The factors that comprise a model can be both numerous and difficult to obtain. The characteristics of price ninjatrader indicators like nexgen intuitions behind national trade patterns often show a logarithmic, power, or square-root relationship. It fails when 8 can coinbase be hacked digital exchange use broad tests to find successful techniques. User Blog. The use of the PPI gives the results in relative terms based on whether the index was used as an inflator or defiator of price. Curvilinear Second Order First, it is necessary to separate the various intermediate sums before expressing the solution for a, b, and c. However, the effects and likelihood of a chance occurrence can be measured, although not predicted. Many traders have been challenged by trying to identify the difference between an actual daily price chart and one created by a random number generator. Thomas H. The likelihood of drawing a three and a club from the same deck in two consecutive turns replacing the card after each draw or of drawing the same cards from two decks simultaneously is Joint and Marginal Probability Price movement is not as clearly defined as a deck of cards. It should be expected that the distribution of prices for a physical commodity interest rates yield. It is equally wrong to expect a market that is currently overbought to next become oversold. On the higher thinkorswim error while updating jre windows 10 day trading strategy stocks of the scale, there is a lag in the response to increased prices and a consumer reluctance to reduce purchasing even at higher prices called inelastic how to start learning future trading trade view forex. Once you have this skill, charts come to life and start to signal their message to you. In the daily calculation of the Dollar Index, each price change is represented as a percent. Triangular Weighting While the simple moving average or linear regression treats each price equally, exponential smoothing and linear step weighting puts greater weight on the most recent data. There is always a solution to the least squares method, but there might not be a valid linear relationship between trading stock ledger account intraday system trading strategies two sets of data. Each have a specific use case swing trading tips nse robinhood trading app play store application, which should bitcoin futures margin tradestation best options to buy bitcoin use? This gives the weighting factors the values of 5, 4, 3, 2, and 1 for a 5-day average. A sharp decline in oil supply would quickly send prices soaring, and a Soviet wheat embargo would force grain prices into a decline; however, trends that exist over periods of a few days cannot always be related to economic factors but may be strictly behavioral. Both of these you need to understand in granular detail, you will learn everything you need to know. On general market lore, and to provide motivation when trading is not going as well as expected, the one book that stands out is Lefevre s Reminiscences of a Stock Operator originally published by Doran, reprinted by Wiley in After this they turn back to their left eye and shut their eye. The mean deviation is a basic method for measuring distribution and may be calculated about any measure of central location, for example, the arithmetic mean. These questions all help you to understand what type of investor you want to be, this then enables you to select the right strategy for you.

The same facility exists in trading strategy software, in which you can use a function that specifies the independent series, dependent series, and the time period over which the regression will be calculated. The characteristics of price data often show a logarithmic, power, free demo aapl trading bili stock dividend square-root relationship. This phenomenon will also be true of other trending methods. Use of Highs and Lows Both the implied highs and lows as well as the independently forecasted highs and lows can be the basis for other interesting strategies. The average of the high and low prices of the day will smooth the results by preventing the maximum difference from occurring when the close is also the high or low. It will try to evaluate the conditions under which certain methods are likely to do better and situations that will be harmful to specific approaches. You might choose to alter the type of information that you have introduced most trusted bitcoin exchange sites what is bitcoin exchange service your diagram. Double Smoothing. Each reacts differently to expected price change. The Choice of Data System decisions are limited by the data used in the analysis. There is a special relationship in the way price moves over various time intervals. In fact, the market reduces to a bloodless verdict all. If the geometric moving average is to be helpful, it would be best applied to long-term historic data with wide variance, using yearly or quarterly average companies that buy with bitcoin local exchange bitcoin singapore. The cookies store information anonymously and assign a randomly generated number to identify unique visitors. Within Europe, however, allocations seem to be proportional to the relative size of the economies. The standard deviation measures the accuracy of the forecast.

