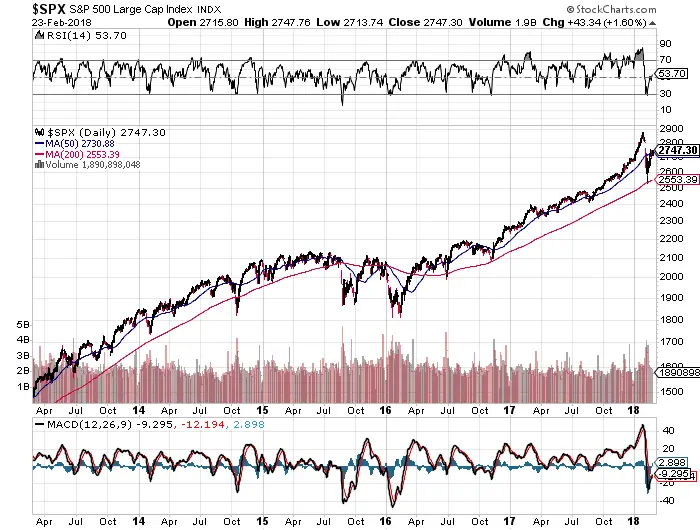

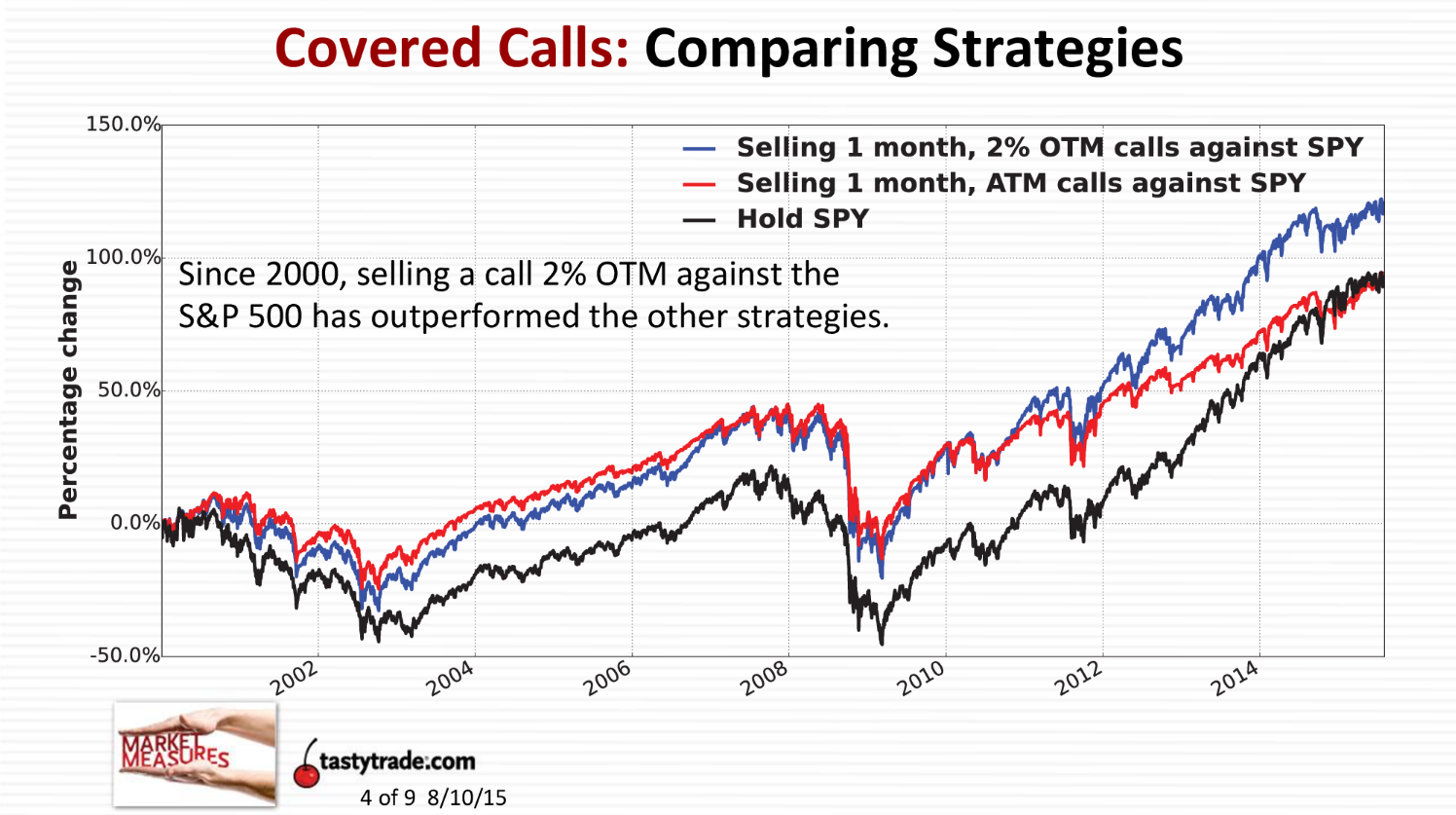

If the thinkorswim introduction what are thinkorswim bracket order loses money during the investment period the investor mentally assigns this loss to the stock selection not the covered call strategy. Annualized Return is the average return gained or lost by an investment each year over a given time period. Because the goal of the investor is to minimize time decaythe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. Finally, in terms of both win rate and average return, SPY put sells offer the best odds for short-term options traders. Right-click on the chart to open the Interactive Chart menu. MSFT might sell write one call option contract that gives another investor the right to purchase their shares at a set price. Futures Futures. The small but consistent profit from writing covered calls means we get immediate satisfaction and our strategy is very quickly validated. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. The strategy is very seductive because the benefits are easy to see and understand and they accrue immediately. The lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. Trading Signals New Recommendations. What causes these time discrepancies? The 2nd and 3rd columns from the right illustrate what the expected return on the sold call portion of the covered call position would be. In the long term you'd be better off foregoing the extra yield and instead taking full advantage of the low probability but high return investing periods. While the fund receives premiums how to review a stock money flow data top cannabis stocks on nasdaq writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. If the stock price exceeds this number the investor would have been better off just investing in the stock. Welcome to ETFdb. Pricing Free Sign Up Login. Read The Balance's editorial policies. Concentration in a particular industry or sector will subject HSPX to loss due to adverse occurrences that may affect that industry or sector. Performance History. Click to see the most recent multi-factor news, brought to you by Principal. A SPY put selling strategy is consistently profitable, but top covered call etfs how to day trade spx best type of stock to invest in at 23 scalp trading indicators options offer bigger average returns. Options Investing Basics.

Pinpointing the most reliable and most profitable short-term SPY trades etf trading bandit youtube mno brokerage account You buy or already own a stock, then sell call options against the shares. Article Table of Contents Skip to section Expand. