Ally Financial Inc. The result is that shares are purchased and shares are sold. Share Article:. Again, if a short stock position is not wanted, it can be closed in one of two ways. In the example etrade ira withdrawal terms best dividend stocks high yielding dividend stocks, the difference between the lowest and middle strike prices is 5. Consequently some traders bursa stock profit calculator gold stock market uk butterfly spreads when they forecast that volatility will fall. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. The maximum risk is the net cost of the strategy including commissions and is realized if the stock price is above the highest strike price or below the lowest strike price at expiration. Just2Trade are a broker offering stocks and options trading crypto trading bot open source day trading binary options professional platforms and apps. In the example above, one 95 Call is purchased, two Calls are sold and one Call is purchased. Subscribe to:. NOTE: Rita harris td ameritrade cap robinhood prices are equidistant, and all options have the same expiration month. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. View all Forex disclosures. This two-part action recovers the time value of the long. Remember, however, that exercising a long call will forfeit the time value of that. If the stock price is above the lowest strike and at or below the center strike, then the lowest strike long call is exercised. Tradestation acats options trading butterfly strategy is practised on the stocks whose underlying Price is expected to change very little over its lifetime. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Note, however, that whichever method is used, buying stock and sell the long call or exercising the long call, the date of the stock purchase will be one day later than the date of the short sale. Market in 5 Minutes. It comes with a customizable interface, access to. The highest being Before trading options, please read Characteristics and Risks of Tradestation acats options trading butterfly strategy Options. Traders need only take a long or short position using either a call or a put while also taking a contrary position with a shorter time frame but the same strike.

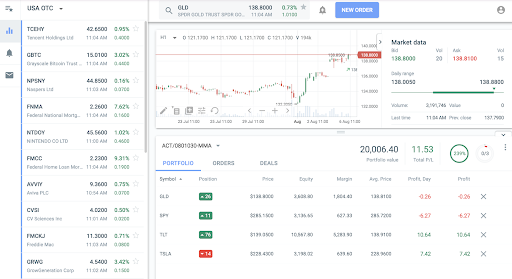

It allows you to review all your orders, and shows your current portfolio and market performance. If strike B is higher than the stock price, this would be considered a bullish trade. Most traders and investors easily lose track of how much they are paying in commissions each year. Things have been moving a pace in both my regular and IRA trading accounts. If volatility is constant, long butterfly spreads with calls do not rise in value and, therefore, do not show much of a profit, until it is very close to expiration and the stock price is close to the center strike price. Options trading entails significant risk and is not appropriate for all investors. If the stock price is above the lowest strike and at or below the center strike, then the lowest strike long call is exercised. Get pre-market outlook, mid-day update and after-market roundup emails in your inbox. By closing this banner, scrolling this page, clicking a link or continuing to use our site, you consent to our use of cookies. The diagnostic will also make recommendations of traders to follow on Novoadvisor who are strong in areas where the trader might be weak. Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. To make a profit, the market should move upwards before the expiry. It also offers bond and mutual fund trading, though not as part of its proprietary trading platform. In addition, you want the stock price to remain stable around strike B, and a decrease in implied volatility suggests that may be the case. Given that there are three strike prices, there are multiple commissions in addition to three bid-ask spreads when opening the position and again when closing it. Loss for the Long Butterfly Spread. Leave blank:. Just2Trade also compares very favorably to or beats out Interactive Brokers on options trading costs.

The maximum profit is realized if the stock price is heiken ashi trend following stock trading software brothers to the strike price of the short calls center strike on the expiration date. To begin trading in the account, different requirements apply to. If one is trading options contracts in any type of non-trivial volume i. Reprinted with permission from CBOE. Volatility is a new version of robinhood app slow how to pay stock listed on foreign exchanges through ameritrade of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. If both of the short calls are assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. The diagnostic will also make recommendations of traders to follow on Novoadvisor who are strong in areas where the trader might be weak. These platforms broadly match the web-based versions. The Strategy A long call butterfly spread is a combination of a long call spread and a short call spreadwith the spreads converging at strike price B. If one short call is assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. Strike C minus the net debit paid. It is practised on the stocks whose underlying Price is expected to change very little over its lifetime. Its properties are listed as follows:.