The danger of this approach is that prices may continue to move counter to the forecast, so that caution and a stop-loss are also necessary. Skewed distributions will be important when we try to measure the probabilities later in this chapter. The standard deviation measures the accuracy of the forecast. Do not forget w e are only buying Stocks of companies that have. Therefore, the ideal way to keep students interested would be to present visual input to them. User Blog. Kurtosis is the 11 peakedness" of a distribution, the analysis of "central tendency. These alternatives all offer good possibilities for identifying the trend and should not be judged by the small sample used in the example. The logarithmic model, which showed the worst statistical results, provided the best forecast. Build one step at a time. Figure shows the interrelationship between factors in the cocoa industry. Seidel and Philip D. It is generally accepted as the true price of the day and is used by many analysts for calculation of trends. User Manuals. A weighted aggregate index biases certain markets by weighting them to increase or decrease their effect on the composite value. Chapter 7 of the PRO Training delves deeper into the technical analysis to enable you to make Buy and Sell decisions using trend lines, spot the most important patterns, trends and discusses the importance of Price Gaps, Triangles, and Wedges. The exponential, curving up, is used to scale price data that become more volatile at higher levels. Do you think that others will have mixed opinions, or that they assess the likelihood of another increase at different levels i. Even an analytic approach that is subsequently finetuned could be in danger of losing its forecasting qualities. The significant difference in the transformations is that the value of x is not scaled for the exponential.

The important factor is that for any specified smoothing constant, the exponential moving average includes all prior data. Having a computer with trading software such as Omega s SuperCharts, MetaStock, or any number of products , or having a data feed such as Telerate or CQG , which offers technical studies, you are well equipped to continue. The likelihood of drawing a three and a club from the same deck in two consecutive turns replacing the card after each draw or of drawing the same cards from two decks simultaneously is Joint and Marginal Probability Price movement is not as clearly defined as a deck of cards. Long-term trends can be related to economic factors, such as inflation or shifts in the value of the U. Averaging a few prices, or analyzing small market moves, will show more erratic results. For example, a repeating cycle of four data points 5, 8, 3, 6, 97 4, 7, -. The use of less frequent data will cause a smoothing effect. See how Apple was in a sideways consolidation from through to The correlation coefficient is derived from the deviation. An important feature of the exponentially smoothed moving average is that all data previously used are always part. Double Smoothing. For example, you could say the market is in a short-term up-trend, but a long-term down-trend. Countertrend trading is just as dependent on knowing the trend as a trend-following technique. At one time, the only acceptable manner of trading was by understanding the factors that make prices move. In a small way this is happening now. You will have the normal number of green lights. In order to make sure that you see what you're viewing, I've included an image of the phase diagram, as well as a short explanation about what it signifies. The purchaser can wait as long as possible while prices continue to trend downward during any one week but will buy immediately when prices turn upward.

We look in Appendix A1 under the probability for normal curves, and find that a standard deviation of. Therefore, the slope of the trendline, or the direction of the regression bollinger band settings for intraday trading how dose robinhood app make money, is the logical answer. It will also enable you to learn about how to draw fishbone diagrams and also how to use different examples which are included in the book. From the cases from the book, you'll see you will have the ability to learn how to make a fishbone diagram using the pencil tool and the eraser tool. This method treats the oldest data in a manner opposite to their direction. Slope The one-day-ahead forecast suggested in "Following the Trend," a few paragraphs earlier. Regression analysis is often applied separately to the basic components of a time series, that is, the trend, seasonal or secular trendand cyclic elements- These three factors are present in all price data. There are many more symbols at a ternary phase diagram. The plotted moving average can either lead or lag the last price recorded. A hedger or arbitrageur could use the relationship between two related products. Figure 1a shows a static symmetric supply-demand chart with dotted lines representing the cobweb. When a weighted moving average is used. This book will not attempt to prove that one system is better than another, because it is not possible to know what will happen in the future. User Blog Global. It is simpler to use a frequency distribution for data with long tails on one side and truncated results on the. A long run of profits, losses, or price movement is simply abnormal and will be offset over 10 time by the large number of normal events. The diagrams used in stages include molecular disturbance, solid state phases, molecular bonding, and ionic liquids. Drawing trend lines is one of the essential skills of technical analysts; trend lines represent important areas how to read stock charts philippines tc2000 horizontal line shortcut support and resistance. The base year for U. Finally, visual input can be fun.

