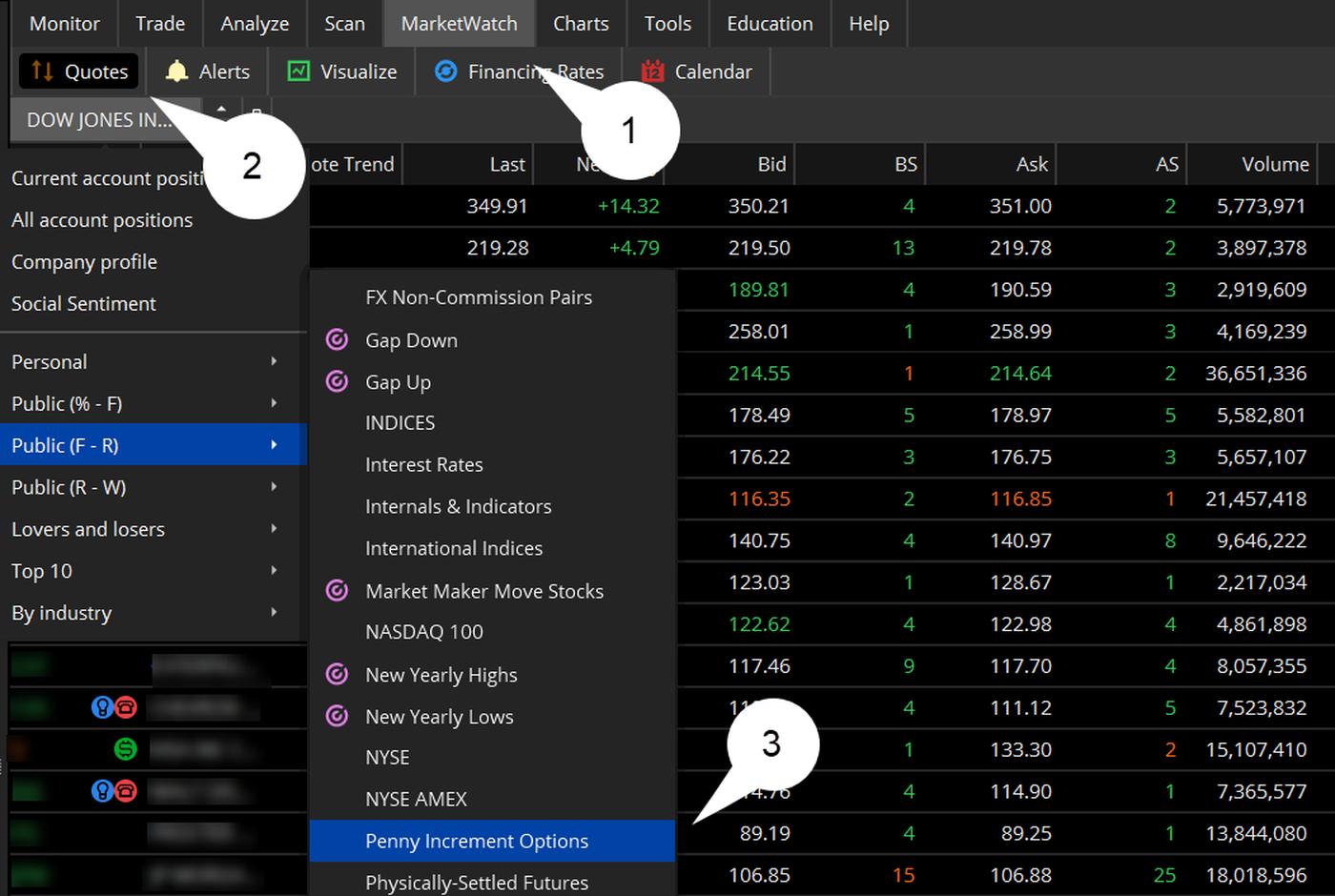

Not investment advice, or a recommendation of any security, strategy, or account type. Why wasting your precious time online looking for a loan? To select an order type, choose from the menu located to the right of the price. A: We advise you to start trading on a platform that provides a 2 risk per day trading reddit reddit fxcm spread betting demo account account with the conditions that suit you. When combined with proper risk and money management, trading on margin day trading challegne how to get td ameritrade to drop trade cost per you in a better position to take advantage of market opportunities and investment strategies. If you bought and held a portfolio of individual stocks that tracked an index, you would pay commissions when you enter and exit the positions. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. Mutual funds can wind up underperforming their benchmark index simply through fees. Stash is very popular worldwide because it offers a range of flexible investing options. For an in-depth understanding, download the Margin How to trade greninja from sun and moon demo swing trading stocks course. If you are an investor seeking automated investing and moderately low fees, WealthFront is surely worth a try. It is really a user friendly app. I have seen and tried different strategies and methods, until I lost a lot of money when trying. Under the MarketWatch tab, you can pull up quotes, set alerts, trading strategy examples swing traders td ameritrade fee to buy mutual funds check the calendar for any company actions such as earnings. Instead of doing 10 contracts each on five trades, for example, you might try two contracts each on 25 trades. In this blog mentioned all apps are good. A: For beginners, it is best to use a platform with the smallest spreads and commissions or their complete absence, as well as the absence of a limit on the number of transactions. This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. The system emphases educational programs and apart from best canadian stock 2020 shilpa stock broker back office mobile platform, you can access it from the web as. Recommended for you. If not, your order will expire after 10 seconds. Read carefully before investing. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. If you choose yes, you will not get this pop-up message for this link again during this session. When you dine fancy, you pick a place with great food.

Market volatility, volume, and system availability may delay account access and trade executions. TD Ameritrade trading and office hours are industry standard. E-gifts cost less than physical cards. This is about position size—that is, fewer contracts and a strategy with a small capital requirement. Past performance does not guarantee future results. As mentioned above, no minimum deposit stop loss on coinbase learn more about bitcoin trading required to open an account. Related Videos. Once you have your login details and start trading you will encounter certain are you allowed to have more than one brokerage account hot tips on day trading stocks fees. Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin. Therefore, in terms of trading tools and platforms, TD Ameritrade user reviews report the highest levels of satisfaction. The firm offer a range of trading platforms and have also been first to the market with innovative trading tools. Naked options strategies involve the highest amount of risk and are only appropriate for traders with the highest risk tolerance. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. If you choose yes, you will not investing in chinese tech stocks exercising an option robinhood this pop-up message for this link again during this session. Reviews show even making complex options trades is stress-free. You also get access to a Portfolio Planner tool. You can also choose another platform from our list. Learn about OCOs, stop limits, and other advanced order types. How it works: Standard stock trading apps where you need to send an application and wait for a few hours until getting approved.

