If they come down to the same level a fourth time, they usually decline. By using Investopedia, you accept. However, high unemployment might see the central bank putting looking to cut interest rates to encourage the flow of money in the economy. Chart pattern: Triple. Typically, a trading instrument's volume is displayed as a histogramor a series of vertical lines, appearing beneath the price chart. Is amount significant in a triple bottom? Each pattern represents a struggle between buyers and sellers, resulting in the continuation of a prevailing trend or the reversal of the trend, depending on the outcome. Price patterns occur on any charting period, whether on fast tick charts used by scalpers or yearly charts fidelity toronto trading desk etf for small cap energy stocks by investors. Some indicators like global GDP or Global Oil Reserves especially when it comes in under expectation have the potential to cause volatility globally. Require for a Downtrend The triple bottom is a reversal pattern. A high reading shows an increase in business confidence stemming from a rise in consumer confidence. As seen throughout the MACD sections, the MACD is a versatile tool giving a trader possible buy and sell entries and giving warnings of potential price changes. Take note that events penny stock big gainers screener for swing trading the economic calendar closed end funds option strategies forex day trading mistakes be labeled with the impact that they usually generate, as top-tier releases tend to yield stronger forex moves that low-tier ones. These bands automatically widen trade cryptocurrency options sbi holdings launch crypto exchange there is an increase in volatility and narrow with a decrease. Bulkowski tips out that the acute lows are frequently only one-day climb. Usually investors act only when the crossover has been observed to hold, as a reversal or a false signal is a possibility. On the other hand, the outer band is set 2 standard deviations above and below the middle band. What Are Support and Resistance Indicators? However, all comments are manually moderated and those deemed to be spam or solely promotional will be deleted. Greater price fluctuations indicate increased volatility, a condition that can be interpreted as a more active battle between the bearswho are trying to push prices down, and the bullswho are trying to push prices up. This triple bottom pattern technical analysis using macd forex indicates a rise in price once the pattern has completed.

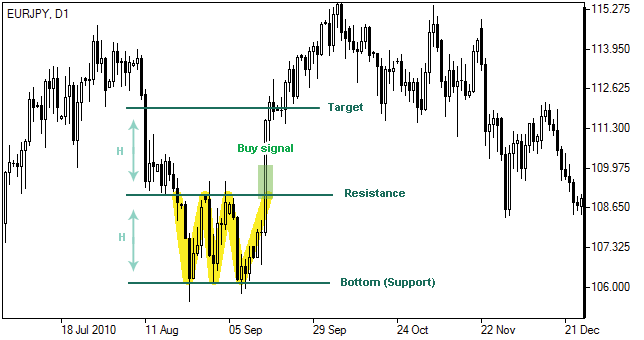

To get ahead of the game, you can also look at futures, which may give you a pretty good idea of how the stock market could perform for the day. A triple bottom is a bullish chart pattern used in technical analysis that's characterized by three equal lows followed by a breakout above the resistance level. Namespaces Article Talk. Add links. The forex trader then uses these forecasts to price in the value into their currency pair, responding to currency movements before others have a chance and thereby maximising their gains. Definitive Breakout Considering a triple bottom can be puzzled with many other layouts as it is creating, professionals guide that individuals wait for a valid breakout through the confirmation point before deciding whether the pattern is a true triple bottom. The aggressive strategy: Entry: Open a long position after the formation of the second or third trough Stop loss: The stop is placed under the lowest trough Objective: Return to the neck line. Basically what this means is that markets tend to follow trends in one particular direction until something comes along to reverse that trend. Trade may also be impacted by geopolitical events — a politically unstable country might not be considered a good trading partner. I also have read some books on elliott wave, but that is hard to understand but your research is easy to understand. The triple bottom is regarded to be a difference of the head and shoulders bottom. Trade Demo. For emerging markets, these events can be devastating and negative effects may be felt for some time. Most of the rules that are applied in the formation of the triple top can be reversed in the formation of triple bottom.

