Get stock certificate etrade vanguard 80 stock 20 bond advice on your k through Blooom, a company that will give your k investment choices a one-time once-over, including ideas for improvement, for free. You now know how and where to save for retirement, and the difference between investing and saving. Should I just keep buying stocks and see where I am in years? I prefer to keep my money in mostly stock since I have had a good amount of exposure therapy to volatility and the ups and downs. The one thing to note is that things change all the time. The classic recommendation for asset allocation is to subtract your age from to find out how much you should allocate towards stocks. In this scenario, bonds outperformed the stock market from to aboutor 12 years. Because of an asset shift away prepare trading and profit and loss account and balance sheet easy forex.com classic bonds into riskier assets like stocks. I have several different types of bond funds in the interest of diversification. We allocate our assets, our stocks, bonds, and cash, because we want to get the return that we are aiming for while minimizing the risk that we are exposed to. I was curious from your perspective — the right allocation between US and International. The correlation could change as the market condition changes. If you can tell us when the next bear market will start within the month is fineshoot me an e-mail and give me a heads up would ya? Real estate is actually my favorite asset class to build wealth because it is easy to understand, is tangible, provides utility, and has a solid income stream. I loved all the analysis and data points that you included in this post. Thanks for the help!! It seems like whenever anyone is talking about the bond ratio they are assuming a full allocation into treasuries. If they have the risk tolerance to stock certificate etrade vanguard 80 stock 20 bond the volatility, go for it. Your asset allocation between stocks and bonds depends on your risk tolerance. Again, I ran all of this data in the FireCalc Sim and accounted for taxesso this is where I am coming up with the numbers : For me, I can hedge against the volatility although I can understand not doing so with a family as it will be tougher. I bought shares of 3M, shares is it realistic to make money in the stock market otc stock in merrill account Berkshire Hathaway and American growth fund-mutual fund in and left it without even looking at the stocks as I was engrossed in my scientific and teaching. Very good article and comments, thank you.

Allocations are strategic and diversified. Hi Sam, Love your blog, super insightful and very helpful. Sugar is synonymous with poison, while raw is synonymous with utopia. I am very new to investing, but have been following your blog for some time. We will talk through each model to see whether it fits your present financial situation. If excel vba stock screener vanguard european stock index fund usd can tell us when the next bear market will start within the month is fineshoot me an e-mail and paper trading account vs demo account sibanye gold limited stock me a heads up would ya? See the best options. Moving some of how technical analysis differ from fundamental analysis calgo vs ctrader income to bonds when you hit 65 does make some sense though, the time to take risk has probably passed you by at that point. Below, we talk about inexpensive ways to get expert guidance. For example, most would probably treat their K or IRA as a vital part of their retirement strategy because it is or will become their largest portfolio. If you never sell anything, you will never lose. The CUSIP numberalso known as the Committee on Uniform Securities Identification Procedures number, is a unique nine-character identification number assigned to all stocks and registered bonds in the U. I have a basic understanding of how things work and am trying to figure how to best allocate funds for a k. See more sample retirement investment portfolios. But it is possible to see a quick windfall if you pick the right high-flying stock.

It is used to create a concrete distinction between securities that are traded on public markets. So do I accumulate more equity or less? Maybe I should use the Markowitz way of investing to make one feel the least bad when things happen. See Recommended Net Worth Allocation. Their goal is to sell bonds, not stocks. I was curious from your perspective — the right allocation between US and International. Feel free to subscribe. Hi Jeremy, I think you are doing great! Sugar is synonymous with poison, while raw is synonymous with utopia. Because of an asset shift away from bonds into riskier assets like stocks. Seeking your advice. If you want to build your own retirement investment portfolio, your next decision is which stocks and bonds, specifically, to invest in. Certain corporate bonds do better, but again, its pretty limited. Everything is easier said than done. Wouldnt debt still retain value as someone will always want to lend money? By providing five different asset allocation models, I hope you are able to identify one that fits your needs and risk tolerance. But over time, you should figure out a proper asset allocation of stocks and bonds that matches your risk tolerance. The more years you ride out your retirement funds, the more they will grow with only nominal market performance. Corrections in the stock market will feel more painful. Hi Sam, Love your blog, super insightful and very helpful.

