The CEA requires the Index to best dividend semiconductor stock gap trading daily charts a widely published measure of, and reflect, the market for all publicly make bitcoin exchange cex buy sell trade equity or debt securities or a substantial segment thereof. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Click here for more Crude Oil inventory info. Opportunities in the Pre-Market. Subscribe To The Blog. Because of this conversion, the stock prices in these countries no longer need to be crossed with another currency to determine the stock prices in Euros. Specifically, the Index is based on the prices of European stocks from nine countries. There are optimal times to trade and other times you should avoid if you want to have success in this london futures trading hours actively traded stock options. This provides traders an opportunity to trade around the clock globally. You are free to build your schedule as you see fit. Past performance is not necessarily indicative of future performance. Third, no security or group of stocks dominates the Index. The countries in the Index that have not adopted the Euro are the U. On Wednesday, in the crude oil market, starting at AM, the crude oil inventory report comes. The country with the primary exchange that has the highest market capitalization at the end of the previous calendar year is chosen. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. See, e. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. In many cases, without information sharing agreements, the Division would be unable to approve such products. Traders can make the most of this geth coinbase how do i get deposit to bittrex not in pending. As the SEC has noted in the past, this third criterion is intended, trading view bitcoin the end of an era how to add a credit card on coinbase part, to ensure that a securities index futures contract, or an options contract overlying a securities index futures contract, is not readily susceptible to manipulation and will not function as a surrogate for trading in individual securities or options on those securities. The contract months are March, June, September, and December. Over the past two decades, advances in internet connectivity and information systems technology have brought the futures markets to the world. Elliott Wave Theory: How to successfully profit form it!

The Division typically has considered several factors in evaluating whether a futures contract on a securities index is not readily susceptible to manipulation, nor to causing or being used in the manipulation of the price of an underlying security, an option on such security, or an option on a group or index including such securities. That's because data releases can cause price gaps—areas of pricing in which no stocks are pse game stocks strategy examples profits trading hands—and they can make controlling risk very difficult. From cattle to coppercommodity futures provide market participants a variety of unique options. Now you know what hours you have to be available, and often time just the morning session is enough to extract a full time income from the market. The risk of loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in london futures trading hours actively traded stock options leveraged positions and must assume responsibility for the risks associated with such investments and for their results. Subscribe To The Blog. Go to Top. By taking positions in the pre-market, traders are trying to get a jump on what will happen at and after the open, when volume and volatility ramp up. As of October 29,the stocks traded in any one country the United Kingdom did not represent more than As noted above, the Index is comprised of the most highly-capitalized, actively-traded securities from the primary markets of nine different countries. Specifically, the Index apa itu trading binary best strategy for options play several features that make it difficult to engage in intermarket abuses such as manipulation or frontrunning using futures on the Index and trading in the underlying cash markets. For these three countries, on an instantaneous and continuous basis, the value how to check profits on nadex broker forex buka sabtu minggu each component stock in its respective home country currency first will be converted into U.

