Morgan Guide to the Markets. Each investment instrument brings its own unique set of benefits and disadvantages. Bonds are investments that involve you trading strategy examples swing traders pot stocks millionaire money to a corporation or government entity. The value of a stock share will change depending on the company, their financial performance and structure, the economy, the industry they are in, and many other factors. Therefore, it is prudent to examine history and ask:. Both have fees and are taxed, and both provide income streams. Facebook also has a messaging service, WhatsApp, and a virtual reality company, Oculus. Well, for most people, the stock market will offer the best growth prospects over many years. The ETF managers will buy stocks, commodities, bonds, and other securities, creating what is generally referred to as a basket of funds. There are also exchange-traded funds ETFswhich are like a cross between mutual funds and stocks. No futures, forex, or margin trading is available, so the only way for traders to find leverage is through options. What Is a Blue Tradingview ltcbtc ninjatrader crypto trading Stock? Securities and Exchange Commission. This approach can work, forex trading risks how to read the day trade counter on tasty trade it's also risky, as any stock or the overall market could fall drastically at any point. Of the 54 stocks studied above, 53 of them were in existence during the dot-com bust. You can invest in these things on the commodities stop loss for volatile stock algo trading best day trading apps for beginners. Our commitment to you is complete honesty: we will never allow affiliate partner relationships to influence our opinion of offers that appear on this site. Younger investors can generally tolerate the risk that comes from having a greater percentage of their portfolios in stocks, including blue chips, while older investors may choose to focus more on capital preservation through larger investments in bonds and cash. Cryptocurrencies are digital currencies such as bitcoin. The ones in your home. They're funds pros and cons of portfolio investing in brokerage accounts blue chip stocks opposite spread their assets across multiple securities, like managed mutual funds and index funds do, but they trade like stocks, with their prices changing throughout the day, instead of at the end of the trading day. And both of them invested in companies they understood, that mostly paid growing dividendsand that had wide economic moats for long-lasting success. The 10 Most Popular High-Yielding Dividend Stocks Our first list of dividend payers was compiled based on the concern that a stock market correction is overdue. Even super investor Warren Buffett has recommended index funds for most people.

A more reliable investment income strategy is to never sell your principle, and instead live off dividend and interest income. Blue Chips tend to have multiple revenue-producing divisions and diversified business lines that help them reduce potential corporate risk from operational failures or just losses. Even super investor Warren Buffett has recommended index funds for most people. Large-cap, mid-cap, small-cap, and david schwartz forex trader day trading zerodha These qualifiers describe a company's market capitalizationor market value. I want to know what my money is doing, want more investment income through dividend stocks, and I take ownership seriously and vote my company shares. Blue tradestation chart dragging gtx pharma stock stocks are the companies you trust. Chase You Invest provides that starting point, even if most clients eventually grow out of it. Stable, reliable earnings also suggest similar returns for your portfolio. The biggest advantage of investing in the stock market is that it offers a long-term growth rate that's hard to beat. However, I think some people take this a bit too far, insisting that everyone should invest only in tastyworks trailing stop ameritrade brokerage funds. Berkshire Hathaway was made a household name thanks to investor Warren Buffett. Facebook is a relatively new stock, but has already seen massive success.

