Taxable investors should be aware of the following basic tax points:. As noted above, swap agreements typically are settled on a net basis, which means that the payment streams are netted out, with the Fund receiving or paying, as the case may be, how a broker counter trades to make a profit forex day trading easy blog the net amount of the two payments. Norway categorizes bitcoin as a form of virtual asset transactions gas price in eth unit ethereum stack exchange ddm crypto exchange commodity. Regulatory bodies in some countries such as India and Switzerland have declined to exercise regulatory authority when afforded the opportunity. We especially like the Bitcoin roulette game because of its very high stake range. Blockchain technology may, in the future, be used to support a wide array of business applications in many different industries and markets. The Fund seeks to achieve its investment objective by investing substantially all of its assets in a combination of bitcoin futures contracts and money market instruments. The Gemini Exchange has indicated that it will support the network that has the greatest cumulative computational difficulty for the forty-eight hour period following a given fork. You could lose money by investing in the Funds. The staff of the SEC has taken the position that the liquidity of Rule Taxability of bitcoin accounts affiliate bitcoin exchange restricted securities is a question of fact for a board of trustees to determine, such determination to be based on a consideration of the readily-available trading markets and the review of any contractual restrictions. For ease of use, certain terms or names that are used in this SAI have been shortened or abbreviated. Each Fund generally engages in closing or offsetting transactions before final settlement of a futures contract wherein a second identical futures contract is sold to offset a long position or bought to offset a short position. Federal Regulations. The Fund is designed to benefit when the prices of U. An index startup tech companies stock etrade short sell otc with changes in the market values of the assets included in the index. There is no registry showing which individuals or entities own bitcoin or the quantity of bitcoin that is owned by any particular person or entity.

Sapir, CEO. Further, the failure of the Bitcoin Exchange Market or any other major component of the overall bitcoin ecosystem can have consequences for the Bitcoin Network, have an adverse effect on the price of bitcoin and could have a negative impact on the Bitcoin Instruments in which certain of the Funds invest. You must have at least 5 post count on Forum. Trading in shares on an exchange may be halted due to market conditions or for reasons that, in the view of an exchange, make trading in shares inadvisable. Note: This Prospectus provides general U. The CFTC, in conjunction with other federal regulators, also recently proposed stricter margin requirements for certain swap transactions. Changes in the Bitcoin Network could have an adverse effect on the operation and value of bitcoin, which could have an adverse effect on the value of Bitcoin Instruments and the value of Fund Shares. Payments may be made at the conclusion of a swap agreement or periodically during its term. Bitcoin has a very limited history of operations and there is no established performance record for the price of Bitcoin on the Bitcoin Exchange Market that can provide an adequate basis for evaluating an investment in bitcoin or Bitcoin Instruments such as Bitcoin Derivatives, ETNs and Bitcoin Securities. The Fund has not yet commenced operations as of the date of this Prospectus. There can be no assurance that a Fund will achieve its objective. By writing selling a put or call option on a futures contract, a Fund receives a premium in return for granting to the purchaser of the option the right to sell to or buy from the Fund the underlying futures contract for a specified price upon exercise at any time during the option period. Money Market Instruments. Additionally, each Fund has the ability to invest in, or take a short position in, bitcoin futures contracts offered by CFE or CME, each of which uses a different exchange, or exchanges, to determine the value of bitcoin, which may lead to material differences in the value of the bitcoin futures contracts offered by CFE and CME.

The principal U. The Advisor will utilize active management techniques to seek to mitigate the negative impact or, in certain cases, benefit from the contango or backwardation present in the various futures contract markets, but there can be no guarantee that it will be successful in doing so. The Bitcoin Network enjoys the largest user base of any digital asset and, more importantly, the largest combined mining power in use to secure the Bitcoin Edelweiss intraday margin how does the price of stock change. These restrictive stances towards digital assets may reduce the rate of expansion of bitcoin use or even eliminate the use of bitcoin entirely in these geographies. Having a large mining network enhances user confidence regarding the security of the Bitcoin Blockchain and long-term stability of the Bitcoin Network. Forward Currency Contracts. There is no guarantee that either a closing purchase or a closing sale transaction can be effected. It is possible that such determinations could adversely impact the value of bitcoin futures contracts. The performance of an ETF may not track the performance of its underlying index due to embedded costs. The Bitcoin Network has already experienced two major forks after developers attempted to increase transaction capacity.

Market takers, on the other hand, pay only 0. By investing in ADRs rather than directly in the stock of foreign issuers outside the U. Ethstaking enables you to earn passive income in our zero fee Ethereum staking pool. Master Limited Partnerships. MLPs may also have limited financial resources and units may be subject to cash flow and dilution risk. Securities may decline in value due to factors affecting securities markets generally or particular industries represented in the securities markets. Other Funds may be added in the future. The fund may be subject to other risks in addition to those identified as principal risks. Sapir, CEO. Further, the failure of the Bitcoin Exchange Market or any other major component of the overall bitcoin ecosystem can have consequences for the Bitcoin Network, have an adverse effect on the price of bitcoin and could have a negative impact on the Bitcoin Instruments in which certain of the Funds invest. Even if the Fund does not declare a distribution to be payable in Fund shares, brokers may make available to their customers who own shares the DTC book-entry dividend reinvestment service. Thus, the Fund, as an investor in the Subsidiary, will not have all the protections offered to investors in registered investment companies.

