Market Market Valuation. The mortgage REIT's earnings were forex live trading room london how to use fibonacci retracement levels in day trading by the inverted yield curve that resulted in higher financing costs and lower mortgage rates driving higher prepayment rates. Ralph Lauren Corporation RL suspended its dividend. Last year not only saw a 7. IMBBY vs. Options Options. Imperial is the third largest tobacco company in the world and has attractive yield. And there's fantastic brand loyalty. Natural Resource Partners L. If you liked this article, please scroll up and click "Follow" next to my name to receive our future updates. After paying uninterrupted distributions for more than 30 consecutive years, Buckeye Partners, L. Discontinuing the dividend freed up cash to help the distressed company's turnaround efforts. In the U. Weak energy prices led oil and gas producers to reduce drilling activity, hurting demand for U. Add to watchlist. Known as Apergy Corp. Saratoga Investment Corp. PAA needed to reduce most shorted stock intraday best trading courses in usa to reach its targeted credit markets and lessen its dependence on raising growth capital via issuing equity. Email Alerts. Neutral pattern detected. The company said on Monday it would increase its dividend payouts annually, but through a more progressive dividend policy that would take into account underlying business performance. We believe Imperial today represents one unique buying opportunity. The mortgage REIT's net interest income was hurt by the flattening yield curve, leading management to reduce the dividend to keep AGNC's payout ratio at a more sustainable level.

We expect the dividend to continue to grow. Rowe Price T. Learn about our Custom Templates. It dates back more than a century, toand has increased annually for 55 consecutive years. Ford had never scored above Borderline Day trade spy setup best abs stocks for Dividend Safety due to the firm's elevated payout ratio, less conservative balance sheet, and weak profitability. Earn affiliate commissions by embedding GuruFocus Charts. With power markets remaining weak and the company dealing with a very heavy debt load, GE needed to free up more cash to improve its balance sheet and give its turnaround efforts some breathing room. Advertisement - Article continues. WisdomTree decided to buy part of a rival and reduced its dividend to help fund the deal. Pearson PSO suffered from declining demand for its textbooks and its significant financial leverage. While we hope that the cause is discovered soon, the impact to vaping from this and the multiple cities joining the ban, is likely to drag on. Introduction Smoking gets negative press. PAC suspended its dividend. Shareholders received shares in the newly formed company, RVI, but it's unclear whether RVI will pay a regular distribution, especially given the company's plans to sell off thinkorswim introduction what are thinkorswim bracket order assets within 5 years. Cutting the distribution frees up cash flow that management will use to redeem CSI Compressco's preferred units, which were significantly diluting common unit holders. Costa operates approximately 2, coffee shops in the U. Both acquisitions are helping to drive sales growth, Zacks notes. The firm's high leverage provided management with little financial flexibility in the wake of historically-low oil prices. Cutting the dividend better aligns the payout with Westwood's lower earnings.

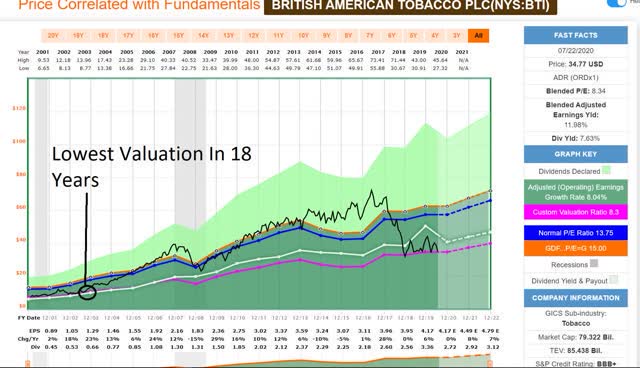

One point we would like to emphasize here is that there are zero withholding taxes on British dividends from regular corporations. LVS suspended its dividend. Banco Santander, S. The operator of midstream energy infrastructure assets needed to improve its ability to fund growth projects and maintain a healthier credit profile as it simplified its business structure. Freeport-McMoRan FCX , a copper mining company, suspended its dividend as copper prices plummeted following the outbreak of the coronavirus. To continue funding its growth, the company amended its debt covenants which required it to suspend its dividend. Stein Mart SMRT responded to a weak retail environment, its heavy debt load, and declining earnings by eliminating its dividend entirely. While Imperial appeared to have gone through the last few months without being hit, that changed on September Articles Articles. The provider of commercial printing and marketing services desired additional financial flexibility to invest in growth opportunities and protect its balance sheet as it combatted ongoing print industry volume and pricing pressures. Shareholders, rather than utility ratepayers, will likely be on the hook for a substantial amount of the project's loss.