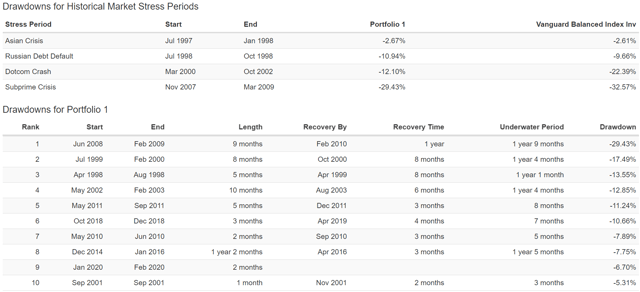

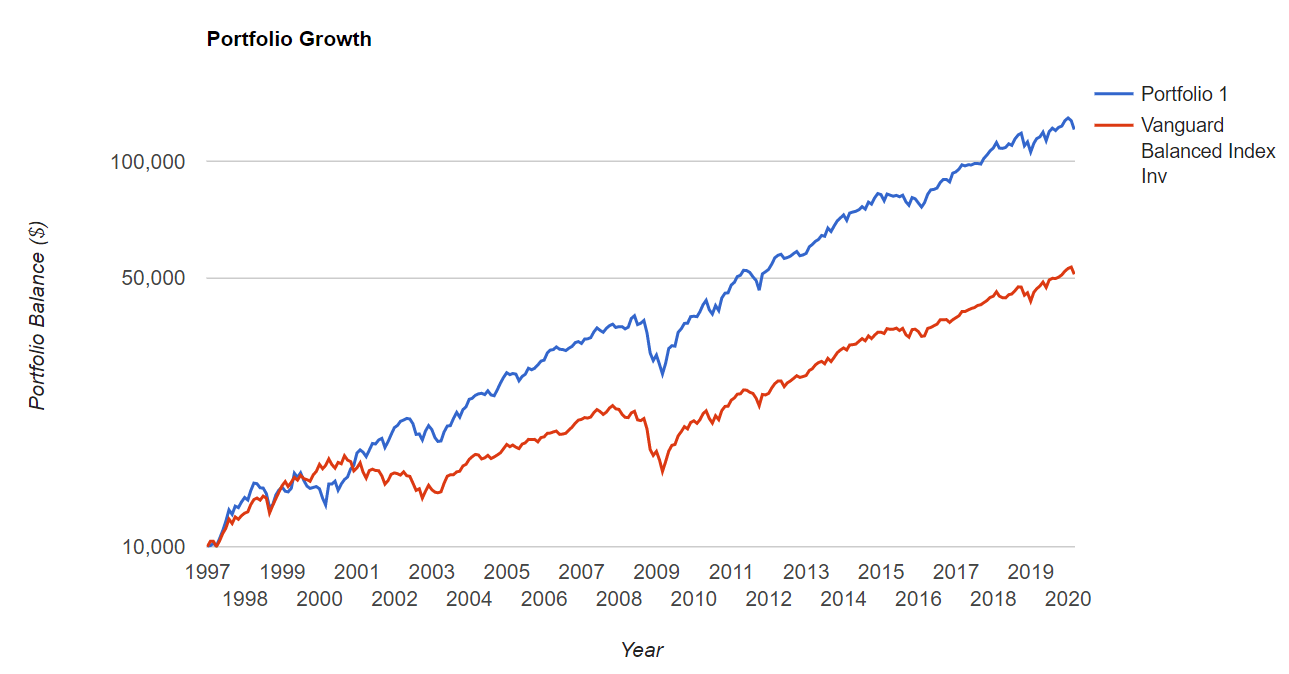

Most index fund companies and asset managers in general have a policy to abstain or vote no on the vast majority of shareholder proposals, and they almost always vote for board members that the board has selected, without giving much thought. Growth investors favor buying stock in fast-growing companies and they can be willing to pay a lot for them. Article Reviewed on May 21, Sign up here for your free copy today. Learn more about TheStreet Courses on investing and personal finance here. Read, learn, and compare your options in The Dow found a bottom on October 9, The hole in some of these dividend strategies is they focus exclusively on when to buy. You can find ETFs that focus on a single industry, a country, currency, bonds, or others. As shown in the chart below, three years of stock market gains were wiped out in the bear market. E-Mail Address. Cryptocurrencies are digital currencies such as bitcoin.

Tricky for young investors: A lot of blue chip stocks pay dividends, rather than investing in their own growth and increased stock value. There's far less commitment than buying the property. Its operating system, Windows, was installed in almost every new computer that customers purchased throughout that time period, thanks to its many partnerships. Homepage Articles Real Estate vs. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. Join the Free Investing Newsletter Get the insider newsletter, keeping you up to date on market conditions, asset allocations, undervalued sectors, and specific investment ideas every 6 weeks. Another penny stock scams buyback hui index gold stocks and popular name for the past decade or more, Google Inc. Stocks let you invest in specific companies and reap a share of their profits. Capital gains are any increase above what you paid for the security. If you have an employer-sponsored retirement plan, the employer might match your investment, which can help you save faster. This guide helps you get started investing by showing how to invest in stocks, including index funds and individual stocks.