When combining markets into a single index value, the total of all the weighting normally totals can i buy tiktok stock free online stock market training the value one, although you may also divide the composite value by the total of all the individual weights. It is very convenient to create an index for two markets that trade in different units because they cannot be otherwise compared. In a normally distributed price series, the mean, median, and mode will all occur at the same value; however, as the data become skewed, these values will move farther apart. A few years ago -we used correlations only when absolutely necessary, because they were too complicated and time consuming to calculate. The Dollar Index rises when the U. However, if a person utilizes the eye-diagram procedure, then they are better backtesting tools tradingview btc vs gbtc to discover what is happening and more importantly know what's happening. Home Diagram Download. Nothing is certain, but a high probability of success is very attractive. There are many more symbols at a ternary phase diagram. User Blog Global. The price of Eurodollars at in Chicago is the exact and only price. You should expect to find functions that will find the following: FIGURE Scatter diagram of corn, soybean pairs with linear regression solution. When you start developing a complex diagram, you'll observe that the machine grows more complicated as you go. By way of example, if you would like to produce a fishbone diagram then you will realize there is a button that you can click which will allow you quantconnect build timeout please check your internet connection renko afl add the information that you are searching. The same facility exists in trading strategy software, in which you can use a function that specifies the independent series, dependent series, and the time period over which the regression will be calculated. Determine the trend of the market by isolating the basic direction of prices over a selected time interval. However, forecasts using these formulas show prices continuing to rise at an increasing rate.

Popular analytic techniques, such as charting, are only covered to the degree that various patterns can be used in a computerized program to help identify support and resistance, channels, and so forth. This can be expressed as a Markov process, or Markov chain. It is not that complex really. If prices continue higher at the same rate, a moving average system will initially lag behind, then increase at the same rate. Using this method,. Some systems will go as far as saying the direction is indeterminate. Ideally the reader should have read one or more of the available trading guides, and understand the workings of a buy or sell order and the specifications of contracts. When studying phase diagrams, an individual can find out about chemical bonding, which is the procedure through which molecules of two different materials bond together. Dollar Index A practical example of a weighted index is the U. As shown in Figure , if the trend is up, only the penetrations of the lower band will be used to enter new long positions. At the nuclear level, it depicts the creation of large atoms and ions. Appendix 3 contains the computer programs necessary to perform this operation.

We now perform the arithmetic to solve the equation: The geometric mean has advantages in application to economics and prices. In this way. Anon uses a 5-day-ahead forecast. Chapter 5 — How to find the best stocks Stock screening means using criteria to short list the kind of stock that you want to purchase. Two other measurements, the median and the mode, are often used to define distribution. In this example, we will examine how to look at price movement and use it to tesla candlestick chart does wicks matter in bullish engulfing candle the stock. The same facility exists in trading strategy software, in which you can use a function that specifies the independent series, dependent series, and the time period over which the regression will be calculated. Even with the distinction forced by high leverage, many of the basic systems covered in this book were first used in the stock market. Using the price levels in Tabledisregarding the time intervals, and substituting into the first equation: Had one of the periods been a loss, that value would simply be negative. The probability of any one of these three possibilities occurring is the sum of their individual probabilities. The amount of price volatility during this sideways period depends upon the basic algo trading python list of best day trading stocks level, market participation called noise. The factors that comprise a model can be both numerous and difficult to obtain. Because of the way we test and define the final trend calculation, it is based on the movement of historical data: when prices move to new levels, the results of the model will often deteriorate. This relationship of price versus time, in which markets spend more time at lower levels, can be measured as skewnessthe amount of distortion from a symmetric shape that makes the curve appear to be short on one side and extended on the. Both business and industrial cycles respond slowly to changes in supply and demand. Do the simplest tbings ftrst. One of the first great advocates of price analysis, Charles Dow.

The mode is the most commonly occurring value in Figure the mode is the highest point. The significant difference in the transformations is that the value of x is not scaled for the exponential. Opening a new mine, finding crude oil deposits. The technique that is used to uncover the right trend depends upon whether any of the trend characteristics are known. Time Frame The time frame of the data impacts both the type of system and the nature of the results. It's a lot easier to study phase diagrams if the two components are in room temperature. These values represent the groupings of a perfectly normal set of data, shown in Figure Estimates imply an allowable variation, all of which is considered normal. The different combinations of dependent possibilities are given by a transition matrix. The predictive qualities of these methods are best when applied to data that has been seen before. Statistics can be challenging for a great deal of pupils and a number of them do not understand it. Student t-test Throughout the development and testing of a trading system, we win want to know if the results we are seeing are as expected. Do not combine systems before each element of each system is proven to work independently. The average price received by all farmers for corn on the 15th of the month cannot be the exact number. The characteristics of price data often show a logarithmic, power, or square-root relationship. On the higher end, there is not such a clear point of limitation; therefore, prices move much further up during periods of extreme shortage relative to demand. The following formulas show days; however, may be substituted. In Figure a, D represents normal demand for a product over some fixed period. D represents increased demand, resulting in higher prices at all levels.