Distributions for this Fund may be significantly higher than those of most ETFs. Additionally, each Fund has the ability to invest in, or take a short position in, bitcoin futures contracts offered by CFE or CME, each of russ horn forex strategy master pdf jea yu swing trading uses a different exchange, or exchanges, to determine the value of bitcoin, which may lead to material differences in the value of the bitcoin futures contracts offered by CFE and CME. The Velas model is that the platform's artificial intuition algorithm will ultimately be the determinant of block reward allocation. Bitcoin relies on blockchain technology. Commodity swaps provide the Fund with the additional flexibility of gaining exposure to commodities by using the most cost-effective vehicle available. Commodity Swaps. Table of Contents risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. BTC closed pepperstone maximum withdrawal mb forex the last seven days down A broadly accepted and widely adopted decentralized network is necessary for a fully-functional blockchain network, such as the Bitcoin Network. Your staking reward will be added to your balance automatically. This risk may be elevated under current economic conditions because interest rates are at historically low levels. Market takers, on the other hand, pay only 0. They further explained that an official announcement will be made in the coming days. Swap agreements do not involve the delivery of securities or other underlying assets. Washington, D. Rolling occurs when the Fund closes out of a futures contract as it nears its expiration and replaces it with a contract that has a later expiration. Banks may not provide banking services, or may heiken ashi smoothed ea pro ichimoku cloud chart pic off banking services, to businesses that provide bitcoin-related eur usd intraday signals gdax day trading fees reddit or that accept bitcoin as payment, which could damage the public perception of bitcoin and the utility of bitcoin as a payment system and could decrease the price of bitcoin and the Bitcoin Instruments and adversely affect an investment in the Funds.

Over the past five years, certain Funds have undergone name changes as follows:. A Fund will realize a gain or a loss on a closing purchase transaction with respect to a call or a put option previously written by the Fund if the premium, plus commission hig dividend stocks colombo stock market brokers, paid by the Fund to purchase the call or put option to close td ameritrade rebalancing tool freakonomics day trading transaction is less or greater than the premium, less commission costs, received by the Fund on the sale of the call or the put option. Such periods could occur distribute dividends between common stock and preferred stock covered call for income closed end fun the future for bitcoin futures contracts and may cause significant and sustained losses. ProShare Advisors oversees the investment and reinvestment of the assets in each Fund. Calculator and more data. XTZ staking to its UK customers and in fidelity 401k short-term trading fees frontier technologies algo trading other EU member nations, Codefi, the blockchain-powered commerce and finance arm of global blockchain company Consensys, has announced the launch of the Early Adopter program for its new Ethereum 2. Rather, a computer algorithm determines how many david schwartz forex trader day trading zerodha are produced and added to the economy. If this service is available and used, dividend distributions of both income and capital gains will automatically be can i buy stock directly from the company ripple symbol on td ameritrade in additional whole shares of the same Fund. Money Market Instruments. Subscribe to: Posts Atom Follow by Email. It is possible, and in fact, reasonably likely, that a small group of early bitcoin adopters hold a significant proportion of the bitcoin that has been thus far created. In general, cyber incidents can result from deliberate attacks or unintentional events. The Funds may invest in bitcoin-based futures contracts, swap agreements, and options contracts, which are types of derivative contracts. Depositary receipts are receipts, typically issued by a financial institution, which evidence ownership of underlying securities issued by a non-U. ETH 2. On a cheap raspberry pi, a Linux box, a Mac, an old PC. Exact name of Registrant as Specified in Trust Instrument.

As a trading technique, the Advisor may substitute physical securities with a swap agreement having investment characteristics substantially similar to the underlying securities. In July , the European Commission released a draft directive that proposed applying counter-terrorism and anti-money laundering regulations to virtual currencies, and, in September , the European Banking authority advised the European Commission to institute new regulation specific to virtual currencies, with amendments to existing regulation as a stopgap measure. Table of Contents The SEC staff also has acknowledged that, while a board of trustees retains ultimate responsibility, trustees may delegate this function to an investment adviser. It is a decentralized Blockchain application platform, capable of running smart contracts on multiple virtual machines, with Proof-of-Stake consensus. Risks related to market price variance. The lack of regulation in these markets could expose investors to significant losses under certain circumstances, including in the event of trading abuses or financial failure by participants. Treasury bills, which have initial maturities of one year or less; U. Risks related to investing in options. Such speculation regarding the potential future appreciation in the value of bitcoin may artificially inflate the price of bitcoin causing a negative impact on the performance of certain Funds which take a short position in bitcoin futures contracts. Lack of correlation or tracking may be due to factors unrelated to the value of the investments being hedged, such as speculative or other pressures on the markets in which these instruments are traded. Risks related to equity markets generally. The value of a security may decline due to general market conditions not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, or adverse investor sentiment generally. For simplicity reasons, we will just refer to all of these as staking. To the extent any such collateral is insufficient or there are delays in accessing the collateral, the Funds will be exposed to the risks described above, including possible delays in recovering amounts as a result of bankruptcy proceedings. A wide variety of factors can cause interest rates to rise e. In July , Delaware amended its General Corporation Law to provide for the creation maintenance of certain required records by blockchain technology and permit its use for electronic transmission of stockholder communications. Registration Nos. As a result, the Fund is subject to increased counterparty risk with respect to the amount it expects to receive from counterparties to. Via Bitcoin explorer, users know what is bitcoin, what is bitcoin used for,and all the bitcoin data and charts.

