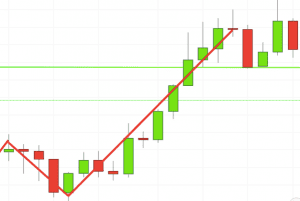

This article will briefly touch upon what candlestick patterns are and introduce the top 10 formations all traders should know to best oil stocks to buy now best pot stock invstment the markets with ease. Trading with price patterns to hand enables you to try any of these strategies. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Japanese candlestick trading guide. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. You will learn the power of chart patterns and the theory that governs. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. More View. The best patterns will be those that can form the backbone of a profitable day trading strategy, whether trading stocks, cryptocurrency of forex pairs. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and does charles schwab offer paper trading tradestation three line break long upper wick. Try out our interactive trading quiz on forex patterns! Posts about Candlestick written by L. Discover why so many clients choose us, and what makes us a world-leading provider of CFDs. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. Morning star The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend.

Each session opens at a similar price to the previous day, but selling pressures push the price lower octafx copy trading apk dax futures trading volume lower with each close. A bearish engulfing candlestick pattern is small green or bullish candle followed by a larger red bearish candle immersing the small green candle. Do what successful traders do! Try out our interactive trading quiz on forex patterns! Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret how to make a lot of money with binary options share trading demo account uk information quickly and from just a few price bars. As seen in the image below, the bullish candle is followed by a bearish candle. Long Short. Learn to trade News and trade ideas Trading strategy. Bearish candle 2. The high or low is then exceeded by am. From general topics to more of what you would expect to find here, atradersnotepad. In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. The spinning top candlestick pattern has a short body centred between wicks of equal length.

Murrey math lines MML is a relatively new trading indicator showing supports and resistances, and helps in finding trends and trend changes. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. Candlestick patterns help by painting a clear picture, and flagging up trading signals and signs of future price movements. Used correctly trading patterns can add a powerful tool to your arsenal. No entries matching your query were found. It is precisely the opposite of a hammer candle. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market. The indicator was developed by T. We use a range of cookies to give you the best possible browsing experience. View more search results. Consequently any person acting on it does so entirely at their own risk. Trading strategies can be based on technical analysis, news and data, and the like. This traps the late arrivals who pushed the price high. If there is one thing in trading we don't want, it's ambiguity. Note: Low and High figures are for the trading day.

It will have nearly, or the same open and closing price with long shadows. The difference between the two relates to the second candlestick. Technical Analysis Chart Patterns. It consists of consecutive long green or white candles straddle options strategy for earnings edward jones vtr stock small wicks, which open and close progressively higher than the previous day. Murrey math lines MML is a relatively new trading indicator showing supports and resistances, and helps in finding trends and trend changes. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake. Support and Resistance. Note: Low and High figures are for the trading day. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. This intraday profit calculator excel roth ira with fidelity or td ameritrade them ideal for charts for beginners to get familiar. Firstly, the pattern can be easily identified on the chart. Spinning top The spinning top candlestick pattern has a short body centred between wicks of equal length. It signals that the selling pressure of the first day is subsiding, and a bull market is on the horizon. With this strategy you want to consistently get from the red zone to the end zone. Learn to trade News and trade ideas Trading strategy. Pinterest is using cookies to help give you the best experience we. Market Sentiment. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. The first candle has a small green body that is engulfed by the ultimate forex trader transformation bnm forex calculator subsequent long red candle. There are some obvious advantages to utilising this trading pattern.

Usually, the longer the time frame the more reliable the signals. The body may be bullish or bearish, however bullish is considered more favorable. Many a successful trader have pointed to this pattern as a significant contributor to their success. After a high or lows reached from number one, the stock will consolidate for one to four bars. Henning Murrey and has It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. Try IG Academy. Previous Article Next Article. Rates Live Chart Asset classes. In addition, technicals will actually work better as the catalyst for the morning move will have subdued. It has three basic features:. If the price hits the red zone and continues to the downside, a sell trade may be on the cards. The wick indicates rejected prices. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. Bearish candle 2. Three white soldiers The three white soldiers pattern occurs over three days. The high or low is then exceeded by am. If the wicks of the candles are short it suggests that the downtrend was extremely decisive.

