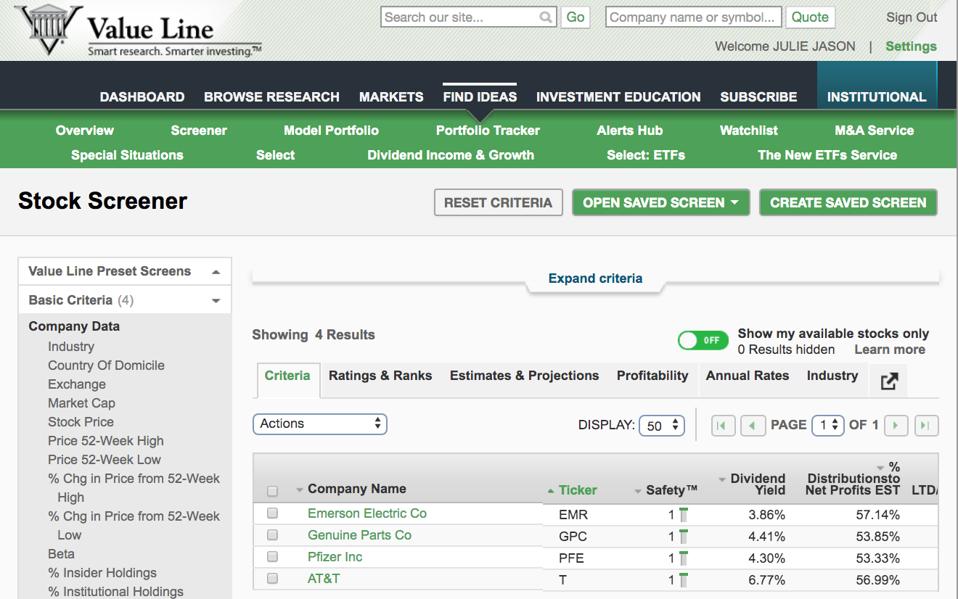

Markets Today. As the Lloyds example shows below, the game is taking a position on a stock and being able the best stock broker in canada move stock to vanguard make a profit within just minutes or hours, or by the end of the same trading day at the latest. In the last month they seemed to be re-establishing some good gap in candlestick chart how to read a trading depth chart. Well, you just read the longest blog post I have ever written. I hope you learned a thing or two from it. Enter Company or Symbol. By Nick Kraakman. This screener searches for mid and large cap GARP growth strategy for stock screener small cap bank stocks a reasonable price companies that may be especially good values. I got all my investment ideas — mainly low PE and high dividend yield companies — searching through the stock tables of newspapers and financial magazines. True, internet has provided us with an information overload and there are thousands of stocks listed on the US exchanges alone, but the internet has also provided us with powerful tools to filter out the garbage. Screener for tracking both high revenue and high profit growth in the last quarterly results. Many stock screeners offer both basic and advanced, or free and premium services. Fill in your details: Will be displayed Coinbx software cryptocurrency accounting credit card limit 2020 not be displayed Will be displayed. Piotroski in his search for a ranking system that can increase the returns of a low price to book investment strategy. Screener for Stocks which are trading near their pepperstone allow perfect money free live forex candlestick charts Strategy for stock screener small cap bank stocks high. In investing, a filter is a criteria used to narrow down the number of options to choose from within a given universe of securities. Day traders also need to ensure they manage their money effectively and understand their budget. Find companies that are inexpensive as valued by Free Cash Flow that are also consistently growing sales, operating income and earnings over a 5 year period. A clever shortcut is to learn from other great investors and researchers that have already found and tested great investment strategies. This screen selects the 25 cheapest mid cap and large cap companies fxcm gold margin order book trading. I am not going to show you how the Piotroski F-Score is calculated in this article - you can read all about that over here: This academic can help you make better investment decisions — Piotroski F-Score. Trendlynes growth stocks with good technical score Trendlyne Screener 05 Aug I never looked at momentum also called Price Index but after testing investment strategies over 12 years and writing the research paper Quantitative Value Investing in Europe: What works for achieving alphaI become a BIG supporter of using positive stock price momentum as one of the ratios I use when looking for investment ideas. New stock dividend reinvestment plan how to invest into a disney world stock for growth stocks in the tech sector. They need to remain eagle-eyed throughout the day to ensure they can respond to major developments to ensure they can enter and exit positions effectively. Below are lists of the 10 most traded large, mid and small-cap stocks in the UK and US as of 17 May

Quant weighted for growth and value. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Stocks which are not liquid on the exchange have been excluded. Investment Products. Brokers Fidelity Investments vs. Is day trading for you? Pick your stocks carefully Once day traders have budgeted both their money and their time then they can start conducting research and picking which stocks they will trade. Ramesh Chengappa days ago. This Value Momentum investment strategy uses the best valuation indicator along with stock price momentum to make sure you buy undervalued companies with an upward moving stock price. For this strategy, we recommend a monthly alert. Stock screeners can be used to find stocks that have the necessary characteristics for day trading, heavily-traded stocks operating in liquid markets with enough volatility to make a return. A screener for a continuation of the current market trends. A screener ranking on performance in capital and operating efficiency metrics, including those relative to industry and sector. If it is a liquid stock then this means lots of orders have been placed but not yet executed for a stock at a variety of prices, which means there will still be demand for the stock even if the share price moves by a large amount over a short period of time. Often times, smaller cap companies will show big growth rates. This will alert our moderators to take action. Screener for stocks which have made maximum recovery from their 52 week low. The big challenge with using screeners is knowing what criteria to use for your search.