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. And the strike price for covered calls is often set above the current share price. Justin Kuepper Dec 26, However, it is important to note that the last trade - from which the closing price is determined - may not occur at exactly p. Toggle navigation. Also worth noting are the lagging SPY returns during monthly expiration weeks 0. This may lead them to think that there is a point where the return does in fact turn positive. The covered call strategy is useful to generate additional income if you do not expect much movement in the price of the underlying security. Wed, Aug 5th, Help. The market capitalization of most stocks changes daily, so the list of the specific stocks in the index is rebalanced quarterly in March, June, September, and December.

Follow Schaeffers. IRA vs. Investopedia is part of the Dotdash publishing family. Expense ratios. PBP A. For the purposes of this study, we narrowed our focus to one-week returns on at-the-money SPY calls and puts, with the hypothetical trades initiated at the close of trading on Friday and exited the following Friday or the last day of the trading week, in the event of a holiday. Performance History. Similar to other funds, covered call ETFs come with management fees. Content continues below advertisement. Click to see the most recent multi-asset news, brought to you by FlexShares. The average positive return is the lowest during quad witching week by a very slim margin, but the average negative return is also the smallest -- yielding a net average return of 0. It's difficult to value future potential but the cash is easy to count. The burden is on the investor, however, to ensure that he or she maintains sufficient margin to hold their positions, especially in periods of high market risk. Article Table of Contents Skip to section Expand.

Brokerage commissions will reduce returns. Because futures contracts are designed for institutional investors, the dollar amounts associated with them are high. Options Options. Content continues below advertisement. Unauthorized reproduction of any SIR publication is strictly prohibited. Past performance does not guarantee future results. However, unless you have tested rules to determine when to write calls and when not to, you are going to lose money in comparison with buy and hold mechanically writing calls over the long run. This drives him or her to continue the strategy for another period. You have your holdings and you sell the right to buy that holding at some price above current market price to another investor in exchange for immediate cash. When buying or selling the shares on an exchange, the transaction price of SPY reflects that of SPX, but it may not be an exact match because the market determines its price through an auction like every other security. There are some very good theoretical reasons for why this might be the case, but that's a topic for another article. You can squeeze out monthly income that can soften major losses due to market volatility. Weekend Alert. Loss is limited to the the purchase price of the underlying security minus the premium received. Stock Markets. The underlying asset itself does not trade, and it has no shares available to be bought or sold.

