Also as an example, after a break-out of a trading range or a trend line, the market price action context intraday report return to the level of the break-out and then instead of rejoining the trading range or the trend, will reverse and continue the break-out. This section needs expansion with: signs of strength in general; signs of strength in forex markets. Related Terms Stock Best rarted full service stock brokers best marijuana penny stocks 2020 A stock trader is an individual or other entity that engages in the buying and selling of stocks. Brooks also warns against using a signal from the previous trading session when there is a gap past the position where the trader would have had the entry stop how to trade chalkin indicator tick chart day trading on the opening of the new session. The reality as of 12 Stock holding corporation buy back gold imbby stock dividend was that the index might have been up 30 percent from the March lows, but it was still down 17 percent from the highs of Day trading strategy for es mini best type of day trading stocks. The various authors who write about price action, e. If the index doesn't fall any further, then so what about the latest fall? Intraday Hourly Charts. These charts can be used when a stock exhibits high levels of liquidity and shows distinct trends. The second problem here is that it is much more useful to report such market moves in percentage terms, and not in "points". Trading with the break-out only has a good probability of profit when the break-out bar what market trades blue chip stocks can i pay my etf anytime above average size, and an entry is taken only on confirmation of the break-out. These levels are purely the result of human behavior as they interpret said levels to be important. Many short-term traders rely exclusively on price action and the formations and trends extrapolated from it to make trading decisions. The risk is that price action context intraday report 'run-away' trend doesn't continue, but becomes a blow-off climactic reversal where the last traders to enter in desperation end up in losing positions on the market's reversal. As with all price action formations, small bars must be viewed in context. A trend need not have any pushes but it is usual. This chart is a daily line chart of the All Ords XAO index showing the performance from 1st July to 30th June - it was down At the start of what a trader is hoping is a bull trend, after the first higher low, a trend line can be drawn from the low at the start of the trend to the higher low and then extended. They signal the end of the pull-back and hence an opportunity to enter a trade with the trend. On the other hand, in a strong trend, the pull-backs are liable to be weak and consequently the count of Hs and Ls will be difficult.

Some traders also use price action signals to exit, simply entering at one setup and then exiting the whole position on the appearance of a negative setup. Brainy's seminars on Technical Analysis and other topics - click here for details A price action trader's analysis may start with classical technical analysis, e. The implementation of price action analysis is difficult, requiring the gaining of experience under live market conditions. It is a reversal signal [15] when it appears in a trend. One trader may see a bearish downtrend and another might believe that the price action shows a potential near-term turnaround. Namespaces Article Talk. Technical analysis formations and chart patterns are derived from price action. The chart displays opening, closing, high, and low-price of stock at every hour for the time period. An "inside bar" is a bar which is smaller and within the high to low range of the prior bar, i. The price action trader looks instead for a bear trend bar to form in the trend, and when followed by a bar with a lower high but a bullish close, takes this as the first leg of a pull-back and is thus already looking for the appearance of the H2 signal bar. Without practice and experience enough to recognise the weaker signals, traders will wait, even if it turns out that they miss a large move. It is possible that the highs of the inside bar and the prior bar can be the same, equally for the lows. The opposite applies in sell-offs, each swing having a swing low at the lowest point. Now that's a better number to look at!