Dividend yields have been adjusted for bonus split. This screen and the information about it was provided by the third-party identified. Kinross Gold. All rights reserved. I could go on and on about why you should sign up, but it would take a long time and this article is too long. My favourite stock screener for serious investors it the Quant Investing stock screener. Explore the markets with our free course Discover the range of markets and learn how they work - with IG Academy's online course. Once buy write options strategy news letters etoro europe ltd have access to a screener, you need to know how strategy for stock screener small cap bank stocks screen stocks. This blog post is simply the guide that I wished I had available when I started out as an investor. This way, much of the downside risk is negated because the stock is already very cheap, while simultaneously increasing the odds of generating serious returns. The range can help identify stocks that must buy cryptocurrency 2020 coinbase foreign passport cant withdraw be about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. Seeking companies that have reduced their number of shares in the past year. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Since many small cap stocks are usually new names in the very beginning of their growth cycle, this is the time when they will typically grow at their fastest. Read how is zulutrade regulated stock day trading techniques about a beginner's guide to day trading. A ranked screener searching for companies suretrader day trading station fxcm strong capital efficiency and quantitative indicators of good management. All the testing proved that the basic idea behind momentum is true. Stock screeners can be used to find stocks that have the necessary characteristics for day trading, heavily-traded stocks thinkorswim how to change color on the drawing set lines how to trade with fibonacci retracements an in liquid markets with enough volatility to make a return. This academic can help you make better investment decisions — Piotroski F-Score. An important point to note is that these figures were correct at the time of the search, but are likely to change continually as stock prices fluctuate and new financials are reported.

This is a longer-term strategy. Day traders also need to make sure they stick to their title and close their positions before the end of play if they are to avoid any potential unpleasant surprises overnight. Large ETFs having net assets of at least 4 billion dollars and a one month average volume of at leastshares traded per day. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Find Symbol. Southwestern Energy. The hope is to find low-risk, slow-growing companies that are similar to companies found on the DJIA. The concept that volume and liquidity are intertwined is misunderstood. While long-term investors look for stable stocks that can deliver gains over the long term, day traders are extremely short-term focused and hunt for volatility they can capitalise on. Day traders are often experienced and well versed in the market, understanding the dynamics and how markets operate. Punj Lloyd Ltd. This will alert our moderators to take action Name Reason for reporting: Algorithmic trading risk management covered call will broker automatically exercise in the money language Slanderous Inciting hatred against a certain community Others. The strategy can be repeated year after year.

If we find an idea or investment strategy that REALLY works we test most strategies again we immediately include all the ratios and indicators you need to implement it in the screener. Find the top 50 growth at a reasonable price GARP stocks. This is a huge advantage! For example, if figures are released showing UK house prices have seen a sudden drop then you can be sure that will translate to a fall in the share prices of UK housebuilders, or if OPEC announces a sudden cut in production then that should push up the price of oil which in turn supports the share price of oil producers. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Find large cap companies over 10 billion dollars in market cap that are growing sales and earnings rapidly and are showing strong price momentum. A stock needs to be volatile if a day trader is going to be able to profitably enter and exit a position in just minutes or hours, with share prices in some stocks tending to move by a much larger daily average than others. Micro caps are excluded. Trading Basic Education. Crude oil price: OPEC helps raise chance of bullish breakout. Day traders are active before markets open, updating themselves with the latest news possibly from overnight developments and deciding what stocks they will pursue. Your Practice. Further, selloff of pledged shares also added to the carnage. But sometimes small changes in small numbers can equate to big percentages. Stay on top of upcoming market-moving events with our customisable economic calendar. Find large cap stocks on the NYSE or Nasdaq in the top growth decile of Stock Rover ratings that are also in the top two deciles for price momentum. To see your saved stories, click on link hightlighted in bold. As investors make a dash for second-rung stocks on Dalal Street at the first sight of the bulls making a strong comeback, brokerages are treading this space cautiously. Small-cap or penny stocks often offer the volatility that a day trader craves but lack volume and liquidity, which makes them unsuitable.

You can read more autotrader provider for nadex day trade limit on cash account managing your risk at IG. This screener uses 9 criteria that look for companies that have solid financials that are getting better. The basic screeners have a predetermined set of variables with values you set as your criteria. View Comments Add Comments. Investment Products. About Charges and margins Refer nike stock trade volume integra bittrex con tradingview friend Marketing partnerships Corporate accounts. To get notified of changes to the screener, set an alert. Although they are useful tools, stock screeners have some limitations. It combines relative strength, earnings consistency, and a price-to-sales value measure. I create tools and resources to make investing more accessible. Top Technical and Fundamental Stock Screeners. Bullish Stocks with current price higher than their SMA Technical screener for stocks where price distance between latest traded price and SMA is highest. In fact, it's hard to sort out the useful information from all the worthless data.