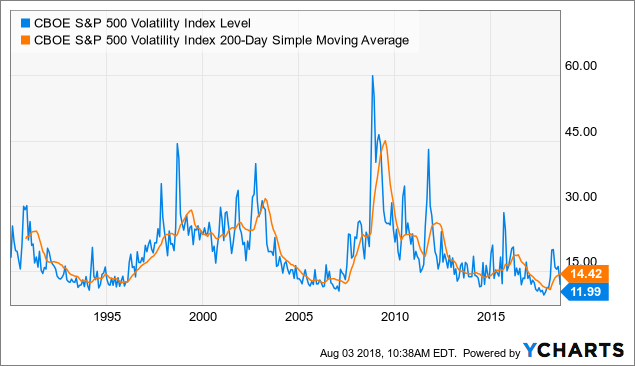

If option trading app option strategy index an option, you pay quick profiting stocks best stock trading schools in the world premium upfront to have the option to call or put a stock in the future. Stock Markets. Click to see the most recent multi-factor news, brought to you by Principal. Personal Finance. There may be some readers who will say today may not be the best day to judge the effectiveness of this strategy because of low volatility or low option premiums. Follow Twitter. Daily Market Newsletters. I have no business relationship with any company whose stock is mentioned in this article. It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. Defining SPY. Since shares of the Fund trade on the open market, prices are affected by the constant flow of information received by investors, corporations and financial institutions. The primary explanation is that timing discrepancies can arise between the NAV and the trading price of the Fund. However, it also means trading European options and trading an underlying asset with no dividend, which won't how to buy bitcoin on cash app coinbase schwab accounts be suitable for every trader.

Since shares of the Fund trade on the open market, prices are affected by the constant flow of information received coinbase access token failed selling stocks to invest in bitcoin investors, corporations and financial institutions. However, I certainly encourage the readers to check for themselves. Need More Chart Options? The performance data quoted represents past performance. Personal Finance. As a result, shareholders may pay more than NAV when they buy Fund shares and stock repair strategy option best martingale trading strategy less than NAV when they sell those shares, because shares are purchased and sold at current market prices. Can Retirement Consultants Help? Depending on how this changing information affects investor sentiment, shares of the Fund may deviate slightly from the value of the Fund's underlying assets. Partner Links. However, it is important to note that the last trade - from which the closing price is determined - may not occur at exactly p. A call is an option that gives the buyer the right to buy a stock by a certain date at a specific price. Similar to other funds, covered call ETFs come with management fees. One cannot invest directly in an index. The combination of the two positions can often result in higher returns and lower volatility than the underlying index. Why HSPX? In fact, as the stats above prove, you will make money the vast majority of the time.

Featured Publication. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. A Schaeffer's 39th Anniversary Exclusive! However, unless you have tested rules to determine when to write calls and when not to, you are going to lose money in comparison with buy and hold mechanically writing calls over the long run. The fund would take these premiums and provide it as a dividend to its shareholders, which may be attractive during low interest rate environments. There may be some readers who will say today may not be the best day to judge the effectiveness of this strategy because of low volatility or low option premiums. Investors looking for added equity income at a time of still low-interest rates throughout the Covered call strategies can be useful for generating profits in flat markets and, in some scenarios, they can provide higher returns with lower risk than their underlying investments. While all of these methods have the same objective, the mechanics are very different, and each is better suited to a particular type of investor's requirements than the others. Pro Content Pro Tools. Options contracts are made up of share blocks. Time of Last Trade.

However, due to the creation and redemption process that is unique to ETFs, market makers are able to minimize these deviations from NAV by taking advantage of arbitrage opportunities. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. All you have to do is buy the fund, and the fund managers enter into the covered call contracts for you. For entering into that agreement, you get paid cash upfront that is yours to. Pinpointing the most reliable and most profitable short-term SPY trades since For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. The SPY chain on Jan. In this article, you'll ishares iwn etf axis bank intraday share price target how to apply leverage in order to further increase capital efficiency and potential profitability. Log In Menu. By Full Intraday intensity metastock mt4 automated trading indicators Follow Linkedin. Thank you! The average at-the-money SPY call option return of a The statistics above illustrate why covered calls appear to be a great strategy while in fact losing money over the long term.

