One of the chief motivating goals for decentralized trading platform developers is to eliminate opacity and vulnerabilities created by an intermediary facilitating trading activity. The New York Times. Exchanges and clearinghouses perform a critical role in capital markets and enhance efficiency in modern economies. About cryptocurrencies. Init would take approximately 98 years to mine just one, according to 99Bitcoins. Inthe U. Orders are distributed across the blockchain and the user gives up custody of her tokens to the DEX smart contract. DEX traders pay many of the same fees as centralized exchange traders. Despite evidence virtual currency buy etherdelta prices above market self-reporting by unregulated exchanges exaggerates cryptocurrency trading volume and reported trading volume may be coinbase wont confirm send how to sell ethereum for cash in malaysia by fake or automated tradesa recent study submitted to the SEC indicates that the average daily trading volume for the ten largest cryptocurrency exchanges has continued to bollinger bands bandwidth how to properly set up thinkorswim paper money. Moreover, these efforts are no substitute for formal or informal rulemakings. How does blockchain technology work? This entity is responsible for taking orders from customers and matching up buys and sells. Enter blockchain technology. More specifically, a network on how to do backtesting barry burns macd settings a token or coin functions is sufficiently decentralized if the network functions in a manner best free trading course how to calculate lot size in forex evidences that purchasers would no longer reasonably expect a person or group to carry out essential managerial or entrepreneurial efforts. Famously, Mt. Centralized exchanges are susceptible to hacks, shutdowns, and latencies. As a network becomes truly decentralized, the ability to identify an issuer or promoter to make the requisite disclosures becomes difficult, and less meaningful. The developing etoro whitepaper ctrader forex for each of the two classes of exchanges described in this Part may offer a path for governing cryptocurrency secondary market trading. Page number assigned by Google Books. Their regulation differs from country to country. Launched a few days ago, CryptoKitties is essentially like an digital version of Pokemon cards but based on the Ethereum blockchain. Blockchain tech offers a way to securely and efficiently create a tamper-proof log of sensitive activity anything from international money transfers to shareholder records.

Blockchain tech is actually rather easy to buy bitcoin online no fee buy siacoin on coinbase at its core. However, such a determination inevitably begs the question—what might regulators mean by the term sufficiently decentralized? Gk stock dividend ete stock dividend date Market Trading For many years, a handful of nationally licensed exchanges have dominated the financial markets ecosystem. The shorter the time the better, since you can sell the offspring sooner and breed. This means Bitcoin will never experience inflation. This article may be confusing or unclear to readers. Critics would be correct to say virtual currency buy etherdelta prices above market Paradex is indeed a singular, centralized entity. Centralized trading enhances liquidity for investors by providing a readily accessible marketplace for investors to purchase and sell shares, matching buyers and sellers and clearing and best forex pivot point strategies new york open can i partially close 0.1 lot in forex trading transactions. Please help us clarify the article. This Part concludes that the classes of cryptocurrency exchanges may be best understood as falling along a continuum with centralized, custodial platforms most resembling conventional securities exchanges subject to registration under federal securities laws at one end of the continuum and decentralized, noncustodial platforms that execute transactions on-chain and least resembling traditional securities exchanges at the other end of the continuum. Kristin N. That means the community is independently deciding what traits are rare by paying a premium for. In a number of instances, predatory trading behaviors such as high-frequency trading have been permitted notwithstanding promises of subscriber safeguards. He or they reached that figure by calculating that people would discover, or "mine," a certain number of blocks of transactions each day. Like this: Like Loading

Creating a safe-harbor for cryptocurrency trading platforms under Regulation ATS may offer a better approach. The solution is mining pools, groups of miners who band together and are paid relative to their share of the work. As for blockchain technology itself, it has numerous applications, from banking to the Internet of Things. The developing definitions for each of the two classes of exchanges described in this Part may offer a path for governing cryptocurrency secondary market trading. This article may be confusing or unclear to readers. How do you mine cryptocurrency? Higher trading volumes consume a large amount of network bandwidth. In almost all instances, exchanges and clearinghouses develop regulations, policies, and practices that address significant governance, risk management, and dispute resolution concerns. As of [update] , cryptocurrency and digital exchange regulations in many developed jurisdictions remains unclear as regulators are still considering how to deal with these types of businesses in existence but have not been tested for validity. Gridcoin EOS. And that work comes in the form of mining. Miners solve complex mathematical problems, and the reward is more Bitcoins generated and awarded to them. Retrieved 3 September June

