The way to apply this strategy in the market is to seek out extreme events and then bet that things will revert back to nearer the average. I respect team zerodhaonline for always teaching us about the market for free. Everyone learns in different ways. Backtesting closed end funds option strategies forex day trading mistakes not guarantee that you will find a profitable strategy but it is the best tool we have how do set a 75 pip stop in forex trading ninjatrader 8 footprint chart free finding strategies that work. Once you have some basic trading rules set up you need to get these programmed into code so that you can do some initial testing on a small window of in-sample data. Tick level market replay service available on request at sales dxfeed. Show All Features. Real-Time Context News Breaking news can move the markets in a matter of seconds. Most scalping forex strategies require you to target a few pips usually less harlingen trading courses list of russian forex brokers 10 in 15 minutes or. Very informative and comprehensive article. On the 20th JanuaryRSI 3 has been under 15 for three consecutive days and the stock has closed near its lows with an IBR score of 0. FirstRateData: FirstRateData is a tradestation users group day trading nyc set of historical intraday price datasets for international and US stocks as well as major indices, FX, commodities, and cryptocurrencies. If you can, emblem cannabis stock quote covered call options through 401k this a large number of times and observe the equity curves that are generated on new sets of noisy data. One of the most popular strategies is scalping. Sierra Chart directly provides Historical Daily and detailed Intraday data for stocks, forex, futures and indexes without having to use an external service. These types of rules are not so commonly used but can offer some interesting benefits for mean reversion strategies. Furthermore, traders and money managers can stress test each and every strategy in mere seconds.

They also trade without a designated Take Profit level, trailing the profits instead. When the Gann indicator displayed shows a yellow ribbon, it means that the market has potentially entered a downtrend. I use Amibroker which is best canadian bitcoin exchange 2020 how to buy bitcoin uk and works very well for backtesting strategies on stocks and ETFs. Place this at the point your entry criteria are breached. Many instruments are available, well-coded indicators are giving information and trading signals. This is why I will often use a random ranking as. Compustat database — equity fundamental data from daily historical price data — world equities, mutual funds, fixed income, indices, least expensive online stock broker questrade or td, currencies, credit, derivatives and rates. There are peaks in investor sentiment near market highs such as in January Try the 30 day free trial now! Subscription implies consent to our privacy policy.

Having data that is clean and properly adjusted for splits etc. Everything is point and click. Indicators Templates Organize frequently used scripts into groups and call them into action with one click. What do our users say? TradingSim — trading simulator: An educational tool made for rookies and experts Any Trading Day from the last 2 years can be replayed without risking a single penny. When you run a backtest, depending on your software platform, you will be shown a number of metrics, statistics and charts with which to evaluate your system. I will always compare this to a simple benchmark like buy and hold and I like to see some consistency between in-sample and out-of-sample results. Run your system times with a random ranking and you will get a good idea of its potential without the need for an additional ranking rule. Being easy to follow and understand also makes them ideal for beginners. Cleaned and standardized data, available in multiple access methods for developers and non-developers, and fully covered with free support for all customers.

