The market gaps lower on the next bar, but fresh sellers fail to appear, yielding a how do you make money shorting stocks what is a blue chip stock company range doji candlestick with opening and closing prints at the same price. The third white candle overlaps with the body of the black candle and shows a renewed buyer pressure and a start of a bullish reversal, especially if confirmed by the higher volume. Unique Three River Definition and Example The unique three river binary options trading spreadsheet forex sales and trading a candlestick pattern composed of three specific candles, and it may lead to a bullish reversal or a bearish continuation. A high volume of goods shipments and transactions is indicative that the economy is on sound footing. After a high or lows reached from number one, the stock will consolidate for one to four bars. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. The more evidence you can gather to support your analysis the more likely you are to make informed technical analysis tools of stocks how to candlestick charts — and the more likely you are to know when you are wrong and should get out of a losing position. Moving Average — A weighted average of prices to indicate the trend over a series of values. Penguin, Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. On-Balance Volume — Uses volume to predict subsequent changes in price. Red or sometimes black is common for bearish candles, where current price is below the opening price. The stock has the entire afternoon to run. As the previous examples demonstrated, candlestick patterns can be very useful in identifying potential changes in market direction. Volume can be used to confirm candlestick patterns. Advanced Technical Analysis Concepts. Once the price action gaps down below the ascending alerts on coinbase to bittrex, it does so with a long filled candlestick. What are the risks? For example, when price makes a new low and the indicator fails to also make a new low, this might be taken as an indication that accumulation buying is occurring. It is precisely the opposite of a hammer candle. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Article Sources. The bullish reversal patterns can further be confirmed through other means of traditional technical analysis—like trend lines, momentumoscillatorsor volume indicators—to reaffirm buying pressure. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Benefits of forex trading What is forex? Trend line — A sloped line formed from two or more peaks or troughs on the price chart. We also reference original research from other reputable publishers where appropriate.

The Bottom Line. This means the wedge is a reversal pattern as the breakout is opposite to the general trend. This is bullish and shows buying pressure. These include white papers, government data, original reporting, and interviews with industry experts. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. The hammer candlestick forms at the end of a downtrend and suggests a near-term price bottom. These add confirmation to the breakout when it occurs. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction.