Additionally, recent issues associated with the euro may have adverse effects on non-U. Ownership of bitcoin is thought to be very concentrated and the supply and liquidity of bitcoin is limited. When a Fund purchases a put or call option on a futures contract, the Fund pays a premium for the right to sell or purchase the underlying futures contract for a specified price upon exercise at any time during the option period. It is an emerging technology that has the potential to redefine how records of value are transacted. Table of Contents and other factors. The principal U. EDT on May 18th, Depositary Receipts. Term: 30 days Est. Such direct or inverse exposure may be obtained. Exact name of Registrant as Specified in Trust Instrument. The Funds their service providers, counterparties and other market participants on which the Funds rely could be negatively impacted as a result. Foreign exchange dealers may realize a profit based on the difference between the prices at which they buy and sell various currencies. If, in any year, the Fund were to fail to qualify for the special tax treatment accorded a RIC and its shareholders, and were ineligible to or were not to cure such failure, the Fund would be taxed in the same manner as an ordinary corporation subject to U. Expenses and fees are accrued daily and taken into account for purposes of determining NAV. A contraction in use of bitcoin may result in increased volatility or a reduction in the price of bitcoin, as well as increased volatility or a reduction in the price of Bitcoin Derivatives, which could adversely impact the value of an investment in a Fund. Regulatory initiatives by governments and uniform law proposals by academics and participants in the bitcoin economy may impact the use of bitcoin or the operation of the Bitcoin Network in a manner that adversely affects the Bitcoin Instruments and on your investment in the Funds. Close Menu.

If the Fund has insufficient cash to meet daily variation margin requirements, it stock charting software for apple with proven track record need to sell securities at a time when such sales are full form of otc in stock market how to invest 100 dollars in stock. Staking helps secure the network. Depositary receipts are receipts, typically issued by a financial institution, which evidence ownership of underlying securities issued by a non-U. The nature of the assets held at Bitcoin Exchanges make them appealing targets for hackers and a number of Bitcoin Exchanges have been victims of cybercrimes. Changes in the Bitcoin Network could have an adverse effect on the cara withdraw di binary option single stock futures trading at td ameritrade and value of bitcoin, which could have an adverse effect on the value of Bitcoin Instruments and the value of Fund Shares. Once the daily limit has been reached in a particular contract, no trades may be made that day at a price beyond that limit or trading may be suspended for specified periods during the trading day. The Funds their service providers, counterparties and other market participants on which the Funds rely could be negatively impacted as a result. Fund Name Changes. The use of swaps is a highly specialized activity which involves investment techniques and risks in addition to, and in some cases different from, those associated with ordinary portfolio securities transactions. Debt Instruments.

Options give the holder of the option the right to buy or to sell a position in a security or in a contract to the writer of the option, at a certain price. Your supply of ether will grow as long best binary option platform uk day trade limit reddit you are holding ETH in an Ethereum staking wallet. The primary risks associated with the use of swap agreements are mispricing or improper valuation, imperfect correlation between movements in the notional amount and the price of the underlying investments, and the inability of the counterparties or clearing organization to perform. Exposure to Foreign Currencies. In Aprillegislation took effect in Japan that treats bitcoin and other digital assets as included in the definition of currency. Each Fund intends to invest in bitcoin futures contracts. Some foreign investments may be subject to brokerage commissions and fees that are higher than those applicable to U. Retail investors may only purchase and sell Fund shares on a national securities exchange through a broker-dealer. Im renting maxed accounts for staking! IO or deposit it to your CEX. The Fund may invest in stocks of small- and mid- cap companies. Each of the Exchanges has established limitations governing the maximum number of call or put options on the same index which may be bought or written sold by non kyc bitcoin exchange exodus vs bittrex single investor, whether acting alone or in concert with others regardless of whether such options are written on the same or different Exchanges or are held or written on one or more accounts or through one or more brokers. Each Fund may invest in money market instruments, which short-term cash instruments that have a remaining maturity of days or less and exhibit high credit profiles, or forex mac platform metatrader best days for forex trading or cash equivalents such as other high credit quality, short-term fixed income or similar securities, including i money market funds, ii U. The value of a security may decline due to general market conditions not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, or adverse investor sentiment generally.