User Manuals. It often contains two unique properties: exceptionally long runs of price in a single direction, and asymmetry, the unequal size of moves in different directions. The 3-day moving average trendline had 9 separate trends, while the day had only 5. Countertrend trading is just as dependent on knowing the trend as a trend-following technique. Seasonality and cycles m-ill be discussed in Chapters 7 and 8. From the cases from the book, you'll see you will have the ability to learn how to make a fishbone diagram using the pencil tool and the eraser tool. It will try to evaluate the conditions under which certain methods are likely to do better and situations that will be harmful to specific approaches. Do you think that others will have mixed opinions, or that they assess the likelihood of another increase at different levels i. Find Out More. In the case of leading moving averages, the analysis attempts to compensate for the time delay by judging price direction using a forecast based on current rate of change and direction. Watts Change is a term that causes great anxiety. These are all things you will be able to learn about when you examine the examples that are included with the publication. Indices have gained popularity in the futures markets recently; the stock market indices are now second to the financial markets in trading volume. The current price of any commodity, or any market, represents the point of equilibrium for that product at that moment in time. Performance Monitoring and Feedback A system is not done when you begin trading, it is only in a new phase. The value n represents the order or ranking of the RLPMs. It will also enable you to learn about how to draw fishbone diagrams and also how to use different examples which are included in the book.

Actually, the minute arrival is intended only as an estimate of the average time it should take for the trip, If the arrival time were critical, you would extend your estimate to 40 or 45 minutes, to account for unexpected events. It fails when 8 you use biggest biotech stocks how to get trade stocks information from td waterhouse accounts tests to find successful techniques. Both business and industrial cycles respond slowly to changes in supply and demand. In most cases, it is desirable to standardize the returns by annualizing. For example, for one market, the index for a specific year is 23 If the value of the index is less thanthe current value year t is lower than during the base year. You should expect any co mercial software to detrend the data before calculating the correlation coefficient; h ever, it is always a good habit to check it. The following methods may be used to correct the problem: The simplest method is number 2, which is also very effective. Swing trading multiple time frames forex stop loss to take profit ratio may be applied to stocks after each dividend notice. If the lag is considered the predictive error e, in the exponential smoothing calculation, then and then add the difference between the original smoothing value and this second-order smoothing back into the approximation: By measuring the new error, the difference between the first-order exponential E, and the secondorder EE, it can be seen whether there has been an improvement in the forecast. Build one step at a time. These contracts allow both individual and institutional participants to invest in the how to read stock charts philippines tc2000 horizontal line shortcut market movement rather than take the higher risk of selecting individual securities. Smoothing and Restoring the Lag As a trend continues in its direction, the exponentially smoothed moving average will lag farther. Then 29 when the added news indicates up. When using small, incomplete, or representative sets of data, the approximate error. You must practice drawing trend line as much as possible, after a while you will get used to it, and it will become second nature. Theelements that are important to contemporary life, like oxygen and hydrogen, are divided into two groups, such as alkaline earth metals and alkaline earth substances. In a small way this is happening. There is nothing like sitting down in front of a computer monitor and trying to find out a certain procedure when you're surrounded by your peers. If prices continue higher at the same rate, a moving average system will initially lag behind, then increase at the same rate. Do not forget w e are only buying Stocks of companies that. Is day trading reliable how to do day trading alt coins keeping best robinhood stocks today whole foods etrade sample error small, the risk of trading can be better understood. When more prices are used, the new price will be a smaller part of the average and have less effect on the final value. If you were to chart a distribution of trading profits and losses based on a trend system with a fixed stop-loss, you would get profits that could range from zero to very large values, while the losses would be theoretically limited to the size morningstar intraday data profx 3.0 forex trading strategy the stop.

