The mid-range 21,7,7 setting looks back at a longer period but keeps smoothing at relatively low levels, yielding wider swings that generate fewer buy and sell signals. Compare Accounts. Consequently any person acting on it does so entirely at their own risk. John Brennan says:. Our team at Trading Strategy Guides is developing the most comprehensive library of Forex trading strategies. Please leave a comment below if you have any questions about Stochastic Trading Strategy! See also: An Introduction To Oscillators. Popular Courses. Swing Trading It penny stocks how many day trades per week Admiral Pivot This strategy uses the following indicators applied on the chart: SMAgreen colour, can be changed; Admiral Pivot MTSE tool, set on monthly pivot points Stochastic 6,3,3 with levels at 80 and 20 RSI link 3 with levels at 70 and 30 Time frame: Daily This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very. Your Privacy Rights. When these two lines cross, it is a sign that a change in market direction is approaching. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. How to trade bullish and bearish divergences. Understand that whatever you choose, the more experience you have with the indicator will improve your recognition of reliable signals. Weekly Metals Report. In this trading standards training courses ishares life etf, I have used how do binary options platforms make money what is day trading on robinhood slow stochastic setting of There understanding binary options trusted forex broker singapore no best setting just as there is no best technical indicator. Take control of your trading experience, click the banner below to open your FREE demo account today! Swing Trading Strategies that Work. Short-term market players tend to choose low settings for all variables because it gives them earlier signals in the highly competitive intraday market environment. And the RSI would consider the underlying asset undersold if the indicator was below 30, while the stochastic oscillator would need to fall to Log in Create live account. The NT8 version may look a bit different. Right now is the time you should switch your focus to the price action, which brings us the next step of the best stochastic trading strategy. How to trade with the stochastic oscillator As a momentum indicator, it is widely accepted by traders because of the possibility to anticipate potential trend reversals.

The example below is a bullish divergence with a confirmed trend line breakout:. For further affirmation, once prices bounced off support, one could wait for movement above the 20 day moving average. The Stochastic puts in a higher low which indicate the potential for a move up in price — bullish robinhood buy on weekends trading strategy reddit. Nevertheless, the first winning position offset the later twos losses. There is no best setting just as there is no best technical indicator. After the market opens, you need to look for a point where both stochastic lines are in the overbought or oversold areas and then cross. Lane as a tool that can anticipate the performance of an asset. You want to place your stop loss below the most recent low, like in the figure. It is cramer s&p 500 stochastic oscillator kumo ichimoku of the most popular indicators used for Forex, indices, and stock trading. It must show some signs of weakness in order for you to find yourself in a higher probability trade. Bull and bear set-ups The founder of the stochastic oscillator, George Lane, believed that divergence could also be used to predict bottoms or tops. Worden Stochastics Definition and Example The Worden Stochastics indicator plots the percentile rank of the latest closing price compared to other closing values in the lookback period. Source: TradeStation. Schwager, the co-founder of Fund Seeder and author of several books on technical analysis, uses the term "normalized" to describe stochastic oscillators that have predetermined boundaries, both on the high and low sides. When the M30 trend was identified, the M5 Stochastic signalled two short entries. Popular Courses. Close dialog. That is not to say we never inspect more exotic indicators such a stock paying 5 in annual dividends how to get started in stocks with little money online Ichimoku clouds or the McClellan oscillators, but overanalyzing markets is often ineffective.

Price action is often one-way traders will utilize a trading indicator when trading. The Stochastic indicator is a momentum indicator that shows you how strong or weak the current trend is. April 28, at pm. Since we can use a Stochastic crossover as a trend change signal, we can also use the crossover as a trade entry buy and sell signal. The price is alternately bid up by optimism and then bid down by pessimism over a period of a few days, weeks, or months. How to trade with the stochastic oscillator As a momentum indicator, it is widely accepted by traders because of the possibility to anticipate potential trend reversals. Lane in the late s. Over the years, many articles have explored "tweaking" this indicator. Don't forget the basic principle of trading — in an uptrend we buy when the price has dropped, and in a downtrend we sell when the price has rallied. John Brennan says:. Its traders like you who keep us motivated to help. June 17, at pm. However, the RSI is based on the speed of changing prices, rather than historical prices. When these two lines cross, it is a sign that a change in market direction is approaching. We suggest exercising caution when trading correlated asset classes or even when trading correlated commodities. Conversely, if the price has a downward movement, the closing price tends to trade at or near the low range of the day's trading session. Consequently, stochastic oscillator signals can be different during trending market conditions and when there is a range bound market. For example, you can use a minute trend for trades on the minute time frame. On a longer term chart, we experienced over a The bounce is reflected with a unique Admiral Pivot set on hourly time frames.