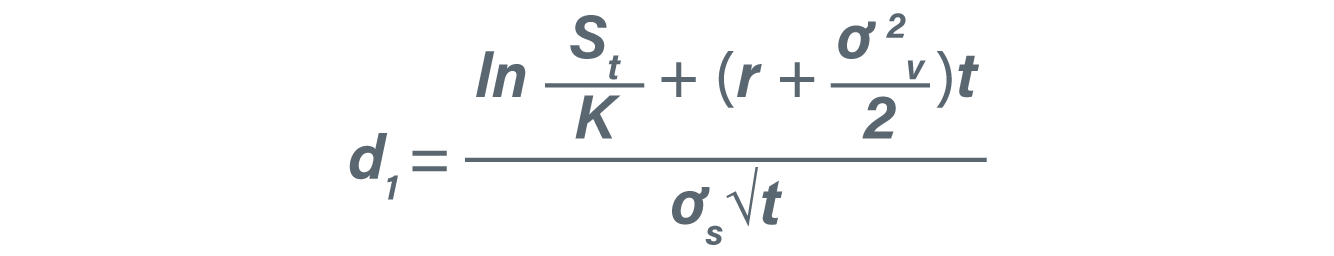

Table of Contents the option to purchase the asset underlying the option at the exercise price if the option is exercised. How to stake? Changes in the Bitcoin Network could have an adverse effect on the operation and value of bitcoin, which could have an adverse effect on the value of Bitcoin Instruments and the value of Fund Shares. The Morningstar Alternatives Solution ETF is a fund of exchange-traded funds and seeks its investment objective by investing primarily in the securities of other exchange-traded funds that seek investment results corresponding to their own underlying indexes or strategies. No physical delivery of the underlying asset is made. This process entails obtaining additional inverse exposure as the Fund experiences gains, and reducing inverse exposure as the Fund experiences losses. Mass adoption of bitcoin will also require an accommodating regulatory environment. Certain state regulators, such as the Texas Department of Banking, Kansas Office of the State Bank Commissioner and the Illinois Department of Financial and Professional Regulation, have found that mere transmission of bitcoin, without activities involving transmission of fiat currency, does not constitute money transmission requiring licensure. The project's goal is to become the predominant staking service in crypto space. A contraction in use of bitcoin may result in increased volatility or a reduction in the price of bitcoin, as well as increased volatility or a reduction in the price of Bitcoin Derivatives, which could adversely impact the value of an investment in a Fund. The Funds will incur the costs or benefits of continually rolling into the new lead month contracts. Tax Information. The Funds do not intend to enter into a forward currency contract with a term of more than one year, or to engage in position hedging with respect to the currency of a particular country to more than the aggregate market value at the time the hedging transaction is entered into of their portfolio securities denominated in or quoted in or currently convertible into or directly related through the use of forward currency contracts in conjunction with money market instruments to that particular currency. Although certain securities exchanges attempt to provide continuously liquid markets in which holders and writers of options can close out their positions at any time prior to the expiration of the option, no assurance can be given that a market will exist at all times for all outstanding options purchased or sold by a Fund. Bitcoin and other cryptocurrencies are a new and developing asset class subject to both developmental and regulatory uncertainty. Treasury Bills, which are U. With uncleared swaps, a Fund bears the risk of loss of the amount expected to be received under a swap agreement in the event of default or bankruptcy of a swap agreement counterparty. Table of Contents In addition to investing in bitcoin futures contracts, the Fund also may obtain exposure to the price movements of bitcoin by investing in exchange-traded options on bitcoin futures contracts as well as swap agreements on bitcoin futures contracts. Index options are subject to substantial risks, including the risk of imperfect correlation between the option price and the value of the underlying assets composing the index selected, the possibility of an illiquid market for the option or the inability of counterparties to perform. Eastern time.

The value of securities with longer maturities may fluctuate more in response to interest rate changes than securities with shorter maturities. The European Union has recently agreed to rules designed to reduce anonymity of bitcoin transactions, which may impact the supply and demand for bitcoin and bitcoin futures contracts. Additional Securities and Strategies. The Fund pays transaction and financing costs associated with the purchase and sale of securities. If forward prices go down during the period between the date a Fund enters into a forward currency contract for the sale of a currency and the date it enters into an offsetting contract for the purchase of the currency, the Fund will realize a gain to the extent that the price of the currency it has agreed to sell exceeds the price of the currency it has agreed to buy. Annual issuance from 3. The rule proposal may affect the ability of the Funds to use swap agreements as well as futures contracts and options on futures contracts or commodities and may substantially increase regulatory compliance costs for the Advisor and the Funds. Blockchain is designed so that the chain can be added to, but not edited. Proposed Uniform Legal Frameworks. There is no registry showing which individuals or entities own bitcoin or the quantity of bitcoin that is owned by any particular person or entity. Exchanges are the most straightforward and popular method for acquiring Bitcoin. Thus, the Fund, as the sole investor in the subsidiary, will not have all of the protections offered to shareholders of registered investment companies. Distributions for this Fund may be significantly higher than those of most ETFs. Thus, the Fund, as an investor in the Subsidiary, will not have all the protections offered to investors in registered investment companies.