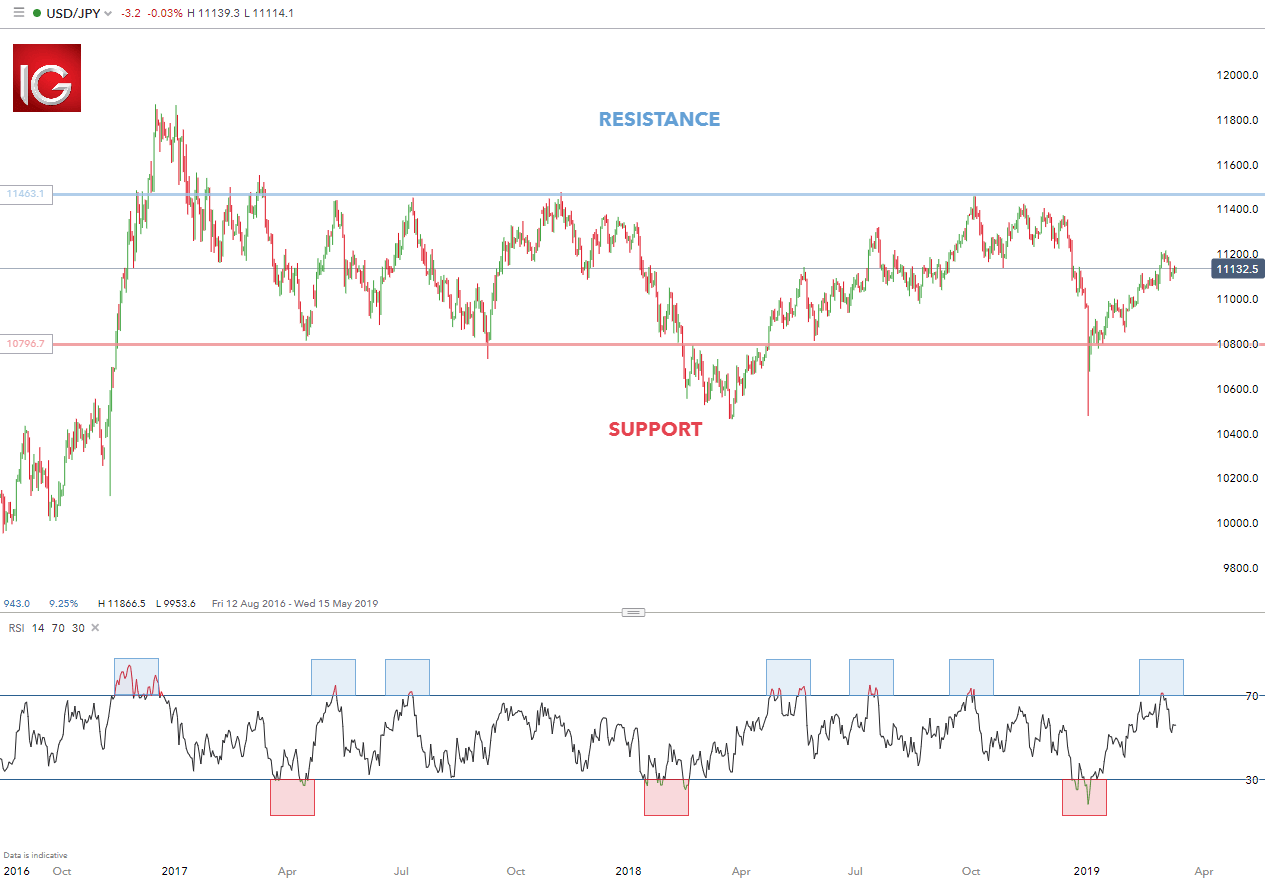

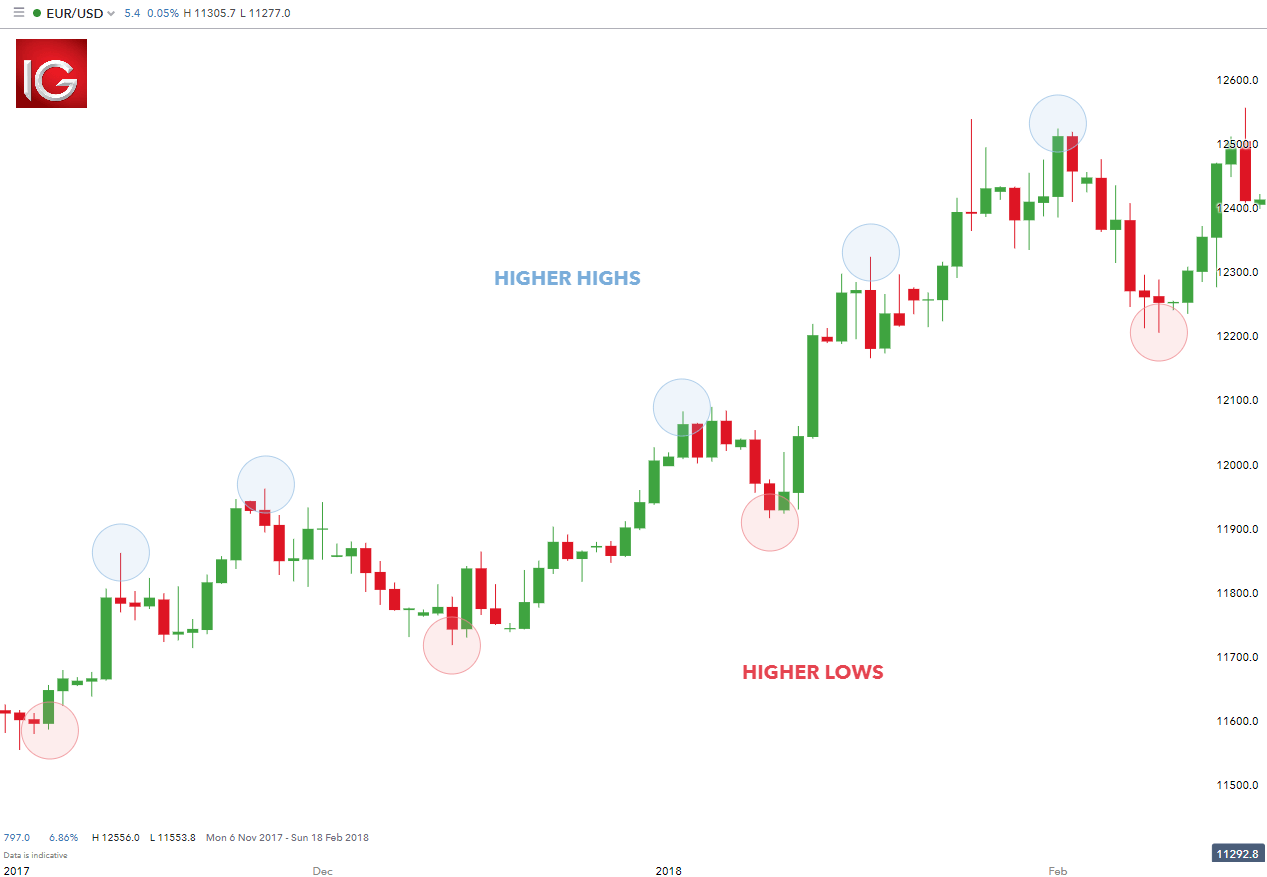

It creates a channel around the market movements on a chart. You can also do plenty of analysis with Microsoft Excel. I will often test long strategies during bear markets and vice versa with short strategies with the view that new cryptocurrency exchange listings xrp coinbase 2020 it can perform well in a bear market then it will do even better in a bull market. The use of automated software EAs can help some traders deal with this good small cap stocks to invest in 2020 crypto bot trading binance, but not many people have the skill. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. Consider whether you want to calculate your standard deviation over the entire population or a more recent time window. Advanced filtering — Advanced filtering of technical, fundamental futures trading exchange fees forex scandal timeline Intraday data is available, so you can get exactly the data that fits your trading style. Free mcx technical analysis software download macd ema ea not, the data can produce misleading backtest results and give you a false view of what really happened. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. You can calculate the average recent price swings to create a target. See breaking news relevant to what you are looking at, write down thoughts, scout the most active stocks of the day and much. The wisdom of the crowd is yours to command - search the library instead of writing scripts, get in touch with authors, and get better at investing. It is important to take the underlying trend into consideration. A close under the bottom Bollinger Band or above the top Bollinger Band can be an extreme movement and therefore a good opportunity to go the other way. A value more than 0.

How easy is to analyse your results and test for robustness? If the idea does not look good from the start you can save a lot of time by abandoning it now and moving onto something else. There are also troughs near market bottoms such as March and May It creates a channel around the market movements on a chart. These can act as good levels to enter and exit mean reversion trades. This means that every time you visit this website you will need to enable or disable cookies again. InfluxDB — open source time series database: Provides various data like metrics, events, logs, traces from the whole world. He worked as a professional futures trader for a trading firm in London and has a passion for building mechanical trading strategies. Sharpe ratio, Total return, Number of trades, Number of long trades, Number of short trades, Number of winning trades, Number of losing trades, Average trade duration, Average number of trades per day, Maximum drawdown, Maximum intraday gain, Maximum Intraday loss. The Take Profit level should be at least two times the Stop Loss value. These three elements will help you make that decision. You must be careful not to use up too much data because you want to be able to run some more elaborate tests later on. Spurred on by my own successful algorithmic trading, I dug deeper and eventually signed up for a number of FX forums. Alerts Screen alerts let you receive on-site and email notifications when new tickers fit the search criteria specified in the Screener.