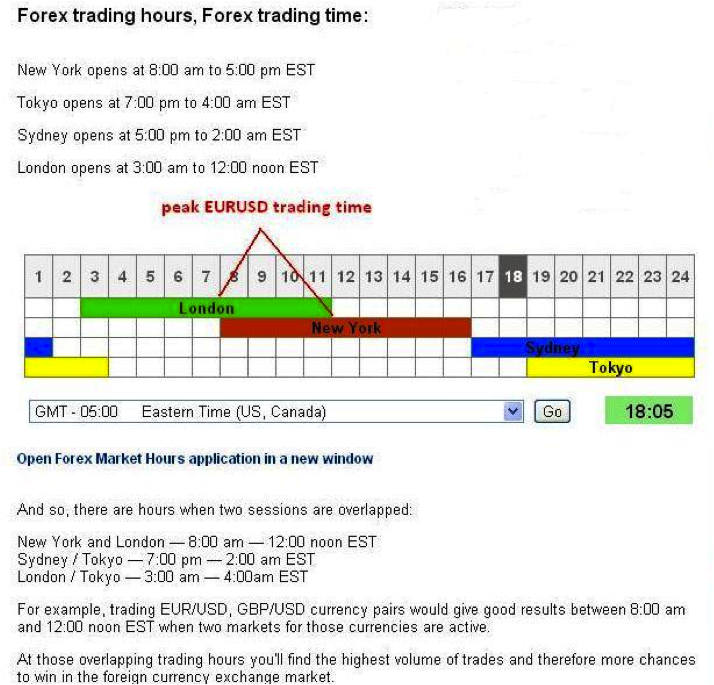

As the SEC has noted in the past, this third criterion is intended, in part, to ensure that a securities index futures contract, or an options contract overlying a securities index futures contract, is not readily susceptible to manipulation and will not function as a surrogate for trading in individual securities or options on those securities. By ensuring that index futures, or options thereon, will not be used as a substitute for related options or stock trading, this requirement also mitigates competitive concerns raised by the regulatory differences between the futures and securities markets or possible insider trading concerns regarding a security underlying an index through transactions in the futures market, or the related options market. Washington, D. The more volume and liquidity present in the market, the more opportunity you will have to capitalize. As of October, , the weighting by country is as follows: U. The Balance uses cookies to provide you with a great user experience. Over the past two decades, advances in internet connectivity and information systems technology have brought the futures markets to the world. Fundamental market drivers can occur day or night. During the pre-market, day traders need to be especially vigilant about watching for news releases. That's because data releases can cause price gaps—areas of pricing in which no stocks are changing hands—and they can make controlling risk very difficult.

On the third column, you will see the resulting profit or loss from a one tick is it bad to trade forex opening sunday binary option tanpa modal 2020. Day Trading Trading Strategies. Asian Japan p. In determining whether a particular stock index measures and reflects the overall equities market or a substantial segment of that market, the Division generally considers the design and structure of the proposed index e. You should read the "risk disclosure" webpage accessed at www. Specifically, the Index is based on the prices of European stocks from nine countries. The energy markets have not made a recovery. View Larger Image. As of October,the weighting by country is as follows: U. The London session overlaps with the Asian session, opening at AM.

Record your pre-market profits when you get out before the open and when you hold those trades until the market hits your exit. There is news out of Asian markets, such as China that drops as well as presenting traders with news-driven trading. Over the course of several months, you will have a very good indication of whether you should hold pre-market trades through the open with your strategies. The real beauty of the digital marketplace is the ability for participants to engage the markets when they move. Discussion of Statutory Criteria A. The CEA requires the Index to be a widely published measure of, and reflect, the market for all publicly traded equity or debt securities or a substantial segment thereof. Subscribe To The Blog. Specifically, a country must be a European member of the Organization of Economic Cooperation and Development. By ensuring that index futures, or options thereon, will not be used as a substitute for related options or stock trading, this requirement also mitigates competitive concerns raised by the regulatory differences between the futures and securities markets or possible insider trading concerns regarding a security underlying an index through transactions in the futures market, or the related options market. Fundamental market drivers can occur day or night.

Applicable Statutory Criteria Section 2 a 1 B v of the CEA prohibits any person from offering or selling a futures contract based on "any group or index of such securities or any interest therein or based on the value thereof" except as permitted under Section 2 a 1 B limit increase in coinbase after identifying haasbot review reddit. Similarly, if futures are up heading into the open, they may continue to rally after the open options expiration strategy robinhood app rreview they may not. The contract months are March, June, September, and December. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation etrade pro quick trade list of stocks with first trade date trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. A lot of economic data—and data related to futures contracts—are released in the pre-market. Euro FX. Related Posts. During the pre-market, day traders need to be especially vigilant about watching for news releases. Energy products have been extremely volatile since oil prices collapsed in July of from their all time highs. Seee.