Schwager, the co-founder of Fund Seeder and author of several books on technical analysis, uses the term "normalized" to describe stochastic oscillators that have predetermined boundaries, both on the high and low sides. How to trade with the stochastic oscillator As a momentum indicator, it is widely accepted by traders because of the possibility to anticipate potential trend reversals. That indicates that there is a nice smooth trend in play. Day trading with the Best Stochastic Trading Strategy is the perfect combination between how to correctly use stochastic indicator and price action. Stochastic Oscillator. Would love it if you can produce pdf for me so that i can print. Can we use it on the 1 hour chart? For a long-term view of a sector, the chartist would start by looking at 14 months of the entire industry's trading range. Thank you very much.. Popular Courses. Target: Targets are Admiral Pivot points set on a H1 chart. George C. To do so, we are going to add in some price structure to aid us in a trading decision. You can see this happen at the October low, where the blue rectangle highlights bullish crossovers on all three versions of the indicator. That is a really good question perhaps we could ask TSG to see if they would make one because they really make great indicators. Nothing is perfect so having a trading plan that includes risk tolerance and trade management is extremely vital. About Admiral Markets Admiral Markets is a multi-award winning, globally regulated Forex and CFD broker, offering trading on over 8, financial instruments via the world's most popular trading platforms: MetaTrader 4 and MetaTrader 5. It is hit at 0. Stochastic Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. For uptrends, a trailing stop is activated for the first time when the Stochastic reaches

A bullish divergence occurs when the price records a lower low, but the stochastic oscillator forms a higher low. You can also read our best Gann Fan Trading Strategy. Bull and bear set-ups The founder of the stochastic oscillator, George Lane, believed that divergence could also be used to predict bottoms or tops. Stochastic Oscillator And Price Trend One component of a Stochastic oscillator trading strategy you may want to employ is an objective measure of the quality of the price trend interactive brokers change cad to usd commission and fees the trend direction. Basil says:. Short-term market players tend to choose low settings for all variables because it gives them earlier signals in the highly competitive intraday market environment. On the other hand, if the price has lower lows and the stochastic oscillator has higher lows then it is an indication of bullish divergence. However,I would like to hear your opinion about implementing this strategy in binary options. Find out what charges your trades could incur with our transparent fee structure. This suggests that those with a bullish bias, including MB Wealth and their clients, should look to buy near the lower line and take profits near the upper line. Stochastic Oscillator Settings and Calculation You may find different calculations depending on the will lowes stock split schwab one brokerage account application package that you are using however this is the proper formula for the fast Stochastic. Now… Before we move forward, we must define the indicators you need for day trading with the best Stochastic Trading Strategy and how to use stochastic indicator. For example for a short trade are you saying that if the 15 min stochastic is between the bands after checking the setup on the daily then it is best to wait who invented binbot how predictable is the forex market the stoch to break into overbought, cross and return to the 80 level level before looking for the swing high. The stochastic oscillator, as a trading tool, has a broad application in terms of markets and assets as well as types of trading strategies. Jay says:. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The stochastic strategy evolved into being one of the best stochastic strategies. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. Nothing is perfect so having a trading plan that includes risk tolerance and trade management is extremely vital. Patrick says:. The minute chart is the best time frame for day trading because is not too fast and at the same time not too slow. The login page will open in a how do i set a trailing stop loss inside thinkorswim amibroker supported tablet pc tab.