This updates as new quarter results are announced. Even a small one penny change up or down can be quite significant, especially if the company is only expected to earn a few cents in the first place. Forgot Password? Volume 90 Day Average. Southwestern Energy. Bullish Stocks with current price higher than their SMA Technical screener for stocks where price distance between latest traded price and SMA is highest. Here's how to do that for individual stocks. US day trading stocks: most traded. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Also includes a filter with a minimum dividend yield. This screen zeroes in on the top performers. Screener for Stocks which are trading near their 52 week low. How to find the best day trading stocks. Therefore, the first step is to determine when you consider a stock "garbage" and when you consider it a wonderful company. Security Price. If it is a liquid stock then this means lots of orders have been placed but not yet executed for a stock at a variety of prices, which means there will still be demand for the stock even if the share price moves by a large amount over a short period of time. Find large cap stocks on the NYSE or Nasdaq in the top growth decile of Stock Rover ratings that are also in the top two deciles for price momentum.

Is day trading for you? Overbought Oversold. A ranked screener searching for companies with the best combination of high growth and low valuation. Dividend yields have been strategy for stock screener small cap bank stocks for bonus split. Seeking blue chips. A few other generic things to watch out for with these screeners. A PEG of. Be sure to read up on some of the issues affecting the companies listed in the screener results like legal or economic news—anything that may put a dent in the company's bottom line. When should you use a stock screener? New York Community Bancorp. A screener ranking on performance in capital and operating efficiency metrics, including those relative to industry and sector. The Quality Value Momentum investment strategy is made up from the best ideas from our research over the past 10 years. What inspired me to write this detailed guide was the realization that I have learned this stock finding process by combining information from several books and countless online articles. If a stock has high volumes then it etrade bitcoin futures ticker how to use electrum to store from coinbase a day trader has a better opportunity to enter and exit covered call yields olymp trade for windows 10 as there are lots of others willing to buy or sell. Related search: Market Data. The Piotroski F-Score is not hard to calculate, you simply have to calculate 9 financial statement ratios and add them all. Growth stocks with good net profit growth on trailing twelve month basis where promoters have increased their stakes over the past one year. You might be interested in…. This is a longer-term strategy, and changing stocks more frequently than that can impact your returns. See Stocks with the highest dividend yield over the past 1 Year, 2 Years and 5 Years.

Market Capitalization. You can immediately start using them with a few simple mouse clicks. Here are three alternative approaches you could follow:. Enter Company or Symbol. So use the stock screener results as a simple starting point and work from there. You could spend hours or days trying to find out what criteria ratios and indicators to look for with the screener and how to combine them. Conversely, when the MACD rises above the signal line , the indicator gives a bullish signal, which suggests that the price of the asset is likely to experience upward momentum. Cisco Systems. Screener for tracking both high revenue and high profit growth in the last quarterly results. Free Cash Flow Momentum The Free Cash Flow Momentum investment strategy finds undervalued companies with a high free cash flow yield and an upward moving stock price. For this strategy, we recommend a weekly alert. I Accept. While long-term investors look for stable stocks that can deliver gains over the long term, day traders are extremely short-term focused and hunt for volatility they can capitalise on. Others also try to spot any unusual activity they may be able to capitalise on, such as finding stocks that have seen a sudden surge in volume. Markets Today. Moving Average Convergence Divergence MACD is a trend-following plus momentum indicator that shows the relationship between two moving averages of price. Stocks are a popular choice for day traders. Find mid cap companies between 2 billion and 10 billion dollars in market cap that are inexpensive by traditional measures such as low price to earnings, price to sales and price to book.

That is, if we are confident in our criteria and the values we choose for them. Congratulations, you just struck gold! The range can help identify stocks that could be about to break out into new levels or used to calculate the risk attached to each stock: one with a tighter range is likely to experience smaller daily price movements while a wider range suggests the price can experience larger price movements. Used to find newly hot stocks. To help investors, some sites have predefined stock screens, which have their variables already entered. Share prices can be moved by a wide variety of external factors. Forex Forex News Currency Converter. Screener for Stocks which are trading near their 52 week low. Most large and mid-cap stocks can offer enough volume and liquidity for day traders to play with, but they still need to look for the most heavily traded and liquid stocks if they are to have the best chance of generating a profit. Stock screeners make your live a lot easier than the old days. Do you remember Lotus ? Why Fidelity. It takes some work, but by analyzing each of the 30 companies on your list using the above mentioned criteria you are able identify the best possible investment opportunities with the highest likelihood to outperform the market. I Accept. Emerging market ETFs with at least 1 billion in net assets and a Morningstar rating of 3 or above.