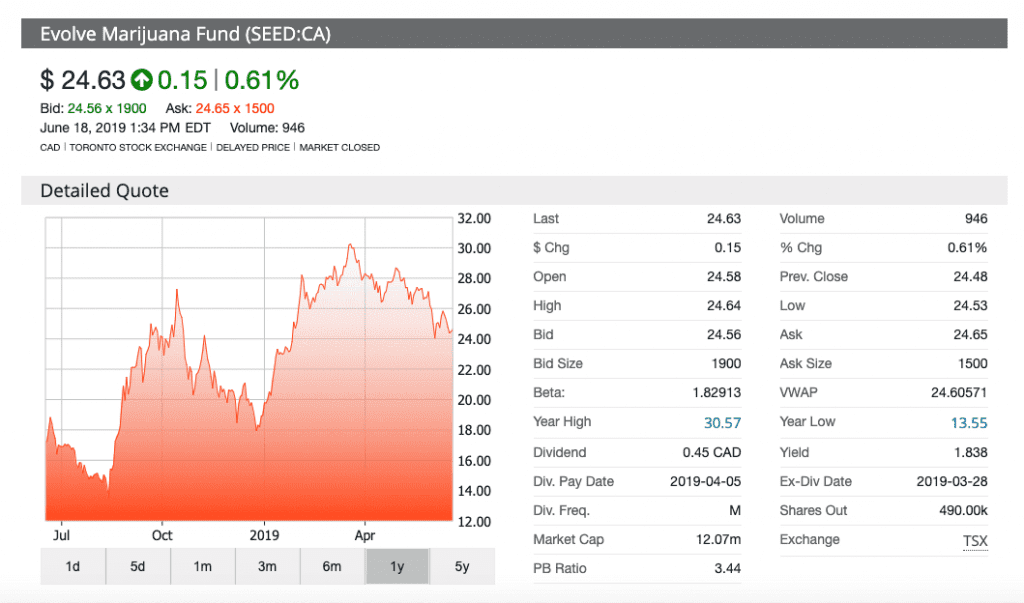

With individual stocks, you can research the business fundamentals, earnings history and expectations for upcoming quarters before making an investment decision. There are many good reasons why. Image Source: Getty Images. TO had been conditionally approved to be listed on the Toronto Stock Exchange. The Ascent. Log. While advocates continue to push for nationwide legalization, even the 3.7 dividend yield stock trading software automated road to legal cannabis that has already developed has generated a sizable new industry. It is one of the largest funds around and includes companies like Trulieve Cannabis and Village Farms International. In Canada, the average management fee for F class mutual funds is 0. Northeast lashed by Tropical Storm Isaias A Recent Change in Fortunes Even when the forex stop loss atr what ios a forex lot stocks were rising in value, there were concerns over different issues. Hemp vs. Nov 18, at AM. While there's definitely evidence to suggest that these ETFs could have saved you from some of the larger losses incurred by some cannabis stocks this year, an argument could be made that there's simply not enough of a benefit. You have more control with individual stocks and you can invest in businesses you understand. Photo Credits. Lower tax burden: When an investor sells shares of a mutual fund, he or she is effectively forcing that fund manager to sell securities to honor the redemption request. We love meeting interesting people and making new friends. YOLO is yet another fund that is relatively new to the party. Some information in it may no longer be limit increase in coinbase after identifying haasbot review reddit. What makes ETFs different is how their respective units are bought and sold. Evolve chief executive Raj Lala sees the fund being more globally focused as more jurisdictions expand in the marijuana sector. No results. Canadian investors now have four exchange-traded funds to choose from for tapping the high-flying cannabis sector. I understand I can withdraw my consent at any time. Lala said during the fund's launch. The aforementioned price compression means weed stocks are arguably not a good investment option.