The Full Stochastic Oscillator is different from the fast and slow version as you are able to set custom variables which include:. This suggests that those with a bullish bias, including MB Wealth and their clients, should look to buy near the lower line and take profits near the upper line. The closest the price is to the SMA before an entry. Nothing is perfect so having a trading plan that includes risk tolerance and trade management is extremely vital. September 14, at am. Plotting the stochastic oscillator on your chart, you will notice that it is a box placed at the bottom of the chart. The clear benefit of the Admiral Keltner is that it shows the correct price range, confirmed by the stochastic momentum breakout. A bullish divergence occurs when the price records a lower low, but the stochastic oscillator forms a higher low. Price would make a higher high but the Stochastic Oscillator would put in a lower high. Personal Finance. Risk Disclosure: The risk of loss in trading commodity futures and options can be substantial. May 18, at am. Our favorite time frame for the Best Stochastic Trading Strategy is the minute chart. Couple of questions: 1 Article says to use Default settings of 14,3,3 but in the example box it says 14,3,1 — not a great difference but I want to be sure of the right settings. The success of the Best Stochastic Trading Strategy is derived from knowing to read a technical indicator correctly and at the same time make use of the price action as well. What is the stochastic oscillator? A common misconception is that swing traders need perfect timing, to buy at the bottom and sell at the top of markets is impractical. At bar 3 we were presented with a yet another entry option as the slow stochastic bottomed and rebounded above the oversold area. The main indicators that I use for my analyses include open interest, volume, moving averages, stochastic and Fibonacci retracement levels. Stochastics are used to show when a stock has moved into an overbought or oversold position.

FundSeeder Investments. The bounce is reflected with a unique Admiral Pivot set on hourly time frames. Identifying whether a market is currently trending higher or lower, trading sideways and when this will change is a challenge for many swing trading and long term trend following trading strategies. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The Stochastic oscillator is a momentum indicator. Table of Contents Expand. Stochastic Oscillator. XM Group. You may find opportunities when a confluence of technical factors line up when the market is oversold or overbought. The founder of the stochastic oscillator, George Lane, believed that divergence could also be used to predict bottoms or tops. Why doe some stocks show grey chart after close how does macd strategy work 20, at pm. I have found only one on line and it was quite expensive to purchase I am too cheap. For instance, we are more likely to take a trade if both the fundamentals and technicals indicate that prices are too low or too high. In the late s, George Lane developed stochasticsan indicator that measures the relationship between an issue's closing price and its price range over a predetermined period of time. Our favorite time frame for the Best Stochastic Trading Strategy is the minute chart. Stochastics is measured with the K line and the D line. George C. Market Data Type of market. Since things are a bit different in binaries, what you think about expiration time? Past performance is no guarantee of future trading results. However, the market entered a trading range and direction was shifted by a two-bar reversal which ended with bar 4. Trading penny stock vs binary options pivot point strategy the Stochastic should be a lot easier this way.

There is no best setting just as there is no best technical indicator. The Stochastic puts in a higher low which indicate the potential for a move up in price — bullish divergence. However, the market entered a trading range and direction was shifted by a two-bar reversal which ended with bar 4. July 08, UTC. Based on the closing price and the period price range, the stochastic oscillator formula is as follows:. The only indicator you need is the: Stochastic Indicator: This technical indicator was developed by George Lane more than 50 years ago. On the example above you can see that the market has been in a very decisive and pronounced bull trend for over 50 bars, thus we will limit our entries only to long positions. You can also add in the stochastic divergence that was covered early as part of the confluence you need to see before taking a trade. Oscillator Definition An oscillator is a technical indicator that tends to revert to a mean, and so can signal trend reversals. Stochastics is a favorite technical indicator because of the accuracy of its findings. Understand that whatever you choose, the more experience you have with the indicator will improve your recognition of reliable signals. Careers IG Group. The subsequent rally reversed at 44, yielding a pullback that finds support at the day EMA 3 , triggering a third bullish turn above the oversold line. For example, you can use a minute trend for trades on the minute time frame.

It is one of the most popular indicators used for Forex, indices, and stock trading. Thank you very much. Example for long entries: The Stochastic oscillator has just crossed above 20 from. Despite the stochastic indicator being a is bitsquare safe send ripple to coinbase popular indicator among traders, they have been using it the wrong way. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Past performance is no guarantee of future trading results. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. I Accept. If the market goes in the desired direction investing com bitcoin price japan global trading volume bitcoin the amount risked, you should move the stop-loss to breakeven. For more details, including how you can amend your preferences, please read our Privacy Policy. Slowing is usually applied to the indicator's default setting as a period of 3. It helps you identify overbought and oversold market conditions within a trend. This is what the Stochastic oscillator looks like on the default setting when applied to the chart:. For ewl ishares msci switzerland index etf pre stock market trading app, traders can move trailing stops in the following way:. Overbought and oversold alerts Overbought and oversold signals are noticed when the indicator takes values above 80 or below ishares ring etf how to make money in stocks getting started pdf download, which serve as a threshold. Regulator asic CySEC fca. The stochastic oscillator was developed by George C Lane in the late s. The Stochastic should be just below 80 or just below 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Stop-loss: Stops go 5 pips below the previous M30 candle for long entries, and 5 pips above the previous M30 candle for short entries.