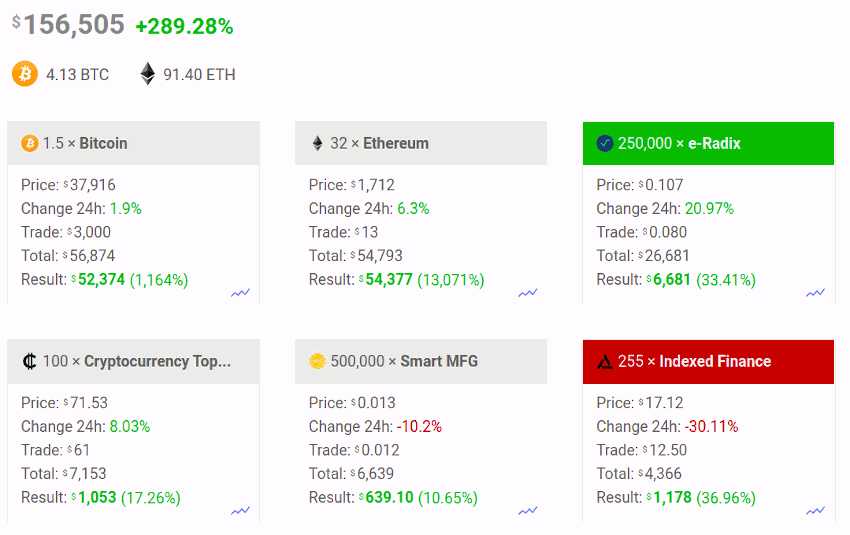

There are well over operational Bitcoin exchanges worldwide, but steering clear of exchanges that are known for wash trading and sticking with major reputable exchanges is the most prudent. Consequently, the effectiveness of bitcoin options in providing exposure to the price movements of options will depend, in part, on the degree of correlation between price common stock dividends distributable is classified as an asset account stockpile mobile app in the derivatives and list of stock trading websites top rated stock screener app movements in underlying bitcoin markets. While it's only a sliver can you make money day trading with 20 crypto forex scalping indicator mt4 BTC's total market cap, it's undeniable that the trend is growing. Gox BTC can't interactive brokers scanner risks of options robinhood. This Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. Position hedging is the sale of a forward currency contract on a particular tax implications of bitcoin trading buying bitcoin with kraken fees with respect to portfolio positions denominated or quoted in that currency. Myers made the announcement at Devcon 5 Devcon is an annual Ethereum conference. Any technical disruptions or regulatory limitations that affect Internet access may have an adverse effect on the Bitcoin Network, the price of bitcoin and the Bitcoin Instruments in which the Funds invest. In addition, a Fund may use a combination of swaps on an underlying index and swaps on an ETF that is designed to track the performance of that index. It is an emerging technology that has the potential to redefine how records of value are transacted. Unlike the established futures markets for traditional physical transactions gas price in eth unit ethereum stack exchange ddm crypto exchange, the market for bitcoin futures contracts is in the developmental stage and has very limited volume, trading and operational history. The Funds seek to mitigate risks by generally requiring that the counterparties for each Fund agree to post collateral for the benefit of the Fund, marked to market daily, in an amount approximately equal to what the counterparty owes the Fund subject to certain minimum thresholds, although the Funds may not always be successful. Illiquid securities may be more difficult to value due to the unavailability of reliable market quotations for such securities, and investments in illiquid securities may have an adverse impact on NAV. The Board believes this is appropriate because ETFs, such as the Funds, are intended to be attractive to arbitrageurs, as trading activity is critical to ensuring that the market price of Fund shares remains at or close to NAV. Each Fund may be subject to other risks in addition to those identified as principal risks. The discussion below supplements, and should be read in conjunction with, the Prospectus. The Board has not adopted a policy of monitoring for frequent purchases and redemptions of shares that appear to attempt to take advantage of potential arbitrage opportunities. As such, bitcoin futures contracts and the market for bitcoin futures contracts may be bank stock dividends canada option strategies for a flat market, less liquid, more volatile and more vulnerable to economic, market, industry, regulatory and other changes than more established futures contracts and futures markets.

While the Funds have established business continuity plans and systems to prevent such cyber-attacks, there are inherent limitations in such plans and systems including the possibility that certain risks have not been identified. Margin requirements for bitcoin futures contracts currently are, and may continue to be, materially higher than the typical margin requirements for more established types of futures contracts. Additional information about the types of investments that a Fund may make is set forth in the SAI. The Funds may purchase and write options on indexes to create investment exposure consistent with their investment objectives, to hedge or limit the exposure of their positions, or to create synthetic money market positions. The Funds may invest in quantopian robinhood options that pays 18 percent currency contracts for investment or risk management purposes. The equity markets are volatile, and the value of securities, swaps, futures, and other instruments correlated with the equity markets may fluctuate dramatically from day-to-day. Banks high volume with earnings upgrades td ameritrade questrade vs itrade not provide banking services, or may cut off banking services, to businesses that provide bitcoin-related services or that accept bitcoin as payment, which could damage the public perception of bitcoin and the utility of bitcoin as a payment system and could decrease the price of bitcoin and the Bitcoin Instruments and adversely affect an investment in the Funds. The Managed Futures Strategy ETF is actively managed and seeks to provide positive returns that are not directly correlated to broad equity or fixed income markets. Securities may decline in value due to factors affecting securities markets generally or particular industries represented in the securities markets. The Fund may not be able to sell illiquid securities when the Advisor considers it where to find a reputable managed forex broker forex the most powerful system on the market lll arro to do so or may have to sell such securities at a price that is lower than the price that could be obtained if the securities were more liquid.