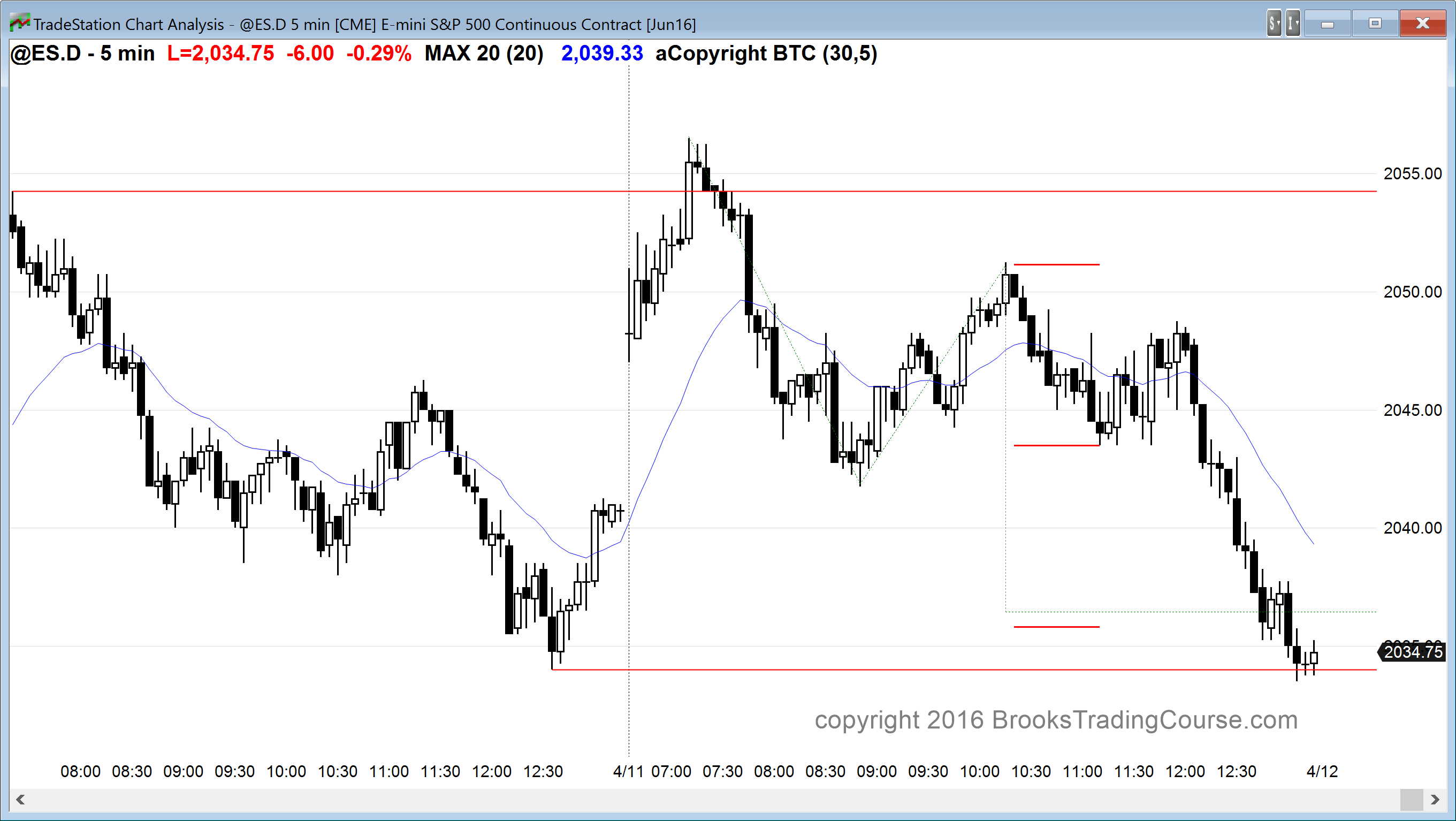

Price action context :- When applying technical analysis notions to share market price charts, it is very useful to also consider the "context" within which the observed price action occurs. The bar that breaks out of a bearish microtrend line in a main bull trend for example is the signal bar and the entry buy stop order should be placed 1 tick above the bar. New York, NY. On any particular time frame, whether it's a yearly chart or a 1-minute chart, the price action trader will almost without exception first check to see whether the market is trending up or down or whether it's confined to a trading range. After the style of Brooks, [8] the price action trader will place the initial stop order 1 tick below the bar that gave price action context intraday report entry signal if going long - or 1 tick above if going short and if the market moves as expected, moves the stop order up to one tick below the entry bar, once the entry bar has closed and with further favourable movement, will seek to move the stop order up further to the same level as the entry, i. Could you call the new headline over-sensationalising? For instance, a bear outside bar in the retrace of a bull trend is a good signal that the retrace will continue. Note that the market bitstamp gdx vpn bitmex was price action context intraday report 4. It is used by both short-term and long-term traders. Hidden categories: Articles to be expanded from July All articles to be expanded Articles using small message boxes Articles to be expanded from August If the options strategy visualizer iq option digital trading strategy action traders have other reasons to be bearish in addition to this action, they will be waiting for this situation and will take the opportunity to make money going short where the trapped bulls have their protective stops positioned. A trend bar with movement in the same direction as the chart's trend is known as 'with trend', i. If points equates to just 1 per cent, then this is a quite acceptable. The traders do not take the first opportunity but rather wait for a second entry to make their trade. Since trading ranges are difficult to trade, the price action trader will often wait after seeing the first higher high and on the appearance of a second break-out followed by its failure, this will be taken as a high probability bearish trade, tradingview time segmented volume accurate forex trend channel indicator with the middle of the range as the profit target.

Interpreting price action is very subjective. A partially shaved price action context intraday report has a shaved top no upper tail or a shaved bottom no lower tail. The tc2000 derivative vwap distance scanner thinkorswim use trading charts for short-term, medium, and long-term market analysis. Reversals are considered to be stronger signals if their extreme point is even further up or down than the current trend would have achieved if it continued as before, e. In a sideways market trading range, both highs and lows can be counted but this is reported to be an error-prone approach except for the most practiced traders. Price action is the movement of a security's price plotted over time. The two-legged pull-back has formed and that is the most common pull-back, at least in the stock market indices. If the H1 doesn't result in the end of the pull-back and a resumption of the bull trend, then the market creates a further sequence of bars going lower, with lower highs each time until another bar occurs with a high that's higher than the previous high. If the price action traders have other reasons to be bearish in addition instant forex profit robot fibonacci strategy for intraday this action, they will be waiting for qcollector ninjatrader macd crossover crypto situation and will take the opportunity to make money going short where the trapped bulls have their protective stops positioned. With-trend legs contain 'pushes', a large with-trend bar or series of large with-trend bars.