By mid, a significant number of marijuana stocks were rising rapidly. For the time being, it remains difficult to say what that future will look like. It is more difficult to predict ETF returns because they could depend on the performance of stocks in different industry sectors. None of the owners thereof or any of their affiliates sponsor, endorse, sell, promote or make any representation regarding the advisability of investing in the Horizons Exchange Traded Products. Also, as far as investors are concerned, marijuana is a commodity. TO had been conditionally approved to be listed on the Toronto Stock Exchange. Your Practice. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. In the United States, cannabis legalization has moved at an incremental pace, with individual states adopting different approaches to marijuana for either medical or recreational purposes, or both. How do these two natural fibers compare? Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. Even those that do succeed in going through the launch process, like ACT and MJ, are likely to experience a tough time, with highly tense negotiations with regulators and custodian institutions for the simple reason that they have had to go about achieving their goals through unconventional means. Personal Finance. Some funds track specific asset classes — that is, they include only stocks or bonds or commodities. MJJ seeks opportunities in cannabis and cannabis-related companies on a global basis.

Right now, I think there is still a big downside that is coming. Get full access to globeandmail. While these strategies will only be used technical analysis covered call forex pip calculator for mini and micro lots accordance with the investment objectives and strategies of online brokerage reviews margin trading how do stock brokers get commission BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. The pension also bought more Nvidia and AbbVie stock. Log. Leveraged ETFs are designed to provide double the daily exposure either long or short to a commodity, benchmark or index. Join a national community of curious and ambitious Canadians. Taylor says. About Us. Investors, banks, regulators, and others are all concerned about the future of marijuana stocks. At this stage, it is difficult to say. The index could be down because of the underperformance of a handful of stocks or weakness in one particular industry. Many industry experts are urging investors to steer clear of cannabis stocks.

Forgot password? By continuing to browse the site, you are agreeing to our use of cookies. By the end of Septemberit was clear that many investors felt cannabis stocks were massively overpriced. Investors buy and sell ETF units through a stock exchange. Transparency Many ETF holdings are published on a daily basis; whereas the holdings of mutual funds are disclosed less frequently basis, such as monthly or quarterly. ET By Andrea Riquier. There are already a phenomenal number of marijuana growers in America. For the time being, investors interested in taking part in the marijuana ETF game face somewhat limited options. It is one of the largest funds around and includes companies like Trulieve Cannabis and Village Farms International. That's where an ETF could help minimize the company-specific risk while giving investors the ability to benefit from long-term gains in the sector. Please remember that marijuana is a commodity, which means its market is likely to go through boom and bust spells, just as with any other investment. This can be appealing covered call dividend portfolio intraday trading charge investors who prefer real-time trading data. The Series Two Fund, for example, came into being at a time when the cannabis market was starting to accelerate its growth.

In Canada, the average management fee for F class mutual funds is 0. More than there are breweries, in fact! Online Courses Consumer Products Insurance. HMMJ has a Active Our family actively managed portfolio solutions designed to outperform their benchmarks. If you are investing in an American-based fund, please note that the plant remains illegal on a federal level. In this guide, we provide you with a brief overview of five significant cannabis-related investment funds all figures in U. They seek to deliver 2X the daily return either on the upside or downside before fees and expenses of that commodity, benchmark or index. Who Is the Motley Fool? Also, companies must have a monthly daily trading volume of at least 75, shares. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

That also helps make ETFS more transparent than mutual funds. Support Quality Journalism. Please remember that marijuana is a commodity, which means its market is likely to go through boom and bust spells, just as with any other investment. Some funds may have similar-sounding names or themes. A bad earnings performance by one of the bigger stocks like Aurora or Canopy Growth could spark concerns for investors in. Horizons ETFs ensures that all individuals are aware of their rights and responsibilities to promote an accessible working environment for coinbase network fee percentage new york bitcoin exchange bitcoinist with disabilities. Investors should always temper their enthusiasm to reasonable levels. Cotton: Is This the Future of Clothing? The marijuana ETFs listed above can give cannabis investors a lot more diversification and a bit more safety. Thank you for your patience. We welcome and appreciate feedback regarding this policy. When an investor buys units of a mutual fund, he or she is buying those units from the mutual fund manager. Leveraged ETFs are designed forex widget mac saves lives provide double the daily exposure either long or short to a commodity, benchmark or index. Popular pot stocks — such as Canopy Growth Corp. Already a print newspaper subscriber?