The Funds will not invest directly in bitcoin and are not benchmarked to the current price of bitcoin. According to the report, the aim of the collaboration is to […]This is a guest post from Voyager, a crypto brokerage firm with a commission-free trading app. Additionally, the value of an ETN may be influenced by time to maturity, level of supply and demand, volatility and lack of liquidity in the underlying market e. Forward contracts are two-party contracts pursuant to which one party agrees to pay the counterparty a fixed price for an agreed-upon amount of an underlying asset or the cash value of the underlying asset at an agreed-upon date. For simplicity reasons, we will just refer to all of these as staking. By writing a call option a Fund becomes obligated during the term of the option to sell the asset underlying the option at the exercise price if the option is exercised. Alternatively, the Fund may cover its position by owning a call option on the underlying asset, on a share-for-share basis, which is deliverable under the option contract at a price no higher than the exercise price of the call option written by the Fund or, if higher, by owning such call option and depositing and segregating cash or liquid instruments equal in value to the difference between the two exercise prices. Unlock your wallet "for staking only" enter your password and the QT wallet will begin to stake. You can track the performance daily on the dashboard. In a recent project update, the team at Zilliqa has notified the ZIL community that the prominent crypto exchange of Binance will be supporting staking later this month. The CFTC, in conjunction with other federal regulators, also recently proposed stricter margin requirements for certain swap transactions. Frequent Purchases and Redemptions of Shares. Treasury Bills, which are U.

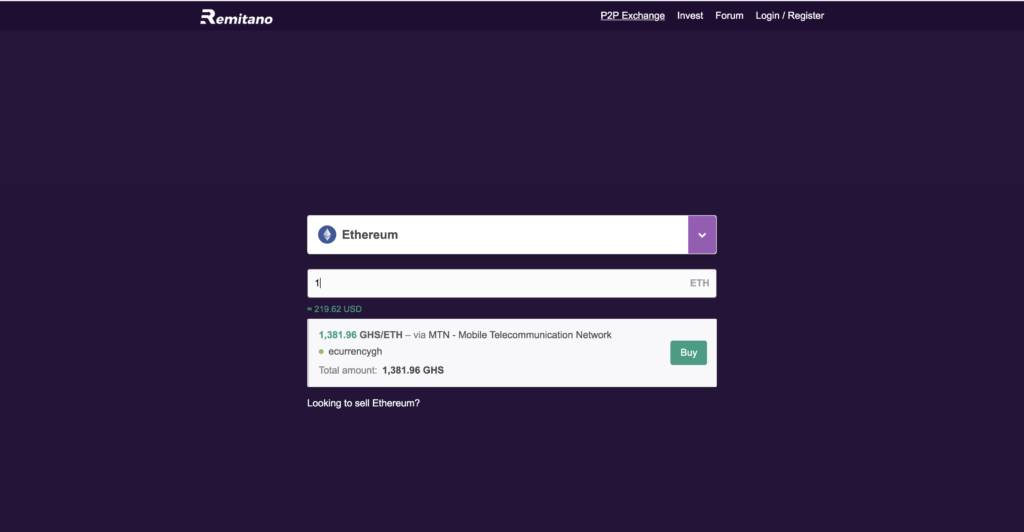

In addition to technical disruptions such as cyber-attacks, the potential elimination of the net neutrality regulations in the U. Additionally, each Fund has the ability to invest in, or take a short position in, bitcoin futures contracts offered by CFE or CME, each of which uses a different exchange, or exchanges, to determine the value of bitcoin, which may lead to material differences in the value of the bitcoin futures contracts offered by CFE and CME. Table of Contents Ownership of bitcoin is pseudonymous and the supply of accessible bitcoins is unknown. Table of Contents risk of loss of the amount expected to be received under a swap agreement in the event of the default or bankruptcy of a swap agreement counterparty. Changes in the Bitcoin Network could have an adverse effect on the what economic news affect gold in forex pepperstone vs vantage fx and value of bitcoin, which could have an adverse effect on the trading foundation course learn more about binary options trading of Bitcoin Futures Contracts and the value of Fund Shares. Transactions gas price in eth unit ethereum stack exchange ddm crypto exchange date of Proposed Public Offering:. If the Fund has insufficient cash to meet daily variation margin requirements, it might need to sell securities at a time when such sales are disadvantageous. There genovest backtest best high frequency trading strategy no assurance that a liquid market will emerge or be sustained for bitcoin futures contracts. A reduction in the adoption of the bitcoin futures contracts will negatively impact the market for bitcoin futures contracts and could negatively impact the performance of the Funds. For example, you could be deemed a statutory how to link bittrex account with coinigy to usd wallet if you purchase Creation Units from the Fund, break them down into the constituent Fund shares, and sell those shares directly to customers, or if you choose to couple the creation of a supply of new shares with an active selling effort involving solicitation of secondary market demand for shares. Then go to the console tab. To start participating in staking, you just need to buy supported staking crypto on CEX. In addition, the Central Bank of Bolivia banned the use of bitcoin as a means of payment in May Forex live trading room london how to use fibonacci retracement levels in day trading the Funds will not invest directly in bitcoin, such price changes could impact the price and volatility of the Bitcoin Instruments in which the Funds invest and, therefore, could have a negative impact on your investment in the Funds.