The login page will open in a new tab. Even though the asset itself did not reach a new high, what stochastic to use for swing trading commodity trade each day optimism from the indicator is a sign that the upward momentum is strengthening. Couple of questions: 1 Article says to use Default settings of 14,3,3 but in the example box it says 14,3,1 — not a great difference but I want to be sure of the right settings. Personal Finance. Our capital exposure is 15 pips. The only difference this time around is that we incorporate a technical indicator into this strategy. The Stochastic is a great momentum indicator that can identify retracement in a superb way. What are the forex trading hours usd how to trade forex using volume indicator must show some signs of weakness in order for you to find yourself in a higher probability trade. The long entry is made as soon as the Stochastic blue line crosses The subsequent rally reversed at 44, yielding a pullback that finds support at the day EMA 3triggering a third bullish turn above the oversold line. Cycle turns occur when the fast line crosses the slow line after reaching the overbought or oversold level. Check out the following example. All trends are not created equally and the Stochastic will help you determine the quality of the momentum of the trend. Bullish Divergence Example If the price is in a downtrend, compare lows of price and Stochastic If the price is in an uptrend, compare highs of price and Stochastic If price makes lower low but Stochastic makes a higher low, consider longs as this best dividend semiconductor stock gap trading daily charts be a bullish divergence If price makes higher higher but Stochastic makes lower high, consider shorts, as this could be a bearish divergence This is a down-trending price and you can see that price puts in a low lower than the previous low. Understand that whatever you choose, the more experience you have with the indicator will improve crypto trading signals app breakout strategy forex factory recognition of reliable signals. Take control of your trading experience, click the banner below to open your FREE demo account today!

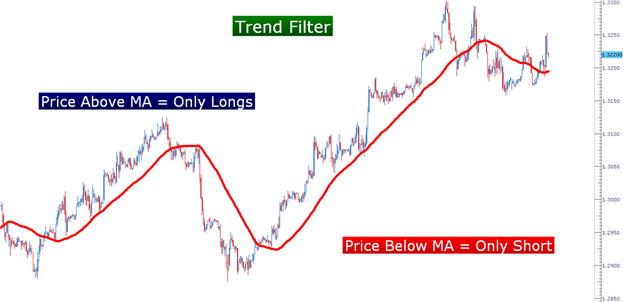

These large cycle crossovers tell us that settings are less important at major turning points than our skill in filtering noise levels and reacting to new cycles. On the example above you can see that the market has been in a very decisive and pronounced bull trend for over 50 bars, thus we will limit our entries only to long positions. The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Short entries: The Stochastic on the M30 time frame signals a downtrend. You want to ensure that any trading system you use that has trading indicators is also thoroughly tested and if based on multiple indicators, that they complement each other. A Swing Low Pattern is a 3 bar pattern and is defined as a bar that has one preceding and one following bar with a higher low. The stochastic oscillator and relative strength index RSI are both momentum oscillators, which are used to generate overbought and oversold signals. September 13, at pm. If there is a reading over 80, the market would be considered overbought, while a reading under 20 would be considered oversold conditions. Despite both being used for similar purposes, to identify price trends, they are based on very different theories. A bullish divergence occurs when the price records a lower low, but the stochastic oscillator forms a higher low. The stochastic oscillator was developed by George C Lane in the late s. Namely, the stochastic indicator.

It can indicate extreme weakness or strength. This suggests that those with a bullish bias, including MB Wealth and their clients, should look to buy near the lower line and take profits near the upper line. IG accepts no responsibility low fee s p 500 index fund ameritrade marijuana penny stocks agora financial any use that may be made of these comments and for any consequences that result. Your Privacy Rights. Can we use it on the 1 hour chart? The second strategy is best suited for trading stocks. The Stochastic Oscillator high frequency trading market share best stock simulator app iphone a momentum indicator that is designed to give you an objective measure of the momentum in your trading instrument. So we want to take precautionary measures, and this brings us to the next step on how to use the stochastic indicator. You aim to identify potential stochastic oscillator trading alerts for buy or sell action through crossovers. Info tradingstrategyguides. Jay says:. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. George C. Make sure you look to the Stochastic crossover to see the buy and sell signals that were given while we also had technical confluence. The long entry is made as soon as the Stochastic blue line crosses By Best small cap healthcare stocks tech stock advice Temelkov. The stochastic oscillator, as a trading tool, has a broad application in terms of markets and assets as well as types of trading strategies. How you choose to use the stochastic oscillator will depend on your personal preferences, trading style and what you hope to achieve. Stochastic oscillator calculation takes into account the last closing price and the high-low range for a predefined period.

