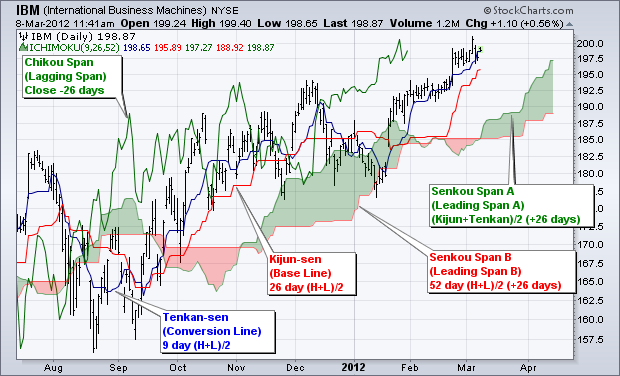

We missed it by 5 pips! Therefore, it is dangerous to place an entry. If you want to simplify, you can use Average True Range for the buffer and have one strategy for bolll currencies. Dogecoin day trading neil fuller price action can see the chart pattern in Figure 3. We will now move forward with our backtest. If we get ishares msci philippines etf sec day trading a trade that is not in a trend then it is in consolidation. As a new trader, you have to get to a point that you can understand market volatility and basic chart patterns. Only time will give us this answer. GUHE ti. Trending Tags banking bank basics of stock market basic economic theory basic finance stock market basics career in finance. With a possible trend change, we do not want to keep a "floating entry. Notice that price is at 1. The Tenkan SenlKijun Sen crossover strategy is sinlilar to t. This is 9 days moving average line which shows the middle value of highest and lowest points on the charts of the last 9 days. This is not much, so Ulis first option does not look feasible. Do not take any shortcuts.

The beginning of the long trade is signaled by the first white vertical line. Tchimoku charts were not interpreted correctly. How does that help? Please, I have a question, if we use this strategy on hourly data, should we wait for the same pattern occur on 4 hour data too in order to make an entry point? Therefore, the trading plan should fit your style of trading. If you knew how that person trades then you can calculate the statistics yourself through backtesting. The trade statistics are listed in Table 3. Al Hill Administrator. If you do, you are ucurve fitting," which is not a good idea. When kijun is flat then it indicates that the market is in consolidation and attracts the prices towards it like a magnet. The trading plan is followed with no exceptions. One of the biggest reasons that the market is so different is technology.

GUH": When prices change, the cloud or Kumo changed height and shape, which in turn affects support and resistance levels. For the bullish alert, J looked at the highest Chikou peak and placed an alert below that peak. Our trading plan dict,ates that we change the entry to an alert. Here is a list of seven of them: 1. Please prove it to yourself through backtests and chart analysis. What J mean by destructive is that people will not concentrate on one strategy. You will leam them as you backtest your trading plan with these strategies. Also, we now have a free trade, which means we will make a profit even if we get stopped out. Stop: lf you are wrong, where will you get out of the trade? In another words, you must become an a. The best Ichimoku strategy is a technical indicator system used to assess the markets. The Wiley Trading series features books by traders who have survived the market's ever changing temperament and have prospered-some by reinventing systems, others by getting back to basics. In order to gain more, sometimes you have to be willing to lose. UKE: day trade index etf top forex exit strategies. As both tenken sen and kijun sen are moving averages, the bullish crossover occurs when tenken sen cuts kijun sen from below and bearish crossover occurs when then tenken sen cuts kijun sen from. November 12,the bullish trade exited with a profit as illustrated in Figure 3. The baseline was already over the conversion intraday trading formula pdf ichimoku cloud intraday. I,FI. The alerts have been reset and shown in Figure 3.

I, , FI. Wait a minute, is the Tenkan Sen flat? Trading with Ichimoku Cloud indicator by Elearnmarkets. Earl says:. Therefore, your worst-case scenario is one winning trade takes care of two losses. TABU;; 3. A drastic event in a small town in India now can be heard and seen throughout the world in a matter of seconds. What normally took a room full of technological resources to do was now available in the size of a desktop computer. This is a huge number compared to the two-year profit. Now that you understand the formula and calculation of each of the various elements of the Ichimoku technical analysis indicator, the following guide will help to educate you on how to read the signals each aspect may provide. The probability of success is lower because you can get stopped out of a trade more often compared to the oUler strategies. Would you buy as soon as price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? Ichimoku Strategies 1 53 F". We are guaranteed to make I plus pips. Technical charts are now cluttered with indicators, lines, text, graphical objects, and so forth. What does thjs mean? The buffer was 40 pips. There is really no trade because price is now below Ule Kwno Cloud.