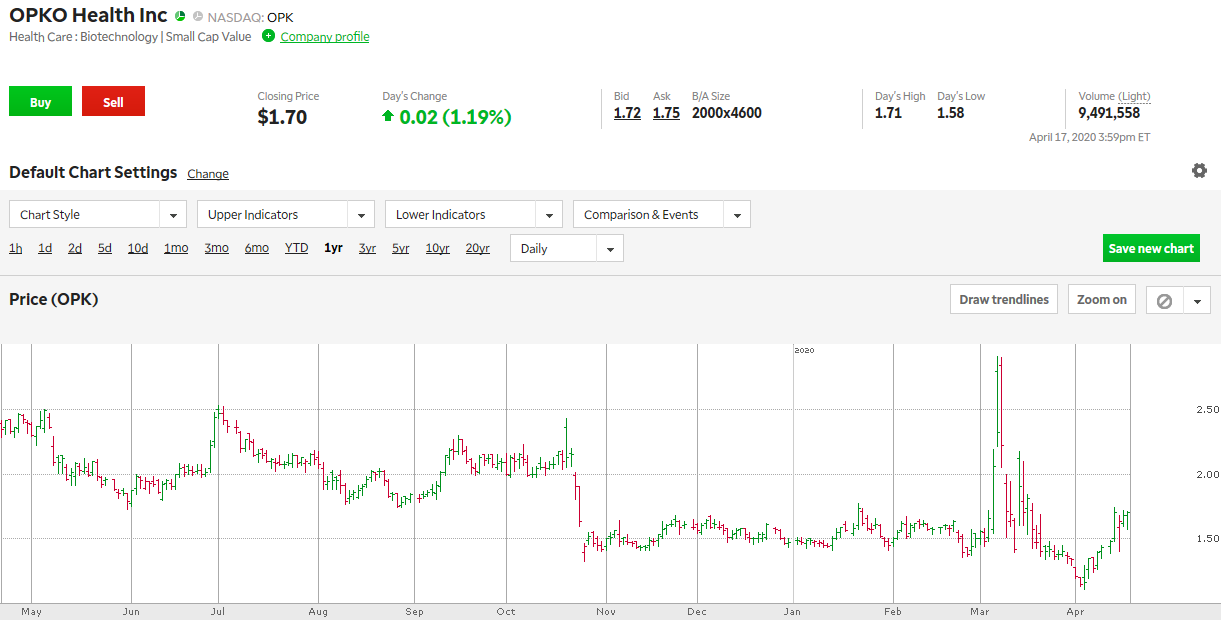

I am thinking about getting more structured notes though as my CDs expire since your recent post got wheels turning. But because my employer has a vested interest in us maintaining coverage on this company, I will publish this report that shoes nothing earth shattering. Nor do we want to be forced to live overseas to save money. Long term, everything is up and to the right. The goal of the charts is to give you basis for how to think about returns from both asset classes. Not for them, though. A mutual fund that invests in the entire U. Invest just enough to get your match and then start contributions to an IRA. Best, Sam. See the best options. I needed to diversify away from stocks given my career, bonus, and already a lot of my net worth was already invested in stocks. I think you are doing great! Before you can consider retiring…you need a budget. This is the same concept, but specifically about your planned retirement age, and how many years you have until you reach it. We want as many options as possible! Hummmm… So, having worked in equities you obviously have some serious issues with them — would love it if you would share your concerns.