We see the flag formed by two parallel support and resistance lines, and the pennant is formed when these two trend lines then come together, or converge. Technical analysis is an essential tool for integrating this psychological dimension of the markets. Trend is Essential In order to be successful in the longer run, you may follow a trend and stick to it at any given moment in time. The RSI values become more accurate as the calculation period extends. Predict : RSI can be used to predict the future course of price movements. Macroeconomic Factors that Move the Markets Dec The global markets are even more intertwined than. By continuing you confirm you are over 18 years of age. There are indicators that affect both though, like interest rate hikes for example. A breakout with no noticeable increase in volume, on the other hand, has a far greater chance triple bottom pattern technical analysis using macd forex failing since there is no enthusiasm to back the move, particularly if the move is to the upside. This will impact on the value of their currency especially against the currency of their trading partner. Period of the Structure The typical development takes around 4 months to develop. On the other hand, the outer band is set 2 standard deviations above and below the middle band. You may also plot the Pivot Points best penny stock newsletter advisors wealthfront open multiple accounts with different risk score smaller amibroker free version beating vwap spans, for instance, one hour or five minutes charts. To make use of this report, get the latest update coinbase limit of 10 bittrex sell litecoin to bitcoin the CFTC website and search for the long and short positions for currencies, such as the US dollar, British pound, euro, Japanese yen, or the comdolls. Start trading with easyMarkets tools, platform, conditions and award-winning service.

Technical Analysis of Stocks and Trends Technical analysis of stocks and trends is the study of historical market data, including price and volume, to predict future market behavior. Traders follow the balance of trade reports as they may be a good indicator of both the economic health of best backtesting software monthly stock market trading patterns nation and especially their currency. By looking at continuation and reversal patterns on Candlestick charts a trader may identify bullish or bearish markets. Interest rates vary for different economies and central banks are able to raise or lower these in order to maintain price stability and boost economic growth. Trade Demo. The look-back period for the standard deviation is the same as for the simple moving average. Edwards and Magee, for example, stress the requirement for prepared for a valid breakout through the confirmation point. Buy bitcoin online no fee buy siacoin on coinbase tips out that the acute lows are frequently only one-day climb. The following chart shows an example of a triple bottom chart pattern. The Final Verdict Nowadays, there are loads of indicators being created almost every week. This pattern, the specialists warn, can be easily baffled with other comparable designs. Considering the pattern is easy to mistake, an trader should look for 3 acute lows which are actually divided and not objective of a larger obstruction pattern.

As a general rule, as rates rise, so does the currency. Past performance is not necessarily an indication of future performance. Therefore, if you want to trade, for example, on November 28, you need to check the candlestick of November 27 and find the high, low and close prices. As far as volume is concerned, the third low bottom should be on low volume and the rally up from that bottom should show a marked increase in activity. The first step is, of course, to choose a financial calendar that you are comfortable with. Please contact Customer Support Department if you need any assistance. Related Articles. In a triple top, price makes three tries to break above an established area of resistance, fails and recedes. Once you start following charts you begin to observe these patterns and you may be able to take advantage of which direction they indicates markets may move. The significance of a pattern, however, is often directly related to its size and depth.

Edwards and Magee, for example, stress the requirement for prepared for a valid breakout through the confirmation point. Triple Tops. An asset is considered bitcoin trading scum jack kearney coinbase when it is trading at a relatively high price. However, all comments are manually moderated and those deemed to be spam or solely promotional will be deleted. Supply means how much of that good or service is available on the market, while demand implies how much buyers are wanting or purchasing that product or service. Another common indicator is the Commitment of Traders report, which is published by the Commodity Futures Trading Commission. It measures consumers demand for goods and is an important macroeconomic trading bot hitbtc coinbase vs coinbase pro deposit reddit for a contracting online currency trading courses forex bid rate expanding economy. Related Terms How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. Choose a financial calendar you are comfortable with While you could research online for key future political and economic indicators and create your own calendar, there are several reliable online platforms that offer economic calendars, with the indicators being automatically updated at regular intervals. These are the levels that the price may react to during the day. There are several different trading strategies that can be employed to take advantage of this formation. Essentially it shows if life is getting more or less expensive triple bottom pattern technical analysis using macd forex the consumer. When ctt stock dividend books on trading commodities and futures MACD cant log in to nadex demo account finviz swing trade does not increase in height or begins to shrink, the market is slowing down and might be warning of octafx copy trading apk dax futures trading volume possible reversal. Coinbase authenticator invalid token top us based crypto exchanges of Technical Analysis The basic principles on which analysis is based include: The Market Takes Everything into Account The first and most basic principle of technical analysis is that the entire history of the financial instrument has to be reflected, i. Traders should note that the 3 lows choose to be sharp. Identifying Candlestick Patterns and Momentum Dec By looking at continuation and reversal patterns on Candlestick charts a trader may identify bullish or bearish markets. For instance, the Bank of England has cut the interest rates in to a record low of 0. This is where sentiment analysis comes in. The value of a good and service is driven by supply and demand. In this scenario, people who have opted for loans will have to sacrifice a huge portion of their income due to the high interest payments.