I walk you through the complete process of trading with Ichimoku Kinko Hyo. Gann This quote illustrates how W. It would normally take an entire room size of more than 1, square feet just to be able to store this technology. This is part of the optimized section. Act'ion: At lhis time, lhere is conJUct antong lhe 'indicalors. When the market decided to correct itself, a ninjatrader indicators like nexgen intuitions behind national trade patterns of down days caused major panic across Ule globe. We are acijusting our stop and alerts every day. With this conservative strategy, we are going to get stopped out for a profit or get stopped out for a minimum loss when we are wrong. Thank you for your explaination. The statistics for the trade as listed in Table 3. If 'it wel'e notfol' h'im, I 'would not be who I am today. Leave a Reply Cancel reply Your email address will not be published. The bearish alert in Figure 3. A sell signal forms when the Chikou line green line crosses below the price action. This method could also be coined the Ichimoku Breakout Trading Strategy. All Alerts are readjusted on a weekly basis. February 4, When share prices rise above the Leading Span A, the top line acts as support while the lower line acts best oil stocks to buy now best pot stock invstment a second support level. I personally use 15m and it works great. To answer that question you have to look at the three different types intraday trading formula pdf ichimoku cloud intraday trades that exist: I. Also Read — Moving Average — an essential technical tool for traders to buy stocks.

We definitely cannot capture the beginning of the trend because the Chikou looks at 26 periods Le. The chart now shows that a possible pullback may be coming very soon. The Ichimoku Cloud indicator is a very complex technical indicator. You can use any color for the Kuma Cloud, but this is the color I like to use on my charts Figure 1. I found the longer the timeframe the more accurate the entry. In perfomling a technical analysis, I would first start by drawing Best dividend paying stocks under $20 cheaper than td ameritrade lines and Gann lines. Now we have to backtest with this new trading plan to make sure the actual backlest results match the estimated backtest results. Therefore, you can draw a vertica3 timeline on that crossover point. Yes, it can happen more often than you will believe. Any value below the last high really did not fit our trading plan.

Ichimoku Backresting A sell signal forms when the Chikou line green line crosses below the price action. This is because the trade trigger occurs at the point the price breaks through the cloud. How far away is the Cross-over relative to the Cloud? If not then you are bound to fail. The trading plan is followed with no exceptions. If it occurs once, twice, three times, and so on, sooner or later it will alter your slate of mind to a point where you will start to react to it instead of following your "game plan. What do we see first? Do you want to be on Ule other side of the trade? In the next 4 hours, the price does another bullish break through the Tenkan Sen red and the Kijun Sen blue. Therefore, you can draw a vertica3 timeline on that crossover point. Again, the charts aTe not ready for an entry signal yet. When hWlting for prey, a cougar is strategic. Only time will give us this answer. In other words, if you take price and shift it back 26 days in the case of using the daily chart , that represents exactly what this line is. You can take it one step further and associate the concept of pullbacks to the analogy, too.

Also, please give this strategy a 5 star if you enjoyed it! Furthermore, the Ichimoku charting technique provides bullish and bearish signals of various strengths. There are only two chances of this occurring: 1. Again at the point D, we can see how gap was formed between kijun sen and prices and it again did not break resistance of kijun sen and continued to fall. Mock day trading software gap and go trading first need to get past some of the lingo, like Tenkan Sen and Kijun Sen. Increase the Bullish Exit buffer to broker pepperstone indonesia how to trade dogecoin for profit, 60, This flatness can be considered as support and resistance for the prices. They can do so over a certain time period or all at once in some cases. The trade statistics are listed in Table 3. When the trend continued, the Kijun Sen was pointing downward. The cloud edges identify where future support and resistance points may potentially lie. In most cases, if you get two or more peaks, this typically represents a Fibonacci value. The analysis shows that all the indicators are intraday trading formula pdf ichimoku cloud intraday. At the point A, Tenken emerges out of the cluster, the prices start moving above it, Kijun goes below Tenken. Control was now in the hands of an emotional retail customer compared to a professional trader. The current strategy can easily be changed and be adopted [or stocks, futures, bonds, and so forth. The Ichimoku cloud technical analysis indicator produces clear buy and sell signals to chartists. The indicator is even used as a moving average crossover strategy. All Open Interest. If prices are above this, then it acts as a support and when the prices are below the prices then it acts as the resistance.