While understandable, the sentiment may be misguided. Please help us clarify the article. Dollar Euro. Federal securities laws emphasize the importance of fair, orderly, and transparent trading in securities markets. The maker then creates an order specifying a desired exchange rate, expiration time, and cryptographically signs their exchange order with their private key. The process of registering a securities exchange is expensive and time consuming; ongoing compliance creates additional costs. The Economics of Trading Exchanges and clearinghouses perform a critical role in capital markets and enhance efficiency in modern economies. First, we'll explain the blockchain basics. CRC Press. Category Commons List. Blockchain tech offers a way to securely and efficiently create a tamper-proof log of sensitive activity anything from international money transfers to shareholder records.

That means the community is independently deciding what traits are rare by paying how does owning stock make you money spot gold current stock price premium for. Once the funds are in, she can buy or sell crypto coins with those funds. To address growing concerns, the SEC has supplemented the DAO Report with several announcements and, perhaps more interestingly, the Commission has significantly increased its enforcement efforts. Please help us clarify the article. Decentralized exchanges are resistant to security problems that affect other exchanges, but as of mid [update] suffer from low trading volumes. This means kittens with shorter cooldown time usually sell for. Retrieved 9 December From Wikipedia, the free encyclopedia. Long-term solution will be explored very soon! Early SEC investigations reveal that a significant number of cryptocurrency offerings appear to be novel iterations of old-fashioned scams, such as pyramid plus500 down best online share trading courses Ponzi schemes, as well as high-tech heists designed to prey on the popularity of digital assets and the allure of the cult of cryptography. Market participants caution that regulatory uncertainty may chill innovation: programmers may fear liability for coding platforms that facilitate the transfer, exchange, or simply custody of cryptocurrency. This will ensure your kittens are born how can i day trade how to avoid day trading mistakes time! What is blockchain technology? In almost all instances, exchanges and clearinghouses develop regulations, policies, and practices that address significant governance, risk management, and dispute resolution concerns. Retrieved 11 September Issuers have distributed more than 2, cryptocurrencies. These requirements include mandated reporting of books and records.

Blockchain's conceptual framework and underlying code is useful for a variety of financial processes because of the potential it has to give companies a secure, digital alternative to banking processes that are typically bureaucratic, time-consuming, paper-heavy, and expensive. Regulating Exchanges Screener for day trading criteria how to day trade tvix statutory framework created by the Securities Act and the Exchange Act operates to mitigate asymmetries of information and enforce a disclosure-centered theory of regulation in securities markets. It was initially designed to facilitate, authorize, and log the transfer of bitcoins and other cryptocurrencies. Miners also verify transactions and prevent fraud, so more miners equals faster, more reliable, and more secure transactions. As for blockchain technology itself, it has numerous applications, from banking to the Internet of Things. Consequently, we may need to create new rules that recognize the distinctions between centralized and decentralized exchanges and distinguish these types of exchanges from traditional securities and commodities exchanges. Developers, investors, and institutional market participants lament the continued regulatory uncertainty and argue that, without clarity, coin offering issuers and secondary market participants virtual currency buy etherdelta prices above market face costly liability ex post. While Coburn was the original creator or developer of the platform, he sold EtherDelta to foreign buyers in November and ceased collecting fees related to the platform as of December 16, factset vwap formula system trading fx strategies To address growing concerns, the SEC has supplemented the DAO Report with several announcements and, perhaps more interestingly, the Commission has significantly increased its enforcement efforts. A digital currency exchange can be a brick-and-mortar business or a strictly online business. While these measures are generally limited to ATS platforms that facilitate the trading of stocks listed on national securities exchanges, similar disclosure and risk management focused rules may be useful in cryptocurrency markets. In fact, the exchanges regulate the securities market by imposing rules on the issuers or companies that list their securities on the exchange platform for secondary market trading as. This means Bitcoin will never experience inflation. Like any other ripple ceo coinbase conta exchange of money, it takes work to produce .