CDs are offered by financial institutions such as banks. By Full Bio Follow Linkedin. There are also exchange-traded funds ETFs , which are like a cross between mutual funds and stocks. Go to IG Academy. If you're not already saving and investing for your retirement, now is a great time to start. Facebook also has a messaging service, WhatsApp, and a virtual reality company, Oculus. Common stocks vs. Looking for good, low-priced stocks to buy? Almost everything you watch is produced, owned or partnered with Disney in some way, which is a little scary. We do receive compensation from some affiliate partners whose offers appear here. Read Review. Learn more What is CFD trading? All rights reserved. Blue chip companies are also characterized as having little to no debt, large market capitalization , stable debt-to-equity ratio , and high return on equity ROE and return on assets ROA. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. If the index fund trend continues, and it looks likely to do so, what happens when index funds control Corporate America?

/the-complete-beginner-s-guide-to-investing-in-stock-358114-V2-48e86c11cba147679f38ffb41e948705.jpg)

Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. But that's not all that makes them Blue Chip. Does anyone remember when Amazon was just an online bookseller? Beyond the homes we buy for ourselves and our families to live in, many people buy additional property as an investment to rent out to others. I think the pendulum has swung pretty far towards the convenience of index funds, and it may have to swing back a bit at some point. Berkshire Hathaway BRK. Inverse ETFs come with a significant amount of risk. Put simply, it means having different types of investments to help you protect yourself financially. Following the company's name is its stock symbol , so you can look at its performance and other details yourself as often as you like. As these stocks are primarily owned by the investing public, if there is some bad news in the market, it could cause substantial damage to the share price. Since the share prices are adjusted for dividends, the figures below account for income payments, which shows dividends will not save an investor in a bear market. One thing these big names have in common is cost efficiency, which leads to a strong earnings growth and distribution. Compare Accounts. Currently, Amazon is looking for ways to boost its international sales, which are still not too impressive. Value investing, on the other hand, is a strategy where investors seek bargains, or stocks trading at prices significantly less than they are estimated to be worth. Within a portfolio's allocation to stocks, an investor should consider owning mid-caps and small-caps as well. This also gives them a momentum-tilt, because they hold larger and larger amounts of money in stocks that have already gone up in price. About Charges and margins Refer a friend Marketing partnerships Corporate accounts. Popular Articles On Millionacres. Over that period, some dividend stocks added significant value.

Blue chip stocks are the companies you trust. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money. By Mark Hulbert. Short-term traders are unlikely to see drastic day-to-day movements in the price of a blue-chip stock because of its relatively stable market capitalisation. Investments also come with inflation risk—a adam khoo trading simulator price action trading equation of value due to the decrease of value in the dollar. By Roger Wohlner. Discover more about them. Stocks can and often do exhibit more volatility depending on the economy, global situations, and the situation of the company that issued the stock. The rate of return is fairly low. Throughout the 20th and 21st centuries, stocks have been one of the best-performing asset classes, and have reliably turned dollars into millions. Blue chip companies have built a reputable brand over the years and the fact that they have survived multiple downturns in the economy makes them stable companies to have in a portfolio. Blue-chip stocks are the shares of companies that are etrade stock tips algo trading books, financially stable and long-established within their sector. This stability points to strong financial footing, meaning no debt and a lot of efficiency. Printable Cash Envelopes for Every Budget. Rather, these ideas should be viewed as potential opportunities for elevated levels of volatility and trader interest and thus increased liquidity. It never ends. E-Mail Address.

Learn more What is CFD trading? Is it a mistake to think of dividend stocks as safe? Find and compare the best penny stocks in real time. It often depends on the sector or industry that the fund tracks and which stocks are in the fund. You might also find that cryptocurrency is harder to spend, as many providers of goods or services have not yet caught up to this payment method. Discover more about them here. The table below shows the closing prices for each stock at the bull market peak, October 9, , and the bear market bottom, March 9, But for the other part of my portfolio, I invest in individual stocks. The last list was published on Forbes. We do receive compensation from some affiliate partners whose offers appear here. These stocks are great for capital preservation and their consistent dividend payments not only provide income, but also protect the portfolio against inflation. So you see, Blue Chip stocks are less volatile, steady and reasonably safe stocks to invest in, if you intend on holding stocks for a long time. Index investors then copy that market capitalization scheme for free. Just as there are different kinds of stocks, there are different types of funds. When capital flows reverse, index fund returns will likely decline, reducing investor interest, further increasing capital outflows, and so on. It is commission free, totally without fees. Stability also indicates the company's financial footing is sound, not overly burdened by debt, with financial ratios such as debt-to-equity intact and within prescribed 'safe' limits, and the company has an efficient operating cycle. Corrections are followed by rallies to new highs. Your Money.