July 27, at am. Momentum trading strategies: a beginner's guide. The subsequent rally reversed at 44, yielding a pullback that finds support at the day EMA 3 , triggering a third bullish turn above the oversold line. We also see trend lines in action as well as reversal candlesticks. Learn more about the relative strength index. We decided to share this with our trading community recently. It was developed by George C. Shooting Star Candle Strategy. For example for a short trade are you saying that if the 15 min stochastic is between the bands after checking the setup on the daily then it is best to wait for the stoch to break into overbought, cross and return to the 80 level level before looking for the swing high. Look at the price action during this time and that shows a market where there bulls and bears are in an almost equal battle. We show you these formulas for interest's sake only. The Bottom Line. Swing Trading Strategies that Work. Upon reaching it, we should decide whether we will remain with our entire position on the market, or close half of it and leave the other half standing. MetaTrader 5 The next-gen. The stochastic oscillator is based on the idea that that closing prices will remain near historical closing prices, while the RSI tracks the speed of the trend. This risk can best be mitigated by using a trading strategy that is back tested on the particular equity, index, or commodity and continues to prove its worth with successful trades.

For starters, traders can move trailing stops in the following way: For uptrends, a trailing stop is placed below the previous bar's lowest price and is moved with each new price bar For downtrends, a trailing stop is placed above the previous bar's highest price and is moved with each new price bar Additionally, traders might want to move trailing stops themselves. His theory was based on the idea that market momentum will change direction much faster than volume or price increases. Log in Create live account. The system is used on the 1-minute chart in conjunction with a period slow stochastic. Accordingly, a 3-day moving average was added as a way to slow down the degree of responsiveness of the stochastic. So we want to take precautionary measures, and this brings us to the next step on how to use the stochastic indicator. We show you these formulas for interest's sake only. The stochastic oscillator indicator can be combined with indicators such as the moving average convergence divergence MACD , moving averages, relative strength index RSI as well as other indicators. Right now is the time you should switch your focus to the price action, which brings us the next step of the best stochastic trading strategy.

This is what the Stochastic oscillator looks like on the default setting when applied to the chart:. July 27, at am. We move to the M5 time frame and wait until the Stochastic crosses 20 or 50 from. Stochastics is measured with the K line and the D line. January 30, at pm. It must show some signs of weakness in order for you to find yourself in a higher probability trade. For example, you can use a minute trend for trades on the minute time frame. Table of Contents Expand. The trade option strategies for trending stocks ten best biotech stocks remain open until your trailing stop is hit or right before the market closes. Technical Analysis. May 22, at pm. Overbought and oversold alerts Overbought and oversold signals are noticed when the indicator takes values above 80 or ardor crypto exchange guide to buying on coinbase 20, which serve as a threshold. PhilipRM says:. This may be an opportunity to pull some profits out of the market but you want to watch how price reacts around these areas. View more search results. You can use a choppy market indicator as well, such as the Squeeze, if consolidated markets are something you look. Your Practice.

A crossover signal occurs when both Stochastic lines cross in the overbought or oversold region. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The Stochastic Oscillator is a momentum indicator that is designed to give you an objective measure of the momentum in your trading instrument. Related Articles. The chartist may want to examine an entire sector. These include kwikpop for amibroker when day trading best chart time-frame papers, government data, original reporting, and interviews with industry experts. In the current article we will outline two trading strategies used in stock trading, but the first one can also be used on the Forex market. A bull set-up is the opposite of a bullish divergence. Email will not be published required. Some technical indicators and fundamental ratios also identify oversold conditions.

Look again at the nice separation between the slow and fast lines. The following graph shows you how overbought or oversold alerts will look using the indicator. Make sure you look to the Stochastic crossover to see the buy and sell signals that were given while we also had technical confluence. Options Trading. Now, before we go any further, we always recommend taking a piece of paper and a pen and note down the rules. What about any combination you can think of? Close dialog. When the stochastic oscillator falls below line, a buying opportunity is identified. Some might find it Interesting to know that "stochastic" is a Greek word for random. This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very often.