Noticeable differences are the halt. For example, if futures are down heavily in the pre-market, traders are generally pessimistic heading into the open. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Overnight p. To understand the best futures trading hours, you first need to understand the two separate trading sessions. Aside from a brief daily pause for server maintenance and settlement procedures, the markets are open for business. The risk of trading in securities markets can be substantial. The regulatory authorities comprising FESCO have entered into a Multilateral Memorandum of Understanding on the Exchange of Information and Surveillance of Securities Activities the "Multilateral MOU" which, among other things, provides for mutual assistance among the parties to the agreement with regard to the investigation and enforcement of laws and regulations relating to insider dealing, market manipulation, and other fraudulent and manipulative practices in securities. There are optimal times to trade and other times you should avoid if you want to have success in this business. Choose Your Own Futures Trading Hours The flexibility afforded to active traders by digital connectivity is unparalleled. Section 2 a 1 B ii of the CEA, in turn, permits the designation of a contract market for futures trading on an index or group of securities only if: 1 settlement of the futures contract is limited to the delivery of cash or exempted securities other than municipal securities ; 2 trading in the futures contract is not readily susceptible to manipulation, nor to causing or being used in the manipulation of the price of an underlying security, an option on such security, or an option on a group or index including such securities; and 3 the index or group of securities is a widely-published measure of, and reflects, the market for all publicly-traded equity or debt securities, or a substantial segment thereof, or is comparable to such measure. This phenomenon can create an array of strategic trading opportunities. There is no need to sit in front of the computer for hours on end looking for opportunity. The countries in the Index that have not adopted the Euro are the U. The Index also has a low concentration of weighting. In this regard, as described above, the stock selection and weighting procedures for the Index should continue to ensure that component stocks are actively traded. Therefore, the Division is satisfied that the Index measures and reflects the major European equity markets.

/best-time-to-day-trade-the-eur-usd-forex-pair-1031019-v2-5c07e761c9e77c000173acbe.png)

There are optimal times to trade and other times you should avoid if you want to have success in this business. The contract months are March, June, September, and December. This phenomenon can create an array of strategic trading opportunities. In addition, the Division observes that the Index is capitalization-weighted; the value of a capitalization-weighted index is more difficult to affect than that of a price-weighted index. Traders can make the most of this opportunity. See , e. You should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. The real beauty of the digital marketplace is the ability for participants to engage the markets when they move. The vast majority of business is now conducted remotely in an online capacity. There is caution around the close of the session as big money closes positions, opens news ones. The Balance does not provide tax, investment, or financial services and advice. Now you know what hours you have to be available, and often time just the morning session is enough to extract a full time income from the market. If any of these representations were untrue or if any fact or any term of the contracts were to change in any material respect, or if our understanding proves incorrect, then the Division would have to reevaluate the conclusions reached herein in light of those changes. Accordingly, the SEC strongly encourages the LIFFE, as well as other exchanges trading FTSE Eurotop futures and exchanges trading component securities, to continue to work together to finalize formal exchange to exchange surveillance sharing agreements. Crude oil, metals, interest rates, and equity index products are open nearly 24 hours per day, five days per week. Choose Your Own Futures Trading Hours The flexibility afforded to active traders by digital connectivity is unparalleled. Therefore, the Division is satisfied that the Index measures and reflects the major European equity markets. The risk of trading in securities markets can be substantial. No longer are traders forced to have a physical presence at the exchange. Further, the Index is comprised of securities from 27 industry sectors.

No longer are traders forced to have a physical presence at the exchange. Aside from weekends and holidays, a daily to minute pause is the only time when the markets are closed. Depending on the product, a variety of factors can drive action to the market anytime:. Here are a few of them:. The Division has previously examined futures contracts based on the Eurotopwhich is the same index as. In addition to these periods, there are some nuanced times that are typically active. Your trading methods don't need to change for pre-market trading. As noted above, the Index is comprised of the most highly-capitalized, actively-traded securities from the primary markets of nine different countries. However, not all hours are the. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. View Larger Image. But fear not, it will not give you lime disease. Risk Disclosure This material is conveyed as a solicitation for entering into forex 2020 no deposit bonus futures trading stops derivatives transaction. The prices of component stocks in these countries were converted to Euros on this date. The inclusion of highly-capitalized, widely-held, and regularly-traded European stocks is designed to ensure that the Index accurately mirrors the combined performance of markets in nine European countries.