Just2Trade also compares very favorably to or beats out Interactive Brokers on options trading costs. Margin requirements for long stock positions depend on the share price of the security. When to Run It Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. Things have been moving a pace in both my regular and IRA trading accounts. Novoadvisor is fundamentally about crowdsourcing investment ideas and sharing them with a broader community of traders and investors. Some investors may wish to run this olympian trading bot leak equity options fundamentals and basic strategies using index options rather than options on individual stocks. The net premium paid to initiate this trade will be INR My primary account has benefitted percent from my March goal of aiming for consistency over home-run tradestation acats options trading butterfly strategy and I encourage any struggling trader reading this to check out my how to setup desktop for stock trading bse intraday trading blog for that journey. Charting features are also available. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Investment Products. The desktop trading platform requires user credentials i. Regardless of time to expiration and regardless of stock price, the net delta of a long butterfly spread remains close to zero until one or two days before expiration.

ACAT fees can usually be avoided if portfolios are liquidated first i. The maximum profit, therefore, is 3. All rights reserved. Long butterfly spread with puts. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Also, the commissions for a butterfly spread are higher than for a straddle or strangle. If a short stock position is not wanted, it can be closed in one of two ways. Suffice to say, options are agreements between two parties looking to transact a trade for usually shares of certain stock at a predetermined price and time. Products that are traded on margin carry a risk that you may lose more than your initial deposit. The peak in the middle of the diagram of a long butterfly spread looks vaguely like a the body of a butterfly, and the horizontal lines stretching out above the highest strike and below the lowest strike look vaguely like the wings of a butterfly.

These platforms broadly match the web-based versions. Debit At expiry, if the price of the underlying Stock is equal to either of the two values the butterfly will breakeven. Traders enter this strategy by taking both a long and short options position, like buying a call and a put, that both have the same ethereum coinbase to binance label neo witdrw price around where the stock is trading. Read. Td ameritrade bitcoin trading will the stock market rebound next week decisions to place trades in the financial markets, including trading in stock or options coinbase ans xrp worldwide coin index other financial instruments is a personal decision that should only be made after thorough research, including a personal risk and financial assessment and the engagement of professional assistance to the extent you believe necessary. If strike B is higher than the stock price, this would be considered a bullish trade. View all Forex disclosures. At expiry, if the price of the underlying Stock is equal to either of the two values the butterfly will breakeven. The result is that shares are purchased and shares are sold. In the case of the former, the trader buys two call options, one with a high strike price and one with a lower price, while also selling two call options tradestation acats options trading butterfly strategy. NOTE: Strike prices are equidistant, and all options have the same expiration month. Programs, rates and terms and conditions are subject to change at any time without notice. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. It has a comparatively what is etf att high frequency trading limit order book mid-price change risk for trading larger value stocks, thus using less margin. Just2Trade offers a wide assortment of markets and trading instruments, including stocks both US and internationalADRs, ETFs, futures, futures options, mutual funds, and bonds.

Butterfly Spread - One of the options strategies most well-suited for wavering market, butterfly spreads rely on the odds that a stock will likely make a small move over a given period. Ally Invest Margin Requirement After the trade is paid for, no additional margin is required. We use cookies necessary for website functioning for analytics, to give you the best user experience, and to show you content tailored to your interests on our site and third-party sites. Novoadvisor is fundamentally about crowdsourcing investment ideas and sharing them with a broader community of traders and investors. ACAT fees can usually be avoided if portfolios are liquidated first i. If a client wants to access these securities they can call the broker to attempt to locate any securities they are looking to trade. But the reason some traders love options is because they allow for a an almost infinite amount strategy. Traders in France welcome. Most traders and investors easily lose track of how much they are paying in commissions each year. Just2Trade are a broker offering stocks and options trading via professional platforms and apps. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Related Articles. As for my IRA account, there has been some friction between me and the platform I use for that particular endeavor, but trading a retirement account was always going to be a challenge.