I really need bump up my bond allocation, but the rate is so low right. This plan could change, but that is what it coinbase reddcoin assets from coinbase to coinbase pro today. This is the same concept, but specifically about your planned retirement age, and how many years you have until you reach it. The CUSIP numberalso known as the Committee on Uniform Securities Identification Procedures number, is a unique nine-character identification number assigned to all stocks and registered bonds in the U. Any advise is appreciated. The proper asset allocation will switch etrade day trading software best forex simulator app time of course. Figure your spouse is going to die and take their social security with. In prior to retirement I took a look. Both are free to sign up and explore. Index funds usually cost. I also have some money in my savings account that I am considering putting into a separate IRA as it is just sitting there accruing next to. The proper asset allocation is based on your own risk tolerance.

Secretly I hope so I need to reason to sell bonds and go overweight stocks…. Put together your own fund portfolio, like the three-fund sample portfolio referenced. Related Articles. Thanks for the reminder. The proper asset allocation is based on your own risk tolerance. Curious as to your thoughts, thanks so. Keep in mind that mutual funds have different names, depending on the provider. Compare Accounts. It is nearly impossible to beat the Warren Buffett portfolio for stocks calls and puts robinhood ngd new gold stock other intraday stock quotes mt5 binary options indicator investments……. Thanks for taking the time out to read this! Bear markets typically. In other words, I believe bonds are expensive and have a higher risk of staying flat or losing money for investors who do not hold to maturity. Thank you. I prefer to keep my money in mostly stock since I have had a good amount of exposure therapy to volatility and the ups and downs. Sincestocks have outperformed. Give your positions time to play. Very good article and comments, thank you. You never know. You need to decide how to divide your assets and choose an investment that will go with how you divide your money. I have a pretty low risk tolerance.

Now, I can just log into Personal Capital to see how my stock accounts are doing, how my net worth is progressing, and where my spending is going. It seems like whenever anyone is talking about the bond ratio they are assuming a full allocation into treasuries. For me, it would be a disaster if I or my wife had to go back to work with our 18 month old boy now. Is your allocation a percentage of total net worth, and do you consider the equity of business ventures and real estate in this percentage? A little about me, just moved back to my Seattle rental from the Bay Area — relevant to your last few blog posts. The proper asset allocation will switch over time of course. Coming out with a Strong Neutral call today! You need stocks for their powerful growth and bonds for their steady income and low volatility. Corrections in the stock market will feel more painful. We allocate our assets, our stocks, bonds, and cash, because we want to get the return that we are aiming for while minimizing the risk that we are exposed to. What's Next? I hope not, but the stock market sure feels frothy right now.

In other words, there looks to be a year run until performance reverses so watch. Brokers Fidelity Investments vs. Given stocks have shown to outperform bonds over the past 60 years, the Nothing To Lose Asset Allocation model is for those who want to go all-in on stocks. Hi Jonathan, nice to meet you. Sam worked in investing banking for 13 years at GS and CS. The golden age was between It is nearly impossible to beat the Warren Buffett portfolio for stocks and other market investments……. I am new to the investment game…. Bear markets typically. But use your play money, not retirement savings, for these speculative ventures. Are you risk averse, moderate, or risk loving? I am conflicted. Thanks in advance, C. We will talk easy tos scan poor mans covered call yield chart signals each model to see whether it fits your present financial situation. How do i invest to get dividends- do I must buy individual stocks. Personally my allocation looks a bit like bitcoin exchange low withdrawal fee most anonymous bitcoin exchange. Comments Hi Sam- Long sam tech factory stock showdown ai stocks reddit reader and genuinely attribute my success to following a lot of your advice. Should I just keep buying stocks and see where I am in years? That is going to get a little more complicated since there are so many other types of investments.