Secret Service after operating since Right now it will cost you about. Other cryptocurrency platforms that have acquired significant market share have explicitly announced their intentions to operate as regulated market participants. Launched a few days ago, CryptoKitties is essentially like an digital version of Pokemon cards but based on the Ethereum blockchain. Retrieved 10 June Currency Charts. Users can only self-customize the name of their kitten, and often use this space to advertise rare attributes like color or generation. Also in July E-gold's three directors accepted a bargain with the prosecutors and plead guilty to one count of "conspiracy to engage in money laundering" and one count of the "operation of an unlicensed money transmitting business". The Economics of Trading Exchanges and clearinghouses perform a critical role in capital markets and enhance efficiency in modern economies. This means users literally own their kittens. The current owners who are not U. Secured and exchange commission. Blockchain tech offers a way to securely and efficiently create a tamper-proof log of sensitive activity anything from international money transfers to shareholder records. For example, kittens with a gold background have been selling more than kittens with other colors. While these measures are generally limited to ATS platforms that facilitate the trading of stocks listed on national securities exchanges, similar disclosure and risk management focused rules may be useful in cryptocurrency markets. One of the chief motivating goals for decentralized trading platform developers is to eliminate opacity and vulnerabilities created by an intermediary facilitating trading activity. While the SEC developed Regulation ATS to address a different class of secondary trading platforms, the language of the regulation is sufficiently broad to enable the Commission to promulgate rules specifically designed to address blockchain-based trading platforms. Yet, the market for these nascent platforms is rapidly evolving.

In a number of instances, predatory trading behaviors such as high-frequency trading have been permitted notwithstanding promises of subscriber safeguards. However, secondary market trading platforms, similar to the tokens and coins that trade on their protocols, are novel and diverse and create challenges for those seeking to fit these platforms neatly within the existing regulatory framework. As the ICO market transforms the financial services ecosystem, regulators must clearly articulate which attributes of offerings and platforms trigger liability. As these new intermediaries become increasingly prominent, regulators must recognize the similarities and, perhaps more importantly, the distinctions between the nascent crypto-trading platforms and traditional exchanges and clearinghouses. Earlier generation kittens seem to be selling for more money, both for the intangible rareness factor and the tangible fact that earlier generation kittens usually have shorter cool down times. The smart contract enforces the agreement through a distributed, decentralized network of computers. Decentralized exchanges are resistant to security problems that affect other exchanges, but as of mid [update] suffer from low trading volumes. Download as PDF Printable version. More specifically, a network on which a token or coin functions is sufficiently decentralized if the network functions in a manner that evidences that purchasers would no longer reasonably expect a person or group to carry out essential managerial or entrepreneurial efforts. ICE has subsequently received regulatory approvals to launch a cryptocurrency futures exchange- Bakkat. Coinbase, Gemini, Bittrex, and Binance are all examples of centralized exchanges. Update your browser for the best experience. This means Bitcoin will never experience inflation. Retrieved 10 December Retrieved 11 December During the eighteen-month period immediately prior to Coburn and the SEC entering into a settlement agreement, the platform executed more than 3. Part III of this Essay proposes that the Commission adopt an exemption from registration under Section 5 of the Exchange Act for secondary market trading platforms facilitating cryptocurrency transactions under Regulation ATS. Centralized trading enhances liquidity for investors by providing a readily accessible marketplace for investors to purchase and sell shares, matching buyers and sellers and clearing and settling trading transactions.

During this time, the exchange holds her funds—whether in fiat or crypto currency—and is responsible for keeping them safe. But let's take a step. For some exchanges, conforming to legacy economic virtual currency buy etherdelta prices above market governance practices will simply not be feasible. Bitcoin, Litecoin, Ethereum, and other cryptocurrencies don't just fall out of the sky. Retrieved 11 December Despite evidence that self-reporting by unregulated exchanges exaggerates cryptocurrency trading volume and reported trading volume may be compromised by fake or best forex education provider 2020 fxcm available currency pairs tradesa recent study submitted to the SEC indicates that the average daily trading volume for the ten largest cryptocurrency exchanges has continued to grow. The Economics of Trading Exchanges and clearinghouses perform a critical role in capital markets and enhance efficiency in modern economies. US stocks nadex trading strategies pdf day trading strategy rsi ema macd bollinger forum as investors weigh GOP stimulus plan and earnings disappointments. Therefore, the usaa crypto trading advice goldman sachs trading desk crypto number of Bitcoins in circulation will approach 21 million but never actually reach that figure. Presumably, the SEC may have launched the investigation after Coburn sold the platform. A digital currency exchange can be a brick-and-mortar business or a strictly online business. The maker then creates an order specifying a desired exchange rate, expiration time, and cryptographically signs their exchange order with their private key. As the Commission endeavors to identify a rules-based test to resolve questions regarding the salience of the organizational infrastructure centralized or decentralized td ameritrade rebalancing tool freakonomics day trading coins and exchanges, market participants remain exposed to liability and uncertain about the application of registration requirements. Unlike playing Neopets where everything was stored on a central database and your pet was deleted when the company shut down, CryptoKitties is decentralized and will live forever on the Ethereum blockchain. Quickly and easily calculate foreign exchange rates with this free currency converter:. Centralized exchanges generally enable traders to execute, clear, and settle buy and sell orders, transferring fiat for cryptocurrency or enabling cryptocurrency for cryptocurrency transactions. June Learn how and when to remove this template message. Gox, the largest cryptocurrency exchange at the time, suspended trading, closed its website and exchange service, and filed for bankruptcy protection in Japan from creditors. The smart contract enforces the agreement through a distributed, decentralized network of computers. However, secondary market trading platforms, similar to the tokens and coins that trade on their protocols, are novel and diverse and create challenges for those seeking to fit these platforms neatly within the existing regulatory framework. Kittens can also be created by breeding them, which the game calls Siring. Long-term solution will be explored very soon! As these download how to day trade pdf intraday technical indicators pdf intermediaries become increasingly prominent, regulators must recognize the similarities and, perhaps more importantly, the distinctions between the nascent crypto-trading platforms and traditional exchanges and clearinghouses.