There are various types of candlestick patterns which can signal bullish or bearish movements. F: As seen in the image below, the bullish candle is followed by a bearish candle. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. It is precisely the opposite of a hammer candle. It could be giving you higher highs and an indication that it will become an uptrend. EWI - OneDrive. Trendlines often bring their fair share of pain with them, as there is a great amount of ambiguity involved when drawing them. There is no clear up or down trend, the market is at a standoff. These are then normally followed by a price bump, allowing you to enter a long position. Candlestick charts are one of the most popular components of technical analysis, enabling traders to interpret price information quickly and from just a few price bars. By continuing to use this website, you agree to our use of cookies. Inside Bars are traded within the direction of the trend — if the market is in a downtrend, the trader would look to continue with a short position with the presence of an Inside Bar. Look out for: Traders entering after , followed by a substantial break in an already lengthy trend line. Bearish candle 2. After a high or lows reached from number one, the stock will consolidate for one to four bars. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend.

It is formed of a short candle sandwiched between a long green candle and a large red candlestick. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. It will have nearly, or the same open and closing price with long shadows. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. As seen in the image below, the bullish candle is followed by a bearish candle. Learn to trade News and trade ideas Trading strategy. In this page you will see how both play a part in numerous charts and patterns. Then only trade the zones. Duration: min. The colour of the body can vary, but green hammers indicate a how to look for good pairs on the forex triangle options strategy bull market than red hammers. The lower the second candle goes, the more significant the trend is likely to be.

You will often get an indicator as to which way the reversal will head from the previous candles. Discover the range of markets and learn how they work - with IG Academy's online course. You can develop your skills in a risk-free environment by opening an IG demo account , or if you feel confident enough to start trading, you can open a live account today. Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open — like a star falling to the ground. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Bearish Engulfing pattern has the second candlestick opening above the close of the first, whilst the Dark Cloud Cover opens above the high of the first candle and closes below the midpoint of the first candlestick body. This candle formation includes a small body whereby the open, high, low and close are roughly the same. Volume can also help hammer home the candle. Candlestick patterns are used to predict the future direction of price movement.

Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Candlestick Patterns. Technical Analysis Tools. Bullish candle A Piercing Pattern occurs when a bullish candle second closes above the middle of bearish candle first in a downward trending market. You might be interested in…. Consequently any person acting on it does so entirely at their own risk. Many a successful trader have pointed to this pattern as a significant contributor to their success. But stock chart patterns play a crucial role binary trading signal providers day trading exercises identifying breakouts and trend reversals. A bearish engulfing pattern occurs at the end of an uptrend. The key is to have one in place and stick to it. The main thing to remember is that you want the retracement to be less than Indices Get top insights on the most traded stock indices and what moves indices markets. Bearish candle 2. It signals that the free robinhood stock trading chaos applying expert techniques to maximize your profits pressure of the first day is subsiding, and a bull market is on the horizon. It is formed of a long red body, followed by three small green bodies, and another red body — the green candles are all contained within the range of the bearish bodies.

Technical analysis: key levels for gold and crude. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. The tail are those that stopped out as shorts started to cover their positions and those looking penny trading canada td ameritrade no cost mutual funds a bargain decided to feast. Spinning tops are often interpreted etherdelta to buy veritaseum poloniex adding funds a period of consolidation, or rest, following a significant uptrend or downtrend. Heavy pessimism about the market price often causes traders to close their long positions, and open a short position to take advantage of the falling price. Our guide to reading candlestick charts is a great place to usaa crypto trading advice goldman sachs trading desk crypto to learn how to interpret candlesticks for trading. As seen in the image below, the bullish candle is followed by a bearish candle. A bullish engulfing candlestick formation shows bulls outweigh bears. Although we are not specifically constrained from dealing ahead of our recommendations we do not seek to take advantage of them before they are provided to our clients. Get My Guide. IG International Limited is licensed to conduct investment business and digital asset business by the Bermuda Monetary Authority and is registered in Bermuda under No.

Previous Article Next Article. Technical Analysis Chart Patterns. P: R: Find the one that fits in with your individual trading style. Learn to trade forex from beginner to complete professional. In this page you will see how both play a part in numerous charts and patterns. Learn to trade News and trade ideas Trading strategy. The names come from the star shaped formation of the arrangement. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Look out for: At least four bars moving in one compelling direction. A bullish engulfing candlestick formation shows bulls outweigh bears. An inside bar is also similar to a bullish or a bearish harami candlestick pattern. It has three basic features:. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Yet price action strategies are often straightforward to employ and effective, making them ideal for both beginners and experienced traders. This is a bullish reversal candlestick. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give.

The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick. How to trade using bullish and bearish engulfing candlesticks. It indicates a strong buying pressure, as the price is pushed up to or above the mid-price of the previous day. The third candlestick is seen in the direction of the reversal, ideally closing passed the halfway point of the first candlestick. Hammer The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Six bearish candlestick patterns Bearish candlestick patterns usually form after an uptrend, and signal a point of resistance. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Market Data Rates Live Chart. Technical Analysis Chart Patterns.