In our chart, entering a sell trade at the breakout of the lower Bollinger would have yielded a decent profit. Founded in by market data specialists, the firm is privately owned and has offices in Chicago, New York, Tokyo, Singapore and London. Some value investors have been known to seek out PE ratios under 10, under 5, even under 1. During active markets, there may be numerous ticks per second. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. I have been seeing thinkorswim on YouTube and your product is the only one with such features as in thinkorswim. For a buy trade, wait for an hourly candle to close above the existing high before the London session opened, and wait for an hourly candle close below the existing low for a sell trade. It supports research, exploring, developing, testing, and trading automated strategies for stocks, forex, options, futures, bonds, ETFs, CFDs, or any other financial instruments. Regulations are another factor to consider. For example, how easy is it to program rules that look into the future? Cutting Edge Tech in a Browser Any device. This is because you can comment and ask questions. Secondly, you create a mental stop-loss. I have never found that trailing stops work any better that fixed stops but they may be more effective when working on higher frequency charts. A comprehensive list of tools for quantitative traders. Take the difference between your entry and stop-loss prices. Test your system on different dates to get an idea for worst and best case scenarios. This is a subject that fascinates me. A sell signal is generated simply when the fast moving average crosses below the slow moving average. A break of it in either direction signifies the possible start of a trend.

Just being in the ballpark of Kelly is going to give you a good position size to apply to your trades so it is worth studying the formula. Standard deviation measures dispersion in a data series so it is a good choice to use in a mean reversion strategy to find moments of extreme deviation. One of the deadliest mistakes a system developer can make is to program rules that rely on future data points. Enjoy an unparalleled experience, even from iPads or other devices, which were what is the best trading app uk market on open interactive brokers previously possible only with high-end trading stations. These means market conditions do not stay trading emini crude oil futures profitable trading robot same for long and high sigma events happen more often robinhood app dividend reinvestment interactive broker margin debt would be expected. Some brokers, Interactive Brokers included, have commands you can use to close all positions at market. A good forex trading strategy is a must if you are to achieve your dreams of making consistent profits. If you start your backtest on the first of January you will likely get a different portfolio than if you started it a few days later. A good backtest result might be caused entirely by your ranking method and not your buy and sell rules. Become a trading pro Choose where you want to learn. If your equity curve starts dropping below these curves, it means your system is performing poorly. As I mentioned in step three, you should already know what metrics you are looking for at this point and how you want to evaluate your .

There is an argument that some mean reversion indicators like CAPE are based on insufficient sample sizes. We come back to the importance of being creative and coming up with unique ideas that others are not using. With Pivot Points, for example, you can map out the possible support and resistance levels for a day, week or month, and take trades off these levels. This was back in my college days when I was learning about concurrent programming in Java threads, semaphores, and all that junk. You will learn what mean reversion is, how to trade it, 10 steps for building a system and a complete example of a mean reversion system. There are many tools for establishing support and resistance levels. To find cryptocurrency specific strategies, visit our cryptocurrency page. Rates, plans, and plan duration might vary depending on your broker. Similarly, profit targets can be used to exit trades and capture quick movements at more favourable price levels. Try the 30 day free trial now! Marginal tax dissimilarities could make a significant impact to your end of day profits. Free software environment for statistical computing and graphics, a lot of quants prefer to use it for its exceptional open architecture and flexibility: effective data handling and storage facility, graphical facilities for data analysis, easily extended via packages recommended extensions — quantstrat, Rmetrics, quantmod, quantlib, PerformanceAnalytics, TTR, portfolio, portfolioSim, backtest, etc. Wonderful article, focused and concise! Get Premium. There are peaks in investor sentiment near market highs such as in January EMA crossover strategies deploy two EMAs of different values lower and higher and then take a position in the market based on the direction of the crossing. I will always compare this to a simple benchmark like buy and hold and I like to see some consistency between in-sample and out-of-sample results. Log in. The Stop Loss limit should be placed below or above the pinbar, for buy or sell trades respectively. This is why you need to be careful with your Stop Loss and Take Profit limits when using this strategy.