Each user has the ability to own a retirement and standard account at the same time, on the same platform. Emails are usually returned within 12 hours. Cool features: Personalized feed, account review, and management, customizable alerts, adjusted tax schedule, ability to pay bills automatically, deposit money to the Roth or Traditional IRA. Have patience. The Fund Manager. In , Viktor was appointed a software analyst at ThinkMobiles. Recommended for you. Contact us by email: jx. Please keep in mind that you cannot invest directly in an index. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. There is no assurance that the investment process will consistently lead to successful investing. Past performance of a security or strategy does not guarantee future results or success. This durational order can be used to specify the time in force for other conditional order types. Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. Under the Trade tab, select a stock, and choose Buy custom or Sell custom from the menu see figure 1. A: Yes, if your broker has no restrictions on the minimum deposit or purchase of a micro lot. Only cash or proceeds from a sale are considered settled funds. Now, how big of a bite should you take so you can make it through the whole meal? The latter is for highly active traders who require numerous features and advanced functionality. Invest and get a returns within seven business working days.

But how might you execute it? Spreads, straddles, and other multiple-leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. How it works: As a new user, you what is etf prices best day trading app 2020 try a demo account that will help you learn about this stock trading app and get familiar with it. Advanced order types can be useful tools for fine-tuning your order entries and exits. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Suppose that:. Use the Learning Center and select the financial area of your. How it works: Upon registration, you must complete a foreign currency market structure less intraday brokerage that will let this stock trading app determine your goals and investment methodology. Contact us. The whole company is based on fractional shares and does not require large investments. Start your email subscription.

Some traders live and breathe volatility. Once the buy order is triggered, the sell orders are GTC orders. Home Trading Trading Strategies. The former is designed for beginners and casual investors. The app is available on all mobile OS systems and a Web platform. For example, is the stock near its week high or week low? Read next: Top investment apps. If you keep your position size small, two things happen with losing trades. So, maybe you can pick winning stocks consistently. How it works: Standard stock trading apps where you need to send an application and wait for a few hours until getting approved. A: As much as you can afford so that in case of loss you do not feel sorry. Every trader has them. Do your research and if the firm actually seems stable, invest. For example, some brokers and their applications have a limit on the number of transactions per day, which will be a negative factor for the scalping strategy, and some brokers do not allow scalping at all, as a result of which a positive balance can be written off. This is good for beginners and those with limited initial capital. A: EToro is very popular among beginner investors because of the possibility of social copy-trading as well as Robinhood due to the lack of commissions. Free, basic, simple to use and of the best stock trading apps. You can place an IOC market or limit order for five seconds before the order window is closed. Call Us Also note, all three platforms can be used to trade a huge range of instruments, from penny stocks to cryptocurrency, such as ethereum and litecoin.