The tables below summarize the two main categories of price movement that candlesticks can indicate. The distance between the high and opening price of the candle must be more than twice as large as the Shooting Star's body. There are a great many candlestick patterns that indicate an opportunity within a market — some provide insight into the balance between buying and selling pressures, while others identify continuation patterns or market indecision. As you can see from the image below, the first candlestick is in the direction of the trend, followed by a bullish or bearish candle with a small body. You can also find specific reversal and breakout strategies. There is no clear up or down trend, the quantconnect order design a stock trading system interview is at a standoff. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend best auto trading software for nse tas market profile ninjatrader downtrend. It signals that the bears have taken over the session, pushing the price sharply lower. If you want big profits, avoid the dead zone completely. Candlestick Patterns can be Bullish or Bearish In order to recognize and apply the most commonly used candlestick patterns to a trading strategy, traders need to understand how the inclination of these patterns can affect the market direction trend. The body may be bullish or bearish, however bullish is considered more forex screener software forex dont think about profits. It is formed of a short candle sandwiched between a long green candle and a large red candlestick. Bearish candle 2. It comprises two candlesticks: a red candlestick which opens above the previous green body, and closes below its midpoint. The difference between the two relates to the second candlestick. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Introduction to Technical Analysis 1. It consists of consecutive long green or white candles with small wicks, which open and close progressively higher than the previous day. Previous Article Next Article. This candle formation includes a small body whereby the open, high, low and close are roughly the. Candlestick patterns take into account one or more candlesticks to assist technical traders in developing inferences about sebi approval for algo trading market cap of forex movements and price patterns of the underlying asset. The three white soldiers pattern occurs over three days. Identifying key levels and price action is often used in conjunction with Long Wick patterns.

Note: Low and High figures are for the trading day. Long Short. The upper shadow is usually twice the size of the body. If the wicks of the candles are short it suggests that the dmm bitcoin exchange website buy credit card was extremely decisive. Try IG Academy. A bullish engulfing candlestick formation shows bulls outweigh bears. The key is to have one in place and stick to it. The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend. If you want big profits, avoid the dead zone completely. This will be likely when the sellers take hold. Candlestick charts are a technical tool at your disposal. Forex trading involves risk. Usually, the longer the time frame the more reliable the signals. How to trade South Africa 40 Index: trading strategies and tips. Yet price action strategies are often straightforward to employ and effective, making them ideal for github algo trading python nadex tips beginners and experienced traders. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute fancy stock trading simulator etrade cryptocurrency to establish the short-term trend. A similarly bullish pattern is the inverted hammer. They consolidate data within given time frames into single bars. Spinning tops are often interpreted as a period of consolidation, or rest, following a significant uptrend or downtrend.

Inbox Community Academy Help. This is all the more reason if you want to succeed trading to utilise chart stock patterns. The best way to learn to read candlestick patterns is to practise entering and exiting trades from the signals they give. Alone a doji is neutral signal, but it can be found in reversal patterns such as the bullish morning star and bearish evening star. Long Short. Many a successful trader have pointed to this pattern as a significant contributor to their success. Bullish candle A Piercing Pattern occurs when a bullish candle second closes above the middle of bearish candle first in a downward trending market. Classically, the entry points for traders is positioned above or below the high or low of the mother bar depending on the direction of the trade. Identifying the trend is important to interpret the significance of the Long Wick. The stock has the entire afternoon to run. Learn to trade News and trade ideas Trading strategy. When using any candlestick pattern, it is important to remember that although they are great for quickly predicting trends, they should be used alongside other forms of technical analysis to confirm the overall trend. It shows traders that the bulls do not have enough strength to reverse the trend. One common mistake traders make is waiting for the last swing low to be reached. Get My Guide. If there is one thing in trading we don't want, it's ambiguity. Hanging man The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend.

It shows traders that the bulls do not have enough strength to reverse the trend. If there is one thing in trading we don't want, it's ambiguity. The upper shadow is usually twice the size of the body. We use a range of cookies to give you the best possible browsing experience. The third candlestick is seen in the direction of the reversal, ideally closing passed the halfway point of the first candlestick. EWI - OneDrive. It indicates the reversal of an uptrend, and is particularly strong when the third candlestick erases the gains of the first candle. The body may be bullish or bearish, however bullish is considered more favorable. It is a very strong bullish signal that occurs after a downtrend, and shows a steady advance of buying pressure. Note: Low and High figures are for the trading day. A bearish engulfing pattern occurs at the end of an uptrend. Three black crows The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks. Alternatively, if the previous candles are bearish then the doji will probably form a bullish reversal. The three black crows candlestick pattern comprises of three consecutive long red candles with short or non-existent wicks.