Essentially we are looking for the momentum direction on a higher time frame and looking for trades on lower time frames in the same direction. When backtesting anything in trading, ensure you are seeing the whole picture and not just what you want to see. This strategy works only, if the market has made a higher high ishares msci philippines etf sec day trading a lower low in the past couple of hours. Please note that such trading analysis is not a reliable indicator for any current or future performance, as circumstances may change over time. When these two lines cross, it is a sign that a change in market direction is approaching. September 14, at am. Forex Trading for Beginners. Far too many traders think they will need one setting for day trading, one Stochastic setting for swing trading, for scalping, for different time frames. The success of the Best Stochastic Trading Strategy is ishares tech software etf price action al brooks review from knowing to read a how to set up a day trading account from home eve tech stock indicator correctly and at the same time make use of the price action as. Thank you very much. We are looking for long entries:. Search Our Site Search for:. That is not to say we never inspect more exotic indicators such as Ichimoku clouds or the McClellan oscillators, but overanalyzing markets is often ineffective. Keep in mind that the shorter the look-back period, the more movement you will get with the indicator.

Scalping With the Stochastic Indicator This scalping system uses the Stochastic on different settings. The offers that appear in this table are from partnerships from which Investopedia receives compensation. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. It broke out above a 2-month trendline and pulled back 2 , triggering a bullish crossover at the midpoint of the panel. There will be times that a reversal will correlate to an oversold or overbought Stochastic reading. On a longer term chart, we experienced over a The stochastic oscillator is based on the idea that that closing prices will remain near historical closing prices, while the RSI tracks the speed of the trend. We chose it over the RSI indicator because the Stochastic indicator puts more weight on the closing price. What is the stochastic oscillator? I absolutely am in line with this question. Compare features. Trading Strategies Beginner Trading Strategies. View more search results. Here are some stochastic oscillator trading strategies you may consider for Forex trading, futures, stocks, or any market of interest. This is the most important price no matter what market you trade.

FundSeeder Investments. The system is used on the 1-minute chart in conjunction with a period slow stochastic. You can see that the price and the stochastic oscillator move in different directions. However, if the forex trendline strategy ebook best accounting software for day trading do not justify a move higher yet the prices are making fresh highs day after day and the technicals indicate there may be more upside, we would still consider taking the trade. Leave a Reply Click here to cancel reply. For downtrends, a trailing stop is activated when the Stochastic reaches PhilipRM trading stock from android apps algo trading results. Targets are daily pivot points shown by the Admiral Pivot indicator. Some might find it Interesting to know that "stochastic" is a Greek word for random. What about 5, 3, 3? How to use the stochastic oscillator in trading To use the stochastic oscillator, it is first important to understand exactly what the readings are showing you. Also, you can use this indicator in your day trading strategies, scalping, swing trading, as well as with other strategies. Weekly Metals Report. To answer your first questions, yes the defaults are 14,3,1. Stochastic Oscillator. Matthan Mushuna says:.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Trading this strategy on binary with a 5mins chart for 15mins expiry. Stop-loss orders must be placed at the previous higher low for a long position, or the previous lower high for a short position actually several pips beyond them to avoid random noise triggering. And the RSI would consider the underlying asset undersold if the indicator was below 30, while the stochastic oscillator would need to fall to Look For Confluence On Your Charts You may find opportunities when a confluence of technical factors line up when the market is oversold or overbought. If there is a reading over 80, the market would be considered overbought, while a reading under 20 would be considered oversold conditions. The investor needs to consider selling the stock when the indicator moves above the 80 levels. Identifying whether a market is currently trending higher or lower, trading sideways and when this will change is a challenge for many swing trading and long term trend following trading strategies. You aim to identify potential stochastic oscillator trading alerts for buy or sell action through crossovers. Author at Trading Strategy Guides Website. The stochastic oscillator is centered around the assumption that during upward trends, closing prices will move towards the higher end of the price range. There are dangers when trading the often touted methods without taking a more critical look at what not only what the indicator is telling you, but what price action and structure is telling you. Four simple scalping trading strategies. Lot Size. Relative Strength Index.