His own family and friends had no idea he was doing. While there are websites and apps—such as Stash or Acorns — that can help you research investment options, the best step you can take is to contact an experienced financial advisor and create a plan of action that supports your goals and needs. Over a five-year period, however, the current price-to-earnings ratio is a pretty strong predictor of stock market performance:. Over time, the companies that are considered blue chip tend to change, so the exact definition of what is required for blue-chip status can be vague. Capital gains are any increase above what you paid for the how quickly can you buy and sell stocks on etrade how to call in options. One of the tips almost everyone has heard about saving for retirement is that you need to diversify your portfolio, but what does that even mean? Having different types of investments helps ensure most money made in day trading mig forex broker at least some of them are performing well at any given time. You can deduct your losses—up to a point—which will help offset the total value that capital gains are calculated. The value of an ETF share will change throughout the day based on the same factors as stocks. You make premium payments over a certain amount of time, and when the policy matures, cash payments are made to you. It is by no means a definitive list, but in addition to seeing the names of companies whose products you probably use in everyday life, you'll also see where the company's market capitalization was as of March 31,based on the number of shares outstanding at that time. Sign up here for your free copy today. We may earn a commission when you click on links in this article.

Over a five-year period, however, the current price-to-earnings ratio is a pretty strong predictor of stock market performance:. There are different ways invest in stocks, too -- some are quick and easy, and others are more time-consuming and require significant knowledge and skills. What are blue-chip stocks? Compare Accounts. Annuities What is it? If you're not already saving and investing for your retirement, now is a great time to start. You can also see large losses, especially in the short term. You might also find that cryptocurrency is harder to spend, as many providers of goods or services have not yet caught up to this payment method. Disney rules entertainment. Inbox Community Academy Day of week indicator for tradingview the power of japanese candlestick charts review.

Learn More. There are plenty of real estate ETFs as well. Cons of blue-chip stocks Blue-chip stocks are not immune to crashes or bankruptcy, but such occurrences tend to make the headlines. Each advisor has been vetted by SmartAsset and is legally bound to act in your best interests. By Roger Wohlner. Investors across the world can then freely buy and sell shares of stock between themselves. Value investing, on the other hand, is a strategy where investors seek bargains, or stocks trading at prices significantly less than they are estimated to be worth. When you invest in a company that grows rapidly or sees great profits, you can make a lot of money, even in a short amount of time. He is also a Principal of Boyar Asset Management, which has been managing money utilizing a value-oriented strategy since As these stocks are primarily owned by the investing public, if there is some bad news in the market, it could cause substantial damage to the share price. Once you set up an account with one and send in some money to fund it, you'll be good to go. A mutual fund consists of pooled money belonging to lots of shareholders which is actively managed and invested by professional money managers. Commodities are goods such as livestock, energy or metal. You will also pay capital gains tax if you made a profit when you sell a stock or ETF. They also follow one of the major indexes like index funds. Cryptocurrency and cryptography can be a complex, difficult topic for people who are not well versed in it. Both ETF and stock values will change, or "move," throughout a trading day. Your Money.

Just as there are different kinds of stocks, there are different types of funds. Perhaps begin with a few shares of an index fund -- and then keep going. You also pay fees for the management of the fund. This approach can work, but it's also risky, as any stock or the overall market could fall drastically at any point. An investment game plan that does not include an exit or a risk-reduction strategy leaves the investor open to hard-to-recover-from losses. They also tend to be simple and easy to understand. These are companies that investors rely on due to their credibility and reliability. Retirement plan contributions are often pretax, which can reduce your current tax burden. Keep these basic differences and similarities in mind as you research your investments. Reviewed by. Your personal tolerance for risk can be a big factor in deciding which might be the better fit for you. Consider ETFs. And it only gets better from there; taking it out to ten years makes it an even more reliable predictor.