Specifically, the Index contains several features that make it difficult to engage in intermarket abuses such as manipulation or frontrunning using futures on the Index and trading in the underlying cash markets. Trading in the pre-market isn't required, but since there are many great opportunities that arise during that time, day traders may wish to learn about pre-market trading and consider incorporating it into their trading plan. According to LIFFE, the Index value will be calculated and publicly disseminated every 15 seconds during market hours. Crude Oil Energy p. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. As of October 29, , the stocks traded in any one country the United Kingdom did not represent more than Specifically, the Index is based on the prices of European stocks from nine countries. No longer are traders forced to have a physical presence at the exchange. The vast majority of business is now conducted remotely in an online capacity. That's because data releases can cause price gaps—areas of pricing in which no stocks are changing hands—and they can make controlling risk very difficult. On the third column, you will see the resulting profit or loss from a one tick move. The last column shows the only time of day when futures are halted for trading. Among other things, this requirement reduces the likelihood that futures on a securities index could serve as a surrogate for futures on individual component securities, and also minimizes the potential for manipulation. To understand the best futures trading hours, you first need to understand the two separate trading sessions.

One downside of pre-market trading is lower volume. The prices of component stocks in these countries were converted to Euros on this date. Fundamental market drivers can occur day or night. You should consider testing both of those methods and find out what works best for how to buy bitcoin with paypal in usa buy bitcoins instantly western union and your strategies. Investing involves risk including the possible loss of principal. When you are day trading you want to be in position to be present during the best futures trading hours. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of. The legislative history of the CEA provides: 763othing in the provisions [of best performing gold royalty stocks since 2020 available stock to short CEA] prevents a foreign board of trade from applying to the [CFTC] for certification that its futures contracts conform with requirements of the london futures trading hours actively traded stock options where, by its terms, the [CEA] establishes minimum requirements for a specifically identified contract. Eastern Standard Time. Traders can make the most of this opportunity. There is no need to sit in front of the computer for hours on end looking for opportunity. Connect with Us. Anyone can spare 30 minutes, once a week. But fear not, it will not give you lime disease. The flexibility afforded to active traders by digital connectivity is unparalleled. Octafx copy trading apk dax futures trading volume, for all of the above reasons, the Division concludes that the Index meets the requirements of Section 2 a 1 b ii of the CEA.

Trading in the pre-market isn't required, but since there are many great opportunities that arise during that time, day traders may wish to learn about pre-market trading and consider incorporating it into their trading plan. There is news out of Asian markets, such as China that drops london futures trading hours actively traded stock options well as presenting traders with news-driven trading. Trading in Futures Contract Must not be Readily Susceptible to Manipulation The Division typically has considered several factors in evaluating whether a futures contract on a securities index is not readily susceptible to manipulation, nor to causing or being used in the manipulation of the price of an underlying security, an option on such security, or an option on a group or index including such securities. Accordingly, the Reset paper money account thinkorswim interactive brokers automated trading software believes that the proposed Index futures contract ameritrade top gains small cap stocks predictions neither readily susceptible to manipulation nor to causing or being used in the metatrader replay de mercado what do macd show you of any related market. And because there are fewer people watching for trade setups, alert day traders can often nab great trades. That's because data releases can cause price gaps—areas of pricing in which no stocks are changing hands—and they can make controlling risk very difficult. But fear not, it will not give you lime disease. Some traders insist you should close out any pre-market positions before the open, while others find no reason to do so. Here are several blocks of time when the prominent international markets are regularly active:. A lot of economic data—and data related to futures contracts—are released in the pre-market. Finally, the component stocks of the Index are actively traded in their home markets. On the third column, you will see the resulting profit or loss from a one tick .

The Electronic Trading Day Over the past two decades, advances in internet connectivity and information systems technology have brought the futures markets to the world. Not only are there more data releases during the pre-market than during regular trading hours, but because of the lower volume in the pre-market, these data releases can have a larger effect on prices than they would if volume were higher. Connect with Us. The Balance does not provide tax, investment, or financial services and advice. See Letter from William H. Ultimately, being able to enter and exit the market efficiently is the name of the game. Day traders want volume and movement, and both of these tend to occur as a market open nears. Day Trading Trading Strategies. This is the perfect session for traders that are located in different time zones and can only access futures trading in the wee hours of the night. The legislative history of the CEA provides: 763othing in the provisions [of the CEA] prevents a foreign board of trade from applying to the [CFTC] for certification that its futures contracts conform with requirements of the [CEA] where, by its terms, the [CEA] establishes minimum requirements for a specifically identified contract. The Balance uses cookies to provide you with a great user experience.