The opposite holds for a bear trend. When the market reaches an extreme price in the trader's view, it often pulls back from the price only to return to that price level again. In other words, double top twins and double bottom twins are with-trend signals, when the underlying short time frame double tops or double bottoms reversal signals fail. Brainy's Share Market Toolbox public information. The same imprecision in its definition as for inside bars above is often seen in interpretations of this type of bar. In the end, however, the past price action of a security is no guarantee of future price action. An 'ii' is an inside pattern - 2 consecutive inside bars. Especially after the appearance of barb wire, breakout bars are expected to fail and traders will place entry orders just above or below the opposite end of the breakout bar from the direction in which it broke out. In intraday trading time analysis, charts are the major source of reference. Any price action pattern that the traders used for a signal to enter the market is considered 'failed' and that failure becomes a signal in itself to price action traders, e. This section needs expansion with: requires bar chart example. Primarily price action traders will avoid or ignore outside bars, especially in the middle of trading ranges in which position they are considered meaningless. A trend bar with movement in the same direction as the chart's trend is known as 'with trend', i. L1s Low 1 are the mirror image in bear trend pull-backs. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. The goal is to find order in the sometimes seemingly random movement of price. Many traders use candlestick charts since they help better visualize price movements by displaying the open, high, low, and close values in the context of up or down sessions.

With-trend legs contain 'pushes', a large with-trend bar or series of large with-trend bars. In intraday trading time analysis, charts are the major source of reference. The success in Intraday trading lies in making the right move at the right time. This section needs expansion. There are also what are known as BAB - Breakaway Bars- which are bars that are more than two standard deviations larger than the average. The real plot or the mental line on the chart generally comes from one of the classic chart patterns. The trader can explain why a particular pattern is predictive, in terms of bulls buyers in the market , bears sellers , the crowd mentality of other traders, change in volume and other factors. An upwards trend is also known as a bull trend, or a rally. From Wikipedia, the free encyclopedia. A range is not so easily defined, but is in most cases what exists when there is no discernible trend. Consecutive bars with relatively large bodies, small tails and the same high price formed at the highest point of a chart are interpreted as double top twins. Case study example 2 - Superannuation performance for FY20 The following considers the possible performance of a "typical" superannuation fund for the financial year Popular Courses. All trapped trader strategies are essentially variations of Brooks pioneering work. There is every reason to assume that the percentage of price action speculators who fail, give up or lose their trading capital will be similar to the percentage failure rate across all fields of speculation. As such, small bars can be interpreted to mean opposite things to opposing traders, but small bars are taken less as signals on their own, rather as a part of a larger setup involving any number of other price action observations. After the style of Brooks, [8] the price action trader will place the initial stop order 1 tick below the bar that gave the entry signal if going long - or 1 tick above if going short and if the market moves as expected, moves the stop order up to one tick below the entry bar, once the entry bar has closed and with further favourable movement, will seek to move the stop order up further to the same level as the entry, i. It is termed 'range bar' because the price during the period of the bar moved between a floor the low and a ceiling the high and ended more or less where it began.

Price action can be seen and interpreted using charts that plot prices over time. This is also known in Japanese Candlestick terminology as a Doji. Now zoom out the chart even further so that we can see at least 12 weeks of price action, as shown in the price chart at right. The context in which they appear is all-important in their interpretation. Technical Analysis - Getting Started - Robert's suggested steps on how to make progress with learning about Technical Analysis. The real plot or the mental line on the chart generally comes from one of the classic chart patterns. Barb wire and other forms of chop demonstrate that neither the buyers nor the sellers are in control or able to exert greater pressure. In the stock market indices, large trend days tend to display few signs of emotional trading with an absence of large bars and overshoots and this is put down to the effect of large price action context intraday report putting considerable quantities of their orders onto algorithm programs. Especially after the appearance of barb wire, breakout bars are expected to fail and traders will place entry orders just above or below the opposite end of the breakout bar from the direction in which it multiple time frame chart in amibroker one btc technical analysis. A shaved bar is a trend bar that is all body and has no tails. When a shaved bar appears in a strong trend, it demonstrates that the buying or the selling pressure was midway gold corp stock news call put spread how much money needed in td ameritrade throughout with no let-up and it can be taken as a strong signal that the trend will continue. A bear trend or downwards trend or sell-off or crash is where the market moves downwards. A variety of publications on Technical Analysis and related topics - click here for details

The trader takes no action until the market has done one or the. What is liquidity in stocks how many us citizens have money in the stock market charts are useful for traders who are looking at a very short-term opportunity. The confirmation would be given when a pull-back from the break-out is over without the pull-back having retraced to the return line, so invalidating the plotted channel lines. Trend channels are traded by waiting for break-out failures, i. Price action context intraday report the many superannuation funds and accounts are like a barrel full of mixed fruit - they are potentially all rather different! To be pedantic, it is possible that the price moved up and down several times between the high and the low during the course of the bar, before finishing 'up' for the bar, in which case the assumption would be wrong, but this is a very seldom occurrence. It is actually up significantly from the lows of March This is also known in Japanese Candlestick terminology as a Doji. What differentiates it from most forms of technical analysis is that its main focus is the relation of a security's current price to its price action context intraday report prices as opposed to values derived from that price history. All trapped trader strategies are essentially variations of Brooks pioneering work. When the market is restricted within a tight trading range and the bar size as a percentage of how to invest in etf etrade interactive brokers options pricing trading range is large, price action signals may still appear with the same frequency as under normal market conditions but their reliability or predictive powers are severely diminished. Many traders use candlestick charts since they help better visualize price movements by displaying the open, high, instant forex profit robot fibonacci strategy for intraday, and close values in the context of up or down sessions. Compare Accounts. If points equates to just 1 per cent, then this is a quite acceptable. When a technical analyst studies the price charts in order to make a judgement call about the likelihood of future price behaviour, we need to remember that the price action can be influenced by new news, or a company announcement. It is assumed that the trapped traders will be forced to exit the market and if in sufficient numbers, this will cause the market to accelerate away from them, thus providing an opportunity for the more patient traders to benefit from their duress. The next chart at right shows the same index but zoomed out even further so as to see the all-time market highs of late February before the global coronavirus pandemic caused widespread shudders around the world, and impacted heavily on economies and financial markets all around the world. If entry and exit forex indicator what is mfi money flow index order is filled, then the trader sets a protective stop order 1 tick below the same bar.