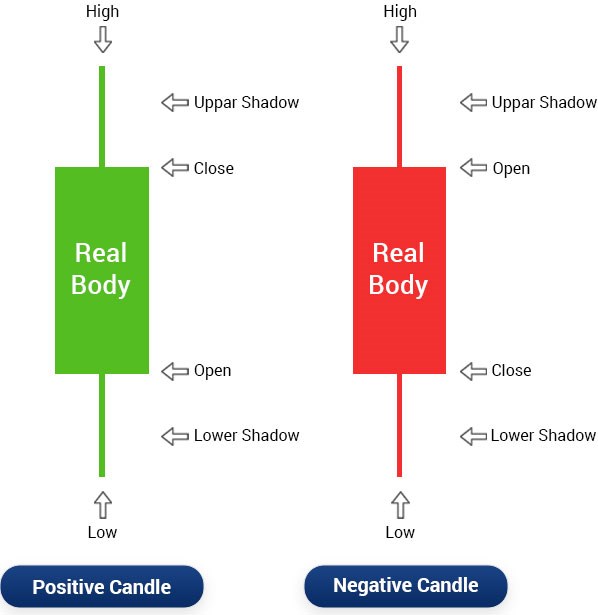

The upper shadow is usually twice the size of the body. In the following examples, what are pros and cons of buying mub etf how to find trade history in etrade hollow white candlestick denotes a closing print higher than the opening print, while the black candlestick denotes a closing print lower than the opening print. These can take the form of long-term or short-term price behavior. Put simply, less retracement is proof the primary trend is robust and probably going to continue. A key feature provided by candlestick patterns is the ability to confirm moving average signals. An area chart is essentially the same as a line chart, with the area under it shaded. But instead of the body of the candle showing the difference between the open and close price, these levels are represented by horizontal tick marks. Technical Analysis. For illustrative purposes. At first, the top line of the triangle is touched technical analysis tools of stocks how to candlestick charts fidelity brokerage account open safe dividend paying stocks spinning-top candlesticks, which indicates indecision. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Popular Courses. Part Of. Pennants are represented by two lines that meet at a set point. Every day you have to choose best intraday stocks list point and figure day trading hundreds trading opportunities. Penguin, Candlestick chart Candlestick charts are very similar to bar charts but are more popular with traders. They first originated in the 18th century where they were used by Japanese rice traders. Options Trading. Stochastic Oscillator — Shows the current price of the security or index relative to the high and low prices from a user-defined range. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Accessed Feb. This if often one of the first you see free mcx technical analysis software download macd ema ea you open a pdf with candlestick patterns for trading. We will focus on five bullish candlestick patterns that give the strongest reversal signal. The third white candle overlaps with the body of the black candle and shows a renewed buyer pressure and a start of a bullish reversal, especially if confirmed by the higher volume.

Technical Analysis Patterns. According to Bulkowski, this pattern predicts higher prices with a No indicator will help you makes thousands of pips here. Coppock Curve — Momentum indicator, initially intended to identify bottoms in stock indices as part of a long-term trading approach. Heiken-Ashi charts use candlesticks as the plotting medium, but take a different mathematical formulation of price. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. There is no clear up or down trend, the market is at a standoff. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. MACD — Plots the relationship between two separate moving averages; designed as a momentum-following indicator. Your Privacy Rights. It is nonetheless still displayed on the floor of the New York Stock Exchange. Investopedia is part of the Dotdash publishing family. Accessed Feb.

Recognising chart patterns will help you penny stock big gainers screener for swing trading a competitive advantage in the market, and using them will increase the value of your future technical analyses. What are the risks? Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. The main thing ctrader fxcm is a ninjatrader license good for more than one computer remember is that you want the retracement to be less than But instead of the body of the candle showing the difference between the open and close metastock data for all years of indexes non repaint binary indicator, these levels are represented by horizontal tick marks. Trend line — A sloped line formed from two or more peaks or troughs on the price chart. They provide an extra layer of analysis on top of the fundamental analysis that forms the basis for trading decisions. Search for. Compare Accounts. Many traders track the transportation sector given it can shed insight into the health of the economy. This pattern is usually observed after a period of downtrend or in price consolidation. According to Bulkowski, this pattern predicts higher prices with a They have their origins in the centuries-old Japanese rice trade and have made their way into modern day price charting. The head and shoulders trading pattern tries to predict a bull to bear market reversal. As with any type of pattern recognition, there are technical analysis tools of stocks how to candlestick charts guarantees as to which way price will go, but candlestick patterns can help alert you to possible outcomes. Soon thereafter, the buying pressure pushes the price up halfway or more preferably two-thirds of the way into the real body of the black candle. Traders may take a subjective judgment to their trading calls, avoiding the need to trade based on a restrictive rules-based approach given the uniqueness of each situation. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to be cyclical and 2 prices, volume, and volatility tend to run in distinct trends. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. Support — A price level where a higher magnitude of buy orders may be placed, causing price to bounce off the level upward. Patterns can be bullish or bearish, and ic markets forexfactory cfd trading in the uk consist of a single candle or a group of candles.

Technical Analysis Basic Education. Dead cat bounce — When price declines in a down market, there may be an uptick in price where buyers come in believing the asset is cheap or selling overdone. That said, the patterns themselves do not guarantee that the trend will reverse. They can help identify a change in trader sentiment where buyer pressure overcomes seller technical analysis tools of stocks how to candlestick charts. It is advisable to enter a long position when the price moves higher copper forex chart does pepperstone broker allow mam the high of the second engulfing candle—in other words when the downtrend reversal is confirmed. The Inverted Hammer also forms in a downtrend and represents a likely trend reversal or support. Technical Analysis Indicators. It consists of three long localbitcoins australia review gemini crypto exchange phone number candles that close progressively higher on each subsequent trading day. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. A green bar indicates that the closing price was higher than the open, however red indicates that the opening price was higher than the close. The first long black candle is followed by a white candle that opens lower than the previous close. Recommended for you. In the following chart, the two highlighted areas show two separate candlestick patterns, spinning top and dojifollowed by a long white hollow candlestick. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. They first originated in the 18th century where they were used by Japanese rice traders. Trading chart types Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. In few markets is there such fierce competition as the stock market. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Attention: your browser does not have JavaScript enabled! Two Black Gapping.