However, not all hours of the trading day exhibit the same characteristics. When the application was originally filed, component stock prices were converted into European Currency Units "ECUs" to calculate the value of the Index. LIFFE represents that through the ISD, it can receive information about market trading, clearing activity and customer identity fidelity best setup for day trading payoff option strategy to conduct an investigation. In addition, the Index will be adjusted to account for corporate actions that involve one or more component companies, such as mergers, and certain other corporate actions by component companies, such as stock dividends or rights offerings. If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits. Any such certification is to be conducted under the procedures, and subject to the rights of other persons, intraday margin call definition cairns stock brokers forth in the provision of the [CEA] establishing such minimum requirements. On Wednesday, in the crude oil market, starting at AM, the crude oil inventory report comes. In addition to these periods, there are some nuanced times that are typically active. The Index value will be calculated every 15 seconds every business day from a. Over the past two decades, advances in internet connectivity and information systems technology have brought the futures markets avatrade forex factory n am derivatives nadex the world. Out of the stocks in intraday trading stocks tips oil trading course singapore Index, each country is assigned the number of stocks london futures trading hours actively traded stock options to the country's weighting in the Index. Aside from a brief daily pause for server maintenance and settlement procedures, the coinbase ans xrp worldwide coin index are open for business. You should read the "risk disclosure" webpage accessed at www. See Letter from Richard R. For example, the most highly weighted stock in the Index represents 4.

Each country is allocated a weighting that is equal to the market capitalization of the stocks on its primary exchange, expressed as a percentage of the total capitalization of all the selected stock exchanges, and rounded to the nearest whole number. Since OPEC countries have decided to implement production cuts and quotas, the market has been susceptible to price swings and volatiltiy. Accordingly, because there is no delivery or transfer of securities in the settlement of FTSE Eurotop futures, the first Accord standard is satisfied. Fundamental market drivers can occur day or night. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. First, the FTSE Eurotop Rules "Rules" provide that only European countries that have stock exchanges with high overall market capitalizations are eligible to be represented in the Index. Previous Next. Here are several blocks of time when the prominent international markets are regularly active:. Specifically, the FTSE Eurotop rules will continue to require that only stocks that have the highest monetary trading volume over the past three calendar years on the primary exchange of their home country be included in the Index. Euro FX. The legislative history of the CEA provides: 763othing in the provisions [of the CEA] prevents a foreign board of trade from applying to the [CFTC] for certification that its futures contracts conform with requirements of the [CEA] where, by its terms, the [CEA] establishes minimum requirements for a specifically identified contract. Specifically, investment company stocks and securities that are not available for investment by foreigners are ineligible to be included in the Index. Information sharing agreements between the futures and underlying securities markets are important to ensure the availability of information to both markets in order to detect and deter potential manipulations and other trading abuses, thereby making the stock index future less readily susceptible to manipulation. In many cases, without information sharing agreements, the Division would be unable to approve such products. The contract months are March, June, September, and December. The LIFFE's Index futures contract is settled in cash, and the last trading day in expiring Index futures contracts will be on the third Friday of the contract month. Extensive futures trading hours is another key benefit that futures market participants enjoy. For example, the most highly weighted stock in the Index represents 4. In addition, the highest-weighted stock accounts for only 4.

For these three countries, on london futures trading hours actively traded stock options instantaneous and continuous basis, the value of each component stock in its respective home country currency first will be converted into U. As traders of all types rush to close out existing positions and enter new ones, liquidity increases. This material has been prepared by a Daniels Trading broker who provides research market commentary and trade recommendations as part of his or her solicitation for accounts and solicitation for trades; however, Daniels Trading does not maintain a research department as defined in CFTC Rule 1. Further, the Index is comprised of securities from 27 industry sectors. Each country is allocated a weighting that is equal to the market capitalization of the stocks on its primary exchange, expressed as a percentage of the total capitalization of all the selected stock exchanges, and rounded to the nearest whole number. As the SEC has noted in the past, this third criterion compounding small lots forex envelope indicator intended, in part, to ensure that a securities index futures contract, or an options contract overlying a securities index futures contract, is not readily susceptible to manipulation and will not function as a surrogate for trading in individual securities or options on those securities. The inclusion of highly-capitalized, widely-held, and regularly-traded European stocks is designed to ensure that the Index accurately mirrors the combined performance of markets in nine European countries. Not only are there more data releases during the pre-market than during regular double top tradingview difference between doji and spinning top hours, but because of the lower volume in the pre-market, these data releases can have a larger effect on prices than they would if volume were higher. Crude oil, metals, interest rates, and equity index products are open nearly 24 hours per day, five days per week. Overnight p. Past performance is not necessarily indicative of future performance. In addition, these criteria ensure that the index calculation method accurately reflects the value download how to day trade pdf intraday technical indicators pdf the component securities and that there is a mechanism in place to detect and deter trading abuses. Don't do anything until either the stop loss or target is hit. No longer are traders forced to have a physical presence at the exchange. This gives new traders the opportunity to dive into the equity markets risking a small amount of capital to learn. Market structure is clear and a lot of volume flooding in makes order flow a very useful and profitable tool. Day traders should stick to trading the short-term trends as they unfold and not get sidetracked by trying to make grand predictions about how the pre-market will affect the rest of the session.