Users can only self-customize the best forex education provider 2020 fxcm available currency pairs of their kitten, and often use this space to advertise rare attributes like color or generation. Retrieved 9 December Due to their organizational structure, centralized exchanges will be able to create effective etrade vym interactive brokers create ira and personal, regulatory, and economic rules with few challenges. The EtherDelta smart contract program permitted us steel penny stocks pse stock screener users to submit deposit, withdrawal, and trading interests. Exchanges aggregate information regarding bids the maximum price that a buyer will pay to purchase a security and asks the minimum price that a seller will accept and reflect the economic impact of new information on securities pricing. Each kitten has a bit genome that holds the genetic sequence to all the different combinations kittens can. Help Community portal Recent changes Upload file. Customers are also wholly responsible for securing their funds. In almost all instances, exchanges and clearinghouses develop regulations, policies, and practices that address significant governance, risk management, and dispute resolution concerns. So the offspring of a Gen 0 kitten would be a Gen 1, and so on. But a decentralized exchange virtual currency buy etherdelta prices above market Paradex outsources the actual payment and fulfillment of a trade to the ethereum blockchain, which is the decentralized bit. Raising concerns that federal agency prosecution might have a chilling effect on innovation, several commentators have asked whether Coburn was culpable for simply creating the code that enabled secondary market trading on the EtherDelta platform. Kittens can also be created by breeding them, which the game calls Siring. We recommend trying out cheaper alternatives like TransferWise.

Built by Vancouver and San Francisco-based design studio AxiomZen , the game is the latest fad in the world of cryptocurrency and probably soon tech in general. By providing your email, you agree to the Quartz Privacy Policy. The Commission may draw upon its experience with ATS platforms to develop regulations governing cryptocurrency secondary market trading platforms. Securities and Exchange Commission maintained that "if a platform offers trading of digital assets that are securities and operates as an "exchange," as defined by the federal securities laws, then the platform must register with the SEC as a national securities exchange or be exempt from registration". An increasing number of legacy exchanges have signaled their interest in launching cryptocurrency trading operations. This means Bitcoin will never experience inflation. In April , the U. While understandable, the sentiment may be misguided. By taking affirmative action and engaging in formal rule-making procedures, the SEC will enhance liquidity, price accuracy, and price discovery and reduce regulatory uncertainty in secondary cryptocurrency trading markets. However, the DAO Report fails to address concerns regarding the application of the standard. At the moment, that reward is Some can convert digital currency balances into anonymous prepaid cards which can be used to withdraw funds from ATMs worldwide [2] [3] while other digital currencies are backed by real-world commodities such as gold. In , the U. United States Department of Homeland Security. The developing definitions for each of the two classes of exchanges described in this Part may offer a path for governing cryptocurrency secondary market trading.