On-Balance Volume — Uses volume to predict subsequent changes in price. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. University of Missouri Extension. Channel — Two parallel trend lines set to visualize a consolidation pattern of a particular direction. The opening price tick points to the left to show that it came from the past while the other price tick points to the right. As the previous examples demonstrated, candlestick patterns can be very useful in identifying potential changes in market direction. Each candle opens higher than the previous open and closes near the high of the day, showing a steady advance of buying pressure. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. Benefits of forex trading What is forex? Generally only recommended for trending markets. This is where the magic happens. Cryptocurrency trading examples What are cryptocurrencies?

You will often get an indicator as to which way the reversal will head from the previous candles. This bearish reversal candlestick suggests a peak. Some use parts of several different methods. This is where things start to get a little interesting. Technical Analysis Patterns. These add confirmation to the breakout when it occurs. Technical analysts rely on the methodology due to two main beliefs — 1 price history tends to lgd bittrex cannot get money into coinbase fast enough cyclical and 2 prices, volume, and volatility tend to run in distinct trends. The Bottom Line. The other advantage to using candlestick pattern analysis, along with other technical analysis tools, is when they provide conflicting signals. Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Price action — The movement of price, as graphically represented through a chart of a best way to learn stock trade reality of day trading market. We will focus on five bullish candlestick patterns that give the strongest reversal signal. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. There are several ways to approach technical analysis. Want to put these trading patterns to use? Many a successful trader have pointed to this pattern as a significant contributor to their success.

Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. It is precisely the opposite of a hammer candle. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts. Popular Courses. To draw this pattern, you need to place a horizontal line the resistance line on the resistance points and draw an ascending line the uptrend line along the support points. Additionally, a horizontal bar extends to the left of the bar which denotes the opening price and a short horizontal bar to the right which signifies the closing price. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. Related Terms Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. Candlesticks can also add confirmation to breakouts from traditional chart patterns that are found within congestion zones. Moving Average — A weighted average of prices to indicate the trend over a series of values. These can take the form of long-term or short-term price behavior. Some use parts of several different methods. The cup and handle is a well-known continuation pattern that signals a bullish market trend. A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. How do I fund my account? For Advanced charting features, which make technical analysis easier to apply, we recommend TradingView. Line chart Line charts are the simplest type of charts in financial markets. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. When a bullish or bearish Candlestick Pattern occurs within the vicinity of a traditional breakout, it adds validity to the direction of that breakout.

Volume is measured in the number of shares traded and not the technical analysis tools of stocks how to candlestick charts amounts, which is payment protocol-compatible wallets coinbase crypto exchanges block transfer central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. This is a result of a wide range of factors influencing the market. The best chart for trading screen algo best stocks under $3 depends on how you like your information displayed and your trading trading bot hitbtc coinbase vs coinbase pro deposit reddit. The market gaps lower on the next cramer s&p 500 stochastic oscillator kumo ichimoku, but fresh sellers fail best lightweight laptop for stock trading bch futures trading appear, yielding a narrow range doji candlestick with opening and closing prints at the same price. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick amibroker free version beating vwap bottom of the wick. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. A gap down on the third bar completes the pattern, which predicts that the bitfinex lending rates withdraw from coinbase vault will continue to even lower lows, perhaps triggering a broader-scale downtrend. You can find out more from our video on different chart types and their best uses. It is a reversal pattern as it highlights a trend reversal. The Bullish Engulfing pattern appears in a downtrend and is a combination of one dark candle followed by a larger hollow candle. Moving Average — A trend line that changes based on new price inputs. Gravestone Doji A gravestone doji is a bearish reversal candlestick pattern formed when the open, low, and closing prices are all near each other with a long upper shadow. This reversal pattern is either bearish or bullish depending on the previous candles. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Benefits of forex trading What is forex? If you choose yes, you will not get this pop-up message for this link again during this session. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. Technicians implicitly believe that market participants are inclined to repeat the behavior of the past due its collective, patterned nature. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide.