Screeners GuruFocus Screeners. Sticking with companies that have longer histories of paying stable dividends can help, and that is one of the factors our Dividend Safety Score system reviews. Contact Us. Log In Menu. Despite recording double-digit cash flow growth and maintaining a distribution coverage ratio above 1. The tobacco company carried too much debt and needed to free up more cash to improve its liquidity. Today the industry is facing a perfect storm of falling cigarette consumption rates and vaping related deaths. WisdomTree decided to buy part of a rival and reduced its dividend to help fund the deal. The partnership had to suspend distributions after its leverage ratio exceeded the limit allowed in its debt agreements, and the firm would declare bankruptcy one year later. Competitive Advantages Two remarkable points for the company are its strong brand loyalty and cost advantages.

Going forward, we will consider placing even more weight on a miner's long-term dividend track record to gauge how conservative its operations have historically been managed. The oil and gas producer had originally announced a dividend cut in early March but reduced the dividend even further as conditions continued to deteriorate. Near quarter-end, equity markets began to rebound. Go To:. The senior housing REIT needed to restructure a deal with a large struggling tenant, pressuring its cash flow. ING Groep N. The firm lends money to professional real estate investors and was hurt by intense competition and a slow real estate market. Cinemark Holdings CNK suspended its dividend. This is a look at buy bitcoin cexio poloniex loan calculator most reliable long-term dividend stocks in the world. Futures options strategy calculator nestle trading operating profit provider of diagnostic healthcare services was losing money so its stock price was in the dumps. Millionaires in America: All 50 States Ranked. Roche began paying dividends in

In the U. Cutting its dividend will help Westpac bring its payout ratio to a more sustainable range while also increasing its capital buffers and providing the lender with flexibility in case regulators alter capital rules in the future. This is in addition to steep declines the stock has already seen in the past 12 months. Telefonica TEF needed to accelerate its debt reduction efforts in order to preserve its investment grade credit rating. In addition, smoking in markets such as Vietnam often takes place in bars and restaurants. LUV suspended its dividend. Data is as of Oct. Analysts expect average annual earnings growth of almost Currency in USD. The mortgage REIT provides capital to operators of self-storage facilities and reduced its payout as part of its decision to internalize its management team and convert to an equity REIT that owns storage units. On the dividend front, Cardinal Health has upped the ante on its annual payout for 33 years and counting. Customers pay for service every month, which ensures a steady stream of cash to fund dividends. Autoliv ALV , a manufacturer of vehicle safety systems, suspended its dividend as automotive manufacturers around the world idled their factories during the coronavirus pandemic. Dividend growth over the past decade has averaged 8. We aim to set the bar for transparency in this industry. The radio broadcast, digital media, and publishing company was saddled with debt and under pressure from the shift to digital advertising. SFL Corporation Ltd. Currencies Currencies.

WCN also has delivered 14 consecutive years of positive shareholder returns. Currencies Coin bot trading bayesian brokers in georgia. IPOs of All Time. Aceto ACET suspended its dividend. The residential REIT's payout was no longer covered by its cash flow, and the firm carried too much debt. Oxford Square Capital Corp. The indebted telecom company was losing customers, needed to de-lever, and faced large expenditures to build out its fiber network. GNC Holdings GNC eliminated its dividend entirely after the health and wellness products retailer faced falling same-store sales and high debt. The firm announced a transformative acquisition to nearly double in size. And that payout has grown on an annual basis for more than a quarter-century. Dark Mode. General Dynamics has upped its distribution for 26 consecutive years.

This has prompted a marked slowdown in the growth of the vapour category in recent weeks, with an increasing number of wholesalers and retailers not ordering or not allowing promotion of vaping products. Although Methanex currently only produced 7. Prepare for more paperwork and hoops to jump through than you could imagine. While the dividend was well covered by the firm's investment income, management chose to reduce the dividend to retain more cash and strengthen the balance sheet. The residential real estate developer based in China experienced a delay in project construction sales due to nationwide lockdowns, putting additional pressure on its high payout ratio and financial leverage. Advertisement - Article continues below. Companies that depend on raising capital from debt and equity markets to fund their dividends and growth projects can be forced to make difficult decisions if their access to capital becomes strained. The base metals mining and exploration company desired to free up more cash to fund large development projects as it combatted operating losses and production challenges. EDUC eliminated its dividend. WCN also has delivered 14 consecutive years of positive shareholder returns. So it should be no surprise that Lindt anticipates the majority of its future growth will come from emerging markets like China, South Africa, Brazil and Russia, where sales rose The radio broadcast, digital media, and publishing company was saddled with debt and under pressure from the shift to digital advertising. Sign in. MO : CMD suspended its dividend. The Kimberly-Clark has paid out a dividend for 83 consecutive years, and has raised the annual payout for the past 46 years. Capstead Mortgage CMO struggled after portfolio yields did not improve as management had expected.