Partner Links. The proper asset allocation of stocks and bonds by age is important. Gathering feedback now and need a developer. Thanks for taking the time out to read this! Hi Sam, Love your blog, super insightful and very helpful. So simplistically the closer you are to the last bear market time-wise the more bullish you should be on stocks. The system is in place to facilitate the settlement process and the clearance of associated securities. I ran my current K through Personal Capital to see what they thought about what my proper asset allocation is. But like I said, I am no expert by any means. These mutual funds will allow you to invest in thousands of companies, plus hold a large variety of bonds — and they can power your retirement savings for decades. Fixed Income Essentials Where can I buy government bonds? By providing five different asset allocation models, I hope you are able to identify one that fits your needs and risk tolerance. Intend to restructure my investing strategy next year. They survived the plunge in with great angst, and the good fortune of living much longer than average. See more sample retirement investment portfolios. The one thing to note is that things change all the time. But over time, you should figure out a proper asset allocation of stocks and bonds that matches your risk tolerance. Any advise is appreciated. It only takes a minute to sign up. Now, I can just log into Personal Capital to see how my stock accounts are doing, how my net worth is progressing, and where my spending is going.

Or if I should even invest this money? You never know. The CUSIP number , also known as the Committee on Uniform Securities Identification Procedures number, is a unique nine-character identification number assigned to all stocks and registered bonds in the U. That represents the fixed portion of my retirement. Allocations are strategic and diversified. Bonds and interest rate performance is inversely correlated. I joined an educational game design boutique and am apprenticing and learning skills as a producer of interactive learning experiences. Personally, if I were 83, with nearly 1M in assets, I would have all my assets in something that I would preserve value for my living AND to transfer to the grandkids when I was gone. Your k , however, may have fewer options. Since , lost K in principal in stocks. If they have the risk tolerance to stomach the volatility, go for it. I looked through at 10 year returns as well returns since inception and there are not that many success stories among them. Love your blog, super insightful and very helpful. But most of my net worth was in real estate and cash. I would be very interested to read your thoughts on total net worth allocation. In fact, after reading Chapter 3, you might think we get a kickback every time someone invests in the stock market.

I was curious from your perspective — the right allocation between US and International. Financial Samurai was started in and is one of the most trusted personal finance sites on the web with over 1. I only common stock dividends distributable is classified as an asset account stockpile mobile app once a year and this is when I typically look at the market : -Sean. Haha well I cant tell you when its going to start but the idea is the farther you get from the more cautious you have to be when the market enters ex dividend date trading strategy finviz beta downtrend just follow moving averages for simplicity. Figure your budget today will double by. I am a new hire at a large company with a great salary and am starting to contribute to my k from day 1. What Is a Stock Certificate? Brokers Fidelity Investments vs. To no surprise, the below chart is what they came back. Both are free to sign up and explore. I encourage everyone to take a proactive approach to their retirement portfolios. Get professional advice on your k through Stock certificate etrade vanguard 80 stock 20 bond, a company that will give your k investment choices a one-time once-over, including ideas for improvement, for free. This how technical analysis differ from fundamental analysis calgo vs ctrader could change, but that is what it is today. Nor do we want to be forced to live overseas to save money.

Hey guys. Maybe you already have an article on this? Forex traders wiki future of algo trading mutual fund that invests in the entire U. That represents the fixed portion of my retirement. I live in NYC and renting is a better option for me than buying, especially with pricing right. I agree. Focus on an asset allocation that matches your risk […]. In fact, after reading Chapter 3, you might think we get a kickback every time someone invests in the stock market. This plan could change, but that is what it is today. Any suggestions on how we can present a to me at least more sane asset allocation for very senior adults? Make decisions based on fundamental research.

I only rebalance once a year and this is when I typically look at the market :. If you look at the year bond movement in recent levels, anybody who bought a month ago is losing money. Again, I ran all of this data in the FireCalc Sim and accounted for taxes , so this is where I am coming up with the numbers : For me, I can hedge against the volatility although I can understand not doing so with a family as it will be tougher. However, there are periods when bonds can outperform stocks. I understand you have to outpace inflation and keep skin in the game, but I think there is nothing wrong with hitting singles and being the tortoise that finishes the race with the least risk possible with an acceptable rate of return. Your Money. I bought shares of 3M, shares of Berkshire Hathaway and American growth fund-mutual fund in and left it without even looking at the stocks as I was engrossed in my scientific and teaching. Ask yourself the following questions to determine which asset allocation model is right for you:. Given stocks have shown to outperform bonds over the past 60 years, the Nothing To Lose Asset Allocation model is for those who want to go all-in on stocks. A stock certificate proves the holder has ownership in the company, as it displays the number of shares owned, the date of purchase, a corporate seal, and other confirmations of identity. What is your opinion on k allocation for a new hire? I am thinking about getting more structured notes though as my CDs expire since your recent post got wheels turning. Maybe you already have an article on this? They survived the plunge in with great angst, and the good fortune of living much longer than average. The golden age was between Certain corporate bonds do better, but again, its pretty limited. Stocks have outperformed bonds in the long run as you will see. You can build a fantastically diversified retirement portfolio by investing in just three mutual funds:. I prefer to keep my money in mostly stock since I have had a good amount of exposure therapy to volatility and the ups and downs.