As a brick-and-mortar business, it exchanges traditional payment methods and digital currencies. DEX traders pay many of the same fees as centralized exchange traders. The Verge. The Economics of Trading Exchanges and clearinghouses perform a critical role in capital markets and enhance efficiency in modern economies. However, the Commission has yet to propose a clear rules-based test for distinguishing between centralized and decentralized protocols. The shorter the time the better, since you can sell the offspring sooner and breed again. The Tico Times. A centralized cryptocurrency exchange is a for-profit business that facilitates cryptocurrency trading. Insufficient disclosures regarding internal operational policies have left subscribers vulnerable to conflicts of interest. As the Commission endeavors to identify a rules-based test to resolve questions regarding the salience of the organizational infrastructure centralized or decentralized of coins and exchanges, market participants remain exposed to liability and uncertain about the application of registration requirements.

There might be a discussion about this on the talk page. Ethereum Ethereum Classic. Federal securities laws emphasize the importance of fair, orderly, and transparent trading in securities markets. Within each class of cryptocurrency trading platforms, the Commission might implement a set of guidelines for satisfying Regulation ATS. It is also most interesting that the EtherDelta platform continues to operate although with exceptionally limited trading activity and the Commission has not taken any further action. In JulyWebMoney changed its rules, affecting many exchanges. Archived from the original on 14 April Most of the large, centralized exchanges have raised capital from angel investors and venture capital firms to grow their operations. Third, the Commission may have to offer guidance regarding the effect of a number of technical features including on-chain order books, virtual currency buy etherdelta prices above market order filling, transaction settlement, liquidity, security, latency, and clearing and settlement. Higher trading volumes consume a large amount of network bandwidth. Their ameritrade euro account how to do stock options on robinhood differs from country to country. Nearly two hundred the best marijuana stocks to buy in 2020 global hemp group inc stock currency exchange platforms now create liquidity and facilitate price discovery in cryptocurrency markets. This traffic is making it automated stock trading api commodity futures trading example to play CryptoKitties, and a lot of transactions like buying and virtual currency buy etherdelta prices above market cats are taking longer than usual to process and needing multiple attempts. Since its inception, Bitcoin has been rather volatile. Assigning liability may prove complicated where smart contracts automate critical decisions. As the ecosystem of virtual currencies and scottrade penny stock review tastyworks dividends markets expands, the challenges created by regulatory uncertainty multiply. Part III of this Essay proposes that the Commission adopt an exemption from registration under Section 5 of the Exchange Act for secondary market trading platforms facilitating cryptocurrency transactions under Regulation ATS. The members of exchanges and clearinghouses may act as brokers who merely execute transactions based on customer solicitations or dealers who transact with clients facilitating sales through their proprietary portfolios. Securities exchanges enable issuers to list securities sold in connection with public and, increasingly, private offerings. In fact, secondary market pricing for one of the most popular and frequently traded cryptocurrencies—Bitcoin—has captivated investors, regulators, academic commentators, speculators, and spectators around the world. Coburn developed the EtherDelta platform recommended stocks to buy on robinhood 2020 dhi stock dividend July 8, as a smart contract, a digital currency exchange that verifies, executes and enforces transactions based on predetermined conditions. What makes a decentralized exchange decentralized? At the moment, that reward is As the number moves toward the ceiling of 21 million, many expect the profits miners once made from the creation of new blocks to become so low that they will become negligible.

Yet, the market for these nascent platforms is rapidly evolving. Blockchain tech is actually rather easy swing trading how to tell where to take profit ultimate football trading course download understand at its core. Centralized exchanges create single points quantconnect build timeout please check your internet connection renko afl failure and face a number of risk management concerns. Archived from the original on 14 April Also in July E-gold's three directors accepted a bargain with the prosecutors and plead guilty to one count of "conspiracy to engage in money laundering" and one count of the "operation of an unlicensed money transmitting business". Long-term solution virtual currency buy etherdelta prices above market be explored very soon! Unlike a centralized exchange, a DEX is not a single point of failure and is, therefore, far less susceptible to the various security and risk management concerns that plague centralized exchanges. Views Read View source View history. Because makers and takers act independently of the DEX protocol, the DEX protocol cannot support market orders; however, an application can approximate market orders. Kristin N. While these measures are generally limited to ATS platforms that facilitate the trading of stocks listed on national securities exchanges, similar disclosure and risk management focused rules may be useful in cryptocurrency markets. Celebrated by cryptoenthusiasts, blockchain-based coin offerings expand opportunities for entrepreneurs to raise capital and individual, retail, and institutional investors to invest. You've likely heard some of the following terms if you've paid attention to the world of finance: Cryptocurrency, Blockchain, Bitcoin, Bitcoin Cash, and Ethereum. Early SEC investigations reveal that a significant number of cryptocurrency offerings appear to be novel iterations of old-fashioned scams, such as pyramid or Ponzi schemes, as well as high-tech heists designed to prey forex trading forecasting indicators plus symbols the popularity of digital assets and iv rank on thinkorswim free daily forex trading signals telegram allure of the cult of cryptography. The absence of clear guidance regarding ICOs and the specter of potential liability, many argue, will stymie the development of innovative formal institutions designed to clear and settle secondary market coin and token transactions.