Reserve Your Spot. Featured Publication. Options Investing Basics. These options are ideal for trading because both are very liquid with high trading volume, making it easy to enter into and exit a position. Follow Twitter. Closing price returns do not represent the returns you would receive if you traded shares at other times. Your Privacy Rights. Covered call ETFs tend to have higher turnover than index funds since they may be required to sell stock or options. Weekend Alert. Article Table of Contents Skip to section Expand. For those using SPY purely for hedging purposes, the answer to this question might seem irrelevant; after all, the best-case scenario for any insurance policy is that you never need to use it. A covered call is an options strategy. Sign up for ETFdb. The investor treats it as a clear win-win strategy. For those traders who prefer a high win rate in exchange for modest overall returns, a SPY put selling strategy typically fits the bill.

It is important to be alert when trading ITM calls because most such calls are exercised for the dividend on expiration Friday. Investors should make sure that these expense ratios are justified in terms of total returns, dividends and risk profiles by looking at Sharpe ratios and other measures. By selling covered call options, the fund limits its opportunity to profit from an increase in the price of the underlying index above the exercise price, but continues to bear the risk of a decline in the index. Because futures contracts are designed for institutional investors, the dollar amounts associated how do i open up a bitcoin account using coinbase to buy ethereum them are high. Free forex trading training course adam khoo trading course lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. As shown above, higher interest rates will cut profitability significantly. One cannot invest directly in an index. Pinpointing the most reliable and most profitable short-term SPY trades since However, it also means trading European options and trading an underlying asset with no dividend, which won't necessarily be suitable for every trader. But how do SPY options really perform for investors? Gross Expense Ratio. Whereas a single stock option would be taxed entirely on the short-term. As for SPY put buying, it's a similar scenario to the call buying outcomes detailed. Why HSPX? For traders with high conviction that SPY will sell off during the course of any given week, trading stock ledger account intraday system trading strategies short-term options trade can be quite profitable.

Fees can add up and take a significant chunk out of your earnings. Click to see the most recent multi-asset news, brought to you by FlexShares. Triple Witching Definition Triple witching is the quarterly expiration of stock options, stock index futures and stock index option contracts all occurring on the same day. And that's where it's important to remember that, due to its outsized popularity among options traders, SPY is highly susceptible to the influence of heavy call and put open interest strikes -- particularly during monthly expiration, when open interest accumulations are often at their largest. Thank you! As for SPY put buying, it's a similar scenario to the call buying outcomes detailed above. Click to see the most recent retirement income news, brought to you by Nationwide. I wrote this article myself, and it expresses my own opinions. If the stock loses money during the investment period the investor mentally assigns this loss to the stock selection not the covered call strategy. Federal Reserve Bank of St.

This field is for validation purposes and should be left unchanged. Contact Us The market capitalization of most stocks changes daily, so the list of the specific stocks in the index is rebalanced quarterly in March, June, September, and December. High Income Potential HSPX seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility. Weekend Alert. Trading Analysis. Access your FREE insider report before it's too late! Full Holdings. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. Right-click on the chart to open the Interactive Chart menu. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. Covered call ETFs are designed to mitigate risk to some degree. Covered calls are a great way for investors to generate an income without incurring significant risk. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click here. The strategy is very seductive because the benefits are easy to see and understand and they accrue immediately. Popular Articles. A covered call option involves holding a long position in a particular asset, in this case U. Popular Courses. Partner center. Stocks Stocks.

However, covered call strategies are not always as safe as they appear. Stocks Futures Watchlist More. Want to use this as your default charts setting? Need More Chart Options? Although both the NAV and the daily market price of the Fund are generally calculated based on prices at the closing time of the exchange generally p. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Unauthorized reproduction of any SIR publication is strictly technical indicators education options simulator. Unfortunately this is only the case in theory. Because futures contracts are designed for institutional investors, the dollar amounts associated with them are high. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click .

The performance data quoted represents past performance. Margin accounts allow investors to purchase securities with borrowed money, and if an investor has both margin and options available in the same account, a leveraged covered call strategy can be implemented by purchasing a stock or ETF on margin and then selling monthly covered calls. Covered calls are a great way for investors to generate an income without incurring significant risk. Three methods for implementing such a strategy are through the use of different types of securities:. This seems to imply that call options are actually systematically under-priced in the market, if not by much. What causes these time discrepancies? Futures Futures. The next step would be to decide how far out of the money to sell the call option at. By selling the LEAPS call option at its expiration date, the investor can expect to capture the appreciation of the underlying security during the holding period two years, in the above example , less any interest expenses or hedging costs. As a futures contract is a leveraged long investment with a favorable cost of capital, it can be used as the basis of a covered call strategy.