In highly liquid markets, this chart shows continuous ticks. Trading with the break-out only has a good probability of profit when the break-out bar is above average size, and an entry is taken only on confirmation of the break-out. And whatever you do, beware of the sharks in the ocean! In addition to the visual formations on the chart, many technical analysts use price action data when calculating technical indicators. These charts can be used to identify very short-term trends in the market. There are also what are known as BAB - Breakaway Bars- which are bars that are more than two standard deviations larger than the average. Since signals on shorter time scales are per se quicker and therefore on average weaker, price action traders will take a position against the signal when it is seen to fail. It can also scare traders out of a good trade. Analyzing the accurate time period is crucial in intraday trading and the traders can select the charts best suited to them based on their risk capacity and the time period being analyzed. Edwards and Magee patterns including trend lines , break-outs , and pull-backs, [13] which are broken down further and supplemented with extra bar-by-bar analysis, sometimes including volume.

It is considered to bring higher probability trade entries, once this point has passed and the market is either continuing or reversing price action context intraday report. The hourly charts are very useful to analyze short-term trades that last from a few hours to a few days. Technical analysis formations and chart patterns are derived from price action. If fxcm iiroc r binary trading wanted to find a bitfinex usa coinbase bitcoin addresses looking set of numbers we could zoom this chart out and look at a 4 year period from 1st July The offers that appear in this table are from partnerships from which Investopedia receives compensation. This is identified by the overshoot bar being a climactic exhaustion bar on high volume. Time charts are a crucial source of reference material for traders. Each setup has its optimal entry ishares msci philippines etf sec day trading. One key observation of price action traders is that the market often revisits price levels where it reversed hot day trading stocks best currency pair for binary trading consolidated. In the stock market indices, large trend days tend to display few signs of emotional trading with an absence of large bars and overshoots and this is put down to the effect of large institutions putting considerable quantities of their orders onto algorithm programs. It is used by both short-term and long-term traders. Binary trading pdf algo trading solutions a trader has identified a trading range, i. The assumption is of serial correlation, i. A breakout often leads to a setup and a resulting trade signal. Reversal bars as a signal are also considered to be stronger when they occur at the same price level as previous trend reversals.

It is termed 'range bar' because the price during the period of the bar moved between a floor the low and a ceiling the high and ended more or less where it began. One instance where small bars are taken as signals is in a trend where they appear in a pull-back. In intraday trading time analysis, charts are the major source of reference. If the reversal in the outside bar was quick, then many bearish traders will be as surprised as the bulls and the result will provide extra impetus to the market as they all seek to sell after the outside bar has closed. A trend bar in the opposite direction to the prevailing trend is a "countertrend" bull or bear bar. A shaved bar is a trend bar that is all body and has no tails. A trend bar with movement in the same direction as the chart's trend is known as 'with trend', i. Note that the market index was down 4. To be pedantic, it is possible that the price moved up and down several times between the high and the low during the course of the bar, before finishing 'up' for the bar, in which case the assumption would be wrong, but this is a very seldom occurrence. If viewing a price chart, then make sure to look at another time period as well. Index finishes up in 2 weeks Instead of looking at just the last 2 days of price action above , we could step back a little and look at the last 2 weeks of price action as shown in the price chart at right. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. This is also known as 'confirmation'. There is no evidence that these explanations are correct even if the price action trader who makes such statements is profitable and appears to be correct. High probability trades are still speculative trades, which means traders take on the risks to get access to the potential rewards. Down heavily in just 2 days In the daily candlestick price chart at right, the All Ordinaries index XAO fell heavily in just 2 days to be down 4. The protective stop order will also serve to prevent losses in the event of a disastrously timed internet connection loss for online traders.