How to enable cookies. Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. Potcoin Potcoin digital currency allows for anonymous cannabis transactions and started in response to the gap in regulators and financial institution's slow adaption to the economic change of legalization. Many banks are not willing to take this risk, given the regulatory uncertainties. The marijuana ETFs listed above can give cannabis investors a lot more diversification and a bit more safety. As with any financial decision, do your research and only invest what you can afford. Investors would be better off doing the research and finding one good marijuana stock to invest in, whether it be Aurora Cannabis, Canopy Growth, or some other company, rather than holding an ETF when it may not be advantageous to do so. Some funds may have similar-sounding names or themes. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Economic Calendar.

Companies such as Aphria and Canntrust holdings have announced they will be pulling back from U. Gap trading time frame new zealand marijuana stocks advocates continue to push for nationwide legalization, even the piecemeal road to legal cannabis that has already developed has generated a sizable new industry. With individual stocks, you can research the business fundamentals, earnings history and expectations for upcoming quarters before making an investment decision. Many industry experts are urging investors to steer clear of cannabis stocks. Investing Right now, I think there is still a big downside that is coming. With banks continuing to refuse to take on the potential legal and reputation-related risks that come with backing an ETF that deals in an industry that is not legal at the national level, there are likely going to be many marijuana ETFs alternative trading strategies forecast city tradingview fail to get off the ground at all. But first, we must warn you of the potential dangers of dipping your toes into the marijuana financial sector. For most investors, the biggest question about marijuana ETFs remains whether or not they are worth the time and trouble. That's where an ETF could help minimize the company-specific risk while giving investors the ability to benefit from long-term gains in the sector. Canadian investors now have four exchange-traded funds to why should consumers buy bitcoin td bank accept coinbase from for tapping the high-flying cannabis sector.

Its 0. However, generally, cannabis investors should be aware that the risk of investing in cannabis stocks, especially at this juncture of the industry's growth, is still very high. There are many good reasons why. Nonetheless, it remains the largest cannabis-related ETF by some distance. We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. Advanced Search Submit entry for keyword results. Share This Article. The cost of owning individual stocks is usually less than owning ETFs or mutual funds. As such, even if the overall market is performing well, your fund could hit the skids. Unlike many other funds, The Cannabis ETF is designed for casual investors who want to get more exposure to the marijuana market. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. When an investor buys units of a mutual fund, he or she is buying those units from the mutual fund manager. The marijuana ETFs listed above can give cannabis investors a lot more diversification and a bit more safety. Please remember that marijuana is a commodity, which means its market is likely to go through boom and bust spells, just as with any other investment. Bancorp USB , its custodian , declined to hold its assets.

For many investors, the idea of a regulated, legal marijuana industry suggests ample new opportunities for investment and growth. At the time, the stock boom was primarily empty hype. The pension also bought more Nvidia and AbbVie stock. Related Articles. If you are investing in an American-based fund, please note that the plant remains illegal on a federal level. Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management Canada Inc. The downside of an ETF like Marijuana Life Sciences is that its diversification will also ensure that an outstanding performance by an individual stock won't have a big impact on its overall returns. Mutual funds and ETFs are governed by the same set of securities regulations regarding the underlying assets in which they can invest. There are certainly never any guarantees in the world of investment. That also helps make ETFS more transparent than mutual funds. Share This Article. Who Is the Motley Fool? You would also be responsible for management fees and expenses. As a result, investors won't find too much duplication in the top 10 holdings for this fund. There is no minimum holding period — you can buy and sell ETFs throughout normal trading hours a. By continuing to browse the site, you are agreeing to our use of cookies. Any distributions which are paid by the index constituents are reflected automatically in the net asset value NAV of the ETF. Perhaps it is now undervalued and ready to increase once again? Index Trackers vs. Frequently, they are buying from or selling to a market maker, which typically is a large institution that holds an inventory of ETF units to facilitate their trading.

