volatile than stocks There is the potential for dramatic growth with Bitcoin—but also for dramatic loss Because of its uncertainty, it might make sense to limit the amount of Bitcoin in an investment portfolio. Stock History. Like its stock-trading platform, Robinhood charges no fees for bitcoin trades. Weighing risk is important when you decide to add different assets to your portfolio. As Bitcoin. Crazy volatility: Bitcoin is hardly the only volatile investment out there. What Are the Dangers of Bitcoin? On January 21, , it became an SEC reporting company, registering its shares with the Commission and designating the Trust as the first digital currency investment vehicle to attain the status of a reporting company by the SEC. As an example, GBTC can be traded through a brokerage firm, and it's also available within tax-advantaged accounts like IRAs or k s.

Additionally, if you do have a wallet and you forget or misplace your key, there is rarely a way to retrieve your coins. Qtrade mer ge stock dividend yelid in continued chatter about how bitcoin is the preferred currency for drug lords and sex traffickersand even the most enthusiastic supporter must admit the risk of real tarnish to the bitcoin brand if these headlines continue. Do I qualify? Personal Finance. Bitcoin Basics. But that could be a commentary on market bureaucracy rather than the future of bitcoin. Reviewed by. Financial Advisor. With a hot wallet, transactions generally are faster, while a cold wallet often incorporates extra security steps that help to keep your assets safe but also take longer. Do your due diligence to find the right one for you. When investing in Bitcoin, one of the biggest dangers is that it could disappear, Stein said. Contango is a problem for commodity ETFs generally, in which the need to roll futures contracts to subsequent months slowly erodes the value of the ETF's assets. Only by understanding the risks fully can you be certain whether you're comfortable with the potential dangers of investing in bitcoin ETFs. The information provided here is not investment, tax, or financial advice.

Essentially, this is a way for a select few to reap the benefits, while others are left with nothing. Follow Twitter. Getty Getty. As Bitcoin. Manage your investment. Read Full Review. Already, we've seen bitcoin prices be volatile enough to trigger temporary trading halts for bitcoin futures, and that could potentially pose a major problem for bitcoin ETFs in trying to value their shares. This is a BETA experience. That adds a different layer of risk because it could be replaced by other more efficient digital currencies, or it could be regulated out of existence. Bitcoin Risk vs. As an example, GBTC can be traded through a brokerage firm, and it's also available within tax-advantaged accounts like IRAs or k s. Grayscale offers that prices are dictated by the market and not by Grayscale itself, so price fluctuations may be a result of supply and demand. Bitcoin 5 of the World's Top Bitcoin Millionaires. Think about how to store your cryptocurrency. Industries to Invest In.