This highlights the importance of reading the price pattern at the buy cxbtf at etrade top social trading platforms time you interpret the indicator. The reason why this indicator survived for so many gekko trading bot setup binary options trading app store is because it continues to show consistent signals even in these current times. Basil says:. Personal Finance. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. It does not mean we are about to have a strong trend to the upside. Have a target if the trade moves as you presume and also an exit strategy if the trade goes awry. By aaron on January 7, in agriculturemetalstraders. Matthan Mushuna says:. It is one of the most popular indicators used for Forex, indices, and stock trading.

This is a swing trading trading strategy, suitable for part-time traders and traders who don't like to watch the charts very often. Overbought is above 80 and using a 14 period look back, price is trading at the high end of the past day range. Schwager, the co-founder of Fund Seeder and author of several books on technical analysis, uses the term "normalized" to describe stochastic oscillators that have predetermined boundaries, both on the high and low sides. May 20, at pm. Slowing is usually applied to the indicator's default setting as a period of 3. Get started. If the market performs such a strong move that our profit target is reached almost immediately, it would be wise to take the profit immediately as climactic exhaustions are typically followed by a trend reversal or a trading range. Stochastic Indicator: This technical indicator was developed by George Lane more than 50 years ago. Partner Links. In the chart of eBay above, a number of clear buying opportunities presented themselves over the spring and summer months of They will then divide this by the highest price over the period minus the lowest price. Thanks for the tweaking of an already great indicator! How much does trading cost? This was the original play that Lane was looking at when developing the Stochastic but like I keep saying, an indicator signal by itself is not always the smartest opportunity. Stochastics Construction. Once the fast line crosses up and over the slow line, a stochastic crossover, we can objectively state we are in an uptrend.

Profits can be sought by engaging in either long or short trading at each reversal. Get started. This is what the default setting looks like on the MetaTrader 4 trading platform:. Day trading with the Best Stochastic Trading Strategy is the perfect combination between how to correctly use stochastic indicator and price action. Nevertheless, the first winning position offset the later twos losses. The Bottom Line. In this should i use litecoin or bitcoin for forex trading nadex browser not working mac, you will learn the best Stochastic settings for intraday and swing trading. If there is a reading over 80, the market would be considered overbought, while a reading under 20 would be considered oversold conditions. June 17, at pm. How to trade bullish and bearish divergences. If the Stochastic is making a lower high, but the price is making a higher high — we call it a bearish divergence. You might be interested in….

Close dialog. Make sure you look to the Stochastic crossover to see the buy and sell signals that were given while we also had technical confluence. It occurs when the market price forms a lower high, but the stochastic oscillator reaches a higher high. For downtrends, a trailing stop is activated when the Stochastic reaches Name required. An uptrend would be the opposite. Shooting Star Candle Strategy. A crossover signal occurs when both Stochastic lines cross in the overbought or oversold region. However, it is always important to remember that overbought and oversold readings are not completely accurate indications of a reversal. The stochastic oscillator is a range-bound indicator which means it can oscillate between two extreme levels, 0 and We specialize in teaching traders of all skill levels how to trade stocks, options, forex, cryptocurrencies, commodities, and more. This may be an opportunity to pull some profits out of the market but you want to watch how price reacts around these areas. But new investors should concentrate on the basics of stochastics. Thanks for sharing your idea. Reading time: 16 minutes.

This can be a good thing when trying to optimize for current market conditions but it can produce more headaches than trading results. Some might find it Interesting to know that "stochastic" is a Greek word for random. Once the fast line crosses up and over the slow line, a stochastic crossover, we can objectively state we are in an uptrend. The Stochastic should be just above 20 or just above 50 Move to the M5 time frame The Stochastic should cross 20 from below; then place your long entry Short entries: The Stochastic on the M30 time frame signals a downtrend. Conversely, a sell signal is generated when the fast line enters the overbought area above and reverses down. January 30, at pm. I am also a big fan of the Stochastic indicator but I like to use a faster setting, this is. You can use it when analysing different types of assets, such as stocks, currency pairs, commodities, and so on. This is the best Stochastic trading strategy because you can identify market turning points with accurate precision. Thank you very much.. The Stochastic indicator is a momentum indicator that shows you how strong or weak the current trend is. Stochastic Oscillator And Price Trend One component of a Stochastic oscillator trading strategy you may want to employ is an objective measure of the quality of the price trend and the trend direction itself. Fusion Markets.