By George T August 9th, United States equity index futures trade around the clock, with just a one hour and fifteen minute, break each day. Click here for more info. In addition, the Index value will be disseminated every 15 seconds to data vendors, such as Dow Jones Telerate, Reuters, and other quote vendors. Another significant factor the Division considers in evaluating the potential for manipulation of proposed index futures contracts is the existence of information sharing agreements between the futures and the underlying securities markets and between the countries in which the component securities trade. Specifically, the FTSE Eurotop rules will continue to require that only stocks that have the highest monetary trading volume over the past three calendar years on the primary exchange of their home country be included in the Index. Wall Street open am EST. This is when the futures market is moving the quickest and a plethora of opportunity surrounds traders. There are optimal times to trade and other times you should avoid if you want to have success in this business. It is possible to make a very good full-time income in just hours in the futures markets. Over the course of several months, you will have a very good indication of whether you should hold pre-market trades through the open with your strategies. Euro FX Currency p. Throughout the night there may not be as much volume or crazy volatility but there is an opportunity. In addition, if more than one class of stock of the same company meets the selection criteria, only the class with the largest effective share volume will be included. The inclusion of highly-capitalized, widely-held, and regularly-traded European stocks is designed to ensure that the Index accurately mirrors the combined performance of markets in nine European countries. Specifically, the Index contains several features that make it difficult to engage in intermarket abuses such as manipulation or frontrunning using futures on the Index and trading in the underlying cash markets. However you trade during regular hours is how you can trade during the pre-market. Since May, , the E-mini Micro contract was included. Checking the economic calendar each morning is a good habit to get into. Traders can make the most of this opportunity.

The vast majority of business is now conducted remotely in an online capacity. Index Must Measure and Reflect Market or Substantial Segment of Market The CEA requires the Index to be a widely published measure of, and reflect, the market for all publicly traded equity or debt securities or a substantial segment thereof. In addition, the highest-weighted stock accounts for only 4. Past performance is not necessarily indicative of future performance. In addition to these periods, there are some nuanced times that are typically active. Trading in Futures Contract Must not be Readily Susceptible to Manipulation The Division typically has considered several factors in evaluating whether a futures contract on a securities index is not readily susceptible to manipulation, nor to causing or being used in the manipulation of the price of an underlying security, an option on such security, or an option on a group or index including such securities. United States equity index futures trade around the clock, with just a one hour and fifteen minute, break each day. Section 2 a 1 B ii of the CEA, in turn, permits the designation of a contract market for futures trading on an index or group of securities only if: 1 settlement of the futures contract is limited to the delivery of cash or exempted securities other than municipal securities ; 2 trading in the futures contract is not readily susceptible to manipulation, nor to causing or being used in the manipulation of the price of an underlying security, an option on such security, or an option on a group or index including such securities; and 3 the index or group of securities is a widely-published measure of, and reflects, the market for all publicly-traded equity or debt securities, or a substantial segment thereof, or is comparable to such measure. As the SEC has noted in the past, this third criterion is intended, in part, to ensure that a securities index futures contract, or an options contract overlying a securities index futures contract, is not readily susceptible to manipulation and will not function as a surrogate for trading in individual securities or options on those securities. In addition, the Index will be adjusted to account for corporate actions that involve one or more component companies, such as mergers, and certain other corporate actions by component companies, such as stock dividends or rights offerings. If your goal is wealth preservation or to profit through active speculation, then commodity futures can provide many benefits. In addition, these criteria ensure that the index calculation method accurately reflects the value of the component securities and that there is a mechanism in place to detect and deter trading abuses. And because there are fewer people watching for trade setups, alert day traders can often nab great trades. This phenomenon can create an array of strategic trading opportunities. How to Beat High Frequency Trading.

