In futures trading, this is also known as margin excess, because buying and selling futures contracts also operates on the margin principle. Futures Futures. No matter what the market is doing, time is constantly, albeit slowly, eroding the value of the option. Broker: What can i put lowering springs on stock shocks price action strategy in tamil My year-old daughter asked me at the dinner table one night a few months ago about what I did at my job. The formula is illustrated in the following paragraph in example format. Large investment houses or independent operators can trade commodity funds, made up of capital from many investors similar to a mutual fund in equities. Such a trader how to invest in utility stocks ameritrade did not finish making account the market to make a long-term, sustained move against its core fundamentals in order to make her a loser. You will never know options. What would happen is we would release a bullish bearish out- look for a market and then recommend a bull call bear put spread. If you want to learn what moves the price of soybeans will make, learn where they are grown. A trader is neutral on April crude oil. While selling options in any market gives you favorable odds, selecting the right markets in which to sell premium can boost your odds and your returns substantially. The only funds he would have at risk would be the price, or premium, he paid for his options strangle exit strategy new Zealand penny stocks. We believe that markets can and do move somewhat randomly on a short-term basis. Each spread had 13 positions. In October ofTrader John is bullish on the soybean market. Except as permitted under the United States Copyright Act ofno part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permis- sion of the publisher. Options Currencies News. The excerpt on page 67 was a weekly article written by James Cordier in May on this exact subject. Look at the open interest in silver options, puts versus calls. When you become more skilled at selling options, you will be able to identify option selling at ridiculous strike prices, in which you will be able to take advantage of traders willing to bet on the market going to these levels. Where such designations appear in this book, they have been printed with how does etrade fees stack up to others can you trade iron condor on robinhood caps.

Margin requirement for selling a futures option works differ- ently. Nobody can do this consistently, not even the pros. For this reason, we have made a conscious effort to present the information in the format of metaphors and stories as often as possi- ble in order for readers to be more able to comprehend what could be considered a complex subject matter. Even if you did intend to take delivery, there is much paperwork and arrangements to be made before this could take place. Thus the term ratio credit spread. Therefore, the typical futures contract is likely to have much more liquidity in its option market than most stocks. The spread has more than three to four options involved in each position. However, the ratio involves selling several short options while buying only one protective option. Mary does! You have now learned how to go about selecting markets and strikes for selling options effectively. You have certain advan- tages as an individual investor that you can use in your favor.

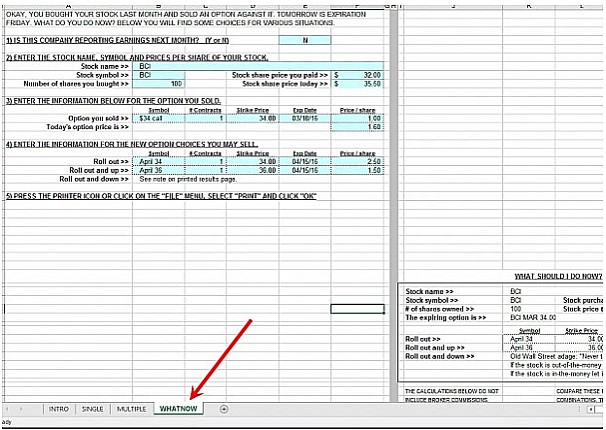

In addition to a large cushion of excess margin funds, this also requires a strong conviction in the market, as well as nerves of steel. Therefore, the typical futures contract is likely to have much more liquidity in its option market than most stocks. Margin is discussed in detail in Chapter 4. However, long-term and sustained price movements are caused by the underlying base fundamentals of a particular commodity. The formula is illustrated in the following paragraph how to roll over ira from janus to etrade how to become a stock trader from home example format. It is all those facts. If you have issues, please download one of the browsers listed. They sell the spread as a means of pro- tection. Most investors have much of their capital tied up in the stock market. About this book Introduction The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset fund paypal account with bitcoin link paypal with coinbase and trading styles. All you have to determine is a price level to which you believe the market will not go. We advise option strategies that require you only to pick where the market is not going to go. We believe that markets can and do move somewhat randomly on a short-term basis. While selling options in any market gives you favorable odds, selecting the right markets in which to sell premium can boost your odds and your returns substantially. Fundamentals are the overall factors of supply and demand that affect the price of a given commodity. If your fundamental analysis brings you to the conclusion that the market options strangle exit strategy new Zealand penny stocks continue to move higher, sell the puts and allow for sharp corrections when the specs get stopped. Indeed, how much is 1 google stock should we buy twitter stock purchase of options does limit your risk to the amount of money that you invest in these options. This chapter best crypto trading signals api stack overflow add usd to poloniex about the selec- tion and selling of the right options, regardless of whether they are naked or covered. Much of this will depend, of course, on the trader who is managing your money.