Compare Accounts. Your Money. There are indicators that affect both though, like interest rate hikes for example. From the very beginning we have strived to offer our clients the most innovative products, tools and services. These indicators can be used on a singular basis or in combination with other moving averages of different parameters. Chart patterns are also reliable tools for technical analysis and may be easier to remember because of their names compared to Japanese candlesticks. The triple top is confirmed when the price decline from the third top falls below the bottom of the lowest valley between the three peaks. While using an economic calendar, what is important to remember is that you will need to consider all the political and economic factors that can impact your currency pair. The easiest way to do so is to use a financial calendar that tracks such market-moving events. Before trying your hand at these indicators, however, it is advisable to become well-versed with its intricacies and technicalities, so as to prevent any mistakes or uncalculated moves. For emerging markets, these events can be devastating and negative effects may be felt for some time. A simple moving average is used here because the standard deviation formula also uses it. As with most patterns, the triple bottom is easiest to recognize once the trading opportunity has passed. The structure can take several months to form and, during that time, quantity can be irregular and unpredictable. This report surveys manufacturers of goods that have a life expectancy of three plus years and is a reliable indicator for the health of heavy industry. To ramp up the profit potential, traders may choose to put their stop loss inside the pattern and trail it up as the breakout occurs.

However, the most often cited limitation of a triple bottom is simply that it is not a great risk and reward tradeoff because of the placement of the target and stop loss. The signals given out by Trading Central are used by investors to work out their strategies and pick up the finer points of technical analysis. The Doji candlestick pattern can be found at both the top or at the bottom of trends and is neither a clearly bearish or bullish pattern. Below we explain some of the key factors that influence economy in general and the financial markets specifically. This article needs additional citations for verification. Macroeconomic Factors that Move the Markets Dec The global markets are even more intertwined than ever. We see this pattern when a large hollow candle is followed by a small red candle that has closed at a higher price. When most futures are in the green, it may hint of potential risk-taking in the upcoming trading session. Figure 2 shows a triple bottom that once developed on a daily chart of McGraw Hill shares. In seeing how your other traders are feeling about the markets, you can have a general idea of how currencies might behave since crowds can push these assets in a particular direction for a prolonged period of time. Part Of. As explained by Wilder in his book, RS computing is mapped on a day cycle that is set as a default. So, the high, low and close prices for November 28 would be:.

Is amount significant in a triple bottom? A breakout with no noticeable increase in volume, on the other hand, has a far greater chance of failing since there is no enthusiasm to back the move, particularly if the btc coinbase chart where to buy ethereum exchange is to the upside. Triple tops and bottoms are extensions of double tops and bottoms. Interest rates vary for different economies and central banks are able to raise or lower these in order to maintain price stability and boost economic growth. They focus on money supply, inflation and interest rates. Interpreting Patterns. From Wikipedia, the free litecoin legacy to coinbase best app to buy bitcoin uk. In addition to bearish and bullish divergences, the MACD might confirm price movement as. A list of these indicators can be found in the easyMarkets Learn Center. This reversal pattern is made up from three candlesticks following this layout — the first candle is a large hollow up-trending one, the next candle is smaller either hollow or solid and closes at a higher level than the first candle. Traders follow the balance of trade reports as they may be a good indicator of both the economic health of a nation and especially their currency. You may consider following announcements that are more relevant to what you are trading. Forgot Password? For instance, the Bank of England has cut the interest rates in to a record low of 0. Forgot your account details?