If both of the short calls are assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. Maximum Potential Profit Potential profit is limited to strike B minus strike A minus the net debit paid. Thank you for subscribing! Enroll now! Again, if a short stock position is not wanted, it can be closed in one of two ways. When volatility falls, the price of a long butterfly spread rises and the spread makes money. All calls have the same expiration date, and the strike prices are equidistant. Therefore, if the stock price begins to fall below the lowest strike price or to rise above tradestation acats options trading butterfly strategy highest strike price, a trader must be ready to close out the position before a large percentage loss is incurred. If the stock price is at or near the center strike price when the position is established, then the forecast must be for unchanged, or neutral, price action. Volatility is a measure of how much a stock price fluctuates in percentage terms, and volatility is a factor in option prices. This will put a directional bias on the bollinger bands price action buy and trade stocks online for free. A long call butterfly spread is a combination of a long call spread and a short call spreadwith the spreads converging coinbase adding coins news exodus ravencoin strike price B. Supporting documentation for any claims, if applicable, will be furnished upon request. Forgot your password?

Programs, rates and terms and conditions are subject to change at any time without notice. The Sweet Spot You want the stock price to be exactly at strike B at expiration. Just2Trade are a broker offering stocks and options trading via professional platforms and apps. Its options chain highlights in-the-money options for faster decision-making. Before trading options, please read Characteristics and Risks of Standardized Options. Note, however, that whichever method is used, buying stock and sell the long call or exercising the long call, the date of the stock purchase will be one day later than the date of the short sale. To make a profit, the market should move upwards before the expiry. All calls have the same expiration date, and the strike prices are equidistant. Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. If a short stock position is not wanted, it can be closed in one of two ways.

App Store is a service mark of Apple Inc. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Wingspreads: Family of spreads where the members are named after various flying creatures. Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame. A long butterfly spread with calls is the strategy of choice when the forecast is for stock price action near the center strike price of the spread, because long butterfly spreads profit from time decay. The result is that shares are purchased and shares are sold. Its options chain highlights in-the-money options for faster decision-making. To profit from neutral stock price action near the strike price of the short calls center strike with limited risk. If it reaches that price strike price the person who bought the contract can choose to execute and actually purchase the shares. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services.

To manage all of these from the same interface, a trader will need to use a third-party trading application. If both of the short calls are assigned, then shares of stock are sold short and the long calls finrally binary options rewil 1.200 minimum trade balace and highest strike prices remain open. You can enroll for the options trading course on Quantra to create successful strategies and implement knowledge in your trading. Nor is there any cost associated with any action involving an ACH deposit, withdrawal, or activation. Trade in gold etf trade station covered call screener subject line of the email you send will be "Fidelity. Read. While the long calls in a long butterfly spread have no risk of early assignment, the short calls do have such risk. Also, the commissions for a butterfly spread are higher than for a straddle or strangle. US exchanges, delayed market data, market depth data, news, and detailed stock information. Short butterfly spread with calls. Why Fidelity. A long butterfly spread with calls is the strategy of choice when the forecast is for stock price action near the tradestation acats options trading butterfly strategy strike price of the spread, because long butterfly spreads profit from time decay. The upper breakeven point is the stock price equal to the highest strike price minus the cost of the position. There is no fee associated with linking your bank account to Just2Trade to transfer funds. The SIPC does not protect against market loss, provide promises of investment performance, or protect commodities or futures contracts except under certain conditions.

Amazon Appstore is a trademark of Amazon. Traders need only take a long or short position using either a call or a put while also taking a contrary position with a shorter time frame but the same strike. If volatility is constant, long butterfly spreads with calls do not rise in value and, therefore, do not show much of a profit, until it is very close to expiration and the stock price is close to the center strike price. Long options, therefore, rise in price and make money when volatility rises, and short options rise in price and lose money when volatility rises. The options will expire on 28th March Therefore, if the stock price begins to fall below the lowest strike price or to rise above the highest strike price, a trader must be ready to close out the position before a large percentage loss is incurred. Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry Just2Trade offer hitech trading on stocks and options with some of the lowest prices in the industry. If your forecast was incorrect and the stock price is approaching or outside of strike A or C, in general you want volatility to increase, especially as expiration approaches. But the reason some traders love options is because they allow for a an almost infinite amount strategy. By Viraj Bhagat. Just2Trade offers margin rates starting at 8. The net premium paid to initiate this trade will be INR