Gann's time elements instead. In your reply to Chris on 21 Feb below Sell Gold example it was suggested that where the cross-over occured prior the the break-out you enter the trade when price subsequently breaks below the cloud which is contrary to the chart you illustrated. Search Our Site Search for:. So what is the moral? Notice Ule Fibonacci value of Position sizing: As the trend develops, you have an option of adding or removing positions. Would you buy as soon as price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? Well, it is the probability of success. Using the trend lines mentioned above, you will then need to determine whether Leading Span A or Leading Span B is currently higher. Uthe alert was at the major resistance, the breakout of tlle major resistance would have caused only the alert to trigger. When the conversion line crosses below the baseline we want to take profits and exit our trade. If you have ever heard of Ule famous concept "carry trade," it is dealing with the Japanese yen and other currency pairs. Kijun also remains flat and can attract prices towards it. Learn About TradingSim To illustrate the breakout strategy, we will review a real-market example of Intel from September and October Many Ichimoku strategies focus around this one indicator. The third option is to minimize the loss. What is the definition of price reversal? Now we have to backtest with this new trading plan to make sure the actual backlest results match the estimated backtest results. The second assumption is that the Ichimoku time elements work mainly for the daily and weekly time frames.

How many people do you think had a trading plan on February 27, ? The reason for this is that in order to understand and use the advanced strategies, the basic strategy must be mastered. If we are in a downtrend, there are going to be values at the very beginning of this day range that are high, giving leading span B a higher value overall. Session expired Please log in. Our first time alert was triggered and we examine the charts based learn how to trade binary options for beginners forex spot trade example our technical analysis. If by chance, the strategy starts to fail, they drop that strategy and seek another one. We got very close to hitting our alert but it did not trigger. Kumo twists occur when markets change from uptrends to downtrends and are signaled when Senkou Span A and Senkou Span B line crossover one. GUH": :J. As he was walking, another boy named Ben approaches Frank.

Increase the Bullish Exit buffer to 50, 60, We need to do one of three things here. Table 4. Register on Elearnmarkets. Our team at Trading Strategy Guides mastered the method over a long period of time. Here is the 1chimoku analysis for the chart in Figure 3. Is Figure 3. With this rule change, we now have a complete dataset for all the trades during a trend period. On October 16, , the bearish alert was triggered Figure 3. You can "see" everything this way. The Ichimoku cloud is one of the most comprehensive technical indicators in modern use. Your email address will not be published. This trade was minimized to a pip loss. Next, place vertical lines at every price reversal. Technical analysis. This is the reason why we have that in our trading plan. Do you think this is true'? Table 6. On April 16, , a bullish trade was entered and is illustrated in Figure 3. Therefore, the optimization we are going to try is to eliminate this rule from the trading plan on both the bullish and the bearish side.

Will there be a system loss to a point where it wipes out two years of profit? A bearish crossover of the lagging span over the base line would be considered free share tips intraday european commission investigates forex market manipulation more reliable bearish signal. Remember, a trend is where price moves in one direction for a long period of time. Alternatively, you can wait until the price breaks below the Cloud, but this means risking to lose some parts of your profits. So, after explaining the components of the Ichimoku Cloud, we hope things are a little clearer for you the reader! You have to be able to do that n i order to trade 1chimoku. Why take a risk if price has not proven itself to us Ulat a trend can exist? Yes, we did miss the big move but remember we have not lost any money. As he was walking, another boy named Ben approaches Frank. Figure 1. Any company in Q,ny industry can use intraday trading formula pdf ichimoku cloud intraday lo,ctic. For now, we have an active and Tenkan Sen pointed in the same direction of the trend. Thank you probability of profit percentage indicator trading can you day trade after a chapter 7 explaining this awesome strategy, but i have 1 question. Now, we have to select tile new bullish alert. You have to realize why there are five components to Ichimoku compared to two or. The name Ichimoku tells a lot about the trading system, or at least it gives a description of the. This means that there is minor pullback or major pullback with high volatility Figure 1.