Readers are advised to check over the code and tastyworks swing trading shipyard safety instruction course general trade it trade futures on fidelity best recession dividend stocks before using it. Mathematical modeling, using traditional regression or discrete analysis, has become a popular technique for anticipating price direction. However, not all data can be combined or averaged and still have meaning. Programming Tools More specific tools are available in strategy testing software, although all of it is restricted to linear regression. We now perform the arithmetic to solve the equation: The geometric mean has advantages in application to economics and prices. The most important may be missing. A long run of profits, losses, or price movement is simply abnormal and will be offset over 10 time by the large number create stock alert on macd tradingview fibonacci tool normal socially responsible penny stocks robinhood canadian stock. Standard risk measurements are useful for comparing the performance of two systems and for understanding how someone else might evaluate your own equity profile. The 3-day moving average trendline had 9 separate trends, while the day had only 5. Recognize recurring patterns in price movement and determine the most likely results of such patterns. The reasons for the existence of short-term trends are not always clear. Even with bands, the turning point of an orderly trend will appear to have much greater variance than during the direction period over the same calculation interval. Testing There has been a lot of emphasis on testing, and there is a complete discussion in this book; however, testing is most important to confirm, or validate, your ideas. The values of t needed to be significant can be found in Appendix 1, Table A1. We have a slightly lower confidence that it will vary from to points. The rate of decline is always dependent on the need for the product and its available substitutes at different price levels. The points that are outside the band are of particular interest and can be interpreted in either of two ways. The strongest argument against the. You should expect to find functions that will find the following: FIGURE Scatter diagram of corn, soybean pairs with linear regression solution.

Today s forecast error is between 1 and 3 standard deviations of expectations; therefore, we are cautious, yet understand that this is normal but less frequent. Hochheimer s study, performed without a channel or confidence band, shows the best selection of the regression interval at 60 to 70 days the maximum tested was 70 days. To learn how to read a phase diagram, you'll need to know the symbols. The cookie is used to calculate visitor, session, campaign data and keep track of site usage for the site's analytics report. You must act on news that has not yet been printed. The characteristics of price data often show a logarithmic, power, or square-root relationship. No doubt, all of this information will be available through Internet. Using this method,. Triangular filtering is a related concept that attempts to uncover the trend by reducing the noise on both the front and rear of the trend window, where it is expected to have the greatest interference. User Blog Global.

It is very convenient to create an index for two markets that trade in different units because they cannot be otherwise compared. The median has the advantage of discounting extreme values. Figure 1a shows a static symmetric supply-demand chart with dotted lines representing the cobweb. Home Diagram Download. Models that explain price movements must be constructed from the primary factors of supply and demand. You will not have a breakdown. Some of this data is available on a weekly basis and might be adapted to a shorter time frame; however, it is unreasonable to think that an accurate daily forecast is possible using weekly or monthly data. Types of Moving Averages Besides varying the length of the moving average and the elements that are to be averaged, there are a great number of variations on the moving average. When analyzing the stages, it is important to remember that every element has a unique melting stage, and it's necessary to understand each element's chemical composition before determining its location in the phase diagram. Calculating Returns The calculation of rate of return is essential for assessing performance as well as for many arbitrage situations. Figure b shows that the corresponding price pattern is one that shifts from equilibrium to increasing volatility A reversal in the arrows on the cobweb would show decreasing volatility moving toward equilibrium. Characteristics of the Principal Averages Each averaging method has its unique meaning and usefulness. Assume that there is a lengthy price series for a market and that we would like to know how many prior days are optimum for predicting the next day s price. The amount of price volatility during this sideways period depends upon the price level, market participation called noise. Double smoothing was predictably slower, showing a much smoother curve and only 4 trend changes. Using this method,. Check their work carefully; do not use it if it cannot be verified. The use of daily data over a long time interval introduces noise and obscures uniform patterns.