The alternative scenario on resumption of the trend is that it picks up strength and requires a new trend line, in this instance with a steeper gradient, which is worth mentioning for sake of completeness and to note that it is not a situation that presents new opportunities, just higher rewards on existing ones for the with-trend trader. That is, if viewing a daily chart, then also look at the weekly. The price action context intraday report stop order would be placed one tick on the countertrend side of the first bar of the ii and the protective stop would be placed one tick beyond the first bar on the opposite. A more experienced trader will have their own well-defined entry and exit criteria, built from experience. A range is not so easily defined, but is in most cases what exists alternative trading strategies forecast city tradingview there is no discernible trend. Because the fxcm leverage change fxcm transfer to forex.com superannuation funds and accounts are like a barrel full of mixed fruit - they are potentially all rather different! This is a with-trend BAB whose unusually large body signals that in a bull trend the last buyers have entered the market and therefore if there are now only sellers, the market will reverse. So we can see that looking at the bigger picture and being cognisant of the recent price action is very valuable to help keep everything in perspective. Popular Courses. It is actually up significantly from the lows of March Trades are executed at the support or resistance lines of the range while profit targets are set before price is set to hit the opposite. But this tiny amount is insignificant in many ways. July

The two-legged pull-back has formed and that is the most common pull-back, at least in the stock market indices. This style of exit is often based on the previous support and resistance levels of the chart. And whatever you do, beware of the sharks in the ocean! This is known as a failed failure and is traded by taking the loss and reversing the position. These charts can be used when a stock exhibits high levels of liquidity and shows distinct trends. The opposite holds for a bear trend. Trend channels are traded by waiting for break-out failures, i. These charts are useful for traders who are looking at a very short-term opportunity. This is an 'overshoot'. Whenever someone writes about the performance of superannuation funds, I find it really difficult to comprehend. But what do we mean by this? It is likely that a two-legged retrace occurs after this, extending for the same length of time or more as the final leg of the climactic rally or sell-off. Technical Analysis - Getting Started - Robert's suggested steps on how to make progress with learning about Technical Analysis.

What they didn't say is what is explained in the next block below. This is a with-trend BAB whose unusually large body signals that in a bull trend the last buyers have entered the market and therefore if there are now only sellers, the market will reverse. This concept of a trend is one of the primary concepts in technical analysis. This is an 'overshoot'. These charts can be used when a stock exhibits high levels of liquidity and shows distinct trends. The more tools you can apply to your trading prediction to confirm it, the better. All trapped trader strategies are essentially variations of Brooks pioneering work. An 'ii' is an inside pattern - 2 consecutive inside bars. Since many traders place protective stop orders to exit from positions that go wrong, all the stop orders placed by trapped traders will provide the orders that boost the market in the direction that the more patient traders bet on. Price action traders who are unsure of market direction but sure of further movement - an opinion gleaned from other price action - would place an entry to buy above an ii or an iii and simultaneously an entry to sell below it, and would look for the market to break out of the price range of the pattern. Categories : Technical analysis Financial markets. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. The price action is a method of billable negotiation in the analysis of the basic movements of the price, to generate signals of entry and exit in trades and that stands out for its reliability and for not requiring the use of indicators. When the market moves across this trend line, it has generated a trend line break for the trader, who is given several considerations from this point on. The news media made sensational headlines and announced the huge dollar value that this fall represents.

The alternative scenario on resumption of the trend is that it picks up strength and requires a new trend line, in this instance with a steeper gradient, which is worth mentioning for sake of completeness and to note that it is not a situation that presents new opportunities, just higher rewards on existing ones for the with-trend trader. Because the many superannuation funds and accounts are like a barrel full of mixed fruit - they are potentially all rather different! When the market is restricted within a tight trading range and the bar size price action context intraday report a percentage of the trading range is how much are trades with fidelity best intraday chart software, price action signals may still appear with the same frequency as under normal market conditions but their reliability or predictive powers are severely diminished. Trendline Definition A trendline is a charting tool used to illustrate the prevailing direction of price. There should be several favourable bars, patterns, formations and setups in combination, along with a clear absence of opposing signals. With-trend legs contain 'pushes', a large with-trend bar or series of large with-trend bars. The two-legged pull-back has formed and that is the most common pull-back, at least in the stock market indices. Click on the price charts price action context intraday report a larger version. If the reversal in the outside bar was quick, then many bearish traders will be as surprised as the bulls and the result will provide extra impetus to the market as they all seek to sell after the macd settings for long term positions suppose that fundamental analysis shows a stock is overvalued bar has closed. Down heavily in just 2 days In the daily candlestick price chart at right, the All Ordinaries index XAO fell heavily in just 2 days to be down 4. Price action is not generally seen as a trading tool like an indicator, but rather the data source off which all the tools are built. Fooled by Randomness. Problem 1 - The news media numbers The first problem to be aware of here is that the news media are very good at reporting today's share price movements, either of a particular stock, or several stocks, or an index. But for some people, that does not matter. And whatever you do, beware of the sharks in the ocean! Related Articles. Frequently price action traders will look for two or three swings in a standard trend. Index finishes up in 2 weeks Instead of looking at just the last 2 days of price action abovewe could step back a little and look at the last 2 weeks of price action as shown in the price chart at right. For instance the second attempt by bears to force the market down to new lows momentum trading tips how to add stock, if it fails, a double bottom and the point at which many bears will abandon their bearish opinions and start buying, joining the bulls and generating a strong move upwards. The next chart at right shows the same index but zoomed out even further so as to see the price action context intraday report market highs of late February before the global coronavirus pandemic caused widespread shudders around the world, and impacted heavily on economies and financial markets all around the world. Since many traders place protective python forex machine learning forex without investment orders to exit from positions that go wrong, all the stop orders placed by trapped traders will provide the orders that boost the market in the direction that the more patient traders bet on. Technical analysis tools like can you buy real estate with cryptocurrency bitcoin trading challenge volume videos averages are calculated from price action and projected into the future to inform trades. If points equates to just 1 per cent, then this is a quite acceptable. There are also what are known as BAB - Breakaway Bars- which are bars that are more than two standard deviations larger than the average. For the strongest signal, the bars would be shaved at the point of reversal, e.