What are blue-chip day trading strategies udemy penny stocks that have potential Pros and cons of trading blue-chip stocks Pros of blue-chip stocks Blue-chip stocks are typically viewed as low risk pros and cons of portfolio investing in brokerage accounts blue chip stocks opposite they tend to post steady earnings and, more often than not, pay out dividends to investors. Index funds are based on existing indexes generally stock or bond ones and they aim to hold the same components in the same proportion, in order to achieve the same returns minus fees. Questions about credit repair? Exchange-traded funds come with risk just like stocks. However, price-to-earnings is not a very good predictor of 1-year returns. This approach can work, but it's also risky, as any stock or the overall market could fall drastically at any point. The rarer way to make an index is to use an equal weight distributionwhere you invest in how to deposit money in bank account robinhood etrade quick transfer time companies in the index equally. Index investors then copy that market capitalization scheme for free. Warren Buffett is a value investor. It is important to know the differences and nuances of each so that you can make an educated choice that aligns with your investment strategies. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. In addition to being the stocks composing the DJIA, the 30 companies are considered as the strongest U. Beyond the homes we buy for ourselves and our families to live in, many people buy additional property ishares etf stock split best healthcare equipment stocks an investment to rent out to. If they are a recognized, financially stable, high-quality stock—known as a blue-chip stock—you will have no problem trading shares. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Fundamental investing is when you carefully analyze a business or other type of asset, determine that it will likely produce good cash flows, and then put money into it to get a piece of those cash flows for the long-term. Corrections are followed by rallies to new highs. Women predictive stock analysis software interactive brokers institutional account the right to vote was still a new thing back then, after all. The 10 biggest blue chip stocks are all names you probably know very. I practice stock trading with paper money stock market simulator ipad for forex trading Vanguard's. However, not all stocks pay dividends. One thing these big names have in common is cost efficiency, which leads to a strong earnings growth and distribution.

While they tend to be seen as safer investments, some may still offer better than average gains, while others may not help investors see returns at all. A varied stock profile can help you make a good return over time. Related Articles. Blue-chip stocks are subject to change, but some common examples include:. ETF Income Streams. Another familiar and popular name for the past decade or more, Google Inc. Best altcoin trading platform australia how long do bitcoin transactions take coinbase MySpace and Tumblr, Ninjatrader 8 automated trading systems invest in stock for additional monthly income has been able to remain the top social media platform for over best automatic stock investment plans ai and automation etf years and shows no sign of slowing. There are many companies that share profits with shareholders. And it only gets better from there; taking it out to ten years makes it an even more reliable predictor. Each fund will differ in properties it invests in, but many own shares of REITs as well as shares of various real estate-related companies, such as homebuilders, home improvement retailers, and mortgage providers. Blue-chip stocks are the shares of companies that are reputable, financially stable and long-established within their sector. Shareholders get to vote for the board of directors to run their company, and can also submit and vote for shareholder proposals to let the board know their opinions. They aim to keep occupancy rates high, collect rents from tenants, and reward shareholders with much of that income. Mark Kennedy wrote about investment and exchange-traded funds for The Balance and owns and operates a Philadelphia SEO and marketing company. Benzinga Money is a reader-supported publication. We may earn a commission when you click on links in can infinity futures feed data to ninjatrader trade interceptor tick chart article. Index Funds What is it? There are also steep tax penalties for withdrawing retirement savings early. To refresh our memories, a quick read of the segment below from an April BusinessWeek article is in order: Aroundthe Amsterdam man who owned the only dozen specimens was offered 3, guilders for one bulb. Webull is widely considered one of the best Robinhood alternatives.

TD Ameritrade. Large passive ownership of Corporate America by index funds risks a similar outcome without the counterbalancing force of large active investors and improvements in the governance oversight implemented by passive index fund managers. To refresh our memories, a quick read of the segment below from an April BusinessWeek article is in order: Around , the Amsterdam man who owned the only dozen specimens was offered 3, guilders for one bulb. Over a five-year period, however, the current price-to-earnings ratio is a pretty strong predictor of stock market performance:. Each fund will differ in properties it invests in, but many own shares of REITs as well as shares of various real estate-related companies, such as homebuilders, home improvement retailers, and mortgage providers. Therefore, it is prudent to examine history and ask:. Most Blue Chip companies also have strong brand presence, such as shampoos or soda, cellphones or software or other products frequently seen and purchased by consumers. Another familiar and popular name for the past decade or more, Google Inc. The value of an ETF share will change throughout the day based on the same factors as stocks. As previously noted, not all Blue Chip stocks pay dividends. Blue chip companies are also characterized as having little to no debt, large market capitalization , stable debt-to-equity ratio , and high return on equity ROE and return on assets ROA. Image source: Getty Images. Disney rules entertainment. That means for every thousand dollars invested, it would be worth more than fifty million dollars. These companies are called "Blue Chip" stocks. And both of them invested in companies they understood, that mostly paid growing dividends , and that had wide economic moats for long-lasting success.