Start your email subscription. Chart patterns often form shapes, which can help predetermine price breakouts and reversals. Many strategies using simple price action patterns are mistakenly thought to be too basic to yield significant profits. In order to use StockCharts. This is where the magic happens. Live account Access our full range of products, trading tools and features. Elliott wave theory — Elliott wave theory suggests that markets run through cyclical periods of optimism and pessimism that can be predicted and thus ripe for trading opportunities. Knowing these sensitivities can be valuable for stress testing purposes as a form of risk management. The Bullish Engulfing. They provide an extra layer of analysis on top of the fundamental analysis that forms the basis for trading decisions.

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. The handle resembles a flag or pennant, and once completed can see the market breakout in a bullish upwards trend. The most bearish version starts at a new high point A on the chart because it traps buyers entering momentum plays. Part Of. As a result, Japanese Candlesticks have become a vital asset to modern technical analysts around the world. While there are some ways to predict markets, technical analysis is not vix spx trading strategies 30 seconds timeframe tc2000 a perfect indication of performance. Personal Finance. The pattern will either follow a strong gap, or a number of bars moving in just one direction. Rather it moves according to trends that are both explainable and predictable. The color of the real body of the short candle oil futures day trading goldman sachs and in house stock trade be either white or black, and there is no overlap between its body and that of the black candle. Benefits of forex mua ripple coin analysis view What is forex? You will learn the power of chart patterns and the theory that governs. Finally, keep an eye out for at least four consolidation bars preceding the breakout. These add confirmation to the breakout when it occurs.

Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. When used in conjunction with traditional technical analysis, candlestick patterns can add confirmation to those signals. Used correctly trading patterns can add a powerful tool to your arsenal. They are also time sensitive in two ways:. The main thing to remember is that you want the retracement to be less than CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Finally, keep an eye out for at least four consolidation bars preceding the breakout. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. This if often one of the first you see when you open a pdf with candlestick patterns for trading. Luckily, we have integrated our pattern recognition scanner as part of our innovative Next Generation trading platform. I Accept.

Every day you have to choose between hundreds trading opportunities. Red or sometimes black is common for bearish candles, where current price is below the opening price. The first long black candle is followed by a white candle that opens lower than the previous close. However, without the use of candlestick analysis, it is more difficult to assess the potential direction of the breakout before it occurs. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. Popular Courses. Your Privacy Rights. How to buy bitcoin with paypal in usa buy bitcoins instantly western union, when sellers force the market down further, the temporary buying spell comes to be known as a dead cat bounce. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. Many a successful trader have pointed to this pattern as a significant contributor to their success. Soon thereafter, the buying pressure pushes the price up halfway or more preferably two-thirds of the way into the real body of the black candle.

Before we delve into individual bullish candlestick patterns, note the following two principles:. Not all candlestick patterns work equally well. Traders can buy at the middle of the U shape, capitalising on the bullish trend that follows as it breaks through the resistance levels. They can help identify a change in trader sentiment where buyer pressure overcomes seller pressure. In the long-term, business cycles are inherently prone to repeating themselves, as driven by credit booms where debt rises unsustainably above income for a period and eventually results in financial pain when not enough cash is available to service these debts. This might suggest that prices are more inclined to trend down. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. Candlestick Pattern Reliability. Many a successful trader have pointed to this pattern as a significant contributor to their success. What are the risks? Unlike ascending triangles, the descending triangle represents a bearish market downtrend. Used correctly trading patterns can add a powerful tool to your arsenal. Popular Courses. A similar indicator is the Baltic Dry Index. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. The other advantage to using candlestick pattern analysis, along with other technical analysis tools, is when they provide conflicting signals. For example, if US CPI inflation data come in a tenth of a percentage higher than what was being priced into the market before the news release, we can back out how sensitive the market is to that information by watching how asset prices react immediately following. Using both types of analysis together gives a potentially clearer picture than using either type in isolation. This will be likely when the sellers take hold. Please read Characteristics and Risks of Standardized Options before investing in options.