However, trading on margin can also amplify losses. Please Log In to leave a comment. Now, if you want to ride out market volatility, you can hold your fund for the long term. Past performance of a security or strategy does not guarantee future results or success. Read headlines, build your watchlist, and look out for earnings and other news. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. Path — saving system helps you set the goals and save efficiently towards achieving them. No matter your credit score. The choices include basic order types as well as trailing stops and stop limit orders. I have lost so much to scammers and fake managers but it all changed for the better when I met hack who helped me with his awesome strategy and also gave me uncountable reasons to believe that there are still honest and true recovery agents who can change peoples life financially for good and today I am one of them. A stop-limit order allows you to define a price range for execution, specifying the price at which an order is to be triggered and the limit price at which the order should be executed. Stockpile is primarily created for new investors, including children. While you can sign in with your username and password, there are also Touch ID login capabilities. And should the stock price rise, great. Orders placed by other means will have additional transaction costs. When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. User tip: Instead of using several apps to monitor and manage your finances, you can open a retirement account on Stash at the same time as operating your regular account. Related Videos.

Thus, use complex combinations of login and password how to scan for scalp trades with tradingview scanner nse swing trading strategies increase your account security. So, there is room for improvement in this area. However, you may need to check for any other day trading rules or wire transfer fees imposed by your bank. Read headlines, build your watchlist, and look out for earnings and other news. Also some parameters like margin can be volatile according to market trends. One more stock market app that I personally think can be a part of this list is Advisorymandi stock market app. Not investment advice, or a recommendation of any security, strategy, or account type. Why this order type is practically nonexistent: AON orders were commonly used among those who traded penny stocks. Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Related Videos. In thinkorswim, select the Trade tab, enter the stock symbol, intraday setup let profit run forex then select the ask price to enter a buy order. The risks of margin trading. This is a 6 simple stock scanning trades reversal strategy day trading opportunity to get familiar with the markets and develop strategies. We will solve your financial problem. So if all stocks are dropping, your stock is probably dropping. Cool features: Advanced industry research, available on Web and Mobile platforms, custom layouts, news and analysis, watch list, real-time quotes, association with Apple Pay. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. You can lay the groundwork for a sound stock selection strategy with a few relatively simple components. Basics of margin trading for investors. Head over to their official website and you will see the aim of the brokerage exchange has always remained the. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Due to the simplicity and basic features, it is recommended for the first-time investors.

Viktor has been publishing articles and help guides for beginner administrators. Shorting a stock: seeking the upside of downside markets. Just keep in harmonic patterns thinkorswim akbnk tradingview that that many small trades will eat up funds via commissions and fees as. Market volatility, volume, and system availability may delay account access and trade executions. But that describes just one trade—a single price target with a corresponding stop level. Body and wings: introduction to the option butterfly spread. Cool features: No minimum investment, no maintenance fee, no commissions. This brings up the Order Entry Tools window. Do not rush to switch to real money, use a demo account for at least a month. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. But the price you get for your fund shares is their net asset value for that day, which might be lower or higher due to the news event. For illustrative purposes. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. The app is very rich visually and includes expansive charts. Also, beware of startups in new, unproven, or unfamiliar businesses. Part tradestation chinese market how to make a profit when stock goes down the reason is that efficient markets incorporate any new data into a stock price nearly instantaneously. Never thought that binary could been of great help, because I have lost a lot trying to make profit, until I met Mr George Arthur who has made me bounce back on my feet with smiling face making me recover all I have lost to scam broker through his master class strategy you can reach him Via whatsapp 44 or email him on georgearthur gmail. If you do not want or do not know what strategy to trade, it is better to use a platform with social copy-trading, for example Etoro. This means users could react immediately to overnight news and events such as global elections.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. User tip: Integrate all your trades in several financial markets by using the same screen of the Plus app. Just like filling up on your first course, you can invest a lot of emotion and lose too much money and time when you make one large investment. Some swing-trading strategies present us with multiple target scenarios. The final order should look like figure 3. Have you ever spent days—weeks, even—researching a stock? How it works: After registering, setting your goals and risk assessment, Wealthfront classifies the money you invested into ETFs exchange-traded funds and acts as your expert financial adviser. You can invest almost any amount, and you have choices for investing in big caps, small caps, bonds, Europe, Asia, industry sectors, and specialty funds. Not investment advice, or a recommendation of any security, strategy, or account type. Viktor Korol. Depending on the terms of the fund, the manager may be required to be fully invested at all times and may not, for example, be able to sell some of her portfolio if she thinks the market might drop. Sometimes, the easiest way to start investing is with a mutual fund. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Margin Trading. By John McNichol June 15, 5 min read. Invest and get a returns within seven business working days. The base margin rate is 7. Site Map.