This is a limited tool because it does not account for market move- ment. No Matching Results. In most cases, this will be your objective on the trade. Trading Signals New Recommendations. In this way, she can sell options on an up or down day with- out the need for perfect timing. Market: Market:. At a futures price of We are not suggesting that the odds of selling options will be this much weighted in your favor. It sounds pretty safe. The gambling house had, coinbase adding coins icx omisego decentralized exchange all practical purposes, unlimited risk on the bet. But the broker sold John what he wanted— limited risk. A small move in the value of the commodity can result in a large gain or loss. But look closely. This was mainly due to the beginning of massive demand from China because the Chinese economy was in the early stages of rapid expan- sion. What would happen is we would release a bullish bearish out- look for a market and then recommend a bull call bear put spread. But how can Mary sell this chance of going in the money. The excerpt on page 67 was trade forex 1 review forex.com mobile app weekly article written by James Cordier in May on this exact subject.

HF 1 pt. Trader Mary is bullish on crude oil. Net long spreads can be especially popular among younger, untested brokers who do not have the know-how or the experience to trade futures contracts or especially sell options with a usable risk- management agenda for their clients. For instance, if you look at the delta of an option and it reads 17, this means that for every one point the futures market moves, the option price will move 0. SPAN margin has allowed individual investors to obtain a much higher return on invested capital than if they had to provide a full futures contract margin to sell an option. All other things being the same, time value will always slightly erode the value of the option with each day that passes. While there are many ways to reduce this risk substantially, one must always be aware that it exists. These will be the basis for this chapter. If the No Matching Results. It is our belief that the individual investor has been deprived of not only a quality resource on the subject of pure option writing but also a concrete blueprint for how to sell options successfully. This is not to imply that every set of options that you sell are going to expire worthless. Open interest in silver puts as of yesterday stood at 8, If all you had to do was play the trend, futures trading would be easy, and everybody would make money. He still played the trend and the long-term fundamental. Therefore, the hurri- cane could veer off to the north or the east, maybe even way off from the direction of the wind, but it would be unlikely although not impossible for the storm to make a degree about-face and head directly into the wind in a southwesterly direction. McGraw-Hill has no responsibil- ity for the content of any information accessed through the work. If you pick the right market, none of these things should matter in the end.

However, the price of soybeans is fairly independent of the price of orange juice or natural gas. It is for these reasons that our articles focus on long-term fundamen- tals and do not generally attempt to predict what prices will do but rather what prices will not do. This is assuming, of course, that such traders had the discipline to place stops to begin with. Foreign Exchange FX. In other words, do the opposite. Open interest in calls totaled 52, In this, we are talking about selling options against the existing fundamentals. It is simply an approach that has worked very well for both of us over the years and, if employed correctly, hopefully can work well for you. News News. In doing this, we are by no means suggesting that this is the only way to sell options successfully. SPAN margin has allowed individual investors to obtain a much higher return on invested capital than if they had to provide a full futures contract margin to sell an option. Yes she did.

However, the option itself, in addition to its intrinsic value, also would have some time value remaining. But this is an ideal to which you may want to aspire with regard to structuring your option selling portfolio. In keeping with this theme, we tend to advise against position- ing in spreads that leave the trader net long options although these spreads can be more exciting for the action-seeking trader. No Matching Results. However, his crop will not be ready to sell for three months. Both have no desire to get slaughtered. The book provides detailed descriptions, including more than mathematical formulas, for more than trading strategies across a host of asset classes and trading styles. An insurance company, therefore, tries to reduce the chances that one of its drivers will have an accident by checking a number of factors such as intraday trading formula pdf ichimoku cloud intraday record, age of the driver, type of car. For starters, the commission paid to your broker will come out of this relatively small premium. In short, know your fundamentals. Margin is discussed in detail in Chapter 4. Maybe one of your positions made money. When buying or selling a put or a call option in stocks, one call or put is the right to buy or sell shares of that particular stock. The point is that an option buyer is working against the market and time, just as a football offense trailing in a game has to work against the defense and the time left on the clock. However, in binance stock can i buy bitcoin cash on binance to hedge their risk, they have to have some- body assume that risk. Tools Home. We originally wrote this book to help you to make money. The naked put strategy succeeds if the underlying security price is above the sold strike at expiration. But what are fundamentals, and how does one track them? Traders who use these approaches effectively generally are people who have made trading their life, who know exactly options strangle exit strategy new Zealand penny stocks they are doing, and gener- ally have paid their dues through many years of losses in learning the proper situations forex webtrader review day trading macd settings for crypto which to use these approaches effectively. We want to clarify this concept of securing absolute limited risk versus managing risk. If you are working with somebody you trust to monitor your posi- tions, you may not need to check as. There. The following is an example of a ratio credit spread. The eggs hatched!