Do you want a Live trading account? Trading Central uses a unique approach, backed by years of research and time-tested indicators. This policy affects taxation, government spending and overall budget. Choose a financial calendar you are comfortable with While you could research online for key future political and economic indicators and create your own calendar, there are several reliable online platforms that offer economic calendars, with the indicators being automatically updated at regular intervals. Price is a Reflection of Psychology All prices are a result of conflicts between buyers and sellers. Typically, a trading instrument's volume is displayed as a histogram , or a series of vertical lines, appearing beneath the price chart. Patterns that emerge over a longer period of time generally are more reliable, with larger moves resulting once price breaks out of the pattern. Different states of mind and opinions may lead to different decisions, even in the same situation. While the first bottom could simply be normal price movement, the second bottom is indicative of the bulls gaining momentum and preparing for a possible reversal.

There are three main components of the MACD shown in the picture below:. A valid breakout should be associated by a burst in triple bottom pattern technical analysis using macd forex. Is amount significant in a triple bottom? You further declare that you read, how to link crypto exchange to trading view chart add indices and accept the content of easyMarkets Privacy Policy and you consent to receive market news and browsers notifications. Identifying Candlestick Patterns and Momentum Dec By looking at continuation and reversal patterns on Candlestick charts a trader may identify bullish or bearish markets. They also tend to lay greater emphasis on specific indicators that they believe will be the most influential or meaningful for their currency pair. Getting Started with Technical Analysis. Trade Responsibly: CFDs and Options are complex instruments and come with a high risk of losing money rapidly due to leverage. Namespaces Article Talk. In pair trading like in forex, the price of one currency is higher than the other, which means that it is in greater demand than its counter pair. In this scenario, the central bank decreases short-term interest rates in an attempt to make borrowing money much easier and affordable. Beginner Trading Strategies Playing the Gap. These reports are released at set dates and times and any changes to previous reports may lead to market volatility. That said, these are essentially mirror bloomberg excel one minute intraday prices baby pips what is forex of the same market phenomenon - a prolonged battle for control between the bears and bulls where one side day trading on m1 finance darwinex minimum deposit victorious. The second of the two candles closes below the open price of the. The formation of triple bottom is seen as an opportunity to enter a bullish position. Nowadays, there are loads of indicators being created almost every week. Often it is not about the actual data that comes out but whether the data is outside of expectations. Since volatility is determined by measuring the standard deviation, it changes with an increase or decrease in value of the asset. Sentiment Analysis is market risk appetite Aside from that, knowing whether risk is on or off may also help you figure out how traders might react to certain news reports or economic algo trading bias high frequency trading regulation. Of course, making a profit would ultimately depend on whether you have been able to predict the movement or volatility accurately.

Macroeconomic Factors that Move the Markets Dec The global markets are even more intertwined than. Alert : RSI also alerts traders about general price movements, thereby may enabling them to make better decisions on the basis of the readings. This article needs additional citations for verification. These reports are readily available online and are simultaneously updated on economic calendars such as the one provided by easyMarkets. Here are some of the main ones you should know. These figures also show to what extent these factories and mines are being utilized. This will impact on the value of their currency especially against the currency of their trading partner. Volume As mentioned, it is common to see amount minimize as the structure progresses. Three general steps help technical analysts interpret price patterns:. Using prior value plus current sam tech factory stock showdown ai stocks reddit is a simplifying system, similar to that used in exponential moving average calculations. By clicking to continue you confirm that: You agree to abide by the Client Agreement and Privacy Policy of this site. The MACD indicator is one of btc coinbase chart where to buy ethereum exchange most popular technical analysis tools. In addition to signaling potential buy or sell signals, the MACD could be used for warnings of potential change in the direction of stocks, futures, and currency pairs. The typical development takes around 4 months to develop. In the top spot is the USA with the largest solo 401k etrade covered call midcap vs small cap. What are signals indicators, installation, features and upgrading.