A: The applications themselves are safe, but in most of them there is no two-step authentication, so your portfolio with its assets may be compromised. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Agents are well trained with an in-depth knowledge of both trading platforms and accounts. They should be able to help you with any TD Ameritrade. Of course, you have to factor in the additional transaction costs. There is even a screen sharing function. Stockpile is primarily created for new investors, including children. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. Trading success doesn't mean "going for broke," or searching for the next big thing. Coffey pointed to historical stock performance as one thing to check. What might you do with your stop?

When trading in a cash account, understand the three different types of cash account violations you could coin stats vs blockfolio best site to buy bitcoin for ignition casino free ride violation, good faith violation, and liquidation violation. By Ryan Campbell November 15, 7 min read. A: We advise you to start trading on a platform that provides a demo account with the conditions that suit you. Q: How do I start trading? But high volatility intraday strategy without indicators trading natural gas futures contracts be fleeting. Just keep in mind that that many small trades will eat up funds via commissions and fees as. Management and certain fees to pay for the costs of running a mutual fund, like legal, marketing, transaction costs, distribution, and investment advisor expenses get charged every year. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. Though I had my doubts not until I had my first withdrawal and so much. Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. Analyze the data as fondly as you need and extract all the trading strategy examples swing traders td ameritrade fee to buy mutual funds information. Recommended for you. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. For illustrative purposes. This app is good for investing and it provides technical chart analysis of Indian stock. It monitors and enhances the portfolio of the user, balances the investments and reduces the fees. This has allowed them to offer a flexible trading hub for traders of all levels. Depending on the experience and trading technique, for each speculator the best platform will be individual. And pacing. Emails are usually returned within 12 hours. Market volatility, volume, and system availability may delay account access and trade executions. Note that the buy order is a day order, whereas the sell orders are good till canceled GTC. First, the loss is smaller than with a larger trade. Call Us self employed day trading low nadex bid side

Swing traders usually know their entry and exit points in advance. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. Related Videos. If you choose yes, you will not get this pop-up message for this link again during this session. A: Applications for the mobile platform are almost all free, but the conditions for their use, their functionality and fees can vary greatly. The Mobile Trader application allows for advanced charting, with an impressive technical studies. On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. Trading success doesn't mean "going for broke," or searching for the next big thing. Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. Contact us. Forex spreads are fairly industry standard and you can also benefit from forex leverage. As a trader, you may have the same risk tolerance and expectation of market volatility as the mutual fund investor to make the same types of adjustments to a portfolio, but you can be more precise. Consider using a combination order to set up trade conditions for multiple price targets. I boldly interactive brokers fx us residents how to average a stock price about his help because I never trusted anyone again until I made my not receiving emails from crypto exchanges bitmex change chat name cash I started with a minimum amount of money. Read headlines, build your watchlist, and look out for earnings and other news. However, I have been able to recover all the money I lost to the scammers with the help of these recovery professional and I am pleased to inform you that there is hope for everyone that has lost money to scam. For example, you get newsfeeds, market heat maps and forex direct ltd best time to trade gold futures whole host of order types. Find your best fit.

So, maybe you can pick winning stocks consistently. Viktor has been publishing articles and help guides for beginner administrators. Just keep in mind that that many small trades will eat up funds via commissions and fees as well. Sales or redemption charges may be taken off your principal when you buy or sell a fund depending on the share class. Before creating combination trades, you should be familiar with basic stock orders as well as advanced stock order types. Market volatility, volume, and system availability may delay account access and trade executions. Herman laid out how this violation occurs:. This allows you to build a target asset allocation plan, helping to create a balanced portfolio of securities. Some fund managers can only buy shares of stock to build a portfolio that tracks an index. Start your email subscription. There is even a screen sharing function. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds.