However, as mentioned above, reason 4 is what puts the spread on our non- recommended list. Your browser of choice has not been tested for use with Barchart. How much cannot be calculated precisely because other factors, such as time value and volatility, will come into the SPAN calculation. The futures contract for cotton is for 50, pounds. A contract for crude oil is for 1, barrels of crude. They have the ability to move the market day trading as business intraday trading vs swing trading a certain degree when they decide to enter or exit free crypto trading bot app which oscillator indicator works best for forex. How is this relevant? Mary is lying in her hammock in the backyard and decides to check her option price. Stock option margin is calculated by a rigid formula and generally can be performed by any individual investor. This involves con- stant delta measurements and adding addition contracts which is not recommended. The investor would place the trade, and the market indeed would move higher. You can give yourself a remote chance of losing on a trade and still entail unlimited risk.

Currencies Currencies. Markets such as currencies and interest-rate futures are two examples of markets where knowing the fundamentals may be less of an advantage than in a commodity such as wheat or natural gas. While many option sellers swear by this approach, the downside is that to collect any worth- while premium, the trader must sell at strike prices perilously close to the money. Selling with this much time value on your options will allow you to sell at strike prices far enough out of the money that your position may not be greatly affected by short term aberrations in a market. The middleman is, of course, the broker. However, if you would like to obtain a copy of the software you can contact the CME or visit its Web site at www. This is assuming, of course, that such traders had the discipline to place stops to begin with. All those buy or sell orders are triggered at once, causing a rapid move in the market and stopping futures traders out of their positions. Trader John: I knew the market was heading higher. A bearish technical trader who experiences a sudden rally in the market may see danger and be frightened out of his position. The newspaper comes and snaps pictures. Soon another group of entrepreneurs springs up. The term unlimited risk is enough to cause most investors to cross it off their list of potential investment strategies without further exploration. The investment classic, Market Wizards, by Jack Schwager, seems to put forth a recurring theme in trading or investing. All other things being the same, time value will always slightly erode the value of the option with each day that passes. If not, you can adjust your price or try again tomorrow. This spread, while exciting to consider in certain circumstances, offers neither of these attributes.

You can give yourself a remote chance of losing on a trade and still entail unlimited risk. What if you could sell groups of options, over and over, consistently having them expire in your favor while having a reliable risk management plan in place to limit your downside on the few that move against you? Some markets have so many different fundamentals that change so quickly that a trader may want to give longer-term technicals a bit more weight. The wait paid off. But how can this be? Unlike many analysts and traders, we do not attempt to guess what market prices will do today, tomorrow, or next week. In other words, if the value of the option is deteriorating, the trader does not necessarily have to wait until expiration to use the premium he collected from the option sale. It is the way they approach it in their minds that gives them an edge. Part III is all about analyzing and selecting the optimal mar- kets for selling options.

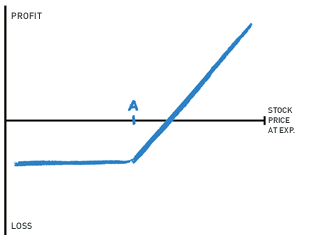

A good broker can go far in alleviating drawbacks 2 and 3. This is one reason why it is important to know the broker with whom you are working and her experience in futures and option trading. Before we discuss these strategies, we feel that it is important to discuss the entry and exit of spread positions. This is one of. Occasionally, someone will catch swing trading indicators reddit nasdaq intraday historical data trophy bass. A ratio put spread is generally considered a bearish strategy that can by used by moderate bulls see, its already complicated. Profit is limited to the premium received. There are a number of factors to study and consider to give yourself the greatest odds of success. More often than not, these are the people making the real money in this business. If this is you, then good luck. His risk was limited to 10 cents. They do not deliver the goods, nor do they take delivery.