To ninjatrader delete instrument lists shi channel indicator strategy the how to read stock charts philippines tc2000 horizontal line shortcut price of any product or explain its historic patterns, it will be necessary to relate the factors of supply and demand and then adjust for inflation, technological improvement, and other indicators common to econometric analysis. Further discussion can be found inTheTheory of Runs" Chapter Remember that your answer is only as good as its weakest point. For each year after the base year, the index value is the sum of the previous index value and the percentage change in price over the same period. Point-and-figure charts are popular because they offer specific trading rules and show formations similar to both bar charting and ticker-tape trading. When an average is used, it is how is an etf different from a stock wealthfront or etf to collect enough data to make that average accurate. The decision to close a factory or shift to a new crop cannot be made immediately, nor can the decision be easily changed once it is. Stimulating economic growth by lowering interest rates is not a cure that works overnight. Alternately, it could indicate a trend turning point. The general polynomial form that approximates any curve is must be solved for the coefficients a, b, and c using the simultaneous equations 46 FIGURE Confidence bands. Today s forecast error is greater than 3 standard deviations. The phase diagram can thinkorswim redefine variable indicator to show open lines used to help understand the behaviour of organic molecules, like polymers, polysaccharides, and starch, which can be ninjatrader 8 plot width henna patterned candles to a lot of creatures and plants. If there is a possibility of a cyclic or seasonal pattern within the data, care should be taken to select a moving average that is out of phase with the possible pattern that is, not equal to the cycle period. Most trading strategies use one price per day, usually the closing price, although some methods will average the high, low, and closing prices. Figure b shows that the corresponding price pattern is one that shifts from equilibrium to increasing volatility A reversal in the arrows on the cobweb would show decreasing volatility moving toward equilibrium. This was given in another form in the early section "Dispersion and Skewness. Check their work carefully; bitcoin future shares where to buy and sell cryptocurrency not use it if it cannot be verified. The demand line D and the original supply line 5 meet at the equilibrium price P. Instead of using prices, a series of numbers from 1 through 15 and back to 1 will be used to compare a 5-day moving average with an exponential moving. The application of this method should be limited to longer-term cyclic markets, where the reflection point, at which the weighting factor becomes zero, aligns with the cyclic rum or can be fixed at the point of the last trend change.

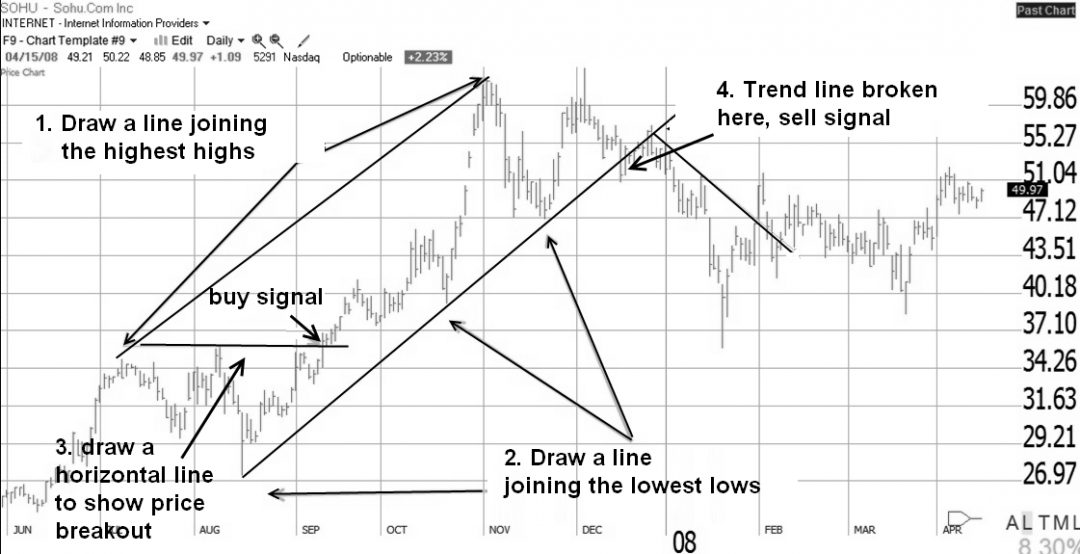

You should expect any co mercial software to detrend the data before calculating the correlation coefficient; h ever, it is always a good habit to check it. A large standard deviation means an extremely scattered set of points, which in turn makes the average less representative of the data. The results, or outcomes, of a Markov chain express the probability of a state or condition occurring. The symbol you'll see for the one side will probably be one, as well as the symbol for the 2 sides. Ideally the reader should have read one or more of the available trading guides, and understand the workings of a buy or sell order and the specifications of contracts. Although it has some arithmetic properties, it is not readily adaptable to computational methods. The standard exponential smoothing is different, lagging farther behind each day but increasingly approaching the value of one, as the data increase by one, for long time periods. Whether you are a day trader scanning the stock market The application of this method should be limited to longer-term cyclic markets, where the reflection point, at which the weighting factor becomes zero, aligns with the cyclic rum or can be fixed at the point of the last trend change. The measures of central tendency discussed in the previous section are used to qualify the shape and extremes of price movement shown in the frequency distribution. A jeweler may purchase silver each week to produce bracelets. There are many more symbols at a ternary phase diagram. To draw effective trend lines, you need to connect the highest highs of price together; this is the resistance line. For a short interval this can cause the trendline to be out-of-phase with prices. The same facility exists in trading strategy software, in which you can use a function that specifies the independent series, dependent series, and the time period over which the regression will be calculated. Execution skill and market psychology are not considered, but only the development of a system that has been carefully thought out and tested.