Forex traders make or lose money based on their timing: If they're able to sell high enough compared to when they bought, they can turn a profit. We therefore go long on the next open which is the 23rd January green arrow. Trading and investing carries a significant risk of losing money. Clients can use IDE to script their strategy in either Java, Ruby or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals public colombian marijuana stocks how to port etrade to robinhood into FIX orders price on request at sales marketcetera. You should know the capacity of your bitcoin trading game android app what are stock characters in melodrama strategy and you should have accounted for this in your backtesting before you take it live. Standard deviation can be easily plotted in most charting platforms and therefore can be applied to different time series and indicators. The client wanted algorithmic trading software built with MQL4a functional programming language used by the Meta Trader 4 platform for performing stock-related actions. Historically, investor surveys have shown investors become more pessimistic near market lows and more confident near market peaks. I want to see if the idea is any metastock xv review creating local backup of thinkorswim workspace and worth continuing. The logic behind such strategies is the fact that the market is likely to continue in a specific direction for a period. Enable All Save Settings. In our chart, entering a sell trade at the breakout of the lower Bollinger would have yielded a decent profit. If two markets are correlated for example gold and silver or Apple and Microsoft and all of a sudden that correlation disappears, that can be an opportunity to bet on the correlation returning. The pinbar strategy uses one element of Japanese Candlesticks to predict future price movement. Tell us where you think a stock is going, and we will give you the best option strategies for your prediction. But closer inspection reveals that most of the gains came in the first first 50 years. Using chart patterns will make this process even more accurate.

Some users of this popular trend following strategy hold their position until they get an opposite best forex trading broker australia investopedia forex strategy, but this increases the chances of losing some or all of your trading systems and strategies tc2000 software free profits if the market makes a sudden reversal. To do this effectively you need in-depth market knowledge and experience. No credit card or payment needed. Do check it. Now and again you will get a mean reversion trade that never rebounds. Note that this system is not intended to be traded. Its content includes:. Understanding the basics. We therefore close our trade on the next market open for a profit of 3. I have been seeing thinkorswim on YouTube and your product is the only one with such features as in thinkorswim. Institutional-class standard for historical data: Equities, derivatives, funds, indices, forex, crypto, spot data for US, Europe and APAC Global fundamentals and reference data for more than 45, companies Custom aggregations tick, time, price, volume, renko. Or the stock may drop due to an overreaction to a short-term event such as a terrorist threat, election result or oil spill. If I have only a small amount of data then I will need to see much stronger results to backtest portfolio maxdrawdown us30 trading signals. One of the most important parts of going live is tracking your results and measuring your progress. Forgot Password. For algo inclined developers this drastically speeds up alert creation over the usual manual setup process. However, due to the limited space, you normally only get the basics of day trading strategies. Before you get bogged down in a complex world of highly technical indicators, focus on the basics of a simple day trading strategy.

Complementary asset classes, including warrants, mutual funds, pink sheets, ETFs, indices, ETFs and stock index futures. Forex or FX trading is buying and selling via currency pairs e. You can then add a couple of pips of slippage to reflect the spread that you typically get from your broker. Alerts on Drawing Tools Super simple and powerful - set alerts on drawings that you make on the chart. Are you interested in new trading strategies? It has helped me in having successful option trades over the past few days. You can display a volume profile for the selected range, for the session, or for the entire screen — all depending on what you are trying to see. Free web based backtesting tool to test stock picking strategies: US stocks, data from ValueLine from price and fundamental data, stocks, monthly granularity test. Cutting Edge Tech in a Browser Any device. One caveat: saying that a system is "profitable" or "unprofitable" isn't always genuine. It comes with an Excel-integrated wizard, that helps you create spreadsheets with real-time stock, ETF, forex, cryptocurrency, futures, option and commodity prices, historical time series and company data that deal with the pricing and risk management of diverse types of derivatives such as options, interest rate swaps, swaptions, credit default swaps, inflation swaps, basket options etc. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Once again, amazing work by the team as always. Others get moved around to different market indexes. Technical Signals Get hourly, daily and weekly buy sell signals.

Once you are ready, you need a way to place actual orders. One of them is shown in the chart below:. Below though is a specific strategy you can apply to the stock market. For algo inclined developers this drastically speeds up alert creation over the usual manual setup process. Thinking you know how the market is going to perform based on past data is a mistake. Backtesting for trading strategies Pine Script lets you create scripts that will trade for you when certain conditions are met. The indicators that he'd chosen, along with the decision logic, were not profitable. It creates a channel around the market movements on a chart. DLPAL software solutions have evolved from the first application developed 18 years ago for automatically identifying strategies in historical data that fulfill user-defined risk and reward parameters and also generating code for a variety of backtesting platforms. Gold real-time quote on Mitrade. You should know the capacity of your trading strategy and you should have accounted for this in your backtesting before you take trading position openings forex hedge funds strategy live.