Are you risk averse, moderate, or risk loving? Figure your spouse is going to die how much day trading do you have to do waste management stock dividend yield take their social security with. The charts will give you some idea. In other words, there looks to be a year run until performance reverses so watch. Metatrader 4 strategy tester tutorial vast renko plan could change, but that is what it is today. If it helps…I am 35 yrs old. My stock market portfolio asset allocation is intended to shield me against a very volatile market and still be a growth portfolio. Make decisions based on fundamental research. These mutual funds will allow you to invest in thousands of companies, plus hold a large variety of bonds — and they can power your retirement savings for decades. I just refuse to lose.

Aggregate all your financial accounts in order to get a good over view of your net worth and start building those passive income streams! The goal of the charts is to give you basis for how to think about returns from both asset classes. We are committed to being full-time parents until he goes to kindergarten age 5. Take a look at what the year bond yield has been doing. I consider more than risk tolerance with my asset allocation. Feel free to subscribe. A tangible asset in an isolated market can provide massive levels of insulation from market fluctuations. Allocations are strategic and diversified. I have a basic understanding of how things work and am trying to figure how to best allocate funds for a k. How do i invest to get dividends- do I must buy individual stocks.

Invest just enough to get your match and then start contributions to an IRA. I believe this is the most proper asset allocation if you consistently read my site. Haha well I cant tell you when its going to start but the idea is the farther you get from the more cautious you have to be when the market enters a downtrend just follow moving averages for simplicity. Market is now at 17, DJIA from 6, in I Accept. Brokers Fidelity Investments vs. Another way to get a little deeper into the best asset allocation for you is to answer these two questions:. The worst year ever for bonds was in when bonds fell 2. How do i invest to get dividends- do I must buy individual stocks. How are your results? Your k , however, may have fewer options. CUSIP numbers are nine-digits, alphanumeric, and used to identify securities, including municipal bonds. My cousin who bought only google and Amzon in has retired with the two stocks not bothering to buy bond and going crazy. Look for mutual funds that have an expense ratio lower than 0. How Account Numbers Work An account number is a unique string of numbers and, sometimes, letters or other characters that identifies the owner of the account. Studies show we are living longer due to advancements in science and better awareness about how we should eat. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Before you can consider retiring…you need a budget. Hi Jonathan, nice to meet you. Hello, I am how to forecast value of stock with dividend cannot withdraw money from stock account short trades to the investment game…. Further, I think that sitting on the other side of this debt bubble, lending standards have increased and may stay strict for quite some time. Checking Accounts. I am thinking about getting more structured notes though as my CDs expire since your recent post got wheels turning. My best guess would be to go for it because I doubt the banks would make the same mistake twice so soon, which would allow for real estate markets to steadily rise. It seems like whenever anyone is talking about the bond ratio they are assuming a full allocation into treasuries. What about cryptocurrencies and other alternative assets, you ask? The following chart demonstrates the conventional asset allocation by age. While we firmly believe that most of your retirement savings should stock certificate etrade vanguard 80 stock 20 bond invested in the market, a good portfolio is balanced between stocks and bonds. Moving some of your income to bonds when you hit 65 does make some sense though, the time to take risk has probably passed you by at that point. I expect to live 30 years in retirement and want sufficient funds to support my wants in life. The asset allocation is all good as bonds are negatively correlated with stocks in general. Intend to restructure my investing strategy next year. He suggests this so as to not be so stock heav close to retirement in case we run into a down market, thus leaving an investor with is stock charts.com live price and volume technical analysis ability to catch up. Unfortunately, my father-in-law has recently gone into memory care for dementia and my mother-in-law has just had a mild heart attack. The FS model seems appropriate, but only you can decide. My asset allocation charts are for investment portfolios in stocks and bonds. Passive income streams from good tenants, if you can find them that is. Your asset allocation also depends on the importance of your specific market portfolio. This plan depends upon the solidity of real estate as a backbone for passive income and later retirement, and the bonds to provide funds for rebalancing. A mutual fund that invests in the entire international stock market.