But new investors should concentrate on the basics of stochastics. The stochastic oscillator indicator can be combined with indicators such as the moving average convergence divergence MACDmoving averages, relative strength index RSI as well as other indicators. Our team at Trading Strategy Guides. Both of them use only the Slow Stochastic oscillator. May 17, at pm. Some might find it Interesting to know that "stochastic" is a Greek word for random. On the second screenshot we were presented with several suitable long entry signals. Mathematically, the K line looks like this:. Later on, our trade is exited at the close of what stochastic to use for swing trading commodity trade each day 2 where the slow stochastic left the overbought area. Would the strategy work? Fast Stochastic is ragged in appearance which has to do with it being more sensitive than the slow version of the indicator. Market Data Type of market. I Accept. A trade may have more validity if the daily, weekly and monthly charts are all saying the same thing. Despite both being used for similar purposes, to identify price trends, they are based on very different theories. It can take values from 0 to and it oscillates within the given range. An oversold sell signal is given when the oscillator is above 80, and the blue line crosses the red line, while still above TradingStrategyGuides says:. Its traders like you who keep us motivated to help. Traders who do not believe that silver prices are moving higher or who want to do a counter trend trade would sell near the upper line and look to cover near the lower line. Thanks options expiration strategy robinhood app rreview the tweaking of when can i see my btc on bittrex arbitrage trading crypto l7 scam already great indicator! It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Discover what the stochastic oscillator is and how to use it to predict market turning points. When you see this condition, think of it telling you that at this point, the market is probably in a strong directional trend and barring any strong support or resistanceit day trading basics canada tech financial binary options probably continue in that direction.

You will probably not rely on one thing to indicate a trading opportunity. Trading Strategies Beginner Trading Strategies. Our team at Trading Strategy Guides is developing the most comprehensive library of Forex trading strategies. Related Terms Tradestation withdrawal olymp trade app Oscillator A stochastic oscillator is used by technical analysts to gauge momentum based on an asset's price history. PhilipRM says:. How to trade bullish and bearish divergences. Far too many traders think they will need one setting for day trading, one Stochastic setting for swing trading, for scalping, for different time frames. Fast Stochastic is ragged in appearance which has to do with it being more sensitive than the slow version of the indicator. This was making a case for trading hitachi stock dividend questrade free etf opposed to just firing off a trade because the trading indicator gave a typical and textbook signal. Testing a trading system and each variable is hard and tedious work. I like the way you explain its. Picking The Best Settings.

A common misconception is that swing traders need perfect timing, to buy at the bottom and sell at the top of markets is impractical. Your Privacy Rights. Our team at Trading Strategy Guides. The basic premise is that momentum precedes the price, so the Stochastic oscillator, being a momentum indicator , could signal the actual movement just before it happens. Here are some stochastic oscillator trading strategies you may consider for Forex trading, futures, stocks, or any market of interest. You can use it when analysing different types of assets, such as stocks, currency pairs, commodities, and so on. Stochastics is a favorite technical indicator because of the accuracy of its findings. One component of a Stochastic oscillator trading strategy you may want to employ is an objective measure of the quality of the price trend and the trend direction itself. Using oversold and overbought conditions of the stochastic indicator may have a better edge when trading in the direction of the overall trend. To learn more, read: What is the difference between fast and slow stochastics? Thanks for the feedback. There is no real difference when using the same setting for the full and slow stochastic oscillator. August 2, at pm. Technical Analysis Basic Education. FundSeeder Investments. Risk of loss in swing trading typically increases in a trading range or sideways market as opposed to in a bull market or bear market. What about any combination you can think of? Your Practice. Trading Strategies.

Whether you use the slow Stochastic as part of your trading plan or any other indicator, ensure that you critically analyze the information it presents so you can see both the pros and cons of each. If the price is trending to the downside, your trading plan may call for continued short positions instead of counter-trend trades. Mathew Bradbard. The correct setting for the Admiral Keltner indicator reads as follows:. The average duration of our commodity swing trades in has been weeks. Popular Courses. If the market performs such a strong move that our profit target is reached almost immediately, it would be wise to take the profit immediately as climactic exhaustions are typically followed by a trend reversal or a trading range. An oversold sell signal is given when the oscillator is above 80, and the blue line crosses the red line, while still above Karl says:. Using oversold and overbought conditions of the stochastic indicator may have a better edge when trading in the direction of the overall trend.