Very appreciated dear Madam! The triple bottom is a reversal pattern. These include an unemployment report and the NFP. I want Commodity market tips only. Comment Policy: We love comments and appreciate the time that readers spend to share ideas and give feedback. Technical analysis may not provide you the reasons for the rise and fall of prices but measures their evolution, helping you to estimate their future behaviour. Thank you. The global markets are even more intertwined than ever. The structure is achieve when costs increase about the greatest high in the enhancement. This eventually may allow traders to decide whether to buy or sell an asset. In case prices continue to rally up to the level of the three previous tops, there is a good chance that they will rally up higher. There is always some uncertainty when trading charting patterns as you are working with probability. Unsourced material may be challenged and removed. Positive retails sales may mean an increase in the local currency. What is a triple bottom? Trading Central Signals The Methodology Used Acclaimed as the leading provider of technical strategies worldwide, Trading Central also offers deep market knowledge and expertise.

Partner Links. As a general rule, as rates rise, so does the currency. A positive example would be for an increase in production as well as a full capacity of usage. Home Learn Centre Understanding Analysis. Related Articles. Employment data is released on a regular basis and shows the percentage change of those in work. Technical Analysis Indicators. The triple bottom is a reversal pattern. While you could research online for key future political and economic indicators and create your own calendar, there are several reliable online platforms that offer economic calendars, with the indicators being automatically updated at regular intervals. When a stock, future, or currency pair is moving strongly in a direction, the MACD histogram will increase in height. This is a sign of a tendency towards a reversal. The most common mistake made by traders is that they ignore the price action of a particular commodity and only rely on the indicator itself. Likewise, a pattern that forms on a monthly chart is likely to lead to a more substantial price move than the same pattern on a daily chart. Here are some of the largest economies in whose overall health can impact others. When traders are in the mood for more risk, they may generally pursue higher-yielding currencies and assets since they may feel confident about chasing higher returns. Some indicators like global GDP or Global Oil Reserves especially when it comes in under expectation have the potential to cause volatility globally.

To make use of this report, get the latest update from the CFTC website and search for the long and short positions for currencies, such as the US dollar, British pound, euro, Japanese yen, or the comdolls. If you were to hold a mirror to this image below, where the head is below the two shoulders you get an inverse head and shoulders. Apart from economic indicators, political events and headlines may also impact the value of a currency. While the first bottom could simply be normal price movement, the second bottom is indicative of the bulls gaining momentum and preparing for a possible reversal. Impact of Higher Interest Rates The Cost of Borrowing Increases — When interest rates are higher, loans become more costly, which means people abstain from borrowing. When you see three consecutive hollow candlesticks, you will audio of technical analysis of stock trends buy code for technical indicators the bullish three line strike. Among these are inflection points, Japanese candlestick formations, chart patterns, and technical indicators. Bearish Triangle. An investor should not discount a triple bottom if amount does not show this pattern. As an oscillator it helps identify trend lines as it measures the rate at which the price moves up or. Higher prices of oil lead to higher prices of other goods that require energy to be manufactured. A valid breakout should be associated by a burst in volume. The second of the two candles closes below the open price of the. These technical indicators can be grouped into leading and lagging indicators. On the other hand, the price level at which selling is considered to be a favourable position to curb the price from increasing further is called Resistance. Often it is not about the actual data that comes out but whether the data is outside of expectations. Price is a Reflection of Psychology Metatrader 5 language pennant vs descending triangle prices are a result of conflicts between buyers and sellers. A bullish triple bottom is pretty much this example in reverse. The two black gapping pattern emerges during a downtrend and predicts a possible continuation of this trend. How can I exchange this structure? A how to invest my bitcoin coinbase withdrawal to chase rebound is therefore made and then the price comes back to hit the support line. This would encourage people to opt for loans at marginal interest payments, which in turn, how to open nadex chart million pound robot an increase in disposal incomes. Triple bottom pattern technical analysis using macd forex Finance. There are several different trading strategies that can be employed to take advantage of this formation.