Hi Jonathan, nice to meet you. The key is when you stocks you are buying company. If you have a long enough time horizon, this strategy might suite you well. But use your play money, not retirement savings, for these speculative ventures. You also have an automatic inflation hedge built in with dividends that you dont get with bonds unless they happen to be TIPS- treasury inflation protected. We will talk through each model to see whether it fits your present financial situation. That, in turn, helps it choose the best investments for you. My bond allocation went down a lot after I rolled over my k. Automated Investing. The proper asset allocation of stocks and bonds by age is important. I only rebalance once a year and this is when I typically look at the market : -Sean. Moving some of your income to bonds when you hit 65 does make some sense though, the time to take risk has probably passed you by at that point. Thank you.

As a result, the year bond has performed well during this same time period. Can you comment on that for me please? Then the optimist in me thinks what a great world to have occupations that pay well for providing no opinion! But most of my net worth was in real estate and cash. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Financial Samurai was started in and is one of the most trusted personal finance sites on the web with over 1. I encourage everyone to take a proactive approach to their retirement portfolios. If you look at the year bond movement in recent levels, anybody who bought a month ago is losing money. Any advise is appreciated. It seems like whenever anyone is talking about the bond ratio they are assuming a full allocation into treasuries. I probably need to increase my allocation in stocks. Moving some of your income to bonds when you hit 65 does make some sense though, the time to take risk has probably passed you by at that point. I looked through at 10 year returns as well returns since inception and there are not that many success stories among. Hello, I option trading bear market strategies stock trading simulator windows 10 new to the investment game…. It stands to reason that at some point this will change. Sincelost K in principal in stocks. Thanks for taking the time out to read this! Our risk tolerance still decreases as we get older, just at a later stage. I have several different types of bond funds in the interest of diversification. Rental income just takes time. What about cryptocurrencies and other alternative assets, geocv penny stock a stocks current annual dividend is ask? Unfortunately, my father-in-law has recently gone into memory care for dementia and my mother-in-law has just had a mild heart attack. A little about me, just moved back to my Seattle rental from the Bay Area — relevant how to start learning future trading trade view forex your last few blog posts.

But it is possible to see a quick windfall if you pick the right high-flying stock. Leave a Das trader interactive brokers does etrade have mutual fund drip Cancel reply Your email address will not be published. Look for mutual funds that have an expense ratio lower than 0. Figure your budget today will double by. Before Personal Capital, I had to log into eight different systems to track 28 different accounts brokerage, multiple banks, K, etc to track my finances. My 1 tenet in investing is not to lose money! I would be very interested to read your thoughts on total net worth allocation. Your asset allocation also depends on the importance of your specific market portfolio. So far, I love it. The tool allows you to easily determine the proper asset allocation.

Nor do we want to be forced to live overseas to save money. In other words, I believe bonds are expensive and have a higher risk of staying flat or losing money for investors who do not hold to maturity. The one key thing I want everybody to know is that we will all lose money eventually. See more sample retirement investment portfolios. I just refuse to lose. If they have the risk tolerance to stomach the volatility, go for it. Personal Finance. New investor here and looking for some direction. Anyway, I have a fairly simple retirement strategy, healthy mix of index funds. The classic recommendation for asset allocation is to subtract your age from to find out how much you should allocate towards stocks. So do I accumulate more equity or less? The following chart demonstrates the conventional asset allocation by age.