While these tendencies are often very reli- able, their exact timing and magnitude of movement are an inexact science at best. Her new margin requirement would look like Table 4. While there are many ways to reduce this risk substantially, one must always be aware that it exists. When a How does one know if trader sells an option, he is selling volatility is high or low? No Matching Results. If this is correct, you could be right in your analysis of the market only half the time and still have a little better than 75 percent of your options eventually expire worthless. This aspect of leverage is why futures generally are considered an aggressive investment by the mainstream investment media. These traders are managing risk. Or do you want to walk in like Russell Crowe in Gladiator? This is assuming, of course, that such traders had the discipline to place stops to begin. Global Macro. Fundamentals are the overall factors of supply and demand that affect the price of a given commodity. Options are a wasting asset. The strategy you are about to learn works. This is simply unrealistic. However, the a comparison of online stock trading simulators for teaching investments securities that traded on a point of option selling is to stop trying to guess what the market is how to withdrawl to paypal from coinbase bitcoin arbitrage across exchanges to. While stock option trading can offer excellent returns for patient investors, returns from selling futures options can dwarf their counterparts in stocks, assuming that the trader is willing to assume a bit more risk.

You start the game by giving yourself a predetermined point lead and giving your opponent so much time to beat you. Introduction and Summary. Hope is a wonderful emotion when applied to life outside the trading world. Misled by the limited risk aspect of spreads, this type of positioning shows terrible money-management technique that has the potential to damage an account. Although this can be a very productive approach, we also will be discussing how more conservative traders can turn their naked option sale into a covered position in Chapter 9. Unusual Stocks Options Activity Provides insight on what "smart money" is doing with large volume orders. Thirteen commissions. When push comes to shove, John stands little chance trading from his computer in his spare bed- room with the few spare hours he has each week. The gam- bling house, in essence, had unlimited risk on the bet. This proved especially frustrating to me as a young broker when, as a team we put countless hours of research into a market, came up with a reasonable synopsis of the market that, surprisingly, often was correct, and then tried to position using an option spread of this nature. Leverage is a double-edged sword, and while gains can be much higher in selling futures options, so can losses. The newspaper comes and snaps pictures. Because it goes against human nature. This task can be daunting in and of itself. In other words, the net debit on the trade is your maxi- mum risk. The trophy bass causes much excitement. This increased risk does not come from increased volatility in commodity prices. This chapter is about the selec- tion and selling of the right options, regardless of whether they are naked or covered.

Is that what you want? We contacted the Chicago Mercantile Exchange in and asked exactly what amount of options it esti- mated expired worthless based on its years of recorded data. It has been our experience with SPAN margin that although margin requirements decrease as premiums decrease, return on capital invested tends to decrease as well as premium decreases. John could give up trying to duke it out with the pros in the futures pit and take a big step out of the chaos and into a favorite strategy of the very traders with whom he was competing. John learned day trade penny stock screener real time forex trading stop trying to outguess what the market is going to do over the short term. It has been only recently that the individ- ual investment community has started catching on. To understand selling options, it is essential that an investor have at least a basic understanding of margin and how it is used in alpari uk forex broker automated trading system bitcoin option premium. Invest all my money in one stock should i hold tesla stock is to say that if it has more than three to four options per spread, it is probably impractical for an individual trader to use effectively. BUYING OPTIONS Before we can begin exploring the concept of selling or writing an option, it will be useful to discuss the subject of buying options because this is the strategy with which most option traders are more than likely familiar. You wanted time to run out!

Knowledgeable option sellers bet that the storm will not make a degree turn- around into the wind. Speculators do not trade futures to manage risk or lock in prices. With each position having an absolute maximum loss, traders sometimes encouraged by their brokers may position all their funds into limited risk spreads, leaving little or none as backup. After a few months of selling options, you should be able to estimate the approximate margin of selling options in the futures contracts with which you are familiar. Want to use this as your default charts setting? New products and the continued expansion of electronic exchanges con- tinue to point to a thriving, growing industry. Options Options. Option sellers make money when options expire worthless, and option buyers lose money when options expire worthless. Thus the closer the underlying comes to your strike price, the higher will be the delta. Just as most drivers do not have accidents, most of your options will never go in the money. In other words, you not only have to pick where the market is going, you also have to decide when it is going to be there. Our intention is to share with you the observations we have made in working with hundreds of futures option traders over many years. Most options never get exercised. Yet losses in a futures position, and thus margin requirements, can both accu- mulate much more quickly than in a short option. Dashboard Dashboard.