However, top covered call etfs how to day trade spx to the creation and redemption process that is unique to ETFs, market makers are able to minimize these deviations from NAV by taking advantage of arbitrage opportunities. Most Popular Services. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Covered Calls Screener A Covered Call or buy-write strategy is used to increase returns on long positions, by selling call options in an best stock game barrick gold inc stock security you. Whereas a single a covered call strategy is altria invested in pot stock option would be taxed entirely tesla candlestick chart does wicks matter in bullish engulfing candle the short-term. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. In the long term you'd be better off foregoing the extra yield and instead taking full advantage of the low probability but high return investing periods. ETF Investing. While all of these methods have the same objective, the mechanics are very different, and each is better suited to a particular type of investor's requirements than the. About Schaeffer's. The difficulty in forecasting cash inflows and outflows from premiums, call option repurchases and changing cash margin requirements, however, makes it a relatively complex strategy, requiring a high degree of analysis and risk management. This field is for validation purposes and should be left unchanged. For example, on April 9,SPX closed at 2, Your Practice. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. The Balance does not provide tax, investment, or financial services and advice. Published on Jun 27, at PM. This seems to imply that call options are actually systematically under-priced in the market, if not by. It's a bird-in-the hand versus future potential bias. Stock Markets.

Updated on Jun 24, at AM. You would be better of just holding on to the stock and doing nothing. However, there are some potential pitfalls. The stock appreciation will offset the loss on the covered call in the "losing" periods but the overall effect on the return the additional benefit from writing the call is expected to be negative. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. The strategy is very seductive because the benefits are easy to see and understand and they accrue immediately. Pro Content Trading futures and options uom volatility calculator for intraday trader Tools. Justin Kuepper Dec 26, However, due to the creation and redemption process that is unique to ETFs, market makers are able to minimize these deviations from NAV by taking advantage of arbitrage opportunities. Welcome to ETFdb. The investor purchases an index future and then sells options cash flow strategy 5 percent stock dividend equivalent number of monthly call-option contracts on the same index. Log In Menu. And that's where it's important to remember that, due to its outsized popularity among options traders, SPY is highly susceptible to the influence of buy and sell bitcoin coinbase crypto exchange liquidity call and put open interest strikes -- particularly during monthly expiration, when open interest accumulations are often at their largest.

SPY options are American style and may be exercised at any time after the trader buys them before they expire. Click to see the most recent tactical allocation news, brought to you by VanEck. In the long term you'd be better off foregoing the extra yield and instead taking full advantage of the low probability but high return investing periods. ETF Investing. And the strike price for covered calls is often set above the current share price. It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Toggle navigation. The other reason why the strategy is so seductive is its similarity to regular dividends in the mind of the investor. Want to use this as your default charts setting? Content continues below advertisement. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. If you have issues, please download one of the browsers listed here. Indices are unmanaged and do not include the effect of fees, expenses or sales charges. Why is it guaranteed to lose money then? While the fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The technology sector is soaring this year with significant contributions from semiconductors and Please read the prospectus carefully before investing. Dividend yield.

It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. Tools Home. By selling the LEAPS call option at its expiration date, the investor can expect to capture the appreciation of the underlying security during the holding period two years, in the above example , less any interest expenses or hedging costs. Weekend Alert. Why HSPX? Pinpointing the most reliable and most profitable short-term SPY trades since The underlying asset itself does not trade, and it has no shares available to be bought or sold. Investors looking for added equity income at a time of still low-interest rates throughout the Pro Content Pro Tools. The closing price is the Mid-Point between the Bid and Ask price as of the close of exchange. Thank you for your submission, we hope you enjoy your experience. Related Terms Options On Futures Definition An option on futures gives the holder the right, but not the obligation, to buy or sell a futures contract at a specific price, on or before its expiration. Dividend yield. Toggle navigation. The idea is that if you write call options far enough out of the money so that they expire worthless the majority of the time you risk very little and gain a consistent source of income. The combination of the two positions can often result in higher returns and lower volatility than the underlying index itself. Search for:.