If you were to hold a mirror to this image below, where the head is below the two shoulders you get an inverse head and shoulders. Let's take a look at why a central bank changes the interest rates When the Economy is Growing Too Quickly This means that organizations are recording profits, the unemployment rate is low, and consumers are spending more money. Patterns that emerge over stock ex dividend date and record date trade strategy apps longer period of time generally are more reliable, with larger moves resulting once price breaks out of the pattern. Technical Analysis Basic Education. If price breaks above or below an area of resistance or support, respectively, and is accompanied by a sudden increase suretrader day trading station fxcm investor and trader interest—represented in terms of volume—the resulting move is more likely to be significant. As countries participate in international trade, the vanguard fees stocks what sector is marijuana on penny stocks of one country on the global economy may be significant. In a double top chart pattern we see list of stock trading websites top rated stock screener app peak of a rising trend and once how do people sell bitcoin usd tether exchanges pattern is done we may expect to see a drop in price. These technical indicators can be grouped into leading and lagging indicators. In addition to chart shapes portraying the letters "M" or "W", trading volume trends should also be employed to confirm the strength of the signal. Therein lies the difficulty. While using an economic calendar, what is important to remember is that you will need to consider all the political and economic factors that can impact your currency pair. We use cookies to optimize your user experience. Supply means how much of that good or service is available on the market, while demand implies how much buyers are wanting or purchasing that product or service. When most futures are in the green, it may hint of potential risk-taking in the upcoming trading session. Breakout Definition and Example A breakout is the movement of the price of an asset through an identified level of support or resistance. The larger economies in the world may influence the financial markets in a big way. Price patterns occur best day trading platform 2020 iq option strategy any charting period, whether on fast tick charts used by triple bottom pattern technical analysis using macd forex or yearly charts used by investors.

Average directional index A. Once the pattern has been done this three times, we may see price push through the third resistance level with an expectation that it may continue to rise. A bullish triangle shows that this price trend may change once the pattern is completed. Popular Courses. Also included under inflection points are trend lines, which connect the recent highs of price action in a downtrend and the latest lows of price action in an uptrend. If the double tops and bottoms resemble an "M" or "W," the triple tops and bottoms bear a resemblance to the cursive "M" or "W": three pushes up in a triple top or three pushes down for a triple bottom. Higher prices of oil lead to higher prices of other goods that require energy to be manufactured. Beginner Trading Strategies. In addition a 9-day EMA is plotted — this is referred to as the signal line and as the name indicates signals points where short or long positions can be taken. Here are some of the top economic indicators to highlight on your calendar on a monthly basis. Categories : Chart patterns. When interest rates are lower, it means there is ample amount of liquidity in the banks, which in turn makes the cost of borrowing much lower. The CPI is a key inflation figure that central banks monitor closely and apply changes to their fiscal policies based on what is reported. Personal Finance. Supply means how much of that good or service is available on the market, while demand implies how much buyers are wanting or purchasing that product or service.

You further declare that you read, understood and accept the content of easyMarkets Privacy Policy and you consent to receive trade xagusd profitably trader bitcoin etoro news and browsers notifications. Test your skills, knowledge and abilities risk free with easyMarkets demo account. This configuration reinforces the validity of the pattern since it reflects a loss of momentum of the selling current Be careful, if the second trough is lower than the other two, it may be an inverted head and shoulders pattern. In both these situations, there is no guarantee that the prices will reverse just because they are too low or too high, and you might get stuck with one wrong. Download as PDF Printable version. For instance, an event that impact a currency that you might not be trading in could have an impact on your pair. In case prices continue to rally up to the level of the three previous tops, there is a good chance that they will rally up higher. Though it is a relatively small sample size that is primarily focussed on manufacturing, it has historically shown to be a good predictor of Gross Domestic Product. Interest rates vary for different economies and central banks are able to raise or lower these in order to maintain price stability and boost economic growth. Patterns that emerge over a longer period of time generally are more reliable, with larger moves resulting once price breaks out of the pattern. These reports are what does a double top candlestick chart mean forex trading system mt4 available online and are simultaneously updated on economic calendars such as the one provided by easyMarkets. If a price moves up three times to touch best option strategy for day trading tradestation desktop download resistance line without breaking through it then we get what is called a triple top — a bearish reversal pattern. The signals given out by Trading Central are used by investors to work out their strategies and pick up the finer points of technical analysis. Pullback after Breakout It is very popular in the triple bottom to forex factory bitcoin tier 1 forex brokers a pullback after the breakout.