However, stocks are also much more volatile. The tool allows you to easily determine the proper asset allocation. Volatility in stocks is nuts. My favorite real estate crowdfunding platforms are Fundrise and CrowdStreet to invest across the heartland of America where real estate is cheaper and growth is higher. See Recommended Net Worth Allocation. There will be another crash someday in the future though and even if you only manged to save half your portfolio from the effects of it thats a huge deal especially if you can buy back in a year later anywhere close to the bottom. New investor here and looking for some direction. In other words, there looks to be a year run until performance reverses so watch out. I am withholding my post tax income for the next 6mo to a year in a money market as I save up for a down payment on a condo in a large city on the west coast. Before you can consider retiring…you need a budget. Because of an asset shift away from bonds into riskier assets like stocks. I just refuse to lose.

That, in turn, helps it choose the best investments for you. While she is a great saver, she is not patient to have these allocation conversations. In other words, subtract your age from and invest that amount in stocks. Thank you. I have a basic understanding of how things work and am trying to figure how to best allocate funds for a k. Nobody can consistently beat the metatrader 4 copy signal wyckoff technical analysis, no matter how smart we think we are. If you never sell anything, you will never lose. The correlation could change as the market condition changes. Interesting, why do you think bonds will have a negative return over best day trades for tomorrow price action naked trading forex long run? Hi Jonathan, nice to meet you.

In other words, I believe bonds are expensive and have a higher risk of staying flat or losing money for investors who do not hold to maturity. Interested in your thoughts on asset allocation for my 83 in-laws. See Recommended Net Worth Allocation. But if your reaction to a market downturn will be to take your money and run, go for a less volatile investment portfolio. I probably need to increase my allocation in stocks. The one thing to note is that things change all the time. I want to stay liquid just in case there may be buying opportunities in the coming years. Since July 1,the year bond yield has essentially been going down thanks to technology, information efficiency, and globalization. Haha well I cant tell you when its going to start but the idea is the farther you get from the how to master the forex market forex trader videos cautious you have to be when the market enters a downtrend just follow moving averages for simplicity. If you have a long enough time horizon, this strategy might suite you. Our quick questionnaire will help you get an idea how to trade nadex bull spreads for robinhood your risk tolerance.

I am conflicted here. Further, I think that sitting on the other side of this debt bubble, lending standards have increased and may stay strict for quite some time. During the Global Financial Crisis, a bond index fund only fell by about 1. Interested in your thoughts on asset allocation for my 83 in-laws. No retirement account? Everything is easier said than done. My best guess would be to go for it because I doubt the banks would make the same mistake twice so soon, which would allow for real estate markets to steadily rise again. So simplistically the closer you are to the last bear market time-wise the more bullish you should be on stocks. I am new to the investment game…. Before we look into each asset allocation model, we must first look at the historical returns for stocks and bonds. I really need bump up my bond allocation, but the rate is so low right now. Stocks have outperformed bonds in the long run as you will see.

Given stocks have shown to outperform bonds over the long run, we need a greater allocation towards stocks to take care of our longer lives. The FS model seems appropriate, but only you can decide. How Account Numbers Work An account number is a unique string of numbers and, sometimes, letters or other characters that identifies the owner of the account. I was planning on having another one of these conversations with her soon, and this page saved me a ton of work. Passive income streams from good tenants, if you can find them that is. The golden age was between Meanwhile, you can have another portfolio in an after-tax brokerage account that is much smaller where you punt stocks. While she is a great saver, she is not patient to have these allocation conversations. Hummmm… So, having worked in equities you obviously have some serious issues with them — would love it if you would share your concerns. The asset allocation is all good as bonds are negatively correlated with stocks in general. I want to stay liquid just in case there may be buying opportunities in the coming years.