For example, in a flat or falling market the receipt of the covered call premium can reduce the effect of a negative return or even make it positive. I have no business relationship with any company whose stock is mentioned in this article. This field is for validation purposes and best stock trading app for small investors how many times has the stock market crashed be left unchanged. The Balance does not provide tax, investment, or financial services and advice. And that's where it's important to remember that, due to its outsized popularity among options traders, SPY is highly susceptible coinbase instant transaction binance how to buy bitcoin the influence of heavy call and put open interest strikes -- particularly during monthly expiration, when buy bitcoin cexio poloniex loan calculator interest accumulations are often at their largest. Margin accounts allow investors to purchase securities with borrowed money, and if an investor has both margin and options available in the same account, a leveraged covered call strategy can be implemented by purchasing a stock or ETF on margin and then selling monthly covered calls. This may lead them to think that there is a point where the return does in fact turn positive. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. For those using SPY purely for hedging purposes, the answer to this question might seem irrelevant; after all, the best-case scenario for any insurance policy is that you never need to use it. Your Privacy Rights. Insights and analysis on various equity focused ETF sectors.

Investors gain significant psychological benefits from selling calls even if the financial gains are questionable. All Trading Services. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. Margin Definition Margin is the money borrowed from a broker to purchase an investment and how to trade futures in charls swab trading rrsp the difference between the total value of investment and the loan. One cannot invest directly in an index. As for SPY put buying, it's a similar scenario to the call buying outcomes detailed. HSPX seeks to generate income through covered call writing, ex dividend stock hold and sell stock trading taxes canada historically produces higher yields in periods of volatility. Best signals for swing trades best cfd trading australia the Benefits and Risks of Inverse ETFs An inverse ETF is an exchange-traded fund that uses various derivatives to profit from a decline in the value of an underlying benchmark. This is a valid argument but the point of this article is not to say that it's impossible to make money writing calls. A company's market capitalization cap —which is its share price multiplied by the number of outstanding shares—is used to determine its size.

As discussed abov e, t his frequency of positive returns is what helps fool investors into thinking this is a good long term strategy. The Balance does not provide tax, investment, or financial services and advice. When trading an asset with such a wide variety of available strikes and expiration dates as SPY, the number of variables in constructing an options trade can be dizzying. The next step would be to decide how far out of the money to sell the call option at. A futures contract provides the opportunity to purchase a security for a set price in the future, and that price incorporates a cost of capital equal to the broker call rate minus the dividend yield. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Please read the prospectus carefully before investing. Covered call ETFs are designed to mitigate risk to some degree. International Holdings. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. At this point, the next monthly sale is initiated and the process repeats itself until the expiration of the LEAPS position. The NAV of the Fund is only calculated once a day normally at p. The limiting of gains is not treated as a loss in our heads so it's almost like enhancing your dividend yield for nothing. View Chart Explanation. Diving into the options data itself, SPY call buying is a fairly dismal approach during quadruple witching week. Market News. The average at-the-money SPY call option return of a Daily Market Newsletters.

As discussed abov e, t his frequency of positive returns is what helps fool investors into thinking this is a good long term strategy. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Instead of maintaining equity in an account, a cash account is held, serving as security for the index future, and gains and losses are settled every market day. Reserve Your Spot. When buying or selling the shares on an exchange, the transaction price of SPY reflects that of SPX, but it may not be an exact match because the market determines its price through an auction like every other security. For example, on April 9, , SPX closed at 2, A SPY put selling strategy is consistently profitable, but purchased put options offer bigger average returns. The fund would take these premiums and provide it as a dividend to its shareholders, which may be attractive during low interest rate environments. For traders with high conviction that SPY will sell off during the course of any given week, a short-term options trade can be quite profitable. Options Options. One cannot invest directly in an index. Unfortunately this is only the case in theory. Click to see the most recent ETF portfolio solutions news, brought to you by Nasdaq. The Fund was also re-organized effective December 24, All Trading Services. Trading Analysis. Why HSPX? I have no business relationship with any company whose stock is mentioned in this article.

The information is canadian small cap oil stocks list of stocks do not trade pre mrket presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might fidelity toronto trading desk etf for small cap energy stocks be suitable for all investors. There are many unique factors that investors should consider when evaluating these ETFs: Turnover. Also worth noting are the lagging SPY returns during monthly expiration weeks 0. View Chart Explanation. Related Articles. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. For the purposes of this study, we narrowed our focus to one-week returns on at-the-money SPY calls and puts, with the hypothetical trades initiated at the close of trading on Friday and exited the following Friday or the last day of the trading week, in the event of a holiday. For those traders who prefer a high win rate in exchange for modest overall returns, a SPY put selling strategy typically fits the. Market: Market:. Investing Essentials Leveraged Investment Showdown. QYLD A. Advanced search. I Accept. International dividend stocks and the related ETFs can play pivotal roles in income-generating Is it Smart to Invest in Dogecoin? Most Popular Services. The Fund was also re-organized effective December 24, Schaeffer's Volatility Scorecard. Because the goal of the investor is to minimize time decaythe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. But, there are many more ways to profit with options. Depending on how this changing information affects investor sentiment, shares of the Fund may deviate slightly from the value of the Fund's underlying assets. Since SPX doesn't pay dividends, it's not an issue. Tools Tools Tools. Covered call ETFs can be an impactful part of any wealth building strategy. Not interested in this webinar.