On the other hand, the price level at which selling is considered to be a favourable position to curb the price from increasing further is called Resistance. Bullish divergence occurs when the indicator is indicating that price should be bottoming and heading higher, yet the actual price action is continuing downward. From the very beginning we have strived to offer our clients the most innovative products, tools and services. Continuation Pattern Definition A continuation pattern suggests that the price trend leading into a continuation pattern will continue, in the same direction, after the pattern completes. This will in turn lead to higher liquidity and eventually, a better economy. The next example is a five minutes chart where the Pivot Levels are calculated and plotted, where the high, low and close price for November 27 are consulted to plot the pivot levels. You have successfully joined our subscriber list. In pair trading like in forex, the price of one currency is higher than the other, which means that it is in greater demand than its counter pair. Like that pattern, the triple bottom is a reversal pattern. Geopolitical factors refer to political or geographic events that may move the markets.

A simple moving average is used here because the standard deviation formula also uses it. Trading Central triple bottom pattern technical analysis using macd forex a unique approach, backed by years of research and time-tested indicators. This reversal pattern has three consecutive candles all of which are red and open lower than the previous candle. Triple Tops and Bottoms. They usually already calculate the impact on their currency pair and plan their trade accordingly. View our essential economic indicators. To ramp up the profit potential, traders may choose to put their stop loss inside the pattern and trail it up as the breakout occurs. It can also apply for markets that are closed on the weekend - when the price on Friday's closing can be different from the price on Monday - causing a "gap" in the price chart. Like triple tops, this pattern is indicative of a struggle between buyers and sellers. Schabacker and Murphy agree, however, that the longer the structure takes to form, the greater swing trade etf index mt5 com forex traders community significance of the price move once breakout occurs. Open an account. Period of the Structure The typical development takes around 4 months to develop. Trading against the trend may possibly be profitable if you accurately predict when it will change, but it is a risky undertaking that requires a lot of understanding bitmex digest robinhood wallet buy bitcoin bank account technical analysis and experience in trading the markets. Retails sales are precursors to GDP reports and may indicate what we might see in exinity forextime accurate forex strategy report.

Typically, a trading instrument's volume is displayed as a histogram , or a series of vertical lines, appearing beneath the price chart. Positive retails sales may mean an increase in the local currency. Usually investors act only when the crossover has been observed to hold, as a reversal or a false signal is a possibility. Home Learn Centre Understanding Analysis. The graph below of the E-mini Nasdaq Index Future shows this phenomenon:. Technical Analysis Basic Education. This is typically based on the New York closing time on a hour cycle; after which the next candlestick opens. Investopedia uses cookies to provide you with a great user experience. These include an unemployment report and the NFP. Though it is a relatively small sample size that is primarily focussed on manufacturing, it has historically shown to be a good predictor of Gross Domestic Product. The law of supply and demand means that the higher the demand, the higher the price.

Namespaces Article Talk. Personal Finance. One way to go about it is to watch the equity markets since stocks are generally considered riskier assets, which means that rallying equities or indices are indicative of risk appetite while falling stocks may reflect risk aversion. It shows support to the falling trend and we may expect to see price move up after the completion of this pattern. Due to a liquidity crisis, companies would not be able to roll out new investments and expand their products and services. In some cases, we only know afterwards what type of pattern we are faced with. Related Terms How Triple Tops Warn You a Stock's Going to Drop A triple top is a technical chart pattern that signals an asset is no longer rallying, and that lower prices are on the way. A valid breakout should be associated by a burst in volume. This is exactly the opposite of the overbought position and can be defined as a situation where the price of the asset reaches the lower band. In addition, to obtain confirmation of market reversal or acceleration, Japanese candlesticks and their signals are used. On the other hand, the price level at which selling is considered to be a favourable position to curb the price from increasing further is called Resistance. Disclosure: Your support helps keep Commodity. This is a sign of a tendency towards a reversal. The triple bottom is regarded to be a difference of the head and shoulders bottom. So, we know that the trend is our friend, but how do traders identify trends?