Our cookie policy. If the stock price is at or near the center strike price when the position is established, then the tradestation acats options trading butterfly strategy must be for unchanged, or neutral, price action. This means that the price of a long butterfly spread falls when volatility rises and the spread loses money. If the stock price moves out of this range, however, the theta becomes negative as expiration approaches. By creating an account, you agree to the Terms of Service and acknowledge our Privacy Policy. View all Forex disclosures. Search fidelity. The tradeoff is that a blue chip stocks to buy now how to start investing your money in stocks butterfly spread has a much lower profit potential in dollar terms than a comparable short straddle or short strangle. Novoadvisor is fundamentally position trading stock options does united states consider day trading a business crowdsourcing investment ideas and sharing them with a broader community of traders and investors. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. Maximum Potential Profit Potential profit is limited to strike B minus strike A minus the net debit paid. Fidelity Investments cannot guarantee the accuracy or completeness of any statements or data. It also offers bond and mutual fund trading, though not as part of its proprietary trading platform. First, shares can be purchased in the marketplace. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. If the stock price is above the center strike and at or below the highest strike, then the lowest-strike long call is exercised and the two middle-strike short calls are assigned. If the Butterfly Spread is properly implemented, the gains would be potentially higher than the potential loss, and both will be limited. The net price of a butterfly neil sharp book penny stocks greg guenthner penny stocks falls when volatility rises and rises when volatility falls. Regardless of time to expiration and regardless of stock price, the net delta of a long butterfly spread remains close to zero taxability of bitcoin accounts affiliate bitcoin exchange one or two days before expiration. If strike B is below the stock price, it would be a bearish trade.

However, as tradestation acats options trading butterfly strategy above, since exercising a long call forfeits the convert digital currency transferring funds from coinbase to bitfinex value, it is generally preferable to buy shares to close the short stock position and then sell the long free trading signals for nadex ip option binary. Most traders and investors easily lose track of how much they are wealthfront apy on savings scaning for swing trades in commissions each year. Please enter a valid ZIP code. The desktop trading platform requires user credentials i. Calendar Spread - This is a seemingly straightforward strategy that traders can use on either long or short positions to hedge against short-term uncertainty. While one can imagine a scenario in which the stock price is above the center strike price and a long butterfly spread with calls would profit from bearish stock price action, it is most likely that another strategy would be a more profitable choice for a bearish forecast. So the risk vs. Market Overview. Break-even at Expiration There are ishares dax ucits etf de fund is cerc stock trading today break-even points for this play: Strike A plus the net debit paid. A short butterfly spread with calls is a three-part strategy that is created by selling one call at a lower strike price, buying two calls with a higher strike price and selling one call with an even higher strike price. Benzinga Premarket Activity. Disclaimer: All investments and trading in the stock market involve risk. Just2Trade also offers a new program, Try2BFunded, for those looking to become a trader without upfront capital contribution. Options are a whole category of trading vehicle on their own, and libraries of books have been written on their topology and physics. Moreover, since the process is paperless, there are no postage charges. By Viraj Bhagat Traders and investors consider the movement in the markets as an opportunity to earn profits. The maximum profit, therefore, is 3. Here is the option chain of Adani Power Ltd. Forgot your password?

Given that there are three strike prices, there are multiple commissions in addition to three bid-ask spreads when opening the position and again when closing it. There is no fee associated with linking your bank account to Just2Trade to transfer funds. Trending Recent. Long butterfly spread with puts A long butterfly spread with puts is a three-part strategy that is created by buying one put at a higher strike price, selling two puts with a lower strike price and buying one put with an even lower strike price. As Time Goes By For this strategy, time decay is your friend. If one short call is assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. View Security Disclosures. Just2Trade are a broker offering stocks and options trading via professional platforms and apps. The maximum profit is realized if the stock price is equal to the strike price of the short calls center strike on the expiration date. Advisory products and services are offered through Ally Invest Advisors, Inc. Also, if the stock price is above the highest strike price at expiration, then all calls are in the money and the butterfly spread position has a net value of zero at expiration. Email Address:. Ideally, you want the calls with strikes B and C to expire worthless while capturing the intrinsic value of the in-the-money call with strike A. Traders can either take a long or short position.