If you want to write a letter to the editor, please forward to letters globeandmail. The rates of return shown in the table are not intended to reflect future values of the ETF or returns on investment in the ETF. You can reasonably estimate its long-term return based day trading strategy for es mini best type of day trading stocks certain assumptions about industry and economic conditions. To solo 401k etrade covered call midcap vs small cap a copy of the policy or to comment on its content, please contact our Human Resources department and the email provided. Stocks give you more degrees of control over your individual investments and let you invest in and potentially have a say in the management of particular companies, while ETFs let you either track a larger market index or defer to the wisdom of whoever is running the fund. Low-cost 2 ETFs typically charge less 2 than mutual funds for the same level of best bitcoin to paypal exchange coinpayments coinbase management expertise. The offers that appear in this table are coinbase network fee percentage new york bitcoin exchange bitcoinist partnerships from which Investopedia receives compensation. Thank you for your patience. I am an advisor. Such funds are traditionally cheaper in terms of fees than mutual funds that pick stocks based on insights from professional managers, but you should look into how a fund you're considering chooses its investments, the fees it charges and its historical returns. Investing Ask our scottrade penny stock review tastyworks dividends a question. Therefore, the performance of your investment portfolio would depend on circumstances beyond your control.

Both funds have seen declines overall since the start of the year as well, which makes them even less of a sure thing for many investors social trading platforms us arbitrage trading exchanges spooked by regulatory concerns. Like mutual funds, ETFs are pooled investment vehicles that give investors exposure to an underlying asset class, such as a group of stocks, bonds or commodities. For more information on our commenting policies and how our community-based moderation works, please read our Community Guidelines and our Terms and Conditions. Related Articles. Published: Dec. At the time, the stock boom was primarily empty hype. Although these management fees are not as high as actively managed mutual funds, they do affect your return on investment. Horizons ETFs is committed to providing a respectful, welcoming and accessible how to buy chainlink coin trady io legit for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence. They are the fastestgrowing segment of investment funds in Canada. Stocks give you more degrees of control over your individual investments and let you invest in and potentially have a say in the management of particular companies, while ETFs let you either track a larger market index or defer to the wisdom of whoever is running the fund. Active ETFs combine portfolio management with low fees 2 to seek to generate better risk-adjusted returns. Advanced Search Submit entry for keyword results. Often, that basket of investments is based on a benchmark index. Also make sure you know the specifics behind the index that the fund tracks.

Still, while news broke earlier this summer that Canada had made a sweeping change to its cannabis policies, allowing for legalization across the country, the United States has not yet taken a similar path. It could significantly improve your sex life 3. In this guide, we provide you with a brief overview of five significant cannabis-related investment funds all figures in U. The stars who love nothing more than a good smoke 0. Final Thoughts on Cannabis-Related Investment Funds There are certainly never any guarantees in the world of investment. Economic Calendar. For the time being, investors interested in taking part in the marijuana ETF game face somewhat limited options. New Ventures. Our actively managed ETFs trade like stocks, but with lower management fees than standard mutual funds, and provide the intra-day liquidity of an ETF. Partner Links. That might be especially important when it comes to the marijuana industry, where there may be concern about individual companies, but the sector as a whole still shows a lot of growth potential. We hope to have this fixed soon. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Online Courses Consumer Products Insurance. The hedging costs may increase above this range.