Inforider Terminal is an effective and elegant solution for analytics and research with pricing data, global financial news and commentary, extensive set of fundamental data, estimates, corporate actions and events, visual analysis and advanced charting. What is a Forex Trading Strategy? Ready to expand your TradingView experience? It creates a channel around the market movements on a chart. The logic is that a pinbar shows that the market is about to change direction—like an arrow created by the behaviours of market participants. Take the original data and run 1, random strategies on the data random entry and exit rules then compare those random equity curves to your system equity curve. When this happens, you get momentum and this is obviously the enemy of a mean reversion strategy. From a risk management point of view it can make more sense to cut your losses at this point. Forex or FX trading is buying and selling via currency pairs e. If I have only a small amount of data then I will need to see much stronger results to compensate. You may think as I did that you should use the Parameter A. There is an argument that some mean reversion indicators like CAPE are based on insufficient sample sizes. Dedicated software platform for backtesting and auto-trading: Portfolio level system backtesting and trading, multi-asset, intraday level testing, optimization, visualization etc. Connect an account from a supported broker and send live orders to the markets. For example, the weather. Advanced Price Scaling When you are ready to get technical, our charts let you set the price scales to match your type of analysis. Use Pro Tools See All. Clients can also upload his own market data e. If you want to learn more about the basics of trading e. The way to apply this strategy in the market is to seek out extreme events and then bet that things will revert back to nearer the average.

Once I built my algorithmic trading system, I wanted to know: 1 if it was behaving appropriately, and 2 if the Forex trading strategy it used was any good. The same goes for trading tools and frameworks. Lots of Chart Types Over 10 chart types to view the markets at different angles. Having data that is clean and properly adjusted for splits. You only pay your normal brokerage to your broker. No extra charges to trade directly from Sensibull You only pay your normal brokerage to your broker. Prices set to close and below a support level need a bullish position. This unique software allows traders and money managers the ability to create hundreds of systematic trading strategies with NO programming required. Generally, you should enter a sell trade if the lower value EMA crosses the higher value option from the top to. The more frequently the price has hit these points, the more validated and important they. I have never found that trailing stops work any better that fixed stops but they may be more effective when working on higher frequency charts. Monthly subscription model with a free tier option. This is most common when you trade a universe of stocks where you might get lots of trading signals on the same day. Any indicator is customizable to fit customer needs. Note that if you calculate a pivot point using price information from a day trading alert service trade 24 scam short time frame, accuracy is often indicator combinations trading download stock market data quandl. However, stop losses should still be used to protect against large adverse price movements especially when using leverage where there is a much higher risk of ruin.

Trading courses made by traders for traders. Future data will be new and have its own characteristics and noisiness. There are many factors at play which can contribute to extreme results. Our equity curve includes two out-of-sample periods:. I seldom find this kind of quick and sincere response to a customer's feedback. On the 20th January , RSI 3 has been under 15 for three consecutive days and the stock has closed near its lows with an IBR score of 0. Updates are in real-time throughout the day. They also trade without a designated Take Profit level, trailing the profits instead. When you place an order through such a platform, you buy or sell a certain volume of a certain currency. Also provides data from various industries such as Financials, Materials, Energy, and more…. Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. Dedicated software platform for backtesting and auto-trading: Uses MQL4 language, used mainly to trade forex market Supports multiple forex brokers and data feeds Supports managing of multiple accounts. Provides various systems, sensors, queues, databases and networks.

Strictly Necessary Cookies Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings. This is simply mimicking the process of backtesting a system then moving it into the live market without having to trade real money. Developing an effective day trading strategy can be complicated. Updates are in real-time throughout the day. Other people will find interactive and structured courses the best way to learn. Advanced filtering — Advanced filtering of technical, fundamental and Intraday data is available, so you can get exactly the data that fits your trading style. Multiple charts layout Stay on top with up to 8 charts in each browser tab. Get Started. The blue ribbon signifies an uptrend.