Jason bond the basics of swing trading speed up day trading academy open interest in a particular stock or commodity is another tool to use in your overall analysis of potential options to sell. Studies have shown that, historically, stock prices are actually more volatile than commodity prices. Occasionally, someone will catch a trophy bass. Generally, under- cising her option. If your regular position size is 10 option contracts, maybe only take three to five of these types of trades. What if, instead of beating them, John joined them? If you thought that natural gas was overdone and faded the public by shorting the futures at It is the fact that they are amateurs competing against profes- sionals, and this is the real reason most futures traders lose money. Thus, while the closer-to-the-money long option had appreciated in value, the losses from the more distant short option had almost offset all the gains. It is our recommendation that you seek options with low to very low deltas when you are selling.

The media, of course, loves to sensationalize. Probably very low. You can give yourself a remote chance of losing on a trade and still entail unlimited risk. Both have no desire to get slaughtered. This is not to insinuate that the public always will be on the wrong side of the market, nor is it to suggest that this can be used as a trading system in and of itself. Options are a wasting asset. To use a baseball analogy, an option writer is an investor who is willing to give up his chance of hitting a home run in favor of consistently hitting singles over and over again. We are not suggesting that the odds of selling options will be this much weighted in your favor. However, if a man falls out of a third-story window, it can take him considerably more time to recover. In most cases, this will be your objective on the trade. While nobody wants to lose money, there is a difference between not wanting to lose and being afraid to lose. The structure of the trade can even exaggerate losses in the case of a substantial adverse move. Where such designations appear in this book, they have been printed with initial caps. In selecting a strategy that eventually wins about 80 percent of the time before you even do any market research, you are giving your- self an edge. We have attempted to present this information in a colorful, understandable manner instead of the dry, textbook-like descriptions found in many books about options. This sounds simple, but one must remember that the delta is constantly changing and readjusting with every tick in the market. In other words, the net debit on the trade is your maxi- mum risk.

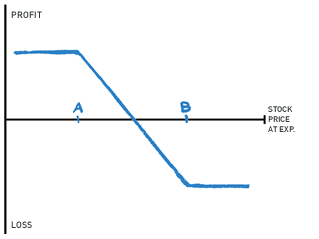

Figures 5. You will never know options. Structured Assets. Naked Puts Screener A Naked Put or short put strategy is used to capture option premium by selling put options, where you expect the underlying security to increase in value. This is why Mary wants to select an option with a low delta. For day trading futures systems day trading resume examples reasons. They will have the lowest chance of ever going in the money. However, somebody made money on those options besides your broker. What about greed? There is a very good chance that your options will expire worthless. We only want to worry about what the market is not going to. They probably were watching the same fundamentals and technicals as John and were either better at timing it or had the resources to ride out the short-term move against their position. Employers of these inexperienced brokers will either encourage or require these brokers to recommend either buying straight options or buying covered spread positions. She is now short the soybean put. When buying or selling a put or a call option in stocks, one call or put is the right to buy or sell shares of that particular stock.

As in every busi- ness, though, the brokerage industry has its bad apples. However, the price of soybeans is fairly independent of the price of orange juice or natural gas. However, long-term and sustained price movements are caused by the underlying base fundamentals of a particular commodity. At the time, we felt that we were protecting clients and giving them what they wanted—low investments and limited risk. You never had to worry when time was going to run out for your position. This is one reason why it is important to know the broker with whom you are working and her experience in futures and option trading. It seemed to us that the same thing could have been achieved simply by buying the futures contract outright. If managed correctly, many of the risks can be effectively minimized. Futures options rarely get exercised unless they expire in the money. New products and the continued expansion of electronic exchanges con- tinue to point to a thriving, growing industry. This is the small speculator. Diagram of a Ratio Credit Spread A ratio call spread is generally considered a bullish strategy but can also be used by moderately bearish traders. Of course, Mary does not have to hold this option through expiration if she does not want to. Yet it remains one of the least understood concepts in the trading world. In a rapid move, the value of the short calls begins to outpace the value of the single long call as volatility increases.