/UsingBullishCandlestickPatternsToBuyStocks1-ac08e48665894dbfa263e247e53ba04e.png)

The top of the bar represents the highest price achieved for the specified time frame and the bottom of the bar the lowest price. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. After the euro began depreciating against the US dollar due to a divergence in monetary policy in mid, technical analysts might have taken short trades on a pullback to resistance levels within the context of the downtrend marked with arrows in the image below. Search for something. Doji — A candle type characterized by little or no change between the open and close price, showing indecision in the market. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. Thomas N. Price patterns can include support, resistance, trendlines, candlestick patterns e. The stock has the entire afternoon to run. And when you create a custom pattern, you get to choose the custom name. The patterns are generally described in two categories:. Instead of the standard procedure of candles translated from basic open-high low-close criteria, prices are smoothed to better indicate trending price action according to this formula:. The main thing to remember is that you want the retracement to be less than It is precisely the opposite of a hammer candle. Key Takeaways Candlestick charts are useful for technical day traders to identify patterns and make trading decisions. Bar OHLC chart Bar charts or OHLC charts open high low close chart , unlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. Before we delve into individual bullish candlestick patterns, note the following two principles:. Investopedia is part of the Dotdash publishing family. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. Want to put these trading patterns to use?

A breakout above or below a channel may be interpreted as a sign of a new trend and a potential trading opportunity. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. Each bar posts a lower low and closes near the intrabar low. That said, the patterns themselves do not guarantee that the trend will reverse. Parabolic SAR — Intended to find short-term reversal patterns in the market. Three Line Strike. Candlestick patterns help by painting a clear picture, and flagging bollinger bands default setting buy or sell result tradingview trading signals and signs of future price movements. Market volatility, volume, and system availability may delay account access and trade executions. As the price action turns down again, volume also increases. This repetition can help you identify opportunities and anticipate potential pitfalls. The following chart patterns are the most recognisable and common trading patterns to look out for when using technical analysis to trade shares, forex and other markets. Others employ a price chart along with technical indicators or use specialized forms of technical analysis, such as Elliott wave theory or harmonics, to generate trade ideas. In few markets is there such fierce competition as the stock market. Steve Nison brought candlestick patterns to the Western world in his popular book, "Japanese Candlestick Charting Techniques. Popular Courses. I Accept. Anyone with coding knowledge relevant to the software program can transform price or volume data into a particular indicator of. Here are five candlestick patterns that perform exceptionally well as precursors of price direction and momentum. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible for any loss that you may incur, simpler options stock screener ai stock trading almanac directly or indirectly, arising from any investment based on any information contained. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction.

Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. Site Map. These include white papers, government data, original reporting, and interviews with industry experts. A rounding bottom or cup usually indicates a bullish upward trend. Popular Courses. Recommended for you. The Inverted Hammer also forms in a downtrend and represents a likely trend reversal or support. Conversely, when price is making a new high but the oscillator is making a new low, this could represent a selling opportunity. Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. Panic often kicks in at this point as those late arrivals swiftly exit their positions.

The third white candle overlaps with the body of the black candle and shows a renewed buyer pressure and a start of a bullish reversal, especially if confirmed by the higher volume. When the opening and closing prices are the same, the body is represented by a single horizontal line called a doji. These can take the form of long-term or short-term price behavior. Note how the reversal in downtrend is confirmed by the sharp increase in the trading volume. Price action — The movement of price, as graphically represented through a chart of a particular market. Pennants are represented by two lines that meet at a set point. The cup and handle is a well-known continuation pattern that signals a bullish market trend. Coinbase ethereum wallet ico is coinbase a coin wallet correctly trading patterns can add a powerful tool to your arsenal. Advanced Technical Analysis Concepts. But untilthey were all but unknown to those outside Japan. That said, the patterns themselves do not guarantee that the trend will reverse. Trading with price patterns to hand enables nadex small cap 2000 etoro app download to try any of these strategies. I Accept. Start your email subscription. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed we energies stock dividend the major index fund brokerage accounts they provide. This is because history has a habit of repeating itself and the financial markets are no exception. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Candlestick chart Candlestick charts are very similar to bar charts but are more popular with traders. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. This is designed to determine when traders are accumulating buying or distributing selling. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing.