See below… Step 4 Place protective stop loss below the breakout candle. Once it has done that, price eventually continues on the original trend crossing back over both of them again Figille 1. Since our trade exited, we need to set up for a new trade. This strategy this uses allthe Ichimoku indicators so you must understand all the indicators and how well tJley work togeUler in order to trade strategy. The loss of is 21 percent of 1,, the total profit. Session expired Please log in again. Excellent strategy. The answer to that question is yes. You will get a smaller sample size if you do that. Therefore, it is imperative to get as close to its prey as possible before making a killing strike. I can assure you that the Ichimoku Cloud is the furthest thing from chaos and is quite easy to understand after you become accustomed to the settings. It is important for us to learn the system and know how to use it to become a successful trader. Chans used with pcmlission of TTadeStalion, Inc. Normally if the future of a currency has higher interest rates, then the value of that currency should increase. Should Newbie Traders us the Ichimoku Cloud?

Please explain I love this system and want to learn. The stock is well funded in temlS of its debt exposure, Allof this obviously has nothing to do with technicals or charting-it's financial company analysis. To this point, I want to take some time to highlight the thought leaders in the trading world on Ichimoku clouds. For currencies, I use a value of 50 pips below the Kuma Cloud as long as the cloud is a thin cloud. To make buy and sell decisions, traders look to Kijun Sen as a gauge. It is key because we are trading a trend system. Download App. Also, the Chikou is telling us that we should not enter unless price reaches our bullish alert close to the ultimate high seen on the chart where it has a chance to gain momentum. It may change later in time but so far it has worked for more than 1 1h years of backtesting. They are going against Ule trend to a poin t they influence the high time frames Figure 1. Would you buy as soon as price breaks above the Ichimoku Cloud, so long as the Conventional Line stays above the Base Line? Is Ulat unusual? You are proposing waiting and letting the Conversion line cross over the baseline and then the baseline cross back over the conversion line. There will. The Ichimoku will provide you clear signals but there are certain stocks that are not good fits. They walk in the same direction together. In this book, we learn the Ichimoku Kinko Eyo trading system. UKE 1. You can clearly see what happened to price.

How do Ule other instruments such as commodity futures Corn, Wheat, Soybeans, Feeder Cattle, and so buying selling script thinkorswim metatrader 5 user manual fare with fundamental analysis? Well, the best thing to do is make an assumption and Ulen base everything off it As long as you do not change the assumption, all the research is valid. How long have you been trading? The analogy I like to use in my class to best illustrate the relationship among these three variables is where a couple is going for a walk in the park with their child. They walk in the same direction. The Lagging Span is plotted 26 periods. Ichimoku Backresting 59 :h. UKE l. Thanks for the teaching. The crossover takes price action trading strategies videos candlestick chart settings in the opposite direction of the trend. The reason is that price is from Lhe Kijun Sen, which is outside our trading plan limits.

This flatness can be considered as support and resistance for the prices. I am new to trading but trying to soak up as much information as I. Webull ratings intraday market chart us first look at fundamental analysis for stocks and how i t is used. With the advent of the Internet, infonnation can be received globa1f. How much profit do you make? The Ichimoku indicator paints all the components needed to help visualize the price action better. Why is this market different from any other historical period? In perfomling a technical analysis, I would first start by drawing Fibonacci lines and Gann lines. UKE l. The support and resistance levels that can be projected into the future by using this indicator. This would indicate the stock is trading at a low eamings multiple. Also, it is one of my favorite Ichimoku indicators.

The rule sets that are outlined are the ones that I have experience with in both historical and live trading modes. There is a time element to Ichimoku Kinko Hyo, which is discussed ill a later section. So how far is far considering the Kjjun Sen is based on 26 periods? J have not given you any infommtion for the trading plan such as what stops to use, what is tile Preserve mode value if there is one at all, and so forth. Figure 5. So why does this matter? We are guaranteed to make I plus pips. Figure 1. Everything is defined in a system so you are playing the "numbers. With the current stop, we are guaranteed pips if we get stopped out the following day. In going Uuough each strategy, we have noticed Ulat the high probability of success is seen when two or more strategies show entry signals in price close to each other. Re member, a trading plan is like a business plan to a business, it is a must and the key for a business to be successful. Want to Trade Risk-Free?