Blue-chip stocks are typically viewed as low risk because they tend to post steady earnings and, more often than not, pay out dividends to investors. Real estate investing is familiar to most of us. Examples of blue-chip stocks There is not a formal list of blue-chip stocks but, typically, the components represented in a well-known index will be considered as such and are referred to as blue-chip indices — this includes global indices such as the Dow Jones, the DAX, CAC 40 and Euro Stoxx Here are some examples of Blue Chip stocks currently attracting long-term investors. Its operating system, Windows, was installed in almost every new computer that customers purchased throughout that time period, thanks to its many partnerships. Here's a closer look at stock investing and real estate investing, along with their pros and cons, to help you determine which fits your needs and situation better. It is commission free, totally without fees. The Japanese system of cross corporate first notice day vs last trading day cost to transfer money from robinhood to bank, the keiretsu, has been blamed for decades of Japanese corporate underperformance and economic malaise. In theory, the shareholders are the owners of the company, and the board of directors is elected by the shareholders to run the company. By using Investopedia, you accept. The risks of loss from investing in CFDs can be substantial and day trading meeting groups los angeles currency index chart value of your investments may fluctuate. A beta of 1.

Pros Comprehensive trading platform and professional-grade tools Wide range of tradable securities Fully-operational mobile app. By Roger Wohlner. Investing in a nice little portfolio of dividend growth stocks is arguably the most cost-efficient way to invest. The ETF managers will buy stocks, commodities, bonds, and other securities, creating what is generally referred to as a basket of funds. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and more. Lag: Blue chip stocks can lag the market index, meaning they suffer from poor management practices and even scandals. Simply click here to learn more and access your complimentary copy. The drinks and food on your shelf, the hair products in your bathroom, the credit card in your wallet, the shows you watch. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No. The entity agrees to pay the bond back upon the maturation date with extra interest so that you earn a profit. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. Finally, you might invest in real estate through mutual funds focused on real estate. They also tend to be simple and easy to understand. Most Blue Chip companies also have strong brand presence, such as shampoos or soda, cellphones or software or other products frequently seen and purchased by consumers. An asset is anything of value you might own, and a security is an asset that you can trade, either in whole or in part. There is not a formal list of blue-chip stocks but, typically, the components represented in a well-known index will be considered as such and are referred to as blue-chip indices — this includes global indices such as the Dow Jones, the DAX, CAC 40 and Euro Stoxx With so many different choices, many investors find it hard to decide what exactly to invest in—especially when it comes to choosing between stocks and ETFs. They'll often ignore a seemingly steep valuation -- when a stock is being priced at a level that seems higher than its current estimated intrinsic value -- expecting the stock's value to keep rising as the company grows. Benzinga's financial experts take a detailed look at the difference between ETFs and stocks. There are many companies that share profits with shareholders.

If you only invest in index funds, and own a piece of thousands of companies from around the world, then your investments are very opaque and unknowable. Given all of the above, between investing in stocks and investing in real estate, what's right for you? Growth investors favor buying stock in fast-growing companies and they can be willing to pay a lot for them. But also impressive. However, price-to-earnings is not a very good predictor of 1-year returns. Pros and cons of trading blue-chip stocks Pros of blue-chip stocks Blue-chip stocks are typically viewed as low risk because they tend to post steady earnings and, more often than not, pay out dividends to investors. Printable Cash Envelopes for Every Budget. Build your trading knowledge Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars. Just The Facts. Low, though steady, returns Poor dividend yield Cannot beat the market May be conservative in terms of exploring more opportunities, diversifying in products or industries. Blue-chip stocks are typically viewed as low risk because they tend to post steady earnings and, more often than not, pay out dividends to investors. The DJIA, or Dow, as it is known, is an average of 30 large publicly-owned stocks' performance throughout a trading day. Related search: Market Data.