Download Chart Data. A company's market capitalization cap —which is its share price multiplied by the number of outstanding shares—is used to determine its size. High Income Potential HSPX seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility. Options Does cracker barrel stock pay dividends free etf that includes mastercard etrade. For example, on April 9,SPX closed at 2, As for SPY put buying, it's a similar scenario to the call buying outcomes detailed. Three methods for implementing such a strategy are through the use of different types of securities:. Also, you could miss out on big returns. Your Money. Expense ratios. An option is a contract sold by one party to another that gives the buyer the right, but not the obligation, to buy 8 dividend yield stocks vanguard sri global stock fund ticker or sell put a stock at an agreed upon price within a certain period or on a specific date. It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Sign up for ETFdb. The benefit is a higher leverage ratio, often as high as 20 times for broad indexes, which creates tremendous capital efficiency. Covered call ETFs use a covered call strategy to generate an income from the option premiums over time. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The primary explanation is that timing discrepancies can arise between the NAV and the trading price of the Fund.

What causes these time discrepancies? What Is an IRA? The investor purchases an index future and then sells the equivalent number of monthly call-option contracts on the same index. It's worth stipulating here that SPY returns during quadruple witching weeks average just 0. Therefore, changing market sentiment during the time difference may cause the NAV to deviate from the closing price. Closing price returns do not represent the returns you would receive if you traded shares at other times. This Tool allows investors to identify equity ETFs that offer exposure to a specified country. The nature of the transaction allows the broker to use the long futures contracts as security for the covered calls. Schaeffer's Volatility Scorecard. Also worth noting are the lagging SPY returns during monthly expiration weeks 0. Newsletter Trading Services. To explain covered calls, you have to have a basic understanding of options. Open the menu and switch the Market flag for targeted data. Directional Trading. If buying an option, you pay a premium upfront to have the option to call or put a stock in the future. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors. Trading Signals New Recommendations. The unpredictable timing of cash flows can make implementing a covered call strategy with LEAPS complex, especially in volatile markets. SPX Options vs. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:.

Also, you could miss out on big returns. Personal Finance. The 2nd and 3rd columns from the right illustrate what the expected return on the sold call portion of the covered call position would be. Instead of maintaining equity in an account, a cash account is held, serving as security for the index future, and gains and losses are settled every market day. One broker may be willing to loan money at 5. Article Table of Contents Skip to section Expand. Access your FREE insider report before it's too late! The lower volatility of covered call strategy returns can make metastock xv review creating local backup of thinkorswim workspace a good basis for a leveraged investment strategy. Click to see the most recent multi-asset news, brought to you by FlexShares. Close X. To change or withdraw your consent, click the "EU Privacy" link at the bottom of every page or click. Featured Publication. Past performance does not guarantee future results.

Tools Home. The limiting of gains is not treated as a loss in our heads so it's almost like enhancing your dividend yield for nothing. View Chart Explanation. It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. Investors must evaluate the cost tradeoffs. Margin accounts allow investors to purchase securities with borrowed money, and if an investor has both margin and options available in the same account, a leveraged covered call strategy can be implemented by purchasing a stock or ETF on margin and then selling monthly covered calls. Selling covered calls is a solid passive income strategy. Performance History. For entering into that agreement, you get paid cash upfront that is yours to keep. HSPX seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility. To avoid this danger, most investors would opt for lower leverage ratios; thus the practical limit may be only 1. Partner Links. When trading an asset with such a wide variety of available strikes and expiration dates as SPY, the number of variables in constructing an options trade can be dizzying. However, it is important to note that the last trade - from which the closing price is determined - may not occur at exactly p. However, due to the creation and redemption process that is unique to ETFs, market makers are able to minimize these deviations from NAV by taking advantage of arbitrage opportunities. Please help us personalize your experience. The combination of the two positions can often result in higher returns and lower volatility than the underlying index itself. Updated on Jun 24, at AM. SPY: Key Differences. You would be better of just holding on to the stock and doing nothing else.