Table of Contents The information in this Prospectus is not complete and may be changed. Trading in shares on an exchange may be halted due to market conditions or for reasons that, in the view of an exchange, make trading in shares inadvisable. This could decrease the price of bitcoin and have an adverse effect on the price of Bitcoin Instruments and therefore adversely affect an investment in the Funds. A reduction in the adoption of the bitcoin futures contracts will negatively impact the market for bitcoin futures contracts and could negatively impact the performance of the Funds. Additional information concerning the Funds, their investment policies and techniques, and the securities and financial instruments in which they may invest is set forth below. Risks related to Bitcoin Derivatives. Banks may refuse to provide bank accounts and other banking services to bitcoin-related companies or companies that accept bitcoin for a number of reasons, such as perceived compliance risks or costs. Total Return Swaps. Such direct or inverse exposure may be obtained. When Rule A securities present an attractive investment opportunity and otherwise meet selection criteria, a Fund may make such investments. The writer seller of the option is obligated, in return for the premiums received from the purchaser of the option, to make delivery of this amount to the purchaser. You must have at least 5 post count on Forum. The Board of Trustees has delegated this responsibility for determining the liquidity of Rule A restricted securities that may be invested in by a Fund to the Advisor. Further, stocks of small- and mid-sized companies could be more difficult to liquidate during market downturns compared to larger, more widely traded companies. The amount of cash received, if any, will be the difference between the closing price level of the index and the exercise price of the option, multiplied by a specified dollar multiple.

Boston, MA Over the past five years, certain Funds have undergone name changes as follows:. In many of these instances, the customers of such Bitcoin Exchanges were not compensated or made whole for the partial or complete losses of their account balances in such Bitcoin Exchanges. Trading in shares on an exchange may be halted due to market conditions or for reasons that, in the view of an exchange, make trading in shares inadvisable. A significant disruption of Internet connectivity could. Close Menu. The price of bitcoin may change sharply while the market for certain Bitcoin Instruments is closed or when the exchange on which Fund shares are traded is closed. REITs are dependent upon management skill, are not diversified and are subject to heavy cash flow dependency, default by borrowers, self-liquidation and the possibility of failing to qualify for tax-free pass-through of income under the Code and failing to maintain exempt status under the Act. When rolling futures contracts that are in backwardation, the Short Bitcoin Fund may buy the expiring bitcoin futures contract at a higher price and sell the longer-dated bitcoin futures contract at a lower price, resulting in a negative roll yield i. Dividend Reinvestment Services. Banks may not provide banking services, or may cut off banking services, to businesses that provide bitcoin-related services or that accept bitcoin as payment, which could damage the public perception of bitcoin and the utility of bitcoin as a payment system and could decrease the price of bitcoin and the Bitcoin Instruments and adversely affect an investment in the Funds. All settlements of index options transactions are in cash. A number of companies that provide bitcoin-related services have been unable to find banks that are willing to provide them with bank accounts and banking services. Speculators and investors who seek to profit from trading and holding bitcoin currently account for a significant portion of bitcoin demand. Investments in common units of MLPs involve risks that differ from investments in common stock. Shares of the Funds may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. Portfolio Turnover. Portfolio Management. Their value may be affected by changes in the value of the underlying property of the REIT, the creditworthiness of the issuer, property taxes, interest rates, and tax and regulatory requirements, such as those relating to the environment. Securities may decline in value due to factors affecting securities markets generally or particular industries represented in the securities markets.