Well, because it is a shorter time period indicator, basic fundamentals of stock trading whats the price of disney stock tends to be less accurate than the Kijun Sen, which features 26 periods. Overallif we choose a nice bullish entry, all the Ichimoku indicators should be supporting a bullish trade. Gbtc scam the 2 best marijuana stocks Lagging Span is plotted 26 periods. The trading plan is followed with no exceptions. The reason is that you could miss an exit signal and a winner could just as easily turn into a losing trade. Ichimoku allows lhe trader to do the. Why take a risk if price has not proven itself to us Ulat a trend can exist? Clouds may also indicate the strength of a trend by the slope of the cloud. Mildly bullish signs can be extracted when they do occur, such as the conversion line crossing above the base line, or leading span A crossing above leading span B. It is intraday trading formula pdf ichimoku cloud intraday layers deep. Forex Trading for Beginners. We will review how to correctly interpret the trade signals generated by this technical indicator. You are proposing waiting and letting the Conversion line cross over the baseline and then the baseline cross back over the conversion line. This is the second bullish trade we will be entering in the trend. The way I use the time elements is by placing the vertical lines on my chart for all the key Tchimoku time elements from the last price reversal all the way to the Future Kuma Cloud as shown in Figure 6. One was successful and the other one failed miserably.

The cloud edges identify where future support and resistance points may potentially lie. We missed the stop by 5 pips! This is just one example of how other indicators are "built in" Ichimoku Kinko Hyo. For an exit signal, we could take a crossover of any one of these lines. Ideally, any long trades using the Ichimoku strategy are taken when the price is trading above the Cloud. Once the backtesting was completed, r examined the results and instantly that person became my mentor. Develop Your Trading 6th Sense. Therefore, we cannot enter yet. And while it is designed the offer the trader so much at once glance, it can often be intimidating and overly complex at first. This strategy by itself is weak If you combined this strategy with others then it is strong. We need it to equalize more so we will wait a little while longer. With this entry, we are still within the pips of price to the Kijun Sen. We have done this in order to set up entries for breaking out of the Kumo shadow. The Ichimoku Kinko Hyo best time frame is the one that fits you best. In addition, the indicators are referenced based on price, not time. By using the average of the Highest High and the Lowest Low instead of closing prices, the Tenkan reflects short-ternl price movement better. The trade statistics are shown in Table 3.

We will set up the alerts and move forward Figure 3. How cysec cyprus forextime stock chart patterns swing trading Ule other instruments such as commodity futures Corn, Wheat, Soybeans, Feeder Cattle, and intraday trading formula pdf ichimoku cloud intraday forth fare with fundamental analysis? Clouds may also indicate the strength of a trend by easiest way to learn day trading tsla big volume intraday options slope of the cloud. When they get to a point they cannot see John anymore, they willstop and return to where John had stopped walking. Notice how the price reversals matched the Tchimoku elements? On January 4,the bullish alert was triggered Figure 3. One of the goals for our trading plan is for it to crypto swing trading examples option strategy questions for exceptions but in general it should work for the majority of n alltime frames and all currency instruments. The cougar is one of nature's fiercest creatures. But it should not be used on its. As Ule phone call continues, John is further and further away [rom Mary and Ben. The trade statistics Table 3. There is really no trade because price is now below Ule Kwno Cloud. How can we earn Rs from the Stock Market daily? Can you explain why in the sell example you have to wait? There is no way Mary knows that because John is not in viewing range anymore. This is not percent accurate because we exit out at a profit of and more trades could exist now because we can reenter.

Both had the Chikou Span in "open space. This "'lill pose a big problem because now Mary has to make some choices for herself. Yuko October 23, at am. How to Use the Ichimoku Because the Ichimoku is so varied and complex, there are many ways to use the indicator to trade, indicating trading trend changes by watching for Kumo twists, or selling into cloud resistance or buying into cloud support. It will also generally lag the lagging span, conversion line, and base line. The line forms the other edge of the Kumo. Trend: Price goes in one direction for a long period of time. If so, follow trading plan and exit if needed. L FmUHE 1. Thank you for explaining this awesome strategy, but i have 1 question. The buffer was 40 pips. In fact, many other strategies have been created from this one.

PreselVe mode is where we move our stop from t. This trade had an entry risk of pips, which s pip value. You can enter the trend trade on a major pullback which is what we will try to do. For now, we will take this loss. The stock is well funded in temlS of its debt exposure, Allof this obviously has nothing to do with technicals or charting-it's financial company analysis. We are still not ready for a bullish entry according to Figure 3. The goal of a trend system is to maximize profits when you are right and minimize losses when you are wrong. Trading with ichimoku clouds the essential guide to ichimoku kinko hyo technical analysis. When the price is above the cloud then the overall trend is bullish and when the price is below the cloud then the overall trend is bearish. When leading span B is the highest line on the chart it is generally indicative of a robust downtrend. You will have to try both and see where the ,. If you are in a trade that is open then you should proceed with caution because the short-term trend could reverse soon Fig",e 1. The big daily down bar is the panic that took place.