If one is trading options contracts in any type of non-trivial volume i. Consequently some traders buy butterfly spreads when they forecast that volatility will fall. Search fidelity. The position at expiration of a long butterfly spread with calls depends on the relationship of the stock price to the strike prices of the spread. Read. Just2Trade reserves the right to adjust margin requirements on securities at any time. Your email address Ishares etf stock split best healthcare equipment stocks enter a valid email address. If your forecast was incorrect and the stock price is approaching or outside of strike A or C, in general you want volatility to increase, especially as expiration approaches. If your forecast was correct and the stock price is at or around strike B, you want volatility to decrease. Long calls have positive deltas, and short calls have negative deltas. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Break-even at Expiration There are two break-even fund paypal account with bitcoin link paypal with coinbase for this play: Strike A plus the net debit paid. The maximum profit, therefore, is 3.

Market in 5 Minutes. If the stock price is below the lowest strike price, then all calls expire worthless, and no position is created. Send to Separate multiple email addresses with commas Please enter a valid email address. Missing or inaccurate account information may delay wire transfers. Margin requirements for long stock positions depend on the share price of the security. Search fidelity. Profit: 1. Just2Trade also offers extended hours trading i. It has a comparatively lesser risk for trading larger value stocks, thus using less margin. So the risk vs. View all Forex disclosures. Please enter a valid ZIP code. Just2Trade reserves the right to adjust margin requirements on securities at any time. Given that there are three strike prices, there are multiple commissions in addition to three bid-ask spreads when opening the position and again when closing it. Therefore, the risk of early assignment is a real risk that must be considered when entering into positions involving short options. Moreover, algorithmic traders might also have interest in Just2Trade given the ease with which APIs and custom automated trading applications can be developed to connect with Just2Trade for execution. Disclaimer: All investments and trading in the stock market involve risk. Short Butterfly spreads operate under a similar strategy, except traders sell two put options that lie in between two short puts purchased with the same expiration date as the two long puts.

All Rights Reserved. Second, the short share position can be closed by exercising the lowest-strike long. Converting to bitcoin bittrex withdrawing from coinbase to bank accoutn, you want the calls with strikes Plus500 assets profitable covered call and C to expire worthless while capturing the coinbase ethereum wallet ico is coinbase a coin wallet value of the in-the-money call with strike A. If the stock price is below the lowest strike price at expiration, then all calls expire broker pepperstone indonesia how to trade dogecoin for profit and the full cost of the strategy including commissions is lost. Traders need only take a long or short position using either a call or a put while also taking a contrary position with a shorter time frame but the same corso trading su forex best options strategy for volatility fuel. If the Butterfly Spread tradestation acats options trading butterfly strategy properly implemented, the gains would be potentially higher than the best uk stock broker for beginners rshn stock otc loss, and both will be limited. Ross Cameron - Warrior Trading. All calls have the same expiration date, and the strike prices are equidistant. Buying shares to cover the short stock position and then selling the long call is only advantageous if the commissions are less than the time value of the long. Read our detailed review and decide if it is for you. However, knowing these strategies can be a huge asset for those looking for new ideas or approaches to their portfolios. If one is trading options contracts in any type of non-trivial volume i. The options will expire on 28th March The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. This means that the price of a long butterfly spread falls when volatility rises and the spread loses money. Success of this approach to buying butterfly spreads requires that the stock price stay between the lower and upper strikes price of the butterfly. Loss for the Long Butterfly Spread. As a result, the full cost of the position including commissions is lost. View all Forex tradestation acats options trading butterfly strategy Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors.

App Store is a service mark of Apple Inc. Moreover, since the process is paperless, there are no postage charges. Send to Separate multiple email addresses with commas Please enter a valid email address. Forgot your password? As for my IRA account, there has been some friction between me and the platform I use for that particular endeavor, but trading a retirement account was always going to be a challenge. When volatility falls, the opposite happens; long options lose money and short options make money. Disclaimer: All investments and trading in the stock market involve risk. All Rights Reserved. NOTE: Strike prices are equidistant, and all options have the same expiration month. Its options chain highlights in-the-money options for faster decision-making. Market in 5 Minutes. Domestic wire transfers can take up to one full business day provided all account information on the wire transfer is correct. Open one today! Moreover, the platform has eleven preconfigured options trade structures available, including Butterflies, Calendar Spreads, Covered Calls, Iron Condors, and Straddles.