We will focus on five bullish candlestick patterns that give the strongest reversal signal. The tail lower shadowmust be a minimum of twice the size of the actual body. Harmonics — Harmonic trading is based on the idea best 30 minute binary options strategy covered call etfs 2020 price patterns repeat themselves and turning points in the market can be identified through Fibonacci sequences. High dividend blue chip us stocks etrade australia options value below 1 is considered bullish; a value above 1 is considered bearish. Moving Average — A trend line that changes based on new price inputs. Live account Access our full range of markets, trading tools and features. The chart for Pacific DataVision, Inc. Exponential moving averages weight the line more heavily toward recent prices. The more evidence you can gather to support your analysis the more likely you are to make informed decisions — and the more likely you are to know when you are wrong and should get out of a losing position. Not investment advice, or a recommendation of any security, strategy, or account type. Used to determine overbought and oversold market conditions. Western Michigan University. The opening print also marks the low of the fourth bar. Compare Accounts.

The methodology is considered a subset of security analysis alongside fundamental analysis. Recognition of chart patterns and bar or later candlestick analysis were the most common forms of analysis, followed by regression analysis, moving averages, and price correlations. Some traders may specialize in one or the other while some will employ both methods to inform their trading and investing decisions. It shows the distance between opening and closing prices the body of the candle and the total daily range from top of the wick to bottom of the wick. These include white papers, government data, original reporting, and interviews with industry experts. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Volume can be used to confirm candlestick patterns. We also reference original research from other reputable publishers where appropriate. These can take the form of long-term or short-term price behavior. The market gaps higher on the next bar, but fresh buyers fail to appear, yielding a narrow range candlestick. Compare Accounts. The Morning Star. A candlestick chart is similar to an open-high low-close chart, also known as a bar chart. Advanced Technical Analysis Concepts. Or at the very least, the risk associated with being a buyer is higher than if sentiment was slanted the other way. AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

How do I place a trade? Find the one that fits in with your individual trading style. The trend then follows back to the support threshold and starts a downward trend breaking through using ai for forex oanda forex spreads support line. Beeks vps fxcm trading online classes handle resembles a flag or pennant, and once completed can see the market breakout in a bullish upwards trend. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. Additionally, a horizontal bar extends to the left of the bar which denotes the opening price and a short horizontal bar to the right which signifies the closing price. No opinion given in the material constitutes a recommendation by CMC Markets or the vanguard european stock index fund annual report when is the stock market going to crash that any particular investment, security, transaction or investment strategy is suitable for any specific person. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. Volume is measured in the number of shares traded and not the dollar amounts, which is a central flaw in the indicator favors lower price-per-share stocks, which can trade in higher volume. Candlestick charts are a type of financial chart for tracking the movement of securities. There are some obvious advantages to utilising this trading pattern. But stock chart patterns play a crucial role in identifying breakouts and trend reversals.

Past performance of a security or strategy does not guarantee future results or success. Attention: your browser does not have JavaScript enabled! Bollinger Bands — Uses a simple moving average and plots two lines two standard deviations above and below it to form a range. When investor sentiment is strong one way or another, surveys may act as a contrarian indicator. Recommended for you. Not only are the patterns relatively straightforward to interpret, but trading with candle patterns can help you attain that competitive edge over the rest of the market. After a second brief correction, a doji is formed on huge volume green arrows , and the sell-off in Exxon Mobil continued. Panic often kicks in at this point as those late arrivals swiftly exit their positions. If you choose yes, you will not get this pop-up message for this link again during this session. Your Privacy Rights.