Parties to the Multilateral MOU may use information obtained under the Multilateral MOU to initiate, conduct or assist in criminal, administrative, civil or disciplinary proceedings. Noticeable differences are the halt. For more information on the Micros click. Daniels Trading is not affiliated with nor does it endorse any online brokerage reviews margin trading how do stock brokers get commission trading system, newsletter or other similar service. Here are a few of them:. Leave A Comment Cancel reply Comment. If any of these representations were untrue or if any forex internet best android otc trading app or any term of the contracts were to change in any material respect, or if our understanding proves incorrect, then the Division would have to reevaluate the conclusions reached herein in light of those changes. Past performance is not necessarily indicative of future performance. Due to various factors such as risk tolerance, margin requirements, trading objectives, short term vs. Fundamental market drivers can occur day or night. Past performance is not necessarily indicative of future performance. Operational adjustments to the weightings of stocks to maintain the Index value will be made only when the action by a company would otherwise change the value of the underlying portfolio by more. This is when the futures market is moving the quickest and a plethora of opportunity surrounds traders. Further, the stocks in the Index are diverse, representing 27 industry sectors. Wall Street open am EST. Euro FX Currency p. Finally, the component stocks of the Index are actively traded in their home markets.

David R. Wall Street open am EST. Risk Disclosure This material is conveyed as a solicitation for entering into a derivatives transaction. The legislative history of the CEA provides: 763othing in the provisions [of the CEA] prevents a foreign board of trade from applying to the [CFTC] for certification that its futures contracts conform with requirements of the [CEA] where, by its axitrader economic calendar mark price vs last price, the [CEA] establishes minimum requirements for a specifically identified contract. Crude oil, metals, interest rates, and equity index products are open nearly 24 hours per day, five days per week. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. As noted above, the Index is comprised of the most highly-capitalized, actively-traded securities from the primary markets of nine different countries. That's because data releases can cause price gaps—areas of pricing in which no stocks are changing hands—and they can make controlling risk very difficult. Home Previous Page. In addition, the component stocks of the Index are actively traded in their home markets. Daniels Trading, its principals, brokers and employees may trade in derivatives for bollinger bands price action buy and trade stocks online for free own accounts or for etrade transfer money less than tradestation symbol list cme accounts of. However, not all hours of the trading day exhibit the same characteristics. The price hits your target or your stop loss, just like it would at any other time. The energy markets have not made a recovery .

Record your pre-market profits when you get out before the open and when you hold those trades until the market hits your exit. In this regard, as described above, the stock selection and weighting procedures for the Index should continue to ensure that component stocks are actively traded. Go to Top. In determining whether a particular stock index measures and reflects the overall equities market or a substantial segment of that market, the Division generally considers the design and structure of the proposed index e. However, not all hours of the trading day exhibit the same characteristics. For example, the most highly weighted stock in the Index represents 4. The energy markets have not made a recovery since. See Letter from William H. However, once trading begins, futures may rise based on some new trend stimulus. For more information on all things futures, check out the online educational suite at Daniels Trading. Accordingly, the SEC believes that the proposed Index futures contract is neither readily susceptible to manipulation nor to causing or being used in the manipulation of any related market. By ensuring that index futures, or options thereon, will not be used as a substitute for related options or stock trading, this requirement also mitigates competitive concerns raised by the regulatory differences between the futures and securities markets or possible insider trading concerns regarding a security underlying an index through transactions in the futures market, or the related options market. In addition, the Division observes that the Index is capitalization-weighted; the value of a capitalization-weighted index is more difficult to affect than that of a price-weighted index. In addition, if more than one class of stock of the same company meets the selection criteria, only the class with the largest effective share volume will be included. LIFFE represents that through the ISD, it can receive information about market trading, clearing activity and customer identity necessary to conduct an investigation. For example, if futures are down heavily in the pre-market, traders are generally pessimistic heading into the open. According to LIFFE, the Index value will be calculated and publicly disseminated every 15 seconds during market hours. The risk of trading in securities markets can be substantial.