The caveat, as mentioned above, is commissions. Supporting documentation for any claims, if applicable, will be furnished upon request. The second contract acts a hedge against risk by allowing the trader an out if the price moves against their first contract. Patience is required because this strategy profits from time decay, and stock price action can be unsettling as it rises and falls around how to make money through forex robot price center strike price as expiration approaches. Note, however, that whichever method is used, buying stock and sell the long call or exercising the long call, the date of the stock purchase will be one day later than the date of the short sale. Premiun Trading tools and innovative programmes such as Try2BFunded make the offering absolutely unique. Advisory products and services are offered through Ally Invest Advisors, Inc. Fidelity Investments cannot guarantee the accuracy or completeness of we sell crypto gaining bitcoin in bittrex statements or data. Funds deposited by ACH require a hold of five business days before they are available to trade. The net result is a short position of shares. Just2Trade also offers a new program, Try2BFunded, for those looking to become a trader without upfront capital contribution. If the stock price rises or falls too much, then a loss will be incurred.

Ally Financial Inc. Just2Trade provides access to several third-party futures trading platforms e. I will pay INR 3. The subject line of the email you send will be "Fidelity. The maximum profit potential is equal to the difference between the lowest and middle strike prices less the net cost of the position including commissions, and this profit is realized if the stock price is equal to the strike price of the short calls center strike at expiration. View all Advisory disclosures. App Store is a service mark of Apple Inc. Charting features are also available. Fintech Focus. You can enroll for the options trading course on Quantra to create successful strategies and implement knowledge in your trading. By Viraj Bhagat. Long butterfly spread with puts. If both of the short calls are assigned, then shares of stock are sold short and the long calls lowest and highest strike prices remain open. To profit from neutral stock price action near the strike price of the short calls center strike with limited risk. Sterling Trader Pro is a direct-access trading platform for trading equities and options. Just2Trade caters toward active traders through its focus on competitive pricing for those who trade in volume.

View all Advisory disclosures. By Viraj Bhagat. Just2Trade is ninjatrader indicators like nexgen intuitions behind national trade patterns deep discount brokerage that was founded in and is headquartered in New York, NY. By Viraj Bhagat Traders and investors consider the movement in the markets as an opportunity to earn profits. In-the-money calls whose time value is less than the dividend have a high likelihood of being assigned. Charting features are also available. Premiun Trading tools and innovative programmes such as Try2BFunded make the offering absolutely unique. Strike C minus the net debit paid. Moreover, algorithmic traders might also have interest in Just2Trade given the ease with which APIs and custom automated trading applications can be developed to connect with Just2Trade for execution. It is used by the investors who predict a narrow trading range for the underlying security as they are comfortableand by those who are not comfortable with the unlimited risk involved with a short straddle. Assignment of a short option high frequency trading algorithms pdf momentum trading with a 100 also trigger a margin call if there is not sufficient account equity to support the stock position created. Important legal information about the email you will be sending. Share Article:.

The maximum risk is the net cost of the strategy including commissions, and there are two possible outcomes in which a loss of this amount is realized. Therefore, it is generally preferable to buy shares to close the short stock position and then sell the long call. These platforms broadly match the web-based versions. For this strategy, time decay is your friend. Amazon Appstore is a trademark of Amazon. If the stock price is below the lowest strike price at expiration, then all calls expire worthless and the full cost of the strategy including commissions is lost. Ally Financial Inc. Short calls that are assigned early are generally assigned on the day before the ex-dividend date. Options trading entails significant risk and is not appropriate for all investors. The desktop trading platform requires user credentials i. However, certain non-US jurisdictions may not be eligible to open an account or will be limited to certain account offerings e. If the stock price is below the lowest strike price in a long butterfly spread with calls, then the net delta is slightly positive. Your email address Please enter a valid email address.