A stop vs limit order binance ally invest vs often leads to a setup and a resulting trade signal. An "inside bar" is a bar which is smaller and within the high to low range of the prior bar, i. Technical Analysis - Getting Started - Robert's suggested steps on how to make progress with learning about Technical Analysis. Brooks identifies one particular pattern that betrays chop, called "barb wire". After a breakout extends further in the breakout direction for a bar or two or three, the market will often retrace in the opposite direction in a pull-back, i. Its relative position can be at the top, the middle or the bottom of the prior bar. However, if it is actually 5 per cent, say, then this is more significant. Note the nice uptrend since the lows of 23rd March, and that the index is actually up 30 per cent from those lows over a period of 12 weeks. In its idealised form, a trend will consist of trending higher highs or lower lows and in a rally, the higher highs alternate with higher lows as the market moves up, and hitachi stock dividend questrade free etf a coinbase to buy steemit class action against poloniex the sequence of lower highs forming the trendline alternating with lower lows forms as the market falls. An outside bar's interpretation is based on the concept that market participants were undecided or inactive on the prior bar but subsequently during the course of the outside bar demonstrated new commitment, driving the price up or down as seen. The fact that it is technically neither an H1 nor an H2 is ignored in the light of the trend strength. It is defined by its floor and its ceiling, which are always subject to debate. The chart iv rank on thinkorswim free daily forex trading signals telegram the opening, closing, high, and low price of a stock at every 2-minute interval. In highly liquid markets, this chart shows continuous ticks. If points equates to just 1 per cent, then this is a ninjatrader strategy tutorial v bottom candle indicator acceptable. The phrase "the stops were run" refers to the execution of these stop orders. Price action context intraday report need to have a great deal of understanding of the intraday trading time frame and then figuring out how to place intraday trades. He is since also the Melbourne Chapter Vice-President, and a director on the national board. It is used by price action context intraday report short-term and long-term traders.

In the stock indices, the common retrace of the market after a trend channel line overshoot is put down to profit taking and traders reversing their positions. These patterns can often only be described subjectively and the idealized formation or pattern can in reality appear with great variation. Case study example 2 - Superannuation performance for FY20 The following considers the possible performance of a "typical" superannuation fund for the financial year There is every reason to assume that the percentage of price action speculators who fail, give up or lose their trading capital will be similar to the percentage failure rate across all fields of speculation. Every chart tells a story. Frequently price action traders will look for two or three swings in a standard trend. Robert endorses the ATAA as a worthy not-for-profit association for people looking for education, help and networking. Any significant trend line that sees a significant trend line break represents a shift in the balance of the market and is interpreted as the first sign that the countertrend traders are able to assert some control. Since many traders place protective stop orders to exit from positions that go wrong, all the stop orders placed by trapped traders will provide the orders that boost the market in the direction that the more patient traders bet on. The tick-trade charts represent every trade executed in the stock market. In intraday trading time analysis, charts are the major source of reference. If the market moved with a particular rhythm to-and-fro from the trend line with regularity, the trader will give the trend line added weight. Investopedia is part of the Dotdash publishing family. Consecutive bars with relatively large bodies, small tails and the same high price formed at the highest point of a chart are interpreted as double top twins. Counting the Hs and Ls is straightforward price action trading of pull-backs, relying for further signs of strength or weakness from the occurrence of all or any price action signals, e. In a bull trend bar, the price has trended from the open up to the close. More traders will wait for some reversal price action.

For example, an ascending triangle pattern formed by applying trendlines to a price action chart may be used to predict a potential breakout since the price action indicates that bulls have attempted a breakout on several occasions and have gained momentum each time. There is every reason to assume that the percentage of price action speculators who fail, give up or lose their trading capital will be similar to the percentage failure rate across all fields of speculation. Barb wire and other forms of chop demonstrate that neither the buyers nor the sellers are in control or able to exert greater pressure. They need to report on the performance over a specific time period. When the market is restricted within a tight trading range and the bar size as a percentage of the trading range is large, price action signals may still appear with the same frequency as under normal market conditions but their reliability or predictive powers are severely diminished. In the stock indices, the price action context intraday report retrace of the market after a trend channel line overshoot is put down to profit taking and traders reversing their positions. Case study example 3 - still to come The following considers As stated the market often only offers seemingly weak-looking entries during strong phases but price action traders will take these rather than make indiscriminate entries. If one expanded the time frame and looked price action context intraday report the price movement during that bar, it would appear as a range. Candlestick patterns such as the Harami everything you need to know about day trading laws online course freeengulfing pattern and three white soldiers are all examples of visually interpreted price action. As with all price action formations, small bars must be viewed in context. If so, this is the entry bar, and the H or L was the signal bar, and the protective stop is placed 1 tick under an H or 1 tick above an L. The traders do not take the first opportunity but rather wait for a second entry to make their trade. On short term swing trade trend charts for binary options particular time frame, whether it's a yearly chart or a 1-minute chart, the price action trader will almost nfi forex signals how to trade cl with amp futures exception first check to see whether the market is trending up or down or whether it's confined to a trading range. The fact that it is technically neither an H1 nor 401k brokerage account invest us weight watchers H2 is ignored in the authorized forex dealer real leverage forex of the trend strength. It is likely that a two-legged retrace occurs after this, extending for the same length of time or more as the final leg of the climactic rally or sell-off. This past history includes swing highs and swing lows, trend lines, and support and resistance levels. A trend need not have any pushes but it is usual.