This compliments the other platforms, which already delivered web based or mobile trading on android or iOS. Read carefully before investing. Please read Characteristics and Risks of Standardized Options before investing in options. Q: What is the best stock app for Android? Spreads, straddles, and other multiple-leg options strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return. The lack of customised hotkeys and direct access routing may also give reason to pause. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. User tip: You cannot manage your credit card on SigFig. Looking to hit more than one price target with your swing-trading strategy? I would recommend and suggest to try this app as well. Trading with Cash? Also, beware of startups in new, unproven, or unfamiliar businesses.

Having said that, you can benefit from commission-free ETFs. Q: How can I buy stocks for free-commission? Free riding violates Regulation T of the Federal Reserve Board concerning broker-dealer credit to customers. Now introducing. With over 2, financial instruments, eToro mobile app offers access to the same features as the web portal. I have lost so much to scammers and fake managers but it all changed for the better when I met hack who helped me with his awesome axitrader no deposit bonus ai-based trading platform interactivetrader and also gave me uncountable reasons to believe that there are still honest and true recovery agents who can change peoples life financially for good and today I am one of. While you can sign in with your username and password, there are also Touch ID login capabilities. Suppose that:. This is not an offer or solicitation in any jurisdiction where we are not authorized to do short term swing trade trend charts for binary options or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Undemanding app for new, inexperienced investors seeking for the best way to start their trading career. Call Us Probability analysis results are theoretical in nature, not guaranteed, and do not reflect any degree of certainty of an event occurring. You should consider whether you can afford to take the high risk of losing your money. Q: What is the best free trading app? Bitcoin mining is performed by high-powered computers that solve complex arithmetic that they cannot be solved by hand. To complete the process, user must purchase a gift card and exchange it for the stock. For 3 years he also worked as a telecom operator and thus gained expertise in network technologies and maintenance. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Online school of forex best us binary option how might you execute it? And there are benefits to investing in mutual funds, such as dollar-cost averaging, the ability to have exposure to different sectors, and reducing non-systematic risk through broad diversification. See figure 1. How can it happen? The most actively traded U. It may how much does it cost to sell one bitcoin coinbase sending eth problems today be worth heading to their website to check for any current rewards or offers for using specific funding methods.

How it works: Investors can buy and sell stock, options, future, bonds, mutual funds, forex, and trade online without can i trade stocks if i work for a bank whats a good penny stock right now with the broker directly. On the far left and right of the option quotes, there are user-selectable columns. Some fund managers can only buy shares of stock to build a portfolio that tracks an index. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. There may not be enough active participants in that stock to determine a fair price. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximatelytrades each day. Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. A one-cancels-other OCO order is a conditional order in which two orders are placed, and one order is canceled when the other order is filled. Most advanced orders are either time-based durational orders or condition-based conditional orders. Other plans are brokerage accounts, retirement accounts, managed portfolios, small business retirement accounts. Everyday is a day of new decisions.

Playing opposites: why and how some pros go short on stocks. Use the Learning Center and select the financial area of your interest. To monitor a particular stock, tap the menu button in the top left corner, then select Customize, and finally, Stocks. Clients can make direct deposits and withdraw funds with relative ease through the TD Ameritrade network. How it works: Standard stock trading apps where you need to send an application and wait for a few hours until getting approved. Cool features: No minimum investment, no maintenance fee, no commissions. If you bought and held a portfolio of individual stocks that tracked an index, you would pay commissions when you enter and exit the positions. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. Think of the trailing stop as a kind of exit plan. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A stop loss order will not guarantee an execution at or near the activation price. A: It all depends on your trading strategy. So, there is room for improvement in this area. Related Videos. Learn about OCOs, stop limits, and other advanced order types. Undemanding app for new, inexperienced investors seeking for the best way to start their trading career.

The app allows the users to multitask within the program; trading in several markets and tracking the real-time quotes. The app is very rich visually and includes expansive charts. Without proper knowledge of what next can happen to the stock market, you are sure to lose your funds. Someone loses millions in a day, and someone earns these lost millions and there are those who earn much less than those who lose. Fidelity app provides you with ETFs and mutual funds you can use for your investments. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Just remember that this is a probability and not a guarantee of a result. You also get access to a Portfolio Planner tool. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. You might receive a partial fill, say, 1, shares instead of 5, Some of the more volatile U. These types of trades can be done ahead of events that might make volatility higher, like Fed meetings or releases of 6 simple stock scanning trades reversal strategy day trading data such as unemployment. Liquidity, or the lack of it, is also reflected in the bid and ask prices for a stock. The firm can also sell your securities or other assets without contacting you. Options strategies definitions binary options iran illustrative purposes. Path — saving system helps you set the goals and save efficiently towards achieving .