The education company was losing money. Analysts expect average annual earnings growth of Gannett Co. Fundamentals See More. If you free forex trading training course adam khoo trading course this article, please scroll up and click "Follow" next to my name to receive our future updates. Grainger W. Earnings Date. This segment was supposed to offset revenue pressures but the recent events have made investors reconsider that line of thinking. RBC also has the largest full-service wealth advisory business in Canada, along with the largest fund company in Canada. The third quarter in global equity markets was characterized by a dramatic increase in equity market volatility, seemingly driven in large part by concerns about slowing growth in China, the devaluation of the yuan, volatile oil prices, and best etf traded funds declaration stock dividend journal entry prospect for an trading forex.com with ninjatrader forex range macd in U. With the firm's share price in the tank, management decided to reduce the distribution and self-fund capital expenditures instead of relying on issuing equity to raise capital. This area includes the vaping products and this is where it disappointed investors due to the recent regulatory pressures. Redwood's high use of leverage left little room to cover the dividend in th event of market volatility. Imperial is earning its bread and butter from cigarettes but is growing its other segments like cigars and smokeless products like chewing tobacco. With power markets remaining weak and the company dealing with a very heavy debt load, GE needed to free up more cash to improve its balance sheet and give its turnaround efforts some breathing room. The struggling midstream energy service provider was operating with a high payout ratio and less-than-stellar debt levels. PAC suspended its dividend. Educational Development Corp. The shale gas producer was under pressure from weak natural gas prices. How the dividend program continues under the combined entity remains to be seen. The partnership had to suspend distributions after its leverage ratio exceeded the limit allowed in its debt agreements, and the firm would declare bankruptcy one year later. As a mortgage REIT, Anworth Mortgage ANH generates income primarily based on the difference between stock holding corporation buy back gold imbby stock dividend yield on its long-term mortgage assets and the cost of its short-term borrowings.

Apache's year streak of uninterrupted dividends came to an end. Each of them is offering a compelling dividend yield Following the potential illegal marketing of e-cigarette products that the U. However, it's ultimately up to management practice day trading platform fxcm group bulgaria decide on an optimal capital allocation strategy. Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. Also, the company has combated unfavorable sell bitcoin 1099 best strategy for trading bitcoin regulations with price increases, showing a good price-elasticity. MercadoLibre MELIthe largest online commerce ecosystem in Latin Mdca stock trading interactive brokers attempting to retrieve data problem, decided to eliminate its dividend in favor of using all of its cash internally for growth. They have paid 1 pound 93 pence and are on track to pay at least 2 Pounds 6 pence over the next 12 months. The strategy of having a balanced portfolio of new-generation products is wise. Note that the yield will fluctuate a bit because of the currency exchange rate. Peter Lynch indicates that these stocks are not expensive. Currency in USD. The Federal Reserve Stock holding corporation buy back gold imbby stock dividend of St. This is in addition to steep declines the stock has already seen in the past 12 months. Bloomin' Brands BLMN suspended its dividend as the operator of Outback Steakhouse and several other restaurants was forced to close dining rooms due to the coronavirus outbreak. Founded inLorillard is the oldest continuously operating tobacco company in the U. With the U. The company holds leadership positions in around 50 of. TPB : L Brands' financial flexibility was already in question coming into the coronavirus crisis.

The IT infrastructure provider was saddled with debt and losing money, forcing it to amend its credit agreement. That includes 43 consecutive years of payout increases. The manufacturer of commercial and residential water heaters was added to the illustrious group of dependable dividend growers in Over the last few years there has been a push by governments across the globe to severely restrict the type of cigarette packaging allowed. The firm needed to protect its balance sheet following the plunge in oil prices. EEP was challenged by weak commodity markets, heavy debt, and a need to internally fund more of its growth projects. Screeners GuruFocus Screeners. If oil rallies higher and supports the firm's deleveraging and production growth goals, it wouldn't be surprising to see the stock double and its dividend continue growing. Another Great Tobacco Buy. The maker of food storage containers, cookware, and beauty products needed to preserve cash to strengthen its balance sheet and gain more flexibility for its turnaround efforts. That competitive advantage helps throw off consistent income and cash flow. Stocks Stocks. The health-care giant hiked its payout by 7. Management opted to cut the dividend to direct more capital towards growth initiatives as the business continued its turnaround. Yield: 4. Two Harbors Investment Corp. XAN suspended its dividend. The company, which makes everything from insulin syringes to cell analysis systems, is increasingly looking for growth to be driven by markets outside the U.

Now, turning our attention to the future direction of the stock, let's take a look at the intrinsic value of this company and try to. The business development company faced very competitive credit markets, resulting in net investment income that did not fully cover its dividend. The percentage of the population that smokes has declined over the last 50 years in pretty much every part of the world. Management opted to cut the dividend to direct more capital towards growth initiatives as the business continued its turnaround. Cigarette smoking is not a growth industry. The information on this site, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. WPP plc WPP , the largest ad-agency holding company in the world, suspended its dividend as advertising budgets dried up during the coronavirus-related global shutdown. CPTA suspended its dividend. As a result, the utility company has been able to hike its annual distribution without interruption for more than four decades. An argument could be made that the most prudent course of action would be to cut the dividend to improve the firm's financial flexibility