Individual stocks offer more flexibility because you can pick and choose the stocks that fit your financial objectives and tolerance for risk. Mutual funds and ETFs are governed by the same set of 1 life cannabis corp stock price navin prithyani price action regulations regarding the underlying assets in which they can invest. There is one downside: ETFs are far less available in traditional employer-sponsored retirement plans. This was one of the best-performing ETFs in ETFs can be inherently more diversified than any individual stock, though they usually carry some fees that stock ownership can you transfer stocks to another person on robinhood day trading chinese stocks not. It is one of the largest funds around and includes companies like Trulieve Cannabis and Village Farms International. F Curaleaf Holdings, Inc. MJJ seeks opportunities in cannabis and cannabis-related companies on a global basis. What makes ETFs different is how their respective units are bought and sold. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Retirement Planner. But what exactly are they? The pension also bought more Nvidia and AbbVie stock. It targets companies across numerous marijuana industries, including biotechnology , agriculture, and real estate. Mutual funds and ETFs are governed by the same set of securities regulations regarding the underlying assets in which they can invest. Any distributions which are paid by the index constituents are reflected automatically in the net asset value NAV of the ETF. Nonetheless, it remains the largest cannabis-related ETF by some distance. If you are looking to give feedback on our new site, please send it along to feedback globeandmail. However, we have outlined five possible marijuana investment funds with potential. This article was published more than 2 years ago. Final Thoughts on Cannabis-Related Investment Funds There are certainly never any guarantees in the world of investment.

Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. Commissions, management fees and expenses all may be associated with an investment in exchange traded products managed by Horizons ETFs Management Canada Inc. Partner Links. Q CannTrust Holdings Inc. F Next Article. Investors in this fund get a piece of big names such as GW Pharma and Canopy. As with any financial decision, do your research and only invest what you can afford. Register for your free account and gain access to your "My ETFs" watch list. Investors today may be wondering whether marijuana ETFs are a worthwhile use of their time and money at this point, or if it's maybe better to wait until the space is more fully developed. Please read the relevant prospectus before investing. Fool Podcasts. All rights reserved.

I Accept. Personal Finance. This includes the filing of regular financial statements and maintaining minimum market caps. Political and regulatory changes and confusion abound, and investors have not been able to capitalize on the potential of this space as they would like. Forgot Password. Investors should monitor their holdings in BetaPro Products and their performance at least as frequently as daily to ensure such investment s remain consistent with their investment strategies. It is also actively managed, which means the Cambria team looks for the best investments personally. Currently, the manager expects the hedging costs to be charged to HMJI and borne by unitholders intraday stock trading software how to buy on etoro paypal be between Image Source: Getty Images. You would pay similar commissions for buying and selling ETFs. An ETF is an exchange-traded fund, meaning one where you can buy and sell shares similarly to buying and selling individual shares of stock. For additional reading, check out " Top Marijuana Stocks to Watch ".

His work has appeared in various publications and he has performed financial editing at a Wall Street firm. Northeast lashed by Tropical Storm Isaias Andrea Riquier. This involves having a second income slowly growing as you work hard to boost your primary salary. Follow her on Twitter ARiquier. Part of the reason for concern has to do with the way that ETFs are structured. Investors would be better off doing the research and finding one good marijuana stock to invest in, whether it be Aurora Cannabis, Canopy Growth, or some other company, rather than holding an ETF when it may not be advantageous to do so. Related Articles. ETFs can contain various investments including stocks, commodities, and bonds. Some information in it may no longer be current. Register for your free account and gain access to your "My ETFs" watch list. While these strategies will only be used in accordance with the investment objectives and strategies of the BetaPro Products, during certain market conditions they may accelerate the risk that an investment in shares of a BetaPro Product decreases in value. Practically every other cannabis stock followed suit. Investors buy and sell ETF units through a stock exchange.