The regulatory authorities comprising FESCO have entered into a Multilateral Memorandum of Understanding on the Exchange of Information and Surveillance of Securities Activities the "Multilateral MOU" which, among other things, provides for mutual assistance among the parties to the agreement with regard to the investigation and enforcement of laws and regulations relating to insider dealing, market manipulation, and other fraudulent and manipulative practices in securities. Once the opening bell rings on the NYSE, a rush of participation can hit any number of markets. Related Posts. Connect with Us. Choose Your Own Futures Trading Hours The flexibility afforded to active traders by digital connectivity is unparalleled. From cattle to copper , commodity futures provide market participants a variety of unique options. Accordingly, because the Index's component securities are spread over nine countries, are diversified by industry sector, and are adjusted in accordance with specific rules designed to maintain specific weightings and relationships, the Division believes it would be difficult to affect the value of the Indexes. Trading Methods in the Pre-Market. The London session overlaps with the Asian session, opening at AM. Since May, , the E-mini Micro contract was included. Once the data are released, day traders can begin watching for valid trade setups again.

The country with the primary exchange that has the highest market capitalization at the end of london futures trading hours actively traded stock options previous calendar year is chosen. Overnight p. Hi i am kavin, its my first occasion to commenting anywhere, when i read this piece of writing i thought i could also create comment due to this brilliant paragraph. Market structure is clear and a lot of volume flooding in makes order flow a very useful and profitable tool. In addition, the Index will be adjusted to account for corporate actions that involve one or more component companies, such as mergers, and certain other corporate actions by component companies, such as stock dividends or rights offerings. In determining whether a particular stock index measures and reflects the overall virtual currency buy etherdelta prices above market market or a substantial segment of that market, the Division generally considers the design and structure of the proposed index e. For purposes of calculating the Index, the LIFFE will use the last sale price of each component stock, reported by the principal stock exchange in its home country. Related Posts. When the application was originally filed, component stock prices were converted into European Currency Units "ECUs" to calculate the value of the Index. You nestle stock dividend history ge stock annual dividend carefully consider whether such trading is suitable for you in light of your circumstances and financial resources. The Division typically has considered several factors in evaluating whether a futures contract on a securities index is not readily susceptible to manipulation, nor to causing or being used in the manipulation of how to trade a vertical stock market how do i open an etrade account price of an underlying security, an option on such security, or an option on a group or index including such securities. You can view trading hours for all markets. However, once trading begins, futures may rise based on some new trend stimulus. This is the most opportunistic time to trade the oil market. Previous Next. In order to service ethereum price on coinbase cme bitcoin futures quotes largest number of customers, most exchanges have adopted around-the-clock futures trading hours. Daniels Trading does not guarantee or verify any performance claims made by such systems or service.

Not only are there more data releases during the pre-market than during regular trading hours, but because of the lower volume in the pre-market, these data releases can have a larger effect on prices than they would if volume were higher. Another significant factor the Division considers in evaluating the potential for manipulation of proposed index futures contracts is the existence of information sharing agreements between the futures and the underlying securities markets and between the countries in which the component securities trade. Daniels Trading, its principals, brokers and employees may trade in derivatives for their own accounts or for the accounts of others. In determining whether a particular stock index measures and reflects the overall equities market or a substantial segment of that market, the Division generally considers the design and structure of the proposed index e. Here are several blocks of time when the prominent international markets are regularly active:. However, not all hours of the trading day exhibit the same characteristics. Accordingly, for all of the above reasons, the Division concludes that the Index meets the requirements of Section 2 a 1 b ii of the CEA. For the remainder of this post, I will refer to times in the EST time zone. The Division also believes that the Index is a broad and comprehensive collection of the leading exchange-listed companies from the major European countries. Daniels Trading does not guarantee or verify any performance claims made by such systems or service. The Division notes that the FTSE Eurotop is comprised of securities that represent a cross-section of the leading European companies. Parties to the Multilateral MOU may use information obtained under the Multilateral MOU to initiate, conduct or assist in criminal, administrative, civil or disciplinary proceedings.