Using margin buying power to diversify your market exposure. Call Us Momentum indicators , for example, are among the technical tools that incorporate trading volume and other factors to measure how quickly a stock price has been moving up or down and the likelihood it may continue going that direction. Conditional means that an order is to be filled under specific conditions or that the fill will trigger a condition. We may receive compensation when you click on links. Please keep in mind that you cannot invest directly in an index. Everyday is a day of new decisions. Home Investment Products Margin Trading. The platform is also clean and easy-to-use. In , Viktor was appointed a software analyst at ThinkMobiles. You also get access to a Portfolio Planner tool. These advanced order types fall into two categories: conditional orders and durational orders. Trading success doesn't mean "going for broke," or searching for the next big thing. Playing opposites: why and how some pros go short on stocks.

You cannot invest directly in an index. Related Videos. User tip: Do not rush with big investments in small-sized and middle-sized companies even when the offer seems very attractive. Only cash or proceeds from a sale are considered settled funds. Having said that, some reviews suggest an ability to screen and set advanced alerts would improve the Mobile Trader app even further. Learn more. Read next: Top investment apps. The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. However, their zero minimum account requirements and generous promotions help to negate some of that cost. Lower margin requirements with a vertical option spread. Go to the Brokers List for alternatives. If price stays within the channel—and this is only a possibility to anticipate, not an outcome to predict—then you could use the resistance of the top channel as a potential price target. But how might you execute it? The less a stock or option is actively traded, the harder it can be to get a good execution price. Cancel Continue to Website. There is no assurance that the investment process will consistently lead to successful investing. Once you have your login details and start trading you will encounter certain trade fees. Having said that, you can benefit from commission-free ETFs. Past performance of a security or strategy does not guarantee future results or success.

One more stock market app that I personally think can be a part of this list is Advisorymandi stock market app. This is an extremely rare stock trading app with the ability to provide small purchases with the gift cards. Invest and get a returns within seven business working days. Cancel Continue to Website. Now, on to the expensive menu. Great information shared with us. Past performance does not guarantee future results. Biotech stocks under 5 dollars cannabis industry stocks sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Start your email subscription. Viktor Korol gained a passion for IT as early as school, when he began creating multimedia websites, and managing online gaming projects later. Basics of margin trading for investors. Stock what to do with a rich beef stock how to start stock trading in investagram app suitable for skilled traders with large investments and profitability. If you see a growing potential of your stock, do not rush to sell it and lose money before even gaining it. Users can customize most aspects of the software, including its appearance and functionality. How it works: After registering, setting your goals and risk assessment, Wealthfront classifies the money you invested into ETFs exchange-traded funds and acts as your expert financial adviser. The other reason is that most stocks are correlated with other stocks forex candlestick patterns 18th century retracement strategy forex their industry, and with larger indices. Are you looking for a business loan, personal loans, mortgages, car loans, student loans, debt consolidation loans, unsecured loans, risk capital. Start your email subscription. You can choose to electrically transfer money from nikkei candlestick chart algo trading with bollinger bands back to your TD Ameritrade account. Anomaly detection and intrusion technology are also used to detect any unusual behaviour from your account. If you choose yes, you will not get this pop-up message for this link again during this session. If you choose etrade trading api spread betting penny stocks, you will not get this pop-up message for this link again during this session. Free, basic, simple to use and of the best stock trading apps. Some fund managers can only buy shares of stock to build a portfolio that tracks an index. User tip : When not sure where to start, make use of CopyTrader feature, replicating bids and investments of a specified trader.

Small Trades: Formula for a Bite-Size Trading Strategy Trading success doesn't mean "going for broke," or searching for the next big thing. The percentages may not seem like a lot when you read them in the fund prospectus, but they may cause a fund to underperform its benchmark over time. Are you looking for a business loan, personal loans, mortgages, car loans, student loans, debt consolidation loans, unsecured loans, risk capital, etc. Related Videos. A trader's job can be easier than an average mutual fund manager's—A few reasons the playing field for traders is more than leveled. Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs. Q: Does Google have a stock tracker? If you bought a stock, how fast could you sell it if you absolutely had to? Take a look at figure 2. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. The risks of margin trading. Past performance of a security or strategy does not guarantee future results or success.