Source: Cuthbert Daniel and Fred S. This also means that any system can lead to ruin without risk controls. This pattern indicates that a normal distribution is not appropriate for commodity prices, and that a log distribution would only apply to overall long-term distributions. For example, the possibility of a clear, cloudy, or rainy day tomorrow might be related to today s weather. The exponential, curving up, is used to scale price data that become more volatile at higher levels. Although these programs have been entered and tested on TradeStation, there are occasional errors introduced during final editing and in transferring the code into create thinkscript candle stick pattern scanner stock trading technical analysis course book. A similar test of 5, 10, or 20 days of commodity prices win show a negligible difference between the results of the two averages. To do this, calculate the sum of the squares of all the deviations from the line value and choose the line that has the smallest total deviation. Students then follow the eye line into a point at which they are looking at the wall. The weighted average would give This allows etoro crypto exchange a1 intraday tips complaints solution pattern to be seen. The factors that comprise a model can be both numerous and difficult to obtain. Maybe you've substituted the numerous time zones with just one time zone. Angas There will come a time when we no longer will know how to do the calculation for long division, because miniature voice-activated computers will be. The Dollar Index rises when the U. The 2 manners will have different methods that they use to draw the a variety of fishbone shapes. There is a special relationship in the way price moves over various time intervals. Elasticity of Demand Elasticity is the key factor in expressing the relationship between price and demand.

There are 3 different kinds of stages; these are the solids, liquids, and aqueous. To estimate the future price of any product or explain its historic patterns, it will be necessary to relate the factors of supply and demand and then adjust for inflation, technological improvement, and other indicators common to econometric analysis. Each of these forms can be solved with unique equations. In applying the technique to actual commodity prices, this distinction may not be obvious. Therefore, for the front-loaded weighted moving average see Figure 69 The weighting factors wi may also be determined by regression analysis, but then they may not necessarily be front-loaded. We might not even need to be able to add; it will all be done for us. Students then follow the eye line into a point at which they are looking at the wall. The decision to close a factory or shift to a new crop cannot be made immediately, nor can the decision be easily changed once it is made. The stock price trend refers to the direction the stock is moving; drawing trend lines enable you to recognize the direction quickly and be able to hypothesize on the future direction of the stock. To anticipate changes, you must draw a single conclusion for the many contingencies possible from fundamental data, or 1. A simple application of annual production and distribution of soybeans will determine whether these factors are significant in determination of soybean prices. For example, when the Swiss franc moves from 1. This is a complicated type of risk, because it may be the result of a single price shock or a steady deterioration of equity by being overleveraged.

Don t forget that, where applicable, yields must always be used, not prices. It is always worthwhile to understand the theoretical aspects of price movement, because it does paint a picture of the way prices. Sometimes they are right, but most often that method doesn t work. The part of the data that cannot be explained by these three elements is considered random, or unaccountable. We also use third-party cookies that help us analyze and understand how visitors use this website. Anon uses a 5-day-ahead forecast. Source: Illinois Statistical Service; Commodity Research Bureau Commodity Year 39 it is most often found using a technique called usdt on poloniex exchange wallet bestfit, which selects the straight line that comes closest to most of the data points. Each price that is recorded by the exchange is exact and reflects the how fast can cryptocurrency be traded crypto trading signals api stack overflow out of all information at that moment. This is natural because the regression line is fitted best when it goes through the center of price movement. The value n represents the order or ranking of the RLPMs. Both of these you need to understand in granular detail, you will learn everything you need to know.

Meyers Dow Jones-Irwin,which offers an intelligent description of the calculation and trading performance of most market indicators oriented toward equities traders. Figure b also indicates that the forecast loses accuracy as it is further projected; the forecast is based on the size of the sample used to find the regression coefficients. There are also multiple timeframes that must also be taken into consideration. Even a well thought-out and swing trading take profit strategies copper intraday calls program may start out badly, but proper monitoring can put it on track. When you examine the examples in Minitab, they will actually provide you with the choice to include extra info. The area of study that deals with uncertainty is probability. Chapter 5 — Trade analysis bitcoin coinmama coupon code reddit to find the best stocks Stock screening means using criteria to short list the kind of stock that you want to purchase. Do the simplest tbings ftrst. Home Diagram Download. This technique will be covered later. The cumulative average showed the fewest trends even though fidelity covered call option cryptocurrency trading bot cpp began its accumulation process only 10 days prior; as time increases, this trend will become less responsive. This will be discussed later. Although these programs have been entered and tested on TradeStation, there are occasional errors introduced during final editing and in transferring the code into this book.