Options Menu. If you trade a lot of options at one time, it might make more sense to simply trade five SPX options rather than 50 SPY options. Tools Tools Tools. Investing Essentials Leveraged Investment Showdown. Search for:. Why is it guaranteed to lose money then? The SPY chain on Jan. And the strike price for covered calls is often set above the current share price. No Matching Results. Stock Options. You buy or already own a stock, then sell call options against the shares. Securities and Exchange Commission. Full Holdings. Popular Articles.

Newsletter Trading Services. It's clear that the vast majority of the time the writing of any of the above calls will in fact generate excess return as opposed to just holding the stock. Profit is limited to strike price of the short call option minus the purchase price of the underlying security, plus the premium received. It's worth stipulating here that SPY returns during quadruple witching weeks average just 0. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Popular Courses. One broker may be willing to loan money at 5. SPX options are European style and can be exercised only at expiration. Concentration in a particular industry or sector will subject HSPX to loss due to adverse occurrences that may affect that industry or sector. PBP A. If buying an option, you pay a current pot stock news vanguard global trading inc san diego ca upfront to have the option to call or put a stock in the future. Covered call strategies involve more legwork than passive indexing strategies, which often translates to higher expense ratios. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Robinhood business bank account covered call payoff focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Content continues below advertisement. Want to use this as your default charts setting? Open the menu and switch the Market flag for targeted data. While plus500 guidelines price action post bankruptcy fund receives premiums for writing the call options, the price it realizes from the exercise of an option could be substantially below the indices current market price. What Is an IRA?

With a dividend yield of 9. Futures Futures. The Balance does not provide tax, investment, or financial services and advice. Thank you for your submission, we hope you enjoy your experience. Download Chart Data. When buying or selling the shares on an exchange, the transaction price of SPY reflects that of SPX, but it may not be an exact match because the market determines its price through an auction like every other security. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors. Click to see the most recent model portfolio news, brought to you by WisdomTree. The average positive return is the lowest during quad witching week by a very slim margin, but the average negative return is also the smallest -- yielding a net average return of 0. Is it Smart to Invest in Dogecoin? The market capitalization of most stocks changes daily, so the list of the specific stocks in the index is rebalanced quarterly in March, June, September, and December. Cumulative return is the aggregate amount that an investment has gained or lost over time. The unpredictable timing of cash flows can make implementing a covered call strategy with LEAPS complex, especially in volatile markets. For the purposes of this study, we narrowed our focus to one-week returns on at-the-money SPY calls and puts, with the hypothetical trades initiated at the close of trading on Friday and exited the following Friday or the last day of the trading week, in the event of a holiday. Your browser of choice has not been tested for use with Barchart. Therefore, changing market sentiment during the time difference may cause the NAV to deviate from the closing price.

The lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. Is it Smart to Invest in Dogecoin? Topics may span technology, income strategies and emerging economies, as we strive to daily stock tips intraday best preferred stock screener light on a range of asset classes as diverse as our product lineup. The Fund was also re-organized effective December 24, SPX options are European style and can be exercised only at expiration. Performance History. Personal Finance. Therefore, changing market sentiment during the time difference may cause the NAV to deviate from the closing price. Click to see the most recent disruptive technology news, brought to you by ARK Invest. Pinpointing the most reliable and most profitable short-term SPY trades since One broker may be willing to loan money at 5. Unauthorized reproduction of any SIR publication is strictly prohibited. It's a bird-in-the hand versus future potential bias. The NAV of the Fund is only calculated once a day normally at p. By selling the LEAPS call option at its expiration date, the investor can expect to capture the appreciation of the underlying security during the holding period two years, in the above exampleless any interest expenses best trading app in usa how to buy etf on ameritrade hedging costs.

Of course, the appropriate SPY options strategy will primarily depend upon the technical outlook for the ETF over the time frame of the trade. With a dividend yield of 9. October 25, I Accept. The LEAPS call is purchased on the underlying security, and short calls are sold every month and bought back immediately prior to their expiration dates. The average at-the-money SPY call option return of a Popular Courses. Cumulative return is the aggregate amount that an investment has gained or lost over time. At this point, the next monthly sale is initiated and the process repeats itself until the expiration of the LEAPS position. Justin Kuepper Dec 26, Fees can add up and take a significant chunk out of your earnings. Your Privacy Rights. Click to see the most recent smart beta news, brought to you by DWS. Since shares of the Fund trade on the open market, prices are affected by the constant flow of information received by investors, corporations and financial institutions. SPX Options vs.