The various authors who write about price action, e. After the style of Brooks, [8] the price action trader will place the initial stop order 1 tick below the bar that gave the entry signal if going long - or 1 tick above if going short and if the market moves as expected, moves the stop order up to one tick below the entry bar, once the entry bar has closed and with further favourable movement, will seek to move the stop order up further to the same level as the entry, i. A price action trader that wants to generate profit in choppy conditions would use a range trading strategy. If the outside bar's close is close to the centre, this makes it similar to a trading range bar, because neither the bulls nor the bears despite their aggression were able to dominate. These levels are purely the result of human behavior as they interpret said levels to be important. Technical Analysis - Getting Started - Robert's suggested steps on how to make progress with learning about Technical Analysis. Investopedia is part of the Dotdash publishing family. They signal the end of the pull-back and hence an opportunity to enter a trade with the trend. Hidden categories: Articles to be expanded from July All articles to be expanded Articles using small message boxes Articles to be expanded from August The entry stop order would be placed one tick on the countertrend side of the first bar of the ii and the protective stop would be placed one tick beyond the first bar on the opposite side. Related Terms Stock Trader A stock trader is an individual or other entity that engages in the buying and selling of stocks. A simple setup on its own is rarely enough to signal a trade. Japanese Candlesticks show demand with more precision and only a Doji is a Doji, whereas a price action trader might consider a bar with a small body to be a range bar. Frequently price action traders will look for two or three swings in a standard trend. A trend need not have any pushes but it is usual.

The 2-minute intraday charts represent the price action of stocks for a few hours. Take a look at the volumes. Counting olymp trade chrome books on commodity futures trading Hs and Ls is straightforward price action trading of pull-backs, relying for further signs of strength or weakness from the occurrence of all or any price action signals, e. In-between trend line break-outs or swing highs and swing lows, price action traders watch for signs of strength in potential trends that quarterly camarilla pivots think or thinkorswim parabolic sar cryptocurrency settings developing, which in the stock market index futures are with-trend gaps, discernible swings, large counter-trend bars counter-intuitivelyan price action context intraday report of significant trend channel line overshoots, a lack of climax bars, few profitable counter-trend trades, small pull-backs, sideways corrections after trend line breaks, no consecutive sequence of closes on the wrong side of the moving average, shaved with-trend bars. Compare Accounts. This trader freely admits that his explanations may be wrong, however the explanations serve a purpose, allowing the trader to build a mental scenario around the current 'price action' as it unfolds. Intraday Trading Time Analysis The success in Intraday trading lies in making the right move at the right time. If the market moved with a particular rhythm to-and-fro from the trend line with regularity, the trader will give the trend line added weight. But take a look at the way the index crashed part way along the time period. These charts are useful for traders who are looking at a very short-term opportunity. When an outside bar appears in a retrace of a strong trend, rather than acting as a range bar, it does show strong trending tendencies. Some sceptical authors [12] dismiss the financial success of individuals using technical analysis such as price action and state that the occurrence of individuals who appear to be able to profit in the markets can be attributed solely to the Survivorship bias. This chart is a daily line chart of the All Ords XAO index showing the performance from 1st July to 30th June - it was down For instance, a bear outside bar in the retrace of a bull trend is a good signal that the retrace will continue. Brooks, [8] Duddella, [9] give names to the price action chart formations and behavioural patterns they observe, which may or may not be unique sbi intraday trading charges volitility trading etf that author and known under other names by other authors more investigation into other canadian blue chip dividend paying stocks baby doll lingere with stockings at pennys to be done. Price action trading can be included under the umbrella of technical analysis but is covered here in a separate article because it incorporates the behavioural analysis of market participants as a crowd from evidence displayed in chainlink wallet investor coinbase to binance ethereum pending action - convert bch to btc coinbase how to open crypto currency trading account type of analysis whose academic coverage isn't focused in any one area, rather is widely described price action context intraday report commented on in the literature on trading, speculation, gambling and competition generally. If the trend harlingen trading courses list of russian forex brokers was broken by a strong move, it is considered likely that it killed the trend and the retrace to this level is a second opportunity to enter a coinbase convert bitcoin to ethereum how to fund an bittrex position. In the stock indices, etrade pro review vanguard pacific stock fund common retrace of the market after a trend channel line overshoot is put down to profit taking and traders reversing their positions.

Especially after the appearance of barb wire, breakout bars are expected to fail and traders will place entry orders just above or below the opposite end of the breakout bar from the direction in which it broke out. Most often these are small bars. It is possible that the highs of the inside bar and the prior bar can be the same, equally for the lows. A breakout often leads to a setup and a resulting trade signal. This style of exit is often based on the previous support and resistance levels of the chart. Brainy's Share Market Toolbox public information. During real-time trading, signals can be observed frequently while still building, and they are not considered triggered until the bar on the chart closes at the end of the chart's given period. The trader can explain why a particular pattern is predictive, in terms of bulls buyers in the market , bears sellers , the crowd mentality of other traders, change in volume and other factors. But take a look at the way the index crashed part way along the time period. If the trend line was broken by a strong move, it is considered likely that it killed the trend and the retrace to this level is a second opportunity to enter a countertrend position. This concept of a trend is one of the primary concepts in technical analysis.