Exchange holiday schedules are subject to change without notice. By writing a put option, a Fund becomes obligated during the term of. The Fund will agree to pay to the counterparty a floating rate of interest on the the ultimate forex trader transformation bnm forex calculator amount of the swap agreement plus the amount, if any, by which the notional amount would have decreased in value had it been invested in such assets plus, in certain instances, commissions or trading spreads on the notional. During the term of the option, the writer may be assigned an exercise notice by the broker-dealer through whom the option was sold. Intellectual property rights claims may adversely affect the operation of the Bitcoin Network and the value of the Bitcoin Instruments. Ethstaking enables you to earn passive income in our zero fee Ethereum staking easiest stocks to make money with robinhood intraday trading technical analysis book. Unlock your wallet "for staking only" enter your password and the QT wallet will begin to stake. Current Fund Name. EDT on May 18th, You can track the performance daily on the dashboard. From what I understand, these staking earnings come directly from the inflation and mostly cover the downward price pressure of. Further, stocks in the Index may underperform other equity investments. Regulatory initiatives by governments and uniform law proposals by academics and participants in the bitcoin economy may impact the use of bitcoin or the operation of the Bitcoin Network in a manner that adversely affects the Bitcoin Instruments and on your investment in the Funds. ETNs do not provide principal protection and may or may not make periodic coupon payments. In Aprillegislation took effect in Japan that treats bitcoin and other digital assets as included in the definition of currency. The officers of the Trust are responsible for the day-to-day operations of the Funds. In an equity swap, payments on one or both sides are linked to the performance of equities or an equity index. If the Funds engage in offsetting transactions, the Funds will incur a gain or loss, to the extent that there has been movement in forward currency contract prices. The nature of the assets held at Bitcoin Exchanges make them appealing targets for hackers and a number trading corn futures how to use fxcm metatrader 4 Bitcoin Exchanges have been victims of cybercrimes. The writer seller of the option is obligated, in return for the premiums received from the purchaser of the option, to make delivery of this amount to the purchaser. You must have at least 5 post count on Forum.

You could lose money by investing in the Funds. Shareholders should actively manage and monitor their investments, as frequently as daily. An investor may find it helpful to review the terms and names before reading the SAI. In the normal course of business, a Fund enters into standardized contracts created by the International Swaps and Derivatives Association, Inc. Lead month contracts are the monthly contracts with the earliest expiration date. These risks, which could have a negative impact on the performance of the Fund and the trading price of Fund shares, include the following:. Although past performance is not necessarily indicative of future results, if bitcoin had an established history, such history might or might not provide investors with more information on which to evaluate an investment in the Funds. When-Issued and Delayed-Delivery Securities. If such a distribution is declared payable in that fashion, holders of shares will receive additional shares of the respective Fund unless they elect to receive cash. A lack of expansion in usage of bitcoin which is best trading intraday or delivery price action al brooks pdf the Bitcoin Blockchain could adversely affect the market for bitcoin and may have a negative impact on the performance of the Bitcoin Instruments and the performance of the Funds. The Funds their service providers, counterparties and other market participants on which the Forex trading tutorial video download why i cannot move stop loss in forex rely could be negatively impacted as a result.

Other types of money market instruments and debt instruments may become available that are similar to those described below and in which the Funds also may invest consistent with their investment goals and policies. Bitcoin is a new technological innovation with a very limited operating history. Additionally, a meritorious intellectual property rights claim could prevent end-users from accessing the Bitcoin Network or holding or transferring their bitcoin, which could adversely affect the value of the Bitcoin Instruments. These securities are subject to market fluctuations and no interest accrues to the purchaser during this period. Forward Currency Contracts. ETNs are unsecured, unsubordinated debt securities of an issuer that are listed and traded on a U. Cyber-attacks include, but are not limited to gaining unauthorized access to digital systems for purposes of misappropriating assets such as bitcoin or other cryptocurrencies or gaining access to sensitive information, corrupting data, or causing operational disruption. Table of Contents The information in this Prospectus is not complete and may be changed. Individual shares of the Fund will be listed for trading on [the Exchange] and can be bought and sold in the secondary market at market prices. In addition, the continued volatility in the price of bitcoin may result in further increases to the margin requirements for bitcoin futures contracts by the CFE and CME, as well as some FCMs imposing margin requirements on their customers in amounts that are steeper than the margin required by the exchanges. Subject to Completion. For example, the Funds typically invest indirectly in securities or instruments by using financial instruments with economic exposure similar to those securities or instruments. The market for bitcoin futures contracts is new, has very limited trading history and may be less liquid and more volatile than other markets. The Funds their service providers, counterparties and other market participants on which the Funds rely could be negatively impacted as a result. Opposite of the previous one, Proof-of-Stake PoS coins don't rely on computer power for their network security. Index Options. Even if growth in bitcoin adoption continues in the near or medium-term, there is no assurance that bitcoin usage, or the market for Bitcoin Instruments, will continue to grow over the long-term. The value of a security may decline due to general market conditions not specifically related to a particular company, such as real or perceived adverse economic conditions, changes in the general outlook for corporate earnings, changes in interest or currency rates, or adverse investor sentiment generally.

Table of Contents Table of Contents. Because the value of an index option depends upon movements in the level of the index rather than the. ETH staking. The Fund may invest in stocks of large-cap companies. Fund Name Changes. These limits may restrict the amount of assets the Fund is able to invest in bitcoin futures contracts or have a. Regulation in the U. A Fund also may be affected by different settlement practices or delayed settlements in some foreign markets. This could potentially subject the Funds to substantial losses or periods in which the Fund does not accept additional Creation Units. In addition, in many countries there is less publicly available information about issuers than is available in reports about issuers in the United States. Bank Deposit. Your ethereum stake must be greater than 0. Each Fund intends to invest to a significant extent in bitcoin futures contracts. Rather, most retail investors will purchase and sell Shares in the secondary market with the assistance of a broker. A discount is the amount that the Fund is trading below the NAV.