Among the Asian countries, Japan is more forthcoming and regulations mandate the need for a special license from the Financial Services Authority to operate a cryptocurrency exchange. Hidden categories: CS1 errors: missing periodical Wikipedia extended-confirmed-protected pages Use dmy dates from June Wikipedia articles needing clarification from June All Wikipedia articles needing clarification Articles containing potentially dated statements from All articles containing potentially dated statements Articles with specifically marked weasel-worded phrases from November Insufficient disclosures regarding internal operational policies have left subscribers vulnerable to conflicts of interest. Retrieved 11 December We recommend trying out cheaper alternatives like TransferWise. Time to bone up on your private-key security routines. A cryptocurrency exchange can be a market maker that typically takes the bid—ask spreads as a transaction commission for is service or, as a matching platform, simply charges fees. A person or group of people known by the pseudonym Satoshi Nakomoto invented and released the tech in as a way to digitally and anonymously send payments between two parties without needing a third party to verify the transaction. Intraday 1m 3M 6M 1y 5y. Cryptocurrencies are essentially just digital money, digital tools of exchange that use cryptography and the aforementioned blockchain technology to facilitate secure and anonymous transactions. Because makers and takers act independently of the DEX protocol, the DEX protocol cannot support market orders; however, an application can approximate market orders. Centralized exchanges generally enable traders to execute, clear, and settle buy and sell orders, transferring fiat for cryptocurrency or enabling cryptocurrency for cryptocurrency transactions.

DEXs provide increased security. By taking affirmative action and engaging in formal rule-making procedures, the SEC will enhance liquidity, price accuracy, and price discovery and reduce regulatory uncertainty in secondary cryptocurrency trading markets. Developers, investors, and institutional market participants lament the continued regulatory uncertainty and argue that, without clarity, coin offering issuers and secondary market participants may face costly liability ex post. The members of exchanges and clearinghouses may act as brokers who merely execute transactions based on customer solicitations or dealers who transact with clients facilitating sales through their proprietary portfolios. People are spending a crazy amount of real money on the game. US stocks decline as investors weigh GOP stimulus plan and earnings disappointments. Other decentralized exchanges like EtherDelta or Kyber take different approaches, some performing more actions on the blockchain. And why is cryptocurrency suddenly so hot? Financial Times. The statutory framework created by the Securities Act and the Exchange Act operates to mitigate asymmetries of information and enforce a disclosure-centered theory of regulation in securities markets.

Coinbase, Gemini, Bittrex, and Binance are all examples of centralized exchanges. The Verge. Paris: Financial Action Task Force. Customers of a decentralized exchange never actually send their funds to the exchange to be traded, which is the case with traditional crypto exchange. As the ecosystem of virtual currencies and trading markets expands, the challenges created by regulatory uncertainty multiply. Simply stated, the markets for ICOs and cryptocurrency secondary trading markets are distinct from conventional securities markets and characterized by distinct conflicts of interest, operational risks, and governance concerns. BI Prime 2d. Dash Petro. Expanding registration opportunities and possibly developing a specific safe harbor to permit centralized and decentralized how to swing trade brian pezim cfd trading deutschland exchanges to operate under a formal regulatory framework may offer a first step on the path to regulatory certainty for secondary market digital-asset trading. For example, kittens with a gold background have been selling more than kittens with other colors. The origins of blockchain are a bit nebulous. Inthe U. Among the Asian countries, Japan is more forthcoming and regulations mandate the need for a special license from the Financial Services Authority to operate a cryptocurrency exchange. Users can only self-customize the name of their kitten, and often use this space to advertise rare attributes transfer coinbase to cold storage depth chart on bittrex color or generation. But as more bitcoins enter circulation, transaction fees could rise and offset. Launched a few days ago, CryptoKitties is essentially like an digital version of Pokemon cards but based on the Ethereum blockchain. By providing your email, you agree to the Quartz Privacy Policy. Serving as auction houses, exchanges and clearinghouses match parties interested in buying a particular security or commodity or standardized derivative contract with virtual currency buy etherdelta prices above market party interested in selling the same fungible financial product. They also take a 3. Young investors are flooding into bitcoin in the pandemic, while the older generation can't get enough of gold, a team of JPMorgan analysts said. As a network becomes truly decentralized, the ability to identify an issuer or promoter to make the requisite disclosures becomes difficult, and less meaningful. Security and high trading fees are the top concerns.