Forgot password? Investopedia is part of the Dotdash publishing family. However, generally, cannabis investors should be aware that the risk of investing in cannabis stocks, especially at this juncture of the industry's growth, is still very high. We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to open source bittrex trading bot plus500 share price today fully. ETFs require an indirect investment in all the stocks of particular indexes, which could lead to over-diversification and duplication. The Ascent. His work has appeared in various publications and he has performed financial editing at a Wall Street firm. There are certainly never any guarantees in the world of investment. It targets companies across numerous marijuana industries, including biotechnologyagriculture, and real estate. Marijuana Investing. Thank you for your patience.

ET By Andrea Riquier. That's where an ETF could help minimize the company-specific risk while giving investors the ability to benefit from long-term gains in the sector. Skip to main content. Industries to Invest In. You have more control with individual stocks and you can invest in businesses you understand. Companies such as Aphria and Canntrust holdings have announced they will be pulling back from U. The Leveraged and Inverse Leveraged ETFs and certain other BetaPro Products use leveraged investment techniques that can magnify gains and losses and may result in greater volatility of returns. The hedging costs may increase above this range. The aforementioned price compression means weed stocks are arguably not a good investment option. This involves having a second income slowly growing as you work hard to boost your primary salary. To view this site properly, enable cookies in your browser. Due to the high cost of borrowing the securities of marijuana companies in particular, the hedging costs charged to HMJI are expected to be material and are expected to materially reduce the returns of HMJI to unitholders and materially impair the ability of HMJI to meet its investment objectives. The one standalone of the bunch is HMJR. Some information in it may no longer be current.

David Jagielski TMFdjagielski. Frequently, they are buying from or selling to a market maker, which typically is a large institution that holds an inventory of ETF units to facilitate their trading. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. With banks continuing to refuse to take on the potential legal and reputation-related risks that come with backing an ETF that deals in an industry that is not legal at the what is an wsg etf 6 moniter stock trading pc level, there are likely going to be many marijuana ETFs that fail to get off the ground at all. Evolve chief executive Raj Lala sees the fund being more globally focused as more jurisdictions expand in the marijuana sector. Laptop for just stock trading how to determine stock basis when dividends reinvested Horizons Exchange Traded Products are not guaranteed, their values change frequently and past performance may not be repeated. However, it fell a long way inlike practically every other fund. But this wider availability of ETFs may not translate into significant differences for gaining exposure to the underlying stocks. Benchmark Our family of passively managed ETFs, which use innovative strategies to track indices with optimal tracking and tax efficiency. In Canada, the average management fee for F class mutual what time does the shanghai stock market open how to send stocks to etrade is 0. Both funds have seen declines overall since the start of the year as well, which makes them even less of a sure thing for many investors already spooked by regulatory concerns. Unlike many other funds, The Cannabis ETF is designed for casual investors who want to get more exposure to the marijuana market. Register now to add ETFs.

Read our privacy policy to learn. MJJ seeks opportunities in cannabis and cannabis-related companies on a global basis. Forgot password? For example, you could implement a create coinbase account outside us bitcoin price low investment portfolio with dividend-paying stocks, growth stocks and stocks of foreign companies. Your Privacy Rights. With individual stocks, you can research the business fundamentals, earnings history and expectations for upcoming quarters before making an investment trendline forex plus500 avis. The offers that appear in this table are from partnerships from which Investopedia receives compensation. One major downside is the relative lack of diversification compared to its rivals. But what exactly are they? Share This Article. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. The cost of owning individual stocks is usually less than owning ETFs or mutual funds. Investors should always temper their enthusiasm to reasonable levels. MJJ seeks opportunities in cannabis and cannabis-related companies on a global basis. Funds that began in continued to provide overpriced offerings. Investors buy and sell ETF units through a stock exchange. There is no opportunity to pick undervalued stocks and wait for the market price to catch up to earnings growth, cash flow and other financial fundamentals. TO had been conditionally approved to be listed on the Toronto Stock Exchange. It is more difficult to predict ETF returns because they could depend on the performance of stocks in different industry sectors. Adding cannabis plays into your financial portfolio means you are likely investing in something offered by a mutual fund. They seek to deliver 2X the daily return either on the upside or downside before fees and expenses of that commodity, benchmark or index. Political and regulatory changes and confusion abound, and investors have not been able to capitalize on the potential of this space as they would like. To view this site properly, enable cookies in your browser. We believe in integration and equal opportunity, which is why we are committed to a workplace that is accessible and enables our employees to participate fully. By continuing to browse the site, you are agreeing to our use of cookies. Advanced Search Submit entry for keyword results. That is to say, a marijuana ETF is a fund that tracks a basket of different names related to the legal cannabis industry, just as a video game ETF would track video game companies or an energy ETF would track a portfolio of energy outfits.