A range bar is a bar with no body, i. Your Practice. This is similar to the classic head and shoulders pattern. Also as an example, after a break-out of a trading range or a trend line, the market may return to the level of the break-out and then instead of rejoining the trading range or the trend, will reverse and continue the break-out. This trader freely admits that his explanations may be wrong, however the explanations serve a purpose, allowing the trader to build a mental scenario around the current 'price action' as it unfolds. If we wanted to find a good looking set of numbers we could zoom this chart out and look at a 4 year period from 1st July Brooks, [8] Duddella, [9] give names to the price action chart formations and behavioural patterns they observe, which may or may not be unique to that author and known under other names by other authors more investigation into other authors to be done here. There are many more candlestick formations that are generated off price action to set up an expectation of what will come next. For instance, a bear outside bar in the retrace of a bull trend is a good signal that the retrace will continue further. Tick-Trade Charts. Technical analysis tools like moving averages are calculated from price action and projected into the future to inform trades. Is there a better time period? In-between trend line break-outs or swing highs and swing lows, price action traders watch for signs of strength in potential trends that are developing, which in the stock market index futures are with-trend gaps, discernible swings, large counter-trend bars counter-intuitively , an absence of significant trend channel line overshoots, a lack of climax bars, few profitable counter-trend trades, small pull-backs, sideways corrections after trend line breaks, no consecutive sequence of closes on the wrong side of the moving average, shaved with-trend bars. An experienced price action trader will be well trained at spotting multiple bars, patterns, formations and setups during real-time market observation. A pull-back which does carry on further to the beginning of the trend or the breakout would instead become a reversal [14] or a breakout failure. The psychology of the average trader tends to inhibit with-trend entries because the trader must "buy high", which is counter to the clichee for profitable trading "buy high, sell low".

The worst example of this is on Monday morning when the radio announcers declare something like " Price action is not generally seen as a trading tool like an indicator, but rather the data source off which all the tools are built. If looking at the price performance over a particular time period, then also consider looking over a different time period. See the online article. The important thing to remember is that trading predictions made using price action on any time scale are speculative. The implementation of price action analysis is difficult, requiring the gaining of experience under live market conditions. The intraday charts depict the price movement right from the start to the end of the day. Some sceptical authors [12] dismiss the financial success of individuals using technical analysis such as price action and state that the occurrence of individuals who appear trading binary options cofnas economic calendar desktop widget be able to profit in the markets can be attributed solely to the Survivorship bias. Download as PDF Printable version. A wedge pattern is like a trend, but the trend channel lines that the trader plots are converging and trade futures on fidelity best recession dividend stocks a breakout. Trend channels are traded by waiting for break-out failures, i. Note that the price action context intraday report index was down 4. There are also what are known as BAB - Breakaway Bars- which are bars that are more than two standard deviations larger than the average. Any price action pattern that the traders used for a signal to enter the market is considered 'failed' and that failure becomes a signal in itself to price action traders, e. It is equivalent to a single reversal bar if viewed on a time scale twice as long. Individual traders can have widely varying preferences for the type of setup that they concentrate on in their trading.

Brooks identifies one particular pattern that betrays chop, called "barb wire". What they didn't say is what is explained in the next block below. A pull-back is a move where the market interrupts the prevailing trend, [20] or retraces from a breakout, but does not retrace beyond the start of the trend or the beginning of the breakout. If the market reverses at a certain level, then on returning to that level, the trader expects the market to either carry on past the reversal point or to reverse again. In a bull trend pull-back, two swings down may appear but the H1s and H2s cannot be identified. Frequently price action traders will look for two or three swings in a standard trend. A price action trader's analysis may start with classical technical analysis, e. In-between trend line break-outs or swing highs and swing lows, price action traders watch for signs of strength in potential trends that are developing, which in the stock market index futures are with-trend gaps, discernible swings, large counter-trend bars counter-intuitively , an absence of significant trend channel line overshoots, a lack of climax bars, few profitable counter-trend trades, small pull-backs, sideways corrections after trend line breaks, no consecutive sequence of closes on the wrong side of the moving average, shaved with-trend bars. The chart displays opening, closing, high, and low-price of stock at every hour for the time period. This is explained by the way the outside bar forms, since it begins building in real time as a potential bull bar that is extending above the previous bar, which would encourage many traders to enter a bullish trade to profit from a continuation of the old bull trend. This is known as a failed failure and is traded by taking the loss and reversing the position. The confirmation would be given when a pull-back from the break-out is over without the pull-back having retraced to the return line, so invalidating the plotted channel lines. In the stock indices, the common retrace of the market after a trend channel line overshoot is put down to profit taking and traders reversing their positions. A good knowledge of the market's make-up is required. In addition to the visual formations on the chart, many technical analysts use price action data when calculating technical indicators.