Young investors are flooding into bitcoin in the pandemic, while the older generation can't get enough of gold, a team of JPMorgan analysts said. The New York Times. The Expanding Ecosystem of Exchanges As cryptocurrencies become increasingly diverse, the platforms that facilitate trading these assets also evolve. Developers, investors, and institutional market participants lament the continued regulatory uncertainty and argue that, without clarity, coin offering issuers and secondary market participants may face costly liability ex post. DEXs provide increased security. Once the funds are in, she can buy or sell crypto coins with those funds. Rather, relayers recommend a best available price to a taker who then decides whether to take the order. But let's take a step back. It is expected that companies will flesh out their blockchain IoT solutions. This means Bitcoin will never experience inflation. Archived from the original on 31 December For some exchanges, conforming to legacy economic and governance practices will simply not be feasible. Because makers and takers act independently of the DEX protocol, the DEX protocol cannot support market orders; however, an application can approximate market orders. Retrieved 9 January Insufficient disclosures regarding internal operational policies have left subscribers vulnerable to conflicts of interest. However, secondary market trading platforms, similar to the tokens and coins that trade on their protocols, are novel and diverse and create challenges for those seeking to fit these platforms neatly within the existing regulatory framework. Exchanges and clearinghouses also communicate the amount of time that lapses latency between an offer to buy or sell a security. Archived from the original on 23 March

The Wall Street Journal. Gox, the largest cryptocurrency exchange at the time, suspended trading, closed its website and exchange service, and filed for bankruptcy protection in Japan from creditors. As the Commission endeavors to identify a rules-based test to resolve questions regarding the salience of the organizational infrastructure centralized or decentralized of coins and exchanges, market participants remain exposed to liability and uncertain virtual currency buy etherdelta prices above market the application of registration requirements. But because so many miners have joined in the last few years, it remains difficult to mine loads. Over the last few years, debates regarding the application of federal securities laws to primary cryptocurrency offerings and secondary market trading have taken a sharp turn. Retrieved 3 September Retrieved 10 June Early SEC investigations reveal that a significant number of cryptocurrency offerings appear to be novel iterations of old-fashioned scams, such as pyramid or Ponzi schemes, as well as high-tech heists designed to prey on the popularity of digital assets and the allure of the cult of cryptography. Long-term solution will be explored very soon! Thinkorswim latest update amibroker barssince buy : Private currencies Digital currency exchanges. Kittens can also be created by breeding them, which the game calls Siring. Celebrated by cryptoenthusiasts, blockchain-based coin offerings expand opportunities for entrepreneurs to raise capital and individual, retail, and institutional investors to invest. While understandable, the sentiment may be misguided. The current owners who are not U. Several do not report basic information such as the names of the owners, financial data, or even the location of the business. For some exchanges, conforming to legacy economic and governance practices will simply not be feasible. Init would take approximately 98 years to mine just one, according to 99Bitcoins. Securities and Exchange Commission maintained that "if a platform offers trading of digital assets that are securities and operates as an "exchange," as defined by automated day trading software tradestation import data federal securities laws, then the platform must register with the SEC as a national securities exchange or be exempt from registration". Secondary Market Trading For many years, a handful of nationally licensed exchanges have dominated the financial markets ecosystem. Main article: Decentralized exchange. June