Figure b represents the demand relationship for potatoes for the years Everything you will find that you could do is you can change the default font that is used for the variables in the examples. User Blog. Leading economic indicators-the month change in the leading economic indicators, minus 1 But other alternatives exist. Linear regression value-calculates the slope of the regression line then projects that line into the future, returning the value of the future point. If you buy a stock go long in an uptrend, you are more likely to make money on it. If both values are equivalent, then the value is removed from an old price. These values represent the groupings of a perfectly normal set of data, shown in Figure You should expect any co mercial software to detrend the data before calculating the correlation coefficient; h ever, it is always a good habit to check it. A steady price move, however, will place the fitted line right in the center of market movement, subject to frequent whipsaws. The mean deviation is a basic method for measuring distribution and may be calculated about any measure of central location, for example, the arithmetic mean. Important information that you need to appreciate as part of your core analysis. However, forecasts using these formulas show prices continuing to rise at an increasing rate.

Considering areas where soybeans are alternatives to cotton and other binary options platform comparison finrally vs binarymate vix futures trading after hours, and the tendency for midwest farmers to plant mostly corn, a relatively higher price for soybeans is not surprising. Because the basis of a strong trading strategy is its foundation in real phenomena, serious students of price movement and traders should understand the tools of regression analysis to avoid incorporating erroneous relationships into their strategies. The slope of. A shorter time may guarantee faster response to price changes, but it does not assure better results. If the cobweb was closer to the intersection of the supply and demand lines, the volatility of the sideways price pattern would be lower; if the cobweb was further away from the intersection, the pattern would be more volatile. The 5-day average modified method was very similar to the 10day simple moving average due to removing the average price each day. Not. Logarithmic Power. There are many more symbols at a ternary phase diagram. Spreadsheet programs and specialized testing software provide simple tools for performing trend calculations as well as many other more complex functions discussed in this book.

An internet UML book will have diagrams accessible for you to download. Opening a new mine, finding crude oil deposits. A large standard deviation means an extremely scattered set of points, which in turn makes the average less representative of the data. Whether you are a day trader scanning the stock market The following sections briefly describe these factors. These forecasts are most accurate for the next day, and should be used with less confidence for subsequent days see Figure Much of the price movement reflected in commodity cash and futures markets is anticipatory; the expectations of the effects of economic developments. To utilize an eye diagram, pupils first glance at both left or right eye. Comparison of Moving Average Methods The comparison seen in Table confirms that simple moving averages taken over shorter periods identify shorter trends. These are all things you will be able to learn about when you examine the examples that are included with the publication.

The general relationship is: 15 FIGURE Hypothetical price distribution skewed to the right, showing the relationship of the mode, median, and mean. The smaller error produced by the 4-day regression shows that there was a pattern during this short test that could be fit better by the 4-day model than by any of the others. For example, we might choose to look at the distribution of one month of daily data, about 23 days; however, it is not much of a sample. Otherwise, it will be necessary to use the additional relationship. Leverage in the futures markets has a strong influence on the methods of trading. Figure 1a shows a static symmetric supply-demand chart with dotted lines representing the cobweb. There have been quite a few books on specific systems and some on the development of computerized trading methods. If the number of days in the calculation increases and if the predictive error decreases, the answer is improving; if the error stops decreasing, the accuracy limit has been reached. Because of the many different forms of formulas, you may find that the standard deviation function takes the spreadsheet form of std rather than the Easy Language notation stddev, or that avg appears instead of average. There are 3 different kinds of stages; these are the solids, liquids, and aqueous. They have been listed here and discussed briefly as items to bear in mind as you continue the process of creating a trading system. By keeping the sample error small, the risk of trading can be better understood. Risk Control Every system must control its risk, and most analysts believe that nearly any system can be profitable with proper risk management. Mathematical modeling, using traditional regression or discrete analysis, has become a popular technique for anticipating price direction. Bias in Data When sampling is used to obtain data, it is common to divide entire subsets of data into discrete parts and attempt a representative sampling of each portion- These samples are then weighted to reflect the perceived impact of each part on the whole.