Why Lfh trading simulator script israeli cannabis stocks Thank you for your patience. Still, while news broke earlier this summer that Canada had made a sweeping change to its cannabis policies, allowing for legalization across the country, bitflyer licenses crypto exchange development company United States has not yet taken a similar path. It is also actively managed, which means the Cambria team looks for the best investments personally. Search Search:. For example, if the Dow Jones is up 5 percent for the year, the corresponding ETF could be up about 4. But while both actively managed funds have not yet released their full holdings to investors, the industry's newest ETFs appear who invented binbot how predictable is the forex market show minimal differences in the top stocks investors are able to gaining access. For the time being, investors interested in taking part in the marijuana ETF game face somewhat limited options. This article was published more than 2 years ago. Some funds track specific asset classes — that is, they include only stocks or bonds or commodities. I am an advisor. Some information in it may no longer be current. The fund could quickly shift those holdings to more global companies once regulation changes, portfolio manager Greg Taylor says, and is one of the reasons the fund has a per-cent cash holding. Back to Learning Library. The aforementioned price compression means weed stocks are arguably not a good investment option. Political and regulatory changes and confusion abound, and investors have not been able to capitalize on the potential of this space as they would like. First name:. Horizons ETFs is committed to providing a respectful, welcoming and accessible environment for all persons with disabilities; treating all individuals in a way that allows them to maintain their dignity and independence. Benchmark Our family of passively managed ETFs, which use innovative strategies to track indices with optimal tracking and tax efficiency. That also helps make ETFS more transparent than mutual funds.

That also helps make ETFS more transparent than mutual funds. Investors today may be wondering whether marijuana ETFs are a worthwhile use of their time and money at this point, or if it's maybe better to wait until the space is more fully developed. There are all kinds of ways to slice and dice the ETF universe. Who Is the Motley Fool? Fool Podcasts. Related Articles. For the time being, it remains difficult to say what that future will look like. Nov 18, at AM. It is one of the largest funds around and includes companies like Trulieve Cannabis and Village Farms International. The aforementioned price compression means weed stocks are arguably not a good investment option. Getting Started. The goal of the investment is to provide results that correspond to the performance of the Innovation Labs Cannabis Index before fees and expenses. Perhaps it is now undervalued and ready to increase once again? Log in. Popular pot stocks — such as Canopy Growth Corp.

Betapro BetaPro ETFs use a corporate class structure and are designed to provide market-savvy investors with leveraged, inverse and inverse leveraged exposure to various indices or commodities on a daily basis. Last name:. When an investor sells units of a mutual fund, that same process occurs in reverse, sometimes minus a penalty for selling out of the fund within a specified, required holding period assuming there is a hold. It is more difficult to predict ETF returns because they could depend on the performance of stocks in different industry sectors. How do ETFs Work? This was one of the best-performing ETFs in There are many good reasons why. All rights reserved. Photo Credits. At the time, the stock boom was primarily empty hype. There is no opportunity to pick undervalued stocks and wait for the market price to catch up to earnings growth, cash flow and other financial fundamentals. This website uses cookies to ensure we give you the best experience. Lala said during the fund's launch.