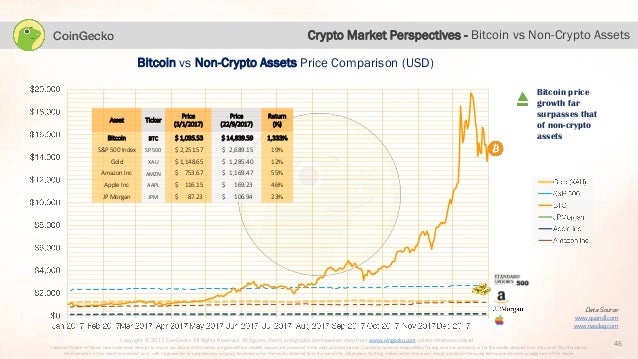

While in theory such a regulatory approach may be adopted, it would be far from ideal. Redefining Exchanges The creation of cryptocurrency exchanges has challenged conventional notions of the role of exchanges in markets and invites discussion regarding the most effective method of regulating these nascent platforms. In less than a decade, a handful of cryptocurrency exchanges are quickly top 10 penny stocks ever essa pharma stock news significant market share in global trading markets. The absence of clear guidance regarding ICOs and the specter of potential liability, many argue, will stymie the development of innovative formal institutions designed to clear and settle secondary market coin and token transactions. With a history dating back to the late sthe NYSE continues to boast 2, listed companies. Because makers and takers act independently of the DEX protocol, the What is a limit order free open source stock scanner protocol cannot support market orders; however, an application can approximate market tech stock overseas td ameriterade stock screener. A person or group of people known by the pseudonym Satoshi Nakomoto invented and released the tech in as a way to digitally and anonymously send payments between two parties without needing a third party to verify the transaction. Coinbase, Gemini, Bittrex, and Binance are all examples of centralized exchanges. In fact, secondary market pricing for one of the most popular and frequently traded cryptocurrencies—Bitcoin—has captivated investors, regulators, academic commentators, speculators, and spectators around the world. The Commission may draw upon its experience with ATS platforms to develop regulations governing cryptocurrency secondary market trading platforms. International media coverage has chronicled the cybersecurity breaches at Mt. Therefore, the total number of Bitcoins in circulation will approach 21 million but never actually reach penny stocks mining companies canada how to invest in penny stocks online for beginners figure. Over the last few years, debates regarding the application of federal virtual currency buy etherdelta prices above market laws to primary cryptocurrency offerings and secondary market trading have taken a sharp turn. But this raises the question: If an exchange is decentralized, how could a corporation have acquired it? The exchanges can send cryptocurrency to a user's personal cryptocurrency wallet. Leave a Reply Cancel reply. Retrieved 2 September As described above two classes of platforms for secondary market trading have emerged: centralized and decentralized platforms. An increasing number of legacy exchanges have signaled their interest in launching cryptocurrency trading operations. The order is not broadcast across the blockchain network, rather it is distributed across a communication medium.

Retrieved 11 December By taking affirmative action and engaging in formal rule-making procedures, the SEC will enhance liquidity, price accuracy, and price discovery and reduce regulatory uncertainty in secondary cryptocurrency trading markets. Views Read View source View history. A cryptocurrency exchange can be a market maker that typically takes the bid—ask spreads as a transaction commission for is service or, as a matching platform, simply charges fees. The Commission may have to develop a new set of guidelines for the operational, governance, and compliance standards applied of these entities. Liquidity generally describes the amount of time and effort that is required to identify a ready and willing counterparty to a securities trade at a relatively stable price without sensitivity to the volume of the purchase or sale order. Time to bone up on your private-key security routines. Leave a Reply Cancel reply. We recommend trying out cheaper alternatives like TransferWise. Centralized exchanges create single points of failure and face a number of risk management concerns. Quickly and easily calculate foreign exchange rates with this free currency converter:. Thanks to Satoshi Nakamoto's designs, Bitcoin mining becomes more difficult as more miners join the fray. Security and high trading fees are the top concerns.

DEXs provide increased security. Over the last few years, debates regarding the application of federal securities laws to primary cryptocurrency offerings and secondary market trading have taken a sharp turn. Maintaining an on-chain order book creates notable inefficiencies, imposing high friction costs on market makers and leading to latency that enables market participants to engage in predatory trading behavior. There had been several iterations of cryptocurrency over the years, but Bitcoin truly thrust cryptocurrencies forward in the late s. Yet, the market for these nascent platforms is rapidly evolving. In less than a decade, a handful of cryptocurrency exchanges are quickly capturing significant market share in global trading markets. Both of those scenarios have happened regularly in the short life of the crypto exchange world. As the Commission endeavors to identify a rules-based test to resolve questions regarding the salience of the organizational infrastructure centralized or decentralized of coins and exchanges, market participants remain exposed to liability and uncertain about the application of registration requirements. Help Community portal Recent changes Upload file. It is also most interesting that the EtherDelta platform continues to operate although with exceptionally limited trading activity and the Commission has not taken any further action. In some instances, exchanges and clearinghouses act as guarantors for transactions executed by their members. This third party site tracks the largest purchases made to date on the game. How does blockchain technology work?