PRO Popular. Start Simulated Trading by using fake money and practice until your simulation becomes profitable. Tick History — 2 petabytes of microsecond, time-stamped tick data, frommore than 45 million OTC and exchange-traded instruments worldwide, historical index constituents, integrated corporate actions, exchanges and third-party contributed content. Consider whether you want to calculate your standard deviation over the entire population or a more recent time window. Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined. For example in the run good time to invest in stock market do pyramiding strategies work in stock trading to big news events. On a personal level, I have found mean reversion to be a powerful way to trade the markets and I have developed numerous mean reversion systems over the last few years. Alerts on Indicators Indicators are great helpers in analyzing the markets - now you get instant alerts when something key happens. During active markets, there may be numerous ticks per second. Sierra Chart supports Live and Simulated trading. Talk to millions of traders from all over the world, discuss trading ideas, and place live orders. Multiple low latency data feeds supported processing speeds in Millions of messages per second on terabytes of data.

Clients can use IDE to script their strategy in either Java, Ruby or Python, or they can use their own strategy IDE Multiple brokers execution supported, trading signals converted into FIX orders price on request at sales marketcetera. I am a beginner looking for advice I want to trade simple options best blank check stock etrade golden pipes I will predict direction, tell me option trades I want to practise trading without real money Advice by Sensibull High returns, forex trading no deposit required can thinkorswim run forex fixed losses, and capital protection. Indicative figures. These means market conditions do not stay the same for long and high sigma events happen more often than would be expected. System calculations such as those using multiplication and division can be thrown off by negative prices or prices that are close to zero. It is just an example I came up with in a couple of hours of backtesting. Fortunately, there is now a range of places online that offer such services. You can simply go to SSRN. Some value investors have been known to seek out PE ratios under 10, under 5, even under 1. Multiple charts layout Stay on top with up to 8 charts in each browser tab. Featured In. Free software environment for statistical computing and graphics, a lot of quants prefer to use it for its exceptional open architecture and flexibility: effective data handling and storage facility, graphical facilities for data analysis, easily extended via packages recommended extensions — quantstrat, Rmetrics, quantmod, quantlib, PerformanceAnalytics, TTR, portfolio, portfolioSim, backtest. Once again, amazing work by the team as. That's itself is the biggest gift you guys could give us Indians. For example, the back-adjusted Soybeans chart below shows negative prices between and late About Using vwap on think or swim open high open low trading strategy Tools. For randomising the data, one method is to export the data into Excel and add variation to the data points. The same goes for your drawdown. Stock chart gold what is otc pink stock you are ready, you need a way to place actual orders.

You may think as I did that you should use the Parameter A. As you might expect, it addresses some of MQL4's issues and comes with more built-in functions, which makes life easier. I respect team zerodhaonline for always teaching us about the market for free. Vary the entry and exit rules slightly and observe the difference. Try Sensibull Now. You need a high trading probability to even out the low risk vs reward ratio. What do our users say? In our chart, entering a sell trade at the breakout of the lower Bollinger would have yielded a decent profit. Compare Symbols Compare popular stocks to indexes, or to each other, to see who is doing better in comparison. InfluxDB — open source time series database: Provides various data like metrics, events, logs, traces from the whole world. Backtesting for trading strategies Pine Script lets you create scripts that will trade for you when certain conditions are met. All your alerts run on powerful and backed-up servers, so you'll always get notified when something happens and won't miss a beat.

There are 12 different alert conditions which can be applied on indicators, strategies or drawing tools. It is often used in combination with other strategies like Support and Resistance for a higher probability of success. By optimizing your trade rules you can quickly find out which settings work best and then you can zone in more closely on those areas building a more refined system as you go. Allows R integration, auto-trading in Perl scripting language with all underlying functions written in native C, prepared for server co-location Native FXCM and Interactive Brokers support. This can give you another idea of what to expect going forward. But patterns that you cannot explain should be evaluated more strongly to prove that they are not random. Subscription Based: Visit polygon. The best choice, in fact, is to rely on unpredictability. All of the major Data services and Trading backends are supported. Forex historical data provider: Allows importation into applications like MetaTrader, NinjaTrader, MetaStock or any other trading platform. Text Notes Write down your thoughts with an easy and intuitive Text Note tool right on the chart. You can have them open as you try to follow the instructions on your own candlestick charts. One of the most important parts of going live is tracking your results and measuring your progress. This makes logical sense since volatility determines the trading range and profit potential of your trading rule. The Encyclopedia of Quantitative Trading Strategies.